Video Transcription

Hey Hey, What’s up, my friend?

Welcome to The Ultimate Candlestick Pattern Trading Course.

On this course, you’ll learn discover high-probability trading setups.

A few of you could be pondering…

“I’m latest to trading would this help me, I don’t know about candlestick patterns, and I don’t know technical evaluation”

Don’t worry, because on this course I’ll walk you thru step-by-step from A to Z on trade candlestick patterns.

Even when you may have no trading experience, by the top of this session, I can assure you that you’re going to have the ability to trade candlestick patterns like a professional.

Sounds good?

Let’s begin…

What’s a Candlestick Pattern?

A candlestick pattern is basically a way of reading a price chart.

It originated back in Japan that’s the history, and the important thing component of a candlestick chart is that it shows you 4 things.

- The opening price.

- The high of the session.

- The low of the session.

- The closing price.

When I take advantage of the term session, it may mean various things…

In case you’re Candlestick charts on a day by day timeframe, it means the high of the day.

Taking a look at Candlestick charts on the one-hour timeframe it means the high of the one-hour session.

It could mean various things…

Depending on the timeframe you’re , we are going to cover that in additional detail later.

Learn how to Read Candlestick Pattern?

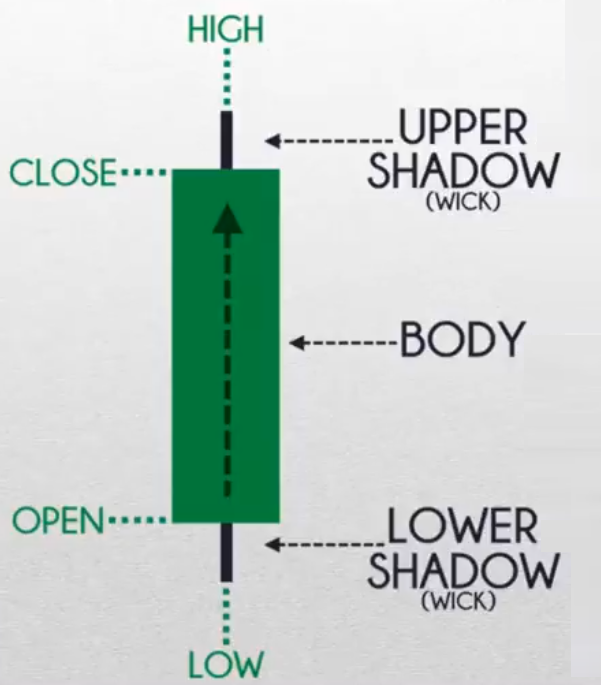

Remember there are only 4 things;

- The open

- The high

- The low

- The close

Taking a look at this:

You may see that the candles are typically two colours either green or red or perhaps might be black or white.

Sometimes you possibly can even change the colour when you want, but generally, probably the most common color is green and red.

While you see a green candlestick pattern it implies that the value has closed higher for the session.

Bullish Candle

You may see that that is the opening and shutting price are these lines over here:

While you see the black shadow, we call it the wick.

The upper wick is the very best of the session, and the lower wick is the bottom of the session.

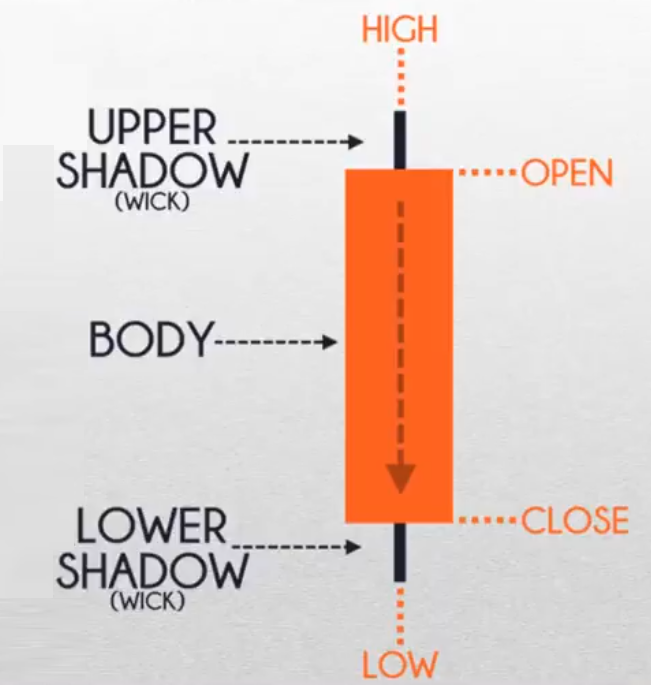

Bearish Candle

The red color bar is often known as the bearish bar.

