What’s the kicking up candlestick pattern?

Attending to know all of the ins and outs of trading candlestick patterns is significant for skilled traders and people just starting out learning about candlestick charting. In this text, we are going to scrutinize the kicking up candlestick pattern. Listed here are some takeaways you get from our writing:

- Kicking pattern definition

- How does the kicking pattern work?

- What’s Kicking Up Candlestick Pattern – Bullish Kickers

- Example of kicking up candlestick pattern

- Market Psychology of Bullish Kicking Up Pattern

- Bearish Kicking Pattern

What’s a Kicking Pattern – The Kicker Patterns Explained

Reading candlestick patterns may be very essential when you are using trend trading strategies. And the likelihood is high that you just do since trend prediction is on the core of trading in every market.

Technical evaluation patterns in trading are represented in charts using so-called candlesticks. Kicking patterns are composed of two lines, namely two candles of assorted types.

It’s a signal providing data about asset price trends in addition to market psychology. Besides fundamental evaluation, it’s a vital tool to find out market behavior.

As one in every of the rare traded patterns, you should utilize it in almost every trading platform as a component of technical evaluation tools.

Kicking up a candlestick pattern is a reversal pattern. It means it points out the strong reversal in market trends. The reversal happening in the marketplace and identified by these patterns often occur to a sudden change in financial policies, turmoils in the worldwide economy, and similar.

Due to this fact it’s a component of trend trading and one of the crucial used patterns on this trading strategy. There are two sorts of kicking patterns. These are bearish kicking candlestick patterns and bullish kicking up candlestick patterns.

It’s essential to understand the difference between gap and kicker patterns. The previous occurs more often than the latter. Actually, the kicking patterns are regarded as a type of exotic and rare patterns within the graph evaluation.

How do Kicking Patterns Work In Trading

Markets are the crossroad for sellers and buyers with opposite intentions. Trend trading relies on predicting the behavior of those two groups.

Candlestick patterns reflect their behavior. They’re suitable and reliable tools for liquid and high-volume markets like stocks, Forex, and commodities.

The kicker patterns are touted as probably the most reliable reversal signal in trading. They announce dramatic changes in fundamentals for a particular market or an organization.

They may very well be bullish or bearish candles. Also, it could appear just like gap patterns, but they imply different market trends.

It’s a reasonably rare pattern occurring within the charts, however it’s probably the most reliable with regards to market reversal signals. To be able to get a transparent picture of the trend, it is advisable to mix this indicator with other tools for market behavior estimation.

What’s Kicking Up Candlestick Pattern – Bullish Kicking Pattern

It consists of two lines – candles. These two candles are generally known as white and black marubozu candles. It’s most reliable when created in an oversold market.

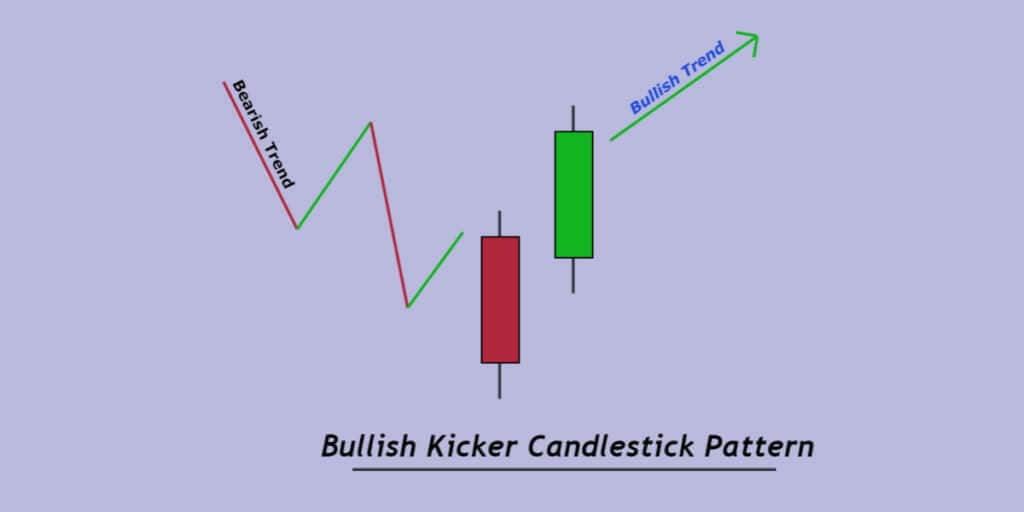

The marubozu candlesticks appear in long lines. The second line’s opening is higher than the primary line’s closing. Bullish kicking patterns are created after a downtrend. Suppose we observe the pattern in a two-day time span.

On the primary day, we see the bearish marubozu candle with an insignificant lower shadow. The following day you may notice the Opening price of the second day of commentary is higher than the closing price of the primary day of commentary of the chart.

A bullish kicking pattern is when a bullish candle opens at or below the close of a preceding bearish candle and closes above the open of the preceding bearish candle. To make it simpler, the body of the green candle must encompass the body of the previous red candle. This is the reason this configuration can be called an “encompassing” configuration.

