You’ve heard that chart patterns matter.

But why?

That’s because they reveal roadmaps for potential market movements…

Warn you to imminent reversals…

Even forecast whether trends will proceed up or down!

It’s all about learning how you can find them – and that’s exactly what I’ll show you today.

On this guide, you’ll:

- Learn what makes up chart patterns and master how you can discover them.

- Understand the differences between reversal patterns, signaling trend shifts, and continuation patterns, indicating ongoing trends.

- Absorb real-world examples showing how these patterns develop in actual markets.

- Collect proven suggestions and methods to extend your trading success using patterns.

- Grasp the constraints and risks that include pattern trading.

Are you excited?

Great!

Then let’s dive in!

Chart Patterns Cheat Sheet: What’s it, and the way does it work?

Chart patterns are a novel way for traders to grasp price movements on their charts.

These patterns have been found throughout markets for years, often providing an uncanny ability to predict potential price movements.

And I get it… you’re probably asking…

‘But Rayner, surely the big financial institutions and corporations aren’t using these patterns to make trading decisions… are they??’

Well, it’s a great point!

These chart patterns don’t occur because traders are making them deliberately…

They’ve more to do with the underlying psychology of the market.

The patterns are inclined to occur at crucial points – price or otherwise – because they hold value for a number of traders at the identical time.

In consequence, the patterns are naturally formed during shifts in the way in which the market is playing out.

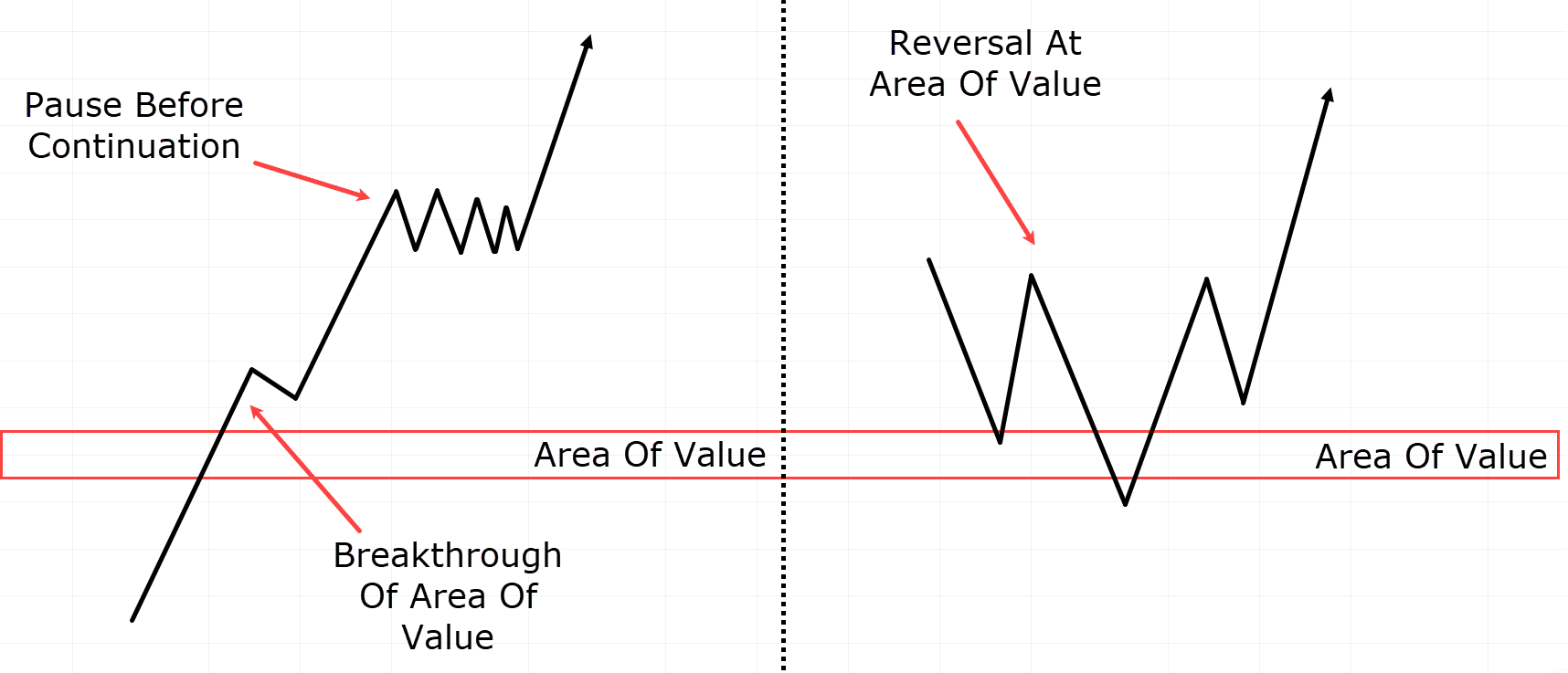

These shifts could possibly be a momentary pause in market prices following a powerful breakout…

…and an uptrend to the emergence of a latest trend – with a higher low formation.

Example of Strong Breakout vs Reversal and Latest Trend

At the top of the day, they’re a visible aid to see changes in market conditions more easily.

…”So what?” I hear you cry!

Well, chart patterns offer guidance on something traders often overlook, although it’s an important aspect of trading…

…I’m talking about entry and exits!

Imagine getting practical input on whether your trade is proving correct or incorrect!

Are you able to imagine the arrogance boost it could give?

Patterns can provide clear take-profit and stop-loss areas, meaning you may plan your trades – even before entering them!

No more blindly entering the market… struggling, and worrying over the very best exit points…

The precise layout of chart patterns means you may make higher decisions, manage your risk higher, and boost your overall trading success.

Types Of Chart Patterns Cheat Sheet

Let’s discuss two fundamental sorts of patterns: Continuation Patterns and Reversal Patterns.

Continuation Patterns:

Continuation Patterns emerge when the market is already trending a certain way.

So finding these patterns after a giant upward or downward move permits you to make the most of a trend’s continuation.

They show whether the continuing trend… goes to maintain going!

You’ll be able to often find them when the market temporarily pauses – before it resumes again.

Reversal Patterns:

Reversal Patterns are more common and easier to seek out across various timeframes.

They indicate a possible reversal within the trend, showing a shift in market dynamics and the onset of a latest trend.

You’ll be able to often find them when…

…the market changes from consistent higher highs and better lows to the primary lower or lower high…

…or at robust support and resistance levels.

Reversal Patterns

I need to debate three Reversal patterns that traders commonly use.

Nevertheless, it’s vital to grasp that there are various more on the market!

So, in the event you feel you would like more of those tools, they’re all the time price trying out!

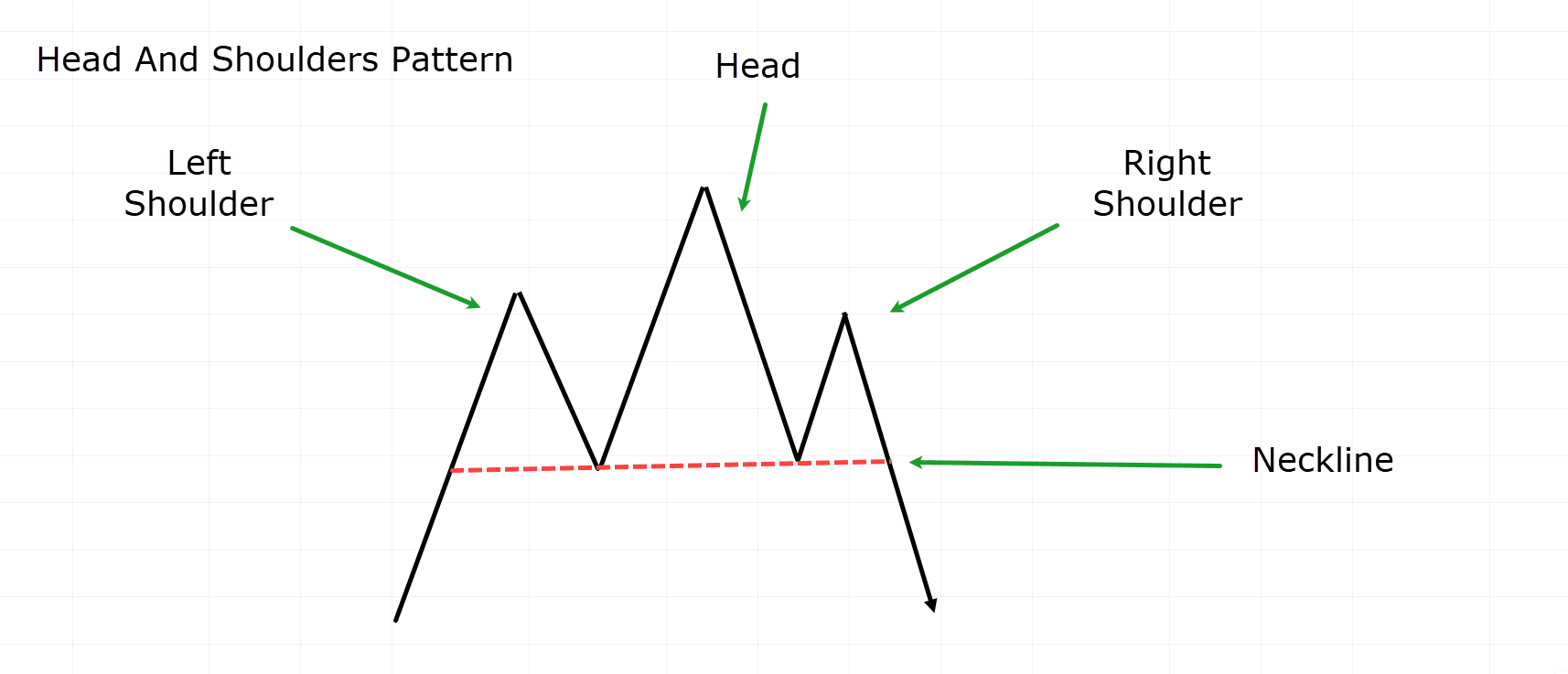

Head and Shoulders Reversal Pattern

Head and Shoulders Example:

The top and shoulders pattern is a bearish reversal pattern you may sometimes find at the top of an uptrend.

What’s the Head and Shoulders Pattern composed of?

- Neckline – The purpose at which the 2 lows of the shoulders meet. Some traders position them where they function as support, while others prefer precision between these two points.

It’s vital to keep in mind that the inverse of this pattern is generally known as the inverse head and shoulders, often found at the underside of downtrends as a bullish pattern.

