This put up is written by Jet Toyco, a dealer and buying and selling coach.

In at present’s buying and selling, we have now a ton of buying and selling setups to select from.

Equivalent to bullish flag sample setups, ascending triangle sample setups, cypher sample setups, and so forth.

Nonetheless…

What do you suppose is one buying and selling setup that’s:

- Easy sufficient to execute

- Straightforward to know

- Is efficient in most markets and timeframe

That, my pal, is the pattern line breakout technique.

Able to know this superior buying and selling setup?

In that case, then let’s get began.

What’s a pattern line and a breakout anyway

Earlier than we get right down to the nitty-gritty particulars…

It’s essential to know the character of the pattern line breakout technique.

As a result of there’s no rattling level utilizing a method if you happen to don’t know its main elements.

So what are these “nature” you could ask?

Nicely, it’s none aside from the:

Let’s get proper into it…

Development line

As you could know, a pattern line is a buying and selling software.

That’s proper.

It’s a buying and selling software, not some magic line in your chart!

It implies that the effectiveness of this software lies in how nicely you employ it.

However right here’s one factor it’s actually good at:

Serving to you establish areas of worth in a trending market

Right here’s what I imply:

So, in an up-trending market, you’d wish to take into account shopping for in these areas!

Easy, proper?

Now, what if the market is ranging or it’s uneven?

Is the pattern line nonetheless helpful?

Good query!

As a result of right here’s one other factor {that a} pattern line is sweet at:

That will help you establish chart patterns.

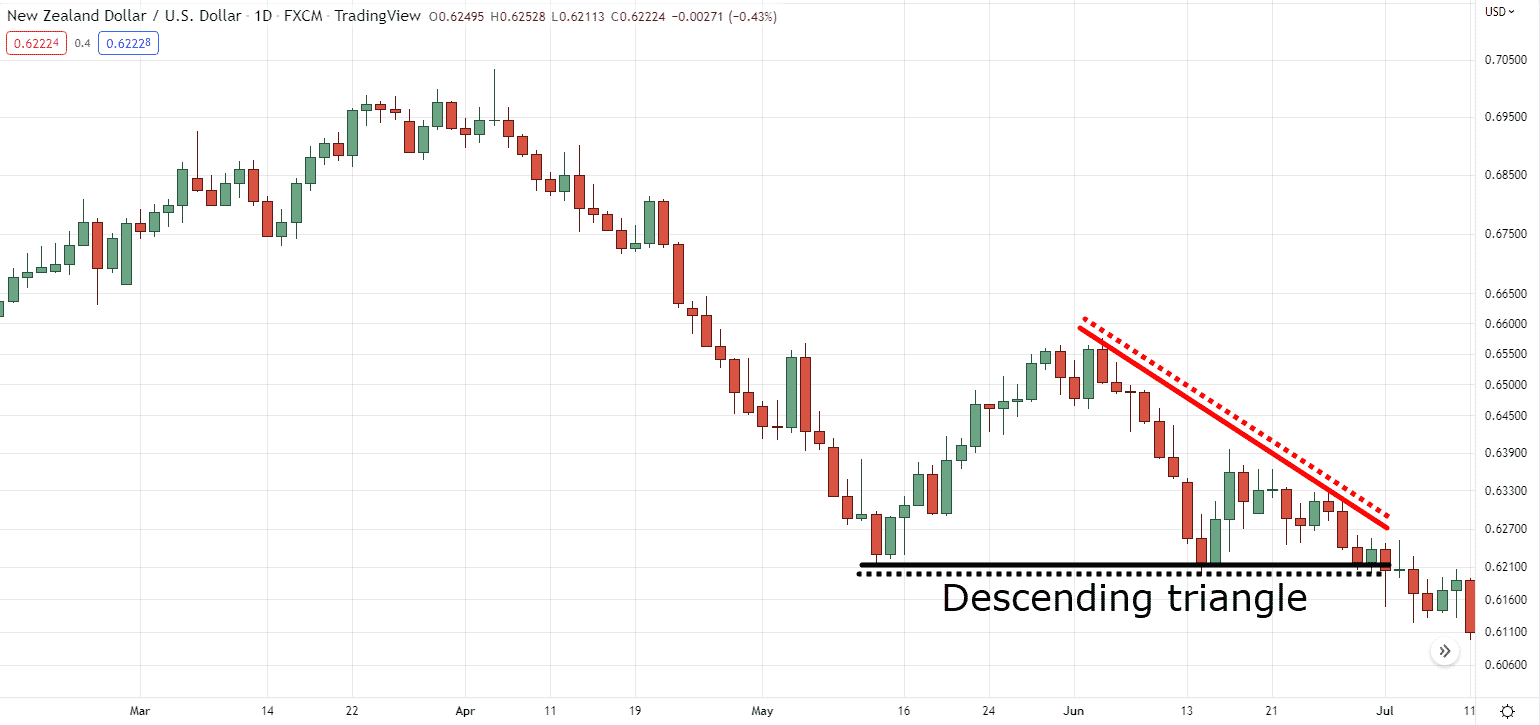

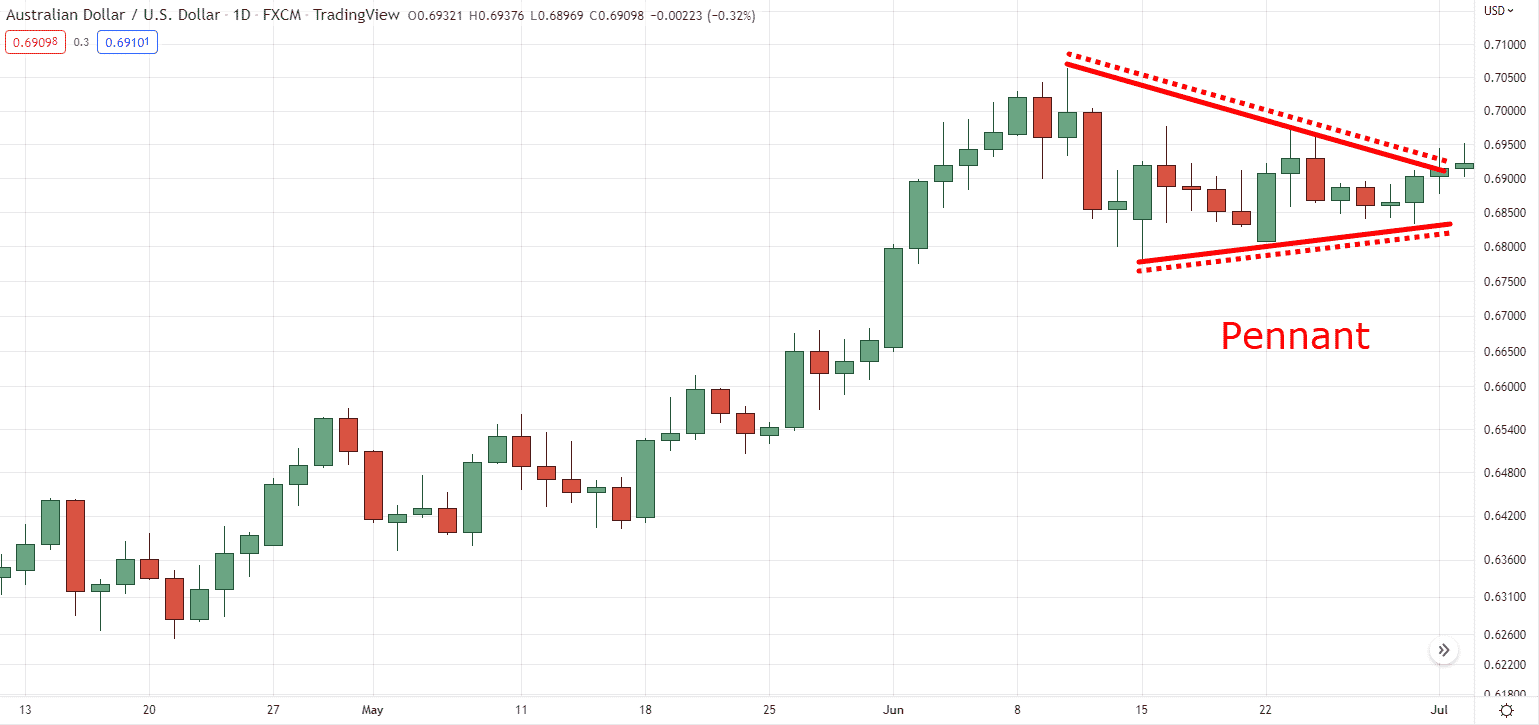

Right here’s what I imply.

