Americans owe about $1.7 trillion in student debt. That’s greater than for every other category of loans other than mortgages.

While the entire owed has skyrocketed over the past three many years, latest student debt has actually been receding in recent times. Indeed, the annual amount students tackle in debt has declined steadily since enrollment in higher education peaked in 2010.

Still, greater than 43 million Americans today have outstanding student loans. Amongst those that have debt, the median amount per household is about $25,000, in response to the Federal Reserve’s Survey of Consumer Funds. (The average student debt balance by household is around twice as high — at nearly $47,000 — as a consequence of a comparatively small share of Americans with six-figure debts pulling up the mean figure.)

Read on for more information on who has student debt, the everyday debt by degree type, how Americans are repaying their debt and more.

Who’s carrying student debt?

The media attention on student debt might lead you to think it’s more common than it actually is. About 1 in 5 American adults has educational debt. That’s a far lower incidence than the 40% of households who’ve a mortgage and the 35% who’ve an auto loan.

That gap is partially because many Americans don’t attend postsecondary education. And even amongst those that do, many don’t borrow money to be able to achieve this. Roughly 4 in 10 bachelor’s degree recipients graduate without debt.

That said, it’s undoubtedly true that taking out a student loan is a standard American experience. Read on for a deeper dive into who those debtors are.