The open is at the other side, it’s now at the highest of the candle.

The close is at the underside.

You may see the low of the session

The bottom and the highs of the session is here over here:

Difference Between a Bearish Bar and a Bullish Bar

The fundamental difference between a bearish bar and a bullish bar is that the open and shut are already opposite sides.

The value has closed lower for the session and the open needs to be above the close.

Depth Knowledge of Candlestick Patterns

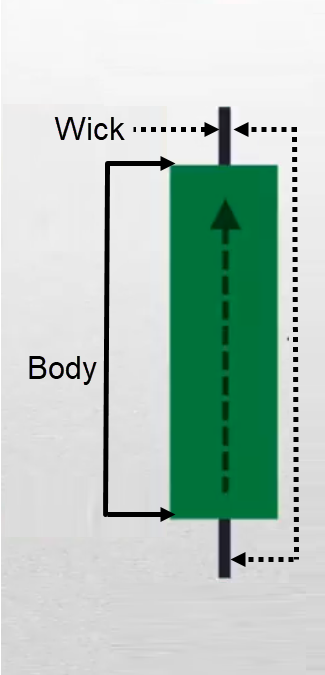

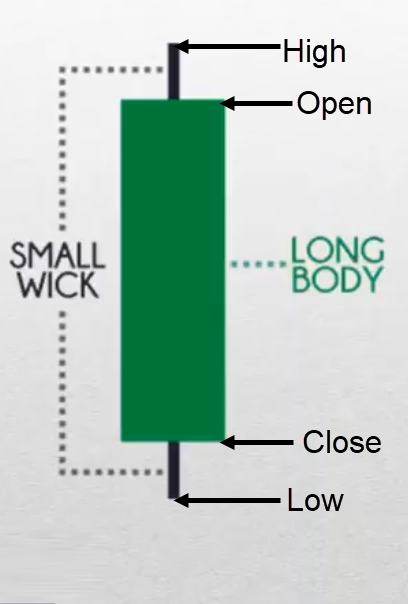

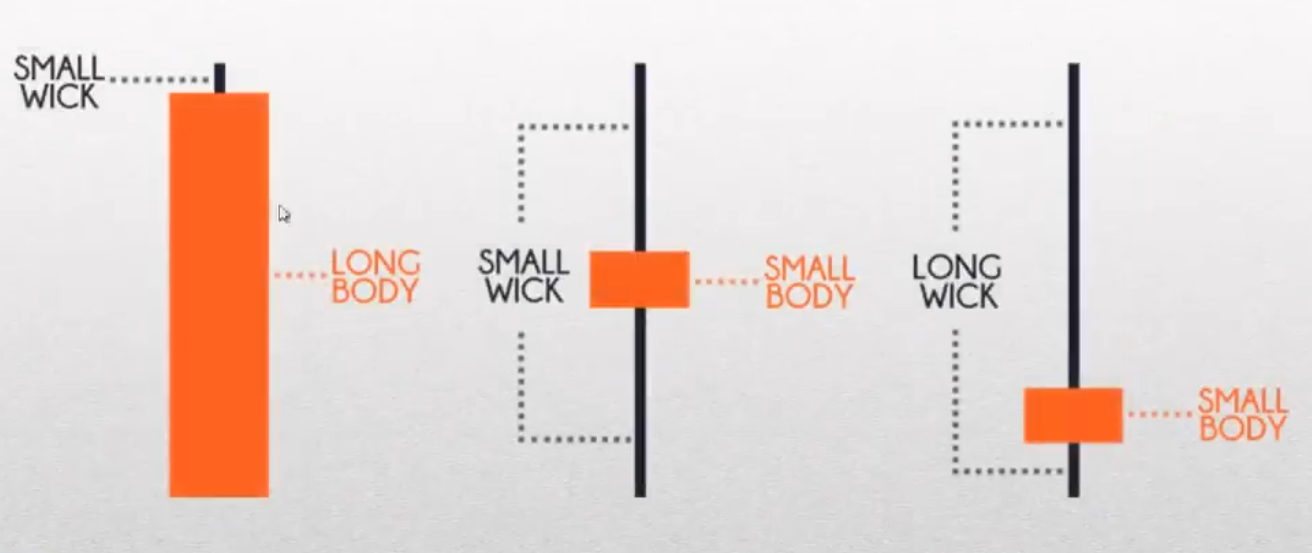

