Let me ask you…

Whenever you first began trading, what were among the first stuff you learned?

Candlesticks.

Moving averages.

Range and trending markets.

And yes, they’re vital topics for a beginner…

But as trading piques your interest, what happens?

You would like more!

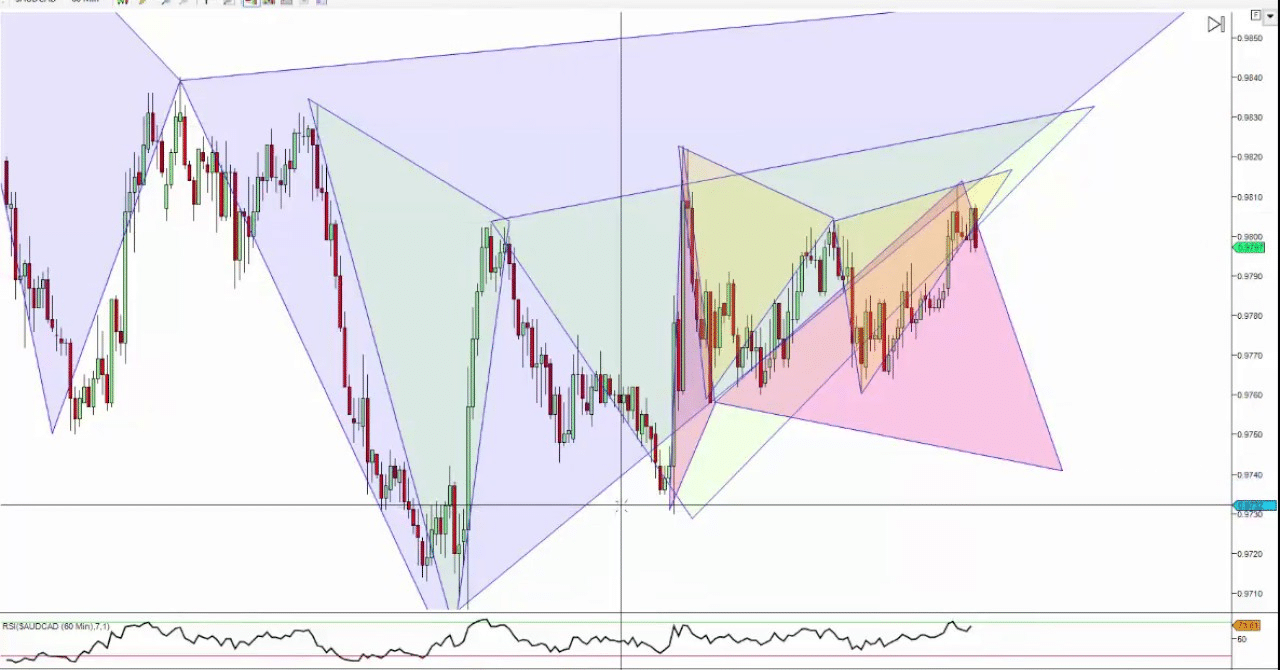

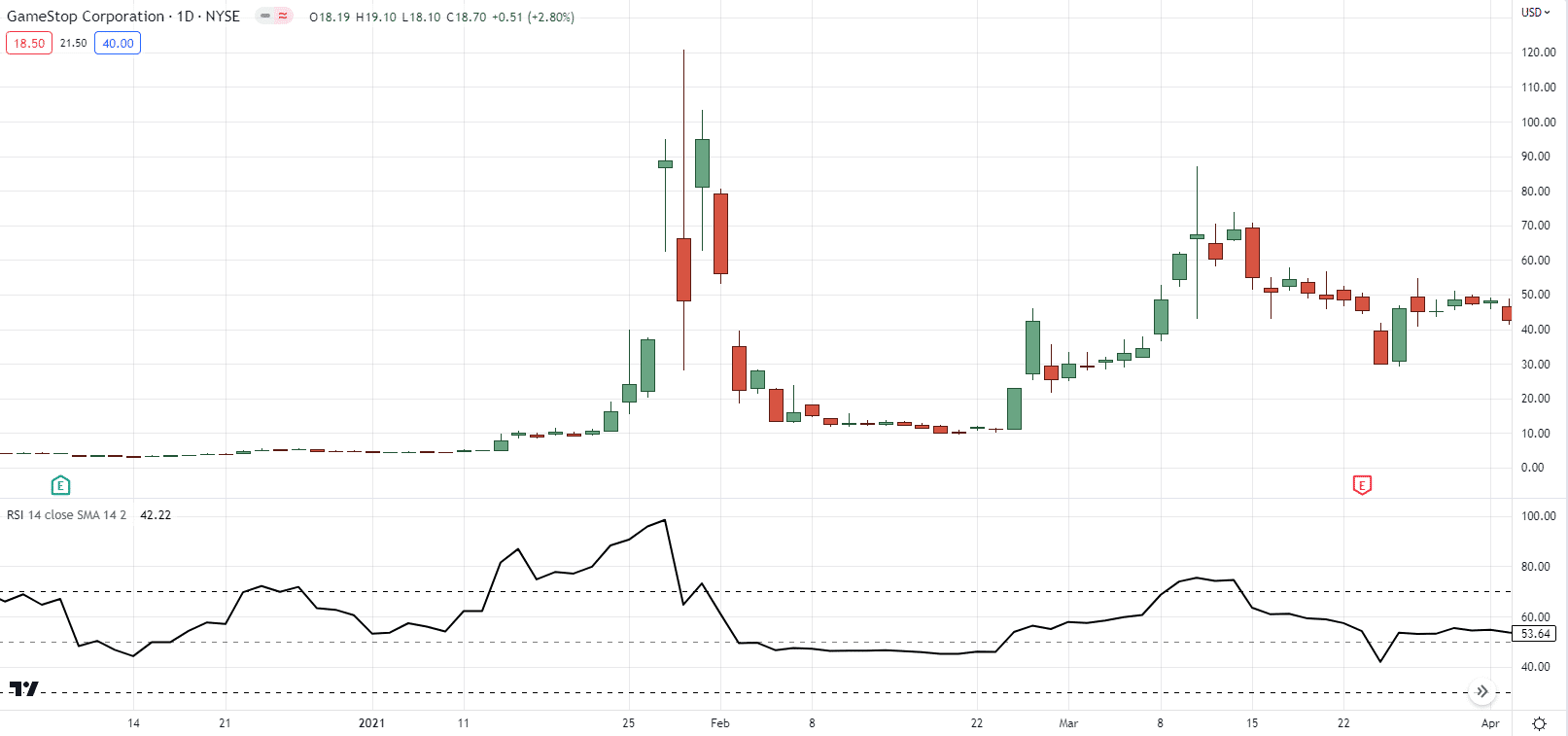

You begin to look into more complicated topics, reminiscent of Elliot waves…

Advanced chart patterns…

Source: Trading Empowered

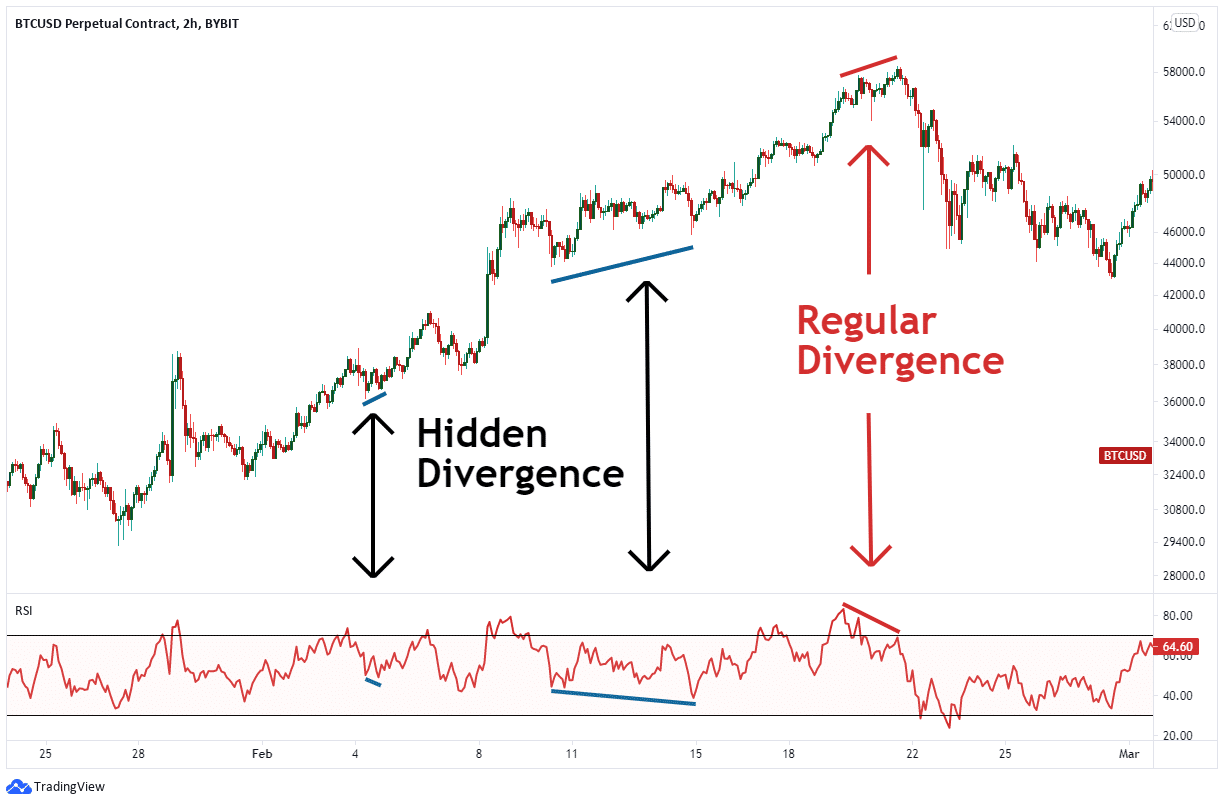

And, in fact, divergence trading…

Source: By bit

At this point, you’ve perhaps taken a peek into those topics.

But I bet you’re still wondering:

“How do I take advantage of it to trade the markets?”

“How do I time my entries, stop loss, and take profit levels?”

Well, that’s why in today’s guide…

I’ll offer you the entire picture of what it’s prefer to master divergence trading!

Specifically, you’ll learn:

- The “hidden” principle behind divergence trading that no other textbook will inform you

- A fool-proof technique that may assist you to master identifying all sorts of divergences in trading

- Which indicator is the very best for divergence trading (it’s not what you think that)

- An entire and straightforward divergence trading strategy (including entries and exits)

- Mistakes to avoid when trading divergences and solutions to beat those mistakes

It is a jam-packed masterclass guide.

So…

I suggest you get your notes and charts up and let’s start!

What’s divergence trading and the way does it work? (it’s not what you think that)