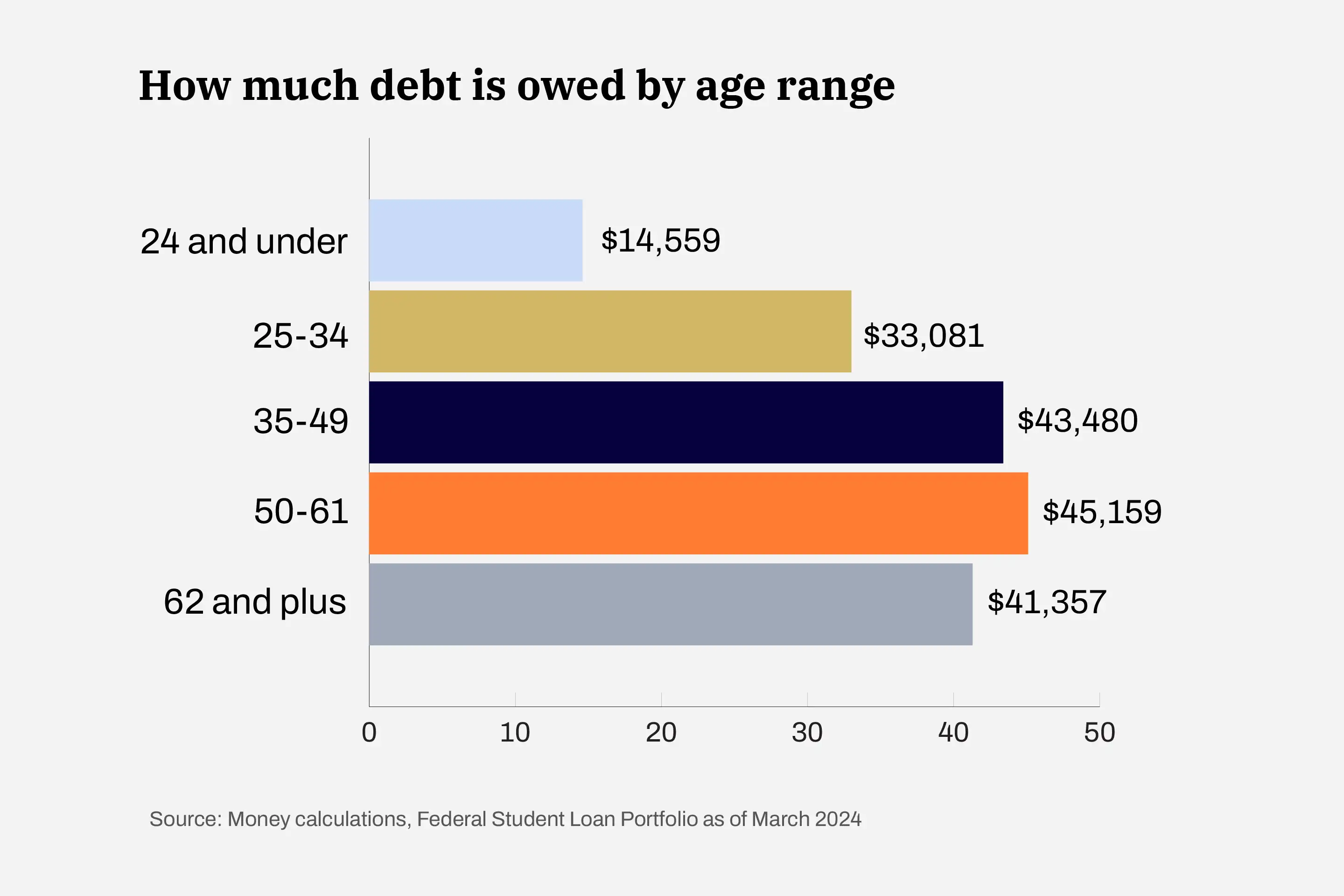

Student debt by age

Perhaps unsurprisingly, most individuals with student debt — about two-thirds of them — are between the ages of 25 and 50. This group also owes essentially the most, federal statistics show. That said, the fastest growing group of borrowers up to now several years has actually been older adults.

There are 2.7 million borrowers who’re 62 or older, a figure that’s up by 59% since 2017. Borrowers aged 50 and up now carry 25% of the nation’s student debt, which is greater than double the share they held 20 years ago. That growth captures debt for their very own degrees, particularly for adults who went back to highschool, and from loans taken out to fund a baby’s education.