Now that you’ve a blueprint, let’s examine a real-life trading example!…

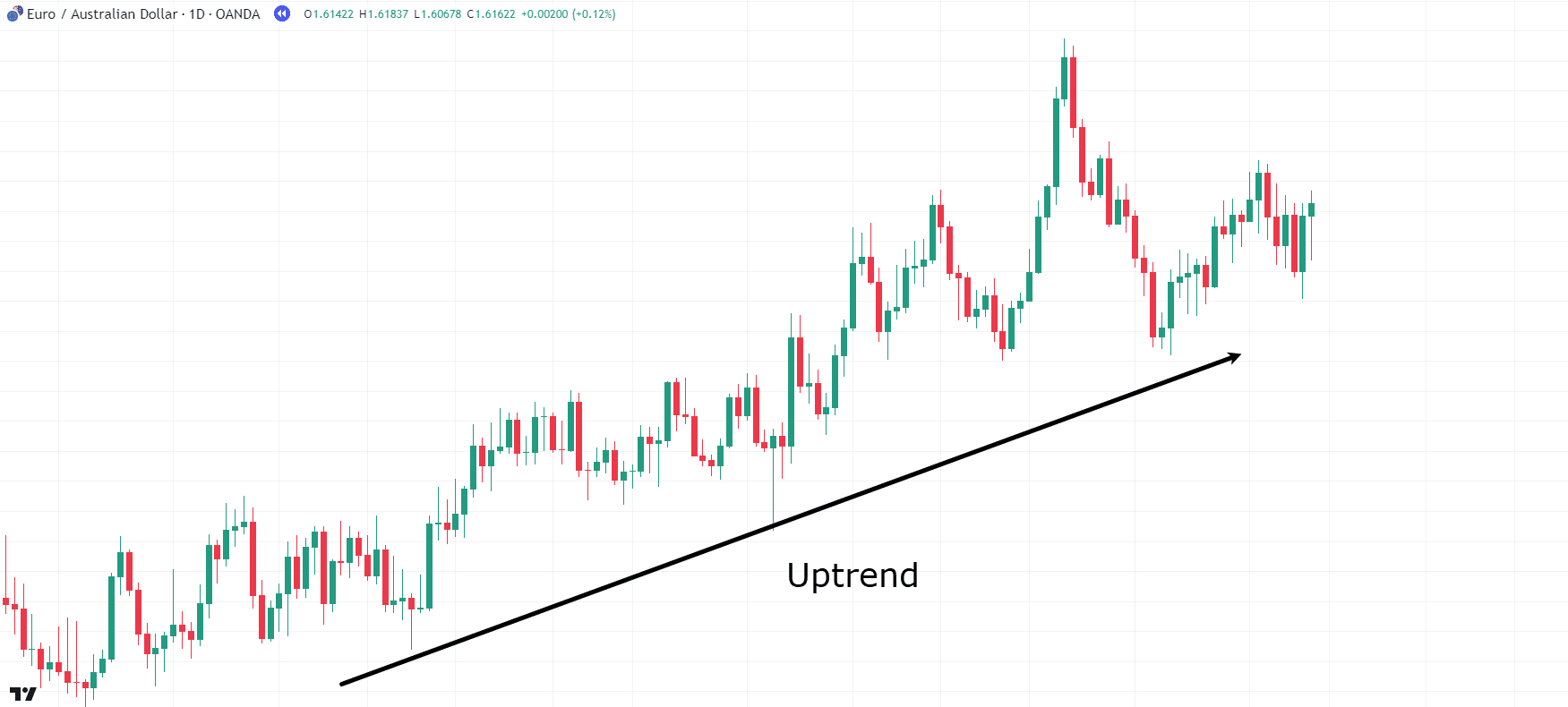

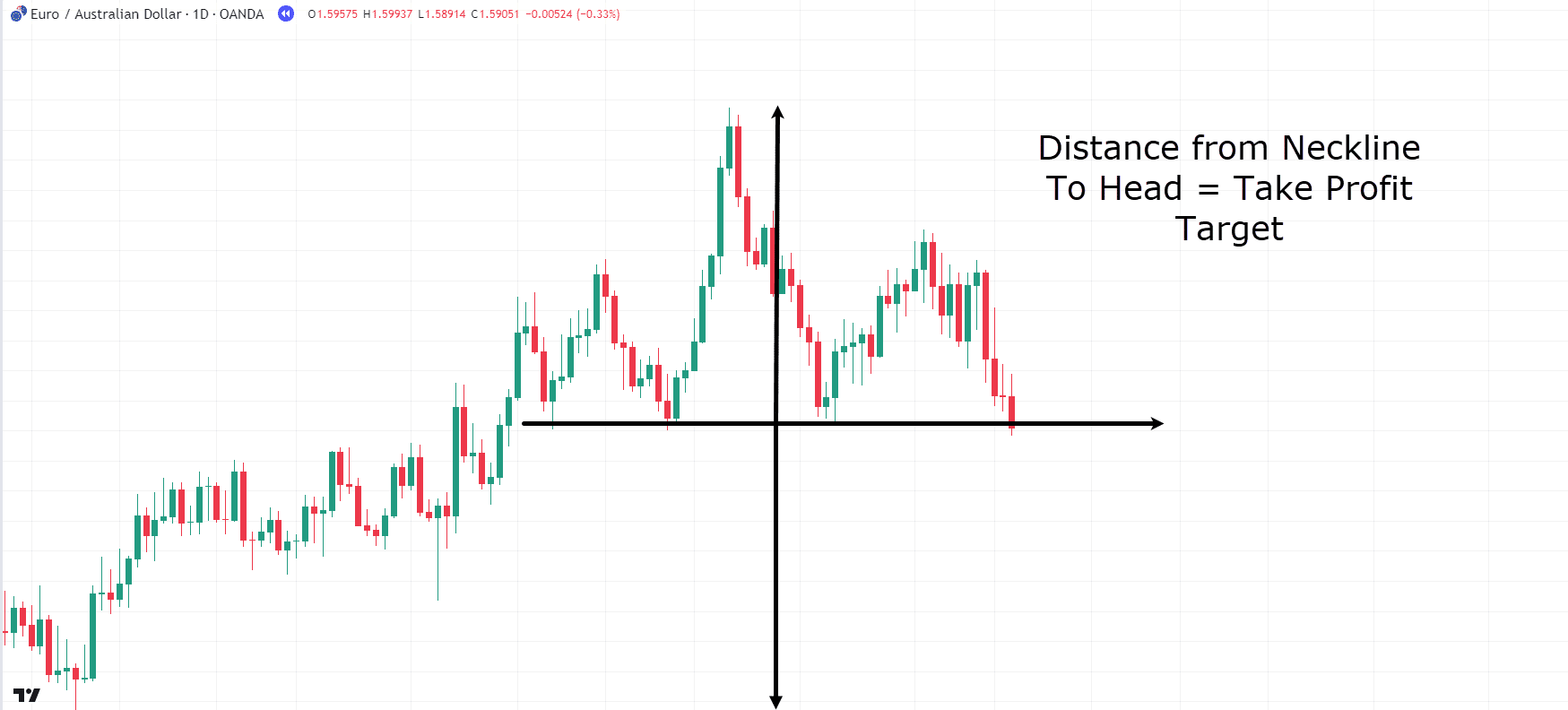

EUR/AUD Each day Chart Uptrend:

On this EUR/AUD each day chart, you may see a transparent uptrend, right?

This uptrend is the very first thing you would like when finding the Head and Shoulder pattern…

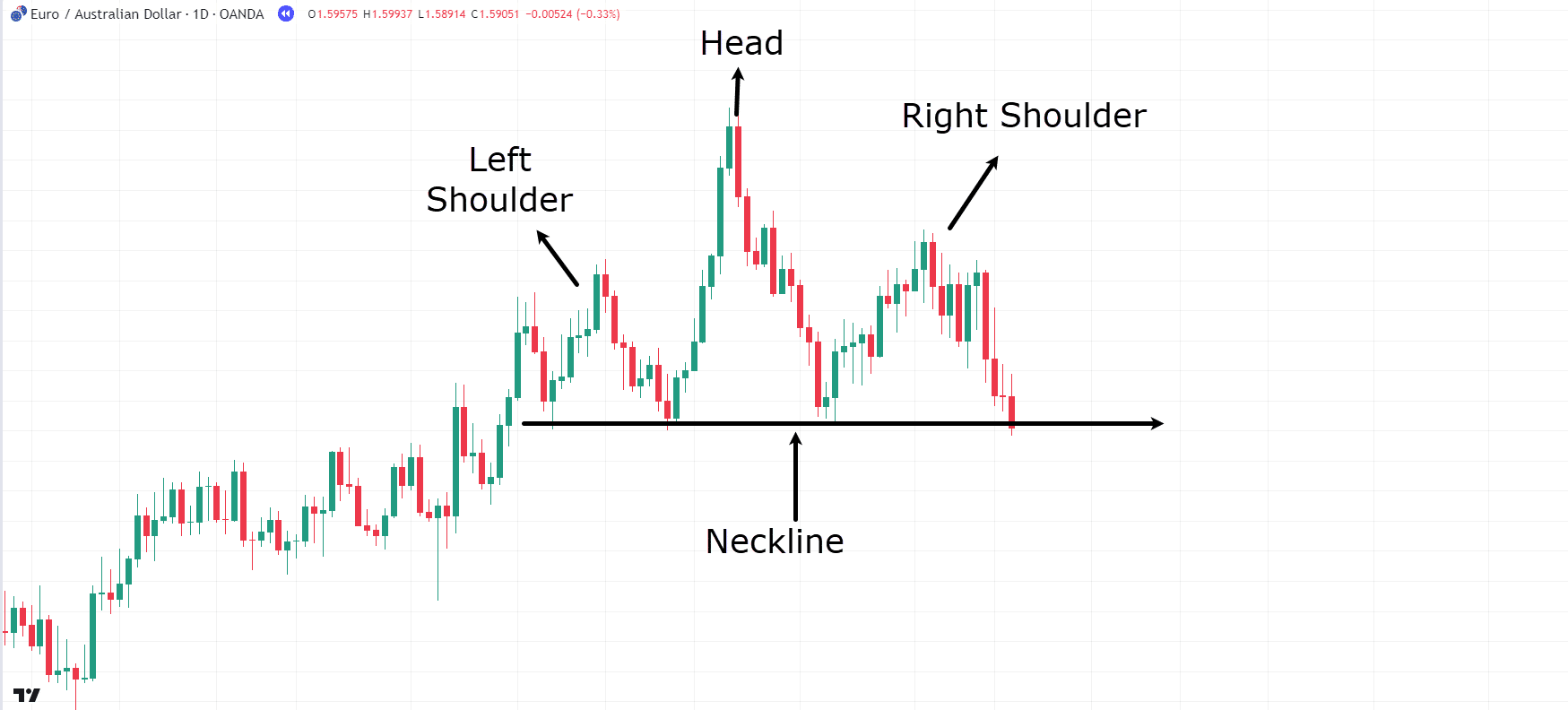

EUR/AUD Each day Chart Head And Shoulders Formation:

Taking a better look, are you able to see the Head And Shoulders pattern throughout the uptrend?

Well, traders often decide to enter a brief position when the neckline of the pattern is breached.

Some traders may wait for a retest of the neckline before taking a brief position, while others may enter as soon as a candle closes below it.

Certain patterns have something called a ‘measured move’…

EUR/AUD Each day Chart Head And Shoulders Measured Move:

Measured moves show where the value may move after the pattern forms…

On this case, the pinnacle and shoulders measured move span from the neckline to the pinnacle.

As a trader, you’d estimate the value to say no by the identical distance found from the highest of the pinnacle to the neckline.

So, measured moves offer a helpful guide for understanding potential profit-taking levels!

Let’s explore the final result…

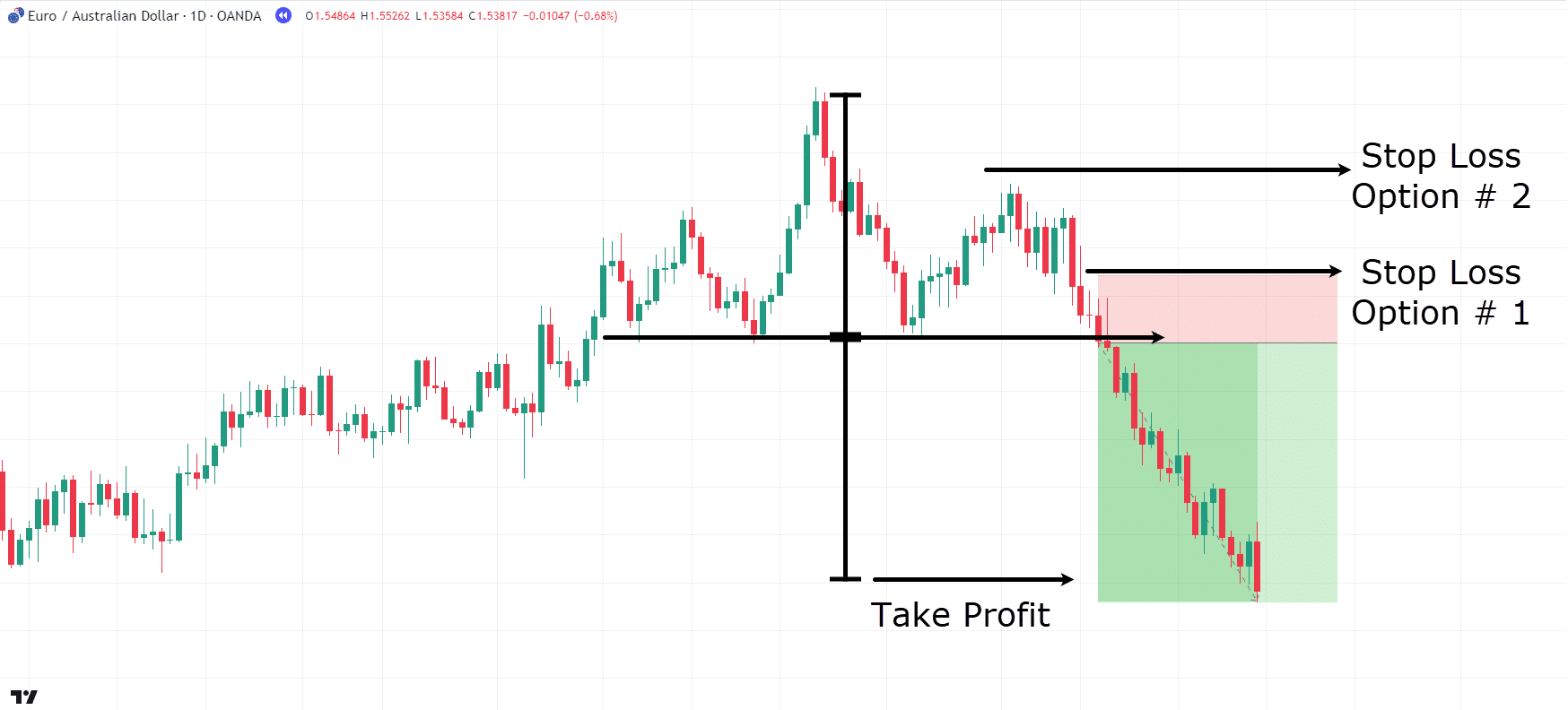

EUR/AUD Each day Chart Head And Shoulders Result:

As shown, the value reached the goal level pretty easily this time!

Now, as for stop loss placement, the pinnacle and shoulders pattern gives you a few options…

The very first thing is to take into consideration timeframes – and your strategy.

You can put your stop loss above the neckline for riskier setups…

…or above the correct shoulder for less dangerous options.

It’s all about flexibility in support and resistance!

The top and shoulders pattern is deemed invalid if the value swiftly rebounds above the neckline.

Does it make sense?

Great! Let’s proceed to a different reversal pattern.

