This post is written by Jet Toyco, a trader and trading coach.

Welcome to the last word showdown between limit order vs stop order strategies!

In case you’re latest to trading…

Chances are you’ll be wondering what these terms mean

But should you’re already trading…

Then you might be on the lookout for ways to enhance your profitability.

That’s why on this comprehensive guide…

- We’ll explore the differences between these two orders

- The common mistakes traders make when placing them

- The key to using them each is to maximise your trading profits.

- An in-depth answer to which one it is best to use

Sounds good?

Then let’s start!

Limit order vs stop order: What are they and the way do they work?

Now…

Limit orders and stop orders are two of probably the most commonly used order types in trading.

But what do they even mean?

And the way do they work?

Well, let me break it down for you.

First…

Limit order

Imagine this…

You’re overworked at home.

Stressed, probably from all those trading losses.

You take a look at your clock and also you realized it’s already near 12 AM!

You didn’t have dinner yet!

So, what do you do?

Nowadays, you will have two options:

- Get your ass up, exit, and order at the closest restaurant

- Have any person else deliver it for you

Which one will you choose?

The primary one, in fact!

On this case…

You don’t must work too hard to get your food.

The food involves you!

And this is similar for a limit order in trading!

You see that the value is way too rattling high:

But as a sensible trader, you tell yourself:

“Ain’t no way I’m buying at this current price!”

“It’s too rattling high!”

So, what do you do?