Such a reasonably versatile software, proper?

So I’m positive you’re now questioning…

How EXACTLY do you apply the pattern line?

Hear intently.

As a result of that is essential to know in terms of the pattern line breakout technique that I’ll share with you later.

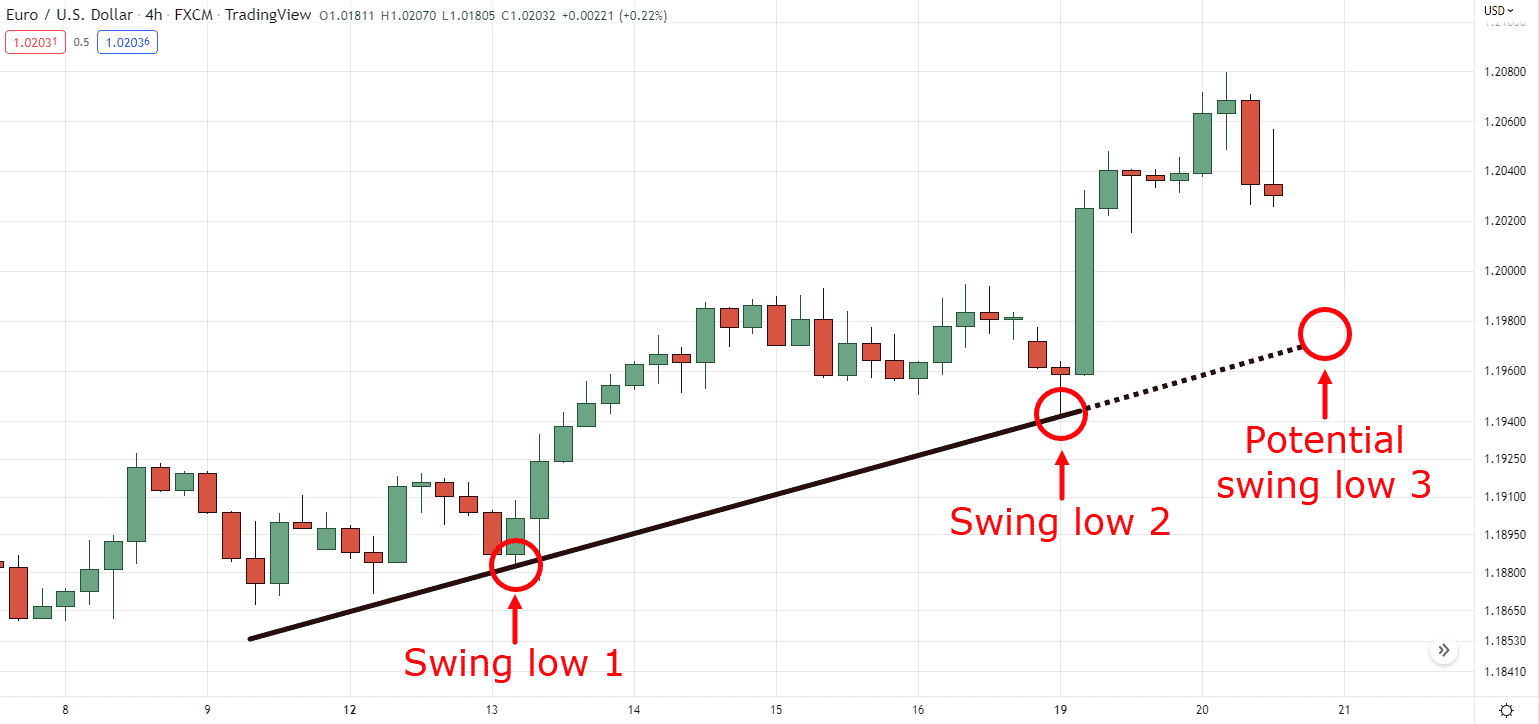

Now, utilizing a pattern line solely wants two elements:

By connecting two swing lows

Right here’s what I imply.

(Vice versa for shorts)

Is sensible?

However If you wish to be taught all there may be to the trendline software and extra, you’ll be able to try this information: The Complete Guide to Trend Line Trading

Subsequent.

Breakout

Right here’s the reality:

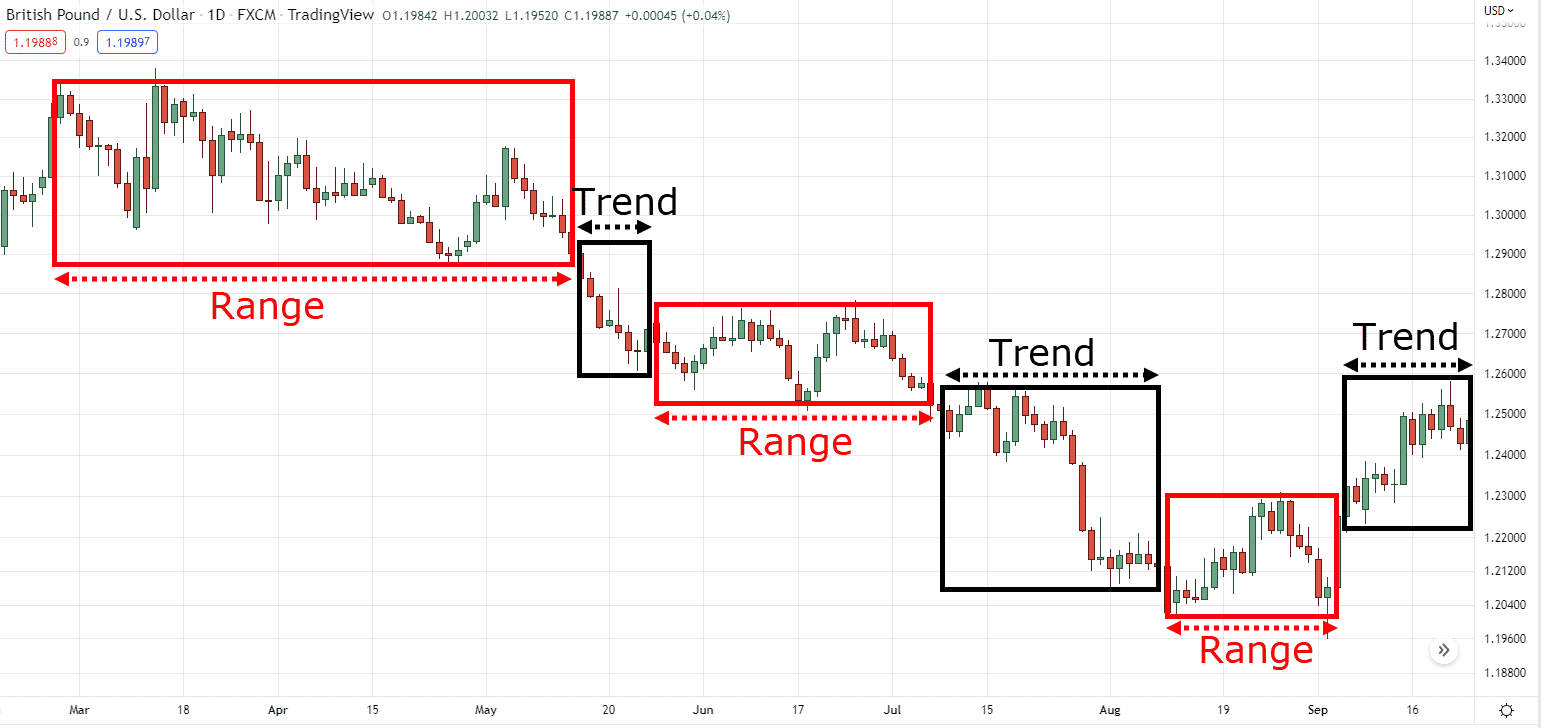

The market strikes in cycles.

From trending to ranging, to trending, to vary, and so forth…

So right here’s the query:

The place precisely are you able to enter this market?

The reply?

Throughout breakouts:

You see…

Earlier than the market goes from ranging to trending, in between these, there are breakouts.