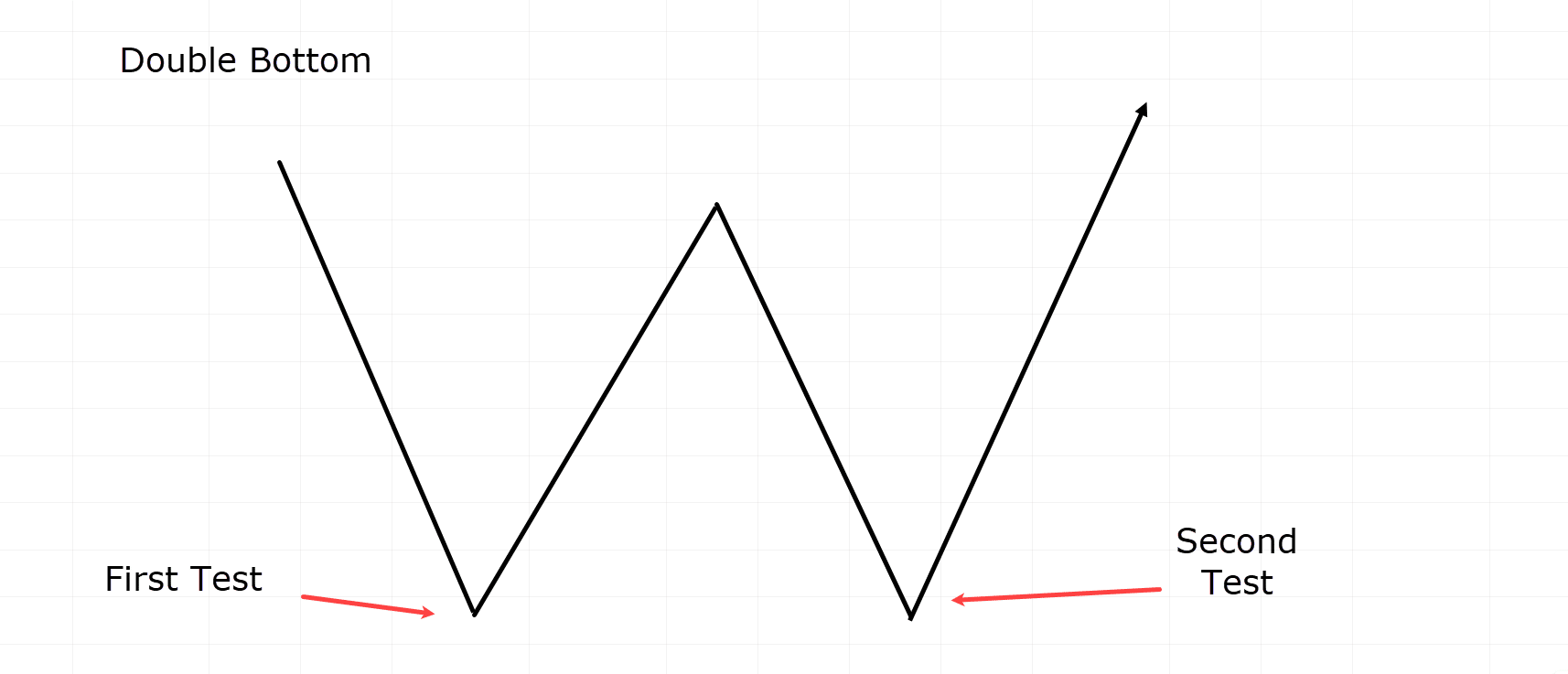

Double Bottom Reversal Pattern

Double Bottom Example:

The double-bottom pattern is pretty common across all markets, and also you’ll often find it at the underside of downtrends.

While it could look easy, it’s some of the incessantly used patterns!

But why is it so popular, you would possibly wonder?

The rationale lies in its ability to point out a latest support zone effectively – invaluable, right?!

What constitutes the Double Bottom Pattern?

- First Test – The initial test represents the purpose where the value bounced for the primary time.

- Second Test – The subsequent test occurs when the value revisits the identical level and bounces again. This marks the second time the realm has been tested.

Now, there should be a while and price movement between the bounces through the first and second tests.

Remember, the inverse of this pattern is known as the Double Top and is found at the top of uptrends.

Let’s examine a trading example of the Double Bottom…

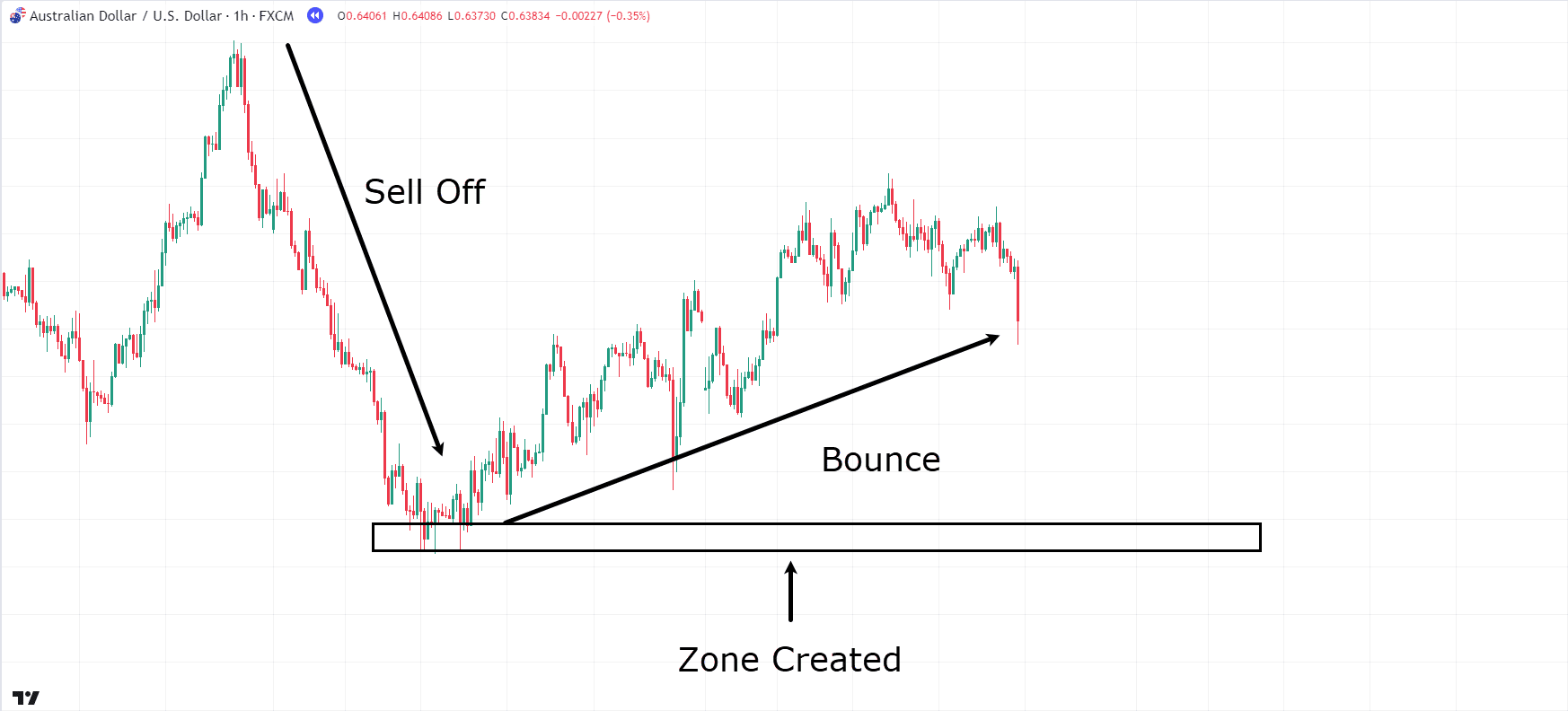

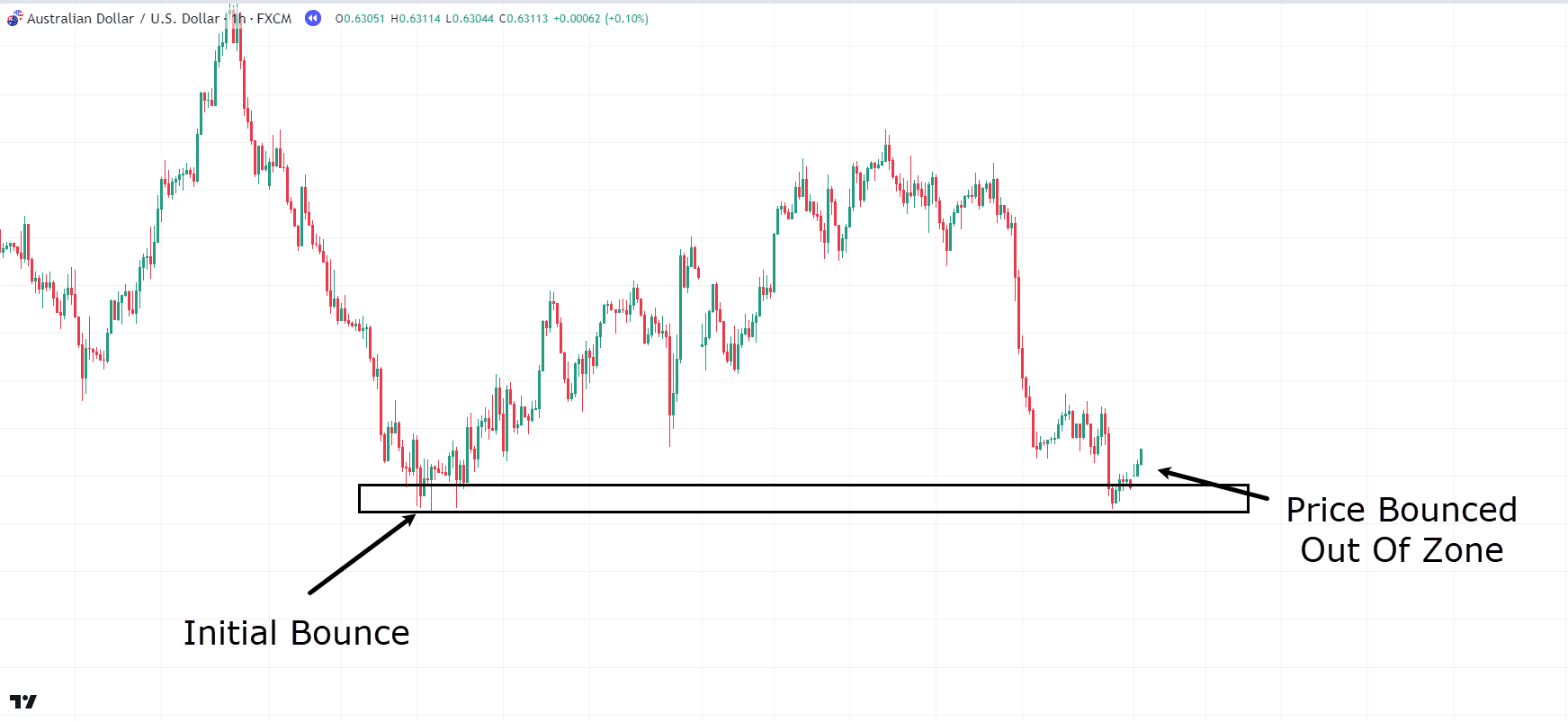

AUD/USD Hourly Chart Double Bottom:

The AUD/USD hourly chart shows a major sell-off followed by a bounce and a move upward…

AUD/USD Hourly Chart Double Bottom Bounce:

There’s a reasonably large period of time between the bounces. Also, take a look at how the value has exited the zone and bounced again…

This implies that this area on the value chart could potentially be a zone of rejection and signal a price reversal, with price rejecting the identical zone.

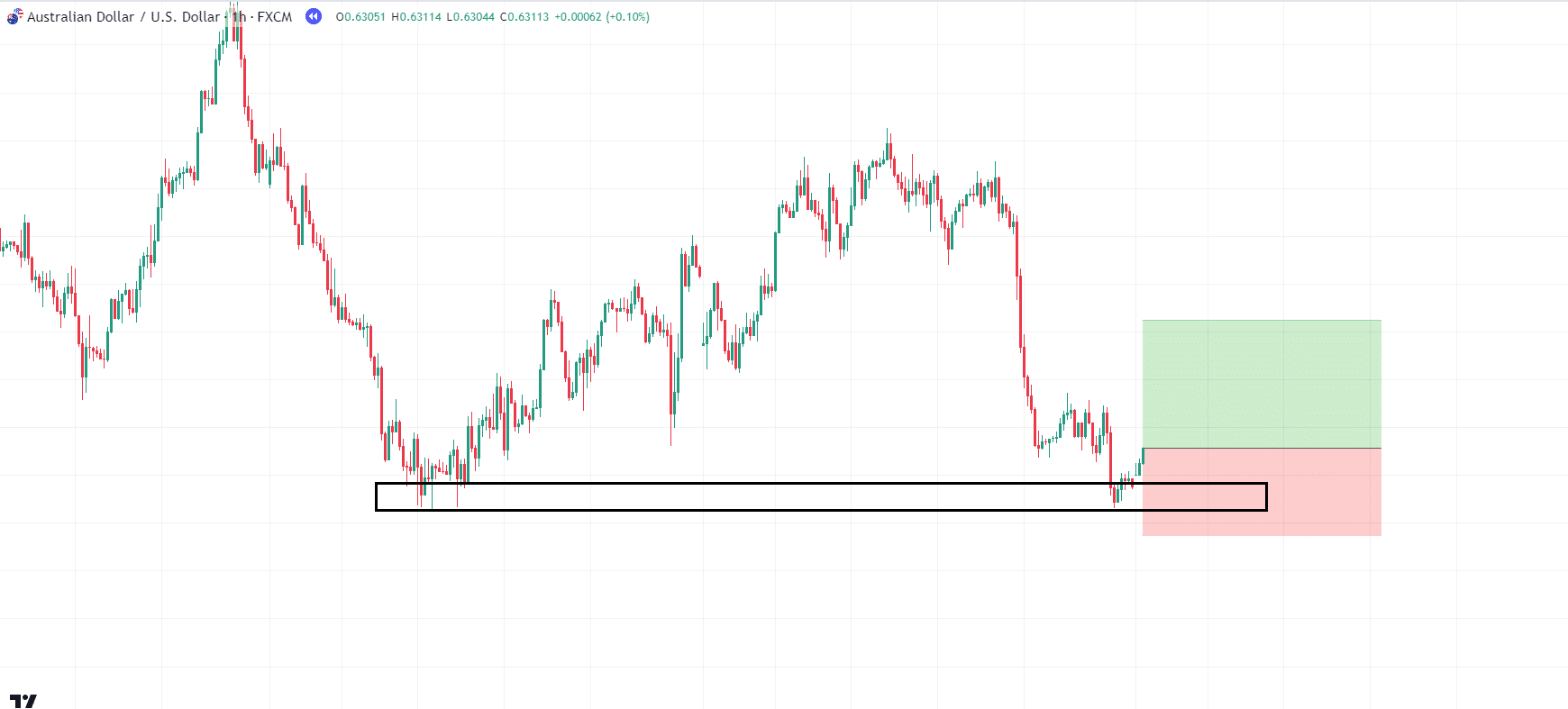

Let’s take a take a look at what an entry might appear like…

AUD/USD Hourly Chart Entry:

As shown, the stop loss will be positioned below the zone.