To place it simply…

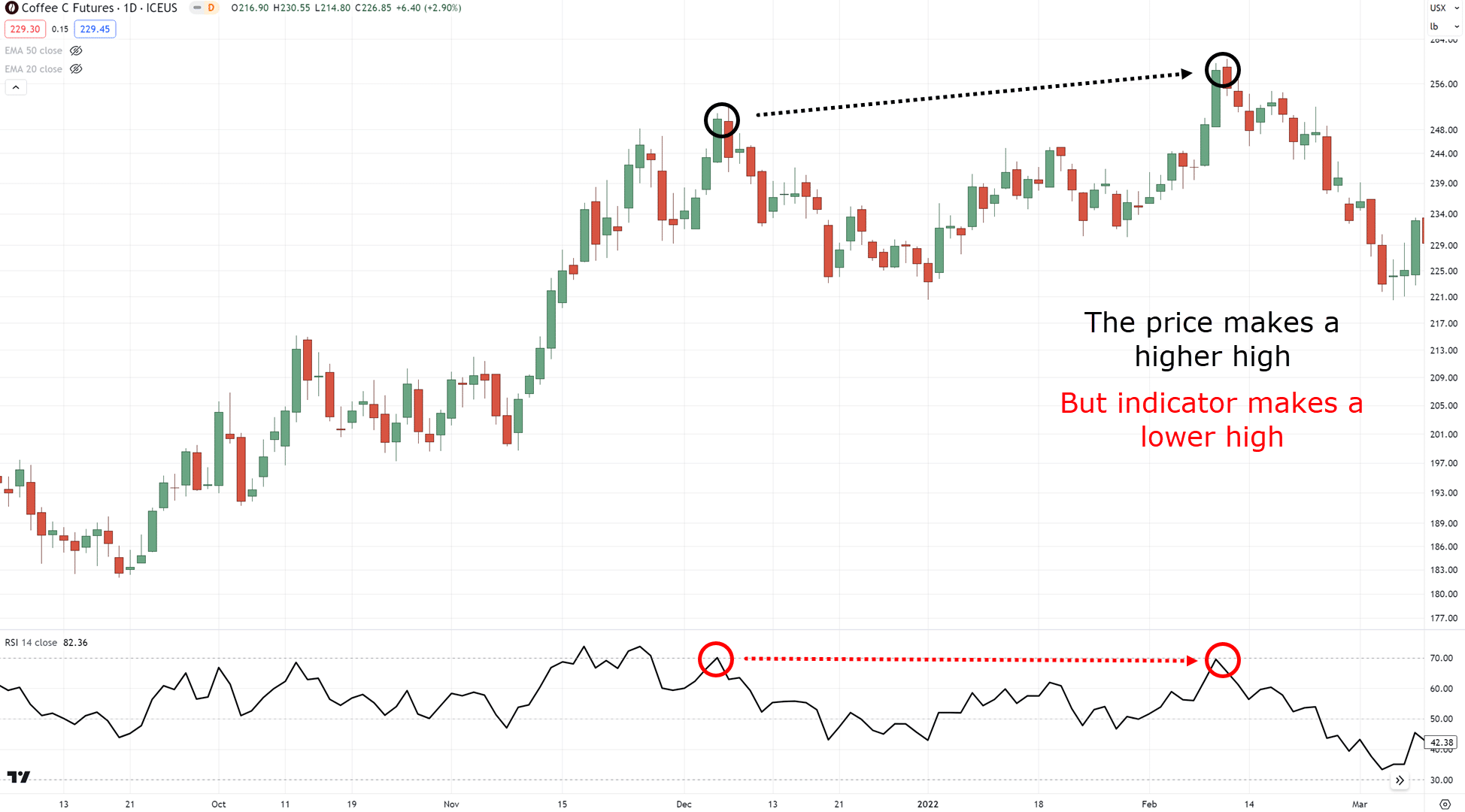

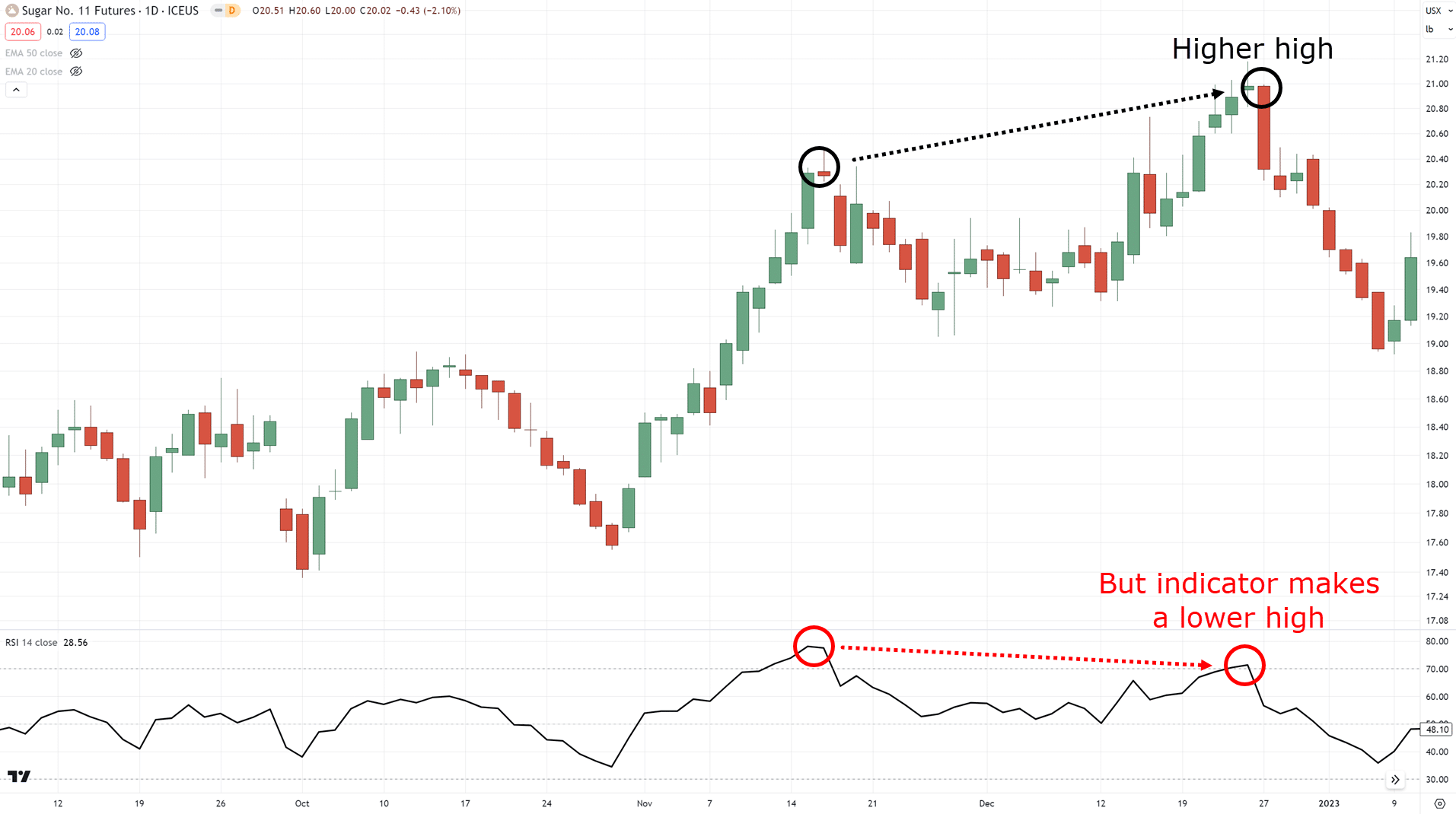

A “divergence” in trading happens when the swing highs/lows in your chart are different from the swing highs/lows shown in your indicator…

And there might be numerous variations of them, as seen on this cheatsheet!…

Now, here’s the thing…

The market consists of buyers and sellers, correct?

That’s why you would like to ask:

How does divergence trading work?

In case you ask someone how divergences work, they’ll probably say…

“Oh, divergences in trading are when the worth makes a better high, however the indicator makes a lower low”

And sure, that’s the textbook definition.

But what does it actually mean?

What are the buyers and sellers doing specifically when divergence happens?

What does your indicator represent?

Let me inform you…

Imagine you’re on a running track, and also you’re able to begin a 100-meter dash.

Once the gunshot pops…

You sprint and make it to the finish line in only 9 seconds!

Holy cow, you’re pretty fast!

Now…

Imagine you make the identical 100-meter dash, but this time you might be being pushed back by a hurricane wind just to complete the race

What do you think that would occur?

Surely, you’ll finish the race twice as long with this rain and wind!

So, how does this relate to divergence trading?

Easy!

There are occasions when the market could make a +16.65% gain in only 13 days, phew!

Alternatively, you possibly can see how Sugar struggled to make +11.17% inside 19 days…

This difference in momentum is a divergence!

Despite the fact that the buyers were in a position to reach a +11% gain…

…you possibly can see that they struggled to get there!

In turn, this may inform you the buyers aren’t as strong as you would possibly think…

Now you is likely to be wondering:

“In that case, we will spot these easily on our charts anyway, right?”

“Why will we even need an indicator?”

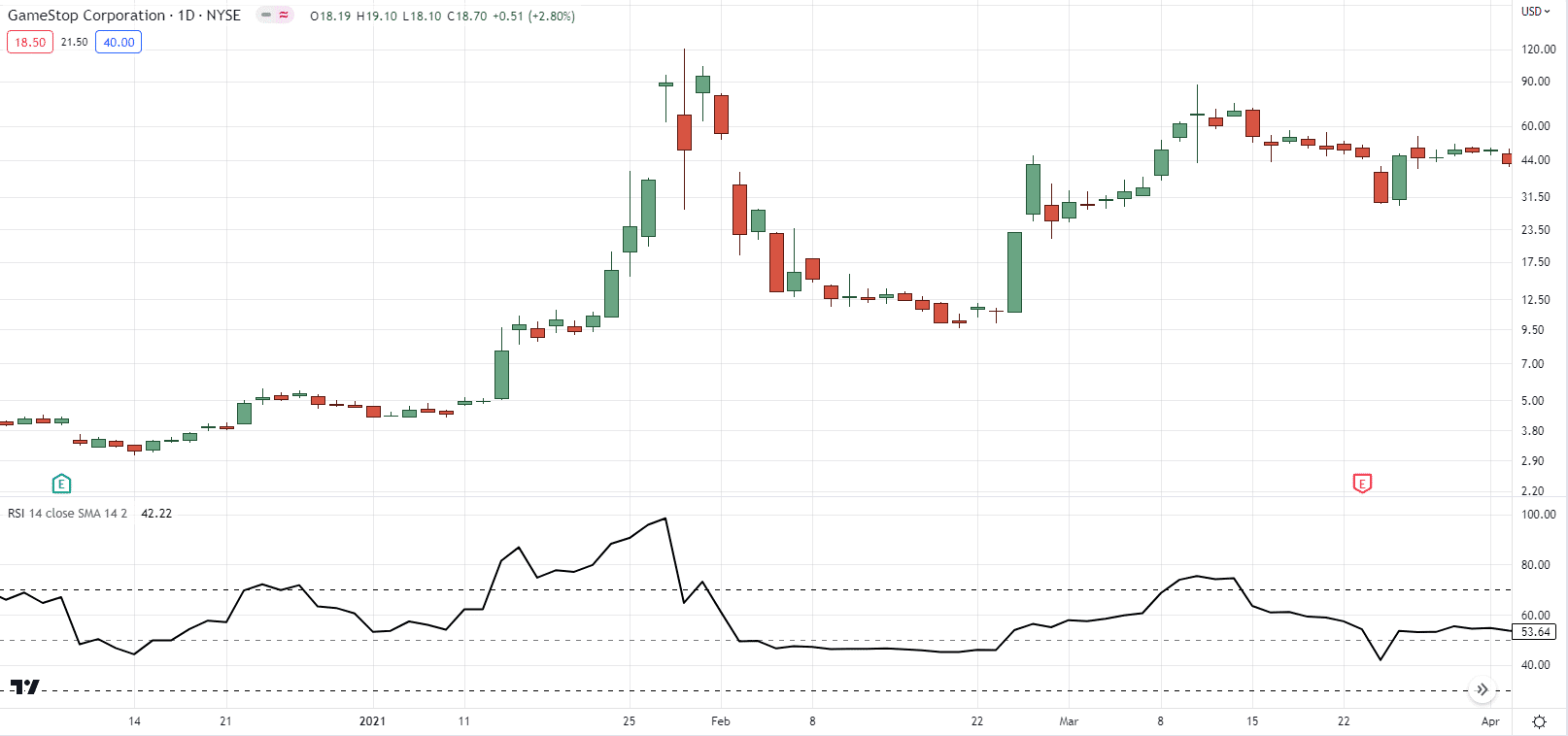

The reply is that charts might be manipulated.

Not by institutions or brokers, that’s not what I mean!

What I mean is that your charts can look different depending on…

…whether you might be on a pc…

… or on a cell phone…

…in case your chart is in logarithmic…

…or non-logarithmic scale…

…the looks might be extremely varied.

But with an indicator – things remain the identical, regardless!…

Which means that your indicator can act as an additional set of eyes when detecting market divergence.

Which now results in the following query…

How do you see divergence trading?

Because surely…

What’s written in a textbook rarely matches up with real-time markets, agree?

That’s why in the following section I’ll share with you proven tricks to assist you to spot divergences higher and more accurately.

Read on!

Master this trading skill first when using a divergence trading strategy

Here’s the reality:

Spotting divergence trading takes practice.

And the very best skill to start out nailing down first is:

Learning tips on how to spot market structures

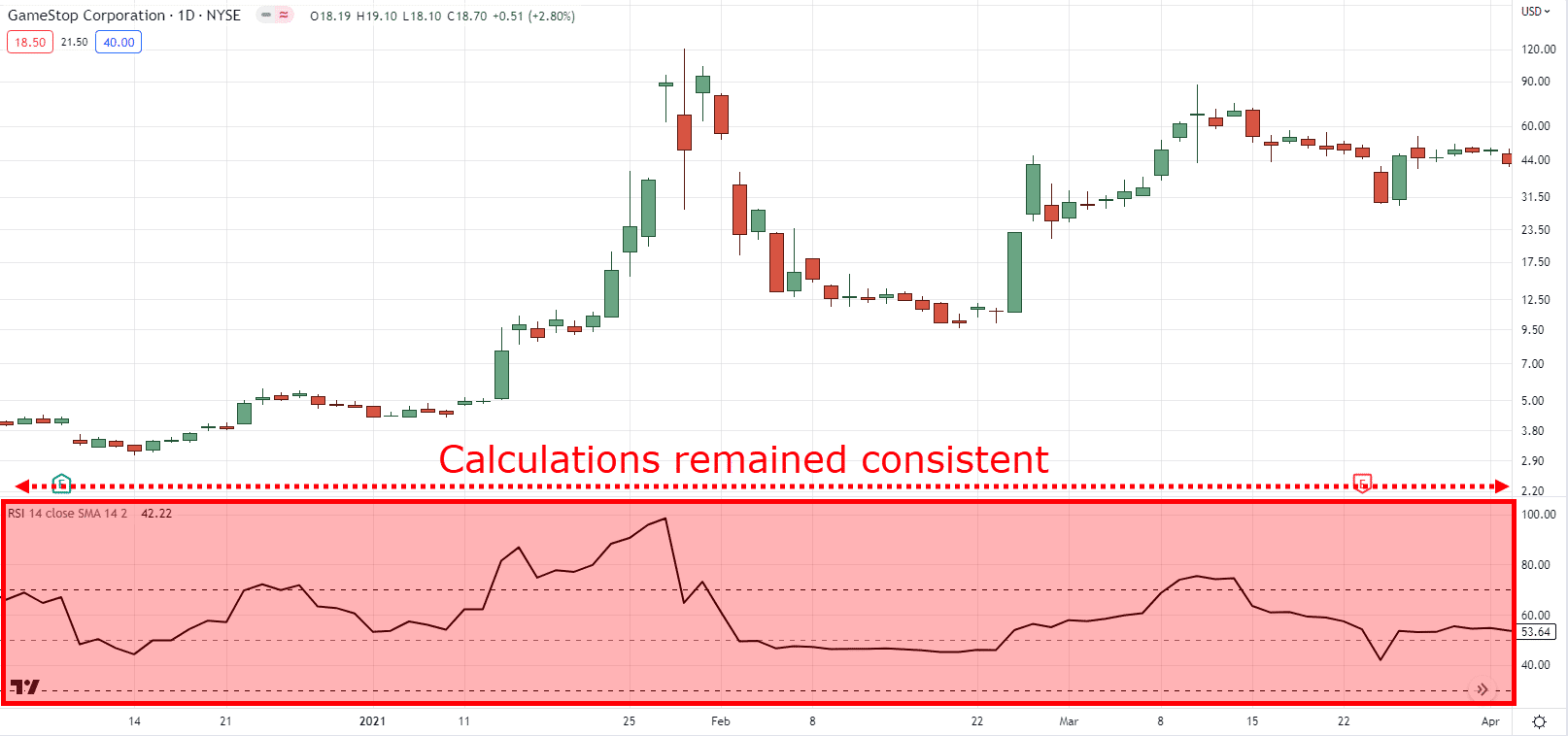

Here’s what I mean…

As you possibly can see, price motion out there could make the next:

- Higher highs

- Higher lows

- Lower lows

- Lower highs

And learning tips on how to spot those is vital to mastering divergence in trading!

Fortunately…

I’ve made a comprehensive trading guide dedicated to you, which you possibly can try here:

Learn how to Read Price Motion (For Dummies)

But within the meantime…

Let’s have a fast exercise, lets?