It’s like receiving your diploma as you graduate from school and at the moment are about to be unemployed.

That is sensible, proper?

In fact, there are “false breakouts” just like the diploma you acquired shouldn’t be your identify.

However that’s one other story for an additional day.

So now that you understand what a pattern line and breakout are, what’s a trendline breakout?

Maintain studying…

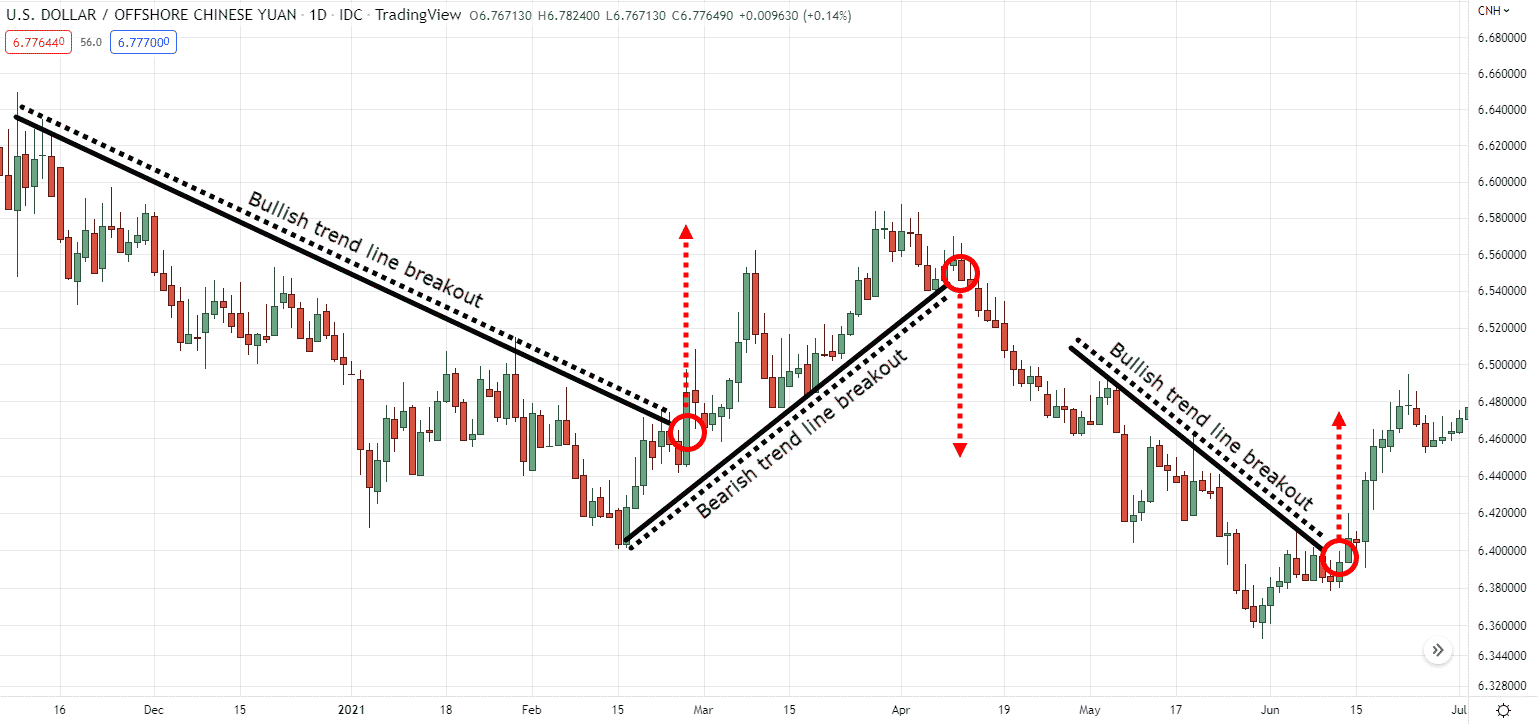

What’s a pattern line breakout and the way necessary can it’s?

Recall:

A pattern line is a software to establish an space of worth in a trending market.

It’s a software to let you know that the pattern is almost certainly going to proceed!

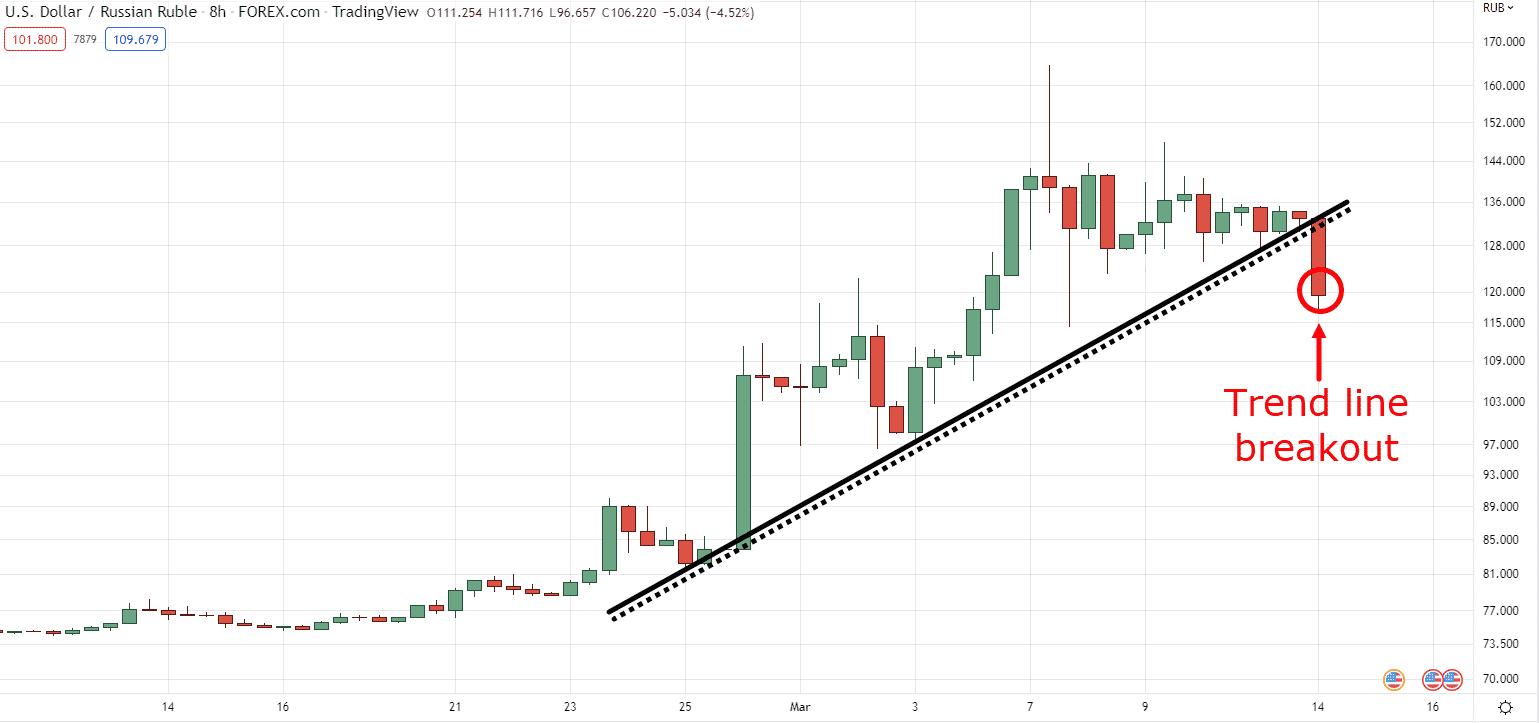

However, what does this let you know when the market closes past a pattern line?

Does this imply that the banks have manipulated the market?

The market is heading right into a recession?

Your dealer is scamming you?

No, no, my pal.

