Do you ever end up in a trade, anxious about possible market volatility and unsure how external events might affect your fastidiously planned positions?

Who hasn’t, right??

Or perhaps you’ve mastered the art of entering trades at strategic levels but hesitate when faced with unpredictable upcoming news or uncertain market conditions?

Well, prepare for a game-changer!

Hedging in trading is the strategic shield that you must help protect your positions from unexpected market swings!

In this text, you’ll:

- Uncover the essence of hedging and why it’s a vital risk management tool

- Explore how hedging can protect your longer-term trades from short-term market changes and unexpected news events.

- Learn easy methods to use hedges effectively so you can control risk and profit from your potential profits.

- Gain insights from real-life examples, illustrating successful hedging strategies from entry to exit.

- Understand the risks and limitations of hedging, together with invaluable suggestions to boost your decision-making and success rate.

Are you able to fortify your trading strategy and embrace the facility of hedging?

Then let’s dive into the world of strategic risk management!

What’s Hedging?

Nearly all of traders hedge to guard a longer-term position because they expect potentially volatile news is incoming…

The reasoning behind hedging is that a trader should still view a longer-term trade as viable but recognize a short-term pullback is feasible if the news goes against their original strategy.

This helps to shield them from drawdowns in case the news is significantly worse than expected, resulting in a market crash.

Let’s delve into an example…

USD/CAD Day by day Chart Long-Term Trade Entry:

Let’s imagine you’re looking at a buy at support on the USD/CAD pair.

Your trade targets are set much higher than the present price, based on previous levels or a selected trading strategy.

Throughout the duration of your longer-term trade, you might be aware that high-impact news events may influence the market, causing potential drawdowns as your trade progresses…

In this sort of scenario, hedging your longer-term trade is price serious about.

Let’s have a look…

USD/CAD Day by day Chart Long Term Trade News Event:

Now, in this instance, let’s concentrate on a marked area on the chart that raises considerable concerns.

After recent unfavorable news for the USD and following a fundamental evaluation, you think it’s pretty likely there’s going to be some negative news for the USD…

USD/CAD 4-Hour Timeframe Chart Short Entry:

That is the purpose where serious about a hedge trade becomes crucial.

Opening a recent short position could possibly be a strategic move to safeguard your longer-term trade from excessive drawdowns!

Let’s proceed to initiate that short position!…

USD/CAD 4-Hour Timeframe Trade Management:

Notice how the worth continued its downward trajectory, coming very near the unique entry point of the initial long-term trade?

If you happen to had hesitated from hedging through the high-impact news period, there’s an enormous probability that the profits out of your long-term trade might have been entirely erased…

…even perhaps turning it right into a losing trade!

But you’ll be comfortable to know that how you select to administer the trade is entirely as much as you!

Some traders might decide to secure early profits from the short position, specializing in a re-entry on the support zone…

Others might decide to await the breach of the support zone, close the long trade, and commit to the brand new downtrend with the short trade…

Principally, in relation to hedging, there’s no definitive right or mistaken approach!

It’s a risk management technique specifically aimed toward protecting longer-term trades.

Traders may vary of their strategies, but mastering it requires practice and a deep understanding of your personal risk management.

You must note, too, that hedging isn’t solely used for situations just like the one described.

It might probably still be a invaluable option when uncertainty surrounds market direction in pivotal market areas…

When used along with effective risk management, it might probably really develop into a useful gizmo for locating profitability in trading.

Let’s have a look at one other example!…

EUR/CAD Day by day Timeframe Entry:

On this scenario, let’s assume you intended to initiate an extended position at a sturdy each day support level where price has historically rebounded…

Targets are unspecified, because the goal of this trade is to be a longer-term position that is dependent upon fundamental evaluation and energetic trade management…

EUR/CAD 4-Hour Timeframe News Event:

For example my point, let’s assume that throughout the trade, you’ve been fastidiously analyzing market news for the Euro and suspect there is important bearish news on the horizon in the following few days…

The 4-hour candles begin to reject and fall wanting reaching previous highs.