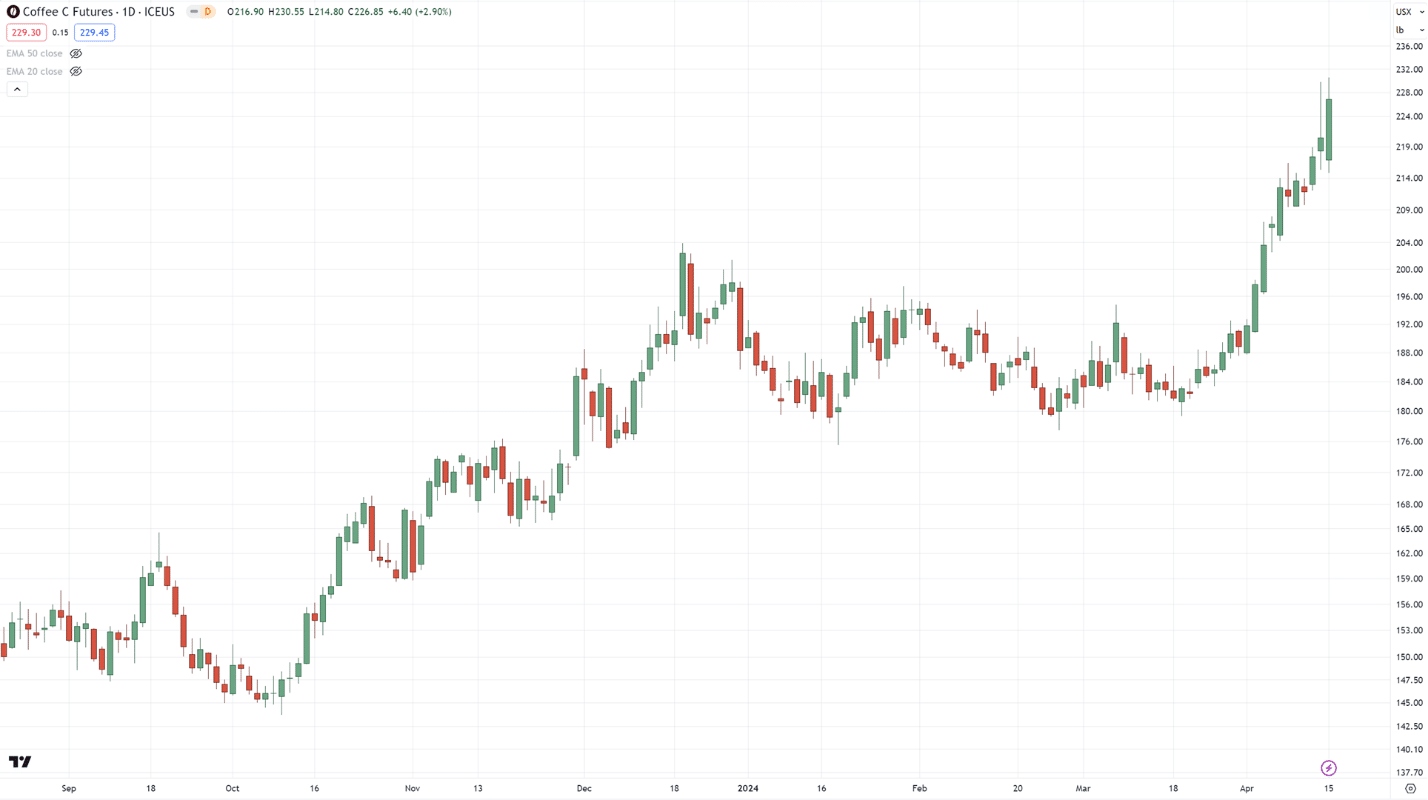

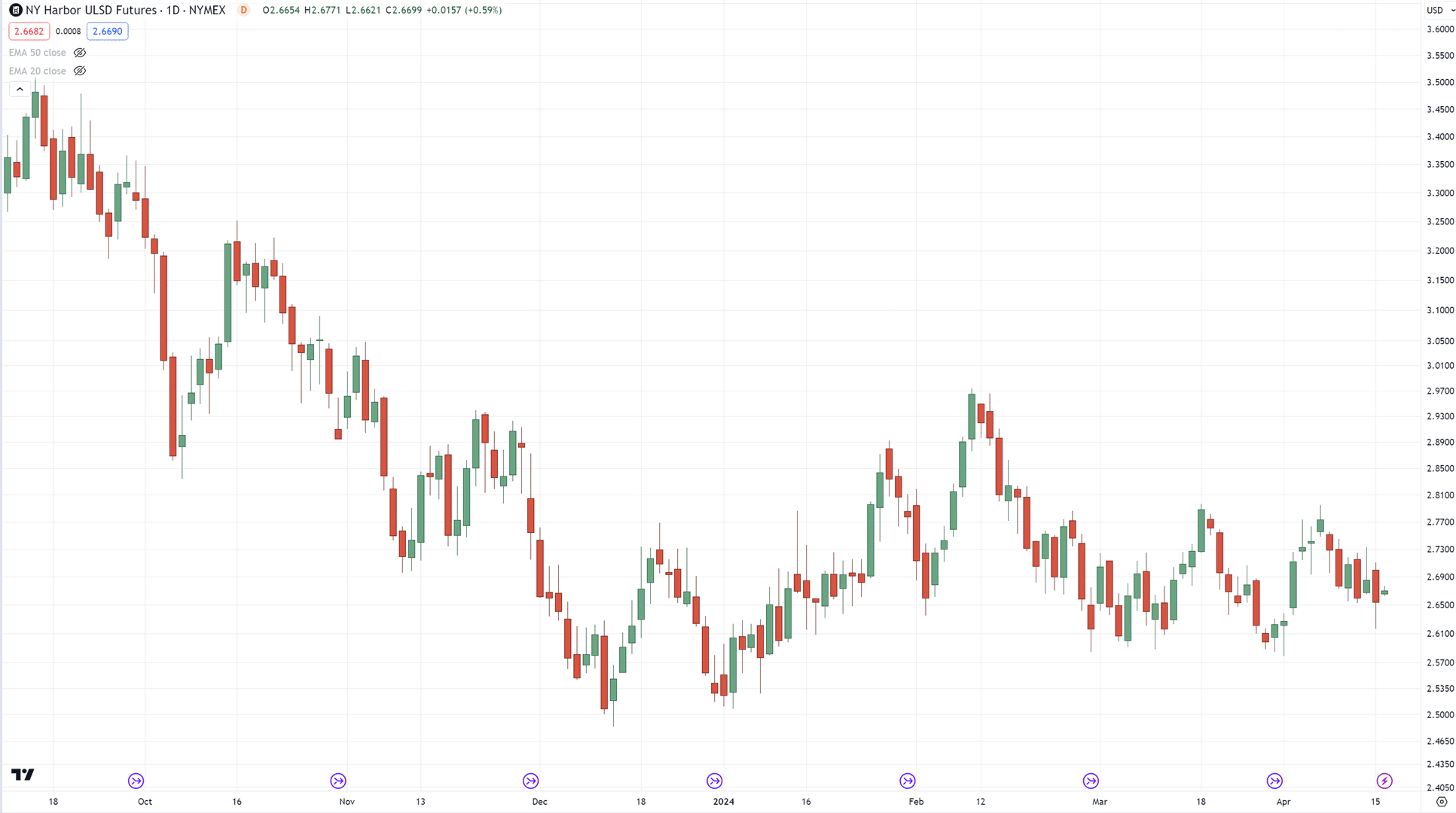

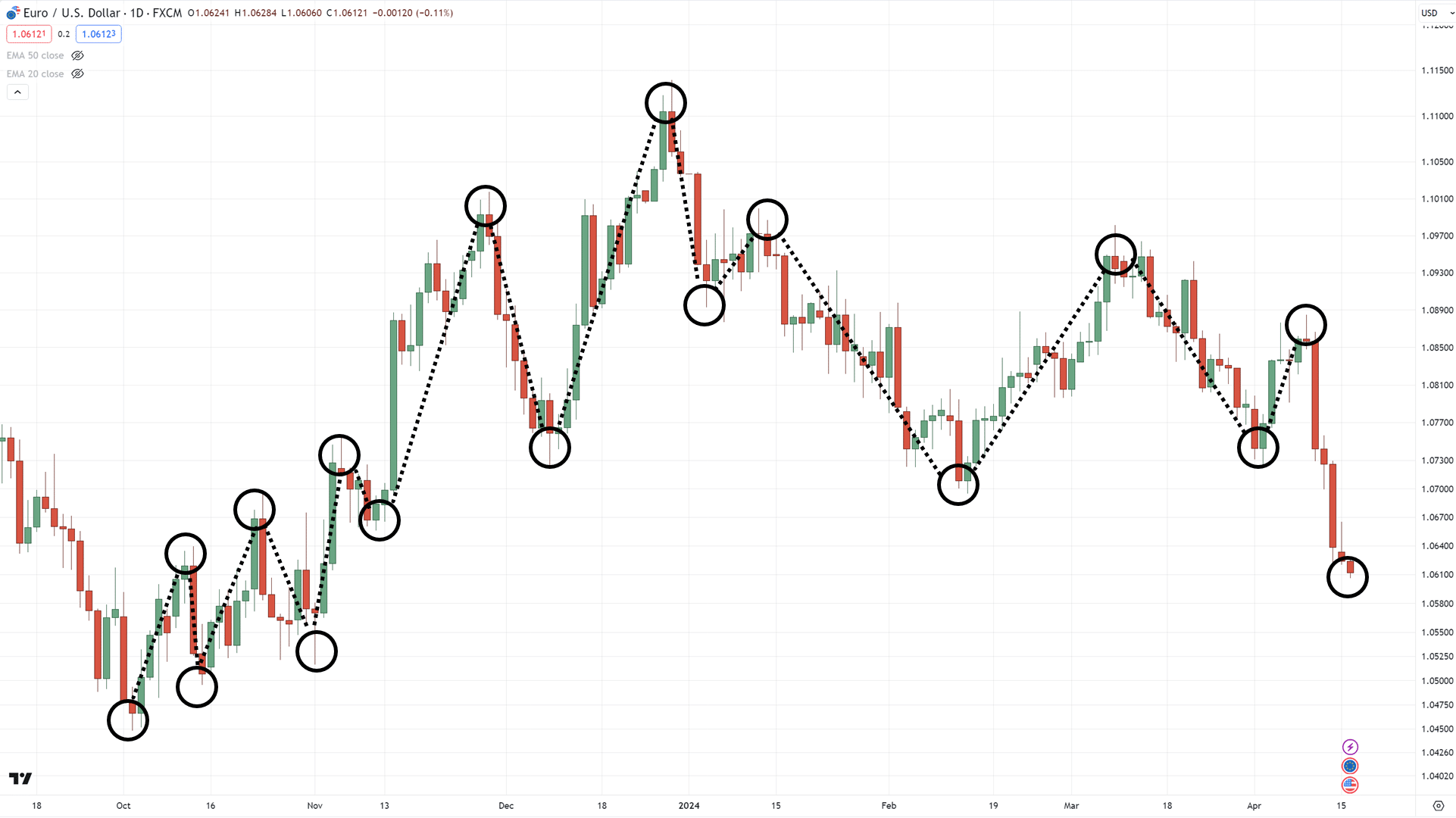

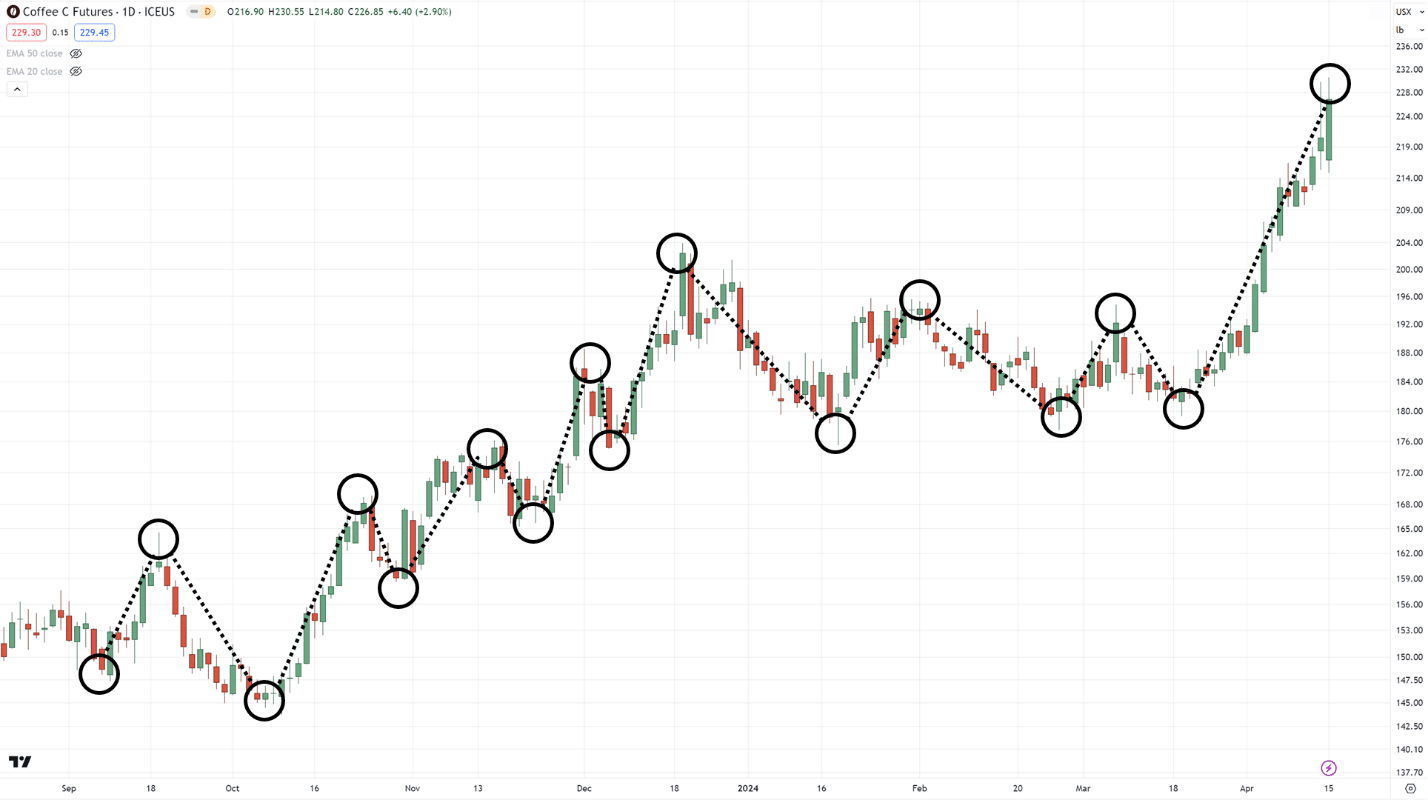

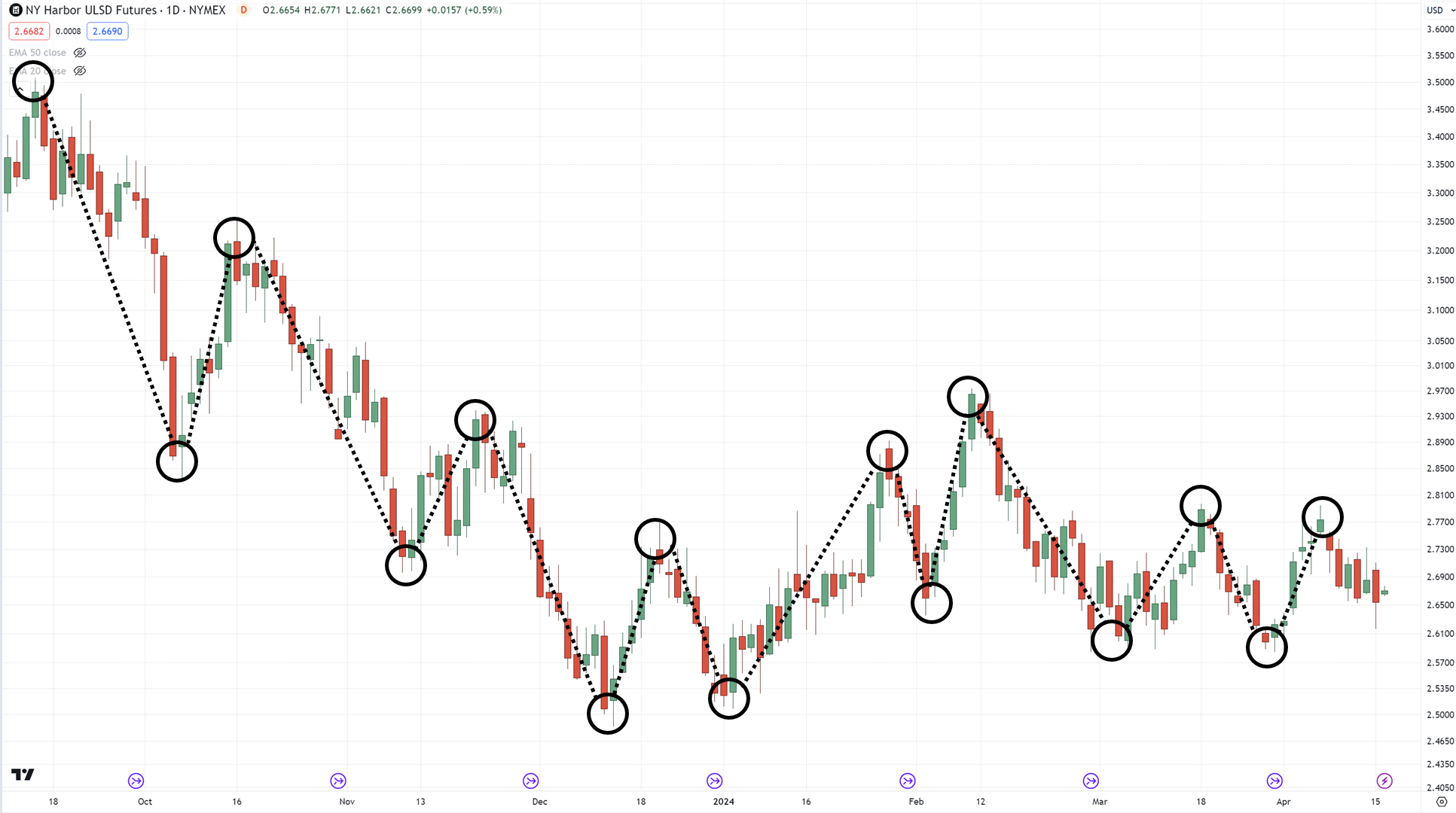

Taking a look at these charts, are you able to plot where the swing highs and lows are?…

All done?

