Klaus Vedfelt

Introduction

The SEC has proposed amendments to reform Regulation NMS. But there are higher ways to reform the NMS. This text lays out the primary of two NMS reform agendas. Each these proposed reform agendas obey my three rules of thumb for improving the financial market structure.

- The reformed system must be safer, with lower systemic risk.

- Provide a tighter bid-ask spread to retail investors.

- Provide greater investor transparency than the old one.

The proposal is for the SEC to easily require its approved exchanges to co-locate. The article analyzes the results of a single multi-exchange location on the prices and efficiency of the equities market.

The present system

The present NMS is characterised by many exchanges that don’t compete. They’re near-identical and multiply the full resource cost of all exchange trading. Setting aside the irrelevant low-volume not-publicly-held latest exchanges (IEX, MEMX, and LTSE) there are 12 SEC-approved stock exchanges owned by three publicly held exchange management corporations (ICE, NASDAQ, and CBOE Global Markets). The three big firms own multiple exchanges to multiply the firms’ receipt of SEC payments and broker-dealer payments resulting from the SEC’s NMS requirements, promulgated in its present form in 2005.

There are two symptoms of failure the present system displays.

- The exchanges now primarily provide execution services to high-frequency algorithm-generated transactions. Retail investors go elsewhere. The multiple SEC-approved exchanges are not any longer a crucial source of fills for retail investors. The bid-ask spread from exchange market makers is simply too wide to compete with the bid-ask provided by OTC broker-dealers often called wholesalers. In brief, the NMS does nothing to satisfy the SEC’s mandate to supply low-cost efficient trading for retail investors.

- Retail brokers not consider using exchanges to execute customer orders. These brokers typically bundle their orders, thereby creating large enough order sizes to draw broker-dealer wholesale trading firms that pay retail brokers for his or her order flow (a practice often called Payment for Order Flow (PFOF)).

The NMS unintentionally rewards exchange management firms for adding to the variety of exchanges. There’s nothing magic in regards to the existing 12 exchanges. The SEC realizes that if permitted, the exchange management firms would add much more exchanges.

The regs of NMS add to the resource cost of retail investor transactions because profit-maximizing market makers will set bid-ask spreads wide enough to permit their very own High-Frequency Traders (HFTs) to make a profit on inter-exchange arbitrage while paying the exchanges’ colocation fees.

The bid-ask spreads generated by exchanges, often called National Best Bid and Offer (NBBO), are so wide that wholesale broker-dealer firms make a benefit from buying retail orders and filling them at prices contained in the NBBO, then arbitraging the retail prices by covering them within the chaos of the NMS.

The effect of high-frequency trading and exchange colocation on retail investors

Exchange management firms have two primary incentives for owning multiple exchanges. First, every major broker-dealer is pressured by its customers and the potential for transactions from arbitrage to co-locate at every SEC-designated exchange. The result’s that exchange management firms can reap colocation fees and maker-taker fees from each added exchange, regardless of what number of there are. HFTs in turn, increase arbitrage profits with each added exchange. The one way the system pays for all these added costs is thru the bid-ask spread paid by retail investors.

The present HFT procedure is to co-locate broker-dealer-owned computers individually at each of the 12 major exchanges. HFT profits are directly related to:

- The space between exchanges

- The variety of exchanges

- And the variety of colocated broker-dealers

Each the price of colocated computers and the profits of HFT firms add to the bid-ask spread exchange market makers show to retail investors. The bid-ask spread reflected in NBBO should be large enough to cover these profits and costs.

The colocation-related profits and costs are a significant share of the resource cost of contemporary equities trading. Yet they’re a value that yields no offsetting advantages to retail traders. They’ve a negative effect on the standard of market prices shown to retail investors and the resource costs of trading.

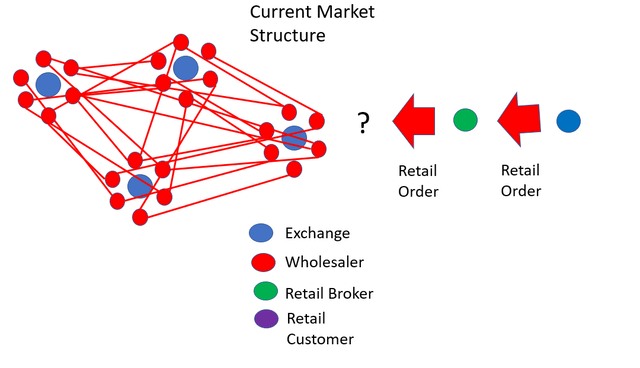

This stylized map of Northern Recent Jersey, where the stock exchange computers are situated, shows how the complex NMS-created market structure creates income for each exchanges and wholesalers that may only be paid by greater bid-ask spreads to retail investors.

