Do you ever recognize an uptrend but hesitate to enter an extended trade?

Perhaps you’re anxious the worth has already moved too removed from the perfect entry point?

Or perhaps you already know the right way to spot regular bullish divergence and are in search of a solution to find possible trend continuations…

Well, I’ve got exciting news for you!

Hidden Bullish Divergence is strictly what you wish!

In this text, you’ll:

- Uncover the differences between hidden and regular divergence and understand how hidden divergence serves as a robust tool for continuing a trend.

- Explore how hidden divergence can assist you capture the remaining momentum of a trend.

- Learn easy yet effective techniques to identify hidden bullish divergence, enabling you to make higher trading decisions with confidence.

- Gain practical insights by real-life trading scenarios, showing you the right way to check out hidden bullish divergence strategies successfully from start to complete.

- Understand the restrictions of hidden divergence and discover invaluable suggestions and tricks to beat challenges, ultimately increasing your success rate.

Able to dive in?

Let’s start your journey to unlock the potential of Hidden Bullish Divergence!

What’s Hidden Bullish Divergence?

Hidden Bullish Divergence gets its name since it’s more difficult to identify and fewer common amongst traders…

But that doesn’t mean it needs to be ignored!

When used appropriately, Hidden Bullish Divergence provides traders with an incredible edge available in the market.

To know Hidden Bullish Divergence, it’s necessary to clarify normal divergence first.

Bullish divergence happens when the worth makes a lower low, but an indicator reminiscent of RSI, Stochastics, or MACD makes the next low.

Now, traders interpret this as an indication that, although the worth is making a lower low, the momentum behind it has began to turn bullish, and the move to the lower low is weaker than the previous one…

Bullish divergence is superb for considering a reversal of the trend.

But, how does hidden bullish divergence occur?

Well, it happens when the worth forms the next low, and the indicator forms a lower low…

…which could be a powerful tool when the worth is already trending upward!

Hidden Bullish divergence successfully represents the purpose available in the market when momentum in an uptrend has been oversold and is able to proceed higher, with the general trend acting because the driving force behind the buy signal.

So what else makes it different from other patterns?

What Hidden Divergence Tells Us: Continuation vs. Reversal

The first function of Hidden Divergence is to assist traders discover entry points in an already established trend.

But unlike regular divergence, which frequently signals a possible reversal, Hidden Divergence is a continuation setup…

It signifies that in Hidden Divergence trades, the goal is to capture price movements that align with the prevailing trend, allowing traders to capitalize on the momentum already in play.

Trading with the Trend!

Because the saying goes, “The trend is your friend,” which also holds true when exploring the hidden divergence setup!

Aligning your trades with the prevailing trend lets you ride the wave of momentum.

This method works especially well if you end up in search of entry points which are strongly supported by a well-established trend…

So by trading with the trend, you position yourself favorably – right from the beginning!

Indicator selection

The MACD, Stochastic RSI, Stochastics, and Regular RSI are a few of a very powerful indicators that might be used to seek out hidden bullish divergence.

Despite the fact that there are other indicators that might be used for divergence evaluation, these are the primary ones that will likely be shown within the examples.

What does Hidden Bullish Divergence Look Like?

Well, now that you simply understand the concept of hidden bullish divergence, let’s delve into the specifics of what try to be in search of as a trader to discover this pattern.

