sabthai / Depositphotos

- Cost inflation is predicted to peak out in fiscal Q4 2022, but they expected it to peak in Q2 and Q3 2022, which it didn’t

- Good Yr gained market share to be the most important alternative tire maker within the U.S.

- The falling U.S. dollar index and China’s re-opening may provide some relief from rising input costs

- Shares trade at 8X forward earnings with a 4.7% short interest

- 5 stocks we value more highly than Goodyear Tire & Rubber

The Goodyear Tire & Rubber Co (NASDAQ:GT) stock fell just over (-50%) in 2022. The largest issue plaguing its business has been continued cost inflation and the impacts of a powerful U.S. dollar. Nonetheless, as these conditions begin to wane in 2023, Goodyear should see margin expansion in North America.

Get The Full Walter Schloss Series in PDF

Get the whole 10-part series on Walter Schloss in PDF. Reserve it to your desktop, read it in your tablet, or email to your colleagues.

Q4 2022 hedge fund letters, conferences and more

Gates Capital Management Reduces Risk After Rare Down Yr [Exclusive]

Gates Capital Management’s ECF Value Funds have a incredible track record. The funds (full-name Excess Money Flow Value Funds), which spend money on an event-driven equity and credit strategy, have produced a 12.6% annualised return over the past 26 years. The funds added 7.7% overall within the second half of 2022, outperforming the three.4% return for Read More

Find A Qualified Financial Advisor

Finding a professional financial advisor doesn’t need to be hard. SmartAsset’s free tool matches you with as much as 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

For those who’re able to be matched with local advisors that may show you how to achieve your financial goals, start now.

Europe’s essential problem has been its soaring energy costs stemming from the Russia-Ukraine conflict. As the most important alternative tire company within the U.S., the Company has been fighting higher input costs stemming from cost inflation across the board, from raw materials to transportation and labor. Net sales still climbed 8% after applying a 15% price hike within the U.S.

They surpassed Compagnie Générale des Établissements Michelin SCA (OTCMKTSL MGDDY) as the highest alternative tire manufacturer within the U.S. Falling oil prices have helped get commuters back on the road because the Company expects normalization to kick in.

Cost Inflation is Still Growing

The massive problem with its Q3 2022 performance was, once more, cost inflation bolstering input costs. It saw raw material costs rise, labor costs, energy, and transportation. While it was in a position to control the impact in North America with price hikes, Europe was a distinct story as energy costs have been skyrocketing. Europe was the large problem in Q3.

Management Losing Credibility

Cost inflation is probably the most significant hurdle for Goodyear. Unfortunately, management has been bad at predicting a peak. That they had predicted the height within the prior quarter believing it occurred in Q2 after which in Q3, which it didn’t. Now they’re predicting it to peak in its next quarter Q4 2022.

The market didn’t buy it as shares sold off regardless. The massive query is will management be zero for 3 within the upcoming quarterly release? The Company expects input costs to proceed rising at a rate of $300 million to $400 million in the primary half of 2023, with the majority of the YoY increase in Q1 2023.

Eco-Tires Displayed at CES 2023

Goodyear has been exploring tires created from sustainable materials moving away from relying solely on rubber. On the 2023 Consumer Electronics Show (CES), the Company displayed recent demo tires that contain 90% sustainable materials with improved rolling efficiencies to enhance energy savings even on electric vehicles.

The tires comprised surplus soybean oil quite than petroleum to keep up pliability and silica from rice husk residue to enhance road grip and fuel efficiency. This improved from the prior 12 months after they created tires comprised of 70% sustainable material. The Company hopes to release a 100% sustainable tire by 2030. The prototype tires are a part of Goodyear’s commitment to reaching zero emissions by 2050.

FX Relief and Cooper Tire Synergy

Once more, Europe has been the issue spot, even regarding FX headwinds. The strong U.S. dollar dramatically impacted net sales, from 15% growth in constant currency to simply 8% YoY.

Nonetheless, the U.S. dollar index has fallen over (-10%) since its highs in late September 2022. This might create a small amount of relief in its Q4 2022 numbers. Moreover, its synergies with its Cooper Tire & Rubber acquisition is predicted to create $165 million in cost savings inside two years of its acquisition which was accomplished in June 2021.

The acquisition helped bolster Goodyear’s footprint in the sunshine truck and SUV market that Cooper focuses on, not to say the extra vehicle maintenance and repair services that may be cross-marketed to Cooper Tire customers. They compete with Driven Brands Holdings (NASDAQ: DRVN) within the auto repair segment. Finally, the China re-opening may boost its business in China as commuters take to the roads.

Analyst Upgrade

Shares of Goodyear Tire were upgraded to Chubby at Keybanc Capital Markets with a $39 price goal. The MarketBeat MarketRank™ Forecast projects 24.48% earnings growth to $1.78 per share with a 40.5% upside price goal of $16.19 and a 2.5 out of 5-star rating.