If the value falls below the zone, the double bottom pattern becomes invalid as the value has begun to form a lower low.

Unlike the pinnacle and shoulders pattern, the double bottom doesn’t offer a clear-cut measured move goal, though.

So for this instance, let’s aim for an inexpensive 2:1 risk-to-reward ratio.

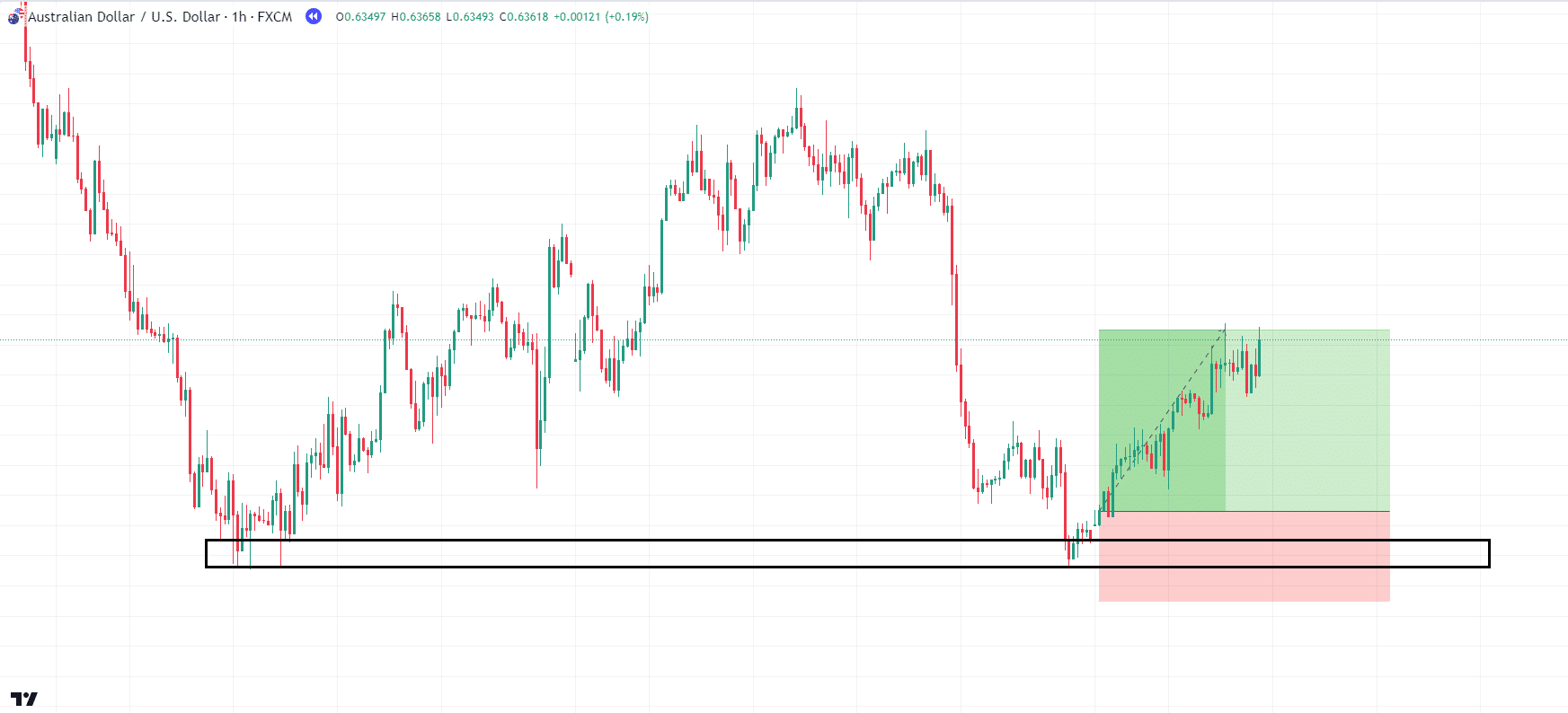

Test it out…

AUD/USD Hourly Chart Exit:

Nice work!

Congratulations!

You effectively entered a 2:1 trade, capturing substantial profits from a straightforward bounce at support using the double bottom pattern!

Note: The triple bottom pattern mirrors the double bottom pattern but features three bounces as an alternative of just two.

Each patterns function visualizations of support levels… they usually make life quite a bit easier!

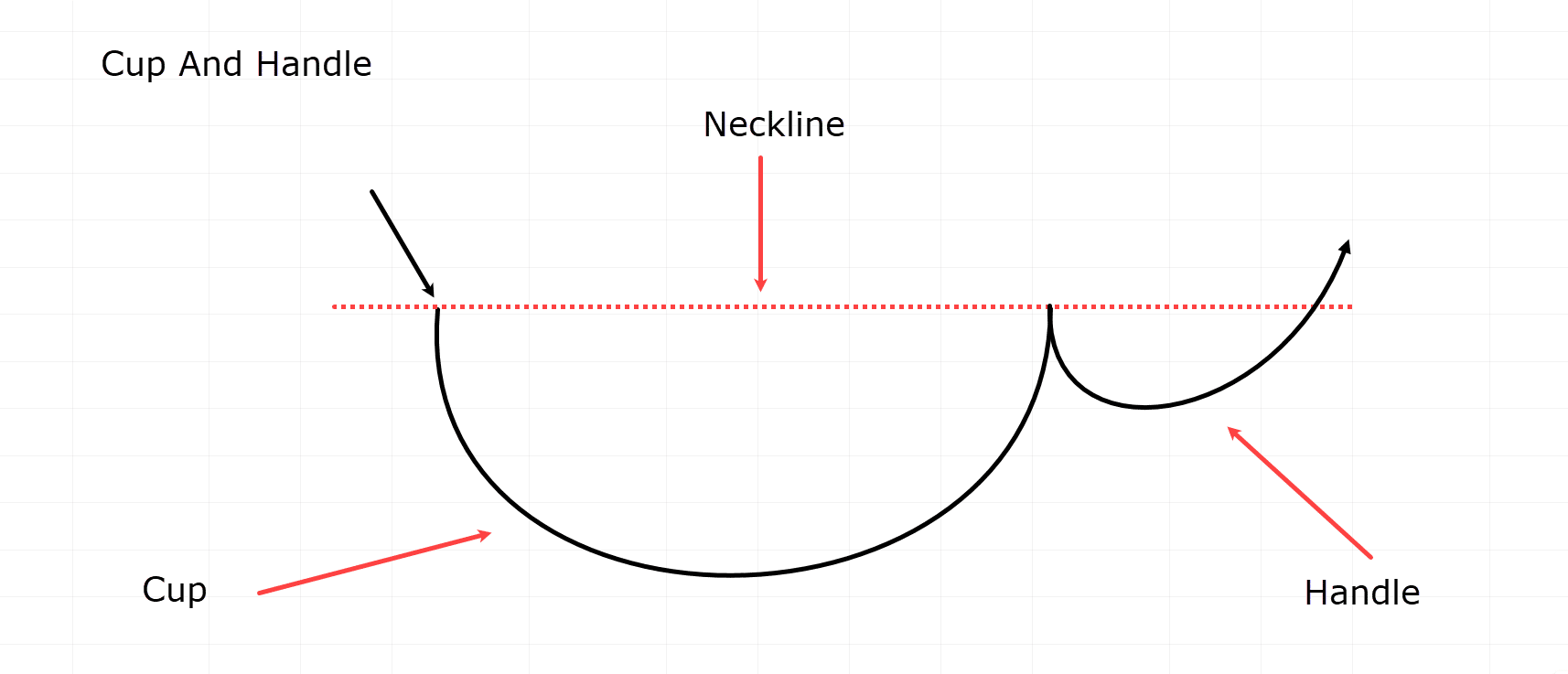

Chart Patterns Cheat Sheet: Cup and Handle Reversal Pattern

The Cup and Handle pattern is a form of rounded bottom formation, although its shape and size can vary.

The important thing feature is the noticeably rounded bottom that resembles… you guessed it… a cup!

Below is a diagram illustrating this pattern…

Cup And Handle Example:

The principal features of the Cup and Handle pattern include a rounded bottom that moves as much as the neckline.

Following the neckline, the value may retrace, forming a handle-like shape.

Sometimes, this handle formation can also be rounded, but it surely shouldn’t be a requirement…

Entry triggers will be found through the handle formation – or upon the breakout of the neckline.

Let’s examine an example of the Cup and Handle pattern in motion!…

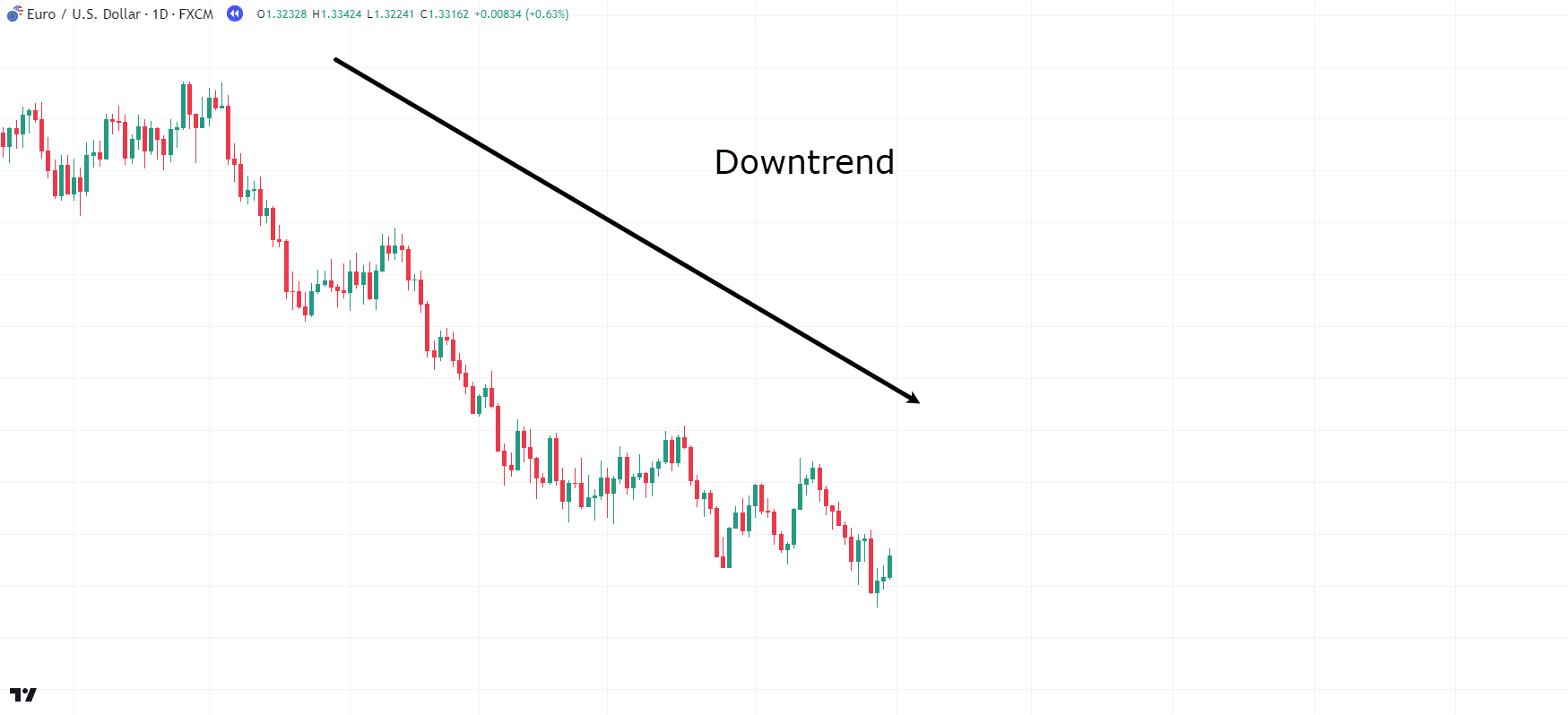

EUR/USD Each day Chart Downtrend:

On this chart, it’s clear that the value is in a each day downtrend…

…which is the very first thing you would like when identifying the cup and handle pattern!…