The very first thing you’ll notice in a candlestick, there are two fundamental components namely:

The body is the green portion and the black shadow is named the wick.

The body tells you who’s on top of things, on this case, you possibly can see that the client is on top of things.

The buyers push the value up and shut on the high of the session.

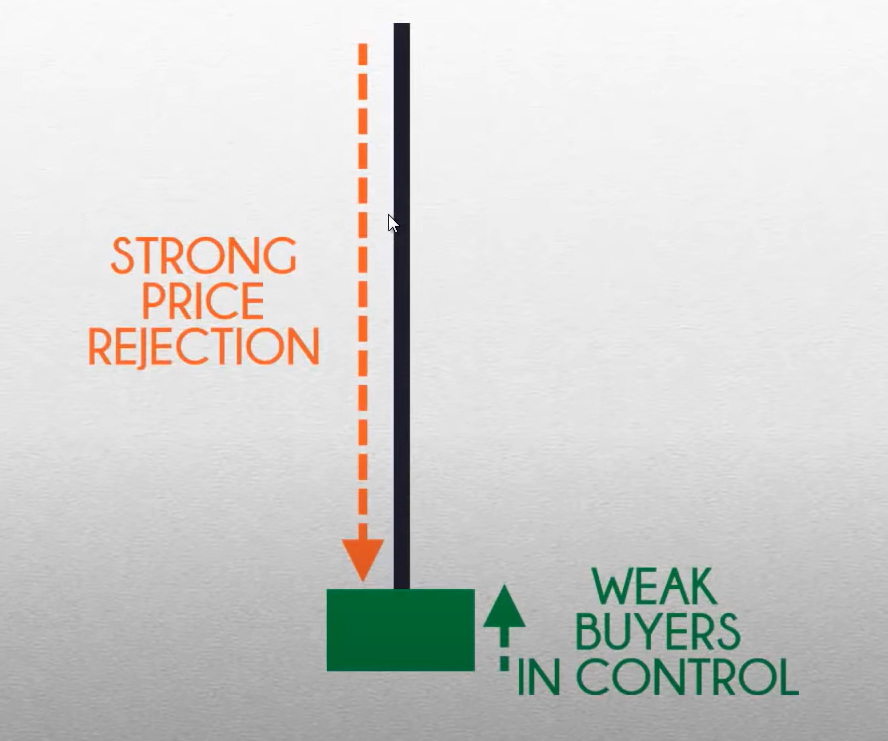

Nevertheless, you possibly can neglect the shadow, because what’s telling you is that there’s a price rejection of upper prices.

Because when you give it some thought, this was once the very best of the session.

