Bitcoin broke past $71,000 Tuesday morning to guide other major altcoins right into a bullish trend per week before the US elections. In keeping with CoinGecko’s tracking, Bitcoin touched $71,075 after dipping last week attributable to rumors circulating over a possible investigation on Tether and the continuing Middle Eastern conflict.

Experts and industry watchers say the recent Bitcoin breakout is linked to increased inflows into Bitcoin ETFs and the joy over the November 4 US presidential elections favoring the crypto industry. Despite Bitcoin’s erratic price movements in the previous few days, Bitcoin currently rides on a bullish sentiment.

Source: Coingecko

Bullish Run Ahead For Bitcoin?

Last week was a rough time for holders and the market as Bitcoin dipped below $66,000 but immediately bounced back and consolidated within the $67,0000 to $68,000 range in the course of the weekend.

Then, Bitcoin broke out and hit $71,075, its best performance over the past 4 months. In keeping with CoinGecko, Bitcoin’s latest price movement this Tuesday is backed by $51 billion in trading volume, double the quantity generated on Monday.

Bitcoin market cap currently at $1.4 trillion. Chart: TradingView.com

Observers like Peter Brandt said that Bitcoin’s latest price motion reflects a latest bullish phase post-halving. In a Twitter post, the seasoned trader shared Bitcoin has accomplished its “inverted expanding pyramid” and that the following follow-through is critical. Brandt further explained that this may very well be Bitcoin’s post-halving run.

Trades From BTC Whales And Inflows Into ETFs Boost The Market

Bitcoin’s recent price surge is attributed to increased trades from Bitcoin whales and inflows into ETFs. In keeping with CryptoQuant’s Mignolet, recent buying may be attributed to whales on Binance, who look like the online Bitcoin buyers in the course of the Asian trading hours.

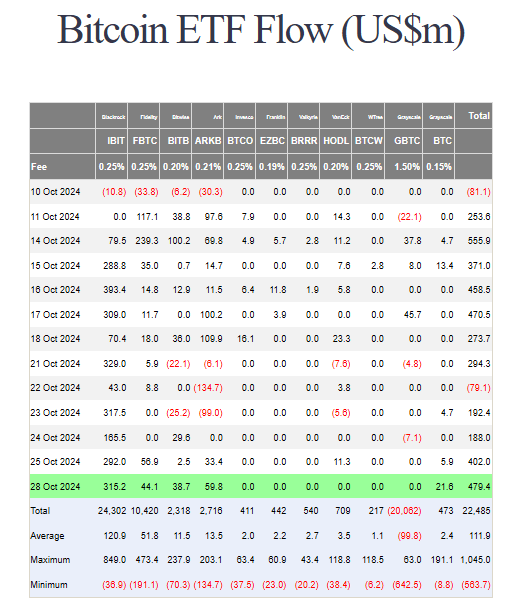

Source: Farside Investors

Also, trading for the Bitcoin ETFs has primarily contributed to the higher-than-usual trading volume. These funds added a net inflow of over 47,000 Bitcoins over two weeks. Other than Bitcoin, other major altcoins also joined the surge. Dogecoin, for instance, increased by 15% attributable to Trump’s popularity. Then, there’s Shiba Inu (SHIB), which jumped by 8%, Ether (ETH) by 4.9%, and Cardano’s ADA improved by 3%.

Image: Zerocap

Greater Highs Next?

For a lot of experienced traders, Tuesday’s big jump sets the tone ahead of November’s US elections. Traders and crypto supporters expect Bitcoin to sustain its gains and even hit latest highs whatever the final result of the presidential elections.

Traders have long favored and anticipated that Donald Trump will win the elections. For a lot of, a Trump win is a bullish catalyst for Bitcoin since he boasts just a few pro-crypto policies. It also helps that Trump gets the backing of Elon Musk, a vocal supporter of Bitcoin and blockchain technology. The Democrats, then again, haven’t made specific policies but plans to introduce regulations within the industry.

Even financial analysts contribute their opinions and projections ahead of the US elections. In keeping with some analysts at Standard Chartered, Bitcoin may hit $73,000 by November fifth. If Trump wins, they predict the value to hit $80,000 and even as much as $125,000 before the 12 months ends, especially if the Republicans win Congress.

Featured image from Dall-E, chart from TradingView