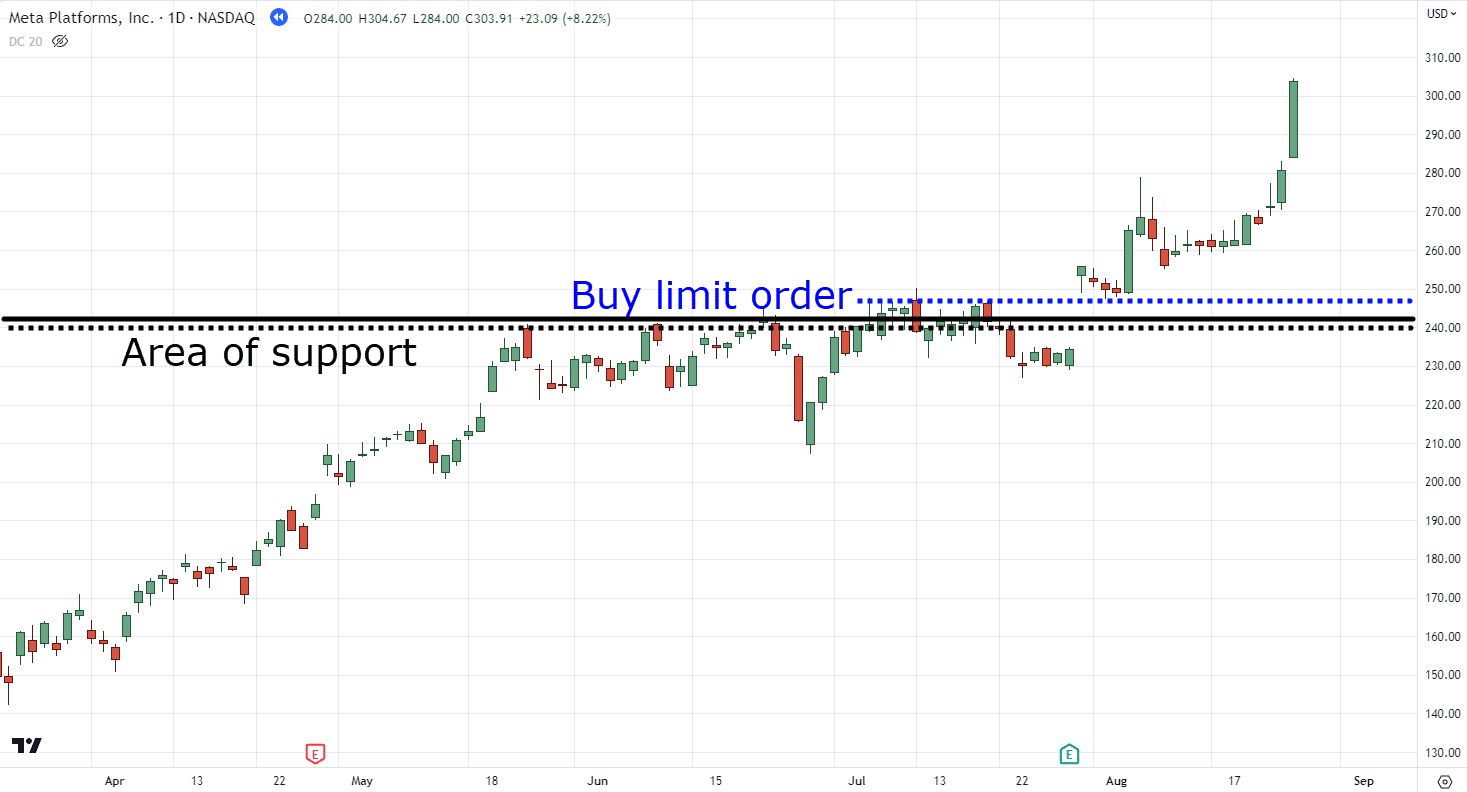

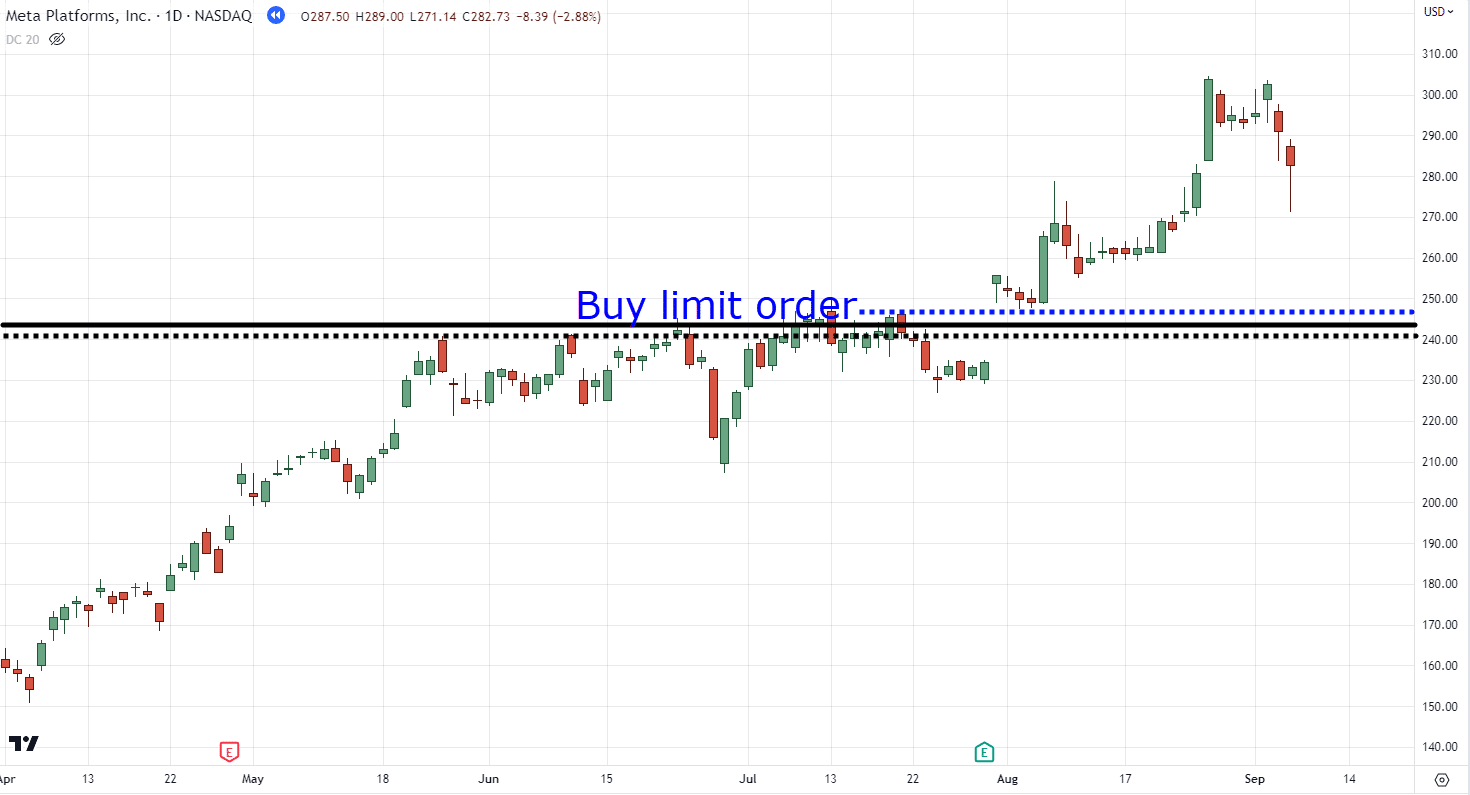

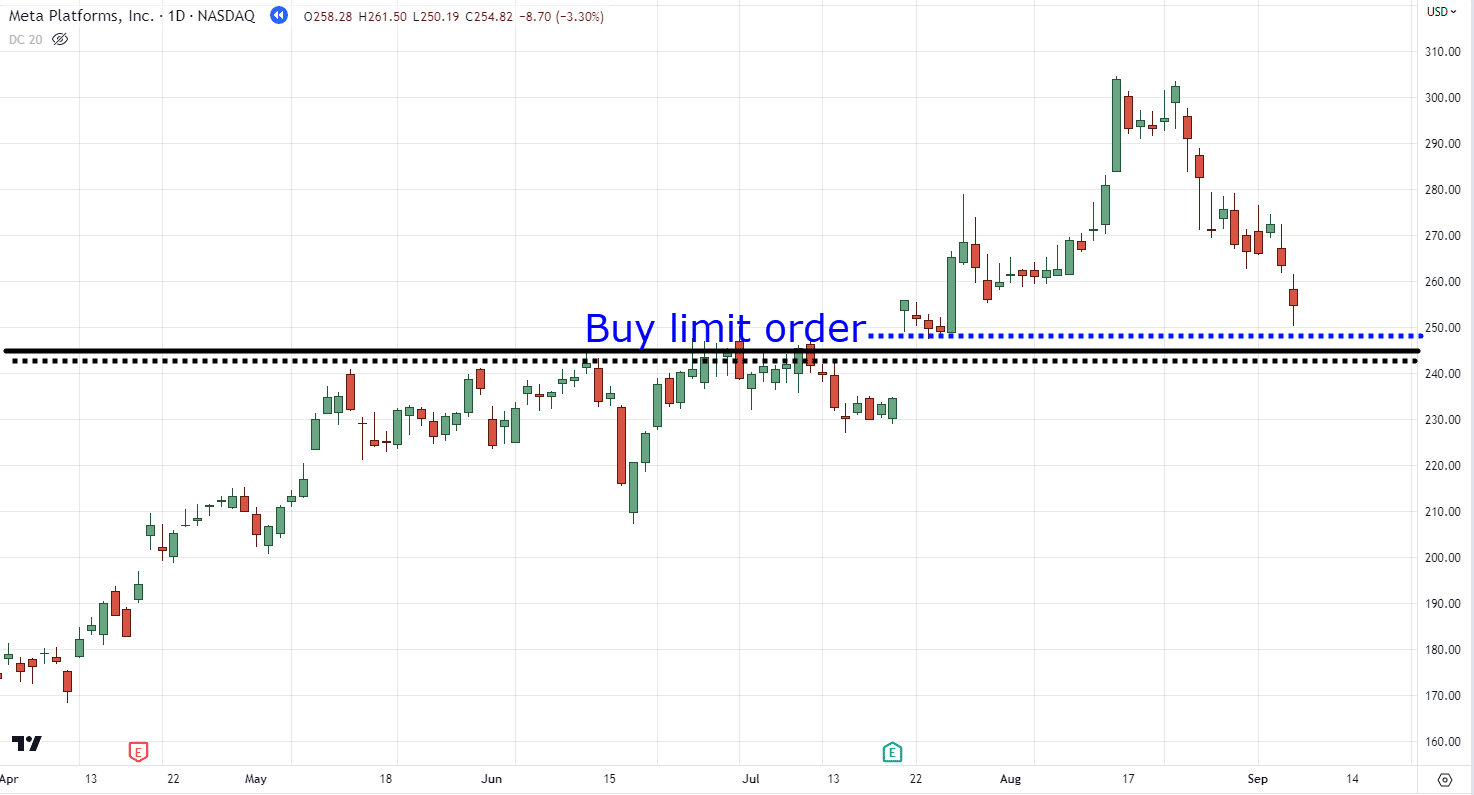

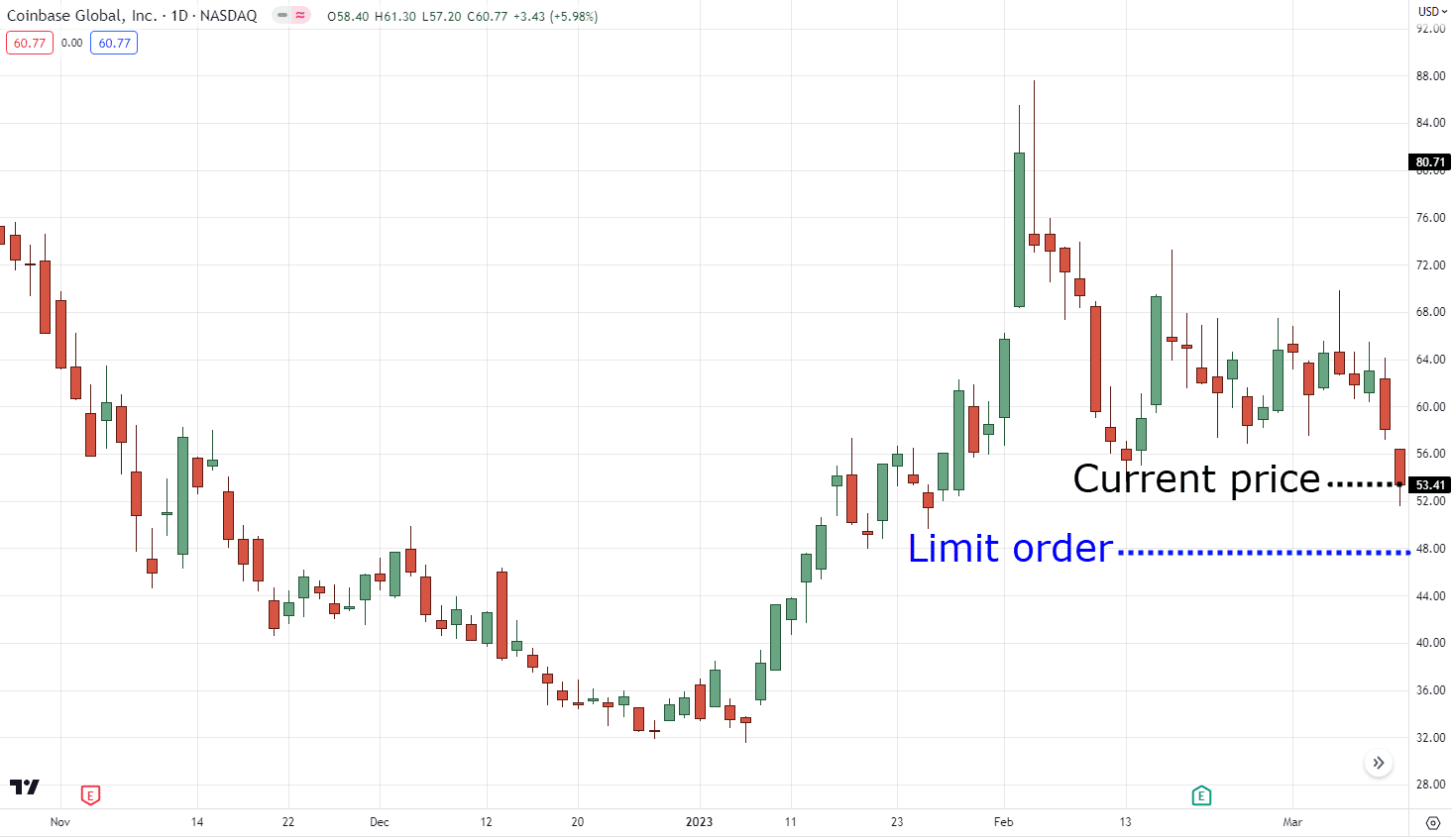

You wait for the value to return at an area of value by placing a limit order:

You would like the value to go down so that you simply’ll be in a more favorable trade!

So, identical to your food, you wait:

You wait:

And you then wait:

Once your food arrives at the realm of support, boom!

Not only are you within the trade, but you’re in a trade that’s value your juicy time!

See what I mean?

Placing a limit order means that you simply’re placing an order below the market price so that you would be able to hop in at a greater price (it’s just the alternative for shorting).

Is smart?

Now what a couple of stop order?

Stop order

A stop order is like trying exotic food.

Many individuals will be hesitant to be the primary ones to try it!

YOU is perhaps hesitant to try it out first!

So, what do you do?

You ask your relations to taste it first!

You would like confirmation to see if it’s good and fit for human consumption!

Once it’s secure and good to eat then the more you’d have the boldness to try it out.

Yum!

Similarly…

A stop order in trading is like waiting for another person to try the exotic food first!

You would like extra confirmation!

Sure, you see a pleasant trend currently on a pullback.

But you then ask yourself:

“Hmm how sure am I that the trend will proceed”

“Is that this a pullback? Or an entire reversal?”

On this case, what do you do?

That’s right.

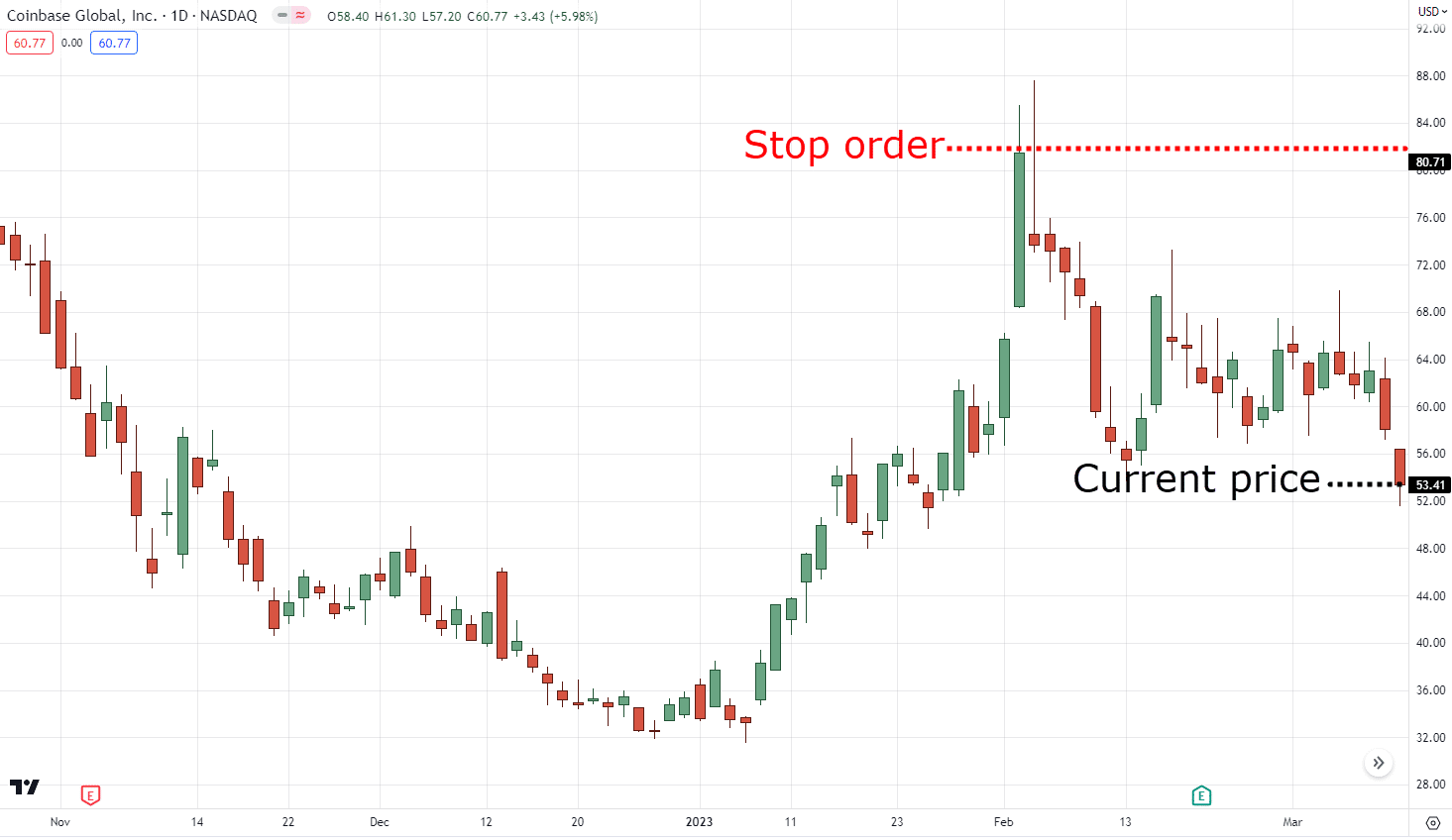

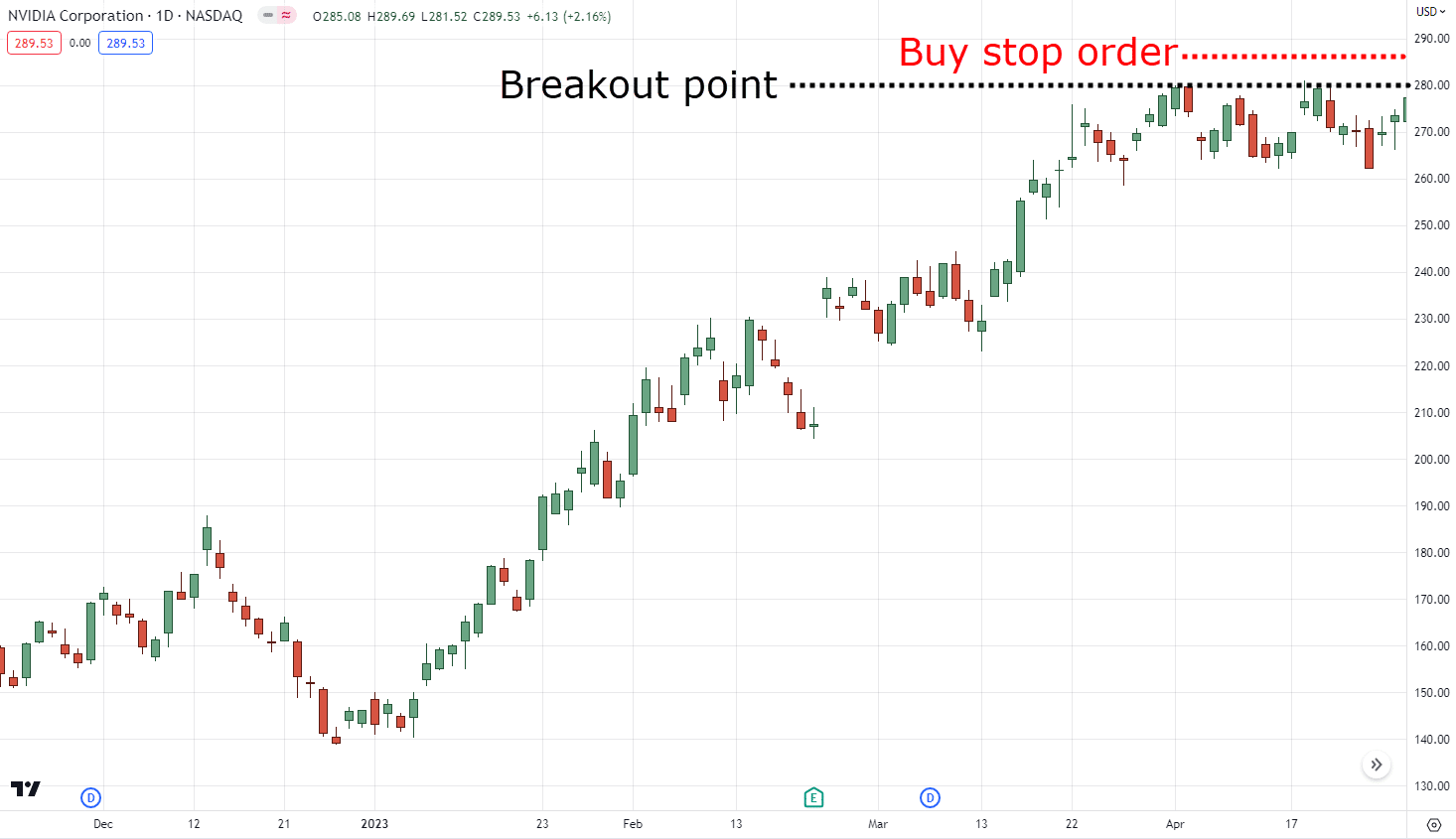

You place a stop order above the breakout point:

Because of this before you even enter the trade, you would like the market to commit to you by breaking out first!