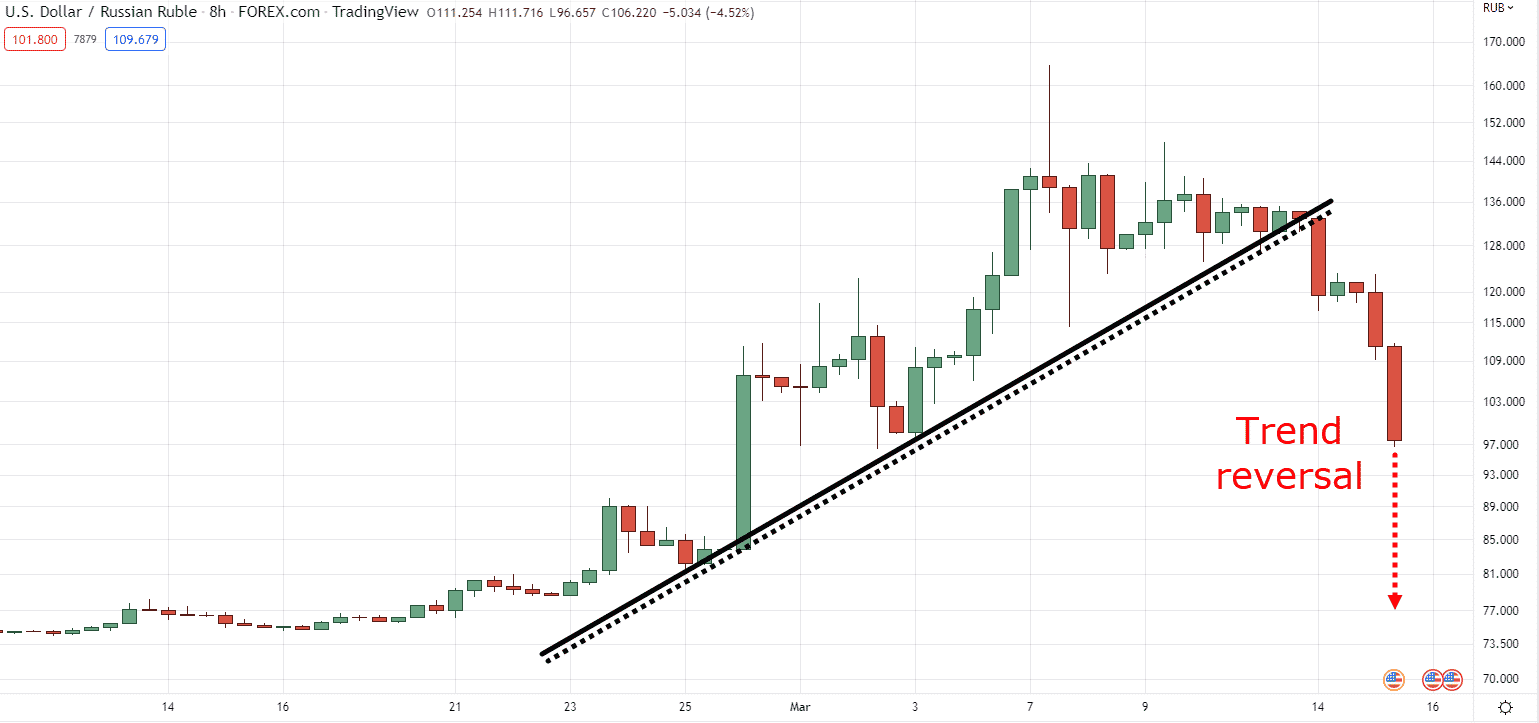

It merely implies that the pattern has reversed!