This simply implies that at one point the sellers pushed the value from these highs down lower until its price closed over here:

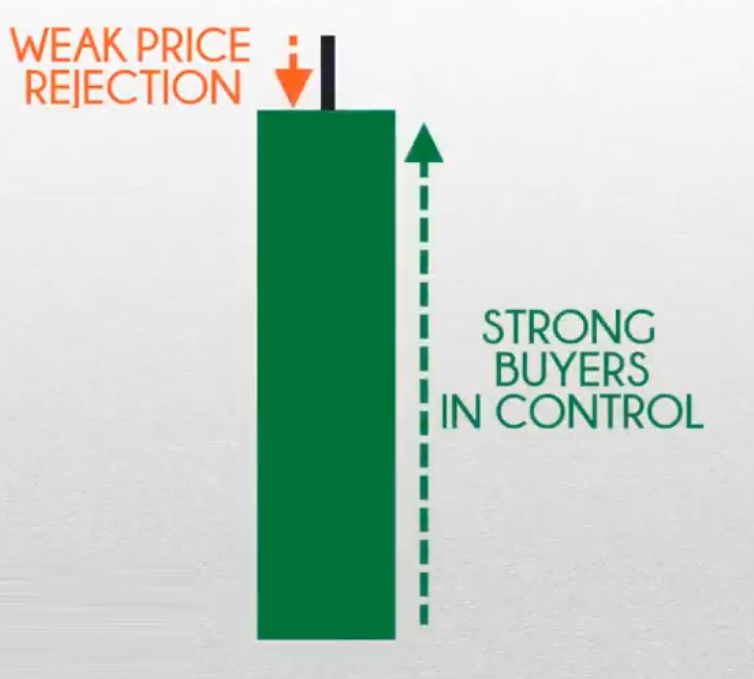

The third thing that I would like you to know is that, take a look at this candlestick.

What’s the scale of the body relative to the wick?

As you possibly can see, you may have a wick and body, but this time the message is totally different. In case you take a look at this candlestick pattern,

It shows that yes, the value did close higher. But when you take a look at the wick, you’ll notice that the value rejection at one point is the very best of the session.

The value got here all the way in which down from the high of the session and closed at that level.

What does this let you know?

It tells you that the buyers did push the value up barely higher for the session. Nevertheless, there was an immense amount of selling pressure and a powerful price rejection that pushed the value lower through the session.

This isn’t a really bullish pattern.

It’s quite bearish. Because it shows immense selling pressure by the sellers. You furthermore mght need to concentrate to those three things.

- The body

- The wick

- The body relative to the wick.

Often, if the wick is for much longer than the body, it’s an indication of price rejection.

That is the way you read candlestick patterns.

Variations To Candlestick Patterns

The primary one I believe is something that you just are probably acquainted with.

The value opened, after which it closed. That is the highs and the lows of the session.

By way of the meaning…

You may see it’s quite straightforward the value opened near the lows it tried to return down lower but was rejected then finally closed near the highs.

It’s an indication of bullish strength.

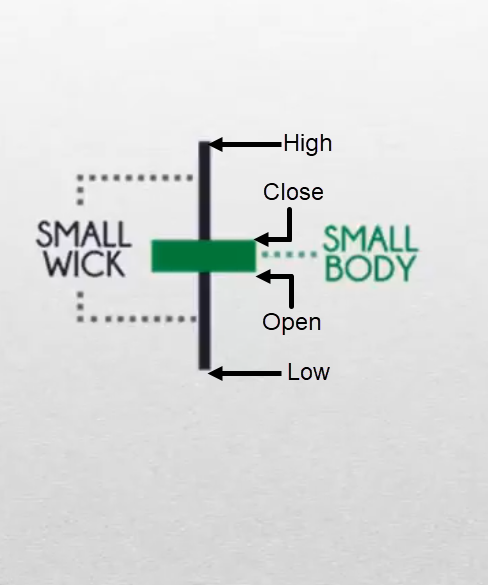

Next…

The value opened and closed.

When the market just opened possibly what happened is that the value got here down lower.

The sellers were on top of things then the buyers took charge and pushed the value all the way in which higher back towards the highs.

Then finally the sellers got here back in and the market closed at this price level.

The meaning behind that is that there’s indecision within the markets where each buyers and sellers are present.

In case you ask me generally, that is what we call an indecision pattern.