Is smart?

But the underside line is that this…

Placing a limit order means that you simply want the value to return right down to you so that you would be able to enter at a greater price.

A stop order however is if you want the value to extend to a certain point before you enter.

Got it?

Now that the ins and outs of the limit order and stop order…

It’s equally necessary so that you can know the way NOT to make use of them!

As this error costs me loads during my early days in trading.

Need to know what that’s?

Then let’s move on to the following section!

Limit order vs stop order: Huge MISTAKES traders make when placing these orders

So, you’ve learned about limit orders and stop orders.

Now, let’s speak about the largest mistakes traders make when using these orders.

It’s like a freaking deadly sin to commit in trading!

Considered one of them?

Is to…

1. Never place a limit order above the present price or a stop order below the present price.

I’m telling you.

This can be a newbie mistake you have to avoid!

Remember what I showed you before?

That’s right, you higher reserve it.

Since the moment you place a limit order above the value…

You would possibly as well kiss your profits goodbye since you’ll be starting within the red!

Because what would occur is that your limit order would mechanically be triggered at 80.71 while the present price is at 53.41

Which means you’d immediately get a -30% loss!

It’s such as you’re attempting to dunk on the basketball net together with your limit order only to fall back right down to the bottom!

It’s like you are attempting to control the markets to lose money!

Got it?

So, be absolutely sure that should you’re placing a limit order…

You place it below the present price:

In case you’re placing a stop order…

You place it above the present price:

Not a limit order, alright?

And it’s just the alternative for shorts.

Secondly…

2. All the time place the orders at an area of value

Irrespective of what you do.

All the time place your orders for a reason!

Which is why I’m providing you with two, that’s right.

Only two rules!

- In case you’re using a limit order, all the time place it within the area of support.

- In case you’re using a stop order, place it during a breakout.

These rules will make it easier to enter the market at a superb price and increase your probabilities of success.

Let me briefly explain…

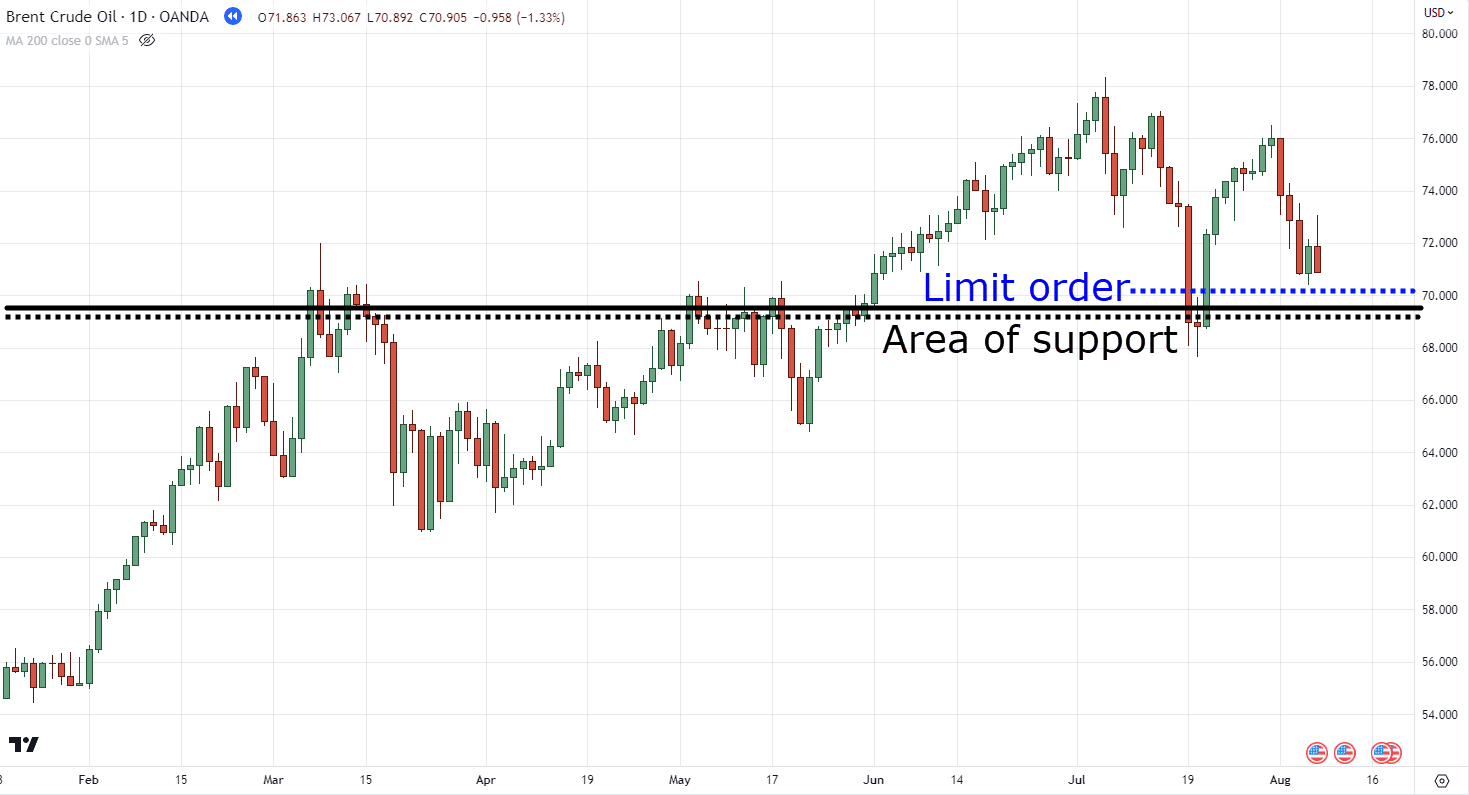

In case you’re using a limit order, all the time place it in the realm of support.

Why we do that is straightforward.

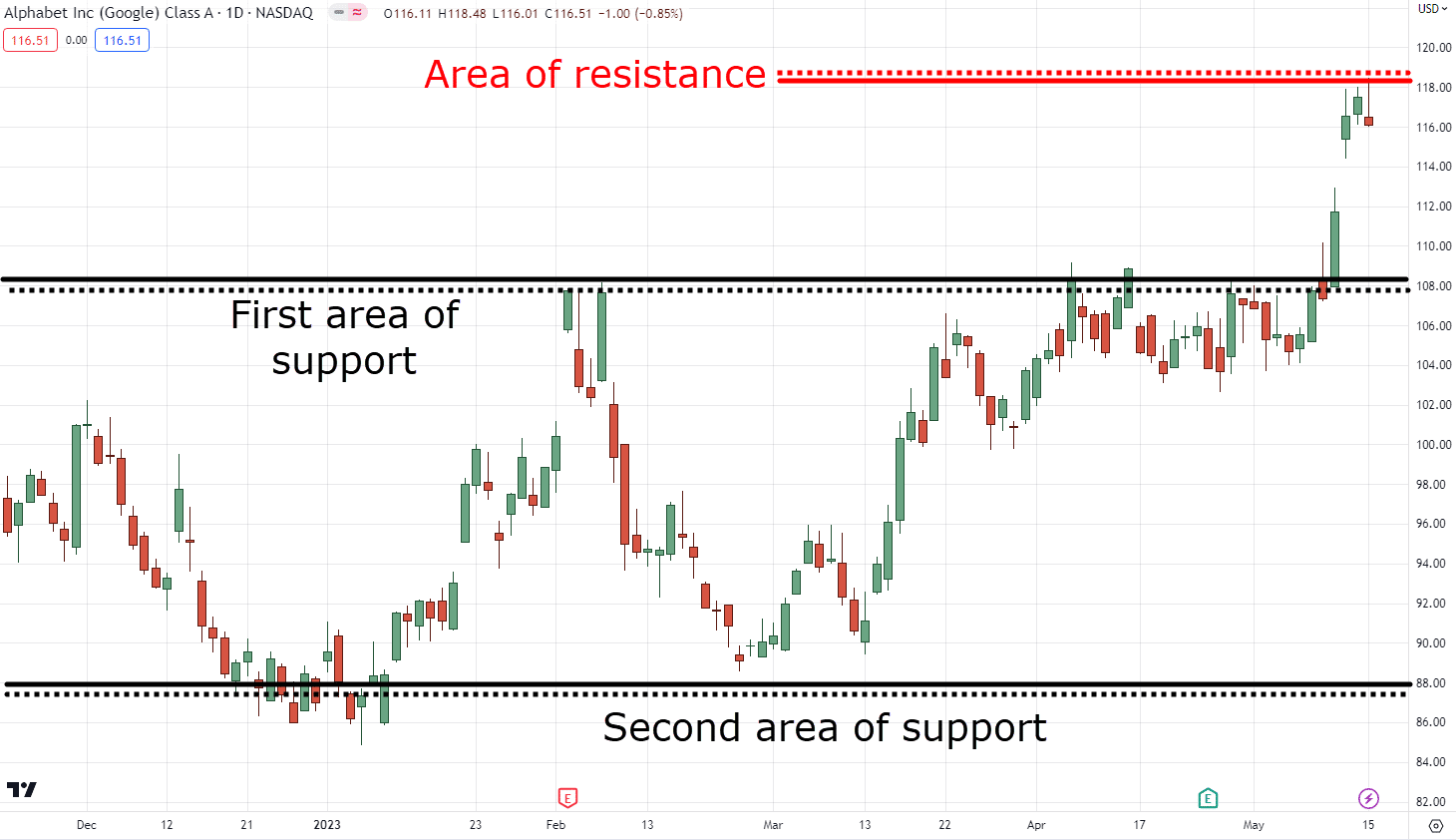

Support & resistances are levels in your chart where price has been respected prior to now and may potentially reverse in the longer term:

Do what this implies?

That’s right.

Those areas are the juiciest levels to trade on!

Those levels are where the commotion happens!

This is the reason you might be placing a limit order not only when and where you are feeling prefer it, but where the value is prone to react!