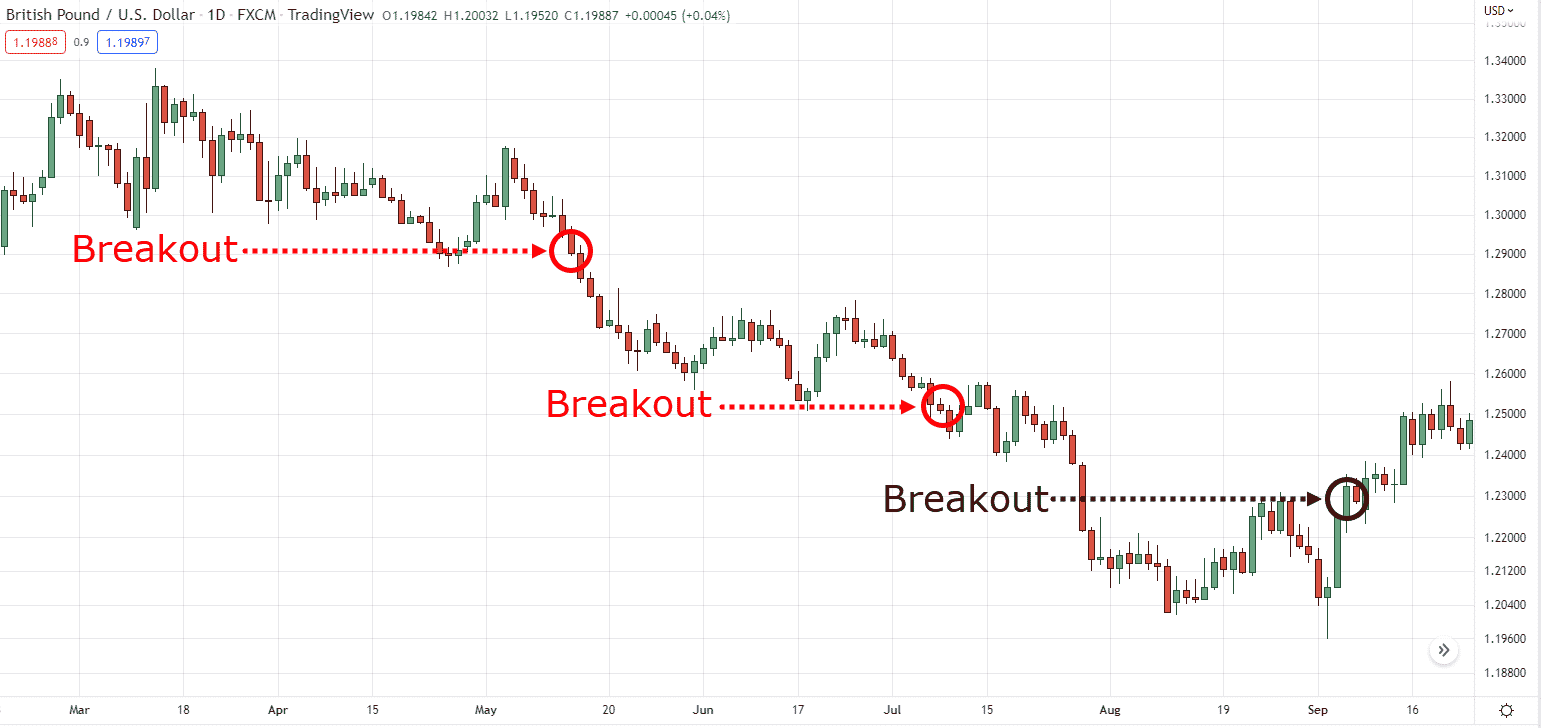

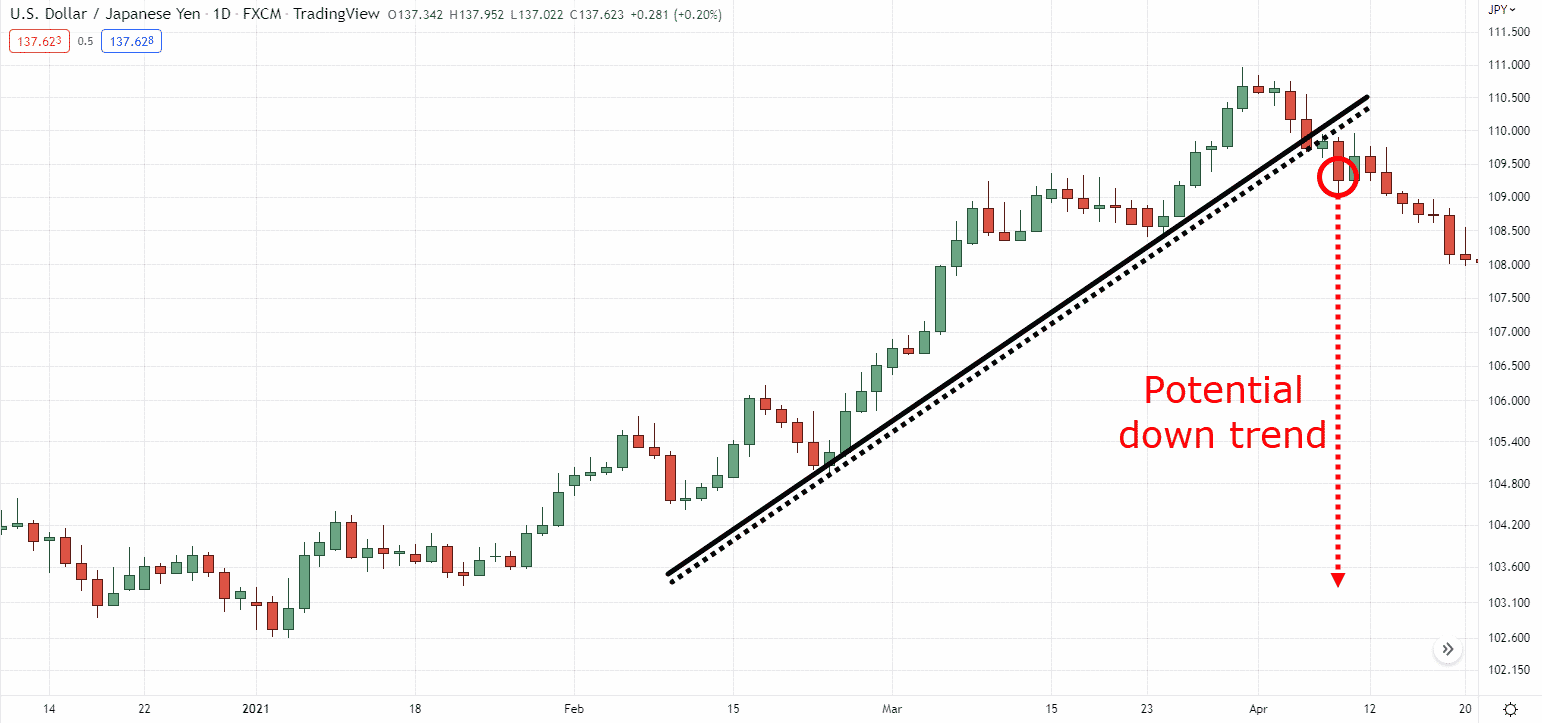

To verify we’re on the identical web page, right here’s an instance of a chart with a number of pattern line breakouts:

At this level, you is perhaps questioning…

“Okay cool, however how is that this necessary and the way can this enhance my buying and selling?

A pattern line breakout can enhance your buying and selling in 3 ways:

- Higher entries

- Probably large threat to reward

- Trailing cease loss

I’ll clarify every of them intimately.

So ensure you’re taking notes!

Higher entries

How does it really feel to be the primary one to order at a fast-food restaurant?

To be the primary one to go inside Disney land and be the primary to hop on a trip?

Feels nice, proper?

And it’s the identical with the pattern line breakout!

Having the ability to time your entries on a pattern line breakout implies that you’re the primary one to hop on a newly creating pattern:

This leads me to my subsequent level…

Probably large threat to reward

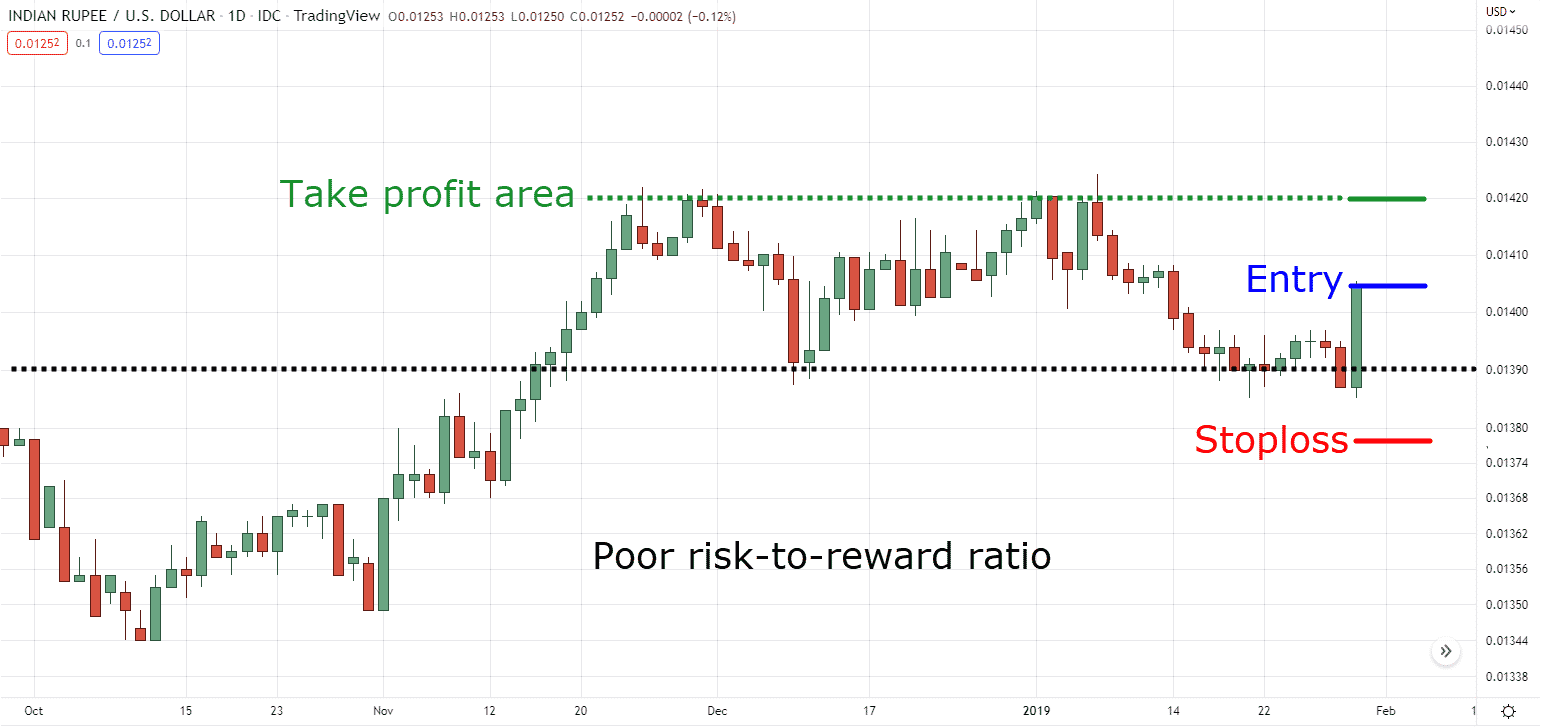

For those who’re a swing dealer I’m positive you perceive that there shall be a variety of instances while you enter a commerce…

However the nearest resistance is simply too shut that you simply resolve to skip the commerce:

