Forex lot sizes can appear to be a little bit of a mystery from the skin.

Although often missed, they play an important role in effective foreign currency trading.

Truly understanding them can provide help to manage risk, resulting in gradual, more reliable account growth.

The truth is, I often get asked about lot sizes and the perfect ways to work them out…

…which is strictly why I made this guide!

So in this text, you’ll cover:

- What exactly forex lots are

- A clearer understanding of pips and their role in lot sizing

- Suitable lot types for various account sizes

- Practical examples showing how one can calculate lot sizes using charts

- Useful tools for quick lot size calculations

Are you ready?

Then let’s dive in!

What’s a forex lot?

A forex lot is the scale of a position you are taking within the forex market, long (buy) or short (sell).

There’s a parallel concept in traditional stock trading.

Just because the variety of shares bought determines the position size in stocks…

…lot sizes let you know what number of currency units are in a forex trade.

Let’s compare by utilizing a stock market scenario.

Say you spend money on an organization and buy 10,000 shares at $1 per share.

The full value of your investment is just 10,000 shares multiplied by $1, which equals $10,000.

Your quantity is 10,000 shares, and your investment is $10,000.

Now, imagine you’re trading currency pairs as a substitute.

If you happen to buy 1 Standard lot of the EUR/USD currency pair, which is 100,000 units of the bottom currency (on this case, the euro), your position size equals 100,000 euros.

Alternatively, purchasing 1 Mini lot of that very same currency pair, 10,000 units of the bottom currency, means your position size is 10,000 euros.

As you may see, lot sizes simply determine the quantity of currency units involved within the trade.

To actually grasp lot sizing, though, it’s essential to grasp the concept of pips…

Understanding Pips

Pips, short for “percentage in points” are the universal unit of measurement in foreign currency trading.

They indicate the smallest price change within the exchange rate of a currency pair.

For many currency pairs, one pip means 0.0001 – apart from pairs involving the Japanese yen, which I’ll discuss shortly.

Let’s test it out in an example.

Suppose you’re trading the EUR/USD currency pair, and the present exchange rate is 1.2000.

If the exchange rate moves from 1.2000 to 1.2005, it has increased by five pips.

Then again, if it moves from 1.2000 to 1.1995, it has decreased by five pips.

Got it?

Trading currency pairs involving the Japanese yen is different, though, as a result of its relatively low value in comparison with other major currencies.

On this case, one pip is such as 0.01 somewhat than 0.0001, so that you’ll need to regulate your math.

For instance, imagine trading the AUD/JPY currency pair, where the exchange rate is 80.00.

If the exchange rate moves from 80.00 to 80.09, it has increased by nine pips.

Similarly, if it moves from 80.00 to 79.91, it has decreased by nine pips.

Did you notice the difference? (check the decimal places!)

Great – then let’s move on!

Different Varieties of Lot sizes

Forex brokers offer various lot sizes – for traders with all types of risk preferences and account sizes.

Principally, there are 4 several types of Lot Sizes:

- Standard Lot: 100,000 units of the bottom currency

- Mini Lot: 10,000 units of the bottom currency

- Micro Lot: 1,000 units of the bottom currency

- Nano Lot: 100 units of the bottom currency

Standard Lot: Preferred by institutional investors and experienced traders as a result of its substantial size, allowing significant exposure to the market.

Mini Lot: Mini lots are suitable for traders with smaller account sizes or those that want to trade with less capital in danger.

Micro Lot: Micro lots are popular amongst novice traders and people with limited trading capital, as they allow precise risk management and smaller position sizes.

Nano Lot: The smallest lot size available, Nano lots are perfect for practicing trading strategies or executing trades with minimal risk.

It’s value noting that orders might be placed at a fraction of 1 full lot, no matter its type, allowing for precision in position sizing (e.g., 0.54 Lots).