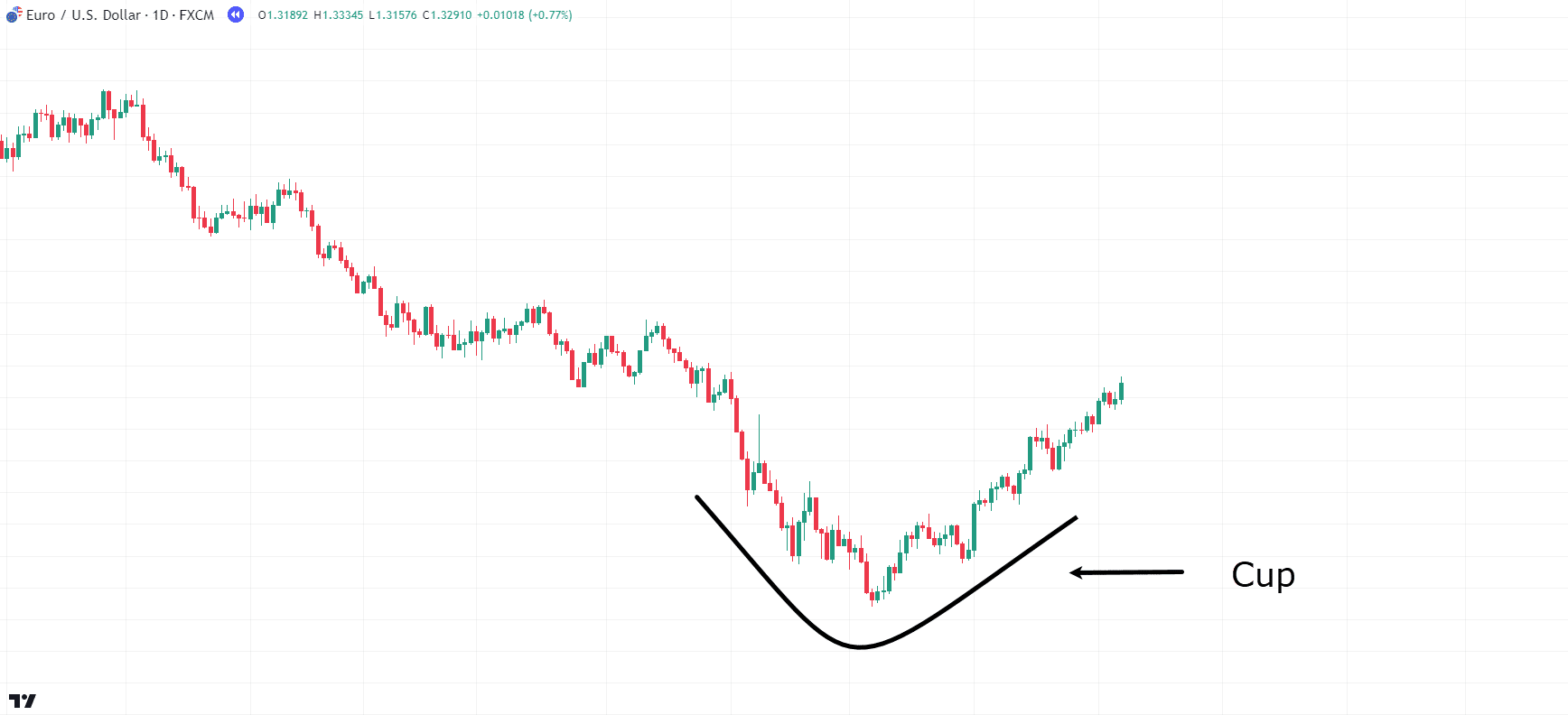

EUR/USD Each day Chart Cup Formation:

As the value retraces, a somewhat rounded bottom begins to form – see it?

Although the cup formation doesn’t must be perfectly round, it is sweet to see a gradual build-in price for it…

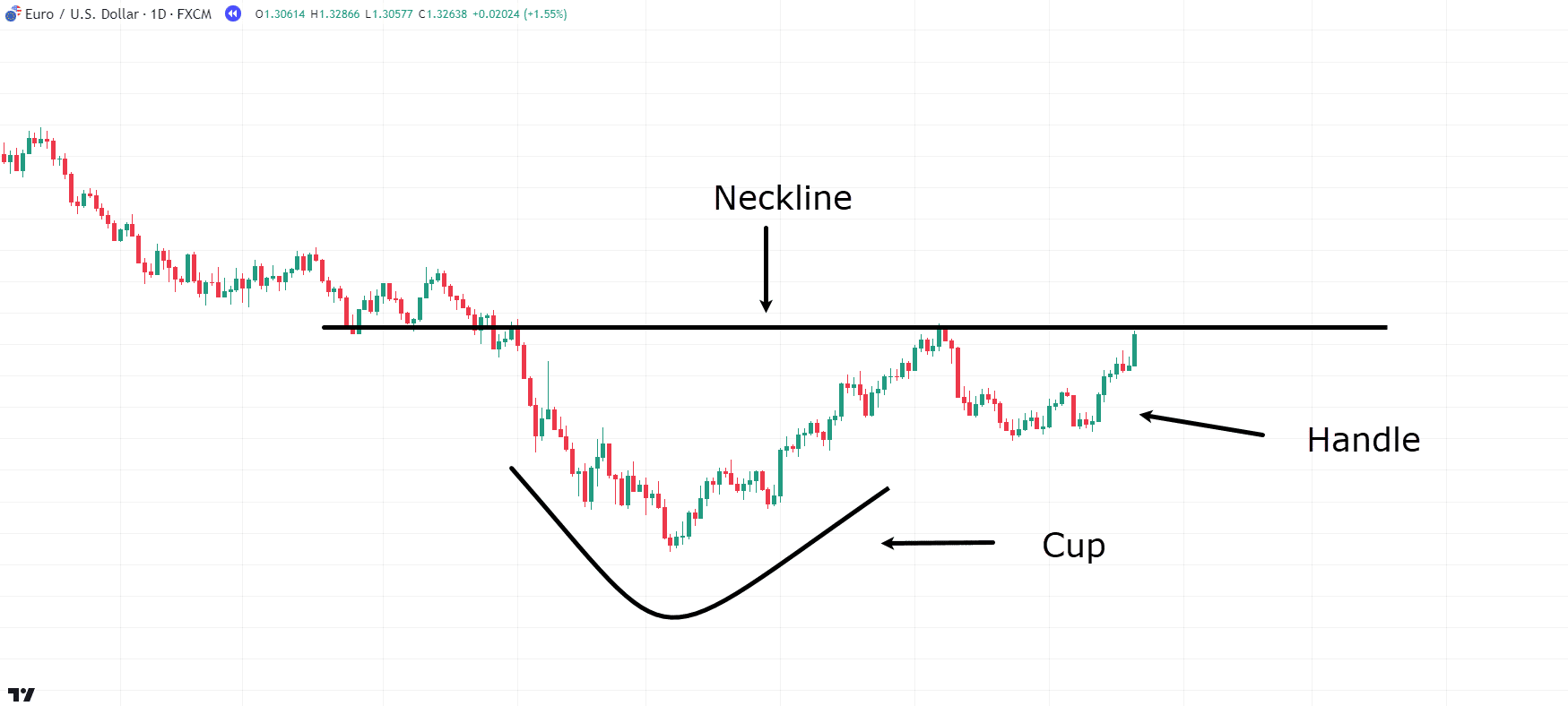

EUR/USD Each day Chart Cup And Handle Formation:

Now, the value has also formed the handle.

The neckline lines up with the previous support, which is a great sign for the longer term…

With each the cup and the handle formation complete, you may start thinking about taking a trade!

This might involve a break and retest of the neckline or just the breakout of the neckline.

Let’s explore what this setup could appear like…

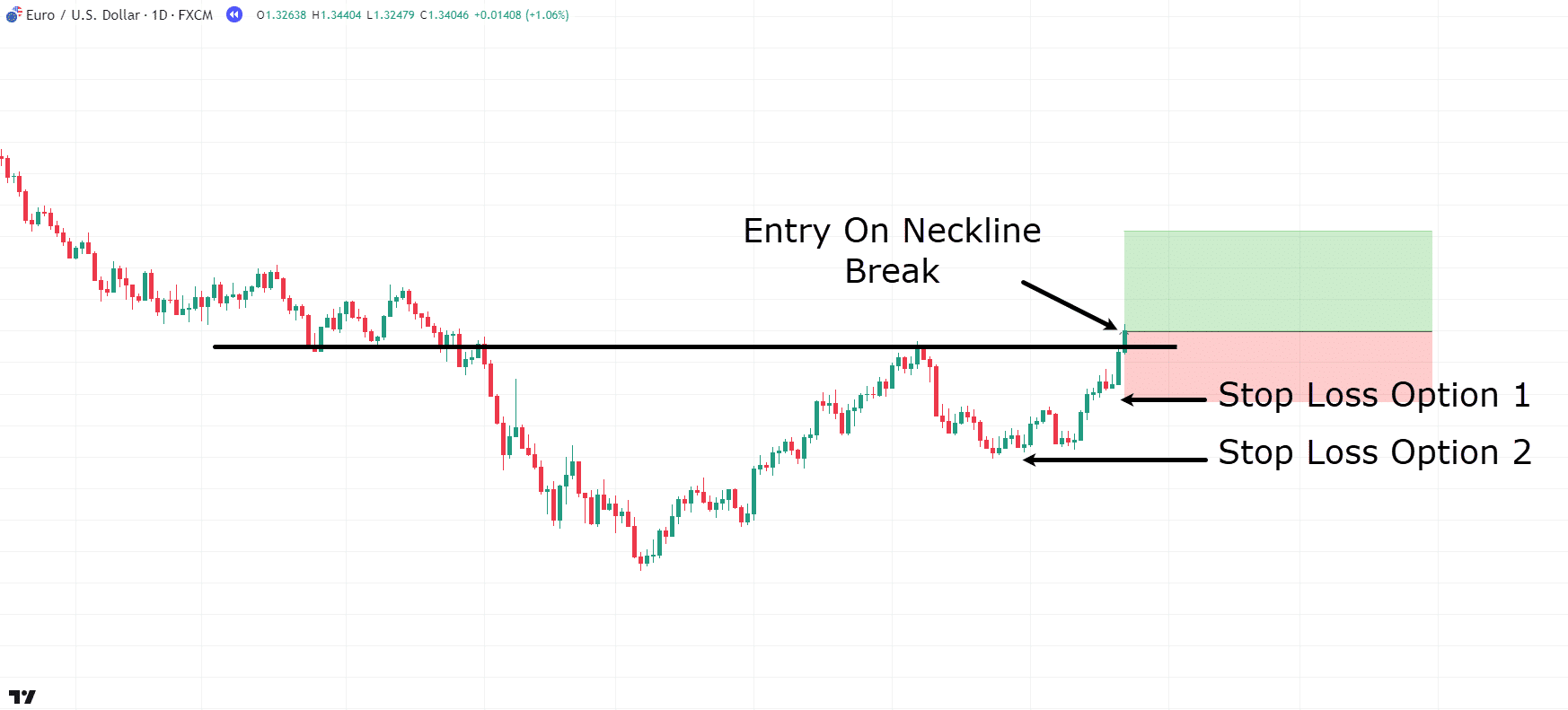

EUR/USD Each day Chart Cup And Handle Entry:

Now, in the event you prefer a more aggressive stop loss, you might place it under the bullish candle where the value originally broke out of the neckline…

If the value falls back below the neckline, it’s time to exit the trade.

Alternatively, you might use the second option to your stop loss in the event you’re targeting a longer-term trend…

…all of it is dependent upon your personal preference and risk tolerance!

Now that how you can discover three major reversal patterns, let’s delve into two major continuation patterns!

Chart Patterns Cheat Sheet: Continuation Patterns

Continuation patterns often show up as flags or triangles.

While I’ve got examples of two variations here, they’re not the one ones

You’ll also hear about wedges and symmetrical triangles on the market – with rules just like those I’ll cover today.