Or how about this…

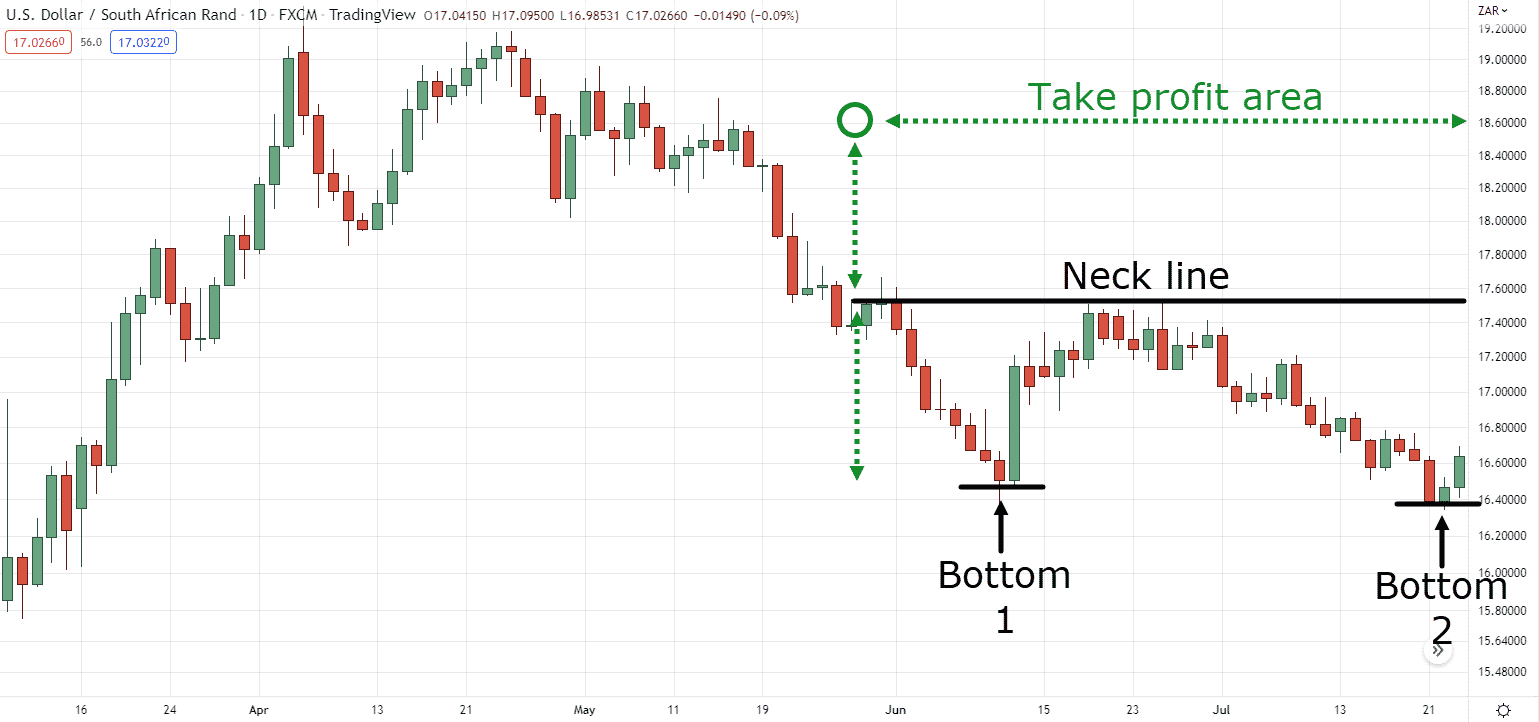

You’re a chart sample dealer.

However you’re restricted to a 1:1 risk-to-reward ratio as a result of it’s a must to “venture” the lows from the highs to establish your take revenue.

Right here’s a double-bottom instance:

It sucks every time it occurs, proper?

What’s the answer?

Add the pattern line breakout setup to your arsenal.

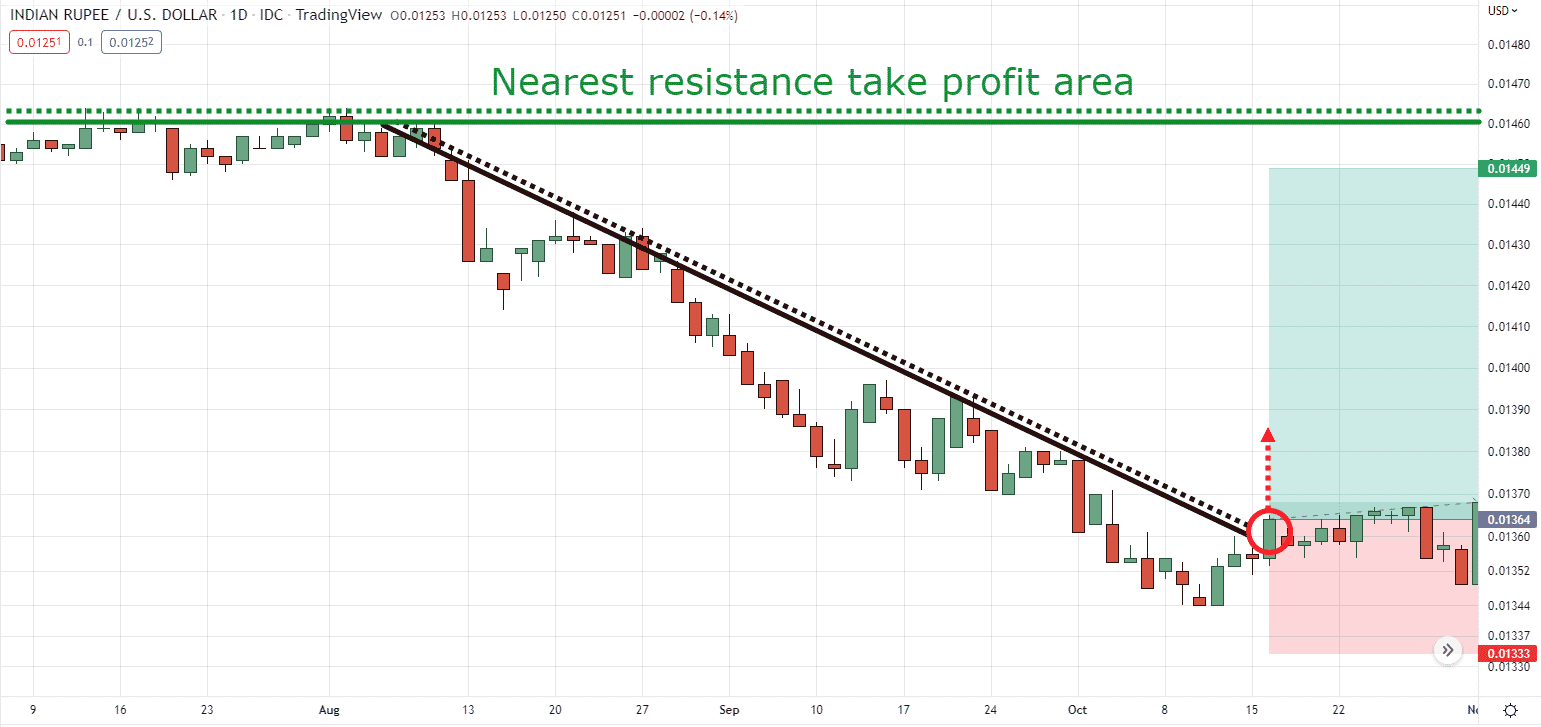

As a result of a pattern line breakout largely offers you sufficient room to seize large risk-to-reward ratios!

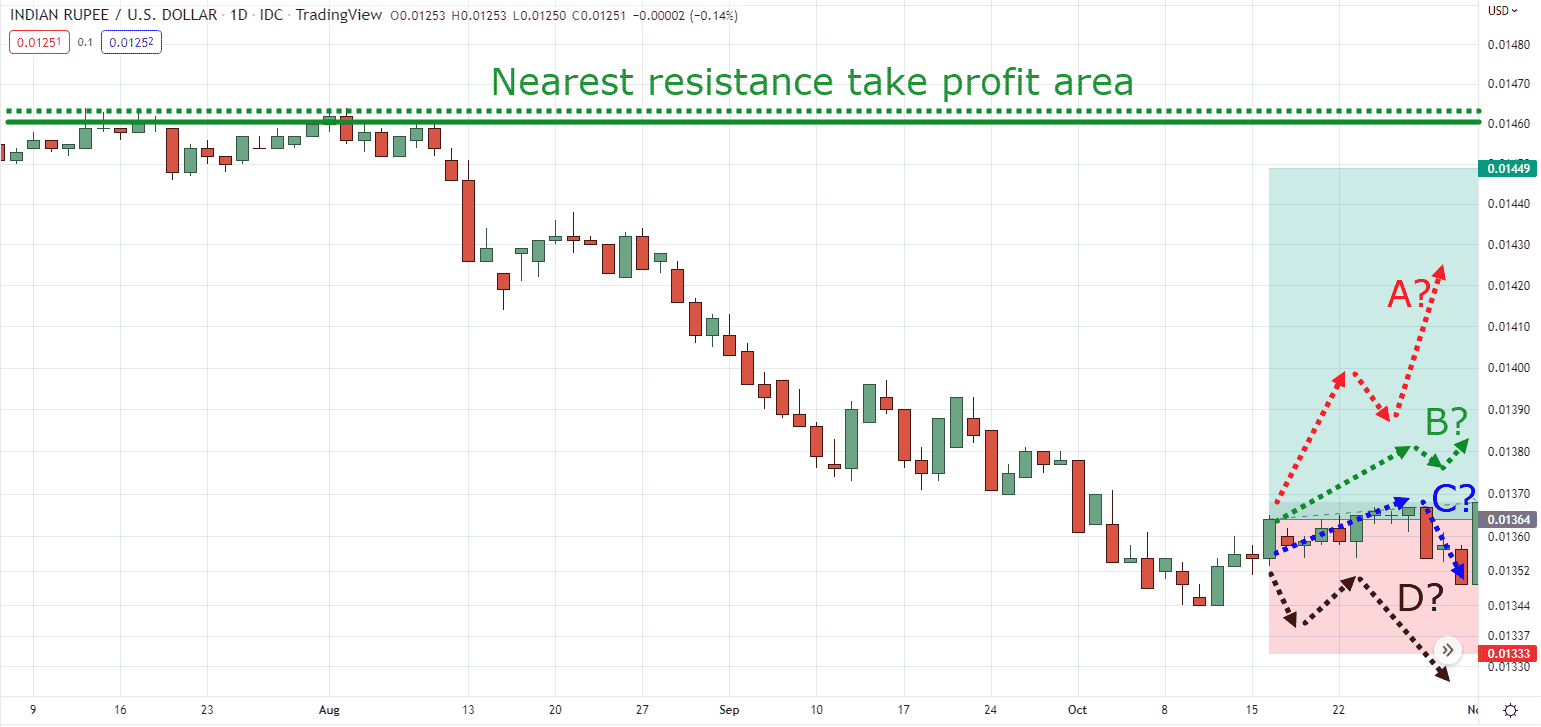

Right here’s what I imply:

I do know, I do know.

