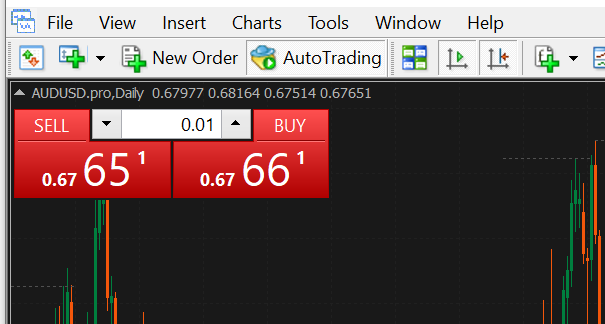

Once you first opened your trading platform, it probably looked something like this…

You think that to yourself:

“What the heck am I presupposed to do with this??”

So, you conquer your first hurdle by learning technical evaluation and learn tips on how to navigate around your platform.

Now, you face your next hurdle…

What number of units must you buy?

And then you definately start pondering:

“Ah, I normally buy 100 shares within the stock market so I’ll just buy 10 simply to be protected”

The subsequent thing you realize?

Your account hits zero right away.

Why?

Because none that you realize…

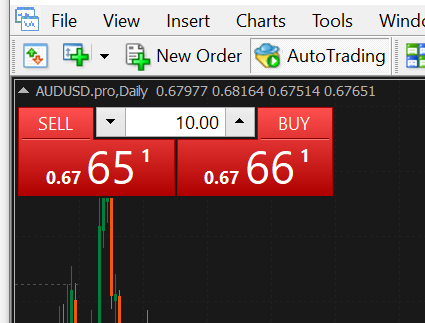

Buying 10 lots means that you just’re entering with 1,000,000 units!

This will not have happened to you but I do know a ton of traders who experienced the same case.

And for this reason an important think to learn first in trading is to learn tips on how to apply risk management in forex first.

Above the rest!

This is the reason in today’s guide you’ll learn tips on how to apply risk management in forex.

Specifically, you’ll learn…

- A precise risk management method that lets you be flexible together with your risk on the forex market

- Accessible position sizing calculators you can use anytime without registering or downloading anything

- A secret to knowing when and the way you must change your risk management parameters

This guide can be quick and snappy.

However the goal is to make sure you immediately apply the learnings after you’re done.

Sounds good?

Then let’s start…

The best way to apply risk management in forex: Percentage risk management method

Now, before I share with you some formulas here I would like you to know a few things first.

On this planet of forex we all the time use the term “lots” just like what I shared with you.

And as a fast cheatsheet, here’s what all of them mean:

- 100,000 Units = 1.00 Lot

- 10,000 Units = 0.10 Lot

- 1,000 Units = 0.01 Lot

- Below 1,000 Units = 0.001 Lot

So, yes…

Please don’t put 1.00 in your trading platform!

But for those who really need to keep it protected, place 0.01 for each trade you do, especially if you have got a foreign currency trading account below $500.

Now, as you grow your account…

You’ll begin to have more flexibility over your risk management.

This is the reason it’s essential learn the proportion risk management method!

In principle, here’s how this risk management method works:

In case your stop loss is hit, you position size in a way that you just only lose 1% of your account balance

This position sizing method is generally best used:

- For trading the lower timeframes

- For putting precise stop loss while maintaining risk

- For any type of trading or investing that has to cope with leverage

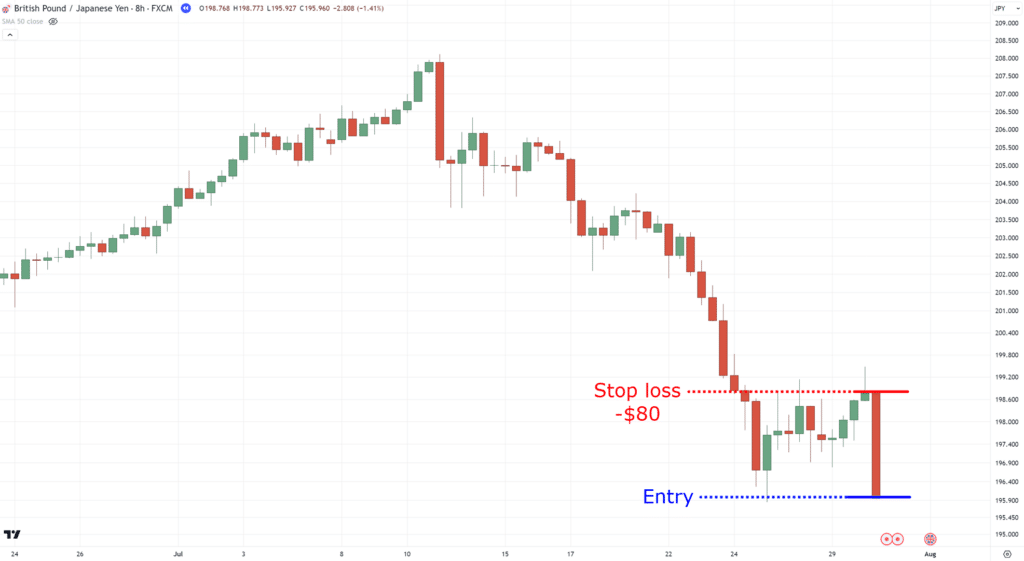

So, for instance…

You may have an $8,000 account.

1% of that capital is $80.

Because of this if my stop loss is hit, I would like to make sure that that I don’t lose greater than $30 on my overall portfolio.

Again, this so-called “1%” is different from the allocation, though we’ve touched on it a bit of before ending the previous section.

But you may ask:

“What makes this position sizing method good?”

Well, the fantastic thing about this position sizing method is you can be flexible on where you place your stop loss.

You’ll be able to place a good stop loss, and still make sure that that you just only lose 1% when your stop loss is hit:

You’ll be able to have a large stop loss, and still make sure that that you just only lose 1% when your stop loss is hit:

See what I mean?

This offers you flexibility on where you must place your stop loss as your potential loss will remain static!

So, back to the query:

How do you apply risk management in forex?

Well, using this formula…

Units to purchase = Risk amount / (stop loss in pips – value per pip)

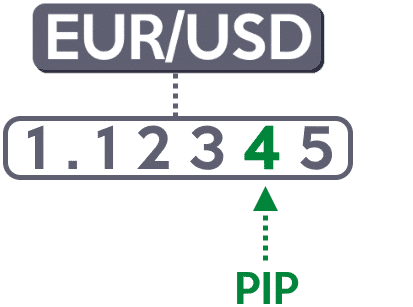

You see, we have now the term “pip” in forex, which is just about just the 4th decimal place of a cross-currency pair!

Nonetheless, we even have the term “pip value.”

Now, what’s it?

Simply put, a pip value is how much you make or lose money if the value moves 1 pip for those who buy 1 standard lot of units.

It’s just like fueling your automobile:

Asking “How much is the fuel per 1 liter?”

Can also be just like asking “How much is the pip value per 1 standard lot?”

The query now could be:

“How will we discover the worth per pip?”

Unfortunately, it’s a calculation of its own…

Value per pip = (1 pip / current price) x 1 standard lot

So, if the present price of EURAUD is 1.62932 for instance, the calculation would look something like this:

Value per pip = (0.0001 / 1.62932) x 100,000 units

When you finish the calculation, the numbers will find yourself as $6.14

Because of this for those who buy 100,000 units of EURUSD, you’ll gain $6.14 if the value moves 1 pip in your favor.

But nevertheless!

The pip value is just a component of our overall equation, so bear with me here, my friend!

Going back to our calculation:

Units to purchase = Risk amount / (stop loss in pips – value per pip)

We now know what our price per pip is, which is $6.14

And together with your $3,000 capital…

You desire to risk 1% of that account in your trade on EURUSD which is $30.

Finally, for this instance, you made the decision to put your stop loss 50 pips below the world of support:

Given all the small print we have now collected the formula now should look something like this:

Units to purchase = $30 risk per trade / (50 pips – $6.14 pip value)

After the calculations, the lots you’d have to buy to enter the trade is 0.68 lots or 6,800 units.