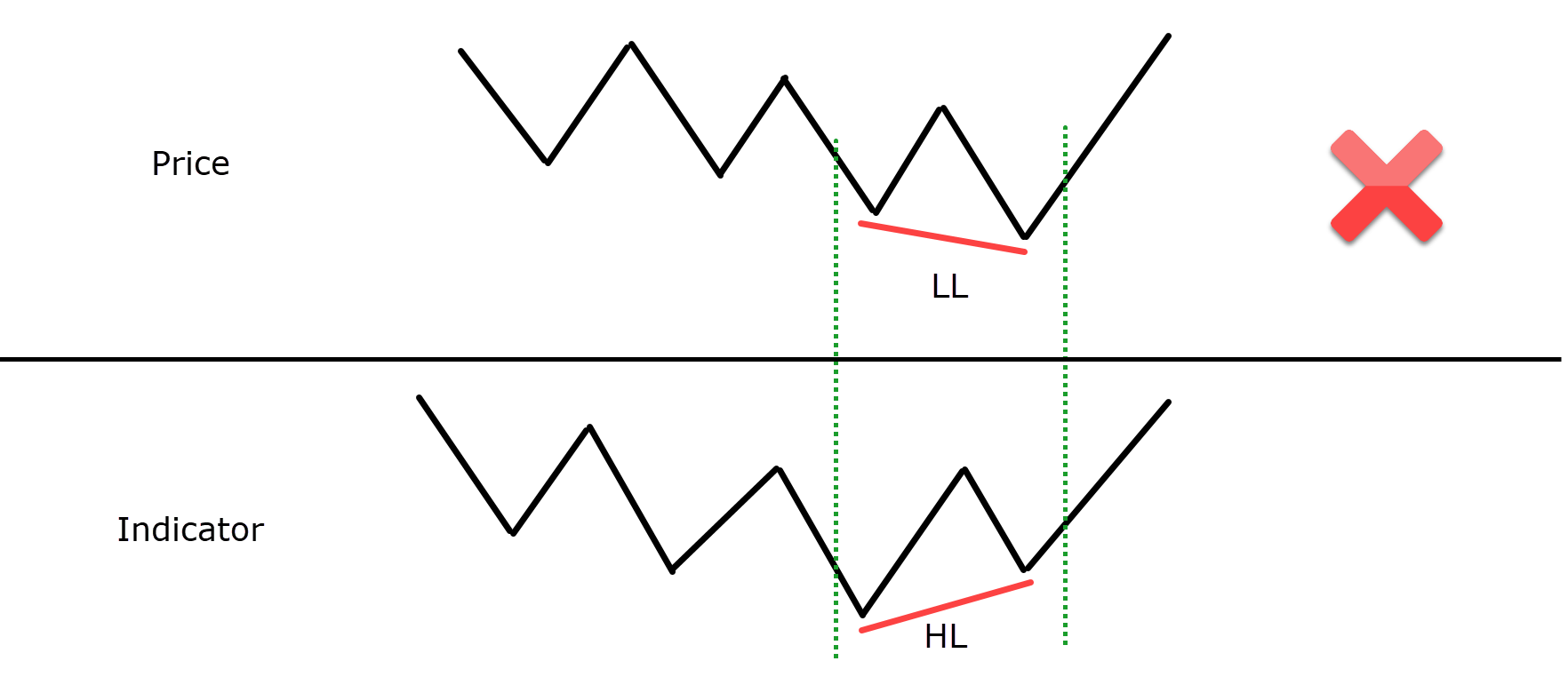

When there’s regular bullish divergence, the worth makes a lower low and the oscillator or indicator makes the next low…

Then again, hidden bullish divergence presents a variation.

On this case, the worth establishes the next low, however the indicator forms a lower low as a substitute.

Let’s visualize this with a diagram…

As might be seen, the worth makes a series of lower lows at first, but eventually, it makes the next low.

…and at the identical time, the indicator records a lower low.

This scenario signifies a hidden bullish divergence!

Let’s explore one other example to solidify the concept…

OK, so, what’s flawed with this instance?

That’s correct!

It’s not actually a hidden bullish divergence…

…the truth is, it’s a daily bullish divergence!

After all, this just isn’t what you would like when in search of the setup for trend continuation that hidden bullish divergence shows!

Now that you might have the concept down, let’s take a look at some examples on real charts to see what you’ll be in search of when making trades…

The way to trade hidden bullish divergence

Let’s explore some real-life trading scenarios by which you possibly can apply the Hidden Bullish Divergence strategy…