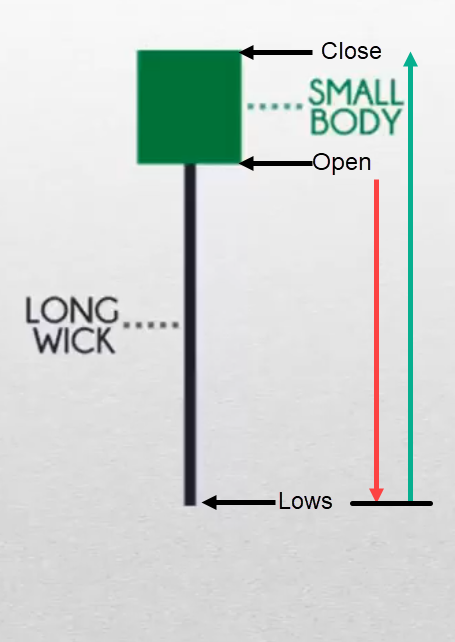

Next…

In case you take a look at this last candlestick pattern, the value opened here:

The market got here down lower, sellers were on top of things then the buyers took charge and reversed back finally closing near the highs.

The meaning of this pattern is rejection of lower prices, the buyers are clearly on top of things.

Moving on…

That is the other of what we’ve got just shared earlier. That is the selling version of it.

Candlestick on Different Timeframes

In case you recall, I said that candlestick charts can appear in numerous time frames.

On a 60-minute timeframe, a candlestick is one hour. For each hour a bar can be painted.

The identical applies to the day by day timeframe. For each 24 hours, a bar can be painted.

That is how candlestick patterns can form on different timeframes.