Because of this for those who enter EURAUD with 0.68 lots, you won’t lose greater than $30 when your stop loss is hit.

Is sensible?

Now, remember!

I’m sharing these formulas in order that if the whole lot goes unsuitable, you’ll still be independent enough to execute trades and apply risk management.

So, you might be all the time free to refer back to this guide.

Now that you realize the ins and outs of tips on how to apply risk management in forex…

How can we automate this?

Surely you don’t need to crunch all those numbers within the forex market right?

So, let me share some tools with you in the subsequent section…

The best way to apply risk management in forex: What tools must you use?

Listed below are some basic criteria I’ll lay down on what sort of risk management tools we’ll use:

- The danger management tool have to be free (no registration required)

- The danger management tool have to be easy to make use of and understand

- The danger management tool must require no installation or download

That just sounds pretty awesome, right?

That’s why I meant it after I said you can apply the whole lot you learned immediately as soon as you finish this trading guide.

So, what are the tools that meet these criteria?

The perfect position sizing tool for forex

Obviously, for forex, we won’t need the portfolio allocation method.

As you’d need leverage to start out trading forex!

So, which platform to make use of to use risk management in Forex?

Well, this one you must already be aware of…

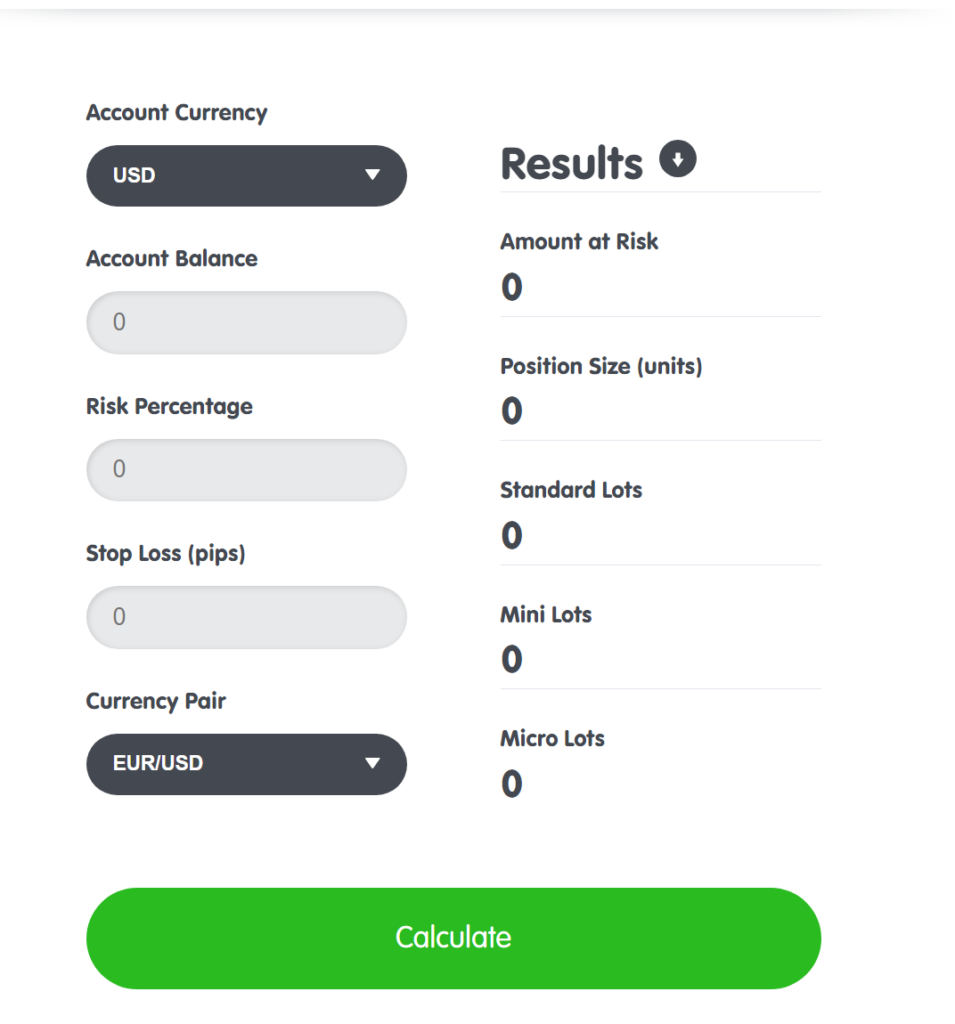

Babypips’ Position Size Calculator

Even before you employ it you’ll be able to already tell that this is so simple as it gets!