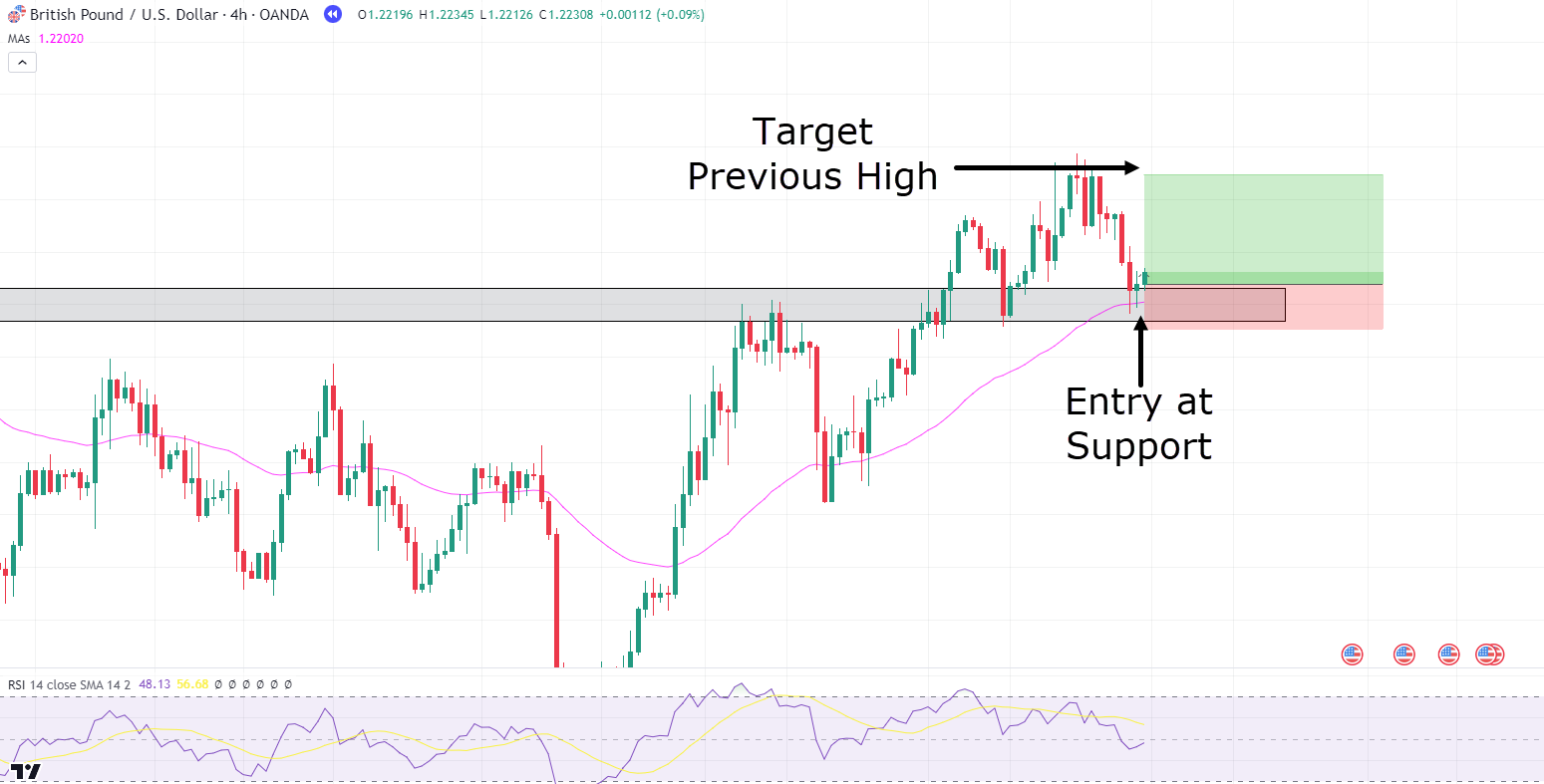

GBP/USD 4-Hour Timeframe Chart:

Take a better take a look at this chart.

For this instance, I’m using the RSI indicator within the default settings.

As you may see, the worth has formed a transparent resistance level on the 4-hour timeframe…

Once the resistance was broken, the worth got here back to retest the zone and successfully bounced, making a fresh support zone after the Support/Resistance flip…

Let’s search for an entry at this zone using hidden bullish divergence…

GBP/USD 4-Hour Timeframe Hidden Bullish Divergence:

As you may see here, the worth has began rejecting on the zone with some hammer candlesticks.

But what’s more necessary is that our RSI indicator has formed a lower low, while the worth has formed the next high!

That is a primary example of a possible Hidden Bullish Divergence setup using a support level in a latest uptrend…

The truth is, several aspects favor this trade, providing added confidence to take the trade:

– The trend is in favor

– Hidden Bullish Divergence has occurred, signifying continuation

– The support level is being tested

– …and rejection candles show that the worth is holding the support level!

Okay, so how would you go about taking this trade?

Let’s have a look!…

GBP/USD 4-Hour Timeframe Chart Entry Scenario #1:

In this primary scenario, you possibly can place your stop loss just under the 50 Moving Average and in addition the support zone…

If the worth falls below these levels, the retracement will likely proceed deeper below the zone, back to another area of value.

You would place your take profit on the previous high…

This enables for a fast and simple trade, enabling you to capture profits swiftly with an in-and-out trade.

