Bitcoin has observed a pointy retrace to $95,000 prior to now day as on-chain data shows whales have been busy depositing to exchanges.

Bitcoin Has Almost Entirely Retraced Its Gains From Christmas

Bitcoin renewed optimism amongst investors when it edged near the $100,000 mark in the course of the rally over Christmas Eve and Christmas Day, but prior to now day, the asset has decided to crush these hopes as its price has crashed.

From the chart, it’s visible that Bitcoin is now all the way down to the $95,700 level, which isn’t terribly higher than the $94,100 mark that the asset was trading at prior to this rally.

The bearish price motion might not be entirely unexpected when considering what on-chain data has been saying.

BTC Whales Have Made Massive Exchange Inflows Recently

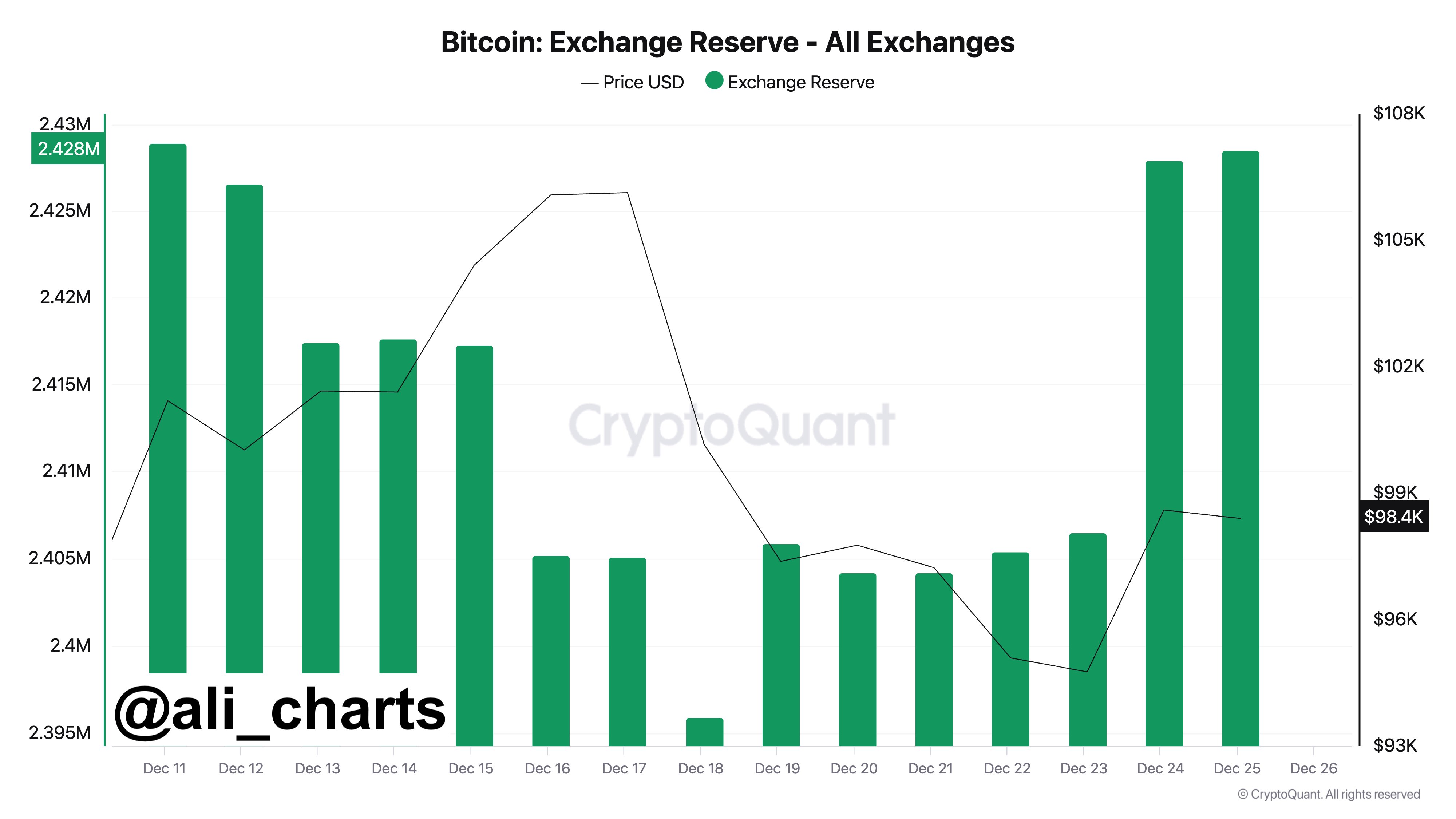

As identified by analyst Ali Martinez in a recent post on X, the exchanges have received massive Bitcoin deposits over the past week. The indicator of relevance here is the “Exchange Reserve,” which keeps track of the whole amount of BTC that’s sitting within the wallets of all centralized exchanges.

When the worth of this metric rises, it means the holders are making net inflows to these platforms. As one among the most important the explanation why investors use exchanges is for selling-related purposes, this sort of trend can have bearish implications for the asset.

Alternatively, the indicator taking place implies the outflows are overwhelming the inflows, and a net amount of the asset is entering exchange-associated wallets. Such a trend could be a sign that the holders are accumulating, which may naturally be bullish for the value.

Now, here is the chart from the on-chain analytics firm CryptoQuant shared by Martinez that displays the trend within the Bitcoin Exchange Reserve over the past couple of weeks:

Looks just like the metric has registered a pointy jump in recent days | Source: @ali_charts on X

As shown within the above graph, the Bitcoin Exchange Reserve was in a decline in the course of the price rally earlier within the month, implying the investors were buying and helping fuel the run.

This wasn’t the case leading as much as and in the course of the Christmas rally, because the indicator registered an enormous increase as an alternative. In total, the investors deposited 33,000 BTC to those platforms over the past week, price roughly $3.15 billion at the present exchange rate.

Most of those deposits got here on Christmas Eve, as is clearly visible within the chart. Thus, it seems the whales were preparing to sell prematurely, and once they thought the value got high enough by Christmas, they pulled the trigger, leading to a price crash.

The Bitcoin Exchange Reserve may now be to maintain an in depth eye on, as any reversals on its graph would mean the investors feel the costs are low enough to again be price buying at.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com