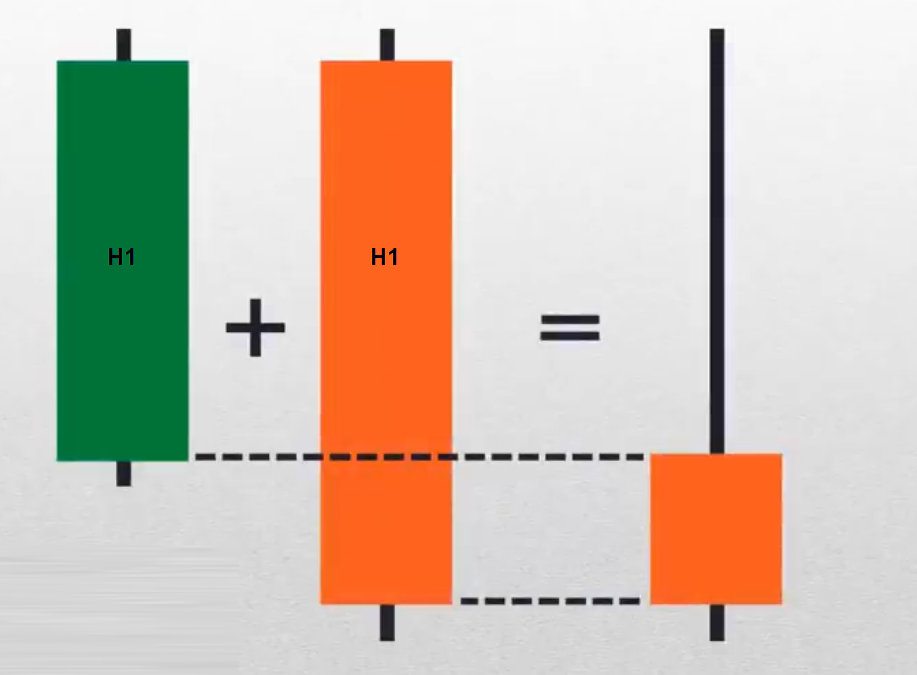

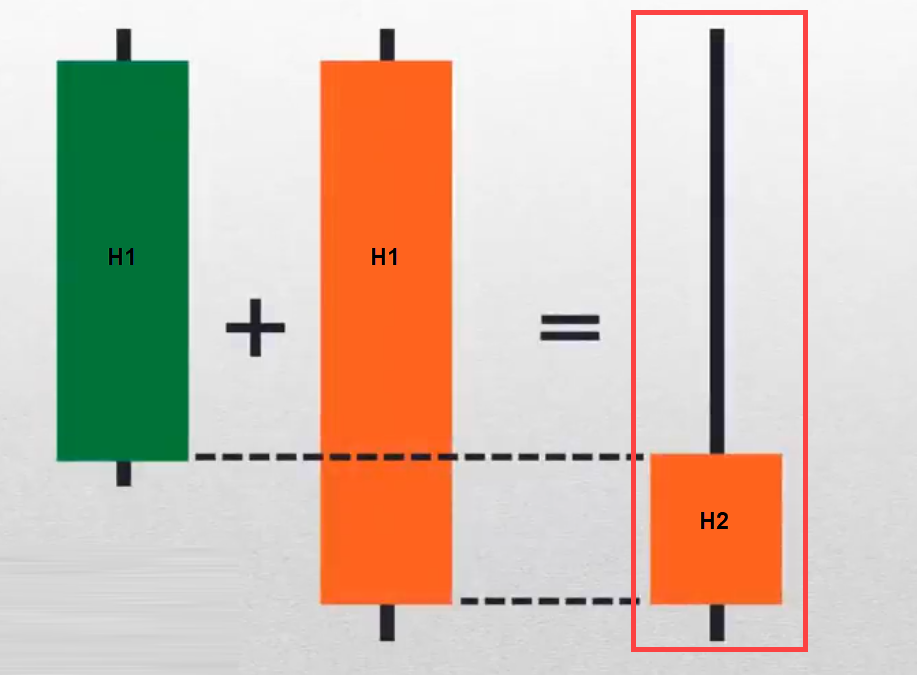

Combining Candlestick Patterns

Candlestick patterns just show you the value of different sessions.

Take a look at this…

Let’s say it is a one-hour candle for the green and the red candlestick respectively.

While you mix these two candlestick patterns, what timeframe is that this going to be?

It could be the H2 timeframe.

How did this candle come about?

A H2 candlestick simply means, identifying the high and the low during the last two hours, the opening price of the primary and second candles.

Does it make sense?

I hope you possibly can understand how candlestick patterns might be combined.

This could be very useful if you’re a price chart.