Through fundamental evaluation, you’ve concluded that price might experience a pullback based on the approaching news…

Subsequently, you choose to initiate a brief trade from this area…

EUR/CAD 4-Hour Timeframe News Event Entry:

On this scenario, assume that you just strategically set the stop loss for the short position well above the previous resistances.

This precaution goals to provide you loads of room for potential volatility which may include the unfolding news events within the upcoming days…

EUR/CAD 4-Hour Timeframe Long Position Close:

In the next days, the Euro experienced worsening news, and as anticipated, the worth chart began its descent!

While watching this downturn and considering the unfavorable news circulating in regards to the Euro, you see a chance to shut out the unique long trade…

The choice is driven by a change in your longer-term pondering on the bullish nature of the Euro.

It’s crucial to notice that, even with the closure of the long position, you continue to maintain an open short position.

In this instance, let’s assume you select to maintain the short position energetic.

Your reasoning is that the continued bearish momentum might be going to stop the unique support level from holding its price…

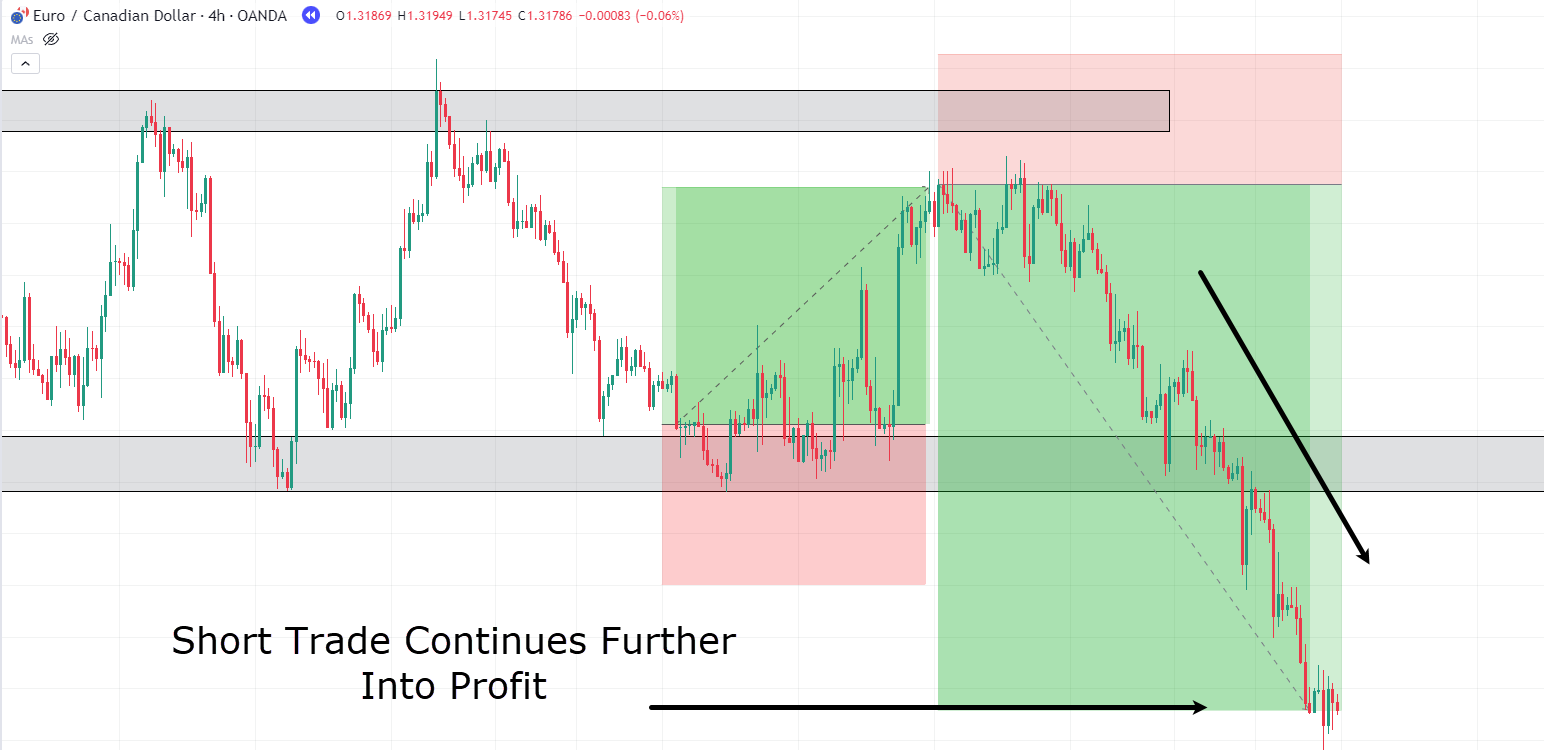

EUR/CAD 4-Hour Timeframe Short Position:

Your intuition proves accurate because the support level fails to carry, and the worth continues its downward trajectory, yielding profits from the short position!

So, this scenario highlights the strategic use of hedging to guard a longer-term trade – especially when faced with unexpected news developments.

While your initial evaluation could have been aligned with a bullish outlook, the flexibility to adapt and implement a brief hedge gives you a greater probability to take care of changing market conditions.

So this instance really shows the importance of staying flexible in your trading approach!

Although you possibly can’t predict future news events weeks prematurely, staying tuned to real-time shifts in market sentiment lets you pivot your bias, creating hedging strategies that may work in favor of your chosen currency pair.

This adaptive mindset positions you to not only limit potential losses but in addition capitalize on recent opportunities!

So keep your eyes and mind open!

How will you make the most of Hedging?

While many traders have a look at hedging primarily as a shield against antagonistic moves in an existing position, the elemental purpose of hedging is just not profit generation…

…but risk limitation! (especially during volatile periods.)

Nevertheless, this conventional use doesn’t tell the entire truth about hedging.

Hedging strategies may even extend to scenarios involving correlated pairs.

Consider two heavily correlated pairs—GBP/USD and EUR/USD.

Despite their correlation, organising a hedge trade becomes a viable option if you happen to hold contrasting views on each pairs.

But just how correlated are they?

