This has been a yr of milestones. Since mid-May, the enduring Dow Jones Industrial Average has notched its first close over 40,000, the broad-based S&P 500 climbed above the 5,500 level, and the growth-powered Nasdaq Composite surpassed the 18,000 mark. This full-fledged bull market comes courtesy of the euphoria surrounding the rise of artificial intelligence (AI).

Without getting overly complex, AI uses software and systems to undertake tasks that humans would normally oversee. What makes AI so special is the flexibility of software and systems to learn and evolve without human oversight. If AI software and systems change into more adept at their tasks over time or perhaps learn recent skills, just about every sector and industry of the worldwide economy would profit.

Although dozens of firms have benefited from investors pouring their capital into the AI revolution, none stands out greater than semiconductor titan Nvidia (NASDAQ: NVDA).

Nvidia has enjoyed a historic operational ramp

Nvidia’s calling card to success has been its AI-driven graphics processing units (GPUs). Specifically, the corporate’s H100 GPU has quickly change into the go-to chip that enables for split-second decision-making in high-compute data centers.

In accordance with the semiconductor-focused analysts at TechInsights, Nvidia was liable for shipping 3.76 million of a possible 3.85 million AI GPUs in 2023. Businesses have lined up to buy the H100 to coach large language models and run generative AI solutions.

Certainly one of the important thing benefits for Nvidia is that enterprise demand for AI GPUs has handily outpaced supply. Based on the law of supply and demand, the value of a superb or service is liable to extend if the availability of said good or service is insufficient to fulfill demand. Nvidia has been in a position to rapidly increase the value of its GPUs, which, in turn, sent its adjusted gross margin to greater than 78% in the course of the fiscal first quarter (ended April 28).

Despite its first-mover benefits, this market-leading company is not sitting on its laurels. Within the latter half of 2024, it’s expected to roll out its next-generation AI GPU architecture, often called Blackwell. This recent platform can expedite quantum computing, data processing, engineering simulations, and generative AI solutions, amongst other tasks.

Beyond Blackwell, CEO Jensen Huang teased its next-gen Rubin platform to the world in June. Rubin can have an all-new central processing unit (often called Vera) and is ready to make its debut in 2026. In other words, Nvidia appears to have a path to sustained compute benefits over its peers.

Although Nvidia has absolutely crushed Wall Street’s loftiest revenue and profit projections for greater than a yr, and its operational ramp has been nothing in need of textbook, evidence is mounting that it might be in a bubble.

While history doesn’t repeat to a T on Wall Street, it does generally tend to rhyme. Based on three compelling charts, we could have already witnessed a top for Wall Street’s hottest AI stock.

Next-big-thing innovations all the time endure an early-stage bubble

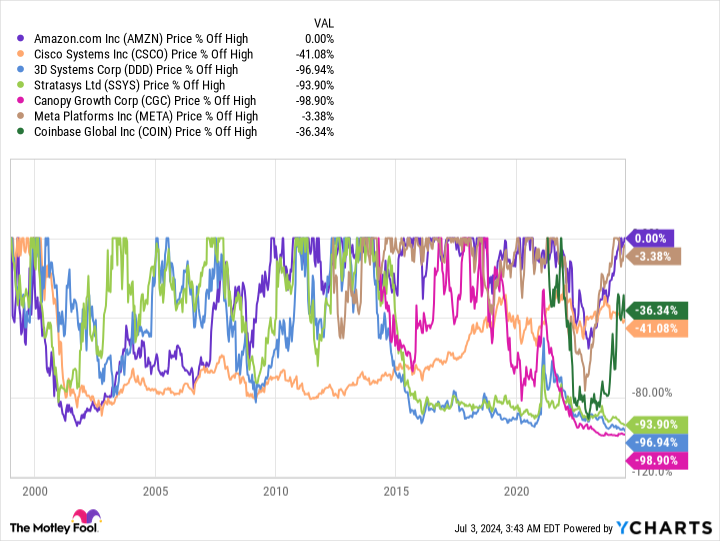

During the last 30 years, Wall Street and investors have had no shortage of next-big-thing investment trends to chase. The appearance of the web, genome decoding, business-to-business commerce, China stocks, nanotechnology, 3D printing, blockchain technology/cryptocurrency, cannabis, and the metaverse have captivated the eye of latest and seasoned investors.