Able to see the reply?

Well, here you go…

The most effective part is that yours doesn’t need to match mine 100% on a regular basis.

…and also you don’t need to plot all of them right down to the smallest detail!

Got it?

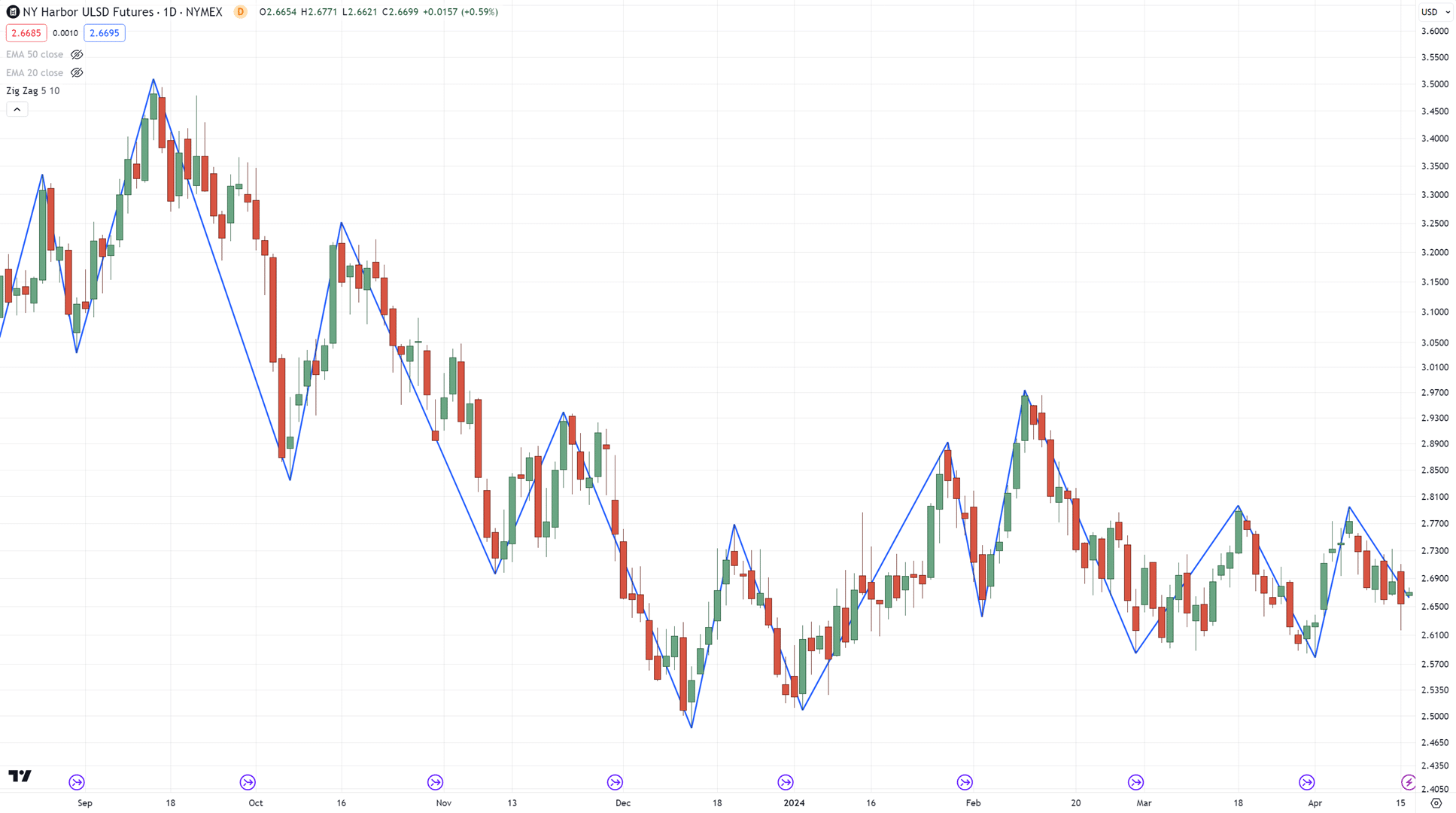

But when you want something more consistent to start out with, you possibly can try the zigzag indicator…

It does all of the be just right for you robotically!

But there’s far more to this indicator than I can write about here, so I suggest checking this guide out:

The Ultimate Guide To Zig Zag Indicator

Now, speaking of indicators…

Which one do you employ for divergence trading?

Let’s tackle that in the following section…

What’s the very best indicator for divergence trading?

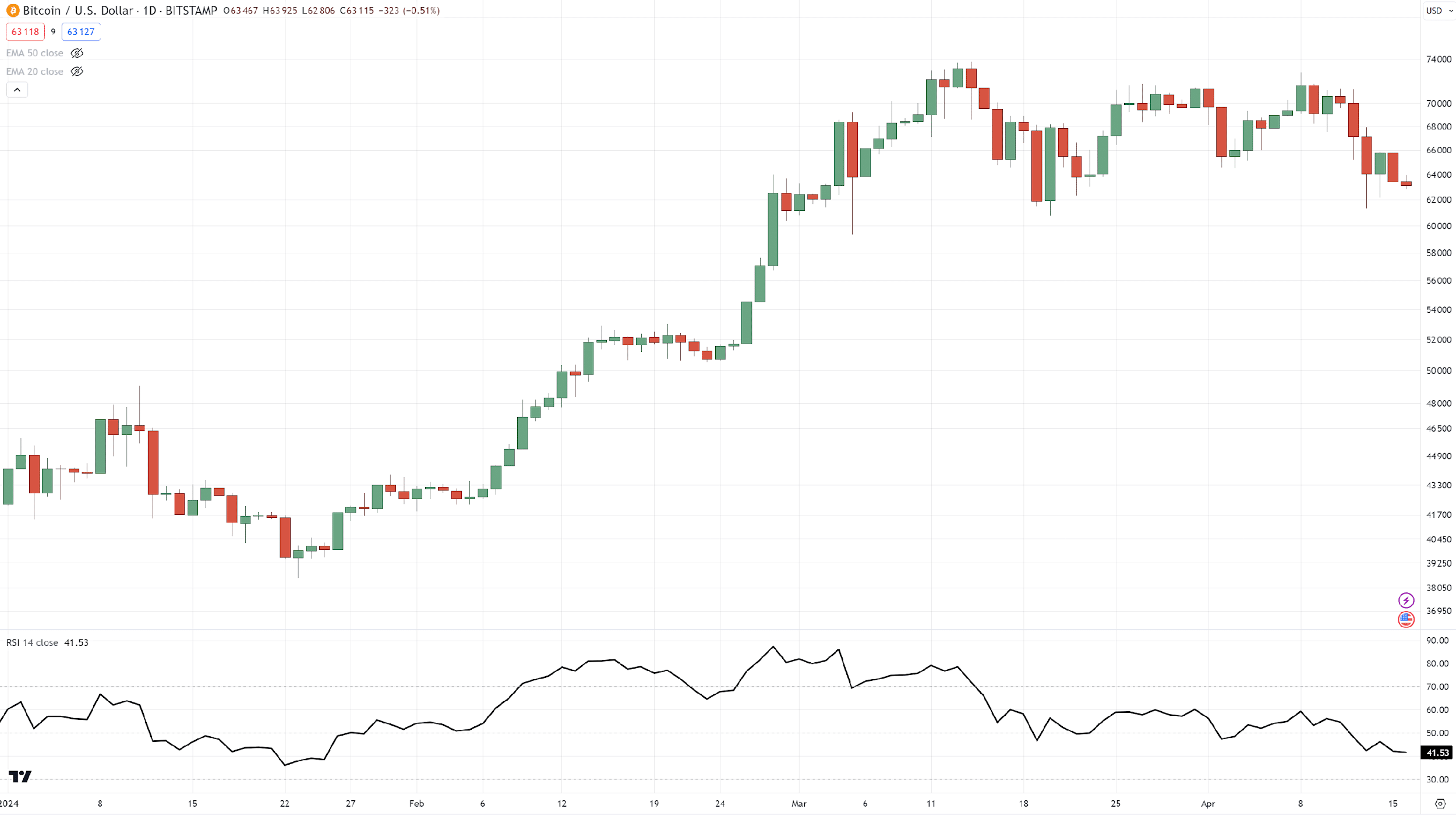

The reality is that numerous indicators might be used for divergence trading.

There is no such thing as a “best” indicator on the market!