Take a take a look at the next table…

Note that Pip Value will all the time be within the quote pair currency, and most major pairs will likely be quoted in divisions of $10.

This Pip Value indicates how much your profit or loss will change with one pip movement…

For instance, if you happen to’re trading 1 Standard lot and the value moves 5 pips in your favor, you’ll gain near $50 in profit, minus fees and spreads.

Then again, if you happen to were trading a Micro lot, the identical 5-pip movement would end in only $0.50 in profit.

So, when using calculators to find out lot size, it’s crucial to think about the pip value for the particular lot size you’re using!

Let’s take a more in-depth look…

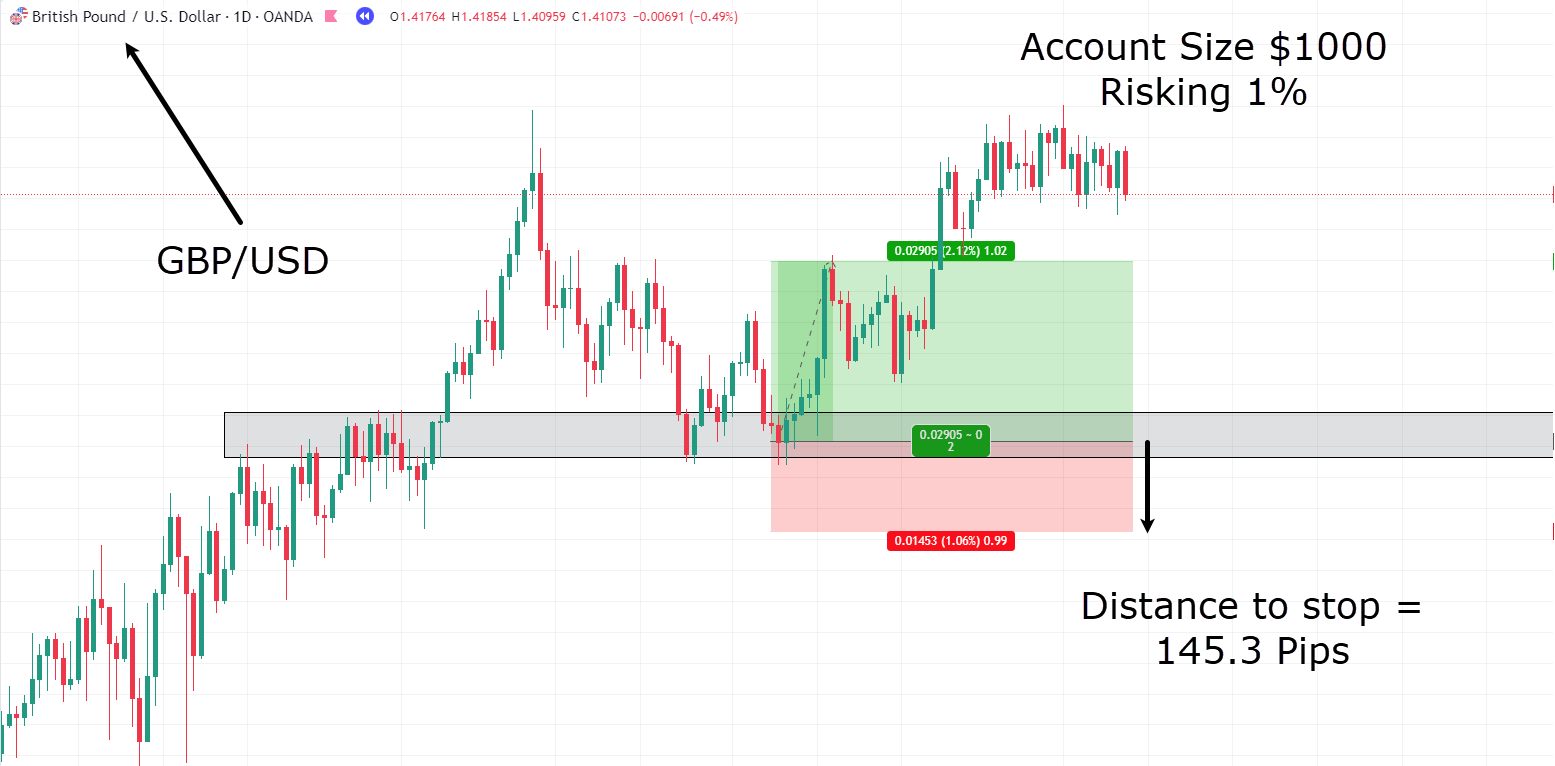

GBP/USD Every day Chart Trade Entry:

Imagine you have got a $1000 trading account and wish to risk $10 per trade.

The gap to your stop loss is 145.3 pips, which we’ll round to 145 for simplicity.

The calculation for determining the lot size is as follows:

Lot Size = (Account Balance x Risk Percentage) / (Pip Value x Stop Loss in Pips)

Take note that the Pip Value will depend on the kind of lot you’ll be using, but I’ll use a Standard lot here:

Lot Size = (1000 x 0.01) / (10 x 145)

= 10 / 1450

≈ 0.0069 Standard Lots

This implies you’d need to make use of roughly 0.0069 Standard Lots.

Nonetheless, entering such a precise lot size might not be feasible, which makes an amazing use case for Mini or Micro lots as a substitute…

Using Micro lots:

Lot Size = (1000 x 0.01) / (0.1 x 145)

= 10 / 14.5

≈ 0.69 Micro Lots

OK so, I understand what you may be pondering…

“I can’t undergo all this maths at any time when I need to enter a position!”

…which is strictly why I like to recommend using a position size calculator to automate the method.

(Still, you will need to understand how lot sizes are worked out behind the scenes!)