Let’s take a take a look at the result!…

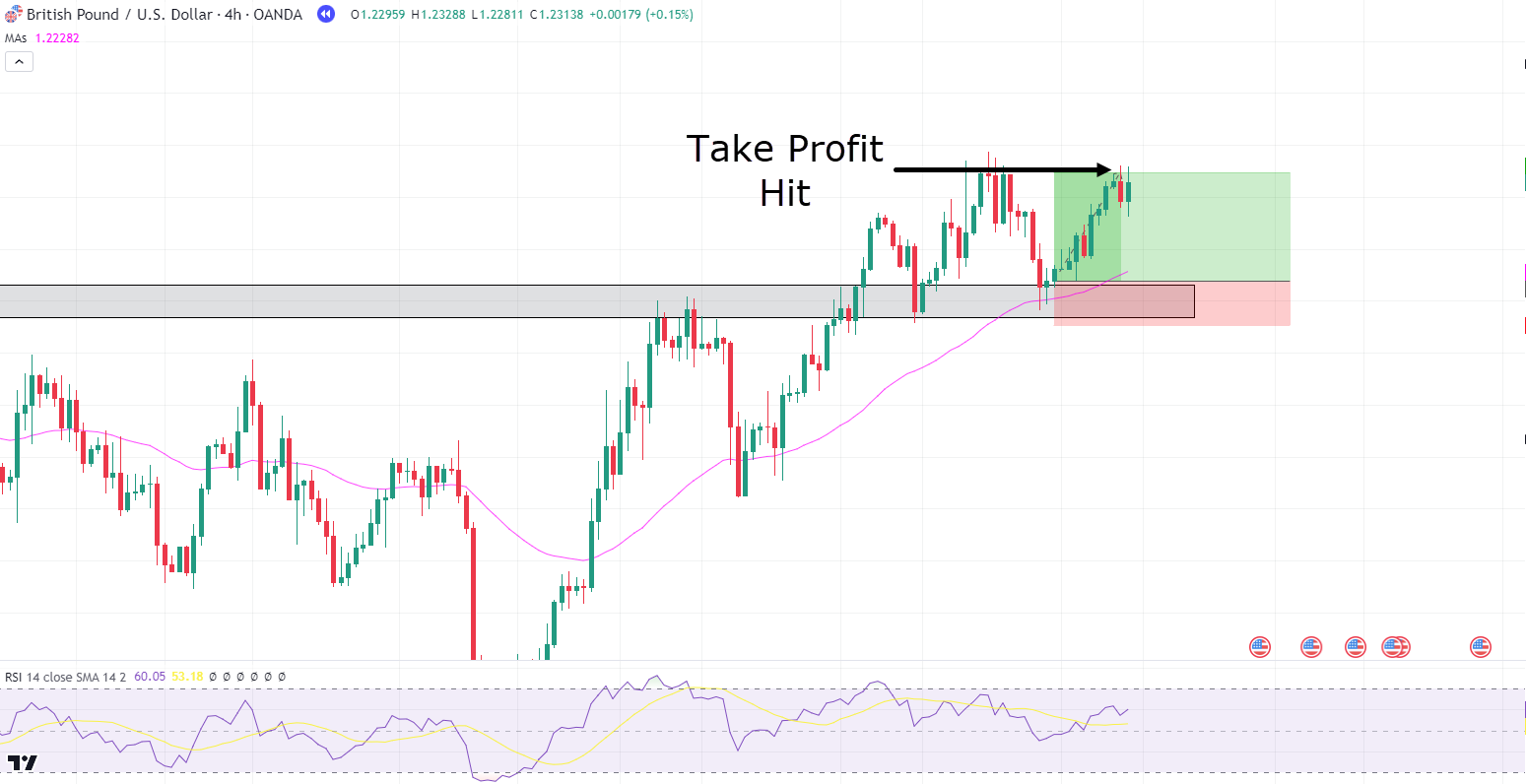

GBP/USD 4-Hour Timeframe Chart Scenario #1 Take Profit:

Nice trade!

This might have yielded around a 2RR trade from simply targeting the previous high, which is a modest and realistic goal.

One other viable exit strategy is using a trailing stop below the moving average, especially if you would like to attempt to capture the trend for a considerable move.

Let’s take a take a look at what would occur when you used this method in scenario #2…

GBP/USD 4-Hour Timeframe Chart Scenario #2 Take Profit:

As you may see, the worth did proceed further than the previous high!

Nonetheless, as the worth retraced, the trailing stop loss had not caught as much as the recent move higher, meaning this trade would have actually yielded less return than scenario 1.

So, is one method higher than one other?

Well… simply because, in this instance, taking profits on the previous high turned out to yield higher results, it is important to know that using the trailing stop in this manner often permits you to capture the trend, especially if it starts to maneuver strongly in your favor.