Descending Triangle Breakdown Reversal

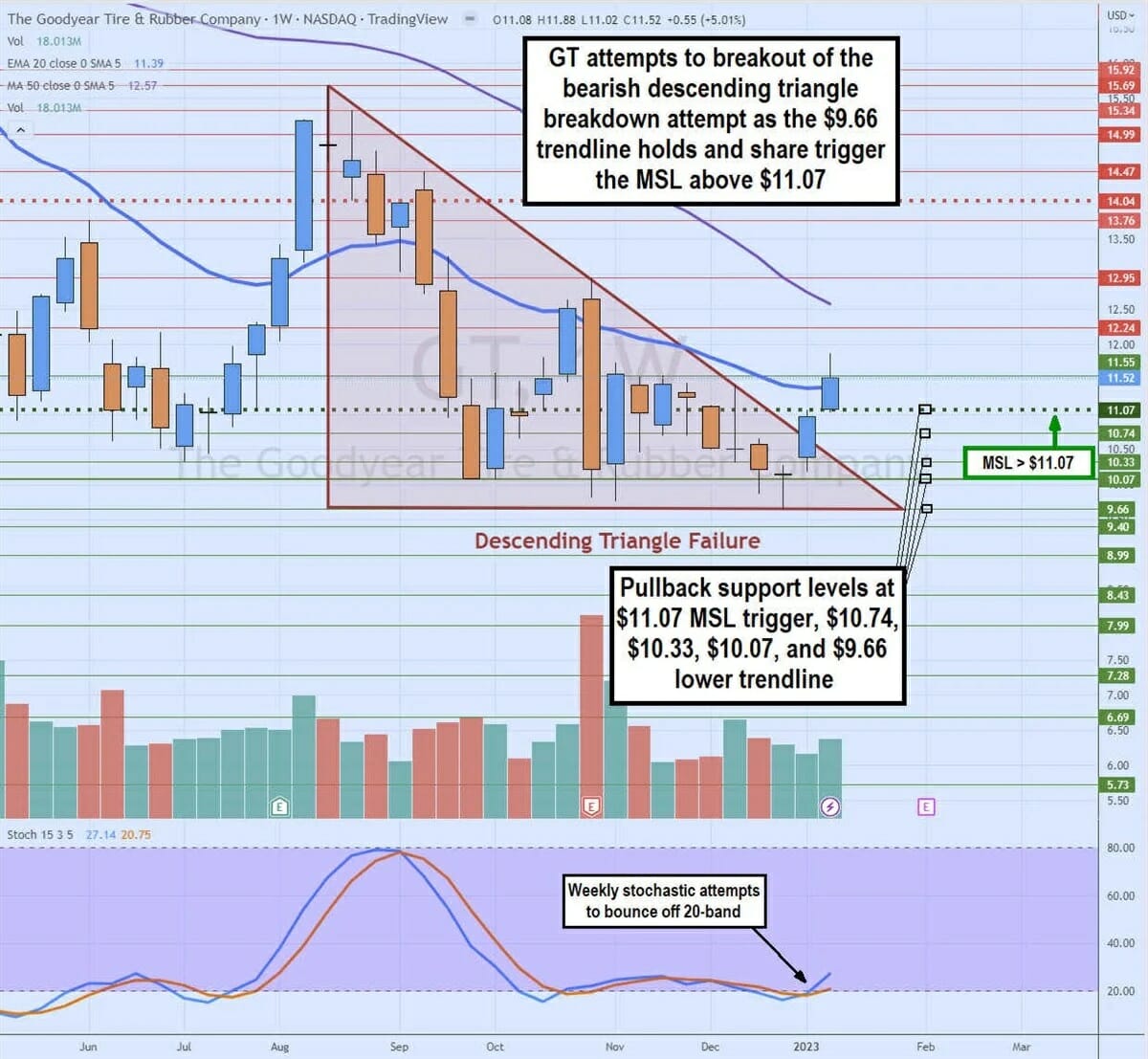

GT stock had been making lower highs on bounces while maintaining a flat-line support of around $9.66 since August 2022. This is known as a weekly descending triangle pattern comprised of a falling upper trendline intersecting with a flat lower trendline.

Eventually, the lower highs on the bounces cause shares to crumble under the lower trendline to trigger a breakdown and one other downtrend to lower levels. GT was set to interrupt down at the top of December 2022. Then an interesting thing happened in January 2023.

Buyers emerged that bought the dips and squeezed shares up through the falling trendline of the triangle to trigger a weekly market structure (MSL) buy signal on the breakout through $11.07.

The weekly stochastic has crossed back up through the 20-band, attempting to extend the buying momentum. The weekly 20-period exponential moving average (EMA) resistance is being tested at $11.39, with the weekly 50-period MA at $12.57. Pullback support levels sit at $11.07 MSL trigger, $10.74, $10.33, $10.07, and the $9.66 lower flat trendline representing the underside of the triangle.

Must you invest $1,000 in Goodyear Tire & Rubber straight away?

Before you concentrate on Goodyear Tire & Rubber, you will need to listen to this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients every day. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to purchase now before the broader market catches on… and Goodyear Tire & Rubber wasn’t on the list.

While Goodyear Tire & Rubber currently has a “Hold” rating amongst analysts, top-rated analysts imagine these five stocks are higher buys.

Article by Jea Yu, MarketBeat