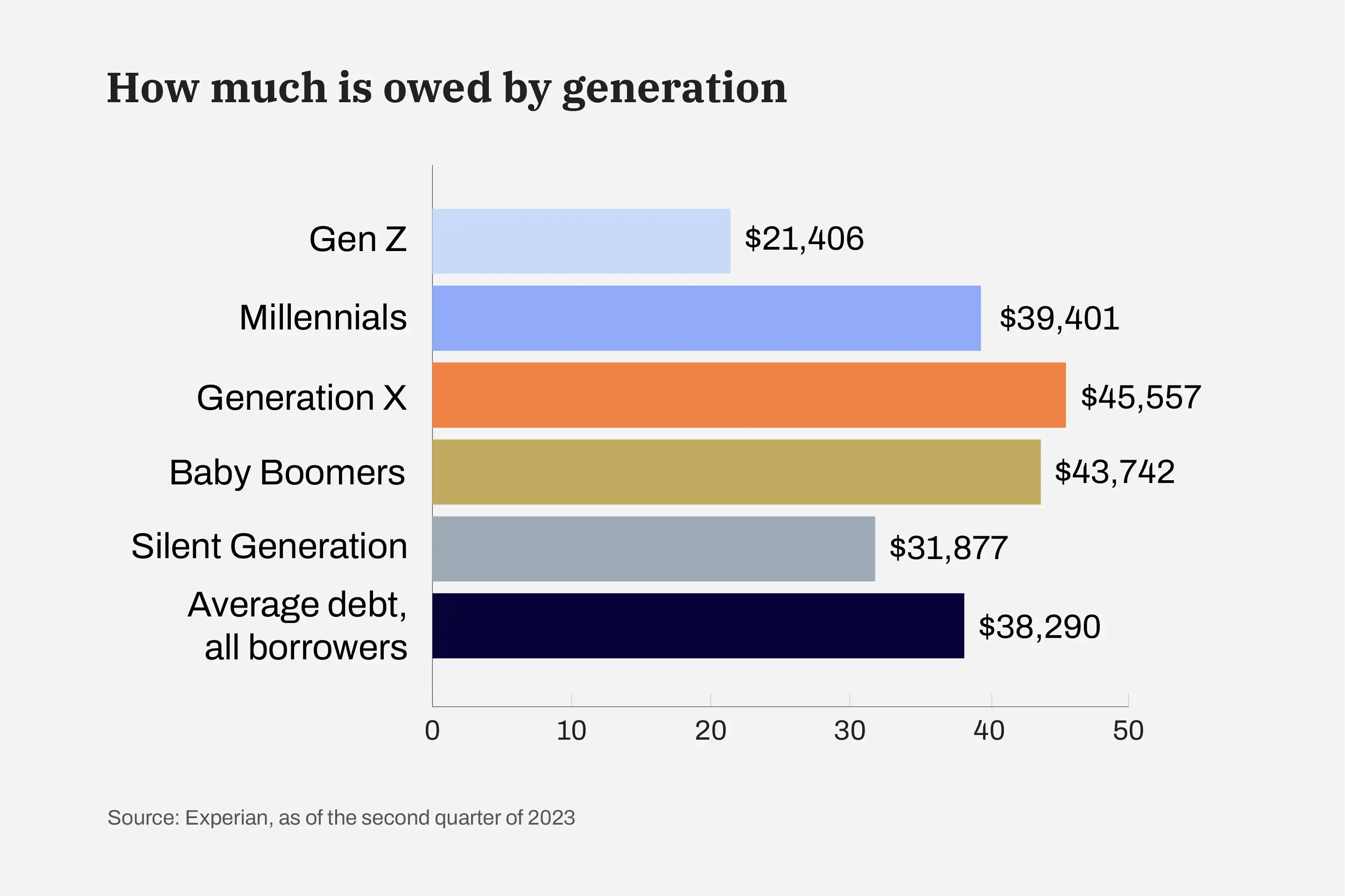

Student debt by generation

Federal statistics don’t break down student debt by generation. Yet data from the credit bureau Experian reveals a generational breakdown that tracks the age statistics reported by the federal government. That’s, Gen X — or Americans aged between 44 years and 59 years in 2024 — hold essentially the most student debt, followed by Baby Boomers (aged 60-78) and Millennials (28 to 43)

Some research has suggested that the youngest borrowers, Gen Z Americans (aged 12-27 years in 2024), are more debt-averse in the case of student loans than previous generations, which could partially explain their lower average debt burden. But many who’re captured within the Gen Z data is probably not done with their education – or with borrowing to fund it. They may still be in college or could eventually re-enroll to earn a graduate degree.

Individuals within the Gen Z and Baby Boomer groups, meanwhile, might still be holding debt from their very own education or from borrowing for his or her child’s education (or each). The identical may apply for the Silent Generation (79 and older), whose student debt averages over $30,000.

Note that these statistics are based on 2023 numbers, and it’s not clear the extent to which recent efforts by the Biden administration to forgive student debt can have modified the figures. A part of the administration’s latest pitch for debt forgiveness, which remains to be facing legal challenges, calls for wiping out the balances of borrowers who’ve held debts for 20 years or longer, which could shift the balances of some older generations.