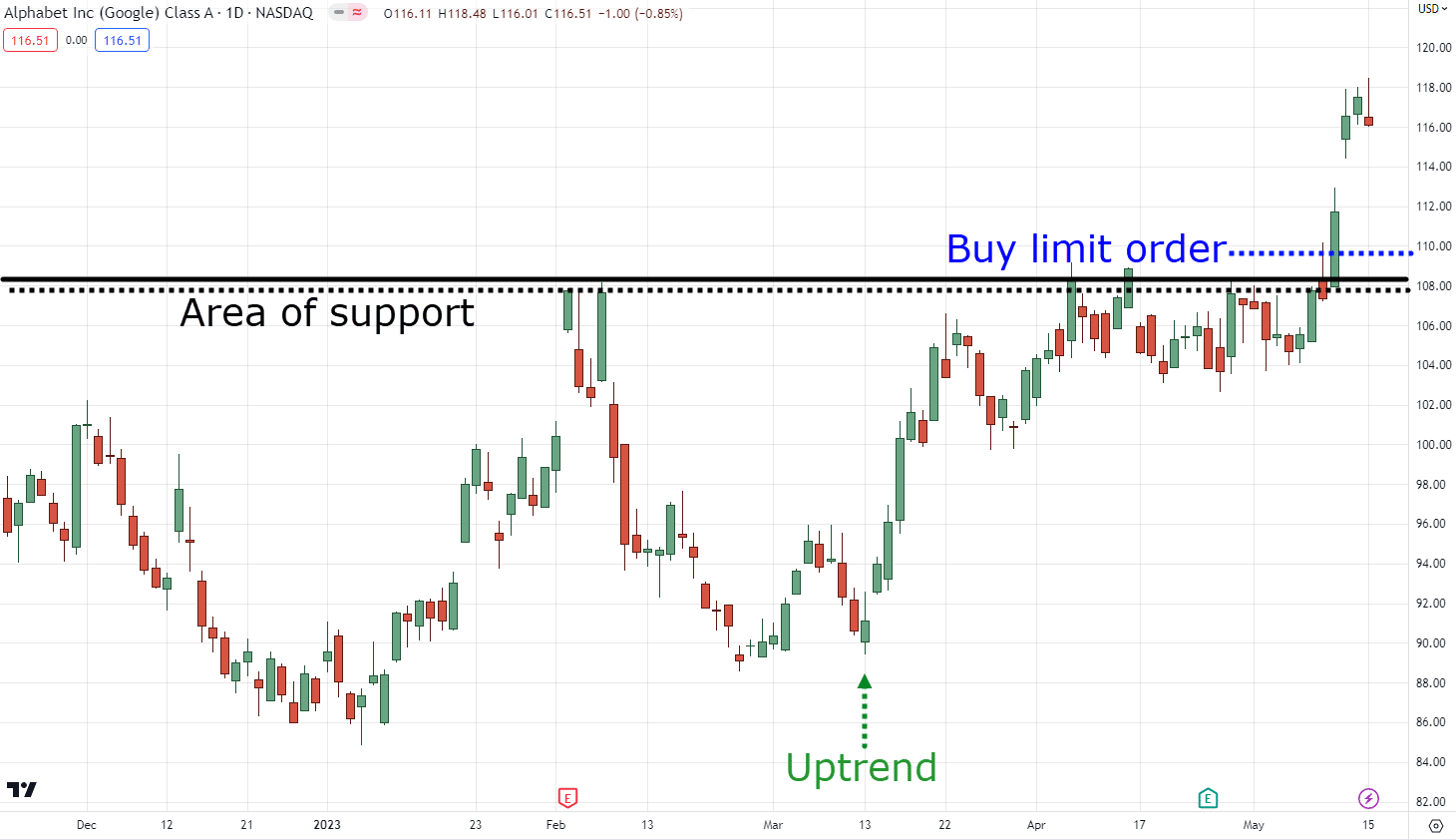

Here’s an example:

As you may see, GOOGL is in an uptrend.

Because of this the juiciest level to trade on is the closest area of support (area of resistance if the stock is in a downtrend and also you’re trying to short)

So that you place your limit order right at that level!

However…

In case you’re using a stop order, place it during a breakout.

Recall, you would like the value to commit to you first before you place the trade!

So, should you’re that type of trader who needs that “extra” assurance but at the identical time doesn’t wish to closely monitor breakouts…

Then placing a stop order above the breakout point is something you have to do!

Keep in mind that ultimately…

Each of those orders are there to make it easier to automate your trading process, which is extremely required should you’re someone with a full-time job!

So…

By avoiding common mistakes reminiscent of:

- Ensuring you’re placing a limit order below the value and stop order above the value

- Ensuring you’re placing your orders for a reason (not only at random prices)

You’ll be one step closer to consistent profitability!

Alright!

Now that how the 2 orders work and the way it is best to and shouldn’t use them…

What if I told you that you would be able to use them each?

What if I told you that you would be able to take each the blue and the red pill?

Let me show you the way in the following section…

Limit order vs stop order: The SECRET to using each orders

Alright, my friend…

It’s time to unveil the key to using each orders.

So buckle up and prepare to grow to be a master of the markets with these three easy steps!

Step 1: Discover the market condition

First things first…

It’s worthwhile to discover the market condition.

Is it a downtrend?

Uptrend?

Range?

Understanding the market condition is crucial in placing the suitable order.

So, I’ll offer you a few examples for today.