Because for those who recall the formula I shared with you, this calculator already does all of it for you.

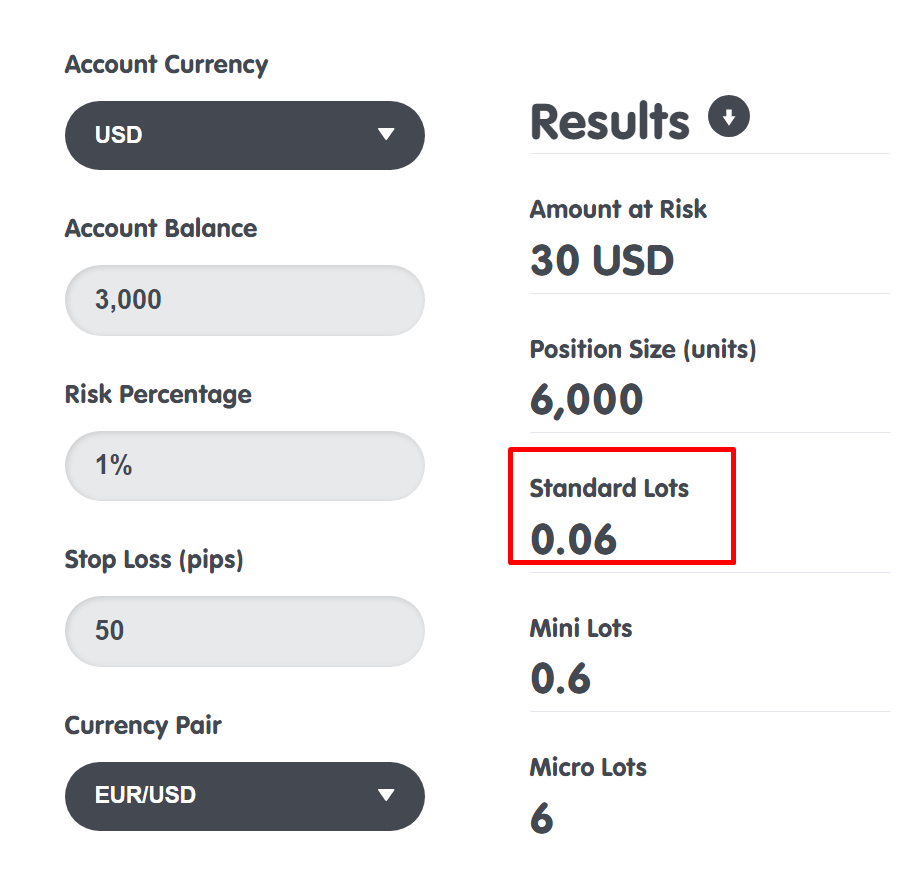

So, let’s say that you just, again, have a $3,000 account and that you just only need to risk 1% per trade.

And eventually, you have got a 50 pip stop loss.

the calculation, you would want to enter trades with 0.06 lots or 6,000 units!

In fact, there may be a downside to this calculator.

Which is that it assumes that you just are entering the trade right away as a market order.

But, what for those who want more flexibility?

What if you must place orders prematurely and apply proper risk management?