Let’s take a take a look at one other example as an example this point!…

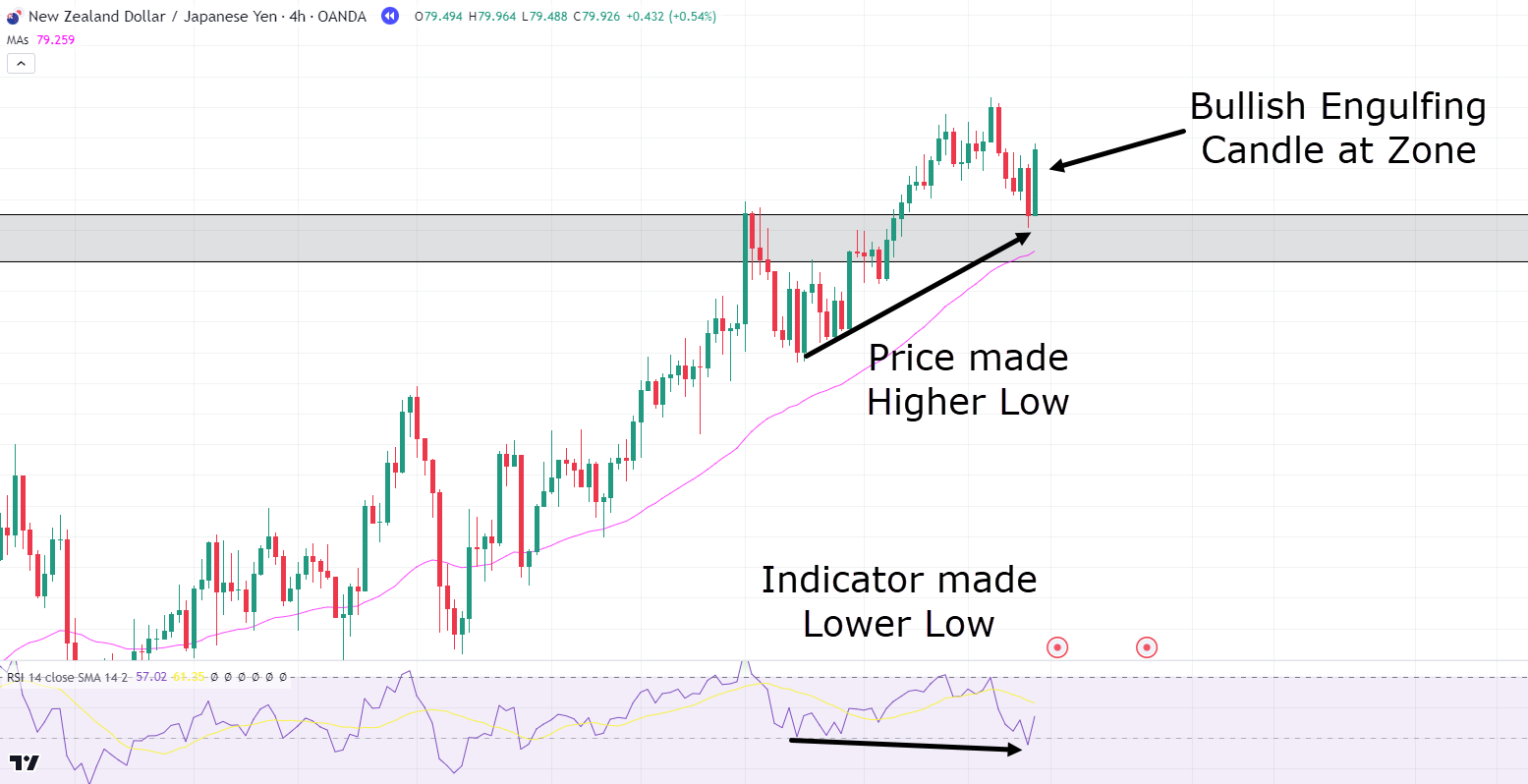

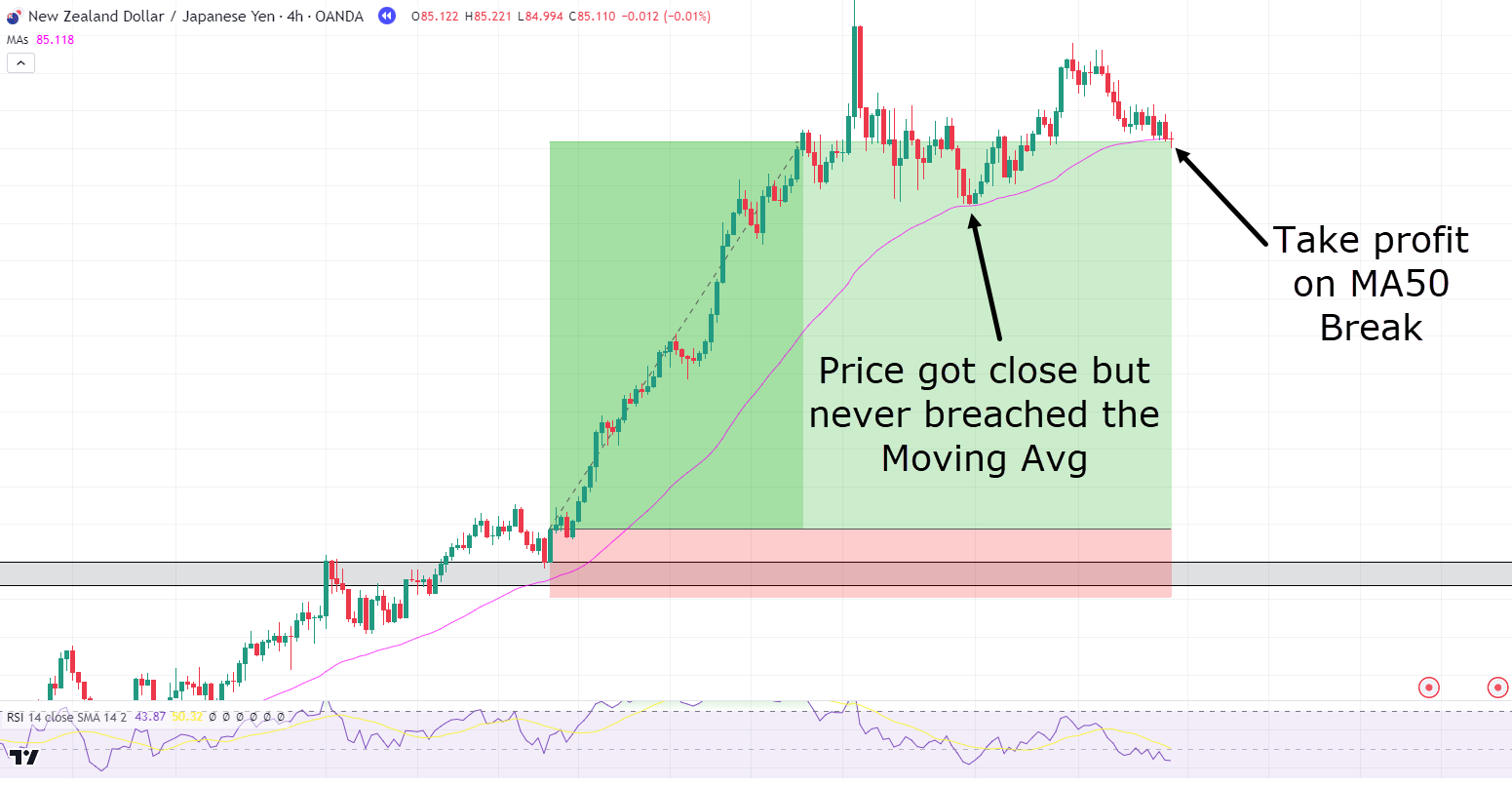

NZD/JPY 4-Hour Timeframe Chart:

Here you might have a really similar situation to the previous example.