Let’s delve into the correlation between GBP/USD and EUR/USD…

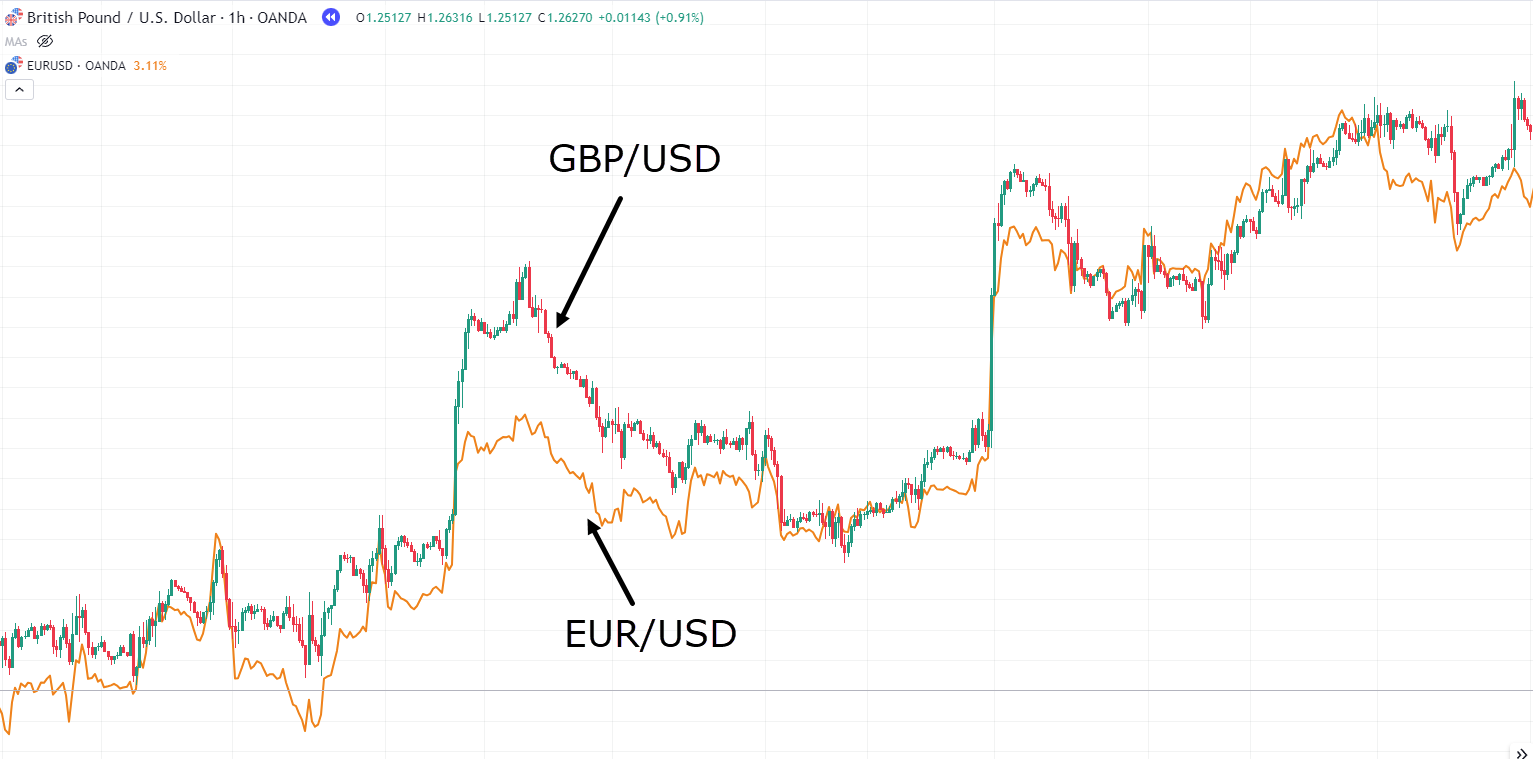

Correlation between GBP/USD and EUR/USD:

Have a look at how the charts move almost synchronously…

It happens this manner since the USD influences each pairs.

Any event impacting the USD is more likely to have a parallel effect on each of those pairs.

So you may wonder the way it’s possible to carry opposing views on pairs that exhibit such close correlation…

And while it’s true, the pairs do act similarly…

…they don’t behave identically!

This difference becomes especially clear when lower timeframe support and resistance levels.

Let’s explore an example illustrating how you can potentially initiate a hedge trade involving these two pairs—EUR/USD and GBP/USD…

EUR/USD 1 Hour Timeframe Chart Support:

Examining the EUR/USD pair, you notice a breakthrough of a minor resistance level, followed by a retest at a support level.

In response, you choose to go long on the EUR, principally taking a brief stance on the USD…

Meanwhile, shifting your attention to the GBP/USD chart, a special picture unfolds…

Here, the worth has breached a support level and has difficulty trying regain ground above it.

This divergence in the worth motion of the GBP/USD pair provides a chance for a hedging strategy!…

GBP/USD 1 Hour Timeframe Chart Resistance:

On this scenario, your evaluation points to the USD strengthening against the GBP…

This creates an interesting hedging opportunity, because the two currency pairs show subtle differences of their price actions.

What makes this strategy particularly appealing is that you just don’t necessarily have to predict the end result of the upcoming news event!

By taking opposite sides on the USD, the long EUR/USD trade suggests a weakening USD, while the short GBP/USD trade indicates a strengthening USD.

Now, let’s introduce the element of a news event.

