Have you ever noticed how some traders appear to grow their accounts unbelievably quickly?

One way or the other, they turn modest beginnings into impressive sums…

Are they using a hidden formula, perhaps?

Well, while it might sound incredible – the reality is much simpler and really achievable.

The key lies in mastering the facility of compounding.

It’s a basic but powerful strategy that reinvests profits to grow your account more quickly.

By understanding and applying compounding, you possibly can transform regular returns into extraordinary outcomes.

The catch?

It requires patience, discipline, and a transparent technique to make it work.

Now, for those who’ve ever felt daunted by compounding or avoided it as too technical, don’t worry.

In this text, I’ll break it down for you step-by-step.

By the tip, you’ll discover:

- What compounding in trading truly means and why it’s so powerful.

- The mathematics behind compounding and find out how to calculate your potential growth.

- Strategies to maximise compounding while managing risks.

- Common mistakes to avoid that may derail your progress.

Able to take your trading to the following level?

Great – Let’s start!

What’s Compounding, and why must you care about it?

Compounding is a strong process whereby profits earned on trades are reinvested to generate even greater returns.

You might think, “But I need to take profits and use that cash!”

But, bear with me for a second.

When used accurately, compounding creates a wealth-generating feedback loop where a period’s earnings are added to starting capital, increasing the bottom for future growth.

Unlike standard returns, which grow steadily, compounding accelerates your wealth over time.

Imagine a trader starting with $10,000 and achieving consistent 10% monthly returns, taking their profits along the way in which…

…in a single yr, they may grow their account to $22,000. Not bad.

Now, compare this to a trader using compounding, increasing their investments as their account grows…

…in the identical timeframe, they might see their account grow to $31,000!

Are you excited now?!

Let’s dig deeper into this…

Key Concepts

The core of compounding lies in reinvestment.

Two elements drive the method: the speed of return and the way often you compound.

They’re absolutely key!

But compounding also rewards discipline and patience.

The longer you retain profits in your account, the more pronounced the compounding effect becomes.

Consider it like a snowball rolling downhill: because it gathers speed, it accumulates more snow, and gets greater, and so forth…

It’s the reinvestment that basically amplifies growth over time.

In truth, I need to share one in every of my favourite quotes with you.

Einstein’s eighth Wonder of The World

Albert Einstein famously referred to compound interest as “the eighth wonder of the world,” saying, “He who understands it, earns it; he who doesn’t, pays it.”

This quote highlights the huge potential of compounding for wealth creation.

For traders, it’s a tool to exponentially grow their capital through consistency and time.

It also shows the importance of starting early, staying disciplined, and reinvesting gains.

Those that master the art of compounding can unlock extra wealth, while those that overlook it risk missing out.

Let’s dig into its technicals!

The Math Behind Compounding

So, compounding is all in regards to the long game.

The easy equation to work out the long run value of your trading account is the next:

Future Value = Principal × (1 + Rate/100)^Time

To grasp it higher, let’s break it into its components:

- Principal: That is your starting capital or the initial amount in your trading account.

- Rate: The share return per compounding period (e.g., monthly or yearly), expressed as a decimal or fraction of 100.

- Time: The variety of compounding periods, corresponding to months or years, over which profits are reinvested.

Let’s take a take a look at an example to picture this higher.

Example

Suppose you begin with $10,000 (Principal), and also you consistently earn 2% per 30 days (Rate). You wish to calculate your account balance after 12 months (Time)…

Future Value = $10,000 × (1 + 2/100)^12

Step-by-step:

Convert the speed: 2/100 = 0.02

Add 1 to the speed: 1 + 0.02 = 1.02

Raise to the facility of time: 1.02^12 ≈ 1.2682

Multiply by the principal: $10,000 × 1.2682 = $12,682…

Comparison Without Compounding

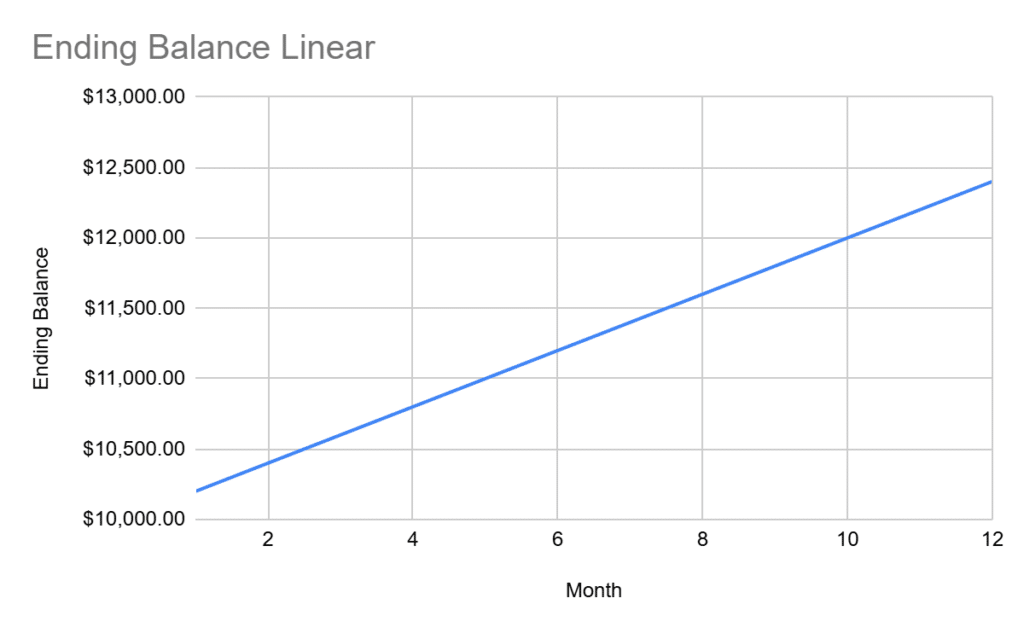

Now, let’s see how, without reinvesting, the account grows in a straight line…

Calculate the full profit: 2% × $10,000 = $200 per 30 days

Multiply by 12 months: $200 × 12 = $2,400

Total balance: $10,000 + $2,400 = $12,400

This shows that compounding adds an additional $282, purely from reinvesting profits…

Which may not seem to be so much, but there may be greater than a month’s price of profits that you simply are missing out on!

You must also note that as time goes on, the difference becomes increasingly extreme.

But before I show you that, I need to clarify why frequency is essential, too.

Compounding Frequency

Unsurprisingly, the more often you reinvest, the faster your account grows.

Monthly compounding (as in the instance) is much simpler than yearly compounding, especially in volatile markets like forex.

Tools like compound interest calculators can assist you to understand these scenarios…

https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

To point out you more clearly, I need to return to the snowball effect from earlier…

The Snowball Effect in Trading

How Compounding Accelerates as Your Account Grows

That is where compounding gets really exciting.

The snowball effect is a wonderful visualization of how compounding gains momentum over time.

In trading, every profitable trade adds to your account balance, meaning the next trades have more capital to work with.

This step-by-step growth means profits can multiply exponentially, as returns are earned in your starting capital PLUS any gains you might have.

Take this instance:

You’ve a starting balance of $1,000.

With monthly returns of 2%.

In the primary month, you earn $20, increasing your balance to $1,020.

Nevertheless, within the second month, your 2% return applies to $1,020, yielding $20.40

Stepping through further, you possibly can see that by the tip of the yr, your account will grow significantly more by reinvesting the additional profits…

Let’s plug in some more numbers to see it more clearly.