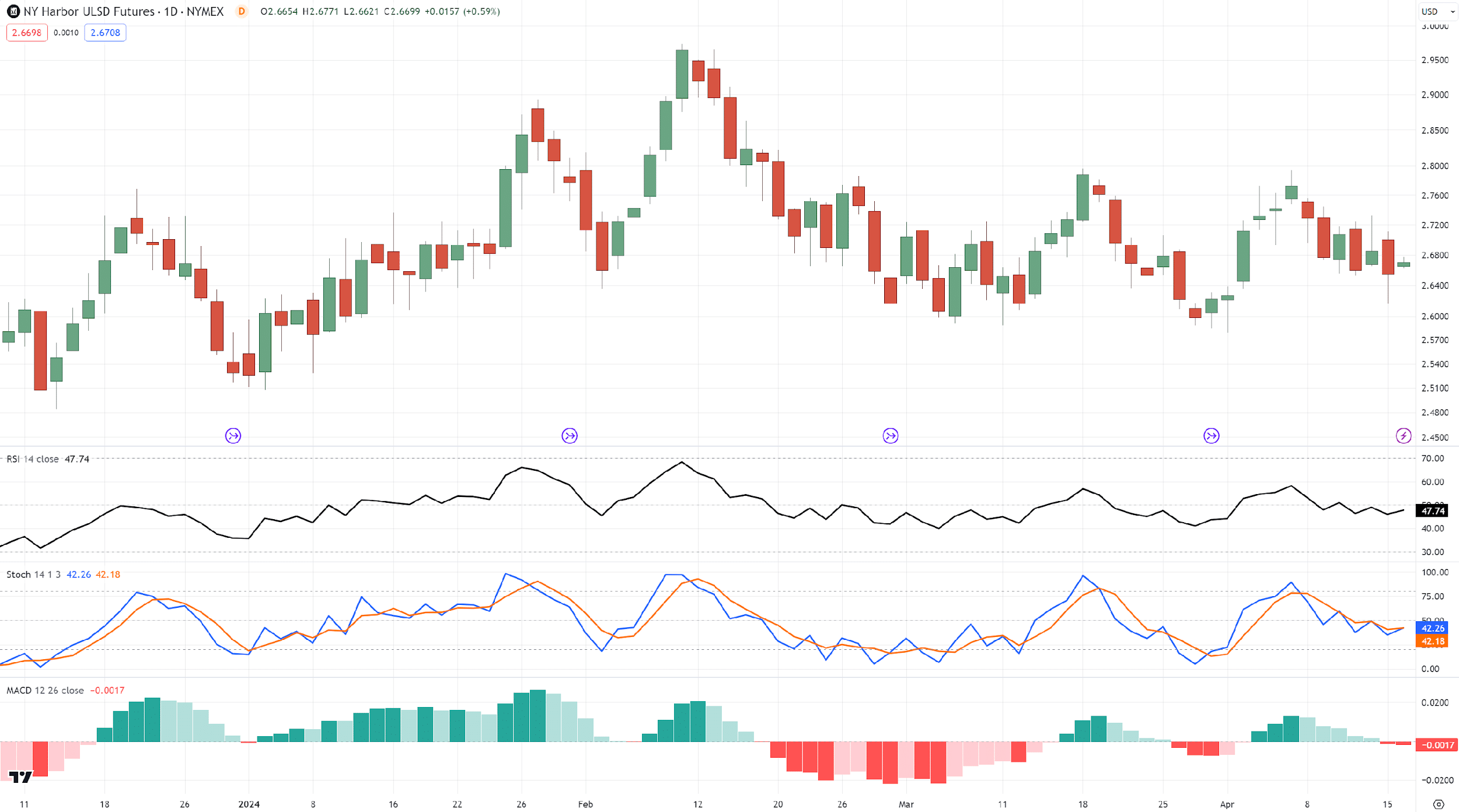

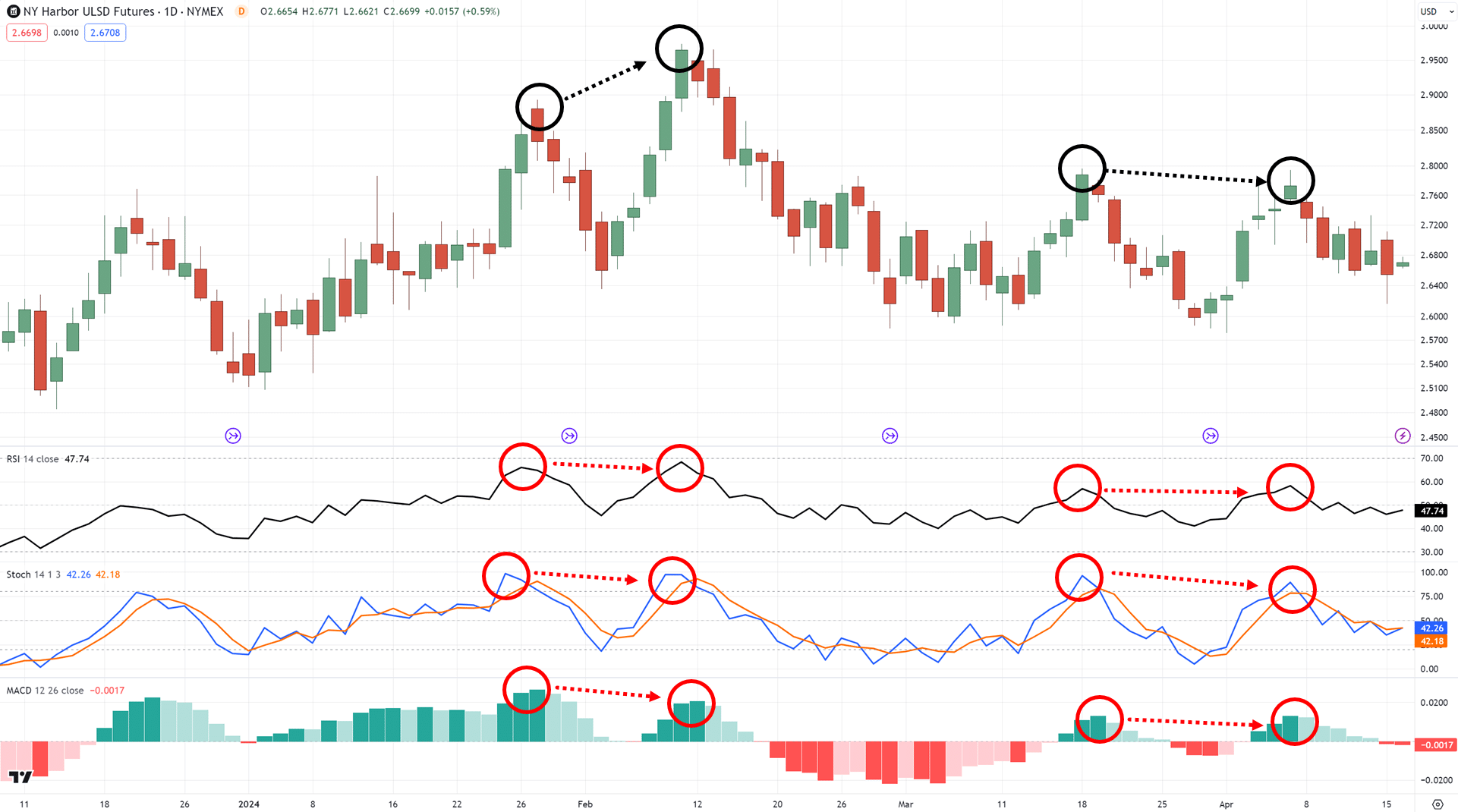

Let me offer you an example…

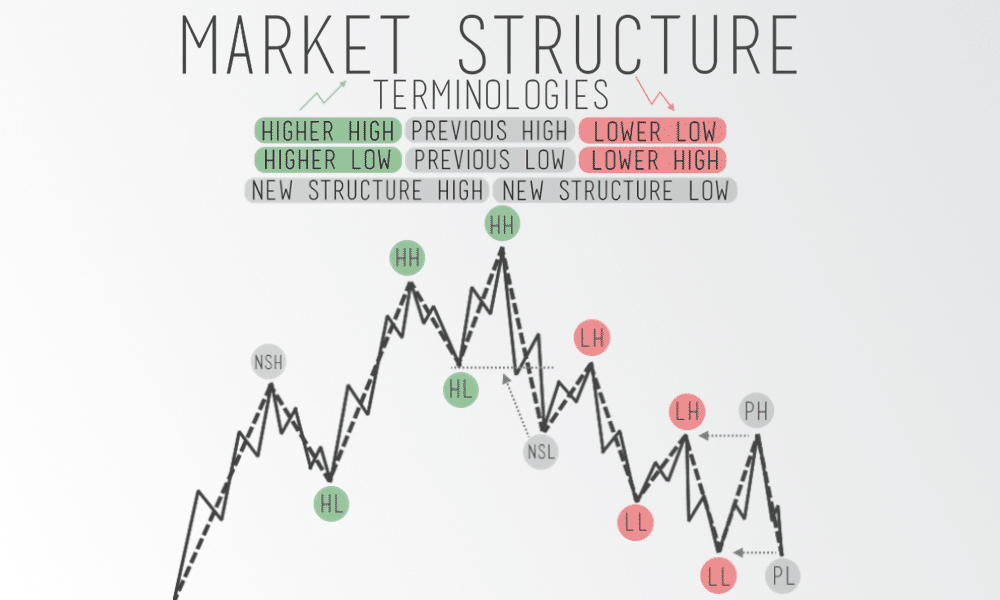

Listed below are three indicators placed together…

As you possibly can see, all of them are able to detecting divergences!

And most significantly, even at the identical time…

It is because they’re all momentum indicators, meant to measure the momentum of the markets!

In that case… how do which indicator to choose for divergence trading?

The secret is this:

Know the indicator to the deepest level, and select one which makes probably the most sense to you.

I understand it comes as a headache to you, but that’s right…

You should know an indicator right down to its core details, reminiscent of its formula.

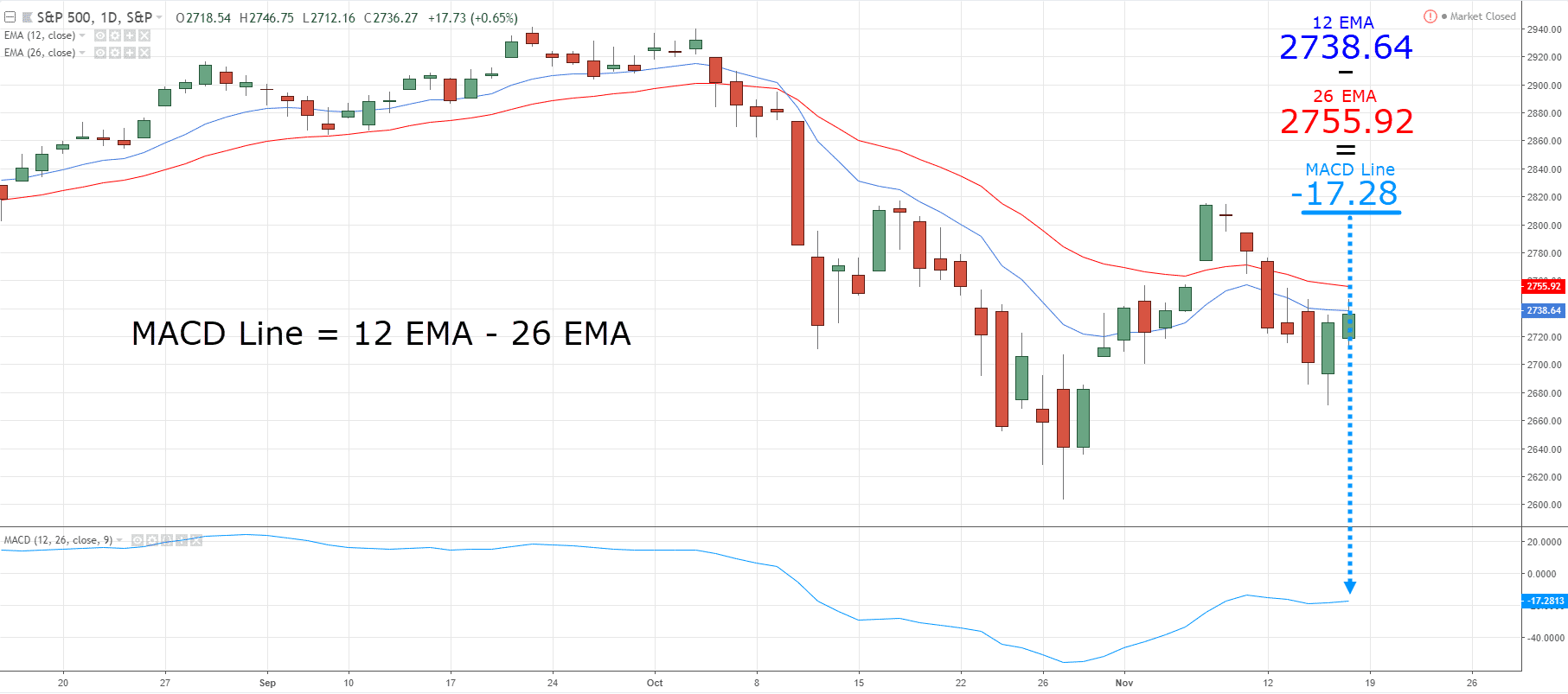

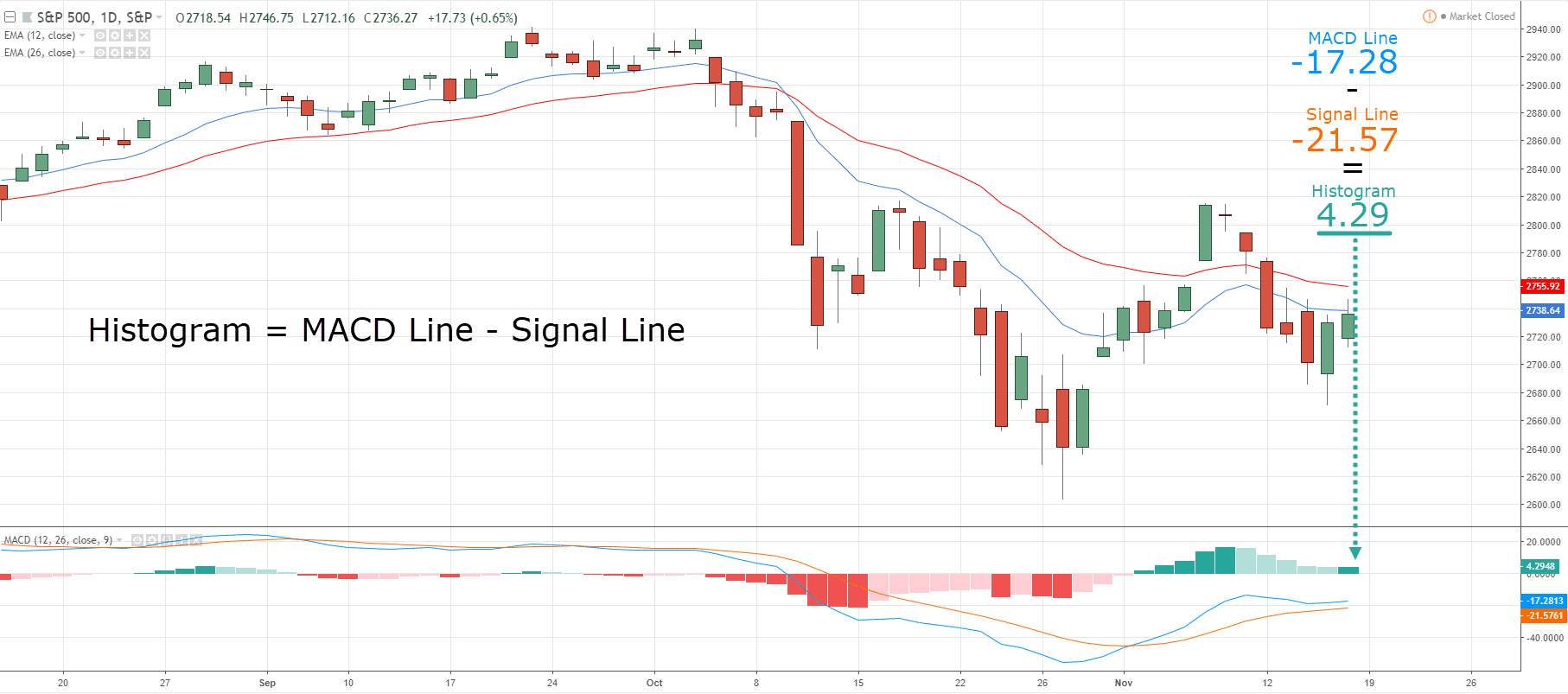

For example, the MACD’s line is calculated by two different moving averages…

One short-term indicator to measure the short-term momentum of the market…

…and one to measure the medium-term momentum of the market.

The signal line then averages the results of the MACD line, and the difference between that signal line and the MACD line creates the histogram that you just see!…

It’s like measuring the temperature data in your area for the past month, after which gaining extra temperature data from the past three months…

By the temperature changes, I’m sure you possibly can tell if things are heading into winter or summer!

Alright – so, how concerning the RSI indicator?

Its formula is just about designed to directly measure the momentum within the markets in an easy way:

RSI = 100 – 100 / [1 + RS]

These numbers might daunting, I do know…

Nevertheless it boils right down to this:

Average Gain / Average Loss

Simply put, if there are more days when that specific market is doing well than when that market is doing badly…

The RSI value increases!

This is comparable to counting calories when attempting to shed extra pounds…

In case you lose more calories than you gain, you shed extra pounds!

Finally, take a take a look at the stochastic indicator.

It’s measured in this fashion:

%K = (Current Close – Lowest Low) / (Highest High – Lowest Low) * 100

%D = 3-day SMA of %K

Where:

Lowest Low = lowest low for the look-back period

Highest High = highest high for the look-back period

%K is multiplied by 100 to maneuver the decimal point to 2 places

To visualise it, imagine you’re at a playground watching a baby on a swing…

The kid swings higher and lower depending on how much momentum they’ve.

The stochastic indicator is like measuring how high the kid swings relative to the very best point they’ve reached!

The %K value tells you ways high they’re straight away, while the %D value is the common height of their swings over the past couple of minutes.

This helps you see if the kid’s momentum is increasing or decreasing, identical to the stochastic indicator helps you gauge the momentum of a stock’s price movement.

Make sense?

So, at this point…

I’m sure you possibly can tell me that every one these indicators have one end goal…

…and that’s to measure momentum within the markets in alternative ways, right?

Nonetheless – all that matters is which of them make probably the most sense to you.

Importantly, you need to never blindly use an indicator simply because another person is using it…

…a winning trader must understand it at a deeper level.

Now…

How does this all fall into place?

How are you going to do divergence trading?

Enter, manage, and exit your trades?

Most guides only inform you what divergence trading is, but don’t teach you tips on how to trade them.

So let’s use every thing that you just’ve learned to this point to trade the markets with divergences!

Divergence trading strategy: How do use it to enter, manage, and exit your trades

Repeat after me:

Divergence trading is barely one a part of a trading plan.

That’s right!

Spotting bullish and bearish divergences is barely one small a part of an even bigger trading plan.

That is why I developed an easy approach when your charts.

And that’s:

The M.A.E.E formula

This formula simply means you…

- Discover the Market structure first (downtrend, uptrend, range?)

- Discover the Area of value on the chart (where’s your support and resistance?)

- Find where your Entry is (bullish or bearish divergence setup)

- Discover your Exit (trailing stop loss or before the closest market structure)

And now…

I’ll reveal to you ways this works!