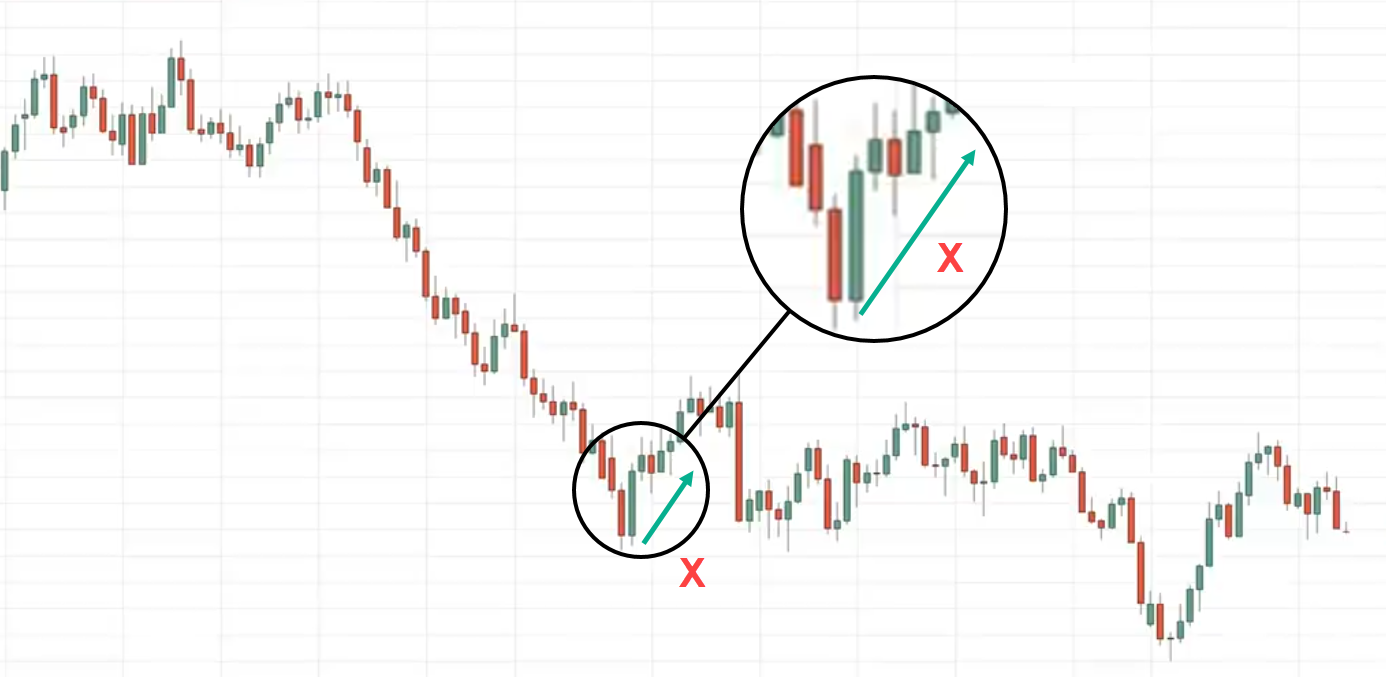

How NOT to Trade Candlestick Patterns

You understand read and mix the candlestick patterns.

How do you not trade candlestick patterns?

This can be a mistake many latest traders make because as I actually have said earlier, when you recall, when you see a green candle, it means bullish, If the candle is red, it means bearish.

What traders would do is that they appear at a chart they usually discover a series of green candles they usually go long.

They are saying…

“The candle is bullish let me buy it”

Bam!!!

The market reverses.

Similarly…They see red candles…

“It’s so bearish!!!”

Rayner’s said…

“Seller is on top of things I should go short”

Bam!!!

The market reverses.

What’s occurring? Why is that?

I’ll explain…

“You don’t need to trade candlestick patterns in isolation”

What’s isolation?

It means you don’t need to trade candlestick patterns by itself. Simply because that candlestick is green or red doesn’t mean you go long or short respectively.

Don’t trade candlestick patterns in this fashion.

How To Trade Candlestick Pattern

I would really like to introduce to you something that I call the “TAE Framework”

T – Trend

A – Area of Value

E – Entry Trigger

When you ought to trade candlestick patterns, remember these three things.

Before I can dive into this technique, I would like to elucidate to you what an entry trigger is.

Entry Trigger

I’d say candlestick patterns are very useful and powerful entry triggers right into a trade.

Before we will go into this framework, let me share with you five powerful candlestick patterns that may function an entry trigger.

Engulfing Pattern:

The green candle is what we call the bullish engulfing pattern. Why is that?

In case you take a look at the body of the green candle, it has engulfed the body of the previous candle.

The previous candle is the red candle.

The sellers were on top of things and on the second candle the buyers were in some way on steroids. It opened near the lows and eventually pushed the value up.

This can be a sign of strength.

It shows that the buyers have reversed all of the selling pressure and more.

For this reason it’s called a Bullish Engulfing Pattern.

Bearish Engulfing Pattern

That is just the other.

Buyers were on top of things, however the sellers took charge and pushed the value lower.

This can be a bearish engulfing pattern telling you what sellers are on top of things.

Hammer and Shooting Star

That is something that you just could be acquainted with.

That is showing you price rejection available in the market. Rejection of lower prices.

At one point, the sellers were on top of things to push the value lower near the lows of this session after which the buyers got here in and pushed the value higher.

This can be a sign of strength.

Rejection of lower prices.

Shooting Stars

That is showing you rejection of upper prices.

The buyers took charge, took the value higher, after which the sellers suddenly got here in and pushed the value down.

This can be a rejection of upper prices

This pattern would provide help to discover market reversals.

Dragonfly and Gravestone Doji

This sounds handful.

But dependent.

This could be very much like the hammer and shooting star.

This can be a sign of price rejection

Morning and Evening Star

This can be a morning star:

That is somewhat much like the Engulfing pattern but with a slight variation to it.

In the primary candle, the sellers were on top of things, and within the second candle, there was indecision available in the market.

Then finally, the third candle opened and pushed the value up and shutting near the highs.

It’s a bullish reversal pattern.

The evening start is just the other of the primary candle.