But these trends share a similarity: early-stage bubbles.

Even though it’s unimaginable to predict when the music will stop, industry-leading businesses for all the above trends eventually face-planted.

As you may see within the chart above, a few of the buzziest investments during the last quarter of a century have nosedived after the bubble burst for his or her respective innovation, technology, or trend. In no particular order:

-

The networking/e-commerce revolution saw Amazon and Cisco Systems shed within the neighborhood of 90% of their values in the course of the dot-com bubble.

-

3D Systems and Stratasys, which led the 3D printing hype, have never come near replicating their ascents from their early 2010s and currently sit 97% and 94% below their respective all-time highs.

-

Canadian cannabis stock Cover Growth has plummeted a whopping 99% since hitting its record-closing high.

-

Cryptocurrency play Coinbase Global dumped nearly 90% from its peak close before rebounding.

-

Social media maven Meta Platforms, which had been the face of the metaverse, plunged by about 80% before rallying to recent highs.

The purpose I’m attempting to make is that investors have overestimated the uptake of each recent technology or trend for the last 30 years, and there is no reason to imagine that AI goes to be any different. History (i.e., the above chart) strongly suggests that lofty growth forecasts for AI aren’t going to be achieved, and a period of maturation shall be needed for this potentially game-changing technology.

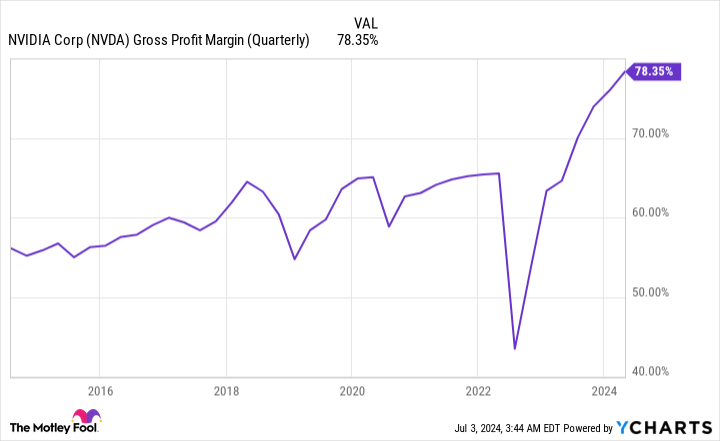

Nvidia’s adjusted gross margin won’t be sustainable

A second reason to suspect Wall Street’s AI leader is in a bubble may be seen in the corporate’s current and forecast adjusted gross margin.

As I noted earlier, Nvidia has undeniably benefited from AI GPU demand outpacing supply. The power to lift its prices has sent its adjusted gross margin higher by 13.72 percentage points over the previous five quarters.

But as you may see within the chart above, an adjusted gross margin of around 60%, give or take a number of percentage points in either direction, has been the norm over the trailing-10-year period. While this does not dismiss that Nvidia has steadily improved its adjusted gross margin over time, it does suggest that a 13.72-percentage-point increase in 15 months is unsustainable.

As an illustration, Nvidia guided to an adjusted gross margin of 75.5% (+/- 50 basis points) for the fiscal second quarter. Although this remains to be well above its historic average, a sequential decline of 235 to 335 basis points for the present quarter suggests that margin pressures are starting to take shape.

Through the second half of 2024, Intel will roll out its Gaudi 3 AI-accelerator chip on a broad-scale basis, and Advanced Micro Devices will beef up production of its MI300X AI GPU. Further, Nvidia’s top 4 customers are all internally developing AI GPUs for his or her respective data centers.