Discover the Market Structure

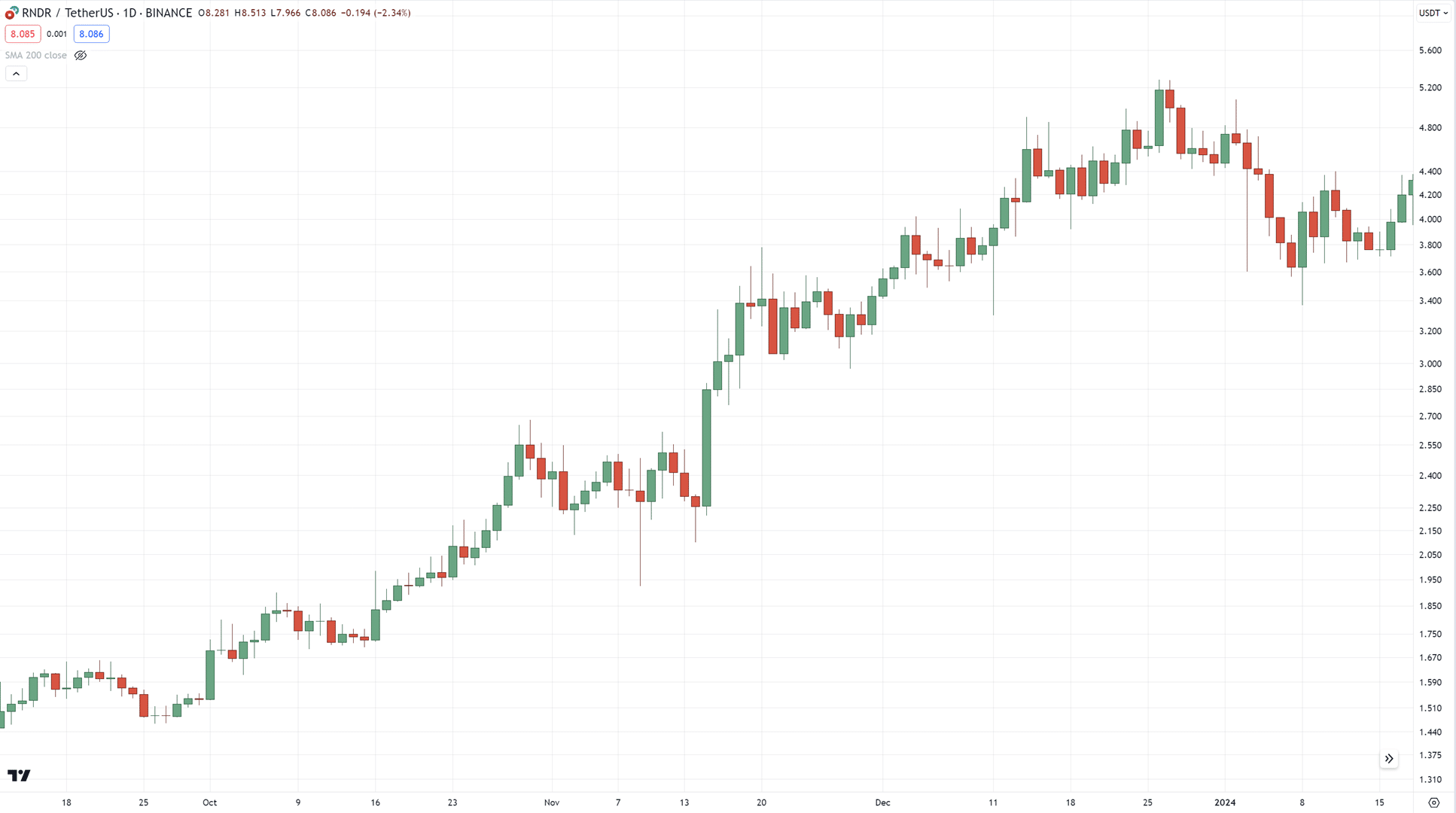

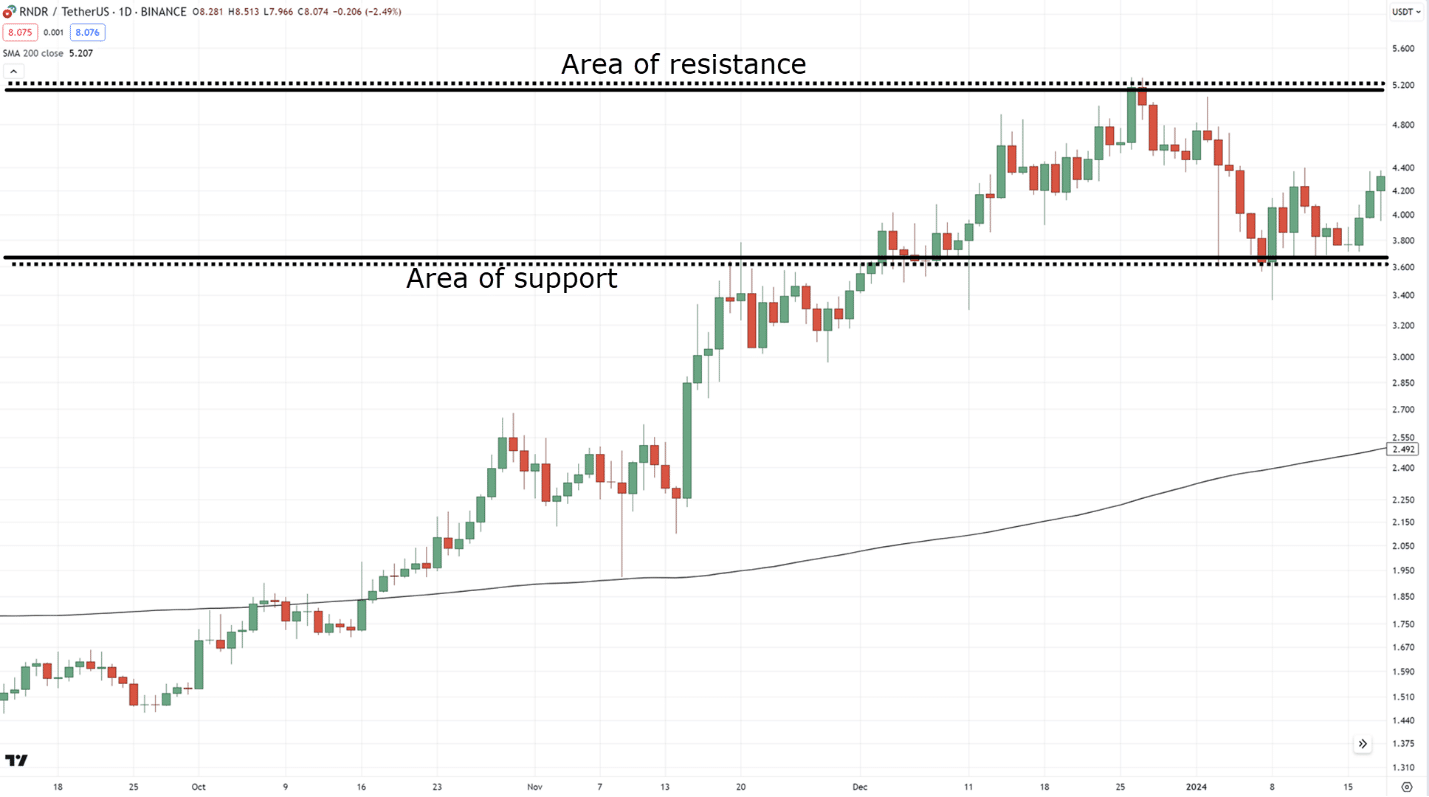

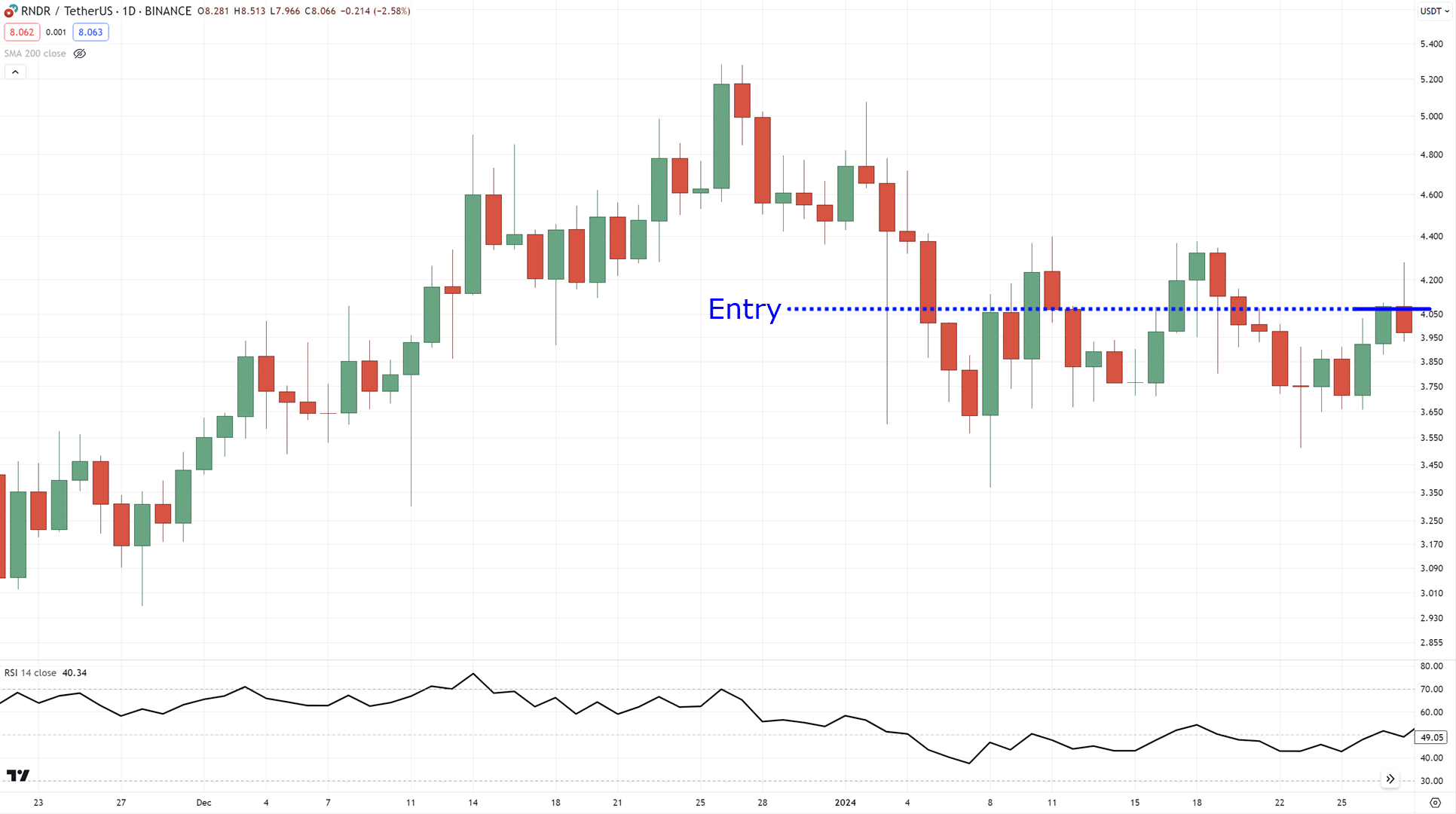

The instance that we are going to use today is RNDR on the day by day timeframe…

Now you would like to ask yourself:

Is that this in an uptrend?

Downtrend?

Or in a spread?

Well, it’s in an uptrend.

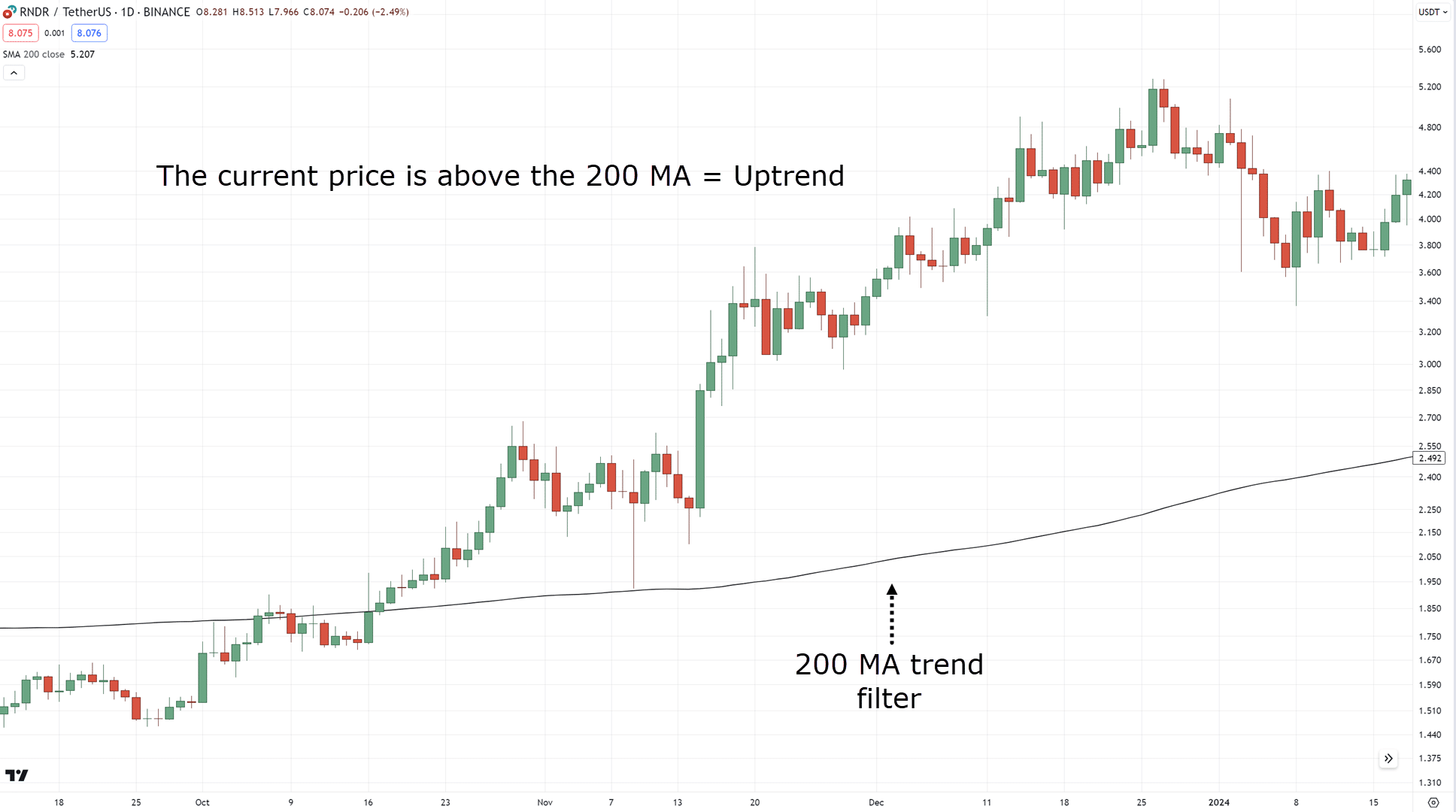

But you would like to develop a rule that consistently defines whether a market is in an uptrend or downtrend!

One such tool that may assist you to is the 200-period moving average…

If the worth is below the 200 MA = Downtrend

If the worth is above the 200 MA = Uptrend

This part is all the time crucial.

Why?

Because when you define that the market is in an uptrend, you would like to make sure you find the “relevant” setup in such market conditions!

Which means that in an uptrend, we only search for bullish divergence.

Make sense?