On this case, you’d need a pip value calculator…

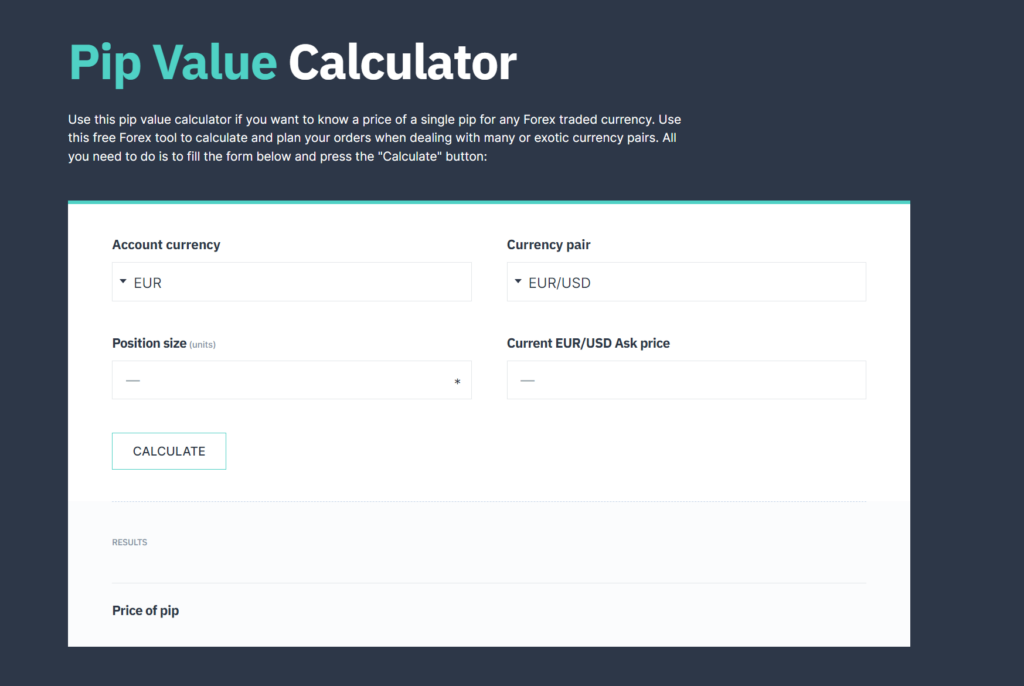

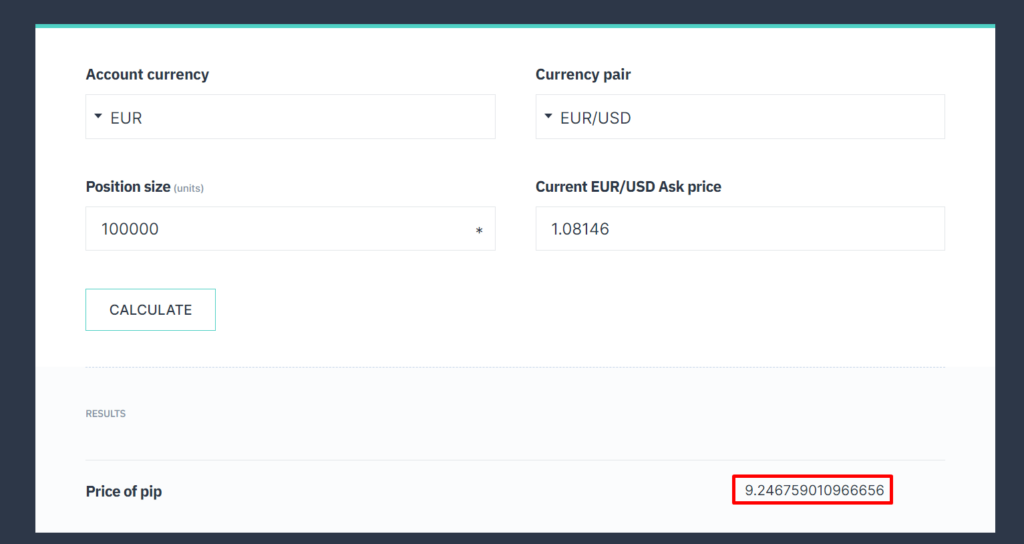

EarnForex’s Pip Value Calculator

Remember the lengthy calculation I shared with you?

Units to purchase = Risk amount / (stop loss in pips – value per pip)

Value per pip = (1 pip / current price) x 1 standard lot

Quite rather a lot, right?

But on this case, we don’t need the worth per pip calculation as we have already got a platform doing it for us!

So, same thing!