Price has created a transparent resistance zone…

At this point, you’re in search of the worth to return back and switch the resistance into support while also observing if some hidden bullish divergence occurs…

NZD/JPY 4-Hour Timeframe Chart Hidden Bullish Divergence:

Have a look at that!

Price made the next low, and the indicator made a lower low on the RSI indicator panel.

You too can spot the bullish engulfing candlestick right on the zone, which helps discover that the zone has buyers holding it as support…

Let’s take a buy!…

NZD/JPY 4-Hour Timeframe Chart Entry:

Let’s also enter the trade after the bullish engulfing candlestick and place a trailing stop just under the MA50, so any breach of it ends in an automatic stop loss or take profit…

NZD/JPY 4-Hour Timeframe Chart Entry:

Wow, Congratulations!

You only captured a significant trend using the Hidden Bullish Divergence strategy!

Are you able to see how Price almost breached the MA but actually treated it as support?

Then, the worth went on to attempt to make a latest high and failed… before breaching the moving average!

This trade would have yielded anywhere from a 4 to six RR, depending on how tightly you trailed the stop loss.

After all, it’s necessary to know that not all trades are going to pan out like this…

…but when you can capture a few these, you’re well in your solution to successfully trading hidden bullish divergence!

Let’s take a look at yet one more example to maintain expectations realistic…

CAD/JPY 4-Hour Timeframe Chart Entry:

Identical to all previous examples, this setup is similar…

Hidden Bullish divergence has occurred at a key area of value!

Let’s take the trade and see what happens when you trail the stop using the Moving average again…

CAD/JPY 4-Hour Timeframe Chart Exit:

Oh no!

Price didn’t proceed on this uptrend and broke below the moving average, barely making any profit.

Well, that is going to occur sometimes… but that’s okay!

Let’s try again, this time within the 1-hour timeframe!…

GBP/CHF 1-Hour Timeframe Chart Entry:

Identical to in previous examples, the worth has undergone a Support/Resistance (S/R) flip, and I’m utilizing the Moving Average as a guide for support together with the trailing stop loss.

On this instance, the worth formed the next low while the indicator created a lower low…

So for this instance, let’s assume I feel that the bullish trend is in full swing and wish to capture as much profit as possible – by leaving the trade open until a candle closes below the moving average.

How did this trade unfold?…

GBP/CHF 1-Hour Timeframe Chart Exit:

Unfortunately, one other loss occurred!

But what if I told you this was a very good thing?

OK okay, I hear you…

“Why’s that Rayner!?”

“How could I possibly be blissful a few loss!!”

Well, I’m not asking you to be blissful as such but consider this loss as a crucial opportunity for learning…

Let’s delve into it…

GBP/CHF 1-Hour Timeframe Chart Evaluation:

An evaluation reveals that there was a chance to take profits on the previous high, leading to a reasonably positive trade end result…

And while it won’t have been the coveted 5RR that traders dream of, seizing the profits offered by the market is usually a smart move…

Alternatively, when you had waited for the break of the Moving Average with an automatic trailing stop, the trade would have been stopped out throughout the first substantial bearish engulfing candle, because it began to breach below the moving average…

Exiting with the trailing stop, then, as a substitute of waiting for the candle’s close, could have prevented a losing trade.

Alright, I do know – it wouldn’t have been a trade to boast about!…

…but capital protection is paramount on this business, right?

Remember, risk management is essential.

It’s crucial to just accept that the Hidden Bullish Divergence strategy won’t at all times unfold as expected…

…or every other pattern for that matter!

Losses are inherent in trading; but you may not less than control the extent of your losses.

Upon analyzing our unsuccessful trades, it becomes apparent that the strategy itself isn’t often the problem—it’s the way you manage it!

As such, the Hidden Bullish Divergence strategy provides a framework to limit risk while maximizing potential profit.

There are another flaws too, in fact…

Limitations

Let’s discuss a number of the limitations that include the usage of Hidden Bullish Divergence.

Could be Hard to Spot:

Unlike standard Bullish divergence, hidden bullish divergence (understandably!) gets its name from the proven fact that it is definitely quite hard to identify!

On the lookout for a lower low on the indicator might be difficult…

…especially in an uptrending market when nearly all of the momentum is pushing the indicator and price upwards.

Which brings me to the following point!

Relatively Unusual:

Hidden Bullish Divergence is rare compared to plain divergence.

When it happens, it could possibly be a helpful tool, but due to setup’s nature, identifying and using it effectively takes a little bit more time and thought…

Can’t Be Utilized in All Market Conditions:

This follows from the previous limitation, as hidden bullish divergence is comparatively unusual.

You, because the trader, are only in search of this pattern to occur in an uptrending market.

This implies you may only really use this strategy when an uptrend.

Late Entry

One among the hidden bullish divergence’s strengths is that it requires loads of confirmation before providing you with a buy trigger.

Nonetheless, this also can lead to a different limitation in that by the point the required confirmation is confirmed, the worth can have already moved a major distance away from the perfect entry or the beginning of the trend.

Realistic Expectations:

Like several strategy, it doesn’t guarantee a 100% win rate.

Any indicator or method can have its limitations, and expecting these trades to achieve success each time is unrealistic!