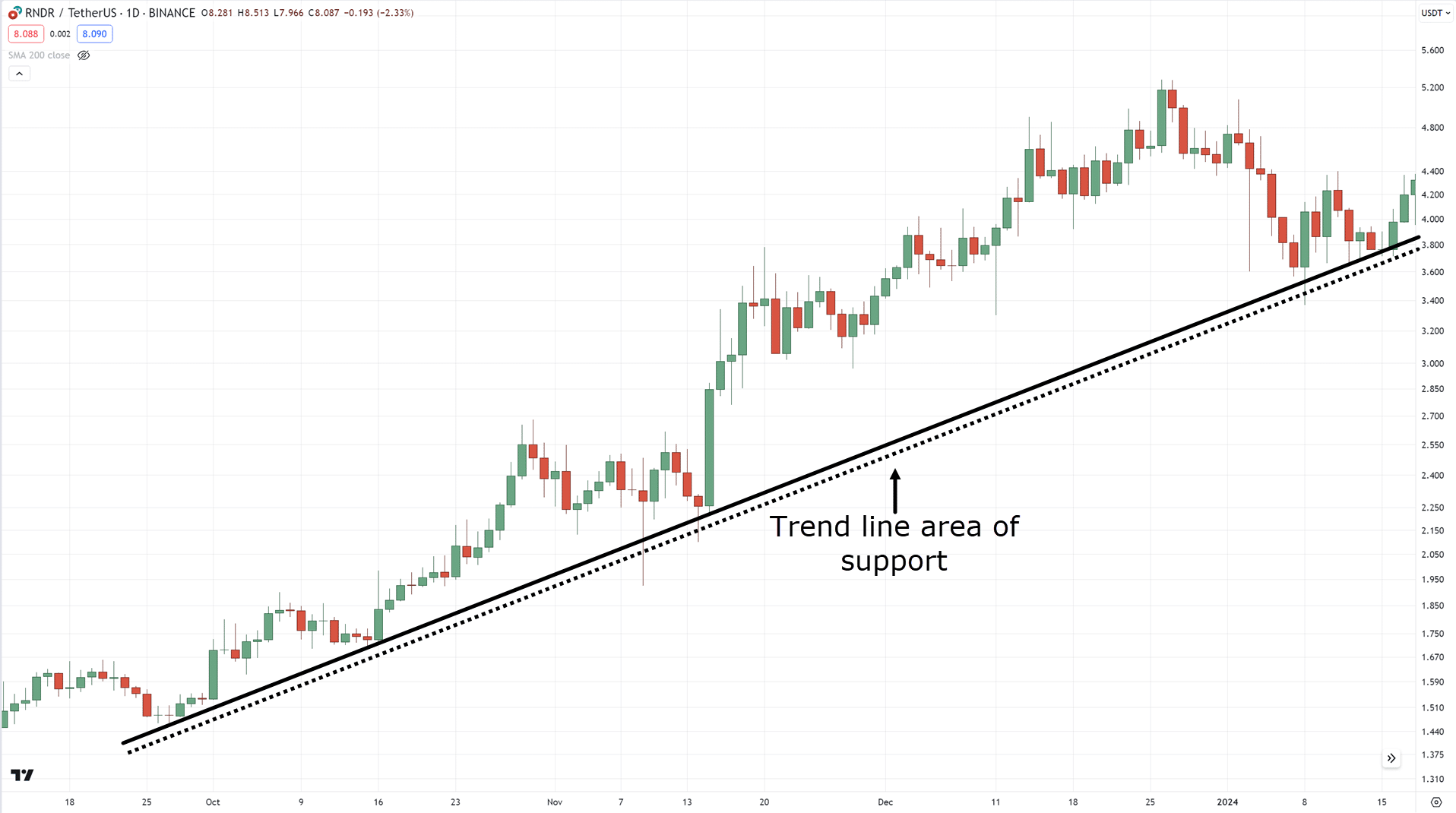

Discover the Area of value

In the case of the realm of value, what involves mind?

Nonetheless, all the time ensure to be mindful that trend lines even have an edge out there and are an excellent tool for locating areas of value in trending markets…

So, now that we’ve defined our uptrend and area of value, next is our entries.

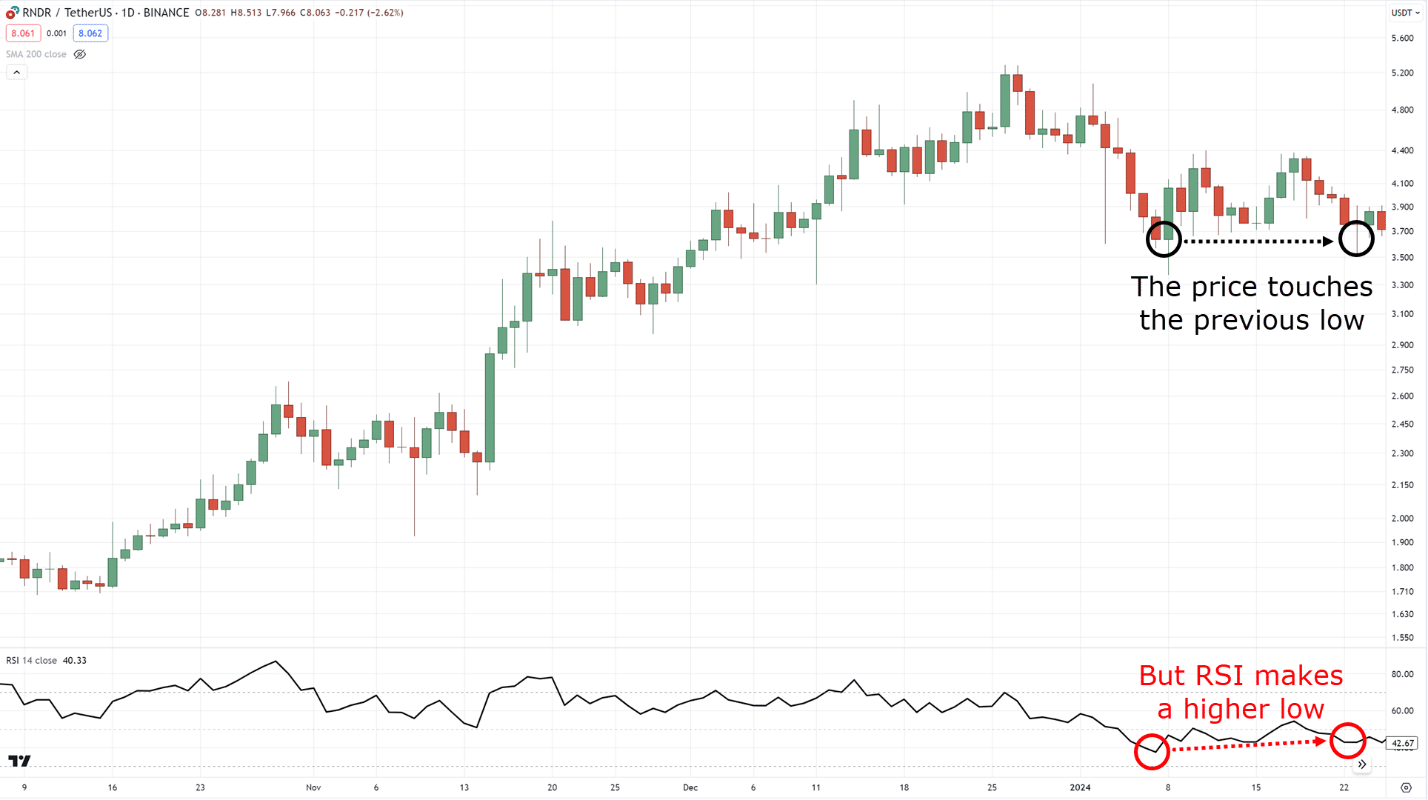

Discover your Entry

As a recap, here’s the cheat sheet for divergence trading…

You almost certainly have already got it saved in your computer, but how and when exactly do you enter?

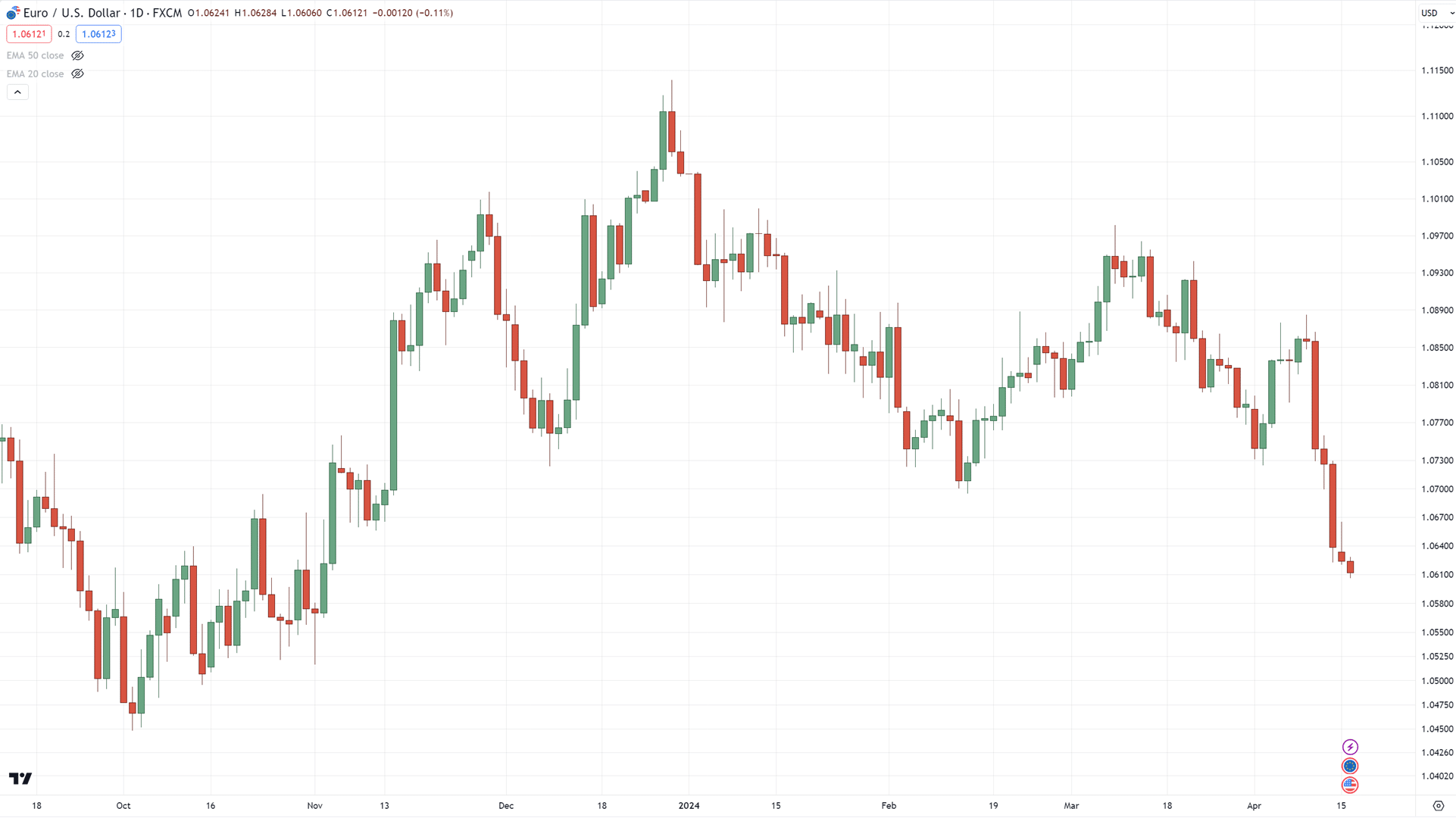

For this instance, we’ll use the 14-period RSI.

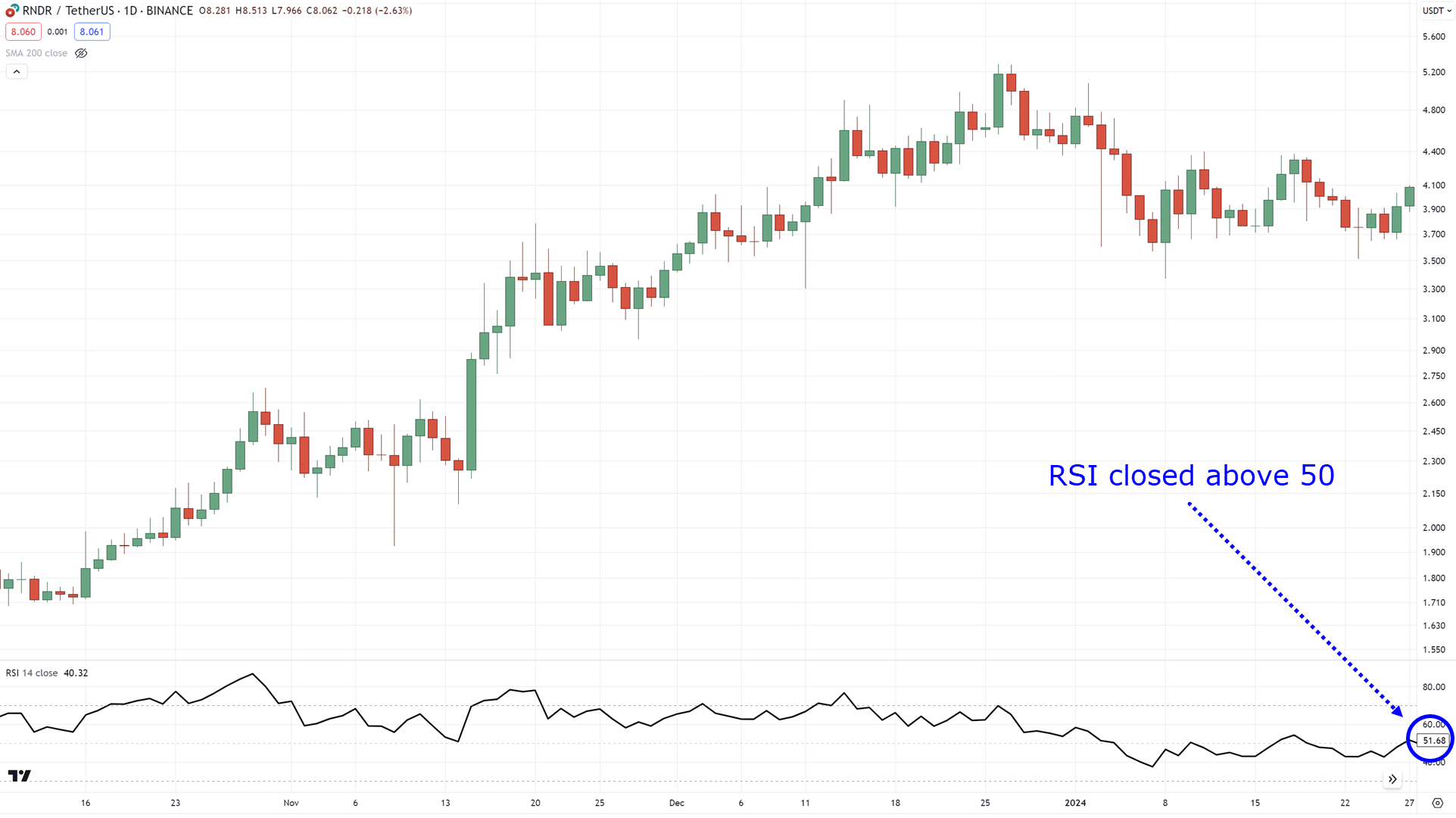

So, once you see a bullish divergence…

Then you would like to wait for the worth to shut above RSI 50…

Then you definately enter the trade on the following candle!…

By the best way…

If the bullish divergence happens when the worth is below RSI 30, then you definitely can wait for the worth to shut above RSI 30 as an alternative.