The fantastic thing about this approach lies in its potential to maximise reward and limit risk, based on the news end result…

Whether the news is positive or negative for the USD, these hedged trades are strategically positioned to administer the market dynamics.

Let’s delve into the potential outcomes!…

GBP/USD 1 Hour Timeframe Chart Stop Loss:

Oh no!

Unfortunately, it seems that the GBP/USD trade has experienced a full stopout!

This underscores the crucial importance of using effective stop-losses, especially when engaged in hedging strategies.

Now, considering that the hedged GBP/USD trade resulted in a loss, let’s assess the potential impact on the concurrently held EUR/USD trade…

EUR/USD 1 Hour Timeframe Take Profit:

Wow!

Have a look at that, a 6.6RR trade by simply exiting using the 50 Moving average break – all from trading the volatility of the news on each side!

Now that’s impressive.

See the way you didn’t have to know what side of the market was the proper side?

OK so yes, you incurred a loss…

But in the method, you furthermore mght gained a whopping 6.6RR…

…leaving you with 5.6 RR!!

When done properly, that is a fantastic tool for trading news events!

Now, while celebrating successes is great, it’s crucial to grasp the risks involved in trades affected by rapid market changes…

Let’s explore situations where the intricacies of hedging call for a cautious and practical approach.

First, a a scenario involving the closely correlated EUR/USD and AUD/USD pairs…

EUR/USD 1-Hour Timeframe Support Entry:

Here, you possibly can observe a seemingly clear support level on the EUR/USD chart, right?

For the sake of this discussion, let’s assume there’s an impending high-impact news event inside the following day…

AUD/USD 1-Hour Timeframe Reistance Entry:

You are taking a brief position on the AUD/USD, using it as a hedge trade against the long position on EUR/USD…

These trades present opposing views, with the EUR trade suggesting a weakening USD, while the AUD trade implies a strengthening USD.

Now, let’s see how these trades unfolded…

AUD/USD 1-Hour Timeframe Stop Loss:

It appears there was a fakeout on this instance…

Nevertheless, one might think that the EUR/USD trade would have turned profitable, right?…