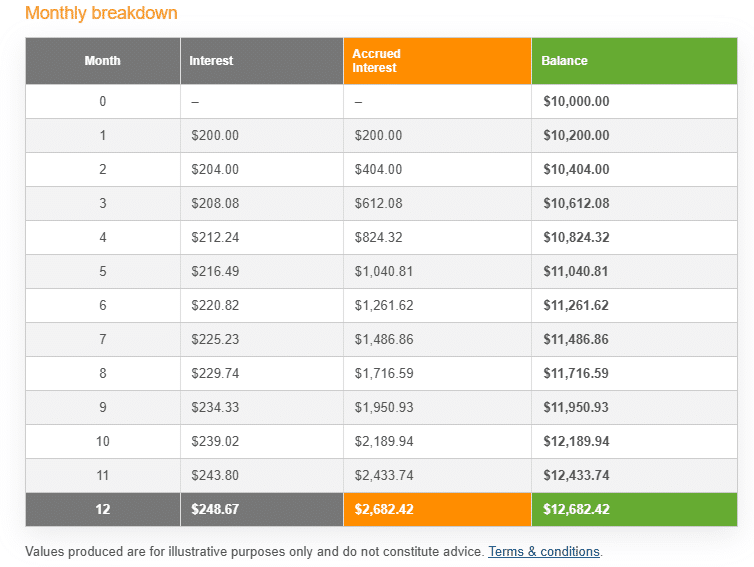

Starting with $10,000…

You consistently achieve 2% per 30 days in your trading account.

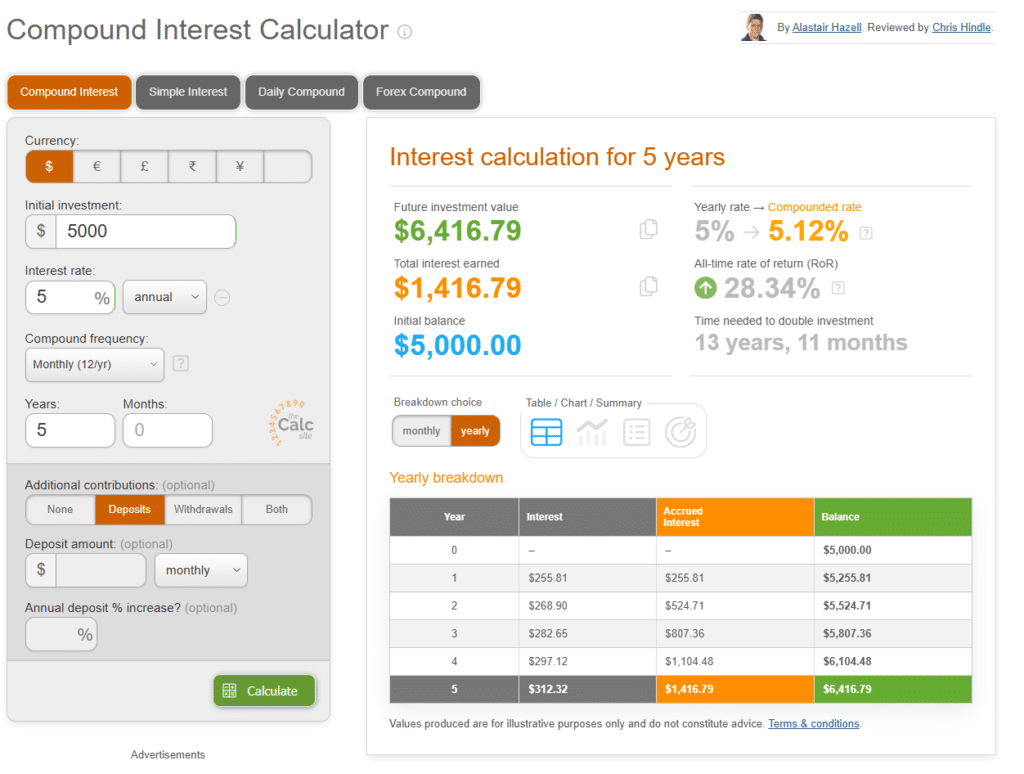

Let’s use the compound interest calculator provided by Thecalculatorsite.com

That is what your first trading yr would appear like using compounding…

First-12 months Breakdown Forex Compounding Calculator:

https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

Not bad!