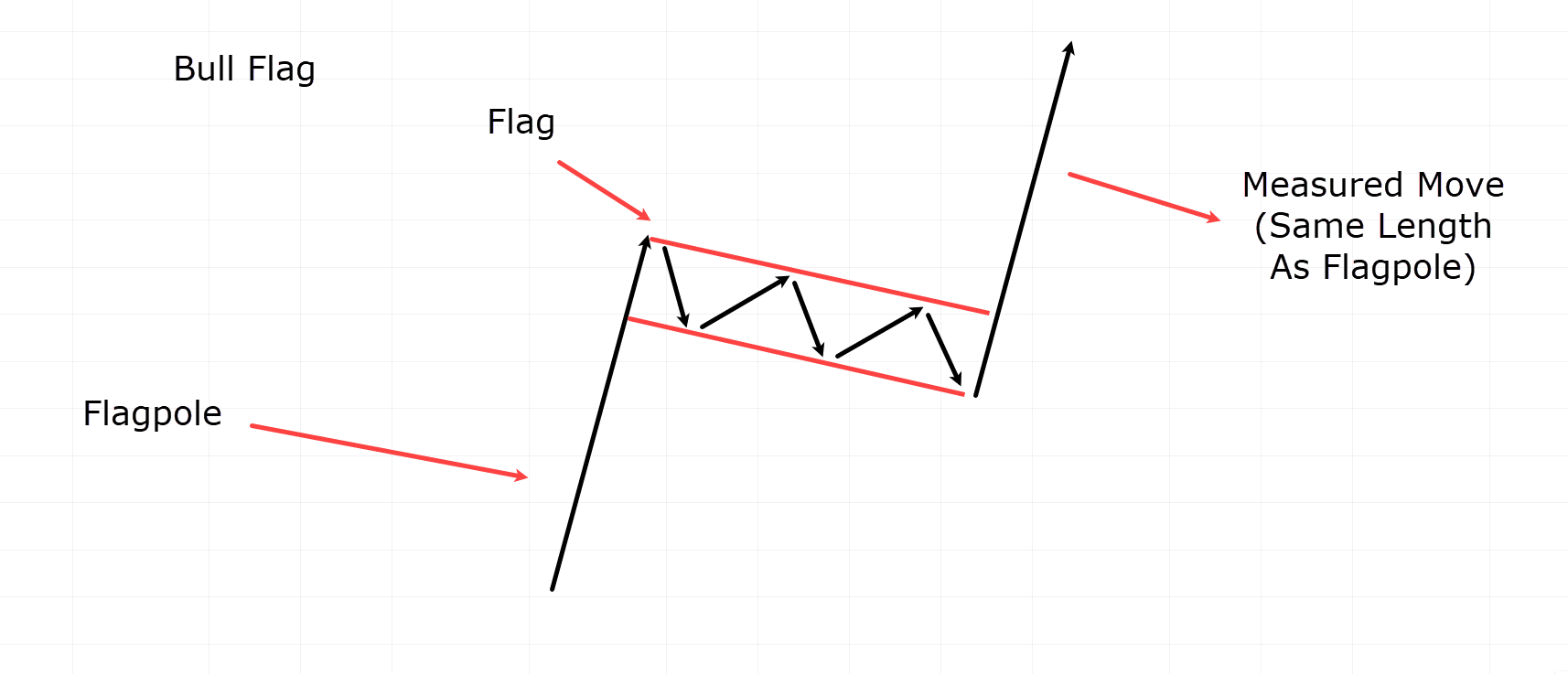

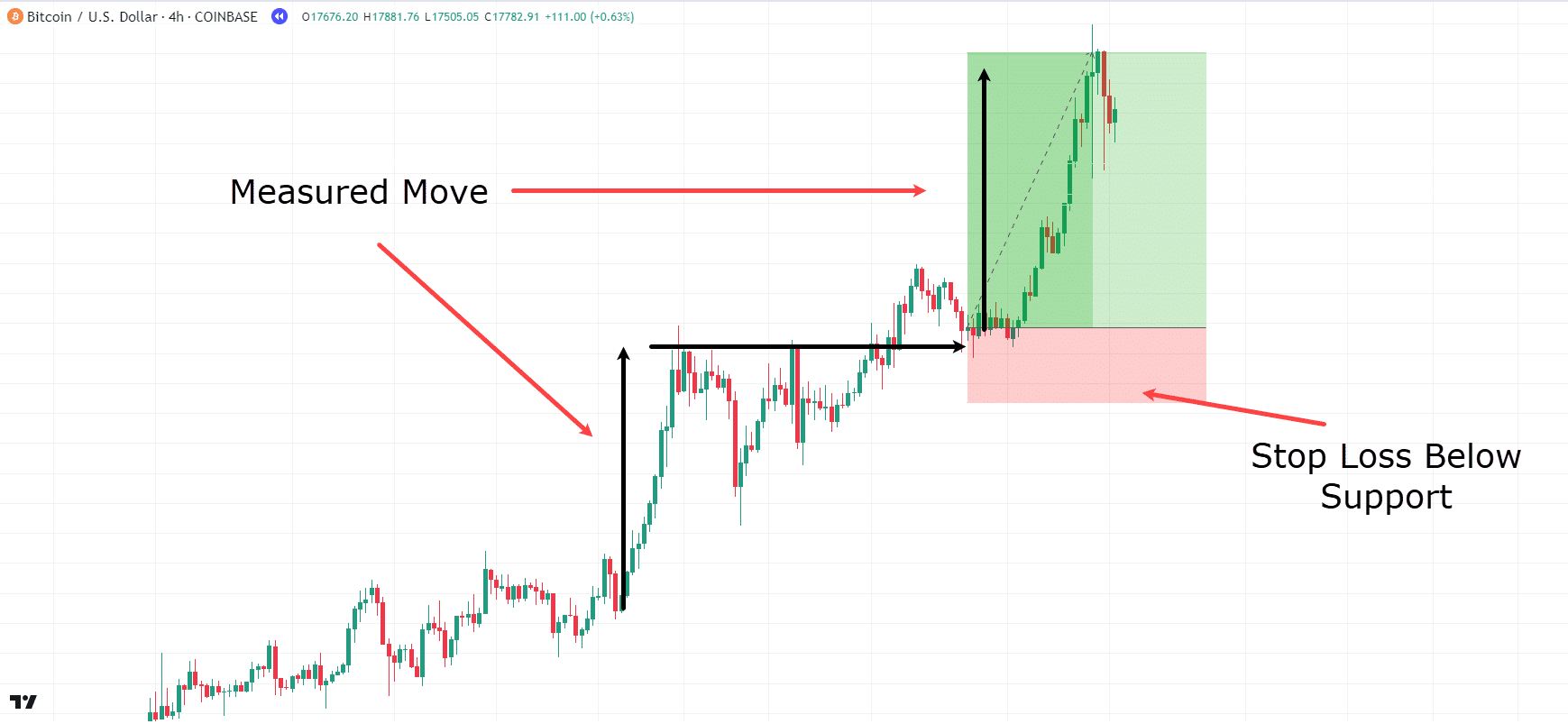

Bull Flag

First up is the famous Bull Flag, with its bearish counterpart being the Bear Flag.

The Bull Flag is often present in uptrends and is best described as a transient pause in price before the following move upward.

You’ll be able to visualize it because the bulls regaining stamina for the following rise!…

Bull Flag Example:

Its measured move is the length of the flagpole, meaning you may expect the value to maneuver at the very least from the underside of the flag to the length of the unique move up (the gap of the flagpole).

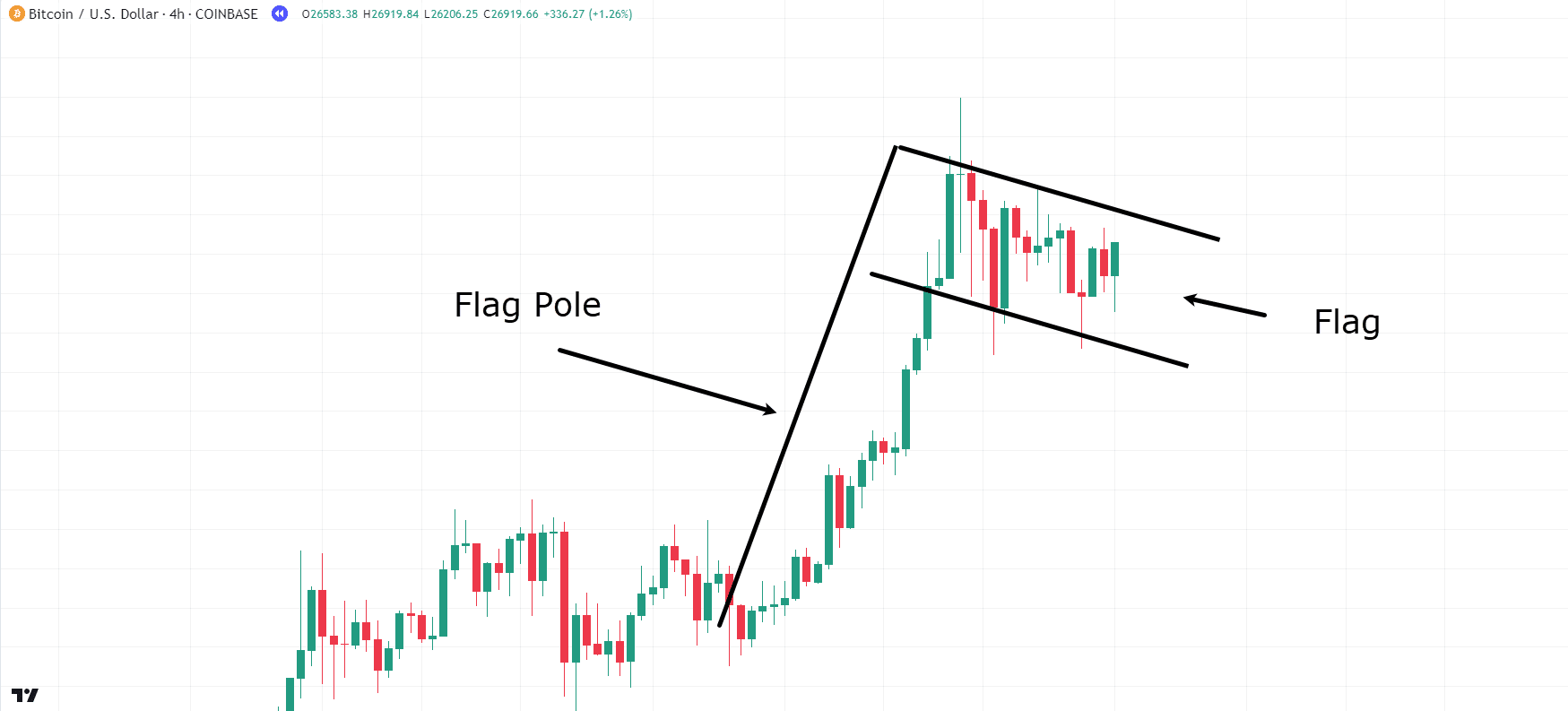

I often find these continuation patterns on the Bitcoin chart, so let’s take a take a look at an example…

BTC/USD 4hr Chart Bull Flag:

On the 4-hour chart, you may see that the value went through a powerful bullish surge before consolidating.

The flag formation could also be showing a downward or sideways trend; so long as the value stays inside a comparatively tight range, it might probably be identified as a flag pattern…

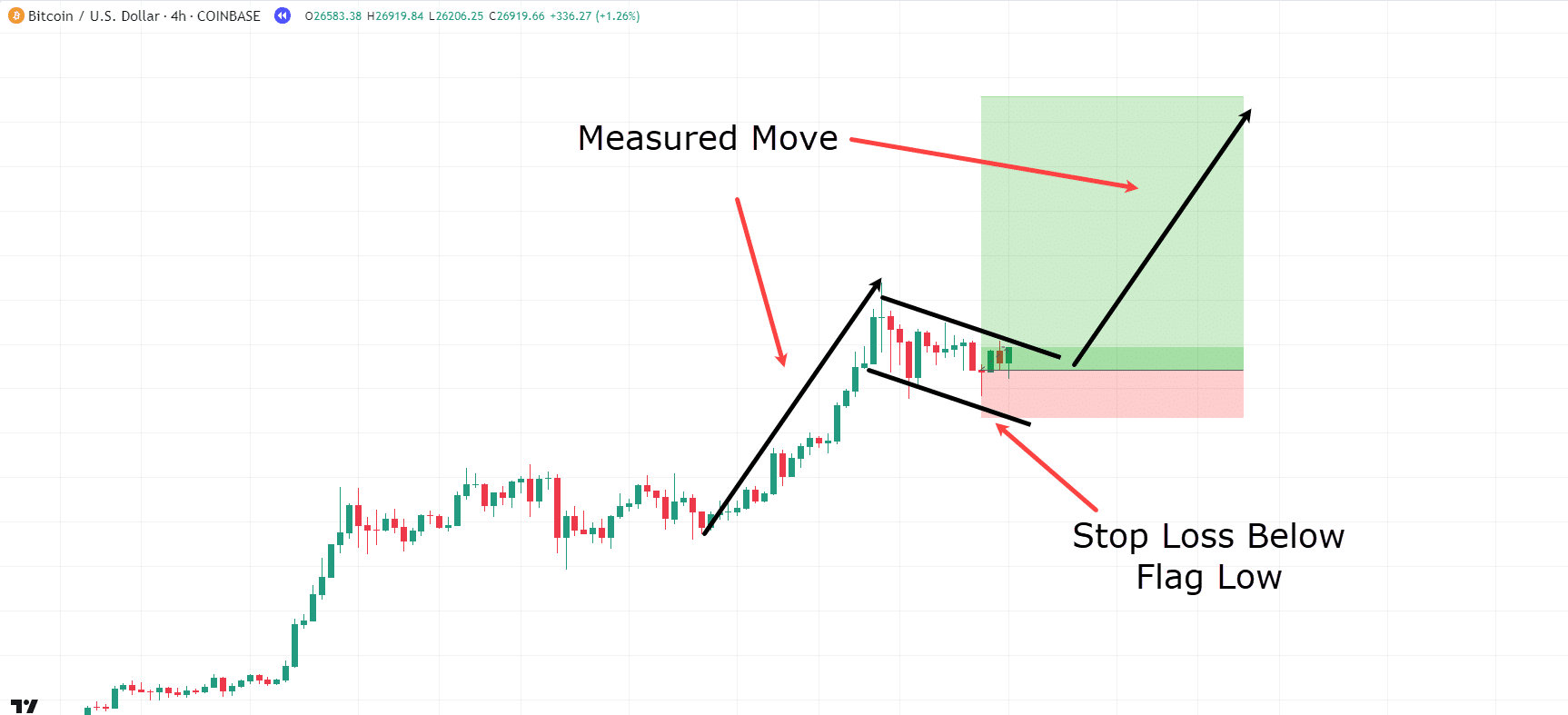

BTC/USD 4hr Chart Bull Flag Entry:

You’ll be able to consider placing an entry anywhere throughout the flag formation.

A fast point to recollect though…

It’s really helpful to attend for the value to the touch the support level of the flag or the underside of the range, and see a rejection before basing your entry on the rebound from the range low.

Flags can persist for days and even weeks, so entering on the range low allows for a wider stop loss.

