I’m sure you’ve heard of famous candlesticks just like the hammer:

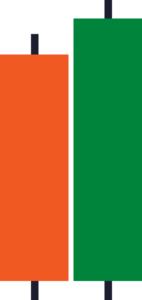

Or the bullish engulfing candle:

And rightly so, as these candlestick patterns are super explosive!

Nevertheless…

There’s one other candlestick pattern that’s the “handiest” out of all of the patterns on the market.

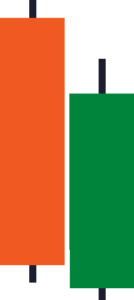

And that, my friend, is the piercing pattern:

And on this trading guide, I’ll share with you simply how useful it may be to your trading plan!

Nonetheless, here’s what you’ll learn for today:

- What makes the piercing pattern different from other candlestick patterns on the market

- The “secret” to using the piercing pattern on how it may make your trading life much easier

- A time-tested formula for trading the piercing pattern (and other candlestick patterns on the market)

- Two key things NOT to do when trading the piercing pattern

In case you’re a candlestick pattern practitioner you then’re in for a treat.

Because at the tip of this guide…

I bet you’ll learn something latest even in the event you’ve been using candlestick patterns for years.

So, let’s start!

What’s the piercing pattern and what makes it different from other candlestick patterns?

In textbook terms…

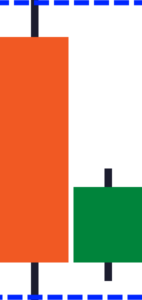

A piercing pattern happens when a candle gaps down on the open:

After which closes back above 50% of the previous candle’s body!

The sellers dived into freezing waters and immediately jumped back up!

You could be wondering:

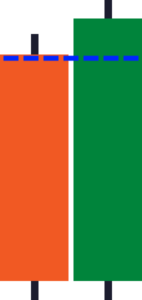

“Wait a minute, that appears like a bullish engulfing candle!”

Well, not so fast, my friend!

In case you recall, a bullish engulfing happens when the candle closes “beyond” the previous candle!

It’s just like the sellers took a dive into cold waters and immediately jumped out into outer space like Superman!

So, if it’s not much like the bullish engulfing pattern…

Then how about an inside bar?

Aha, quite close!

But as you possibly can see, the entire body of the recent candle is contained in the previous candle!

Now I do know you could be pondering:

“Why are we comparing the piercing pattern to other candlesticks?”

The reply is that this:

In the true world of trading, our “textbook” definitions break down.

Due to this fact, there could be exceptions to our textbook definitions of them.

So, if I ask you…

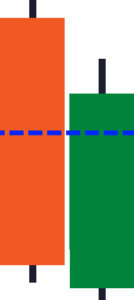

Is that this an inside bar or a piercing pattern?

Do you include the wicks in context or not?

In case you answered contained in the bar you then are correct.

Why?

For this reason one easy rule:

The candle must close no less than 50% of the previous candle.

And yes, this excludes the wicks!

So, are you able to see how necessary it’s to distinguish the piercing pattern from other candlestick patterns?

Now a fast test…

Which certainly one of these candlesticks is piercing, inside, and engulfing?

In case you’ve got the next answers:

- Bullish engulfing

- Inside bar

- Piercing pattern

You then’re now ready for the following section!

Because now that you simply’ve nailed down easy methods to spot a piercing pattern…

I’ll teach you easy methods to use it to enter your trades accurately.

Ready?

Then let’s move on…

Why the piercing pattern is probably the most convenient candlestick pattern to enter the markets

Let me ask you…

How do you enter off of a candlestick pattern?

Because identifying them is one thing, trading them is one other!

So, how do you trade them?

Market order

Let me explain…

Once you see a sound bullish candlestick for instance:

What you do is place a market order manually at the following candle open.

Easy as that!

We wait for the candlestick to form and we place a market order!

Nevertheless, there’s a downside…

You’d should wait for the candlestick to shut and enter the trade manually

Sure, waiting for a candle to shut can allow you to avoid false signals so that you don’t enter prematurely.

Nevertheless…

We will’t be on our screens on a regular basis!

And this method makes it even harder for many who trade the lower timeframes!

So, how will we solve this?

Enter, the piercing pattern.

Buy stop order

Piercing offers probably the most flexibility.

Because as a substitute of placing a market order, we’d be placing a buy-stop order!

Here’s what I mean:

That’s right.

You’d want the piercing pattern committed to you.

So, when you’ve spotted a sound piercing pattern:

You place a buy-stop order right above the previous candlestick!

But here’s the thing…

What if the market kept going lower without hitting your stop order?