Considering all you’re doing is using your profits and funneling them back into your trading account.

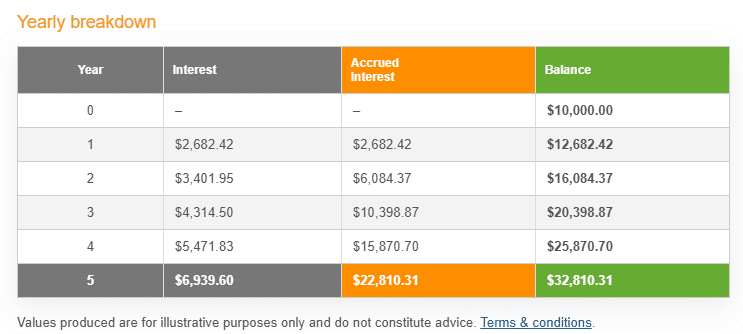

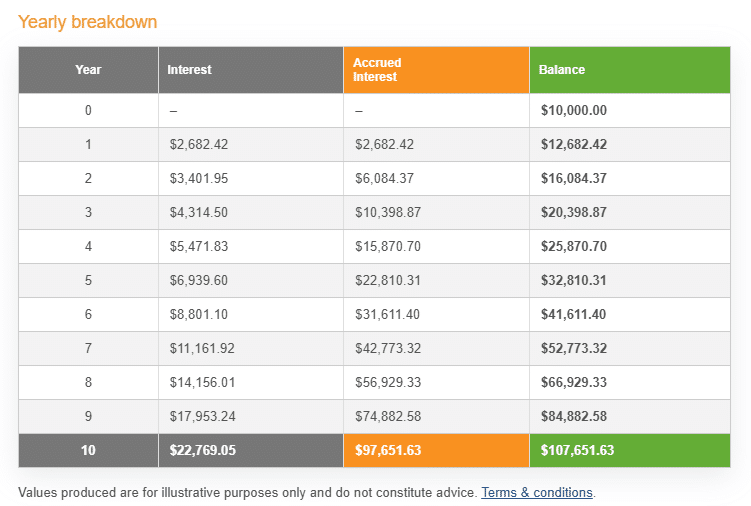

However it gets super interesting as you reach the 5-10-year period.

Take a look at the 5-year breakdown for those who were to proceed these consistent profits…

5-12 months Breakdown Forex Compounding:

Something should stand out here.

Are you able to see how long it takes time to your initial investment to double?

It wasn’t until the third yr, right?

Without knowing higher, most individuals lose trust in the tactic before seeing its true power.

Nevertheless, if you might have the patience to breach that barrier… the additional profits really begin to shine!

Need more convincing?

Let’s take a look at 10 years…

10-12 months Breakdown Forex Compounding Calculator:

…a whopping $107,651 from 10,000 dollars start!

Now, you is likely to be pondering, “10 years is a protracted time for that form of gain…”

But it’s best to remember this uses returns of two% per 30 days.

It’s definitely achievable!

In fact, numbers may vary depending on profitability and consistency…

In actual trading, there are ups and downs affecting how compounding works…

Nevertheless, the facility of compounding is evident.

You possibly can see the snowball effect in play, as your account starts small but gains momentum, growing larger.

Let’s move on to some strategies to maximise these profits even further!

Strategies to Maximize Compounding in Trading

1. Reinvesting Profits

It’s the entire foundation of what it means to compound a trading account.

Nevertheless, it’s best to note that some traders take the approach of reinvesting some of their profits – not all of their profits.

I like to recommend trying out compounding with smaller numbers to start with.

And remember – taking money out here and there’ll only delay the method.