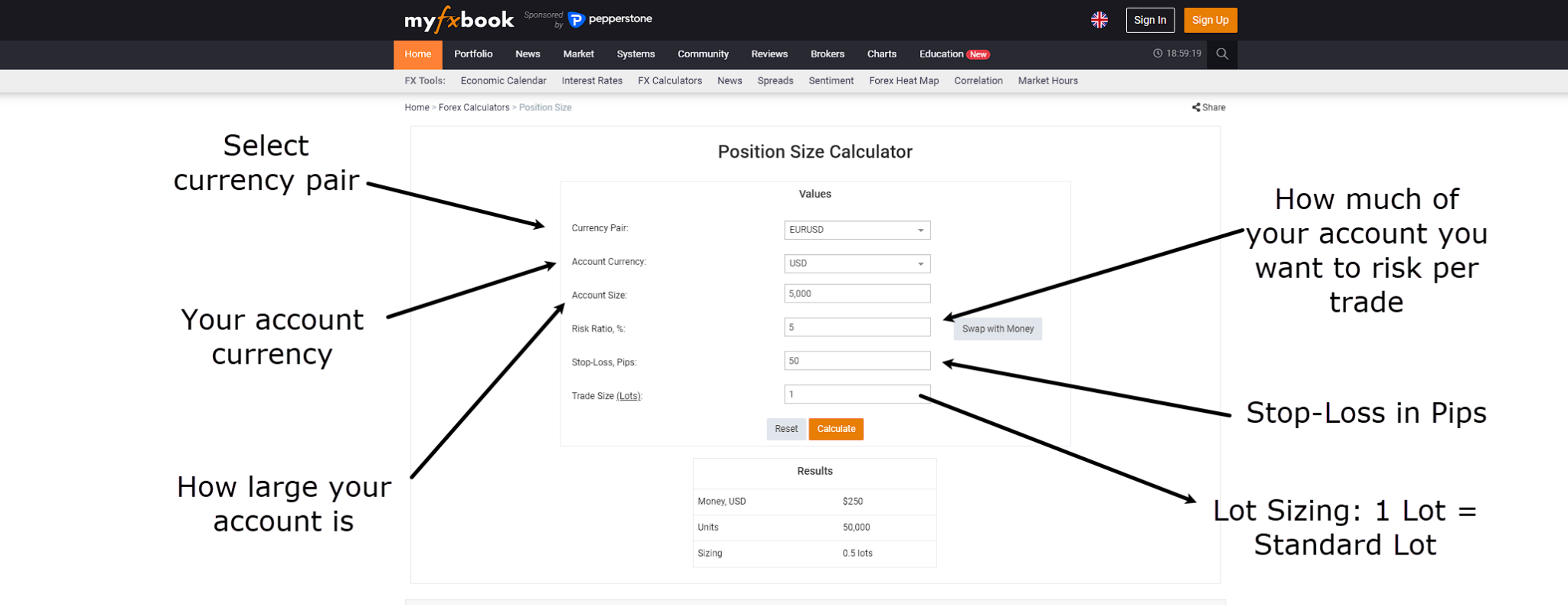

For the following example, let’s use a free web-based position size calculator, Myfxbook…

Myfxbook Position Size Calculator

Suppose you have got a $20,000 account and are willing to risk 2 percent on each trade, which amounts to $400 per trade.

Given this risk tolerance, you may afford Standard lot positions, as it really works well with the $10 price movement per pip.

Now, let’s examine the chart…

AUD/USD Every day Chart Trade Entry:

On this scenario, we’re a brief trade on the AUD/USD pair.

The gap to the stop loss from the entry point is 102.8 pips.

But how would you input this trade right into a position size calculator?

