Bitcoin has observed a rally beyond the $71,000 level through the past day as on-chain data shows demand for the coin has notably increased.

Bitcoin Apparent Demand Has Spiked To Notable Positive Levels Recently

As an analyst in a CryptoQuant Quicktake post explained, the demand for Bitcoin has seemed to be on the rise again recently. The on-chain metric of interest here is the “Apparent Demand,” which keeps track of the difference between the BTC production and the changes in its inventory.

The one solution to produce BTC is by adding recent blocks to the chain and receiving block subsidy as compensation, so the asset’s production is equated to the quantity that the miners are getting in rewards day-after-day, often called the Issuance.

BTC’s ‘inventory’ might be considered a part of its circulating supply, which has been sitting still for greater than a yr. Thus, the changes within the inventory could be the online variety of tokens maturing into or exiting out of this group.

Now, here’s a chart that shows the trend within the Bitcoin Apparent Demand because the start of the yr 2024:

The worth of the metric appears to have been positive through the previous few weeks | Source: CryptoQuant

As displayed within the above graph, the Bitcoin Apparent Demand had slumped to levels across the neutral mark through the earlier phase of consolidation that the asset had passed through. Still, recently, its value has surged to notable positive levels.

After the rise, the indicator has reached the identical high as in February of this yr. From the chart, it’s visible that what followed back then was BTC’s rally to a recent all-time high (ATH).

Thus far, the recent burst of demand has also accompanied a fresh rally within the cryptocurrency’s price, which has taken the asset above the $72,000 level. Given the trend that occurred in the primary quarter of the yr, it’s possible that BTC could enjoy further upside if the Apparent Demand continues its growth.

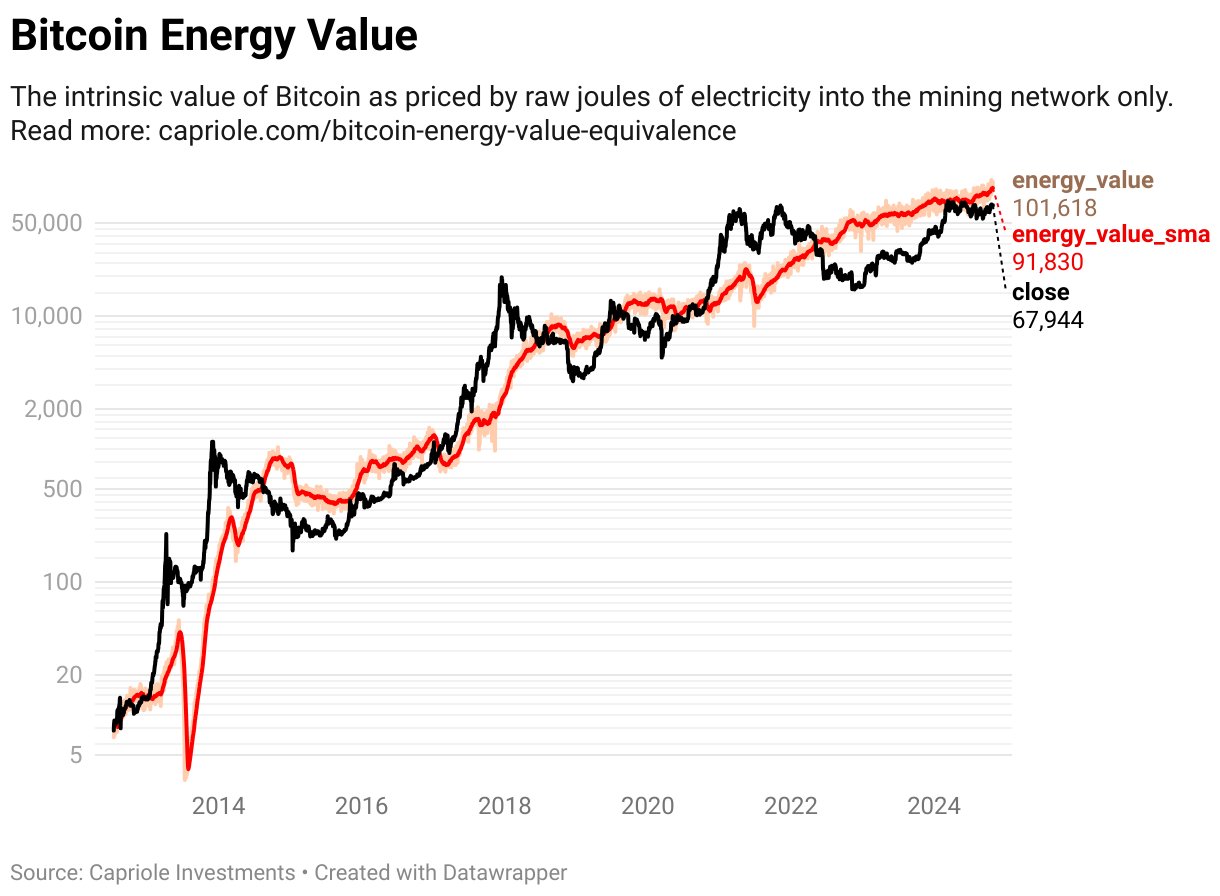

In other news, the Bitcoin Energy Value has recently crossed the $100,000 level, as Capriole Investments founder Charles Edwards explained in an X post.

The “Energy Value” here refers to a model for the cryptocurrency that calculates its fair value as a function of the quantity of energy (measured in Joules) spent to provide it. The energy here is of course the one miners use to power their computing machines with, to perform the duty of BTC mining.

Here is the chart for the metric shared by the analyst:

The trend within the BTC Energy Value over the coin's history | Source: @caprioleio on X

The graph shows that that is the primary time that the Bitcoin Energy Value has broken beyond this level.

BTC Price

On the time of writing, Bitcoin is trading at around $72,400, up almost 8% over the past week.

Looks like the value of the coin has shot up during the last 24 hours | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, Capriole.com, chart from TradingView.com