Once you begin to make significant gains and wish to take money out of your account, withdraw only what you wish…

…minor sacrifices now result in much larger rewards later!

As you saw within the previous example of what 10 years of consistent profitability looks like, years 4 onwards deliver a big income.

Reinvesting demands a disciplined mindset and a sturdy trading technique to manage larger position sizes effectively without falling to undue risks.

I actually have also seen very successful traders reinvest their earnings in other investments, corresponding to the stock market, mutual funds, or ETFs.

That’s what smart wealth generation looks like.

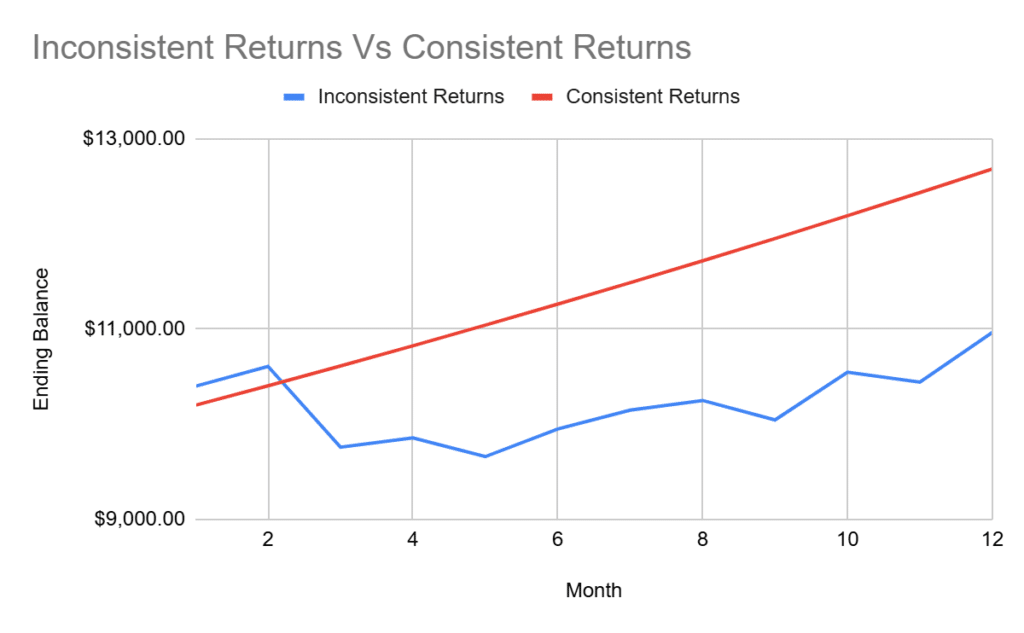

2. Achieving Consistent Returns

Consistent gains are way higher than sporadic gains in terms of compounding.

Regular and slight profitability often gives higher long-term results than irregular, large wins.

For instance, a trader consistently earning 2% per 30 days will outperform one who alternates between 5% gains one month and 4% losses the following.

To attain consistency, traders should give attention to high-probability trades, disciplined execution, and avoiding unnecessary risks.

Tools like trade journals and performance tracking can assist maintain focus and refine strategies for regular returns…

Inconsistent Returns Vs Consistent Returns:

As you possibly can see from the graph above, inconsistent returns severely impact the speed of profitability.

This isn’t to say that compounding is a nasty idea for many who could also be barely inconsistent of their trading returns, though.

In any case, losing months will all the time occur in trading, and that’s natural.

Nevertheless, it’s something to be mindful of as you undergo your trading journey.

3. Risk Management

Risk management is a no brainer in any trading plan, but its impact on compounding is large.

Without effective risk management, compounding efforts can quickly come undone!

To guard capital and sustain growth, I like to recommend all the time setting a maximum risk per trade, corresponding to 1-2% of the account balance.

You must also adjust position sizes to match account growth so your exposure doesn’t fluctuate.

This approach minimizes the impact of losses, especially during volatile market conditions.