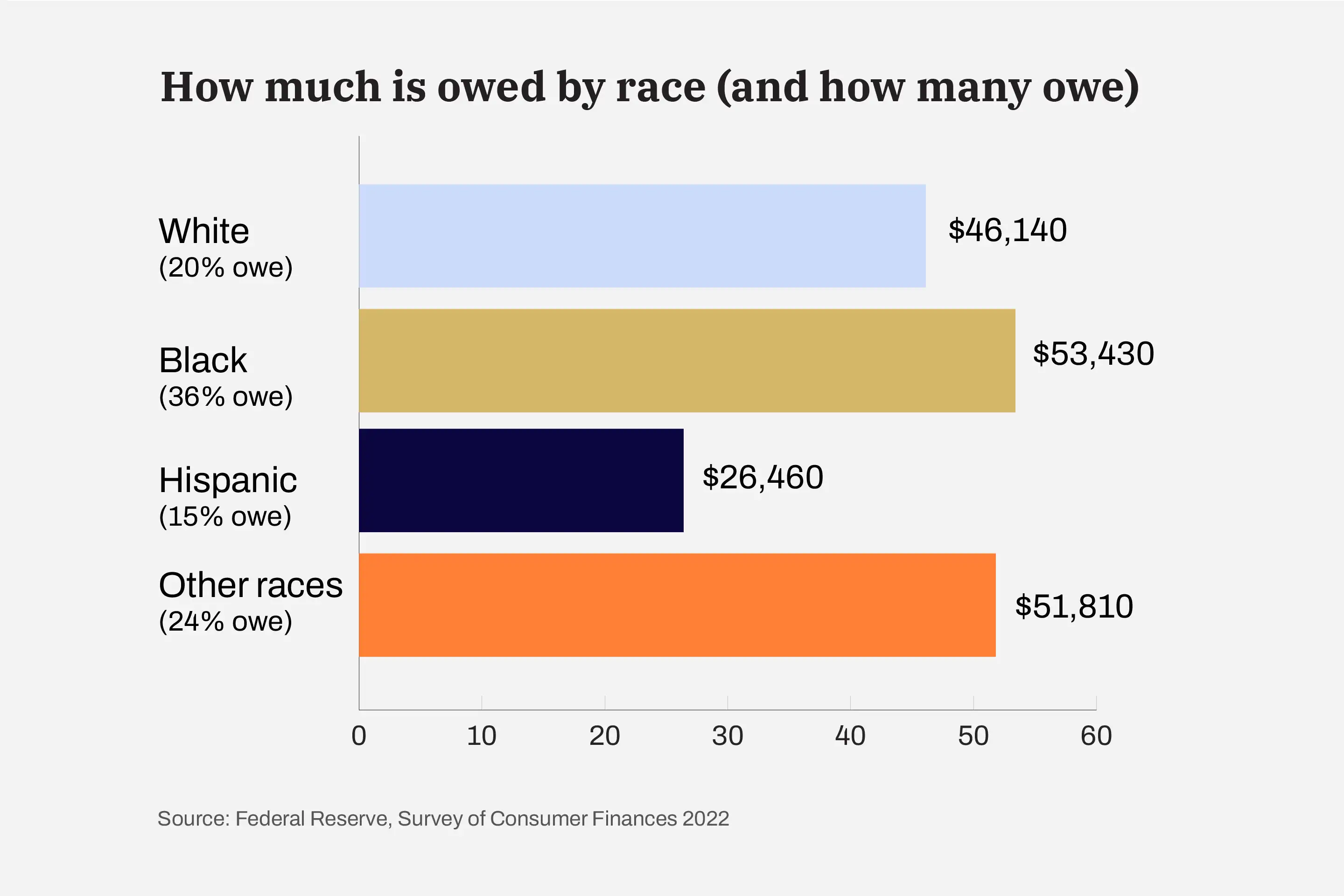

Student debt by race

As with other forms of financial products, the use and outcomes related to student debt look different once you break the info down by race.

Black borrowers carry higher average balances than their white peers; additionally they are likely to take longer to repay the debt. Hispanic students, then again, are likely to be way more debt-averse than their peers, which might be seen within the lower share of Hispanic households with debt and their more modest average balance. One report found that despite the fact that these students borrow less, they still report feeling more stressed about debt than their white peers.

Here’s the typical student debt in response to racial group, together with the proportion of households who’re carrying such debt. Data reflects all age groups for individuals who are carrying student debt.

The share of white and Hispanic households holding student debt has been relatively regular since 2010; depending on the yr, 18% to twenty% of white households have held student debt, together with 14% to fifteen% of Hispanic households.