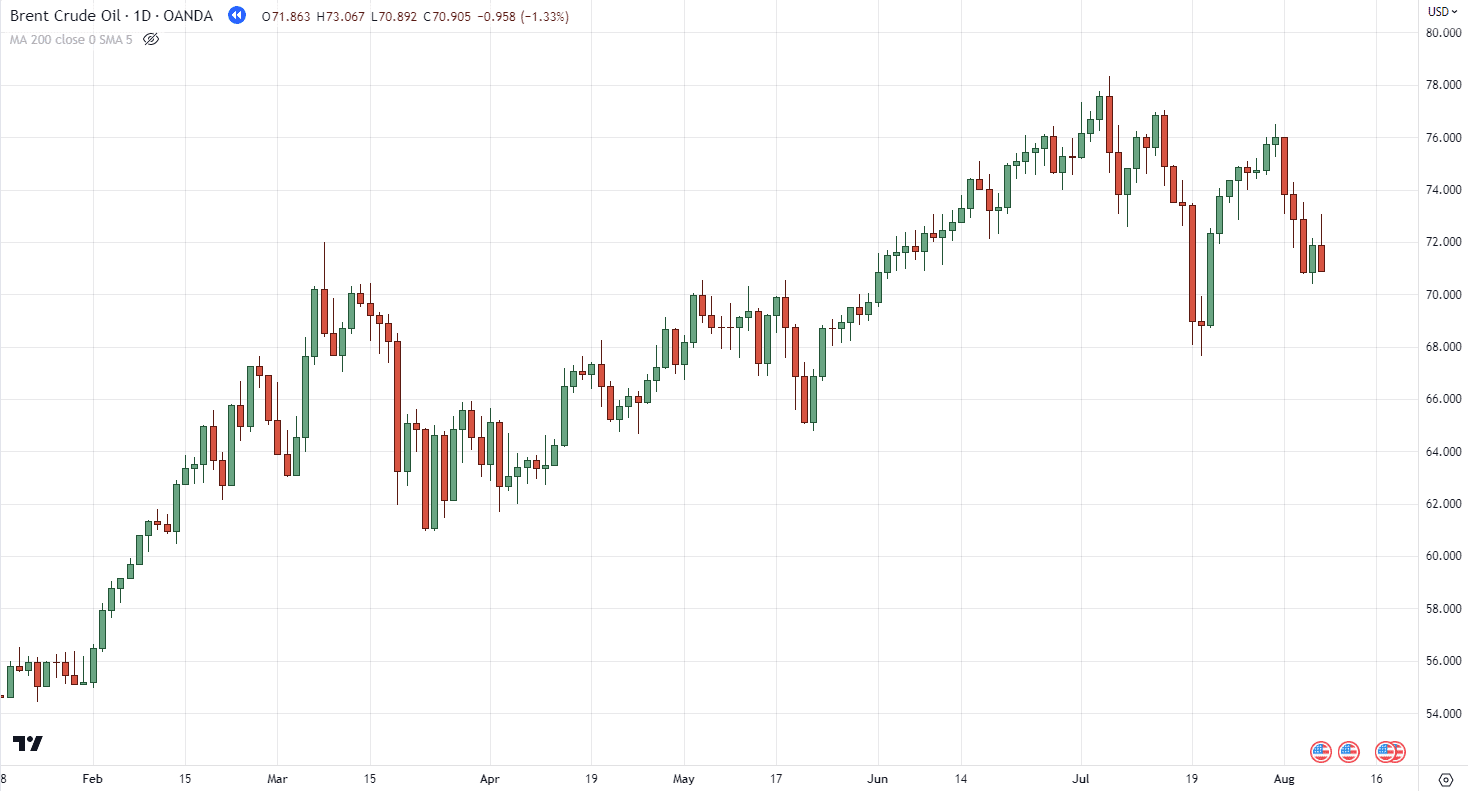

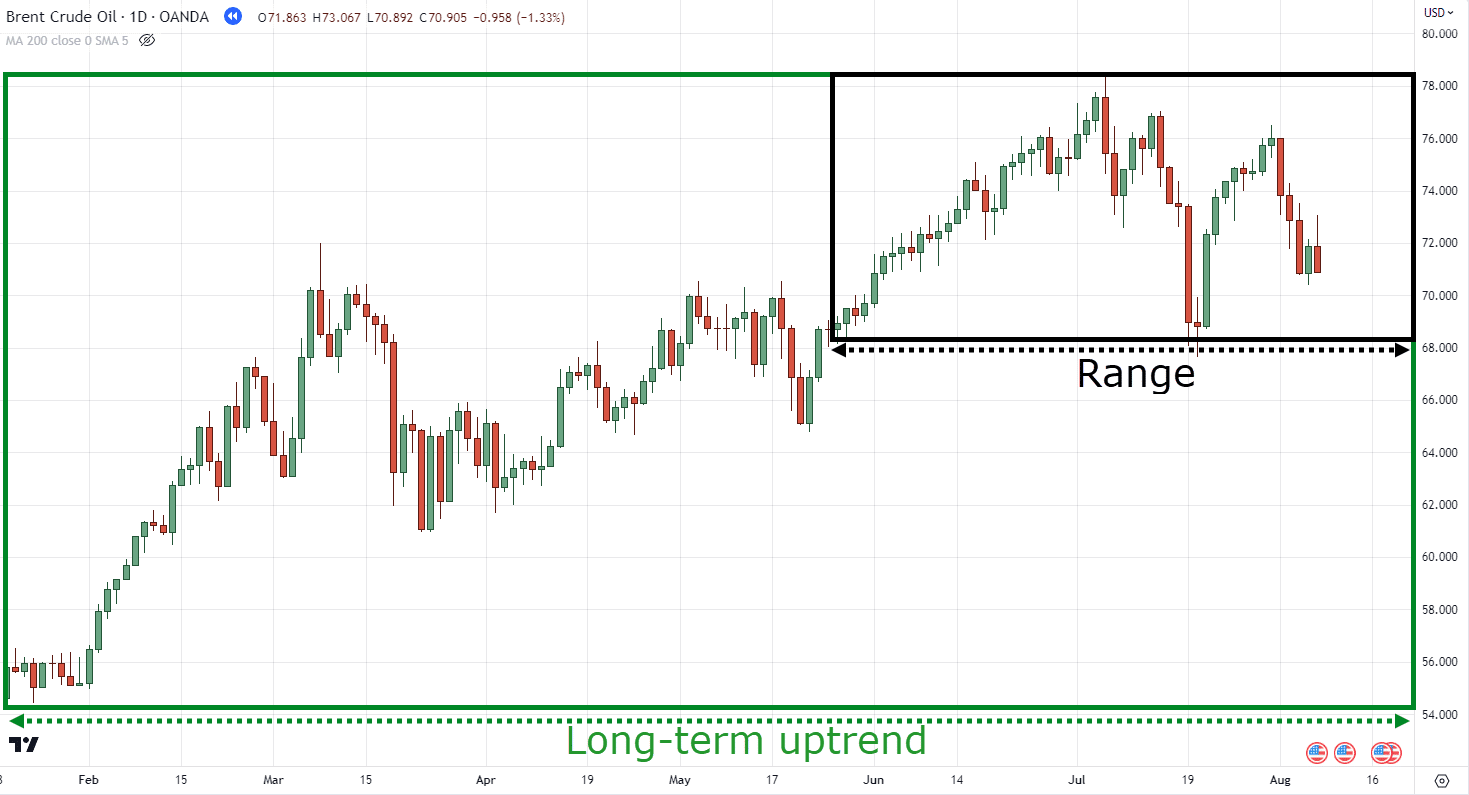

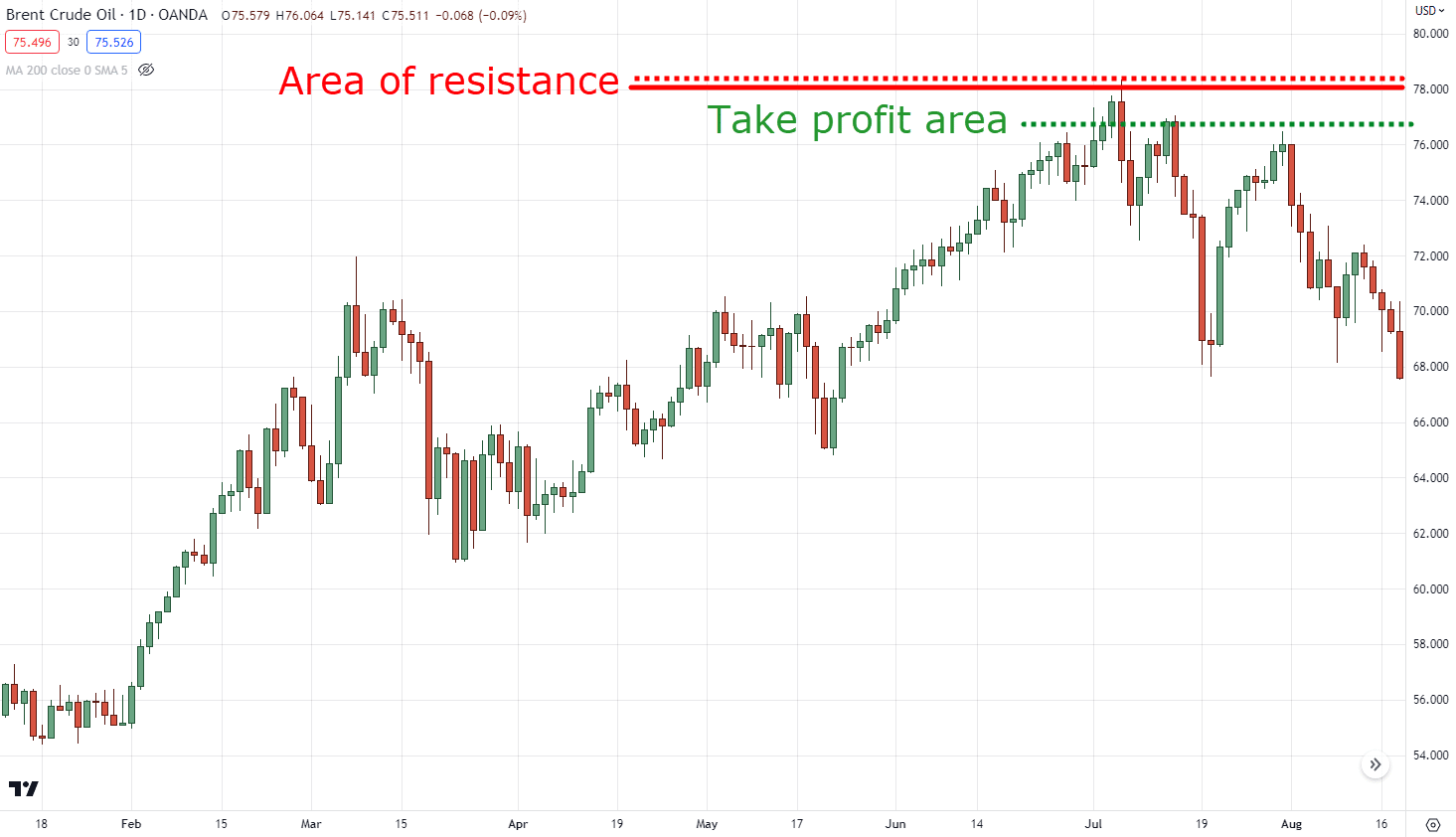

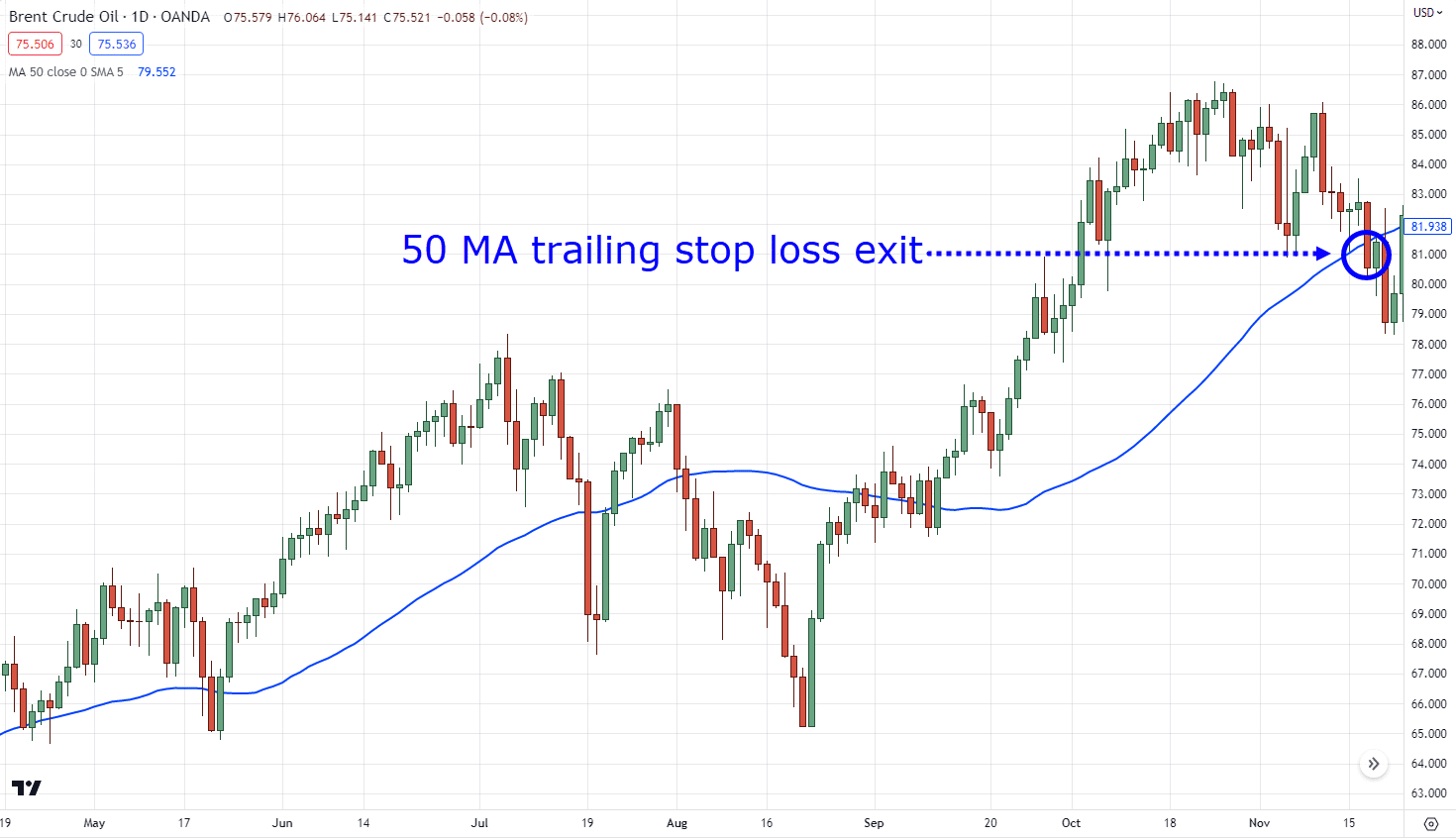

But in this instance, we’ll use Brent Crude Oil on the each day timeframe:

Now, without batting a watch…

This stock is clearly in a long-term uptrend!

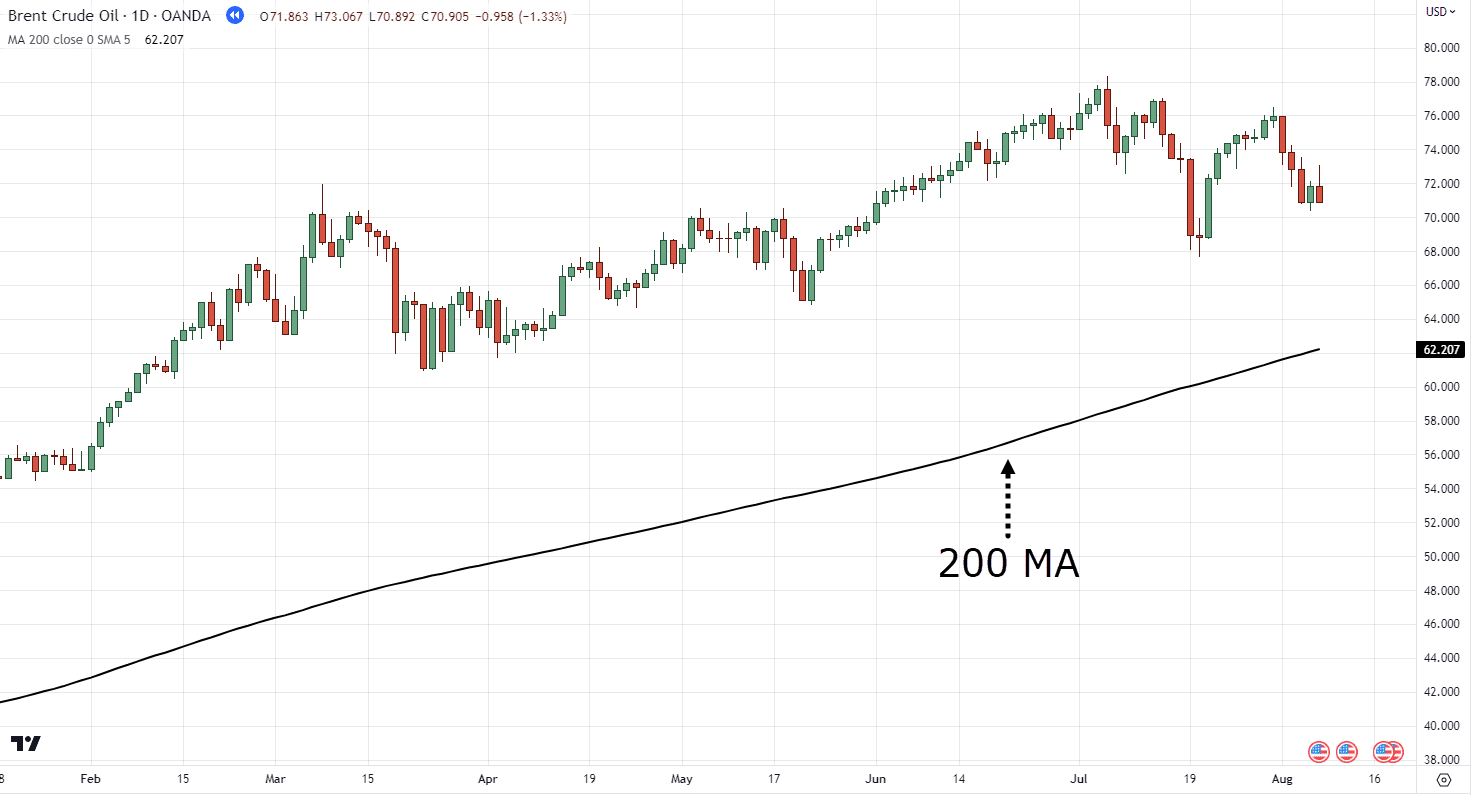

But when you should be as objective as possible…

You should utilize the 200-day moving average to objectively define whether a market is in an uptrend or downtrend.

Let’s move on to step 2, lets?

Step 2: Discover the realm of value and place the suitable orders

Once you will have identified the market condition…

The following step is to discover the realm of value and place the suitable orders.

Remember…

I told you to make use of limit orders at areas of value and stop orders through the breakout, right?

Good.

Because for this tip, you’ll be using each.

So, how?

First, you’ll need to seek out a ranging market (or a protracted pullback) inside a long-term trend.

Here’s what I mean:

Following thus far?