Say you might have a $1000 trading account and incur a losing streak of 5 trades to lose 5% of your account….

Your account is now $950.

On this case, it’s essential to position your latest trades as in case your trading account is now 5% less.

This implies your position sizing should match the 1-2% of $950, not the unique $1000.

This restricts further losses from having a bigger impact in your remaining balance.

In fact, this restricts your winners as well…

…but while you construct the account back up, it really works in your favor. (as shown within the tables)

Emotional discipline is equally essential, as larger account sizes amplify potential gains and risks.

Sticking to your risk thresholds implies that growth continues steadily without exposing the account to devastating drawdowns.

Trust the technique of the compounding and proceed to focus on your percentage increase reasonably than counting the cash lost and won on each individual trade.

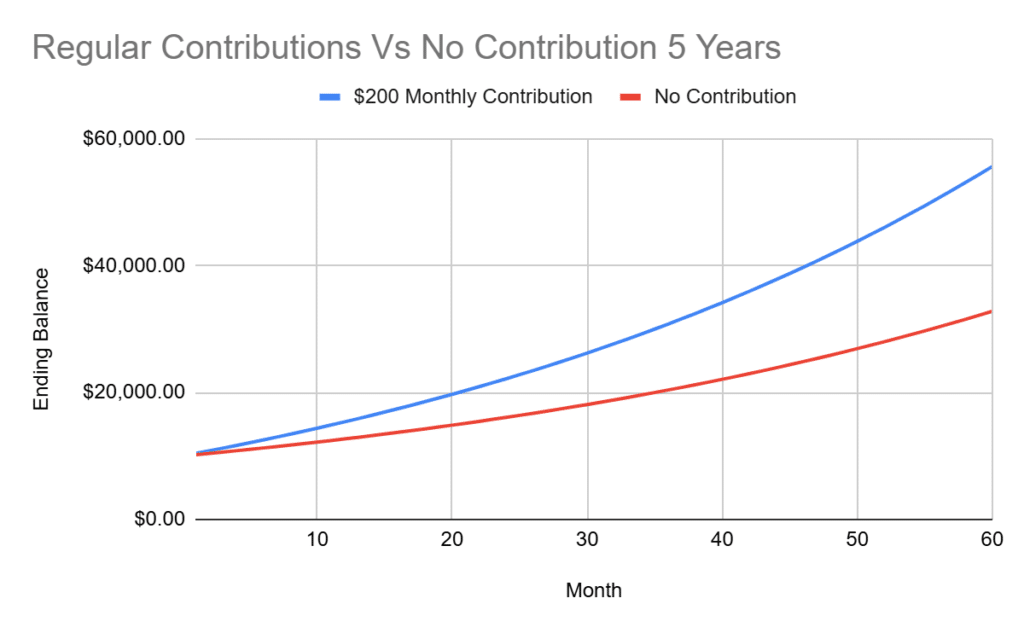

4. Regular Contributions

I can’t stress enough how much regular contributions, on top of profits, can impact your trading account.

This isn’t about only a physical win.

It’s a mental win, especially if you might have reached consistent profitability.

Adding external funds to a trading account alongside reinvesting profits can further speed up growth, too.

For instance, a trader contributing $200 monthly to an account earning 2% per 30 days will experience significantly faster growth than relying just on trading gains.

This dual approach gains from the combined power of savings and compounding, making it especially priceless for traders with regular income sources outside of trading.

Let’s take a look at an example.

Should you were to contribute an additional $200 a month to your account over 12 months, your progress would look so much higher…

After deducting the $2400 contributed over the yr, you’ll still find yourself near $300 dollars higher off.

It doesn’t sound like so much, right?

But what about over a 5-year period?…

Over 5 years, the difference is way more noticeable!

The regular contributions ending value is $55,620 vs. no contribution at $32,810, simply from adding an additional $200 a month.

Again, even for those who deduct the quantity contributed, you continue to find yourself around $11,000 higher off.