It is important to practice different methods and indicators for the Hidden Bullish Divergence technique to determine what works best in your timeframe and assets.

Suggestions and tricks to extend success rate

As noted, it’s necessary to acknowledge that not all trades will end in success.

Nonetheless, there are invaluable suggestions and tricks to assist you stay out of trades until further confirmation, increasing the likelihood of a win…

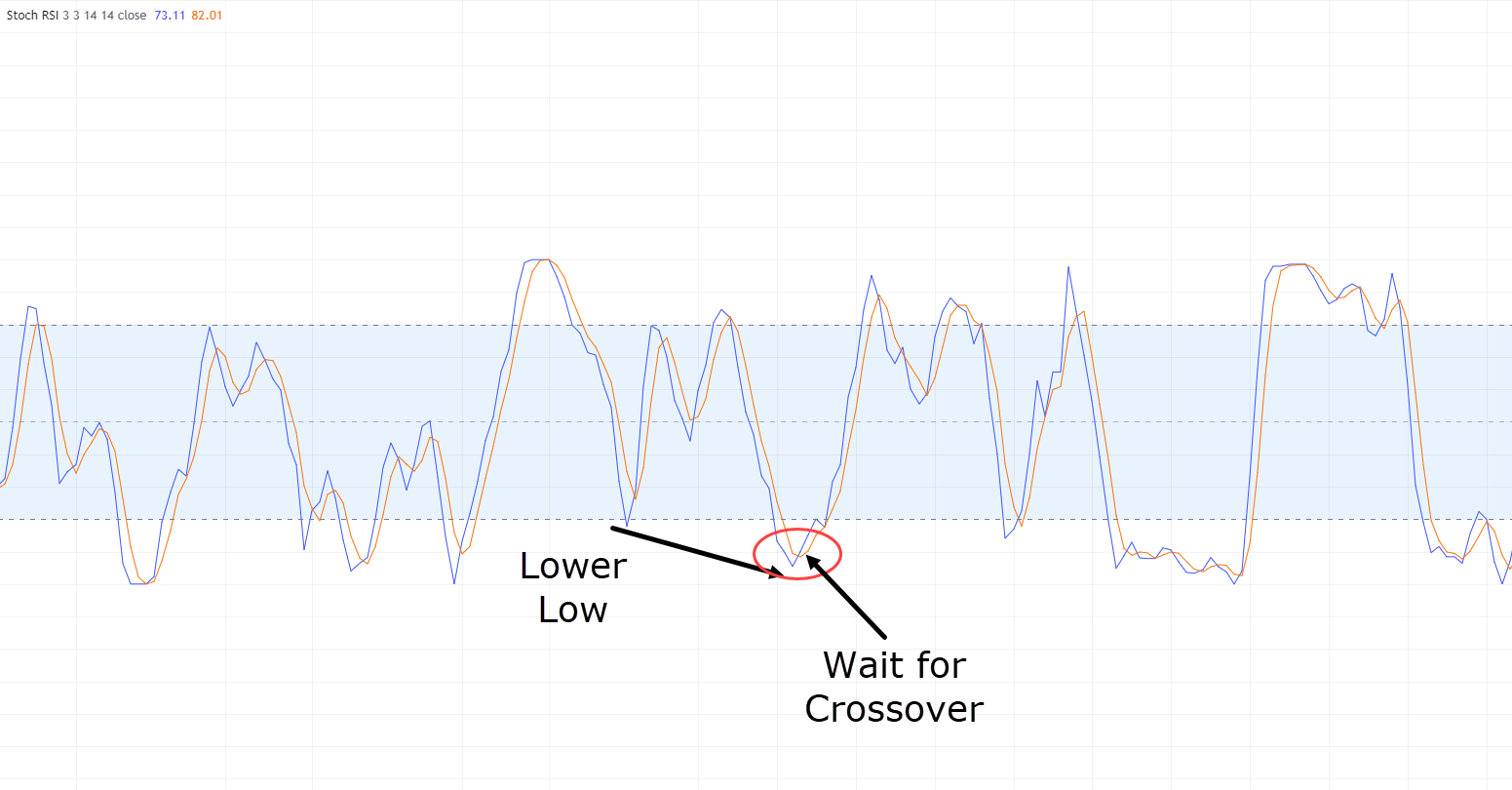

Indicator Crossover

Let’s start with the Indicator Crossover.

Some indicators used for divergence have two lines that cross over one another…

Stochastic RSI Crossover example:

Taking Stochastics for example, when price forms the lower low, the 2 lines on the Stochastic haven’t crossed over.

Waiting for this crossover allows you, because the trader, to enter the trade when momentum has truly shifted back to the bulls!