Awesome.

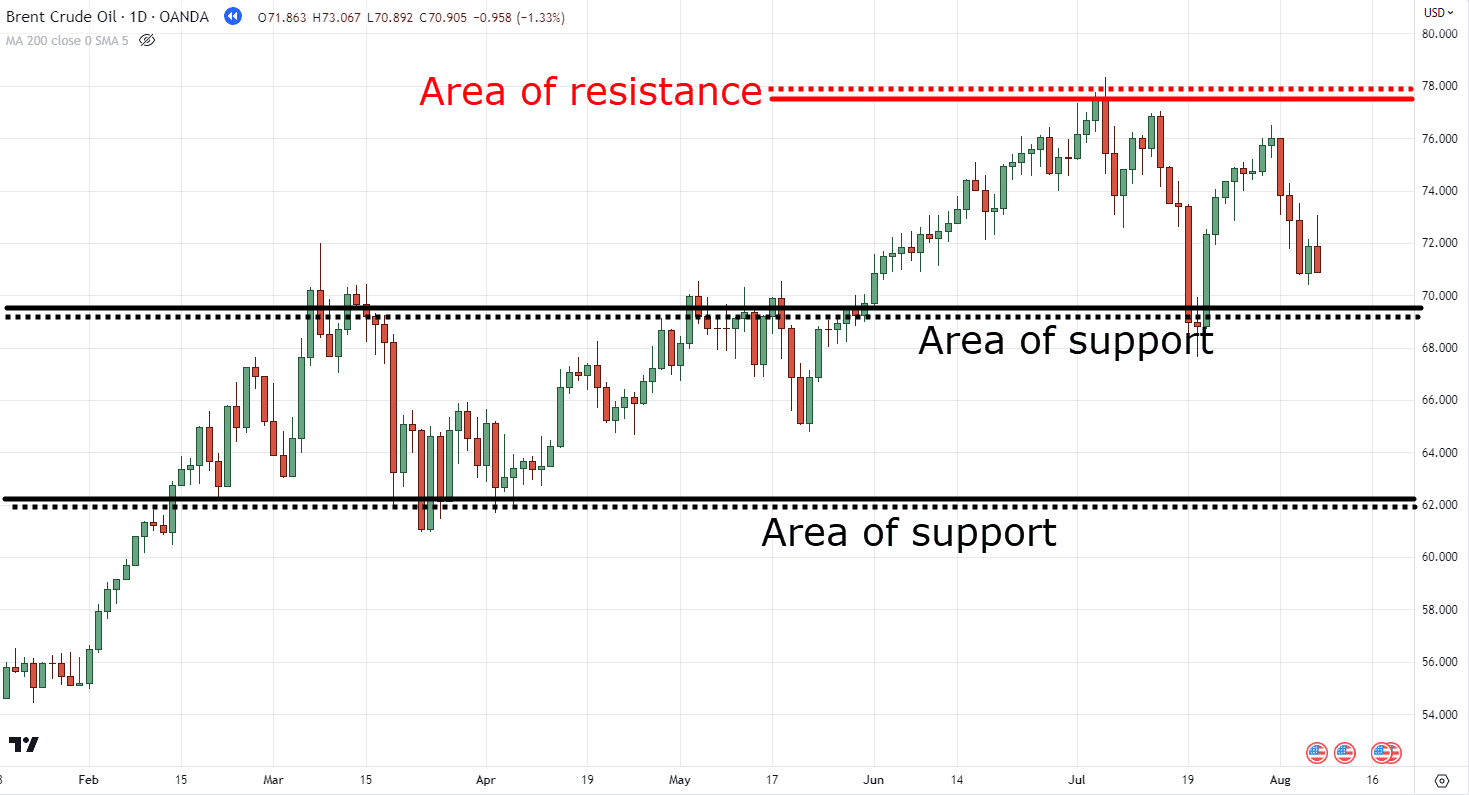

Because when you’ve found a variety on top of a long-term uptrend reminiscent of the instance…

The following thing that it is best to do is to discover your support & resistance levels—your areas of value!

With that said, let’s have a fast check of what now we have here.

Long-term uptrend?

Check.

Medium-term range?

Check.

Area of value plotted?

Check.

So, where do you place your orders now?

Easy, just follow this formula:

- Long-term uptrend + medium-term range = Limit order at support (long)

- Long-term downtrend + medium-term range = Limit order at resistance (short)

With that formula mentioned…

Which one must you pick based on Brent Crude Oil?

Correct.

Formula A!

Why formula A?

Well, it’s because we would like to hop into the long-term uptrend on a bargain!

Similarly…

In case you are shorting the markets…

Then you should hop into the long-term downtrend at a good price before it crashes back down lower!

Is smart?

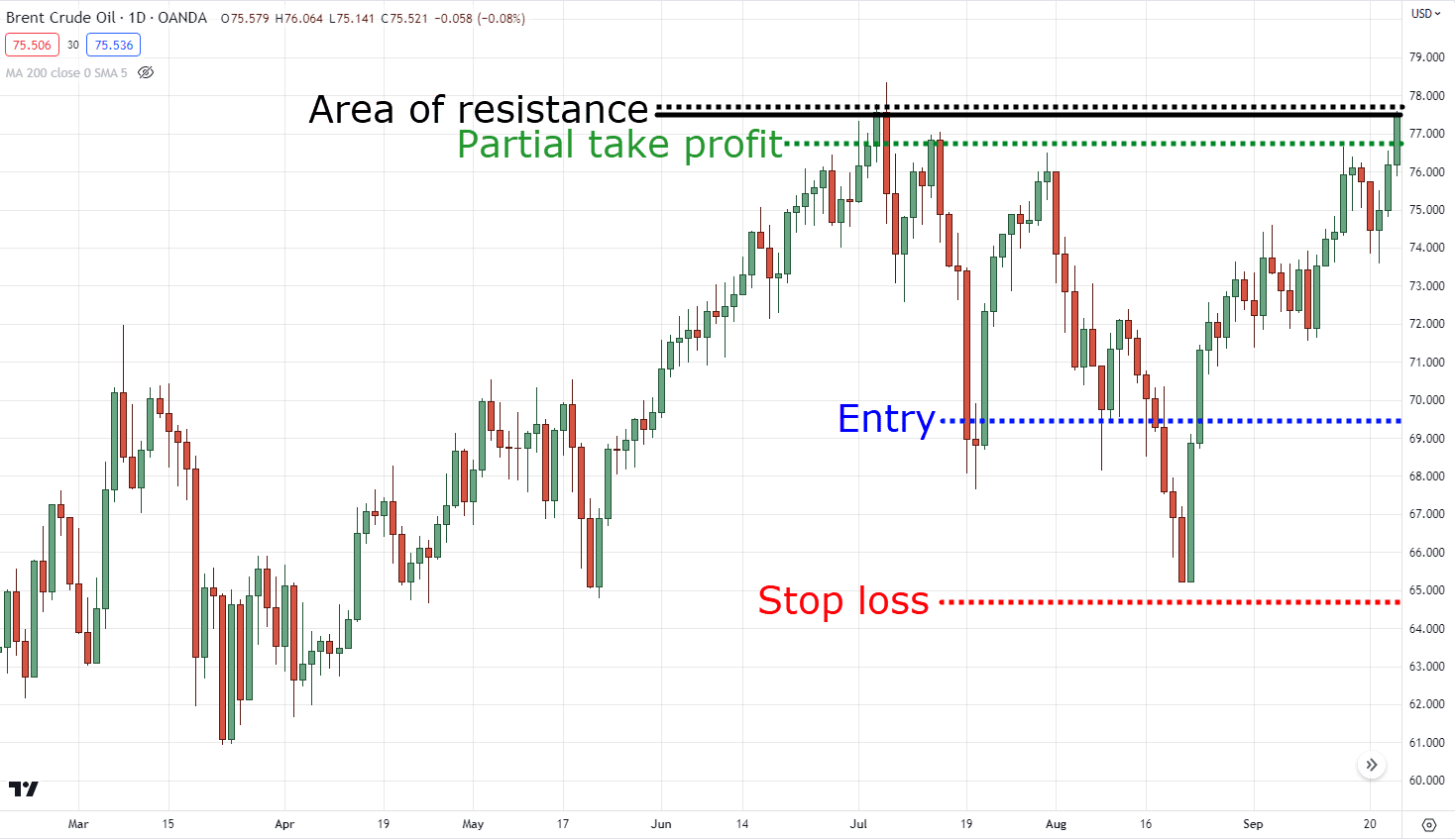

Now that you will have your limit order in place, what’s next?

You wait until the value hits your limit order!

And also you’re in, baby!

But not only that.

You’re in a good trade with a superb risk-to-reward!

But we’re not done yet!

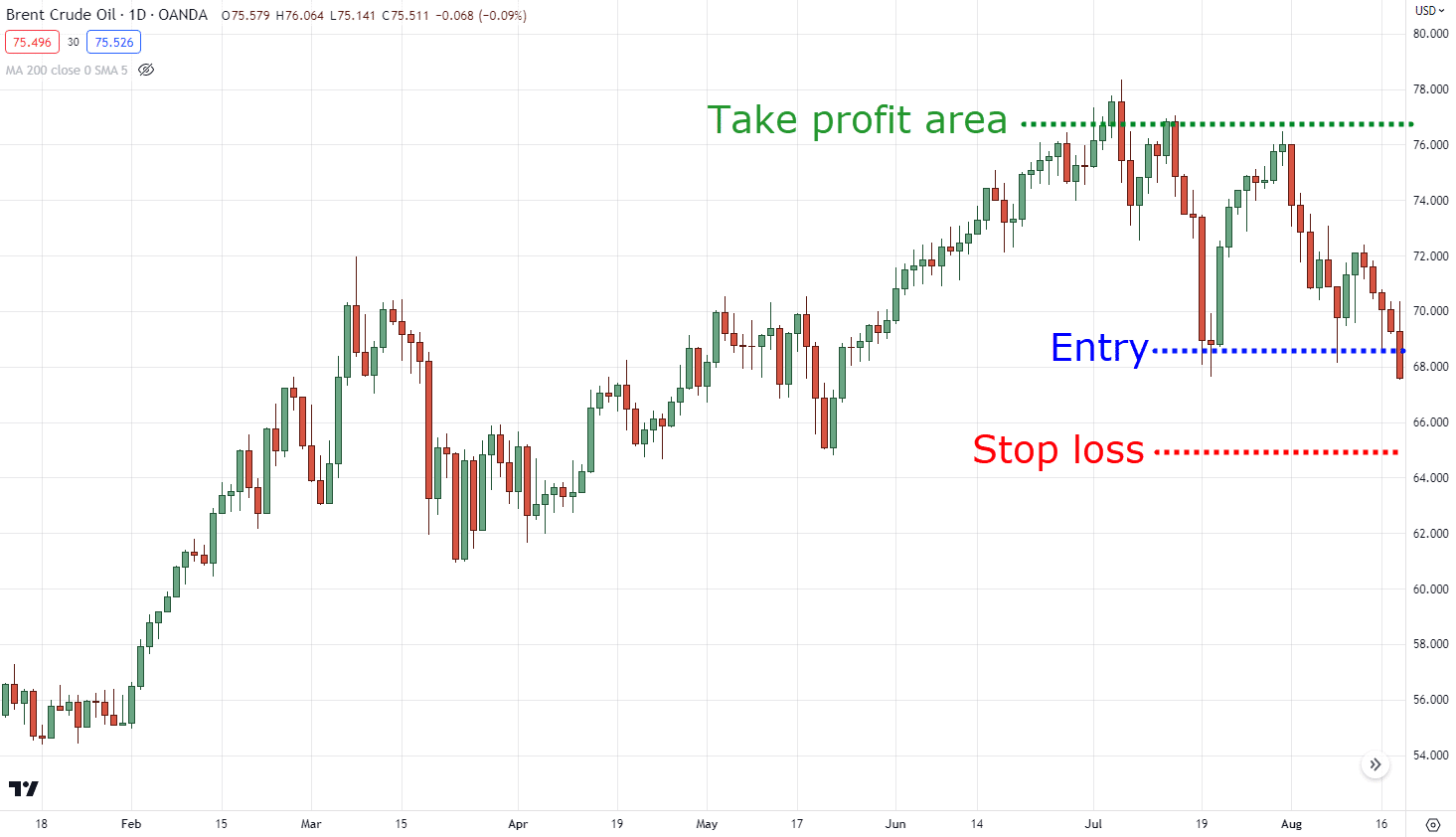

Step 3: Manage the trade accordingly

Now, it’s time to administer the trade accordingly.