A number of issues can occur between your entry and your take revenue stage:

So, what would you do in case the market goes into a spread or makes one other bullish pattern line breakout?

Let me let you know…

Trailing cease loss

The most effective half in regards to the pattern line breakout is that not solely you need to use it to time your entries.

You may as well use it to path your cease loss!

Let me clarify…

Let’s say that you simply managed to hop on a trending market and also you resolve to path your cease loss:

How would you exit this commerce with the pattern line breakout?

First, plot your pattern line:

Then await the worth to shut above the pattern line resistance (a.okay.a. a pattern line breakout reverse to your open commerce):

Mainly, if the market makes one other pattern line breakout…

Then you’ll be able to exit earlier than it hits your unique take revenue:

(As a result of it signifies {that a} new pattern/leg of the transfer would possibly happen.)

Wonderful, am I proper?

It doesn’t matter what set-up you employ, whether or not you’re hopping on a pattern or timing reversals…

You may at all times use the pattern line breakout to each enter and exit your trades.

Now…

Let’s put every little thing that you simply’ve discovered thus far and make them into a whole buying and selling technique.

In order that after you’ve completed this coaching information…

You’ll instantly be capable of apply them to your charts.

Honest sufficient?

Good.

Then let’s get proper to it.

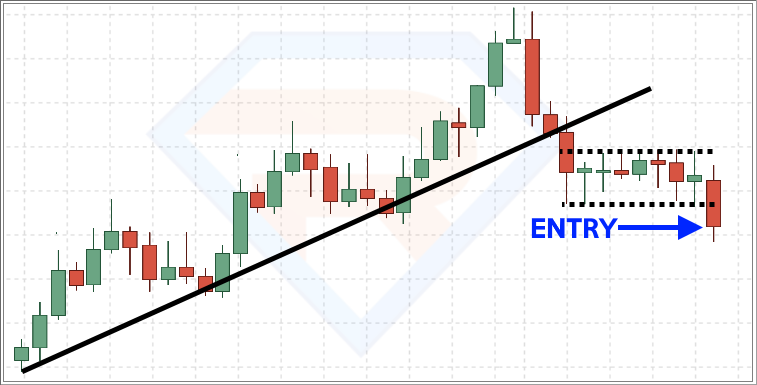

A pattern line breakout technique to dominate the markets

Let’s get straight to the purpose.

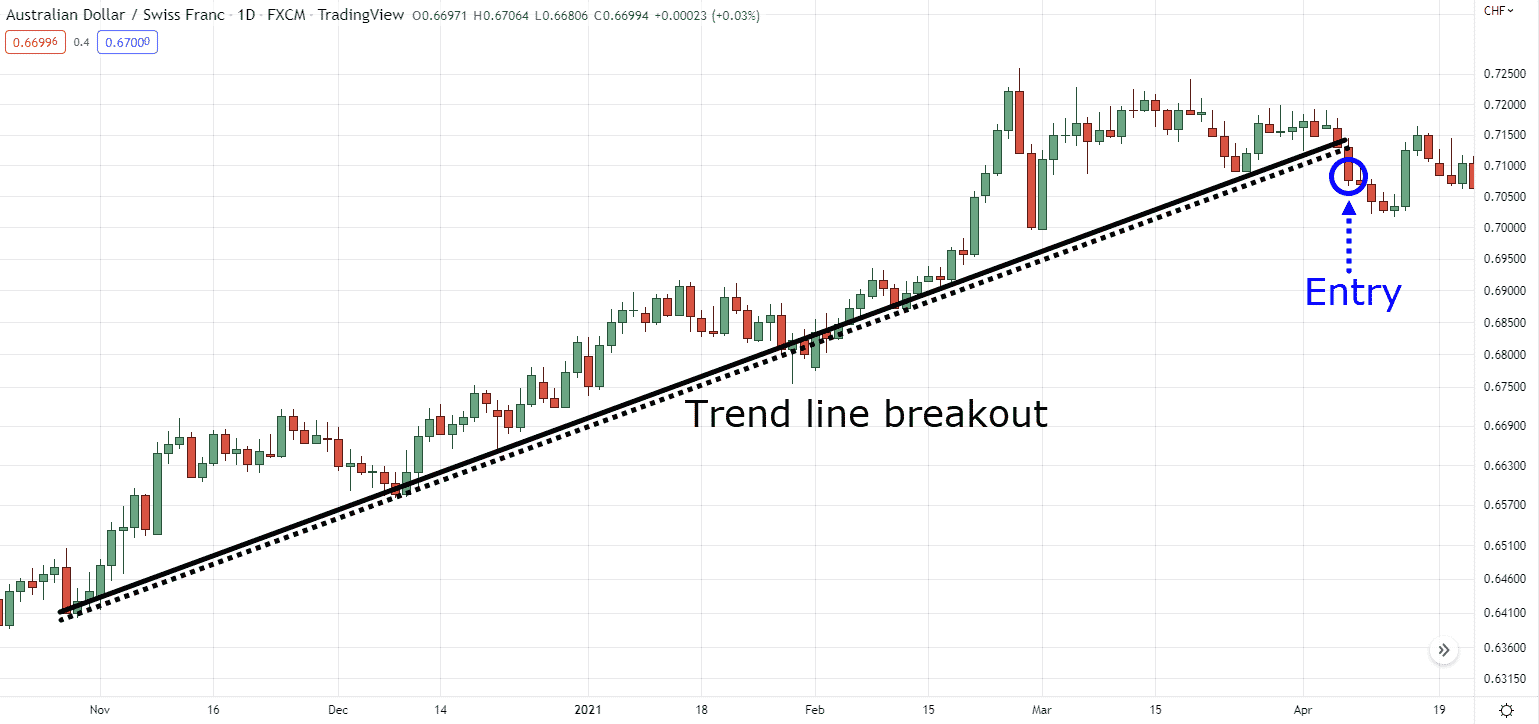

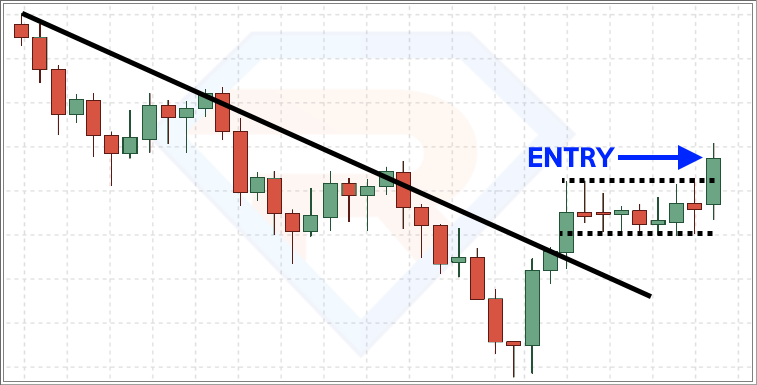

This technique will at all times are inclined to appear like this:

So, each time you take a look at your chart and also you wish to commerce the pattern line breakout, at all times look out for this sample.

Caught in your head already?

Superior.

Now, each technique is available in three elements (or else it isn’t one):

- Entry setup

- Cease loss

- Take revenue

Let me train them to you.