That’s not the case with Black families, as data from the Federal Reserve’s Survey of Consumer Funds shows. In 2010, 24% of Black households held student debt. In 2022, the share had climbed to 36%. The standard student debt by household for Black borrowers also climbed faster than for other racial groups in that point period.

A big cadre of research now shows that student debt disproportionately burdens Black borrowers. Not only are Black students more more likely to borrow, and to want to borrow more, but they struggle way more with paying back their loans. For instance, 30% of Black college graduates with federal student loans report having defaulted at the very least once, in comparison with just 10% of white graduates, the Federal Reserve Bank of Richmond reports. An earlier study found that Black college graduates usually tend to default than white college dropouts.

Student debt by gender

Women have outnumbered men on college campuses for many years now. So it is sensible that girls, overall, hold more student debt than men, because there are simply more women who attend college and subsequently more women who borrow.

But women even have higher debt balances than men who’ve earned the identical degree. Women with a bachelor’s degree leave college with $2,700 more in loans than men, in response to the American Association of University Women. Women also take about two years longer to repay student loans.

Black women are doubly burdened: One report found about 43% of Black women who had enrolled in some form of postsecondary education had student loan debt in 2022. That’s in comparison with 19% of white women and 15% of white men.

Student debt by state

Cities which can be home to a high share of employees with advanced degrees are likely to have higher student debt balances, as you’d expect. But state-by-state borrowing averages are harder to make generalizations about, for the reason that options for inexpensive education, availability of state financial aid and the fee of living after college can all play a task in how much residents borrow and the way they’re in a position to pay it down.

That said, most of the states with the very best average debt balances are on the East Coast, while those with the bottom balances are likely to be in the midst of the country.