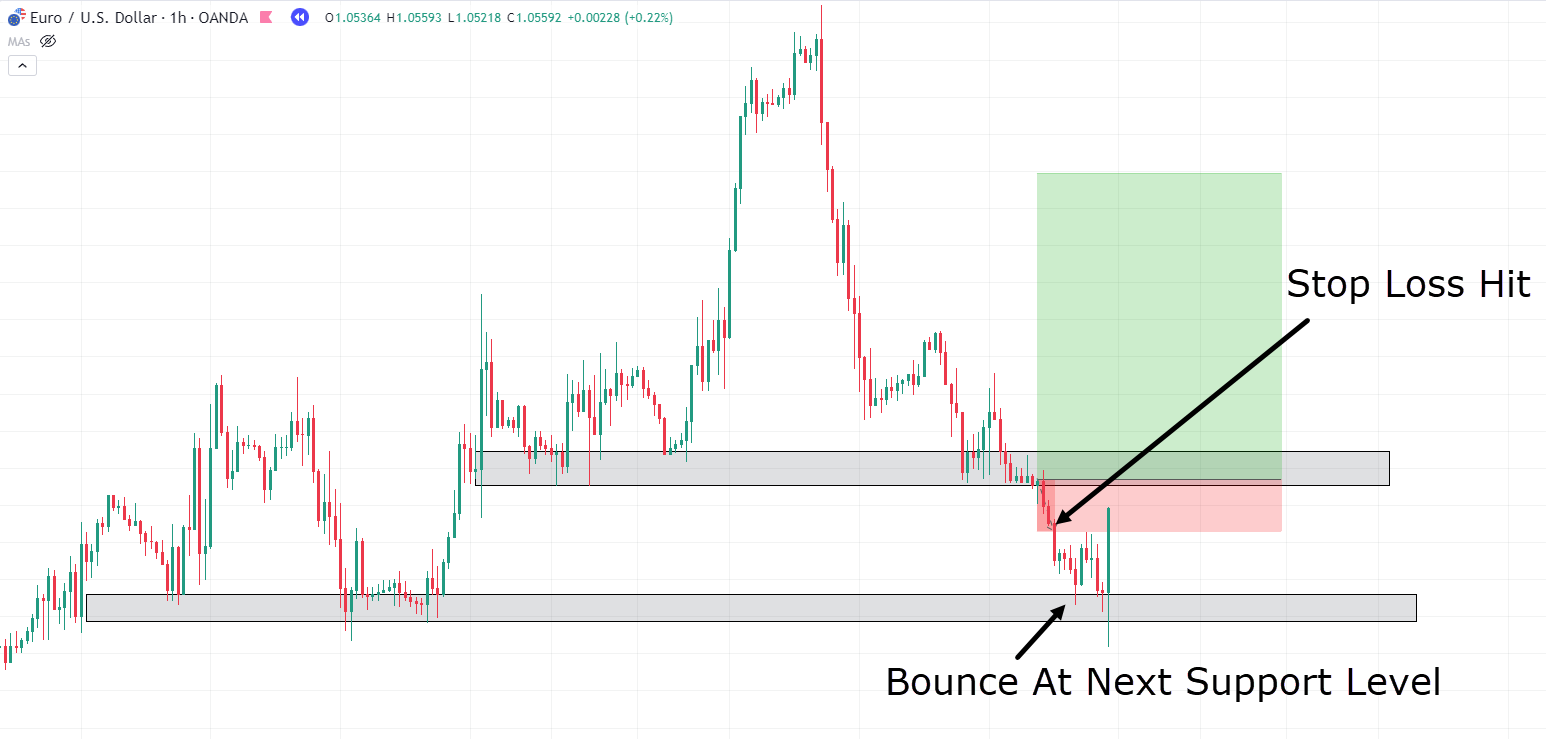

EUR/USD 1-Hour Timeframe Stop Loss:

Surprisingly, each trades hit their respective stop losses.

So, it’s fair to say – the market’s intricacies aren’t at all times straightforward!

Despite one reaching the stop loss, the opposite trade faced an analogous fate…

As you possibly can see, for whatever reason, the worth was drawn to the following lower support level – where it got the bounce you were searching for!

This will likely be influenced by aspects like news timing, and the potency of support and resistance levels, which might all impact the end result of hedged trades.

You must do not forget that the unpredictable nature of markets implies that news events may coincide with periods of low volatility, delaying reactions until a later time.

Alternatively, news may not even sway the market in any respect!

Fascinated by it this manner really highlights the importance of a nuanced approach to hedging.

While this strategy doesn’t hinge on news events exclusively, especially on shorter timeframes, it proves invaluable for securing profits during uncertainty surrounding potential high-impact news.

It’s also crucial to acknowledge that this method may not at all times yield success.

A strong understanding of where price is probably going to search out support or resistance, together with an awareness of serious news events, is crucial.

So, while hedging can provide opportunities to capture profits when uncertainty looms, it carries the danger of facing losses on each ends if market conditions don’t align along with your expectations.

Now, let’s review the advantages of hedging as a fast recap.

Advantages of Hedging

You don’t must know the end result

The largest advantage of hedging is its ability to free traders from the necessity to predict market directions.

With orders placed in each directions, traders can confidently allow profitable trades to mature while swiftly cutting losses with effective stop-loss management.

This approach minimizes risk, reducing the pressure to at all times be correct in trade predictions!

By prioritizing proper risk management, traders can concentrate on maximizing gains, understanding that being right on a regular basis is just not at all times essential to achieve success!

Profiting Across Timeframes

Hedging can function a useful gizmo, able to generating profits across various timeframes.

Traders can capture gains in shorter timeframes while maintaining positions in longer-term trades.

This dual-pronged approach minimizes downsides and optimizes potential returns!

Riding the Market Flow

An often-overlooked advantage of hedging is its capability to align traders more harmoniously with market dynamics.