1. Entry setup

Earlier than this pattern line breakout setup is totally cooked, it wants two elements:

- Development line breakout

- A bearish flag sample breakout (or a bullish flag sample breakout for lengthy setups)

You’re in all probability pondering:

“Maintain up, why is the bearish flag sample concerned now?”

Right here’s why:

To cut back the probabilities of a false breakout.

Right here’s what I imply…

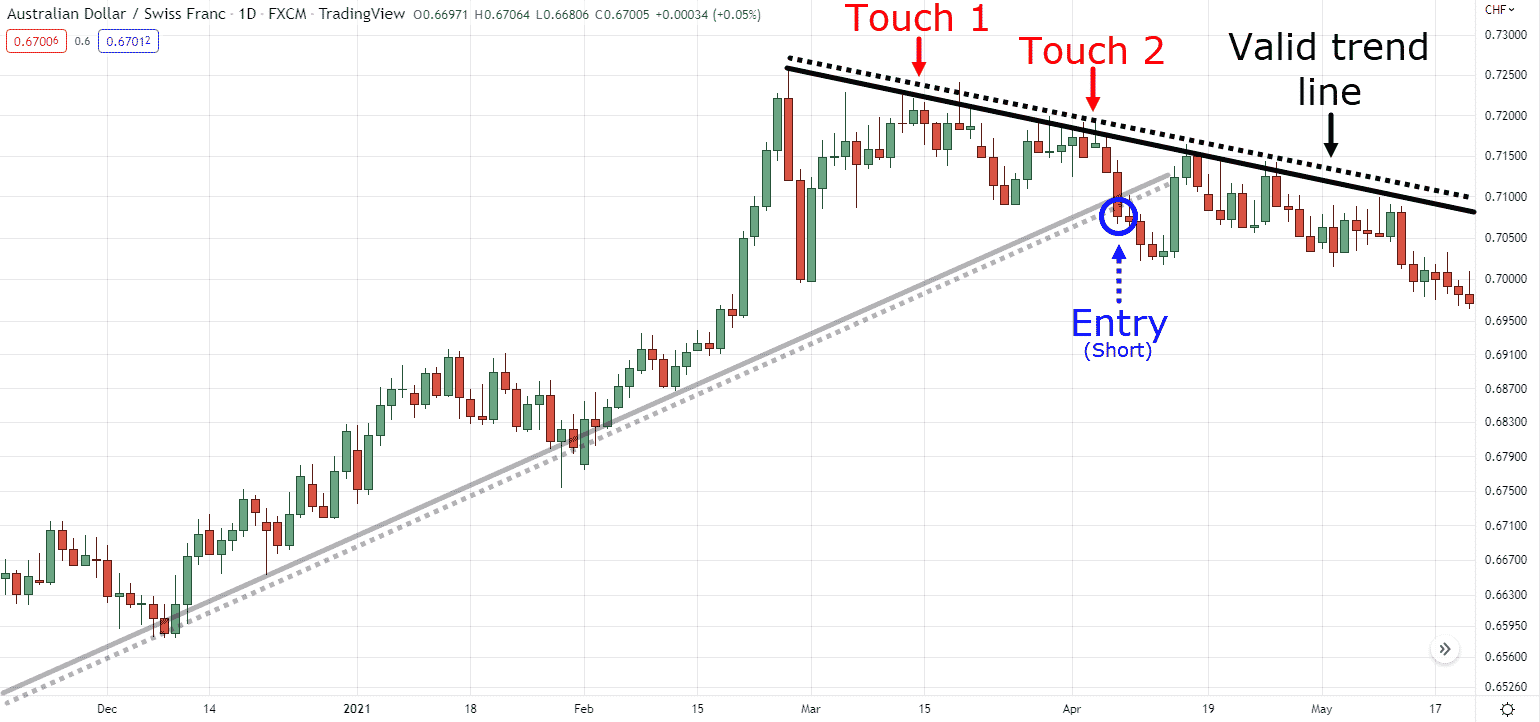

You see, having a bearish flag sample after a pattern line breakout is a affirmation that the transfer is legitimate.

Are you able to see how necessary that is?

So…

When you each have a pattern line breakout and a bearish flag sample like this:

Anticipate a breakout and enter the following candle open:

Subsequent.

2. Cease loss

Check out this:

Let me ask you, what’s the logical place you’d place your cease loss?

Likelihood is you’d place it right here:

That’s too rattling large!

But when we add a bearish flag sample to the combination, the place do you suppose you’d place your cease loss now?

Slightly below the bullish flag sample, after all:

Isn’t this higher?

By having the bearish flag sample concerned within the pattern line breakout…

Not solely do you get to substantiate the sample, however you additionally get to have a tighter cease loss!

So what do you do now while you’re within the commerce?

How will you’re taking your earnings?

Let me present you.

3. Take revenue

Much like what I’ve taught you within the earlier part, you’ll be able to take into account to:

- Have a set goal revenue

- Path your cease loss

- Or each

And there you go.

The pattern line breakout buying and selling technique!

Now, I do know that I’ve shared with you a method on this information.

Nonetheless, remember that you continue to want two issues other than a very good buying and selling technique.

And they’re:

- A very good threat administration

- A very good market choice methodology

- A very good buying and selling routine

All of those are essential to your buying and selling, so I extremely counsel you learn them right here:

Forex Risk Management and Position Sizing (The Complete Guide)

The Essential Guide to Currency Strength Meter

Part-Time Trading – How To Do It Successfully Without Quitting Your Job

So with that stated…

Let’s—

Wait, you need extra buying and selling ideas?

Alright.

Let me provide you with yet another “method” to scale back your threat and improve your rewards with the pattern line breakout buying and selling technique.

Bonus: superior commerce administration methods for the pattern line breakout setup

I do know you’re in all probability questioning:

“There’s a approach to cut back threat and improve rewards?”

“That’s unimaginable!”

In fact, there’s no such factor as a “holy grail” get-rich-quick buying and selling idea.

There’ll nonetheless be shedding trades.

However sure, it’s potential and I’ll show it to you…

Development line breakout technique superior commerce administration

Right here’s the way it works.

When you enter a pattern line breakout technique together with a bullish flag sample.

You’d wish to take into account risking 0.5% of your capital.

It implies that if the market hits your cease loss, you gained’t lose greater than 0.5% of your capital.

Now…

If that proportion would not make sense to you, go learn the articles I’ve talked about above first!

However anyway.

As soon as the market makes one other bullish flag sample breakout…

Transfer your cease loss to breakeven then open one other place by risking one other 0.5% threat per commerce:

Repeat the identical course of till a pattern line breakout has occurred or if the worth hits your take revenue stage:

Fairly cool, proper?

By scaling in, your “precise” threat, if the commerce goes south, continues to be the identical as you progress the primary commerce’s cease loss to breakeven!

Basically…

You need the market to substantiate your buying and selling thought first by risking small, then scaling into the commerce because the market makes one other second bullish flag sample.

However hear intently:

Make sure that to by no means scale in if the following bullish flag sample is simply too shut.

Bought it?

Additionally, hear nearer…

Immediately, I’ve shared with you successful buying and selling setups to assist me illustrate this buying and selling idea.

However in the true world of buying and selling, there shall be shedding streaks.

So, promise me that you’ll backtest and personal this technique your self earlier than you threat your hard-earned cash.

Aright?

Professional tip 1: You may proceed repeating this course of by repeatedly scaling in till it hits your fastened take revenue stage

Professional tip 2: You may threat 1% per commerce in your first place, however solely scale and threat 0.5% in your second place.

With that stated…

I’ve come to the tip of this pattern line breakout technique information.

So let’s do a fast recap on what you’ve discovered at present.

Conclusion

- A pattern line is a software that appears for areas of worth in a trending market, whereas a breakout is an indication that the market situation is about to vary

- A pattern line breakout is when the worth closes past a pattern line space of worth, signaling a possible pattern reversal within the markets

- Utilizing a bull/bearish flag sample to go with the pattern line breakout technique can provide you a greater risk-to-reward ratio

- You may take into account risking small on an preliminary place, and scale in because the market confirms your buying and selling thought

So, with every little thing that I’ve shared with you thus far…

What have you ever discovered?

What are some ideas are you going to use instantly to reinforce your buying and selling?

Let me know your ideas within the feedback under!