Right here we go. The brand new 12 months is upon us, and in preparation, the Avenue’s analysts have been lining up their prime picks for 2023. It’s a little bit of cliché, however a enjoyable one – and one that may additionally convey some fascinating shares to buyers’ discover.

Keep in mind that the analysts have been watching the markets all 12 months, maintaining shut monitor of previous and present efficiency, they usually’ve constructed up an image that places shares into perspective. For the retail investor, the 12 months’s accrued evaluation is a gold mine of knowledge, serving to convey some sense to the market – and the analysts’ High Picks are an amazing software for reducing proper to the chase.

So, let’s get the most recent scoop on some analysts’ High Decide shares for the incoming 12 months. We’ve ran them by the TipRanks database to additionally gauge common Avenue sentiment towards these names. Listed here are the main points.

Cytokinetics (CYTK)

First up on our ‘prime decide’ checklist is Cytokinetics, a clinical-stage biopharma agency engaged within the discovery and improvement, for commercialization, of first- and next-in-class muscle activators and inhibitors, for the remedy of debilitating illnesses that compromise muscle perform and efficiency. The corporate’s drug candidates are small molecules engineered to impact contractility.

Over the course of 2022, this firm benefited from having a number of packages within the pipeline – and that’s nonetheless a bonus. However final month, the corporate introduced that the FDA’s Cardiovascular and Renal Medication Advisory Committee, by an 8 to three vote, determined that, primarily based on Section 3 trial outcomes, the corporate’s drug candidate omecamtiv mecarbil didn’t present advantages that ‘outweigh its dangers for the remedy of coronary heart failure with lowered ejection fraction (HFrEF).’

Apparently, nonetheless, in what may appear uncommon conduct, the inventory surged forward following the damaging choice. That’s as a result of the choice now lets the corporate focus its energies on the drug thought-about to have the larger potential.

The corporate has one other Section 3 drug candidate, aficamten, which can also be nearing the industrial stage. This drug candidate is present process the Section 3 SEQUOIA-HCM research testing the drug on sufferers with symptomatic obstructive hypertrophic cardiomyopathy (HCM), with enrollment at 70 websites within the US.

Cytokinetics has loads of money accessible to cowl bills associated to the shift in focus. As of the tip of 3Q22, the corporate had money and liquid property totaling $896.2 million, in comparison with mixed R&D and G&A bills of $110.9 million, giving a money runway adequate for 8 quarters of operation.

It is a key issue for JMP’s Jason Butler, who has excessive hopes for aficamten. “The corporate famous that it expects to finish 2022 with >$800MM in money which we consider is a powerful foundation to fund broad aficamten improvement and industrial readiness. Administration additionally commented that it’s going to present an replace on enrollment within the aficamten Section 3 SEQUOIA-HCM trial within the close to time period and indicated that progress is encouraging. We view outcomes from this trial in 2H23 as a key worth inflecting occasion for the corporate and drives our conviction for CYTK as a prime decide for 2023.”

Accordingly, Butler provides shares in CYTK an Outperform (Purchase) score, with a $71 value goal that means a achieve of 55% within the coming 12 months. (To observe Butler’s monitor report, click here.)

Cytokinetics will get loads of help on Wall Avenue; Its Robust Purchase consensus score is predicated on 11 latest critiques that embrace 10 Buys over simply 1 Maintain. The shares are promoting for $45.82 and their $63.18 common value goal suggests a one-year upside potential of 38%. (See Cytokinetics’ stock forecast at TipRanks.)

Calix, Inc. (CALX)

From biotech we’ll shift to cloud tech, and have a look at Calix. This firm presents cloud computing and software program options within the communications trade, with platforms and providers for broadband suppliers and different digital communications prospects. Calix’s merchandise enable enterprise prospects to drive enterprise and buyer interactions extra effectively, for efficient monetization.

This firm’s concentrate on enabling broadband and fiber comes at an opportune time, because the Federal Authorities’s latest infrastructure invoice consists of funding for such tasks, particularly in rural areas. This units up telecom corporations – and their supporting adjuncts, like Calix – for good points going ahead. And in some instances, these good points have already develop into seen.

Calix beat its income and earnings estimates in its final reported quarter, 3Q22. The corporate confirmed $236.3 million on the prime line, in comparison with beforehand printed steerage of $211 million to $217 million. The highest line was additionally up 37% year-over-year and got here in $21 million above the analysts’ expectations. On the backside line, non-GAAP EPS was reported at 34 cents, down from the 36 cents in 3Q21 – however nicely above the 18 cent to 24 cent EPS forecast within the steerage, and nicely above the 23 cents analysts had predicted.

In his protection of CALX shares for Needham, analyst Ryan Koontz writes, “Broadband and fiber deployments are anticipated to see a number of extra years of sustained progress, even in mild of a difficult macro, and stay prime of thoughts as we enter 2023. We designate CALX our prime decide for the 12 months and add it to Needham’s Conviction Listing… We see CALX in its infancy of upsell for its Calix Cloud software program merchandise which, provide recurring, excessive margin subscription income that may additional remodel its working mannequin. A various, non-concentrated buyer base additional reduces threat whereas easing provide chain and a just lately elevated CEO instill execution confidence.”