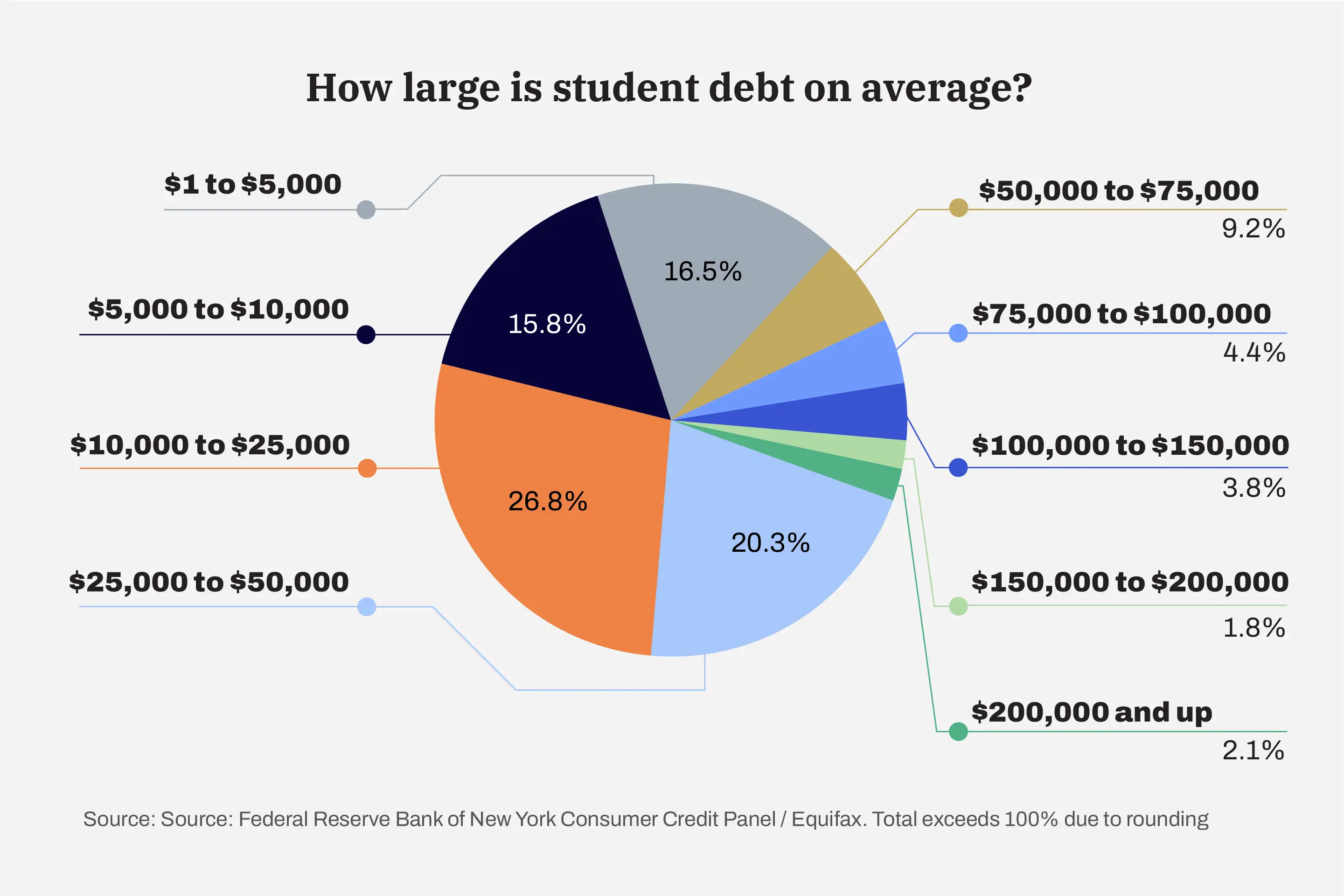

Student loan borrowers by balance owed

Most borrowers even have relatively small debt balances. Greater than 30% of borrowers, for instance, owe lower than $10,000, while lower than 8% of borrowers owe greater than $100,000.