In our example, the divergence happened when the RSI was above 30, so we waited for the worth to shut above RSI 50.

All clear?

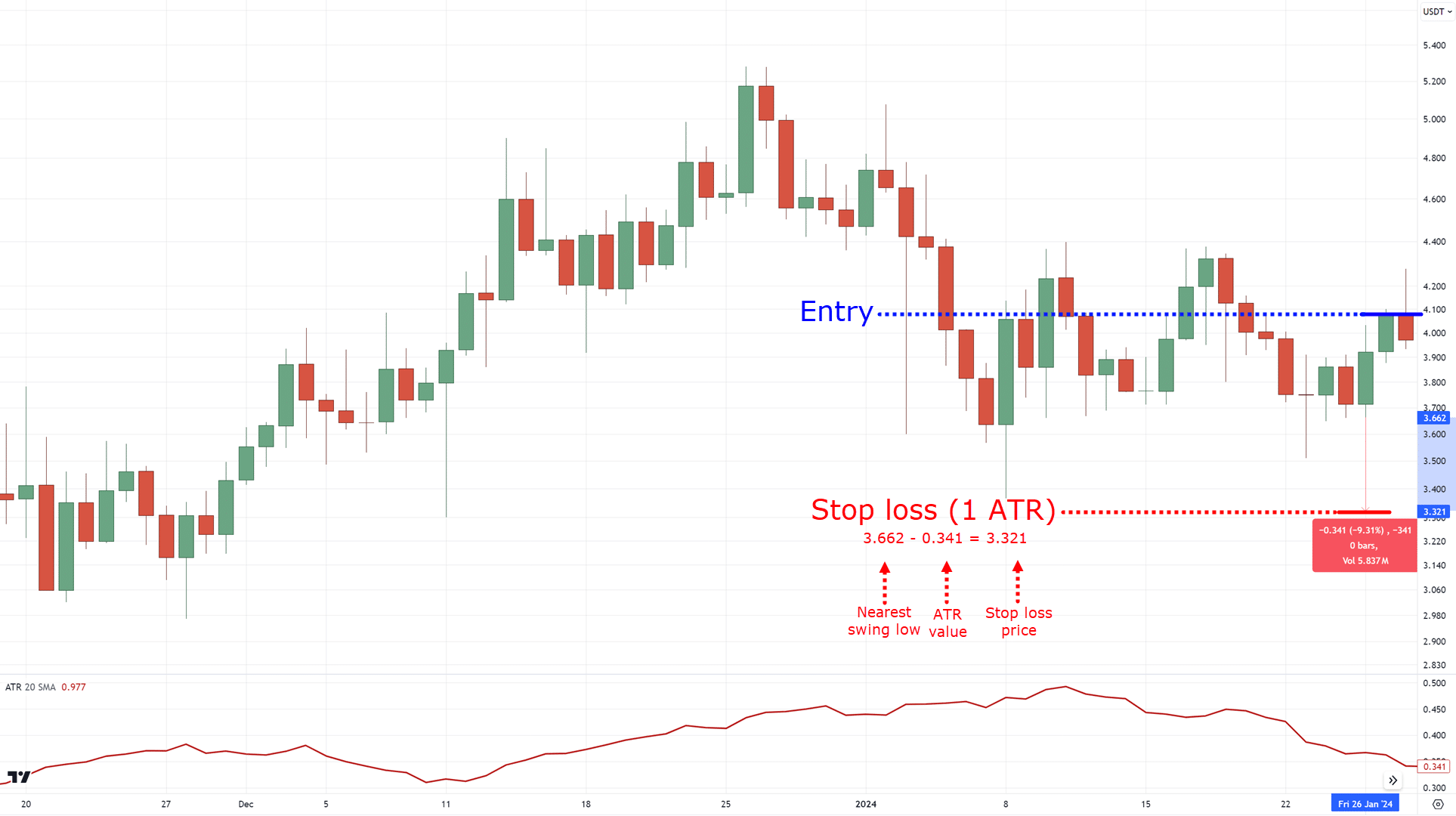

Discover your Exits

This might be worked with a few caveats to take into consideration…

Where’s your exit in case you’re right, and where’s your exit in case you might be improper?

What about your stop loss and take profits?

Now, if the worth closes above RSI 30 and makes a legitimate bullish divergence trading setup, you would like to subtract 1 ATR below the lows…

In case you’re an everyday reader, then you definitely’ve probably heard concerning the ATR numerous times.

But that’s because this indicator is so versatile, and offers you an objective technique to set your stop loss!

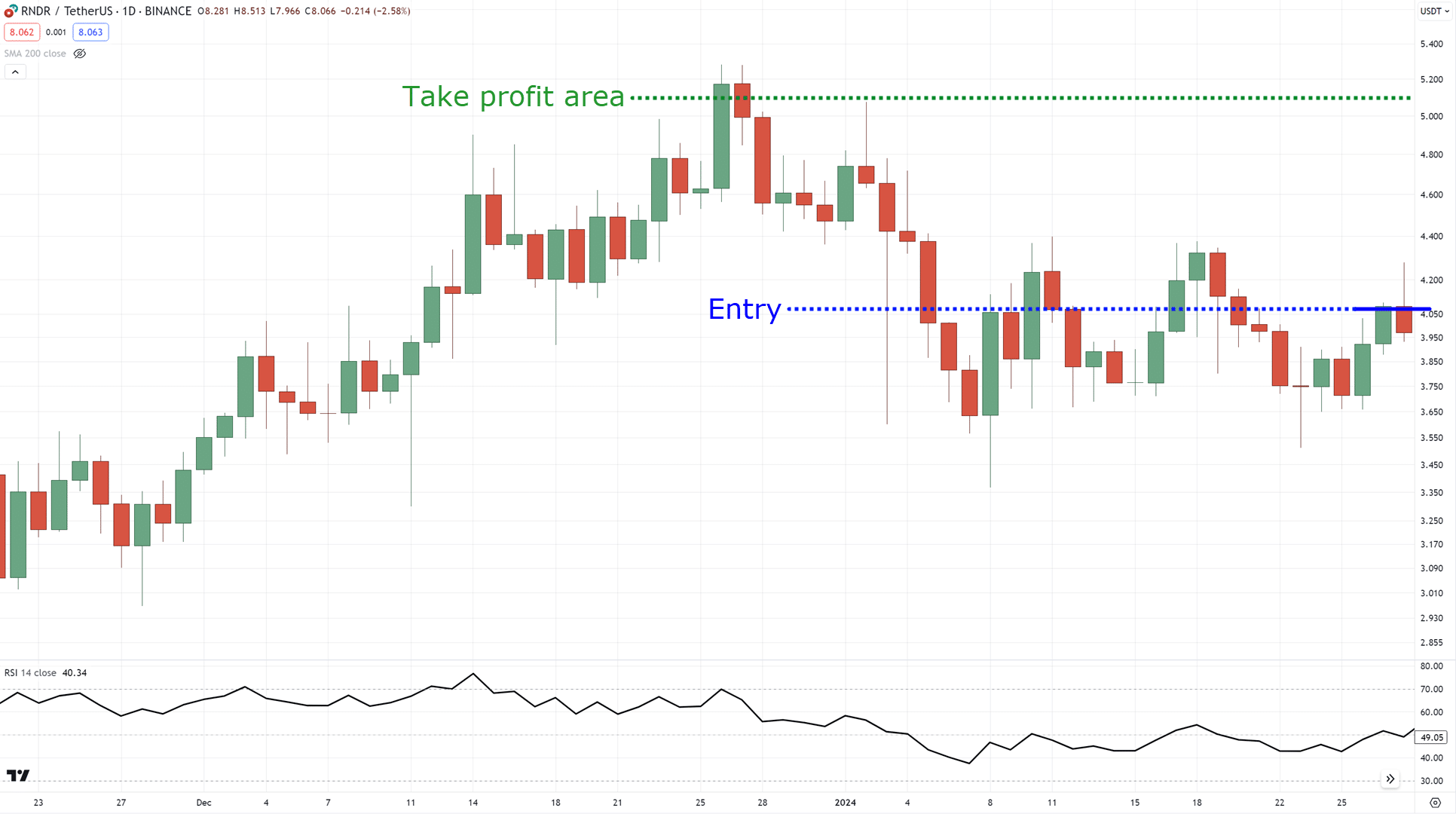

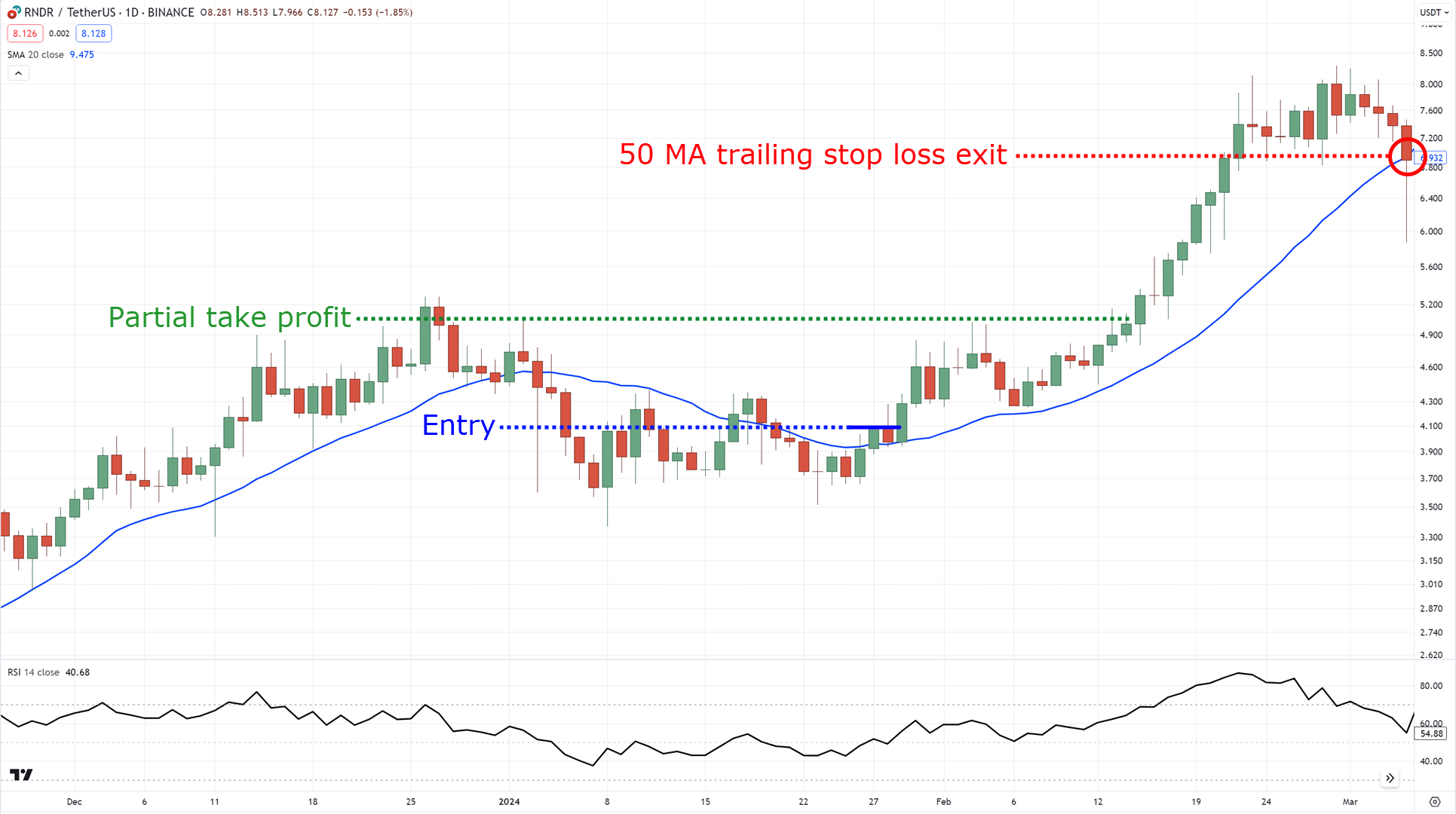

Now, how about taking profits?

You may consider taking profit before the closest high…

Or you possibly can consider partially taking profit at the closest high and trail your stop loss using a medium-term moving average reminiscent of the 50 MA!…

In fact, that is only a cherry-picked example, nevertheless it is sensible, right?

Now here’s the thing…

This setup is pretty conditional.

Meaning, it could actually take some time to identify a setup where bullish or bearish divergences form at an area of value.

To treatment this, you have got two options:

- Trade the lower timeframes, reminiscent of M30 – H1

- Or trade the higher timeframes but deal with multiple markets and have more open trades

Got it?

Finally, before I end this guide…

I need to share with you some extra notes on what to not do with divergence trading.

That is crucial, because it’s vital to know tips on how to do it the fitting way and tips on how to do it the improper way!

What to not do when using a divergence trading strategy

There’s little question about it…

There are numerous things that you will need to be mindful as a trader.

Nonetheless, listed below are crucial things on what to not do with divergence trading…

Being inconsistent together with your timeframe

I discussed which you can decide to do divergence trading on the lower timeframe or higher timeframe.

That is why I even have to emphasise to you straight away to decide on a timeframe that you possibly can persist with.

Once you have got it, practice spotting divergences in trading on that consistent timeframe.

The very last thing you would like to do is try to identify divergences on all timeframes… it gets messy fast!

Remember, while you’re inconsistent in your trading, you get inconsistent results.

Blindly following the divergence trading cheat sheet

Here’s the reality:

Regardless of what the same old textbook (and even this guide) shows you…

There’ll all the time be slight variations, and there might be exceptions.

So when doubtful, stay out!

Finally…

Not practicing enough to discover swing highs and lows

The effectiveness of divergence trading mainly is dependent upon how well you possibly can spot them.

That is why you will need to consistently practice plotting your swing highs and lows with or without the zigzag indicator that I shared with you!

And again, we have now an entire training guide dedicated to it, which you possibly can try here:

Learn how to Read Price Motion (For Dummies)

Sound good?

With that said, let’s have a fast recap of what you’ve learned today!

Conclusion

There’s no way around it…

Divergence trading can take a while and practice to get used to.

That’s why I designed this guide in a technique to shortcut that learning curve, assist you to avoid noise, and direct you to concepts that need your deal with your technique to divergence trading.

Nonetheless, here’s what you’ve learned today:

- A divergence happens when the worth appears to make significant gains however the indicator detects that the momentum to succeed in such gains is slowing down (and vice versa for bearish)

- Learning tips on how to spot swing highs and lows effectively is the important thing to identifying and spotting divergences

- Different indicators might be used for divergence trading reminiscent of MACD, Stochastic, and RSI, but what’s crucial is so that you can select an indicator that makes probably the most sense to you

- Using the MAEE formula creates an entire trading strategy for divergence trading

- All the time ensure to be open for slight variations of divergences within the cheatsheet, real-time trading will all the time be different

There you go!

An entire masterclass to divergence trading!

Now…

As you apply this method, all the time be happy to return to this guide.

Nonetheless, here’s what I’d prefer to know:

When have you ever first heard of divergence trading?

Do you propose on trying it out after reading this guide?

In case you’re already using divergence trading, what suggestions would you recommend?

Let me know within the comments below!