Now, for this instance, let’s assume you placed a stop loss very near the range low…

To your goal, you’ve used the measured move from the initial impulse up…

Note that bull flags may not all the time reach their measured move, so analyze price motion often and make decisions based in your trading strategy and goals…

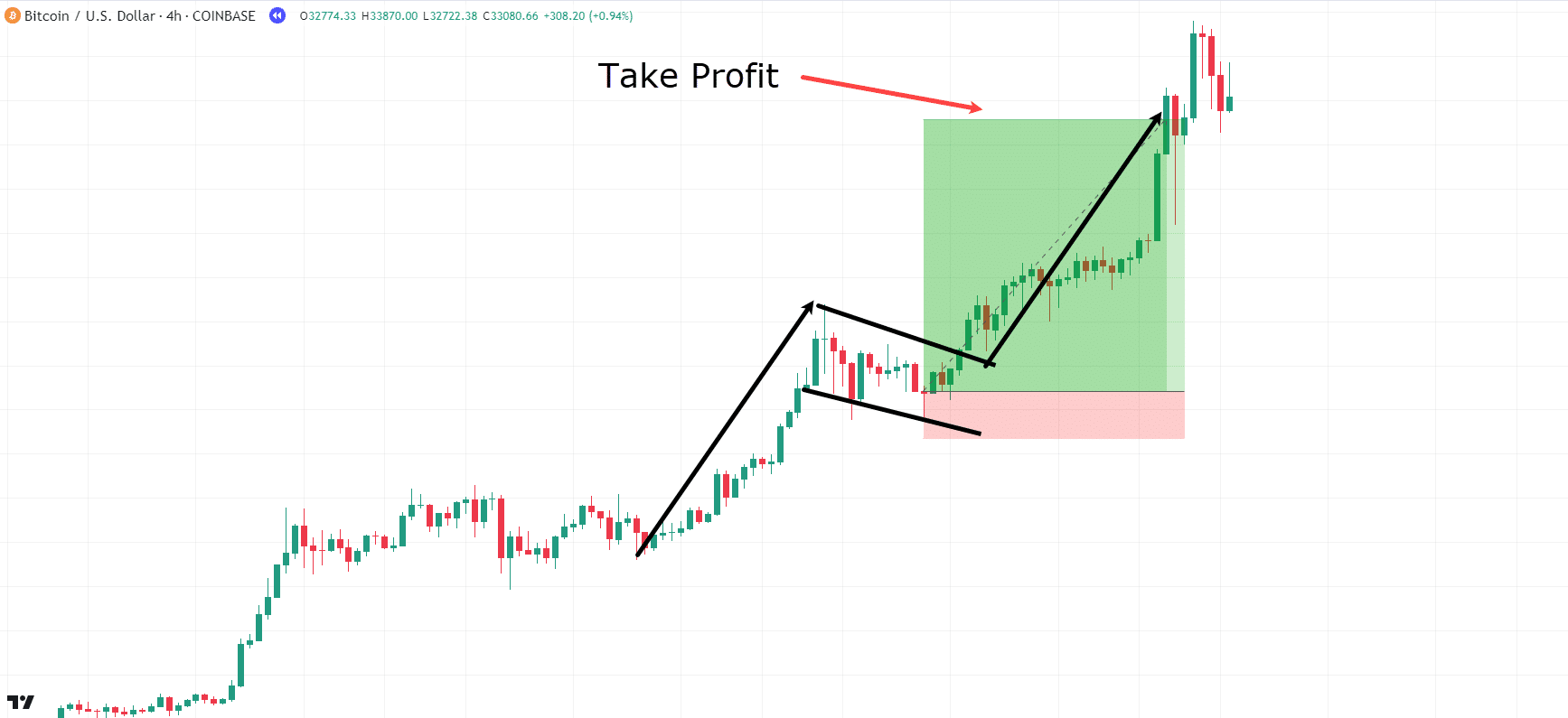

BTC/USD 4hr Chart Bull Flag Exit:

Congratulations on a successful Bull Flag trade!

This pattern tends to perform well in highly volatile markets, reminiscent of the cryptocurrency market.

Now, let’s explore the ultimate pattern, which is analogous to the Bull Flag: the ascending triangle!

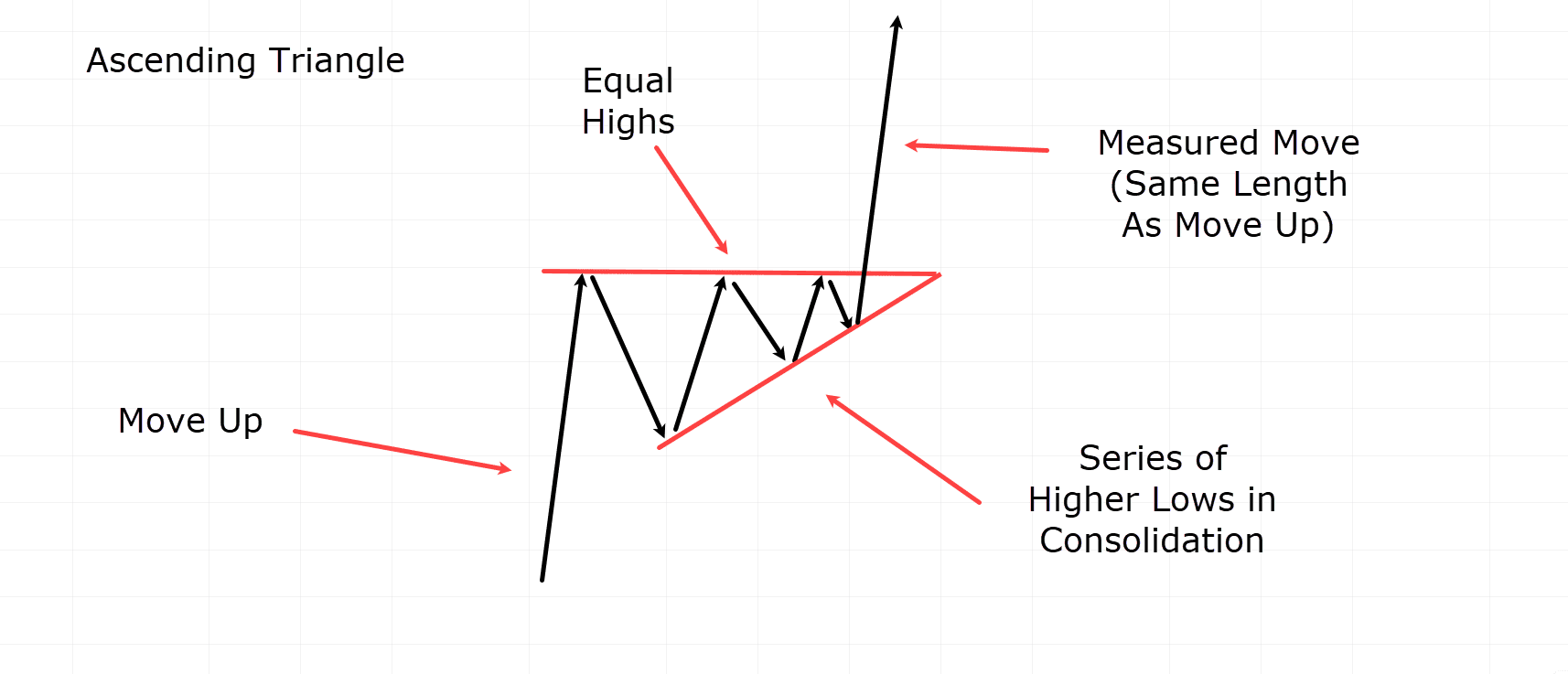

Ascending Triangle

The ascending triangle is one other continuation pattern that shows a solid upward trend followed by a short-term stop in price because it forms a series of upper lows and equal highs.

After that, the value stays put until it reaches the equal highs of the triangle after which breaks out in continuation…

Ascending Triangle Example:

Much like the Bull Flag, the measured move of the ascending triangle matches up with the initial price move as much as consolidation.

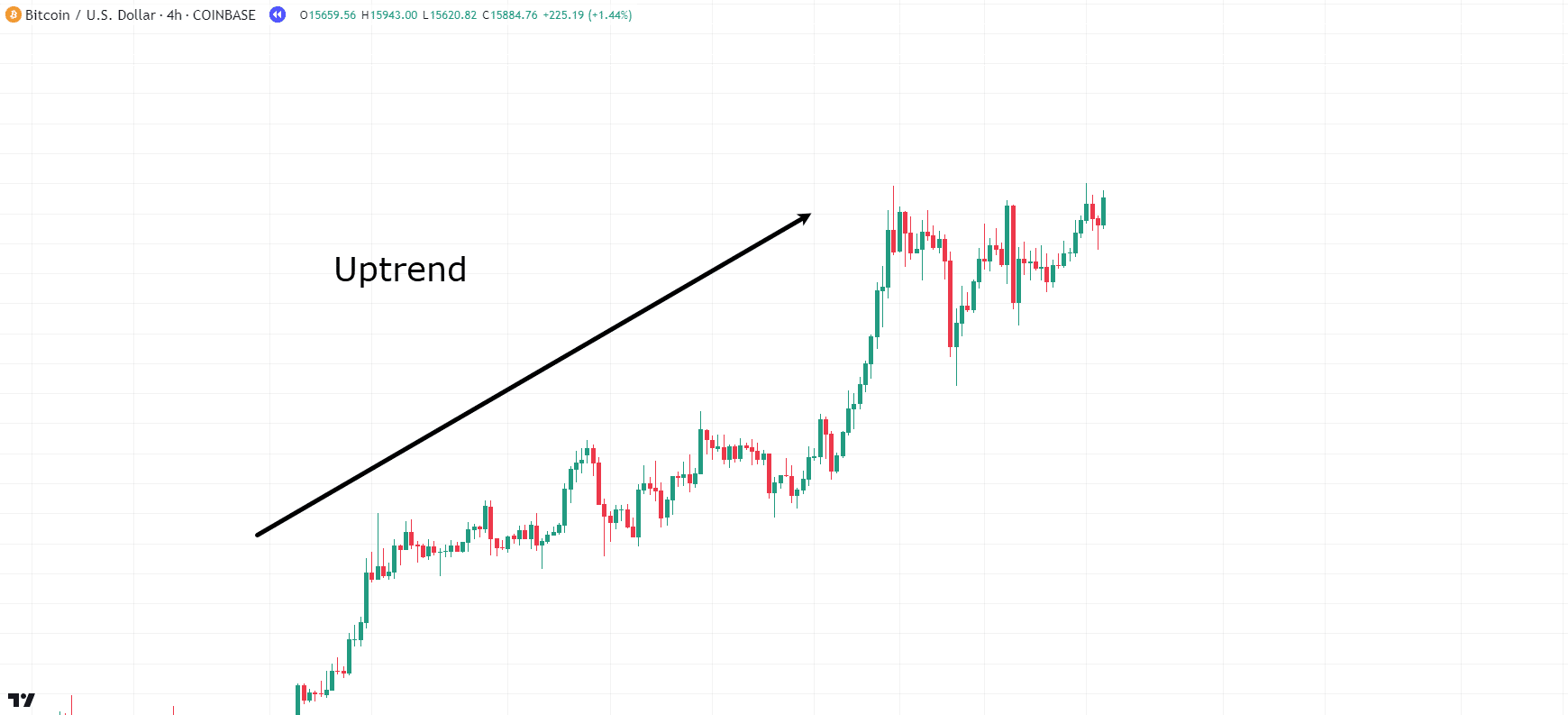

Let’s explore one other example, this time using Bitcoin after a major bullish surge…

BTC/USD Uptrend Example:

For an Ascending Triangle continuation pattern to form, a powerful bullish uptrend is crucial…

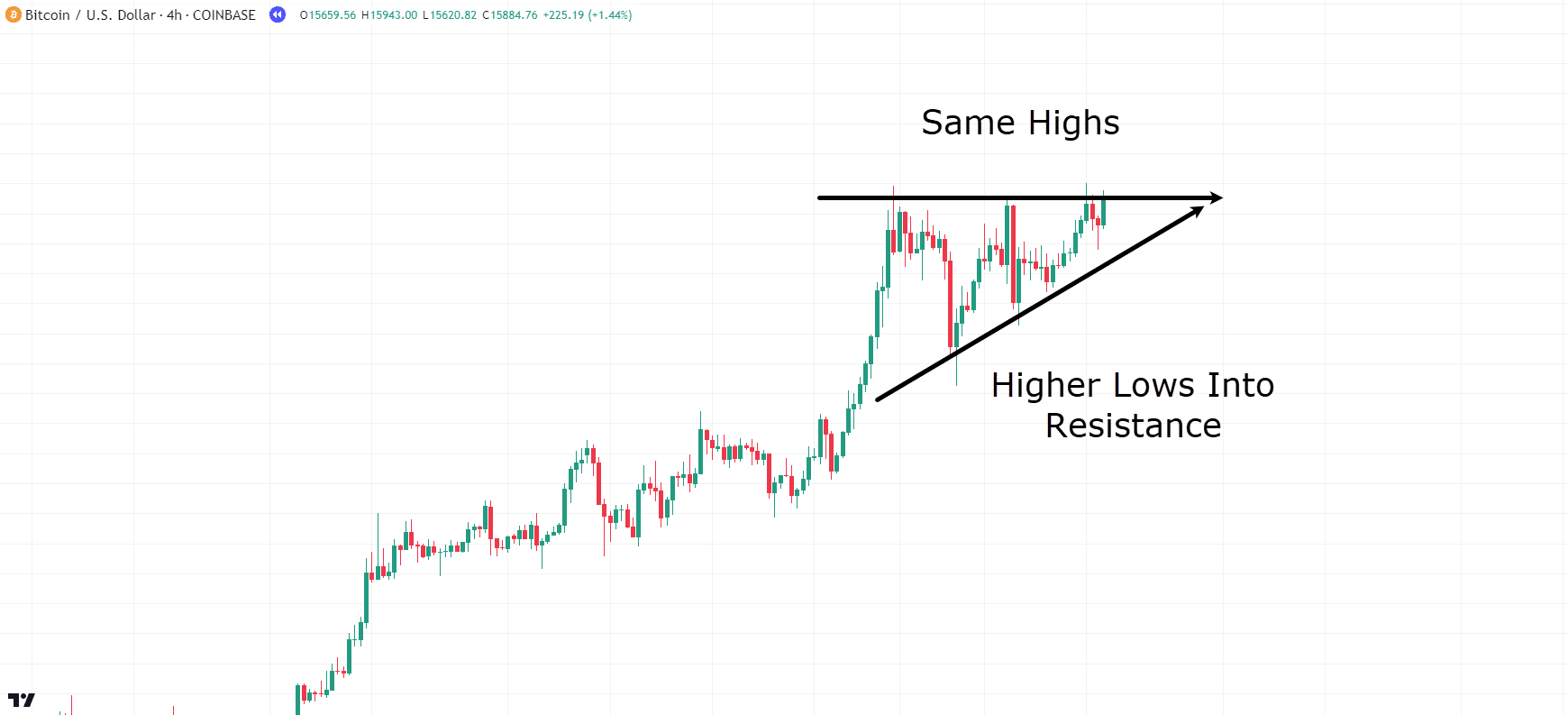

BTC/USD Ascending Triangle Example:

Because the diagram shows, price forms higher lows while coming across the identical highs…

This pattern shows how the value doesn’t form a lower low and regularly tightens towards the resistance level.