Average student debt by degree

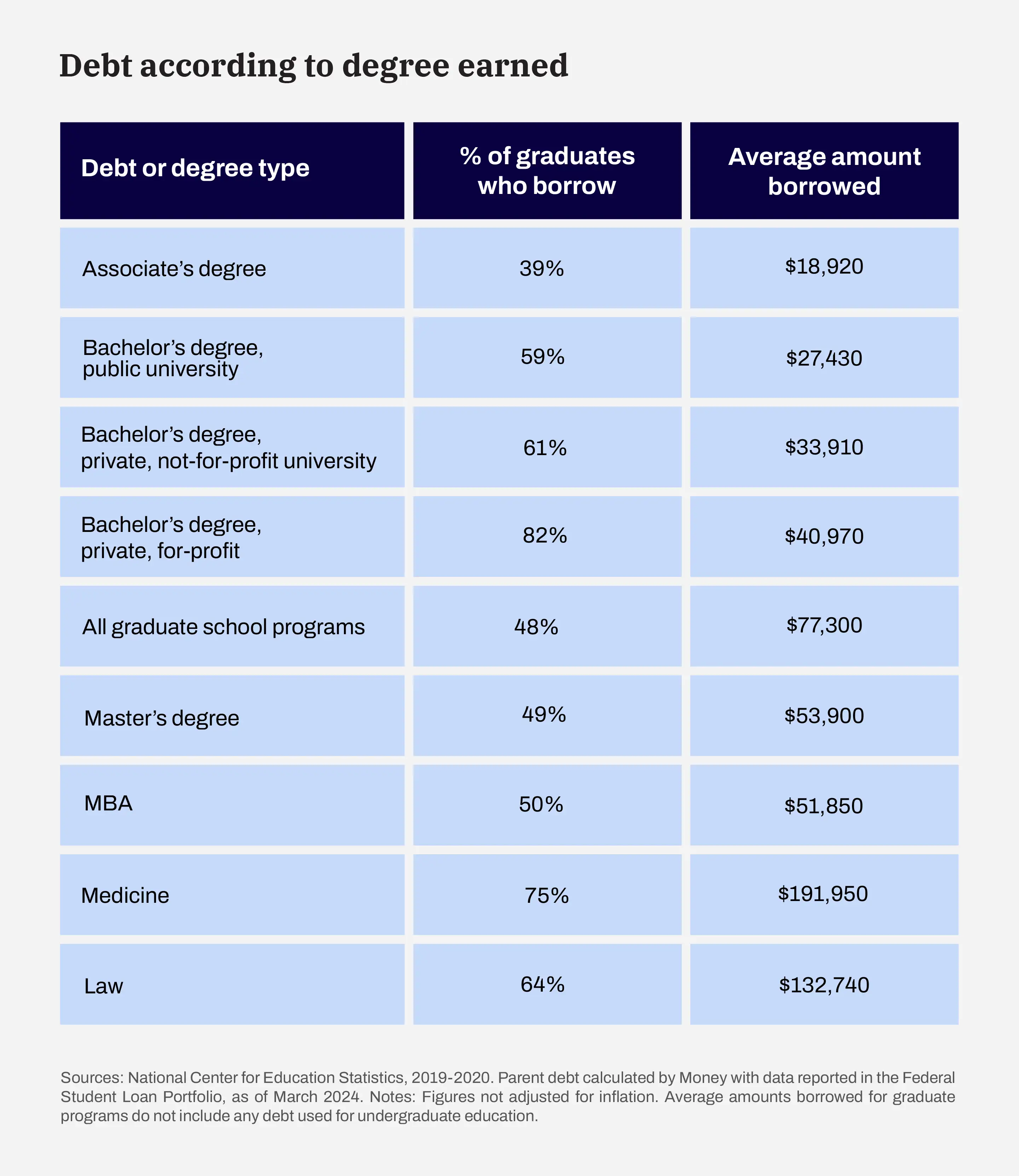

Debt varies widely by the extent and form of degree earned, with skilled degrees, including medical, law, dentistry and veterinary degrees, routinely topping the list of graduates with the biggest debt burdens. Even inside a particular degree, debt can vary based on school type. The general average for a bachelor’s degree, for instance, is $30,500, but the typical at for-profit colleges is higher than that at traditional private and non-private colleges.

How are borrowers repaying their student loans?

When federal borrowers enter repayment, they’re placed within the “standard” repayment plan, which is a 10-year term with all monthly payments equal.

In point of fact, most borrowers take longer than 10 years to do away with their debt, either through paying it off in full or qualifying for some form of forgiveness. One estimate, from financial aid expert Mark Kantrowitz, puts the everyday loan pay-off time at between 16 and 19 years.

Before the pandemic student loan payment pause, the median monthly payment was between $200 and $299, in response to the Federal Reserve. Some 40% of borrowers who’re paying back their student loans are in repayment plans that tie their monthly payments to how much they earn and offer loan forgiveness for any outstanding balance after a certain variety of payments have been made.

Here’s a snapshot of how borrowers are repaying their loans, per federal statistics.

- 25.4 million: # of borrowers in repayment

- 12.5 million: # of borrowers in repayment are in an income-driven repayment plan

- 5.2 million: # of borrowers in deferment or forbearance

- 7.1 million: # of borrowers are delinquent

Note: The list above only captures borrowers with federal Direct Loans. Borrowers with older loans from the Federal Family Education Loan Program usually are not included.

Private student loan statistics

Greater than 90% of outstanding student debt in America is federal debt. But there are students and fogeys who turn to private student loans every yr to fill within the gaps left after federal financial aid is tapped.

Through the 2022-2023 school yr, families borrowed greater than $10 billion in private loans. That is a 6.7% increase from the yr before, in response to Enterval, a lending analytics firm. The common private student loan balance is just over $13,000, Enterval’s data show. In all, Americans hold an estimated $130 billion in private student debt.

More from Money:

These Are the Best Colleges in America

Down Payment vs. Student Loans: Methods to Determine Where to Put Your Money