Let’s say you have got a $3,000 account and also you’re risking 1% which is $30 and your stop loss is around 50 pips.

And that you just are placing a limit order on EURUSD at the value of 1.08146.

the calculator, our pip value is $9.25 per one standard lot (yes, on this case all the time put 100k)

If we plug within the numbers…

Units to purchase = $30 risk / (50 pips – $9.25 pip value)

Units to purchase = $30 risk / 40.75

Units to purchase = 0.74 units

And yes, you’ll be able to create your spreadsheet to automate the remaining of the formulas.

But that’s just about it!

P.S. The variety of units to purchase in this instance is a distinct number from the previous example because I placed a distinct ask price

Now…

I’m sure there are rather a lot more calculators on the market that fully automate things.

There are trading platforms that have already got an integrated risk management calculator in them.

There are even indicators to put in in your MetaTrader 4 to use risk management!

But on this case…

I did my best to share with you essentially the most accessible calculators on the market as I don’t need to spend half of this guide teaching you tips on how to register with certain brokers are install indicators on our platform.

With that every one said and done, we’re not done yet.

Because in the subsequent section, I would like to do something very special for you.

More of a “bonus” on what you’ll learn on this guide.

Because for those who noticed…

I all the time ask you to risk 1% of your account per trade or allocate 10% of your account per trade.

But when can you modify those numbers?

When must you risk 0.5% per trade?

How about allocation, what do you allocate 20% of your capital per trade on a single stock?

How do you go about it?

Let me inform you in the subsequent section…

The best way to apply risk management in stocks and forex: The key to changing the parameters

The underside line is that this…

The way you modify your risk depends upon the market condition and what time of trading style you have got.

This is the reason on this final section I’ll share with you tips on how to apply risk management for intraday trading in forex.

But mainly, the lower the timeframe you go, the more precise it’s essential be.

Especially in your risk management.

This is the reason for lower timeframe trading you’d need to adopt the percentage-based risk management for Forex.

Remember the formula I shared with you?

Units to purchase = Risk amount / (stop loss in pips – value per pip)

Yes, I do know that I shared with you tools on tips on how to automate them as much as you’ll be able to.

But I pulled them out simply to refresh your memory!

In the sooner examples, I shared with you that you must risk 1% risk per trade in case your stop loss is hit, right?

But this time…

For those who’re trading below the 1-hour timeframe it’s highly really useful that you just only risk 0.5% risk per trade (no matter whether it’s a bull or bear market).

Why is that?

The explanation is frequency.

The upper the frequency of your trades, the faster the feedback you’ll get in your results

And faster the feedback signifies that the larger the chance your emotions can be involved (i.e. greed and fear).

So, to scale back your attachment to single wins and losses, you’d need to risk 0.5% risk per trade in order that your mind is more focused on the numbers than the returns.

Got it?

And that’s the whole lot for today!

The world of risk management is exciting, and what I’ve shared with you today is just the tip of the iceberg.

Nonetheless, I made sure to share with you adequate to get you began trading within the forex market as soon as possible.

So with that said, let’s do a fast summary of what you’ve learned today…

Conclusion

Here’s the reality:

Knowing tips on how to apply risk management in forex must come first and never last.

This ensures that you just don’t blow your hard-earned money regardless of how again and again you mess up!

Worse case?

Your portfolio bleeds.

Supplying you with enough time to stop the bleeding and learn from mistakes (as a substitute of nuking your portfolio with one trading mistake)

So, here’s a fast recap of what you’ve learned today…

- Having a risk-based percentage position sizing is a little more complicated to use, but this offers you each the pliability of placing your stop loss anywhere while also maintaining risk.

- There are free and accessible position sizing calculators ready so that you can access, corresponding to calculators from BabyPips, and EarnForex.

- For those who plan to trade the lower timeframes, risk 0.5% per trade and even lower corresponding to 0.25%

And that’s just about it!

An entire guide from beginner to advanced on how you’ll be able to surgically control the chance parameters of your portfolio!

But this time I would like to listen to what you think that.

What are another risk management methods you realize of?

And for those who trade crypto, how do you apply risk management there?

Let me know within the comments below!