By reducing the have to be infallible in your predictions, you possibly can adapt swiftly to changing market conditions.

If anticipated price bounces fail to materialize? Well, you possibly can seamlessly switch sides, enabling the capture of serious market movements.

In essence, when executed well, hedging enables traders to operate with confidence within the face of market uncertainties, making a far more interesting and profitable trading experience!

Risks and Limitations

Vulnerability to Volatility

Considered one of the numerous risks you’ll find with hedging is susceptibility to volatility…

When there’s market turbulence, swift and unpredictable price movements can trigger stop losses on each side of a hedged trade…

This scenario is amplified when market reactions are different from expected outcomes, especially during high-impact news events.

Risk increased

This is an important risk to take into consideration when employing hedging techniques.

As shown within the last example, especially when a trade is just not yet in profit, initiating a hedging trade could end in a stop-out on each trades.

Principally, this motion doubles the quantity of risk with a hedge bet on a correlated trade.

When each trades don’t go your way, it might probably result in quick stop-outs that might have been restricted to simply one trade…

Subsequently, it’s essential to make use of hedging as a method in suitable environments and situations!

Spreads Widen During News Events

During high-impact news events, spreads out there can widen – quite a bit!

This widening of spreads increases the danger of triggering stop losses on each side before the market stabilizes and absorbs the news impact…

Traders should be mindful of this and consider its implications for effective risk management.

Prerequisite: Accurate Support and Resistance Levels

Successful hedging relies heavily on the careful identification of support and resistance levels.

If you happen to draw levels incorrectly or don’t understand how the market works, you may enter trades too early on one pair while experiencing fakeouts on the opposite.

To avoid this error, traders should be careful to make certain that their technical evaluation is correct!

Lower Timeframe Suitability

The hedging approach, particularly involving correlated pairs, is simplest on lower timeframes.

The dynamics of contrarian views on similar pairs are more obvious over shorter periods, providing windows of opportunity for successful hedging.

This phenomenon is less common on higher timeframes, where market imbalances are inclined to be corrected more swiftly.

Frequency and Quality of Setups

Quality setups for hedging, especially when approached from a support and resistance perspective for correlated pairs, may not occur all that usually!

Uneven prices can occur out there due to the best way people trade and interact with it, even when there aren’t any major news events happening.

Traders must recognize the random nature of those setups and watch out of their market evaluation to discover the highest moments for successful hedging.

In summary, while hedging offers invaluable risk mitigation advantages, traders must navigate these inherent risks and limitations through careful evaluation, accurate technical interpretation, and a powerful awareness of market dynamics!

Conclusion

In conclusion, hedging stands out as a flexible risk management strategy, offering traders a useful shield against market uncertainties!

With careful management of each long and short positions, hedging is a novel solution to take care of unstable situations.

By exploring the wonderful details of hedging on this guide, you’ve gained insights into its advantages and limitations.

It’s a risk management tool that, when wielded with precision, lets you trade confidently within the face of unpredictable market events.

To sum up, you’ve:

- Unearthed how hedging is usually a significant risk management tool.

- Explored how hedging might be employed in longer-term trades to reduce drawdowns attributable to high-impact market news.

- Acquired recent practical techniques that enable you to reduce risk while maximizing profits in high-volatility scenarios.

- Obtained insights from real practical examples illustrating what hedging looks like on lower timeframes and the potential outcomes when price deviates from expectations.

- Assessed the risks and limitations of hedging, together with invaluable suggestions to boost decision-making and success rates.

As you prepare to include hedging into your trading, do not forget that, like every strategy, it has its nuances!

Careful consideration of market conditions, proper timing, and adherence to risk management principles are essential.

So, armed with a deeper understanding of hedging, it’s time to place this data into practice!

I invite you to experiment with different scenarios, refine your approach, and adapt the concepts to your unique trading style.

What are your thoughts on hedging?

Have you ever explored its potential in your trading?

Be happy to share your experiences and insights within the comments below!