Easy!

Just keep shifting your buy-stop order, due to this fact, you get an excellent higher entry price!

Until it gets triggered…

P.S. Only shift your buy-stop order lower only if you spot a sound piercing pattern again!

Now here’s one other query that’s necessary to reply…

How long is your buy-stop valid?

Here’s the tricky part.

But the reply is that this:

When the piercing pattern isn’t any longer at an area of value:

Let me inform you more in the following section…

A step-by-step framework for trading the piercing pattern

Entries are only a small a part of a trading plan.

Do you agree?

(Say yes)

Good, you agree!

One mistake candlestick pattern traders often make is that they rely an excessive amount of on candlestick patterns!

But the reality is, a single candlestick pattern won’t dictate a market direction.

It’s the entire market structure itself!

So, how can we use market structures to our advantage?

At the identical time…

Complimenting what you’ve learned so far with the piercing pattern?

The M.A.E.E. formula

This easy framework will save your trading portfolio!

But, what does it mean?

It stands for 4 things…

- Market structure

- Area of value

- Entries

- Exits

So, how will we integrate the piercing pattern into this framework?

Let me teach you…

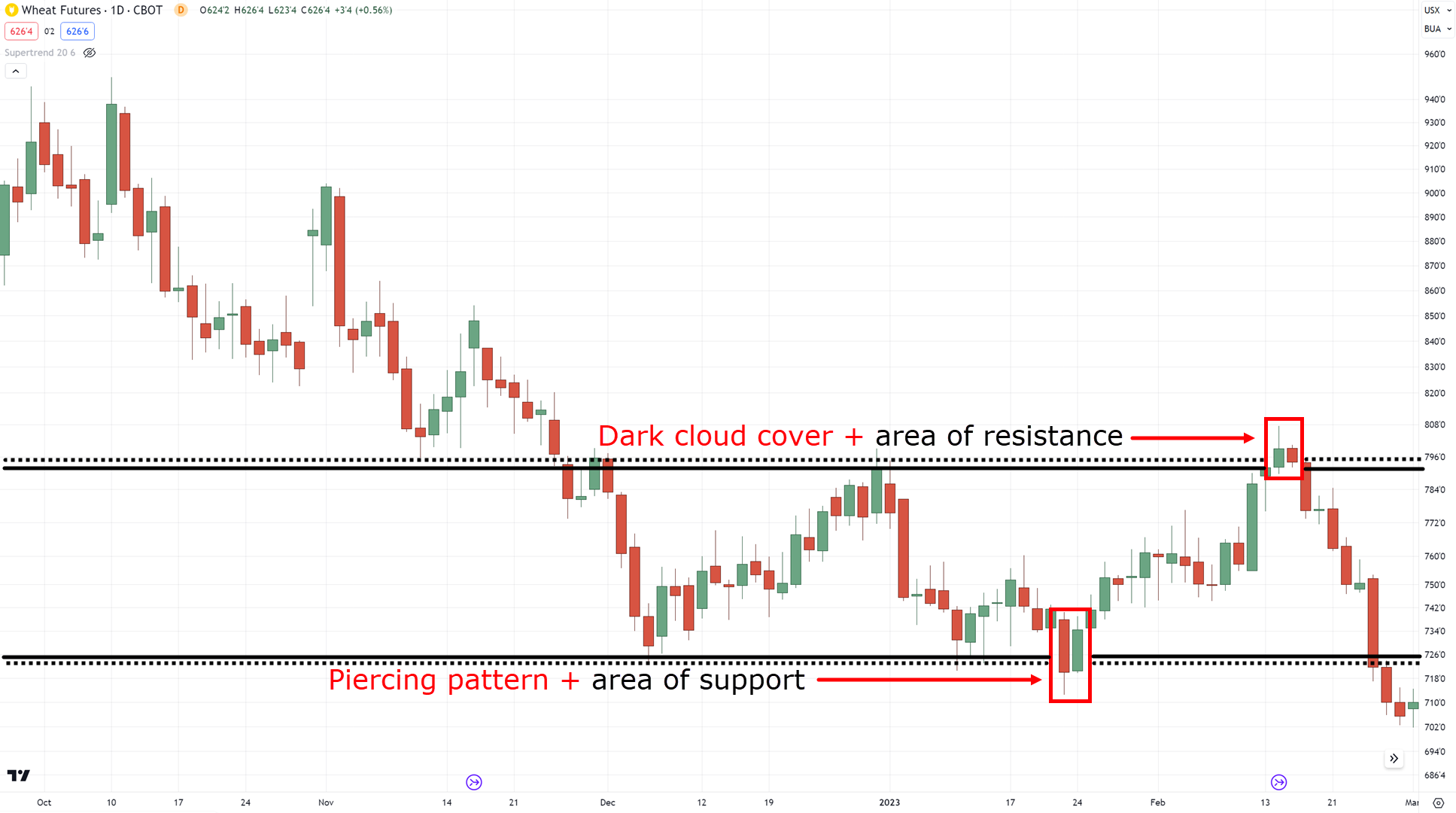

Step #1: Discover the market structure

This part is pretty necessary.