Even when Nvidia’s AI GPUs easily retain their compute benefits, overwhelming enterprise demand for GPUs may allow these competitors to thrive and/or reduce data center space for Nvidia’s chips. Briefly, Nvidia’s fiscal second-quarter margin guidance looks like a warning that its adjusted gross margin has peaked.

We have seen this before — and it wasn’t a fairly sight

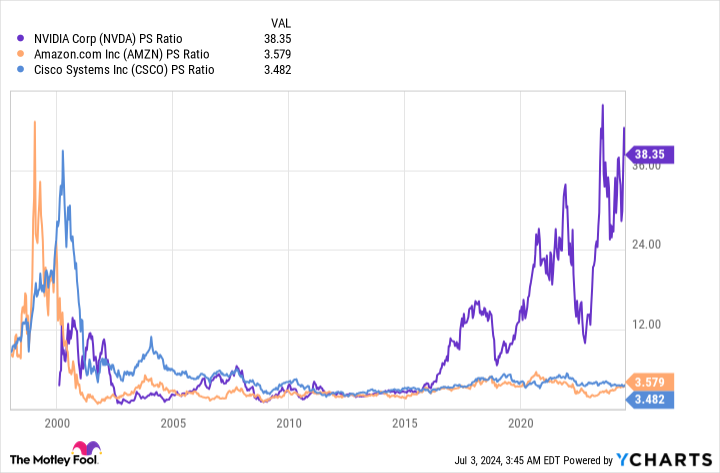

The third damning chart for Nvidia has to do with its valuation.

To be fair, some traditional fundamental metrics suggest Nvidia could still be something of a bargain for long-term investors. As an illustration, Nvidia’s shares ended the July 2 session at near 34 times forward-year earnings. While it is a higher forward-year earnings multiple than the benchmark S&P 500, it isn’t unreasonable if you think about that Wall Street is forecasting an annualized earnings growth rate of 46% for the corporate through 2028.

Nonetheless, one other valuation metric is undeniably concerning.

As you may see within the chart above, Nvidia is valued at greater than 38 times its trailing-12-month (TTM) price-to-sales (P/S) ratio. For market-leading businesses on Wall Street, that is considered one of the best readings we have ever witnessed. In actual fact, the reading of 42 times TTM P/S that Nvidia reached in mid-June effectively matched the height from Amazon and Cisco Systems prior to the bursting of the dot-com bubble.

History has consistently shown us that prolonged valuations may be powered by euphoria over the short run. But when examined over an prolonged timeline, market leaders with nosebleed P/S ratios are eventually pummeled. Although there is no concrete strategy to know ahead of time when a top has occurred, we have seen this scenario play out before, and the final result hasn’t been pretty.

While Nvidia has the tools to stay a successful company over the very long run, these historic charts strongly suggest that essentially the most direct AI beneficiary is in a bubble.

Must you invest $1,000 in Nvidia without delay?

Before you purchase stock in Nvidia, consider this:

The Motley Idiot Stock Advisor analyst team just identified what they imagine are the 10 best stocks for investors to purchase now… and Nvidia wasn’t considered one of them. The ten stocks that made the cut could produce monster returns in the approaching years.

Consider when Nvidia made this list on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $786,046!*

Stock Advisor provides investors with an easy-to-follow blueprint for fulfillment, including guidance on constructing a portfolio, regular updates from analysts, and two recent stock picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of directors. Sean Williams has positions in Amazon, Intel, and Meta Platforms. The Motley Idiot has positions in and recommends Advanced Micro Devices, Amazon, Cisco Systems, Coinbase Global, Meta Platforms, and Nvidia. The Motley Idiot recommends 3d Systems and Intel and recommends the next options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Idiot has a disclosure policy.

3 Charts That Strongly Suggest Artificial Intelligence (AI) Titan Nvidia Is in a Bubble was originally published by The Motley Idiot