Let’s discover…

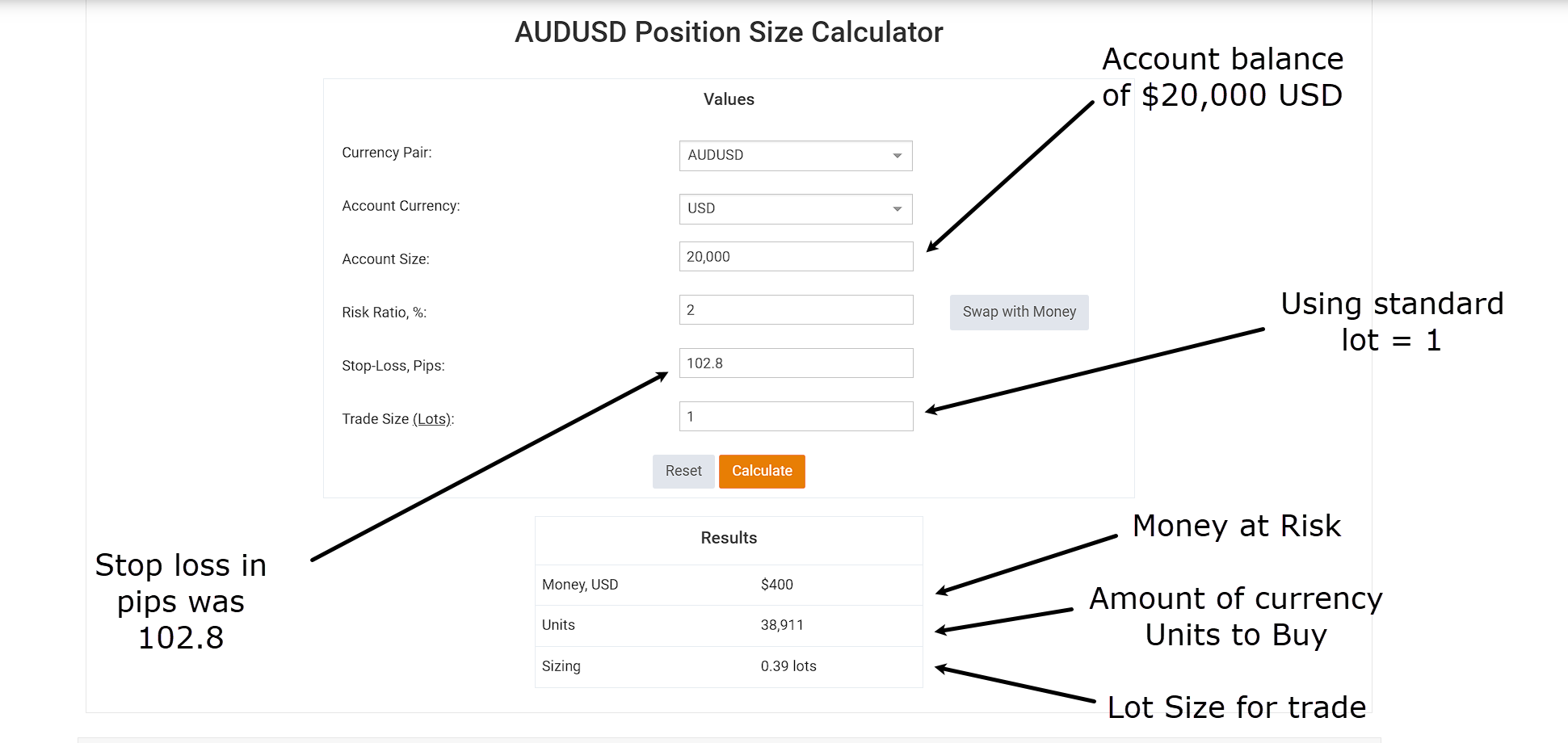

Position Size Calculator Trade Example AUD/USD:

As you may see, the calculated units required for this trade amount to 38,911.

When calculating lot sizes, though, it’s common to round up or right down to the closest decimal point.

On this case, 38,911 is rounded as much as 39,000, meaning lots size of 0.39 Standard Lots.

If the value hits your stop loss, your stop will trigger a buy order, and you may buy back 0.39 lots at a lack of -$400.

Conversely, if the value reaches the 2RR (Risk-Reward) goal, your take-profit order would buy back your 0.39 Lots at a profit of around $800.

Does this make sense?

Great!