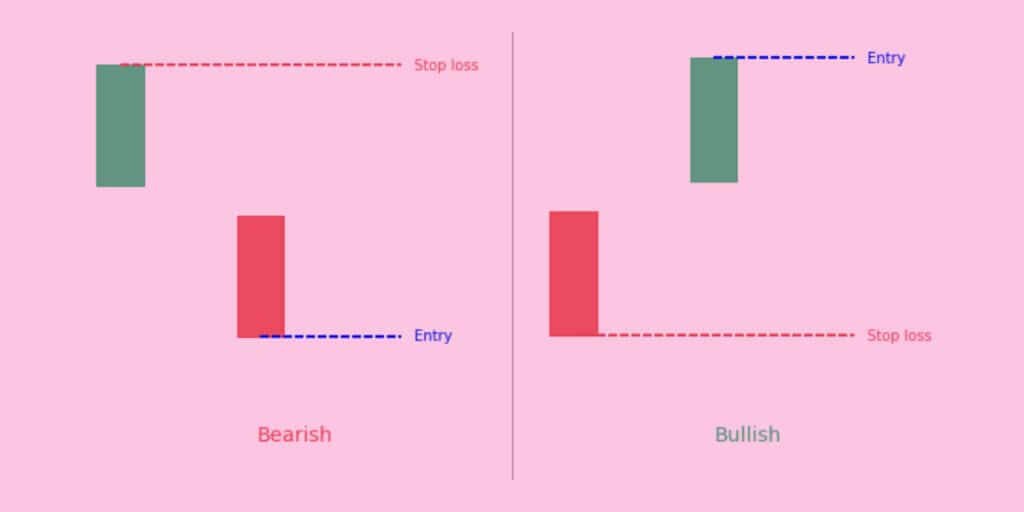

For the test, you’ll open a trade when this configuration appears. The stop loss might be placed below the low point of the 2 engulfing candles and the take profit might be placed at a ratio of 1:1.

You can even use the ATR (Average True Range) indicator which is able to let you know if the bullish candles are large enough to avoid some false signals.

Psychology of Bullish Kicking Up Candlestick Pattern

With a bullish kicking candle, the primary day’s negative candle is a sign that bears are totally on top of things. Anyway, the large gap the next day is a big change in market psychology.

The bulls had the choice to eliminate the losses the bears got the sooner day and add further gains with the gap and long bullish candle.

What makes this trend reversal so powerful is that a complete day of bearish trends placed on the very starting is currently losing money.

At the purpose when these shorts give up and are compelled to repurchase these shorts, much serious purchasing strain might be added to the market driving costs up considerably further.

What’s a bearish candlestick pattern?

We cannot talk in regards to the kicking up without mentioning its opposite pattern. It’s a bearish candlestick pattern. So what does it represent? It’s an announcement of a downtrend in an asset’s value. Mostly it happens after a protracted uptrend and is a signal of a brand new reversal within the downtrend. It’s a highly reliable signal when it occurs in an overbought market.

The body of the 2nd candlestick must swallow that of the primary (and never necessarily swallow the shadows).

The first candlestick should be green (with some exceptions, see below), and the one who swallows it should be red.

The shadows of the 2nd candlestick are preferably short.

Such a structure is formed when, following an uptrend, the day after a day’s advance, prices open higher than the day gone by’s close, however the bullish forces dry up, and costs fall to finally close below the opening of the day gone by. Earnings from the day before are, subsequently, totally erased. That shows that a bearish force is emerging. The lower shadow of the two nd Japanese candlestick should ideally be short since it shows that the bears have taken over and the bulls have did not push prices up.

It needs to be noted that the body of the first candlestick is usually green but that a really small red body, or a Doji, may also be suitable for this structure.

The larger the body of the two nd Japanese candlestick is in comparison with that of the 1 st and the more significant the structure might be. Even when the body of the two nd candlestick swallows the body of several candlesticks, the signal will only be higher. This can be the case in the instance above, where the candlestick’s body swallows the bodies of the 2 previous candlesticks. Strong volumes could also confirm the figure.

Regardless of the quality of the signal, it would be higher to attend for confirmation of the figure by the next candlestick, which may have to open lower if we would like to sell on D+1 (D being the day of the 2nd candlestick of the engulfing structure ) or be red if we prefer to attend for the following close and sell on the opening on D+2.

The invalidation threshold could also be placed either above the very best formed by the structure or in response to the third method, depending on the participant’s investment horizon.

However, it’s interesting to mix the commentary of reversal patterns with support and resistance lines. A bearish engulfing can thus sometimes form at the extent of resistance.

Kicking Up Candlestick Pattern – Bottom line

Kicking up candlestick patterns is one of the crucial reliable trend signals for financial markets trading. Spotting trending movements in a stock or other market types could be very lucrative. Nonetheless, being caught in a reversal is what most traders fear.

A reversal is any time an indication that the trend direction of an asset is changing. Having the ability to spot the potential for a reversal tells a trader that they need to exit their trade when market conditions not seem favorable.

Reversal signals can even trigger latest trades, because the reversal may cause a brand new trend to begin.

Nonetheless, any indicator used independently may cause problems for a trader. Considered one of the pillars of technical evaluation is the importance of confirmation. Technical trading is far more reliable when a secondary indicator confirms the signals.

Given the danger of trying to select a market top or bottom, it is crucial that, at a minimum, the trader uses a breakout of the trendline to substantiate a signal and at all times uses a stop loss in case it breaks. disillusioned. The Relative Strength Index (RSI) also gives reliable confirmation at many negative divergence reversal points in our tests.

Moves to latest highs or lows cause reversals. Due to this fact, these models will proceed to occur out there in the long run. An investor can watch some of these patterns, together with confirmation of other indicators, on current price charts.