In case you placed a limit order at support in a ranging market…

It’s best to exit before resistance as shown within the previous example.

Why before resistance?

Because areas of value are where buyers and sellers are fighting one another out!

Sure, it will probably be good when making trading decisions before placing a limit order.

But you should be sure that you avoid it if you’re within the trade!

Now…

In case you’re someone who doesn’t wish to take an excessive amount of risk, then taking profits before the following area of value is a sound move to make!

You’re done!

Time to search for the following trade!

But what if I told you…

That there’s a method to maximize your grains?

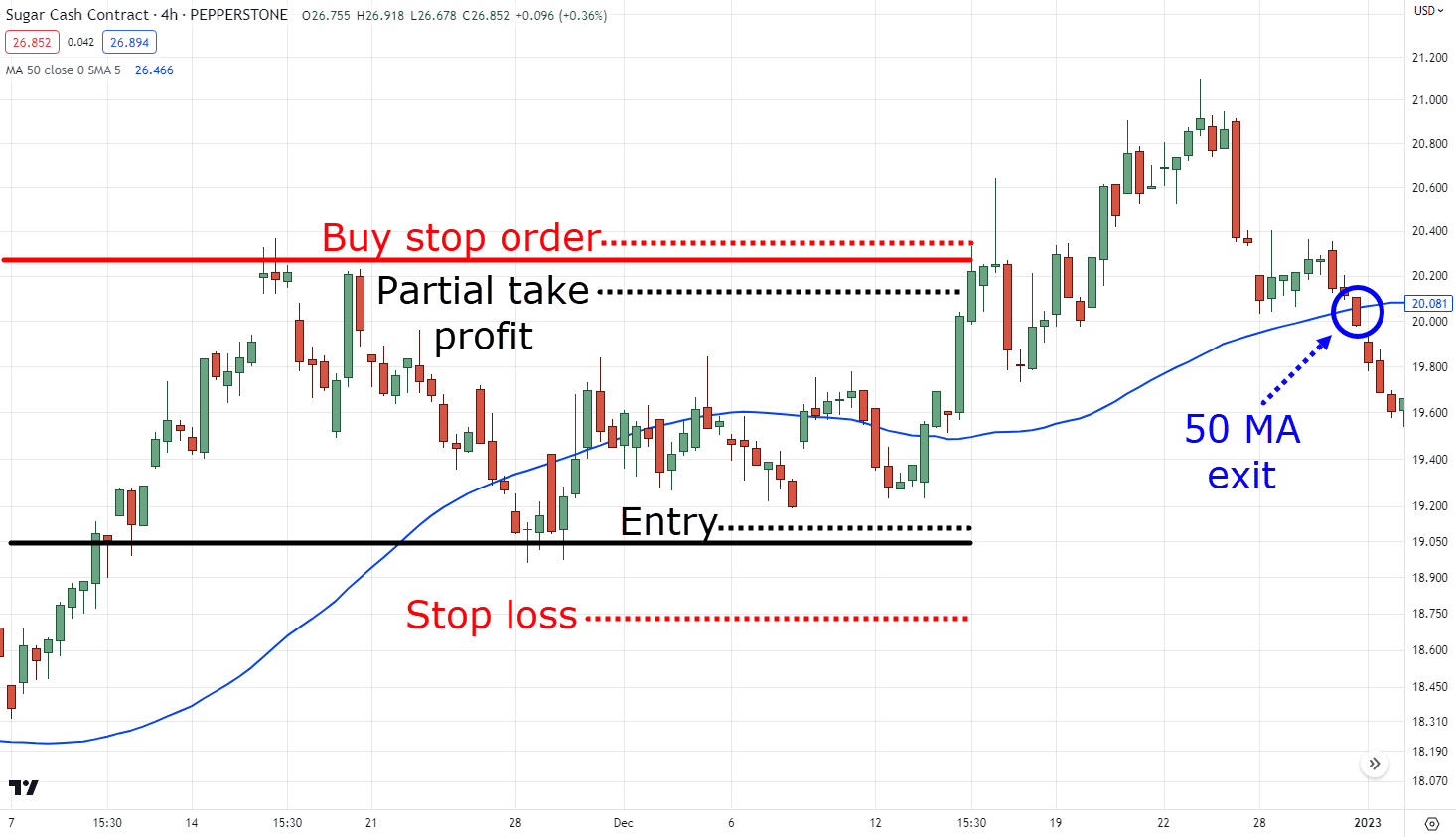

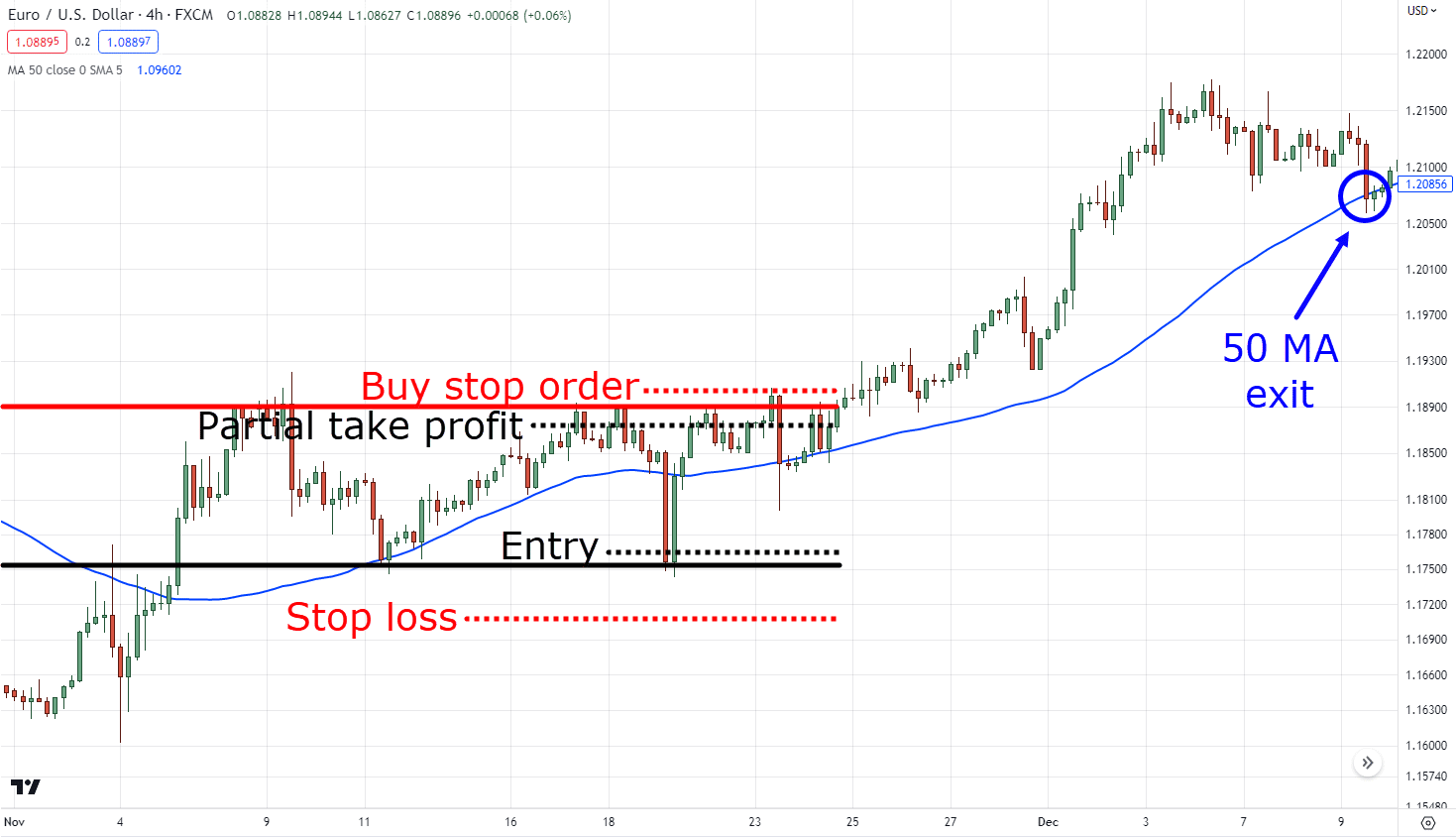

Bonus: Partial take profit before resistance, then place a stop order above breakout to trail stop loss

Still here?

Great!

Because if you should take things to the following level, then listed here are three bonus suggestions for you…

- Once your trade hits your first goal profit, only take 50% of your profits

- When you’ve taken partial take profits, place a stop order on the breakout

- Trail your stop loss using a medium-term moving average

Ready to succeed in the climax of this trading guide?

Then keep reading!

Once your trade hits your first goal profit, only take 50% of your profits

Remember our limit order setup where you entered the lows of a variety while the long-term trend is undamaged?

Great!

Because should you resolve to remain within the trade and anticipate the continuation of the long-term trend…

You then can take half of your open profits.

Why would you do that?

Well, doing this is able to put you in a greater psychological state as you may be more comfortable riding the trade longer because you’ve already taken partial profits.

That is sensible, right?