Ultimately, as the value continues to squeeze tighter, the resistance eventually gives way!

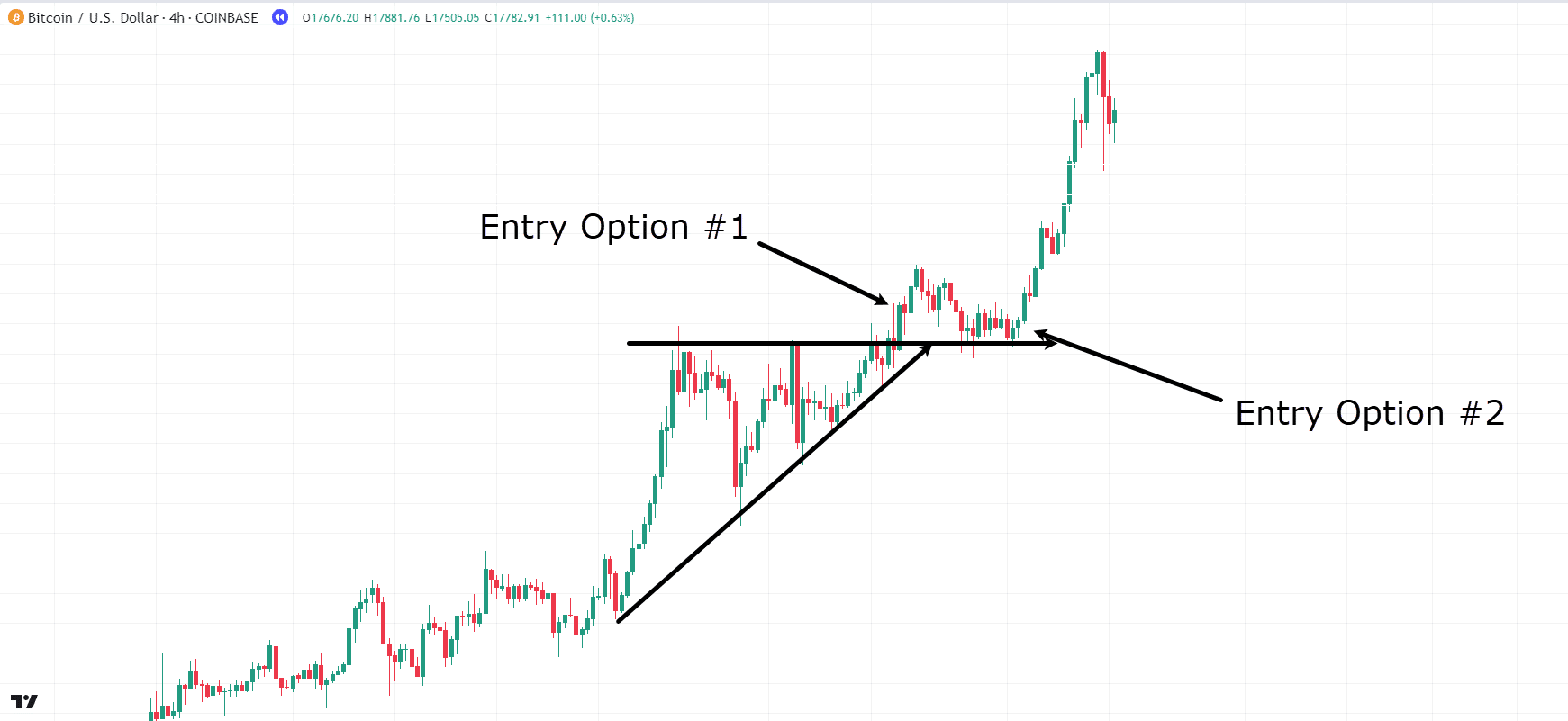

Let’s explore potential entry points…

BTC/USD Ascending Triangle Entry Options:

Within the chart, there are several entry options available:

- Entry Option #1: Enter because the breakout above the highest of the triangle occurs.

- Entry Option #2: Wait for a retest of the resistance-turned-support line.

Going for the second entry option gives stronger confidence within the breakout, but there’s a risk of missing the trade if a retest doesn’t occur…

So did this trade reach its measured move?

Let’s have a look!…

BTC/USD Ascending Triangle Measured Move:

Well, how about that – the value reached the measured move distance as shown!

The stop loss for this instance was placed safely under the resistance or triangle top, and the trade was entered on the retest quite than the breakout this time.

So… Congratulations!

You now can master the core continuation and reversal patterns!

You’re already well in your technique to trading quite a lot of market conditions far more effectively!

Now let’s get a couple of more hints in there…

Suggestions when Trading The Chart Patterns Cheat Sheet

Flexibility

Understand that trading patterns require flexibility.

Patterns are available in various forms, and slight variations of their structure don’t necessarily make them void!

Quite than being super strict about rules, view patterns as an art form that adapts to market conditions and nuances.

Profit Taking

While patterns just like the Head and Shoulders do offer measured move targets, you could take a look at the broader context of the trend.

Sometimes, it’s a lot better to ride the complete trend quite than simply exiting on the pattern’s goal.

Take a great take a look at your trading goals and the general market trend to work out the very best profit-taking strategy.

Use with other trading tools!

Patterns can show you beneficial entry and exit signals, but they shouldn’t be used just by themselves.

Mix them with other technical indicators like candlestick patterns, support and resistance levels, and moving averages to round out your trading decisions.

Extra layers of study can provide confirmation and strengthen your trade setups.

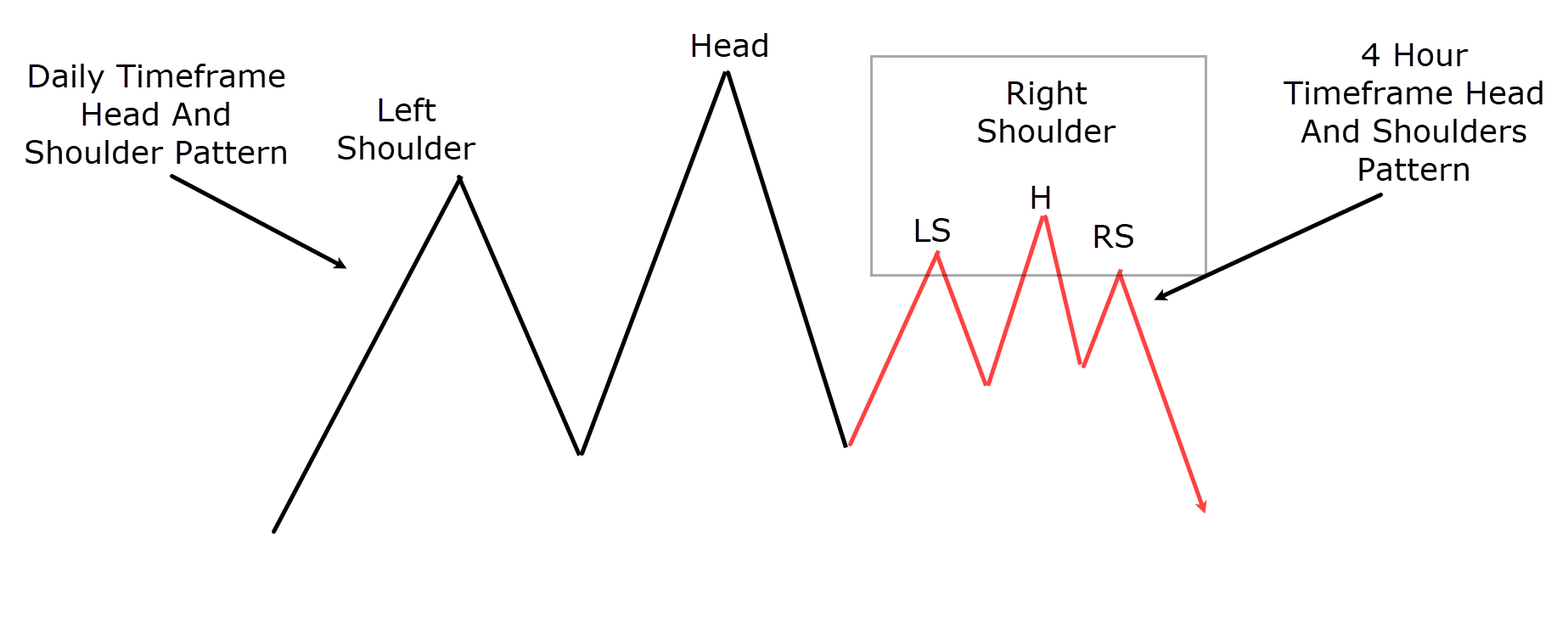

Patterns are Fractal

Understanding that patterns are fractal in nature is crucial for traders.

Okay, I hear you…

“What do fractals must do with it?”

Essentially, it implies that patterns can appear across any time-frame, from the smallest to the biggest.

Let me show you what I mean…

Fractal Example Head And Shoulders Pattern:

In this instance, the chart actually displays two instances of the Head and Shoulders pattern.

On the each day timeframe, you may see the first Head and Shoulders pattern unfolding…

But in the event you zoom in a bit, you can even see the correct shoulder of the pattern forms a Head and Shoulders pattern on a lower timeframe.

That is all well and good, but – how could it affect your decision-making?

Well, firstly, it boosts the strength of the sell signal.

With two bearish patterns forming, and the second matching up with the top of the upper timeframe pattern, you may have more trust in your evaluation.

Secondly, it means you get a more precise entry point!

As an alternative of using the each day head because the stop-loss level, you might potentially use the lower timeframe head because the stop-loss zone…

This alteration creates a tighter stop-loss, giving a greater risk-to-reward ratio for the trade.

Now, it’s vital to acknowledge that, akin to candlestick patterns, the upper timeframe patterns carry more significance than those on lower timeframes.

But at the top of the day, it really shows that patterns will be pretty fractal, right?

Limitations Of Using The Chart Patterns Cheat Sheet

While patterns will be powerful tools in trading, you do need to grasp their limitations.

Patterns don’t all the time work

Like all points of trading, patterns aren’t foolproof and should not all the time produce what you’d expect!

Numerous things influence market movements, making it unimaginable to ensure the success of anybody trade.

When a pattern fails to materialize as expected, it’s crucial to stay calm and analyze the situation.

As an alternative of becoming frustrated, take into consideration why the pattern failed and speak in confidence to changing your viewpoint based on what the market is showing you.

For instance, if a head and shoulders pattern fails, it’d signal that the market is taking the neckline as a support level, which implies it’s time to alter up your trading strategy in that case.

Patterns aren’t Similar

One challenge traders face when coping with patterns is their variability in shape and size.

It’s common for patterns to have slight deviations from textbook examples… which may often result in evaluation paralysis!

Traders may hesitate to execute trades, perhaps attributable to minor differences in the way in which a pattern looks.

So, it’s vital to acknowledge that no pattern will look similar in every case.

Overcoming this hurdle requires specializing in the core principles of the pattern – and never worrying a lot about minor details.

Conclusion

So, in conclusion, I hope you may see how chart patterns are vital assistants to your trading!

Whether revealing potential reversals, or continuations out there, they provide beneficial insights into market dynamics and help uncover great opportunities.

By finding big changes in market structure and flow, reversal patterns show you when a trend might change and when it’s time to get in at first of a latest trend.

However, continuation patterns show times of consolidation and short breaks before principal trends resume, supplying you with possibilities to enter positions which might be going with the trend.

Armed with this understanding, you may begin navigating the markets with more confidence, making higher trading decisions based on these patterns!

To summarize, in this text, you’ve:

- Gained crucial knowledge concerning the value of chart patterns and their role in market evaluation.

- Explored various sorts of patterns, including reversal and continuation patterns.

- Learned about five specific patterns through real-world examples, enabling you to master their application in your trading.

- Discovered beneficial suggestions to boost your pattern trading strategies and gain a competitive edge out there.

- Recognized the constraints and risks related to trading patterns, highlighting the importance of risk management.

So – congratulations on adding these powerful tools to your trading arsenal!

A solid understanding of chart patterns will increase your probabilities of finding solid trading opportunities.

Now – I’m desperate to hear your thoughts on chart patterns too!

Have you ever used chart patterns before?

I do know there are plenty on the market, so let me know if you’ve a favourite that isn’t listed within the article!

Share your insights within the comments below!