Then let’s delve into some extra methods for calculating your lot sizes…

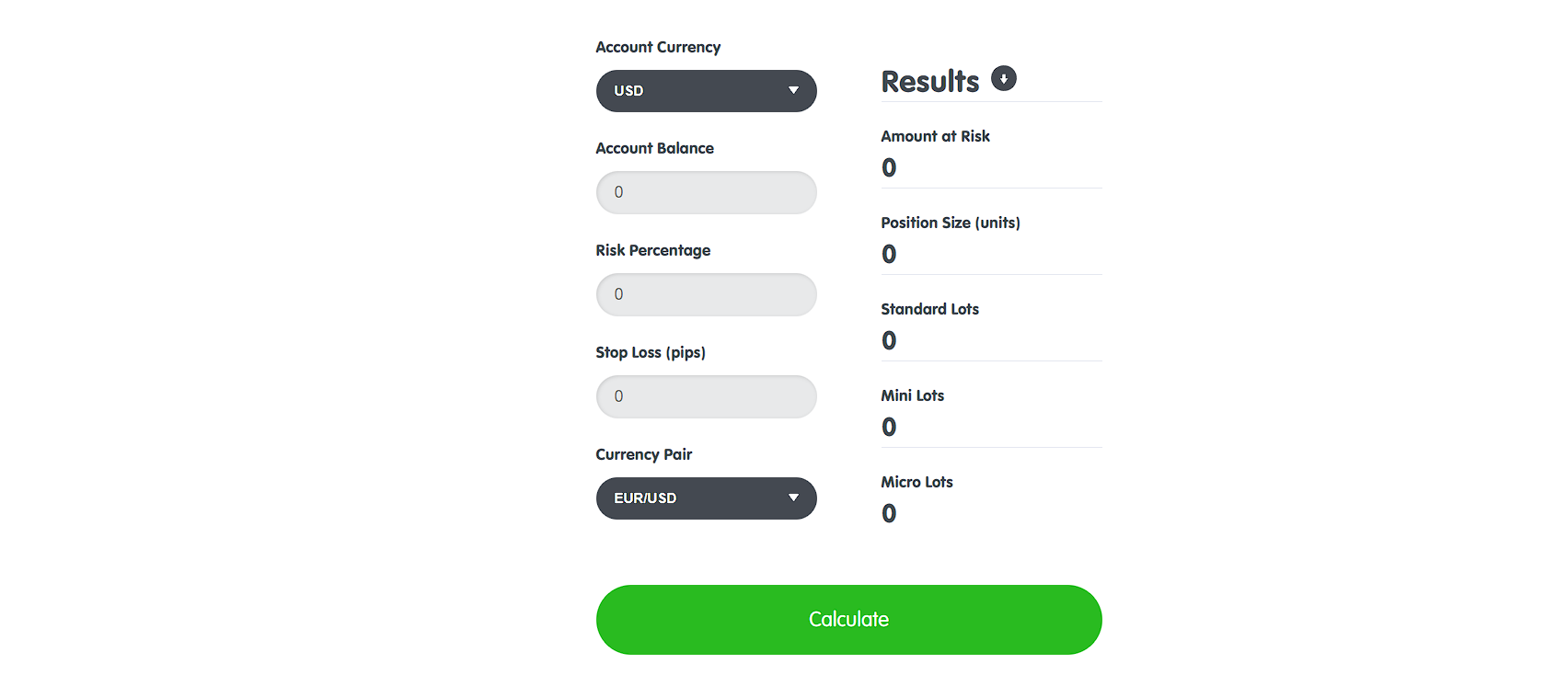

Other Lot Size Calculators

Web Browser Calculators

Similar to the Myfxbook calculator, numerous other forex brokers and web sites offer similar tools, through web browsers on various devices.

You’ll be able to input your account details, risk parameters, and trade specifics to receive easy lot size recommendations.

For instance…

BabyPips Position Size Calculator:

