On-chain data shows the Bitcoin long-term holders have began a phase of distribution recently. Here’s what this might mean for BTC’s price.

Bitcoin Long-Term Holders Have Just Sold Over 177,000 Tokens

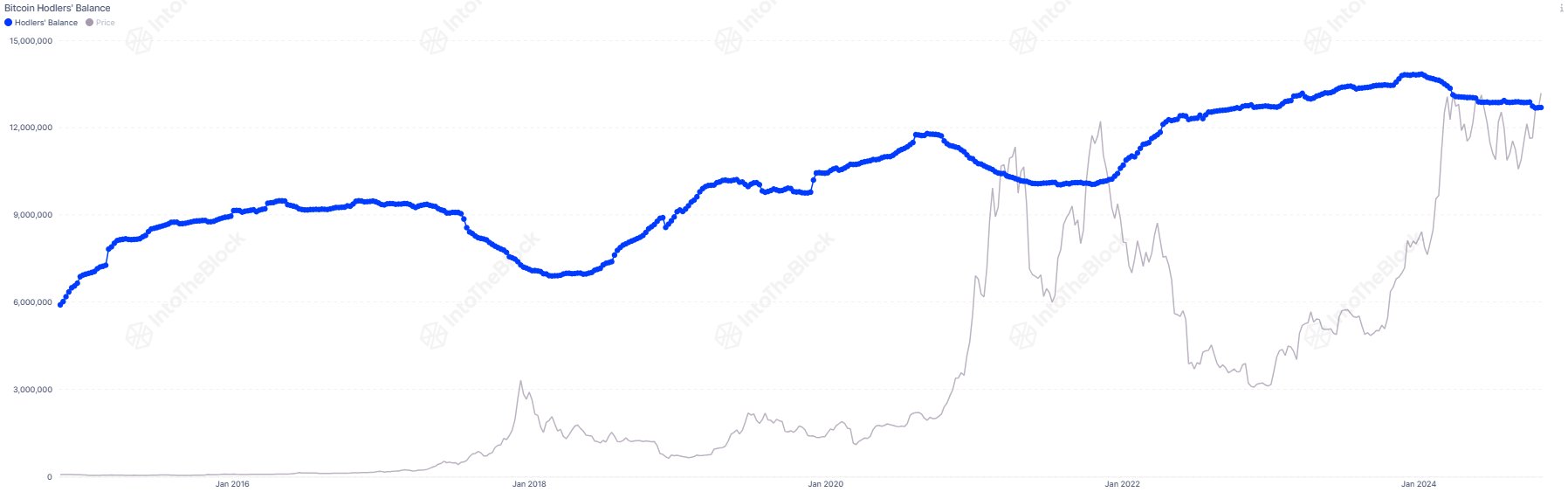

As identified by CryptoQuant community analyst Maartunn in a recent post on X, old coins have seen a negative balance change recently. Below is the chart from the market intelligence platform IntoTheBlock cited by the analyst, which shows the balance changes for various holder groups on the Bitcoin network.

The groups here have been divided based on holding time: investors who bought their coins inside the past month fall contained in the <1 Month cohort (coloured in yellow), while those that bought between one and twelve months ago are put into the 1-12 Months group (pink).

Within the context of the present topic, neither of those is of focus; the relevant cohort is the third one (blue), which accommodates the investors who’ve been holding for greater than twelve months.

Statistically, the longer an investor holds onto their coins, the less likely they turn into to sell said coins at any point. Thus, the 12+ Months cohort would come with probably the most resolute of the hands on the network.

From the chart, it’s apparent that these HODLers had been busy accumulating through the 2022 bear market and the 2023 recovery rally, however the trend has seen a shift in 2024.

In the course of the first quarter of the yr, the balance change of this Bitcoin cohort turned significantly red, implying that the long-term holders were taking the gains of their patience.

These diamond hands eventually saw their selling pressure dry up because the cryptocurrency’s consolidation following its recent all-time high (ATH) stretched on until finally, their balance change hit completely neutral levels.

Recently, as bullish waves have returned for Bitcoin, the balance change for the group has turned red again, implying these HODLers have began selling over again.

As for what this might mean for the cryptocurrency, perhaps historical pattern could shed some light. “Long-Term Holder activity often acts as a contrarian indicator,” says Maartunn. “LTHs are likely to buy (increase holdings) during price dips and sell (reduce holdings) during price surges.”

It’s visible from the chart, nevertheless, that while the LTHs do time their selling with bull runs, the actual top of the cryptocurrency doesn’t occur until their distribution has gone on for a lengthy period. This might potentially imply available room for BTC to go in the present rally, before a ceiling is hit.

Something which will invalidate the pattern, though, is the proven fact that the dimensions of selling from the LTHs has been less intense this cycle, as IntoTheBlock has identified in an X post.

“While long-term holders are selling, it’s less aggressive than in past bull peaks,” notes the analytics firm. Thus, it’s possible that the present Bitcoin cycle is establishing a recent dynamic available in the market.

BTC Price

On the time of writing, Bitcoin is trading around $68,800, down greater than 3% over the past week.