You possibly can imagine that as you proceed your trading journey and play with more cash, these differences begin to get more extreme, too.

So, now that you simply see the true power of compounding, let’s take a look at some mistakes to avoid.

Mistakes to Avoid in Compounding

Market Volatility

When considering compounding, volatility shouldn’t be your friend.

Market volatility often tempts you to make impulsive decisions, chasing sudden price swings or exiting positions too early.

While volatility is all a part of the market, failing to include it into your strategy can result in significant losses.

To mitigate the risks of volatility, it’s best to avoid high volatility market times corresponding to news events or high spread trading times.

Should you are in a trade, use a stop loss to stop market volatility from having a big impact in your account balance.

Diversify your trades across different pairs or assets to reduce exposure to volatility.

Remember, a disciplined approach with a sound risk management plan ensures you possibly can navigate volatile periods without derailing your progress.

Emotional Discipline

For my part, emotions are one in every of the most important obstacles to trading success.

Fear, greed, and overconfidence, sometimes called the “trading triad”, can result in costly mistakes.

For instance, fear might prevent you from taking well-calculated risks.

Greed may drive overtrading or cause you to carry onto trades for too long and never take profits at the suitable time.

Overconfidence may end up in careless trades without proper evaluation.

To keep up emotional discipline:

- Follow a structured trading plan.

- Take breaks when feeling stressed or overwhelmed.

- Keep expectations realistic to avoid emotional highs and lows.

Having control over your emotions is crucial for long-term success and maximizing the advantages of compounding.

Lack of Patience

Everyone’s been there.

I need to Get Wealthy Quick!

But do you remember the story of the hare and the tortoise?

Impatience is a standard trading pitfall.

Rushing into low-quality setups or revenge trading when things don’t go your way can hinder each profitability and the advantages of compounding.

True success in trading requires a long-term perspective.

To practice patience, it’s best to all the time wait for high-probability setups reasonably than force trades.

Allowing trades to achieve their planned outcomes as a substitute of acting on impulse is one other great technique to practice patience.

The secret’s to give attention to the larger picture, understanding that consistent growth takes time.

Remember, it is a marathon, not a sprint!

Be the tortoise.

Inconsistent Strategy

Incessantly changing strategy isn’t just bad for compounding; it’s a poor trading technique on the whole.

Continuously switching approaches often results in erratic returns and missed opportunities, stopping traders from realizing their potential growth.

As mentioned before, inconsistency is an actual compound killer.

Should you end up wanting to swap strategies, it’s best to as a substitute commit to a well-tested and proven strategy that aligns with market conditions.

This isn’t to say that you could’t adjust your approach, small adjustments are wonderful…

…but your core beliefs by which you’re trading mustn’t seriously change from daily or week to week.

I all the time recommend you commonly review and refine your approach based on performance and evolving trends.

Conclusion

Compounding is a strong tool that has the potential to rework a modest trading account into substantial capital over time.

Through the use of the strategy of reinvesting profits, maintaining consistent returns, and practising solid risk management, you possibly can unlock incredible growth.

In this text, you covered the essential strategies and pitfalls of compounding in trading:

- Exploring how compounding works and why it’s a game-changer for traders.

- Reviewing the mathematics behind compounding with real-world examples.

- Examining the snowball effect and its role in accelerating account growth.

- Learning practical strategies to maximise compounding, including reinvesting profits and consistent contributions.

- Observing common mistakes that may derail your compounding journey and find out how to avoid them.

By applying these principles and avoiding the pitfalls, you’ll not only improve your trading outcomes but in addition construct a disciplined, robust approach for long-term success.

Once you truly understand the facility of compounding, your trading journey becomes much more exciting.

Now it’s your turn!

Have you ever experienced the facility of compounding in your trading?

What strategies have worked best for you?

Share your experiences and thoughts below.

I’d love to listen to the way you’re using compounding to attain your trading goals!