TradingView

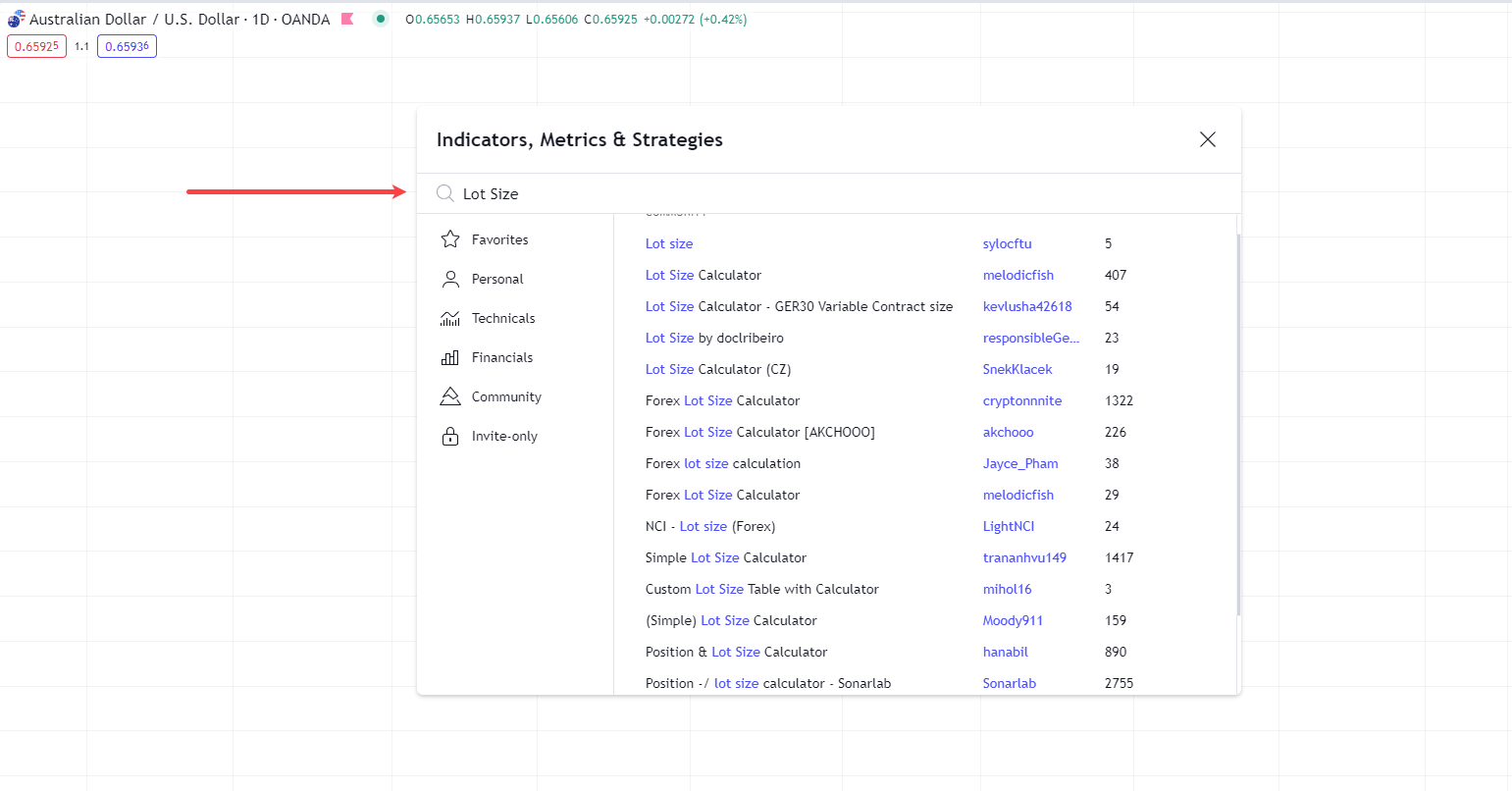

If you happen to prefer using TradingView as your lot size calculator, there are many indicators and plugins available totally free.

Simply seek for “Lot Size” in the indications window to seek out an inventory of them.

Test out a number of options and select the one which most accurately fits your needs, adjusting any settings to match your account details and preferences…

TradingView Lot Size Calculators:

Metatrader

Using Metatrader as your lot size calculator may require a bit more initial setup, however it functions principally similar to other options.

Whether you’re using Metatrader 4 or 5, seek for lot size calculators specific to the platform you’re using.

Most of those plugins provide installation instructions, allowing you so as to add them as layers or indicators to your Metatrader platform…

Earnforex.com Metatrader Plugin:

Conclusion

In conclusion, mastering correct position sizing is important for achievement in trading.

Effective forex lot sizing plays an important role in managing risk, enabling sustainable growth in your trading account.

Ignoring or neglecting it could easily result in losses and hinder your progress as a trader – so take note!

To summarize, in this text, you’ve:

- Learned what Forex lot sizes are

- Explored the role pips play in position sizing

- Discovered the differing types of lot sizes

- Identified how one can calculate you lot sizes manually

- Found latest tools to calculate lot sizes efficiently

Congratulations on uncovering one other crucial tool for successful trading!

You might be well in your option to becoming a profitable trader by calculating the right position sizing.

Now – I’m desirous to hear your thoughts on forex lot sizing…

Do you currently use certain tools or web sites to calculate your lot sizes?

Have you ever considered the connection between pips and lot sizes in your trading strategy?

Share your thoughts and experiences within the comments below!