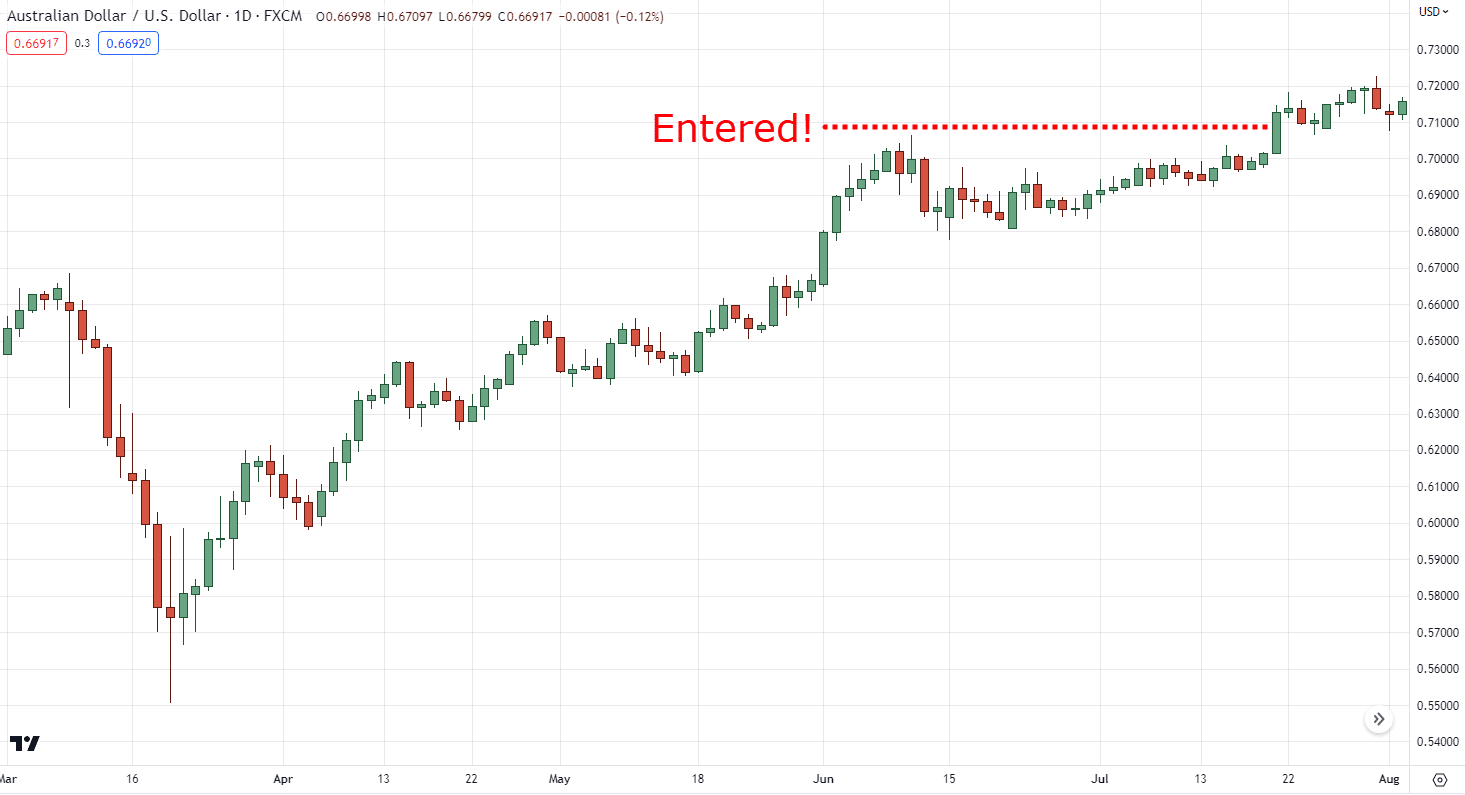

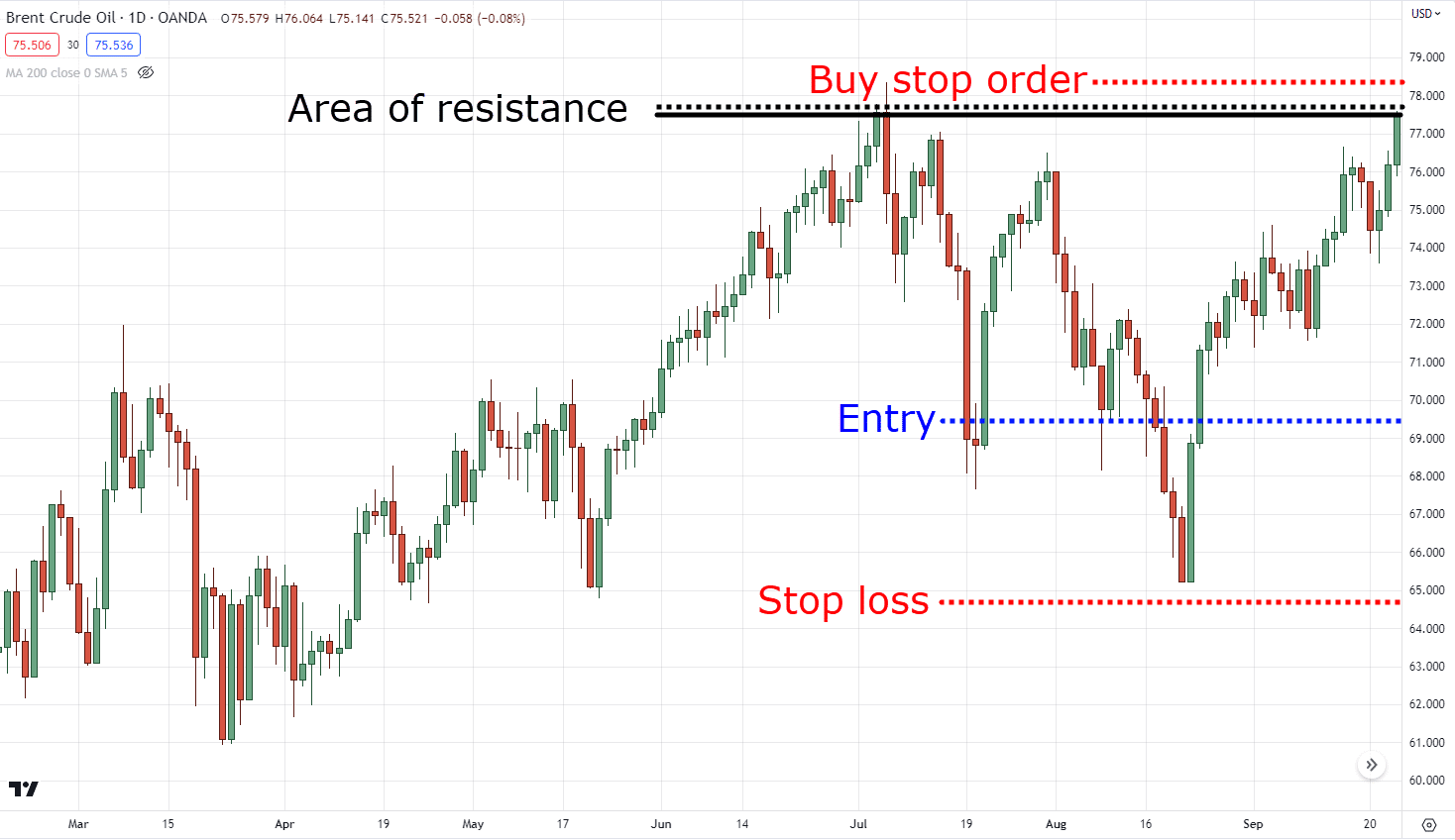

When you’ve partially taken profits, place a stop order on the breakout

Here’s the reality…

We will never guarantee breakouts within the markets.

This is the reason I discussed the word “anticipate” earlier, remember?

And since we cannot guarantee breakouts what will we do?

That’s right.

We only set a stop order.

Because of this you don’t do anything until an actual breakout is confirmed.

Because let’s face it…

False breakouts do occur!

That my friend, is methods to trade what you see.

Not what you think that!

This is the reason if the market does break out and hits your stop order…

Then it’s a transparent sign that the long-term trend is about to resume.

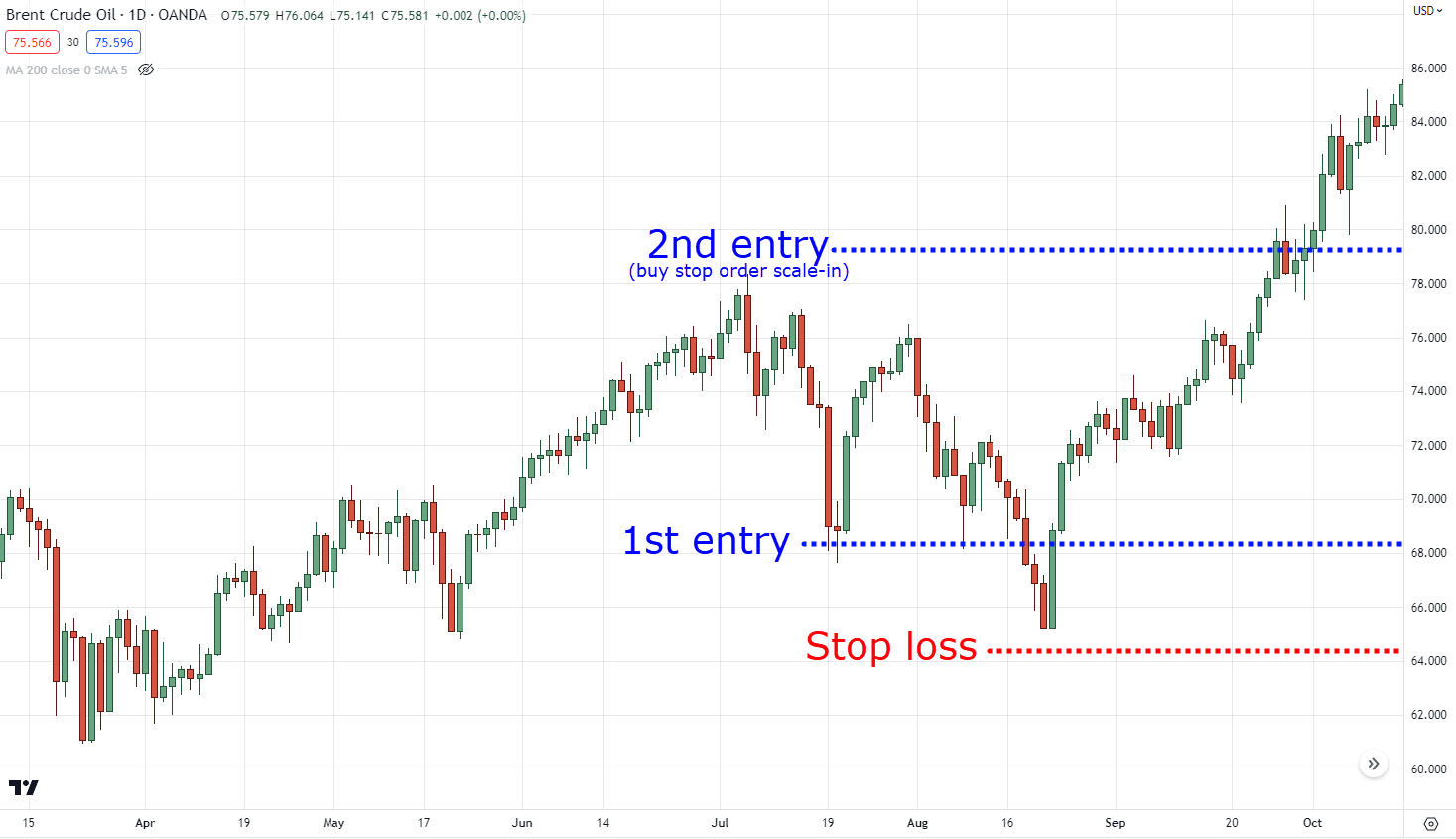

So, you scale into your trade once more!

Lastly, how do you manage your trade this time around?

Here’s a tested and proven solution…

Trail your stop loss using a medium-term moving average

Remember the 200-period moving average to objectively define trends?

Great!

Now just lower that period to a 50-period moving average so that you simply’d only exit your trade if it closes beyond it:

Pretty amazing, right?

With these extra steps, you may each minimize risk and increase your rewards!

Now as promised…

Listed here are a pair more examples of what I’ve taught you today.

BTCUSD Every day timeframe:

EURUSD 4-hour timeframe:

Sugar 4-hour timeframe:

There you will have it!

The key to using each orders!

So, before I end this guide…

Remember to all the time discover the market condition, place the suitable orders, and manage the trade accordingly!

Limit order vs stop order: Which one is the very best and which one must you use?

Sure…

I could have shared with you methods to use a limit order and a stop order together with price motion.

But the reality is that you would be able to use each forms of orders across different trading styles!

And that may overwhelm you!

I feel obligated to be sure that I offer you the “perspective” needed to make use of these orders.

So…

In case you’re a pullback or range trader, you’ll wish to use a limit order

There are numerous trading styles where a limit order will be suited.

That will be trading styles reminiscent of:

- Harmonic pattern trading

- Elliot wave trading

- Mean reversion trading

To enrich those styles with a limit order, you may think about using tools just like the Fibonacci retracement.

However…

In case you’re a breakout or trend trader, you’ll wish to use a stop order

Once more, trading styles where using a stop order will be useful with:

- Momentum trading

- Trend following

And eventually, you need to use a wide range of tools reminiscent of moving averages and the Donchian channel to make it easier to out.

Normally!

Use a limit order for pullbacks and ranges, and use a stop order for breakouts and trends.

Most of all…

Ensure to all the time do your due diligence by testing concepts yourself before risking money!

Conclusion

There you will have it!

The whole lot that you must find out about limit order vs stop order (and more).

Through the use of them appropriately and in the fitting market conditions, you’ll have the opportunity to take your trading game to the following level!

So, here’s a fast recap of what you’ve learned for today’s trading guide:

- A limit order is a variety of order you place below the value to time pullbacks, while a stop order is a variety of order you place above the value to time breakouts out there

- Never place a limit order above the value or place a stop order below the value, moreover, all the time place your orders in areas of value

- You should utilize each limit and stop orders by timing pullbacks and breakouts

- The effectiveness of a limit or stop orders rely upon how well it complements a certain trading style

Congratulations!

You’ve come to the top of this guide!

So, this time…

I would like to listen to your thoughts.

Do you employ a limit or stop orders?

Or do you favor to enter markets manually at their current price?

Let me know within the comments below!