Buyers are on top of things and the second candle is an indecision candle. Then the third candle the bears got here in and pushed the value lower closing near the lows.

Tweezer Bottom

This can be a powerful pattern.

It shows you rejections of lower prices two times.

First and second rejection.

This can be a sign of strong rejection of lower prices.

Tweezer Top

At one point, it was on the high of this session before the sellers pushed the value quite a bit and eventually closed near the center of the range of the candle.

Then the following candle, the value opens and the buyers took charge and got rejected at the identical level before the sellers pushed the value lower closing near the low.

Two times the value rejection of upper prices, it is a bearish reversal pattern.

The TAE Framework

Now that you just understand the five powerful candlestick patterns, how does this fit into the TAE framework?

We’ve settled the entry triggers portion due to the reversal patterns that you just saw earlier, those are the entry triggers which you can use to enter the trade.

But before you trade it, remember we said don’t trade it in isolation, which means we’ve got to make use of other aspects or other market conditions to search for.

Before we wait for our entry trigger, the conditions that we search for are the TAE framework.

What we’re on the lookout for is that if the value is above the 200MA, we could have an extended bias.

Because of this we would like to be a buyer on this market condition.

If the value is below the 200 MA, we’ll have a brief bias. which means we are going to only be seeking to short.

Trend

- If the value is above the 200MA, have an extended bias

- If the value is below the 200MA, have a brief bias

Understand that after I define the trend, it doesn’t mean that simply because the value is above the 200-period moving average you go long immediately…

That is just to present you a bias that now it’s time to be buying. It’s time to be on the lookout for buying opportunities.

Area of Value

- Support and Resistance

- Moving Average

- Trendline

- Channel

Entry Trigger

- Engulfing pattern

- Tweezer Tops and Bottom etc.

Using this framework, we will then formulate trading strategies to profit in bull and bear markets.

Remember the very first thing we’re on the lookout for is the trend

If it’s an uptrend, we glance to purchase and we are going to buy it at an area of support, moving average, after which we search for an entry trigger.

The entry trigger can be a bullish reversal pattern like a hammer, a bullish engulfing pattern, dragonfly doji, etc.

Does it make sense?

Example:

Let’s bring all of the concepts together

I don’t have the 200MA on the chart but useless to say, the trend is down because you possibly can see that the market is moving from as much as down.

The value got here into this area of resistance. The value was rejected thrice.

You’ve got this entry trigger (Shooting Star)

Now you’re trading candlestick patterns within the context of the market meaning you’re trading candlestick patterns based on market structure.

Based on the trend this increased the probability of your trade understanding.

The shooting star occurred on the resistance in a downtrend and the market did proceed barely lower.

One thing to indicate is that the examples I showed you might be all winning trades but in point of fact, you won’t get all winning trades.

You’ll likely meet losers.

The explanation why I share winning trades is that it’s easier as an instance the concept but again those charts or fairly the possibility you might be seeing now are cherry-picked.

Example:

What’s the trend?

Downtrend.

Where is the world of value?

This time around the world of value is a moving average and it acts as a dynamic resistance.

What’s your entry trigger?

We’ve a bearish engulfing pattern.

We’ve three things

The trend, area of value, and entry trigger.

We will go short and have our stops somewhere in regards to the highs.

Conclusion

Candlestick patterns are definitely probably the most popular subjects relating to technical evaluation.

Nevertheless, it’s all the time used the unsuitable way.

For this reason in today’s guide I’ve shared with you that:

- A candlestick consists of an open, high, low, and shut

- The difference between a bearish and bullish candlestick pattern is the colour of the body, and the length of its wick

- Candlestick patterns has numerous variations from large body and small body, to long wicks and short wicks

- Different candlestick patterns can equate to different patterns on the upper timeframe

- The unsuitable approach to trade candlestick patterns is to enter the trade without the market structure

- One of the best approach to use candlestick patterns is to make use of it as an entry trigger

- You should utilize the T.A.E. framework to trade candlestick patterns

How about you…

Do you agree with the concepts I’ve shared with you today?

If that’s the case, which one stands out probably the most to you?

Let me know within the comments below!