Why?

Because in the event you spot a pleasant uptrend:

You then’d wish to search for bullish piercing pattern setups to hop into the uptrend.

In case you spot a downtrend:

A dark cloud cover setup is the other of the piercing pattern!

And if it’s a variety:

Then search for each piercing pattern setups but only after they are on the highs and lows of a variety:

Is smart?

But for the following steps, we’ll use an uptrend as our example:

Next…

Step #2: Discover the realm of value

That is ultimately the bread and butter of the piercing pattern.

Why?

Because any candlestick should never be traded in isolation!

That’s why it’s crucial to at all times discover an area of value.

Now, since our example is in an uptrend we’d wish to search for an area of support:

P.S. There’s multiple sort of area of values which you possibly can learn more here.

Onto the checklist…

Market structure?

Check.

Area of value?

Check.

Next?

Step #3: Discover your entry (piercing pattern)

At this point, this requires no further explanation.

We will find this setup here:

Pretty straightforward, right?

The piercing pattern should be traded only when an area of value is present!

Now…

It’s easy to enter trades, but just a few (latest) traders ask:

When will we exit?

Step #4: Discover your exits

This doesn’t only mean after we take profits, it also means after we cut our losses.

That’s right!

It’s not at all times in regards to the money, but additionally the way you manage your risk!

So, as for our stop loss…

Subtract 1 ATR from the lows:

And for taking profits (the very best part, I do know) you’d wish to take profit before the closest high:

When trading range markets, the identical principle applies.

But yes, I do know…

The danger to reward doesn’t look too pretty.

That’s why you possibly can partially take profits after which trail your stop loss:

Is smart?

Now, I do know I’ve skimmed past many points akin to risk management and trade management.

But not to fret as you possibly can learn more about it here:

How you can Use Trailing Stop Loss (5 Powerful Techniques That Work)

The Complete Guide to ATR Indicator

Before I allow you to go into the wild…

You will need to understand how NOT to make use of the piercing candlestick pattern as well.

So, read on!

How NOT to make use of the piercing pattern within the markets

In any trading concept…

It’s crucial to understand how that idea is supposed for use, in addition to how not to make use of it.

Why?

Easy, since the piercing pattern itself is a tool!

And the effectiveness of such a tool is dependent upon how well you utilize it.

So, when or how do you NOT use the piercing pattern?

Don’t use the piercing pattern stop order method on gapping markets

In case you often end up ending up on charts like this:

Then ignore using candlestick patterns on the whole.

Why?

Since you’re simply getting a TON of false signals there!

Because of this a line chart would supply higher information when trading on charts like those.

(though these sorts of charts are sometimes common in penny stocks or illiquid crypto coins)

Next…

Never use the piercing pattern in isolation

That is the large hole that I’ve taught you easy methods to plug throughout this guide.

But it surely must be said one last time:

At all times use the piercing pattern within the context of the market.

Briefly?

Don’t trade the piercing pattern like this:

Trade it like this:

Knowing your areas of value is crucial!

That’s just about it!

A fast and snappy guide to identifying the piercing pattern!

So, let’s have a fast recap of what you’ve learned today.

We could?

Conclusion

With a ton of candlestick patterns to memorize on the market…

The piercing pattern provides you with great flexibility to enter your trade in your terms.

Nonetheless, here’s what you’ve learned in today’s guide:

- A piercing pattern is formed when a candle closes 50% of the previous candle (this key rule is what differentiates the piercing pattern from other patterns on the market)

- The piercing pattern could be used to enter your trades by profiting from the buy-stop order or sell-stop order to make your trading easier

- A proven option to trade the piercing pattern is to make use of the M.A.E.E formula, a step-by-step to analyzing, entering, and exiting your trades

- A piercing pattern (or any candlestick pattern) just isn’t meant for use on illiquid markets, in addition to being traded in isolation, or using it without the context of the market structure

Over to you!

Do you think that you possibly can apply some concepts here to other candlestick patterns?

Also, do you like to enter your trade at the present price?

Or do you like to place limit or stop orders to make things easy for you?

Let me know within the comments below!