Data shows the Bitcoin Open Interest has seen a surge to a recent all-time high (ATH) recently, an indication that volatility could possibly be brewing for BTC.

Bitcoin Open Interest Has Been Going Up Recently

As identified by CryptoQuant founder and CEO Ki Young Ju in a recent post on X, the Bitcoin Open Interest has just set a recent record. The “Open Interest” here refers to an indicator that keeps track of the whole amount of BTC-related derivatives positions which might be open on all centralized exchanges.

Below is the chart shared by Young Ju that shows the trend on this metric over the previous couple of years:

The worth of the metric appears to have been heading up in recent days | Source: @ki_young_ju on X

As is visible within the graph, the Bitcoin Open Interest has been on the rise recently, which suggests that the investors have been opening fresh positions in the marketplace. Following the most recent continuation of the rise, the indicator has hit a price of $20 billion, which is a recent record. As for what this high could mean for the cryptocurrency’s price, a high Open Interest is mostly followed by sharp volatility within the asset.

On paper, this volatility can take the coin in either direction, but from the graph, it’s apparent that peaks within the indicator have, in truth, normally led to tops for the cryptocurrency.

The source of the volatility is generally mass liquidation events, which could be probable to happen when the market has a considerable amount of positions with high leverage involved.

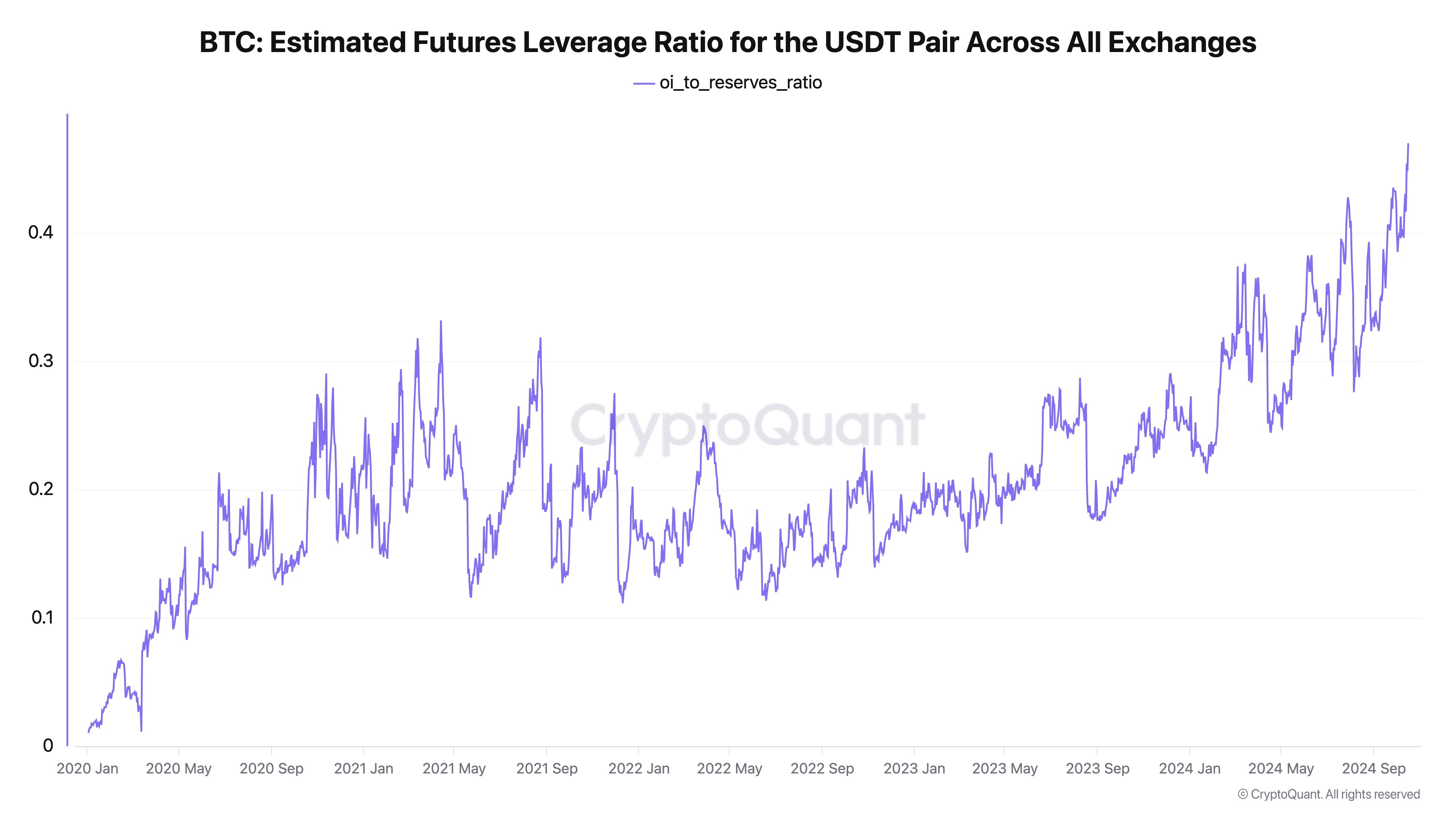

In one other X post, the CryptoQuant CEO shared the information for the Bitcoin Estimated Leverage Ratio, which mainly tells us in regards to the average amount of leverage that users are currently choosing.

Looks just like the value of this metric has also been rising recently | Source: @ki_young_ju on X

The Estimated Leverage Ratio is calculated because the ratio between the Open Interest and the whole exchange reserve of the underlying asset. In the present case, Young Ju has posted the version of the indicator that tracks the positions which have Tether’s stablecoin, USDT, because the collateral.

While this actually doesn’t cover your complete market, this version of the metric can still provide us with a touch of the final trend being followed by traders as a complete.

As displayed within the above graph, the Bitcoin Estimated Leverage Ratio for the USDT pair has shot up recently, which suggests the investors have increased their appetite for risk.

Thus, with all this leverage involved, BTC could truly be prone to seeing a volatile explosion. Considering that these recent positions which have been popping up could possibly be long positions, the traders betting on a bullish final result may once more be those to get caught up within the volatility.

BTC Price

Bitcoin had crossed above the $68,000 level yesterday, however the asset appears to have seen a pullback since then because it’s now all the way down to $67,200.

The value of the coin appears to have been riding an uptrend over the previous couple of days | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com