Stock splits have been fairly common amongst corporations related to artificial intelligence (AI). It’s because they’ve performed so well over the past year-and-a-half that their stock prices have reached a level where a split is a great idea.

One company that has recently joined this club is Super Micro Computer (NASDAQ: SMCI), commonly referred to as Supermicro. It announced a 10-for-1 stock split effective Oct. 1, which is able to take its stock price from around $630 to $63 per share.

While the stock split is exciting news, I believe there may be a fair higher reason to purchase the stock now before the split occurs.

Its data center products have been in huge demand

While Nvidia may get all of the headlines since it is related to the AI infrastructure being built out, many more corporations are benefiting from the identical tailwinds. Supermicro is one in all them as its products, starting from data center hardware to finish racks, are in high demand.

While many corporations provide similar products to Supermicro’s, they stand out among the many competition for 2 reasons. One, Supermicro’s servers are highly configurable and will be tailored to suit a workload of any size. Two, Supermicro’s servers are more energy-efficient than the competition, which is a big consideration because energy input costs are significant over the lifetime of the server.

These benefits have caused Supermicro’s revenue to blow up over the past yr, and more growth is slated to occur as well.

Looking forward to its fiscal 2025’s first quarter (ending Sept. 30), management expects $6 billion to $7 billion in revenue, starting from 183% to 230% growth. For fiscal 2025, it anticipates $26 billion to $30 billion in revenue, which could be 74% to 101% year-over-year growth.

That is important progress and an enormous reason to take a position within the stock immediately. At the tip of fiscal 2023, Supermicro had a long-term annual revenue goal of $20 billion. And at the tip of fiscal 2023’s second quarter, this goal was only $10 billion.

Clearly, this market is rapidly expanding, and the appetite for Supermicro’s products is growing alongside it. Nevertheless, this goal has once more been raised in its most up-to-date results to an astonishing figure of $50 billion in annual revenue. That is an enormous upside from its current projections, and I believe it is an exceptional reason to own the stock, as Supermicro has consistently reached its long-term targets.

Nevertheless, following its Q4 2024 earnings announcement, the stock plunged 20%. This looks as if an odd response, but that is because one other vital metric saw some weakness.

The stock is priced fairly low cost in comparison with peers

While revenue growth is vital and grabs headlines, investors must also see growing profits. Supermicro’s margins plunged in Q4 as a result of latest product launches, and that weakness is predicted to last for many of fiscal 2025. Nevertheless, this drop is short-sighted considering because if Supermicro recovers its margins by the tip of fiscal 2025, it can represent an enormous value opportunity.

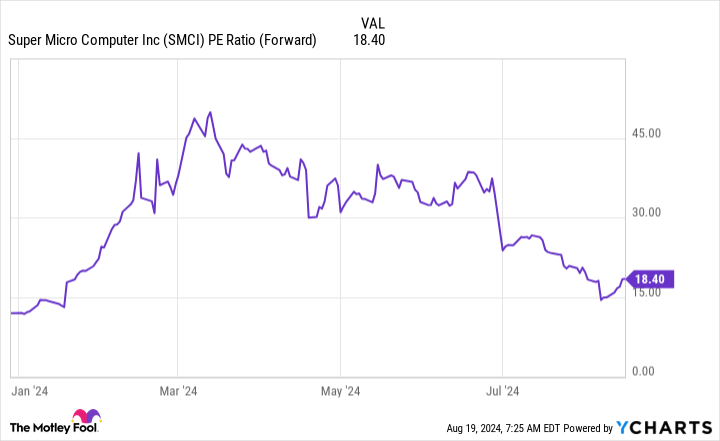

Right away, the stock trades at 18.4 times forward earnings. In comparison with most stocks available in the market, this figure is pretty low cost. It also indicates 72% earnings growth over the following yr.

Supermicro’s management has already projected 74% revenue growth on the low side, so its earnings would must stay at this lower state for all the yr for the present valuation to make sense.

This disconnect represents a robust buying opportunity for the stock, and a patient investor could see a satisfying return from an investment if Supermicro’s margins recuperate over the following yr.

Must you invest $1,000 in Super Micro Computer immediately?

Before you purchase stock in Super Micro Computer, consider this:

The Motley Idiot Stock Advisor analyst team just identified what they imagine are the 10 best stocks for investors to purchase now… and Super Micro Computer wasn’t one in all them. The ten stocks that made the cut could produce monster returns in the approaching years.

Consider when Nvidia made this list on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for achievement, including guidance on constructing a portfolio, regular updates from analysts, and two latest stock picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure policy.

Super Micro Computer Announced a Stock Split. But There’s an Even Higher Reason to Buy Right Now. was originally published by The Motley Idiot