Current market structure (Creator)

The SEC seeks to encourage competition amongst exchanges. But based on the speculation of competition, competition will reduce the price of production to a minimum. The associated fee of production in equities trading is the bid-ask spread. With the present system, this competition never happens as evidenced by the proven fact that multiple exchanges are owned by each major firm.

The colocation market structure

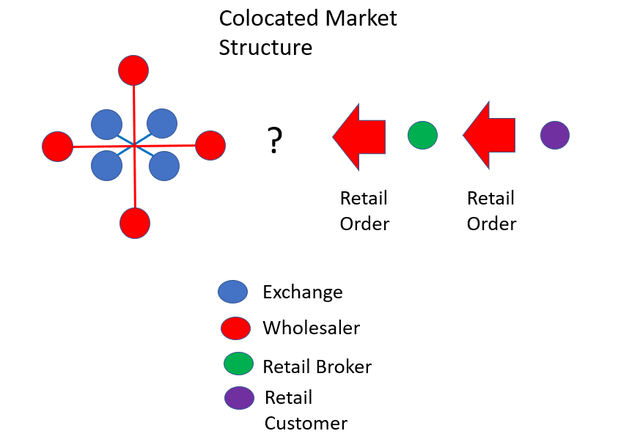

But because the graphic below displays, colocated exchanges return equities trading to the competitive model. Since the exchanges are colocated, every broker-dealer sees the very best bids and offers of all exchanges instantaneously. This eliminates the motivation for market makers to cite different bids and offers on each exchange. Which means bids and offers on all exchanges might be equivalent, eliminating the necessity to shop the exchanges.

Colocated market structure (Creator)

Furthermore, the effect of a single bid-ask spread from all exchanges eliminates the motivation for retail brokers to pay wholesalers to seek out the very best bid or offer. This can end in the return of retail brokers to the exchanges since wholesalers are not any longer arbitraging retail orders against a poor NBBO. Once retail brokers get a greater deal trading directly with the exchanges, payments to wholesalers for order flow might be nonsense. No SEC regulatory involvement is required to eliminate PFOF.

Allowing competitive forces in a colocated exchange environment to eliminate the PFOF that competition within the multi-exchange environment created is much better for the retail investor than leaving the NMS essentially unchanged apart from adding one other layer of resource cost resulting from a second SEC-mandated marketplace where wholesalers compete with one another to reduce the payment for order flow of the NMS. On its face, the addition of one other marketplace will increase the resource cost of equities trading – precisely the mistaken direction to send the equities market structure.

One other implication of the return to competition between exchanges is that equity market-makers will not see any reason to make markets on multiple exchange. This ultimately will bring markets back to the elemental conundrum confronted by the Commodity Futures Trading Commission (CFTC) in futures trading. If the cost-minimizing structure of trading is a single exchange clearing every trade, how is the regulator going to forestall the exchange from seizing monopoly profits?

Conclusion

How can we escape this retail-investor-unfriendly NMS? Some think that retail investors cannot help themselves. Attributable to their numbers and heterogeneity, retail investors are an unruly lot. The meme frenzy of January 2021 displayed the truth that retail investors will not be well thought out. Motives for purchasing a stock corresponding to punishing Wall Street short sellers and the entertainment value of shopping for something in the idea that you will discover someone more silly to purchase the stock at a better price don’t encourage dispassionate policymakers to permit retail investors to administer their very own financial markets.

However, the success of Vanguard Securities’ model, ownership by its own investors, and the highly successful passive stock index funds that followed show that retail investors can sometimes solve their very own problems.

The NMS, however, shows that government regulation isn’t necessarily a greater source of investor assistance. The NMS has inadvertently abandoned retail investors. A regulation like the present SEC proposal to perversely add one other layer to the already excessive resource cost of retail trading, aspiring to reduce the price of PFOF (??) isn’t an intuitive solution.

This much simpler proposal would eliminate PFOF with none added resource cost, actually removing billions from the resource cost of retail investing.

In a follow-up article, I’ll show how retail investors can dramatically reduce the price of clearing, a second way for retail investors to enhance their access to financial market services at a lower cost. This transformation would begin to place retail investors’ financial market structure within the hands of the investors themselves.