Quantifying this stance, Koontz places a Purchase score right here, with a value goal of $88 that signifies room for a possible upside of 29% within the 12 months forward. (To observe Koontz’ monitor report, click here.)

The Robust Purchase consensus score on this inventory is unanimous, primarily based on 7 latest critiques from the Wall Avenue analysts. The shares are buying and selling for $68.43 and the $81.57 common value goal implies {that a} achieve of 19% lies forward. (See Calix’s stock forecast at TipRanks.)

Cepton (CPTN)

Final on in the present day’s checklist is Cepton, a maker of automotive LiDAR techniques. These are the most recent phrase in digitally primarily based, laser ranging know-how, and signify the state-of-the-art for automotive sensor know-how, with notably helpful purposes within the growing autonomous automobile area of interest. In that area of interest, LiDAR would be the ‘eyes’ of the automotive, and the techniques must be each correct and extremely detailed. Cepton prides itself on delivering LiDAR items which are each dependable and scalable, with lengthy vary, excessive decision, and three-dimensional notion.

LiDAR techniques even have purposes in different fields, reminiscent of satellite tv for pc mapping. Cepton is concerned in non-automotive purposes, and its LiDAR items have discovered houses in ‘good metropolis’ applied sciences, enabling pedestrian, highway, and rail site visitors analytics. They can be present in industrial robots and floor autos.

The automotive sector of the LiDAR enterprise is the principle attraction, nonetheless, and Cepton has a strong base there. The corporate is a associate with the Large 3 automaker GM, and supplies sensor items for a number of platforms, together with two upcoming Cadillacs. And, throughout Q3 of this 12 months, Cepton signed an settlement to obtain a $100 million funding from the Japanese authentic tools producer (OEM) Koito, which is able to present funding for the corporate’s subsequent stage of progress and LiDAR scaling.

Cepton is within the early phases of its progress, and the marketplace for LiDAR techniques is simply starting to open up. The corporate reported 3Q22 product income of $1.8 million, up 171% y/y. The agency’s web lack of 11 cents per share was a slight enchancment over the 12-cent loss reported within the year-ago interval. Cepton expects to see between $7 million and $9 million in whole income for calendar 12 months 2022.

5-star analyst Gus Richard, of Northland Securities, notes that Cepton has the ‘proper product’ for the quickly increasing automotive LiDAR trade, and he writes, “We consider that a lot of the auto OEM lidar exercise includes 4 corporations with CPTN being one among them. Two top-tier auto OEMs have moved from the RFI (request for data) stage to RFQ (request for citation). RFQ consists of value discussions and automobile integration. One of many RFQs may very well be a lifetime award of over $1B. The Firm has moved into a sophisticated engagement with a third OEM, a prime 10 OEM in North America. We consider that CPTN additionally just lately engaged with a smaller European OEM.”

All of this provides as much as a “High Decide” from Richard, with an Outperform (Purchase) score, and a $4 value goal that means a strong upside of 215% by the tip of the 12 months. (To observe Richard’s monitor report, click here.)

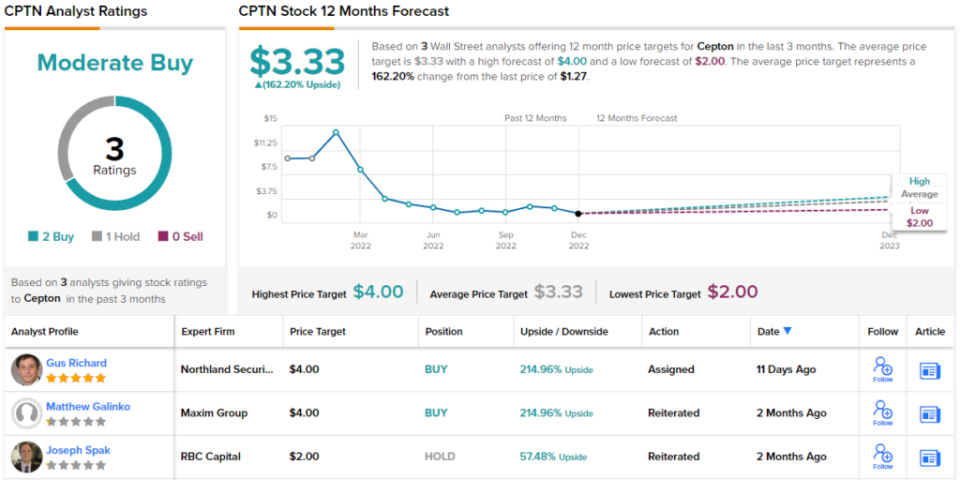

Total, Cepton holds a Average Purchase score from the analyst consensus, primarily based on 3 critiques together with 2 Buys and 1 Maintain. The shares are priced at $1.27 and have a median goal of $3.33, suggesting a one-year upside of 162%. (See Cepton’s stock forecast at TipRanks.)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.