In some cases, this might mean entering a trade a bit later, nevertheless it provides a further layer of confidence when making trading decisions…

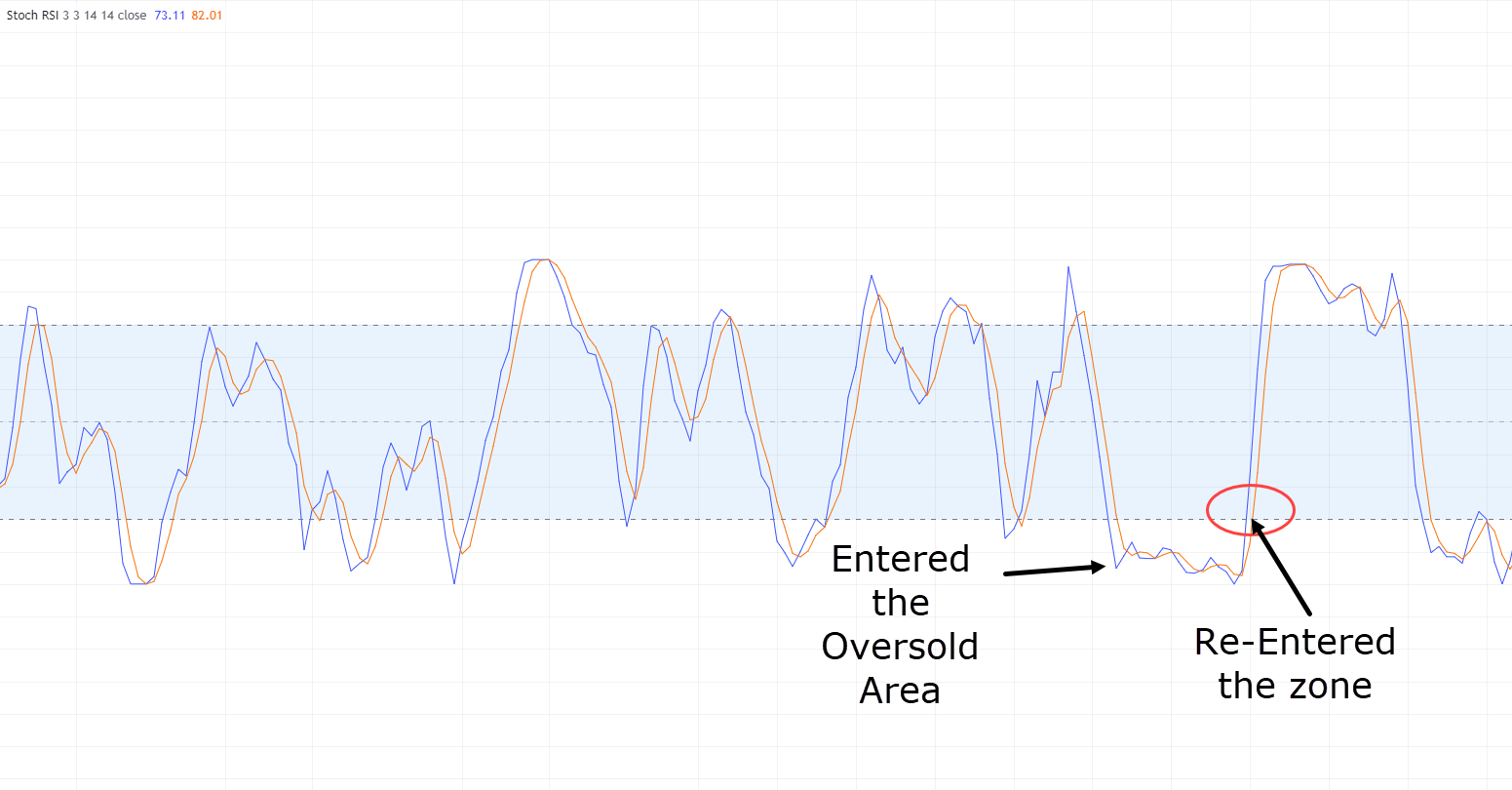

Oversold areas

Overbought and oversold areas are less relevant to hidden divergence scenarios, nevertheless it’s price mentioning that in case your setup is in an oversold area, it is likely to be useful to attend for the worth to go away the oversold range…

Stochastic RSI Oversold example:

If the worth is in an oversold area and forms the lower low for the hidden bullish divergence, sometimes it’s best to attend for the indicator to exit its oversold area.

Then, you may place the trade because the momentum truly begins to shift in favor of the bullish trend.

Patience!

Last but not least, all the above relies heavily on one thing…

…perhaps essentially the most difficult thing…

…being patient!

Traders often rush into the very first thing they see, taking every possible trade.

Nevertheless it’s necessary to take a deep breath…

…and take only the perfect setups.

When using the techniques above, practice patience in waiting for them to occur!

At the top of the day, being patient might cause you to miss some trades, but I assure you that it would prevent overtrading, taking poor setups, and questioning your trading strategy altogether.

Conclusion

In conclusion, the Hidden Bullish Divergence strategy emerges as a robust tool for capturing the continuation of bullish trends, offering a precise entry trigger.

Combining this strategy with other technical evaluation tools increases the probabilities of a successful trade by aligning several favorable aspects.

Throughout this comprehensive guide, you’ve acquired the knowledge obligatory to navigate and execute the hidden bullish divergence setup.

Furthermore, you’ve gained insights into its limitations and discovered invaluable suggestions and tricks to further elevate your success rate.

To summarize our journey:

- You now possess a deep understanding of the distinctions between regular bullish divergence and hidden bullish divergence, enabling you to discern essentially the most suitable market conditions for every.

- Armed with the knowledge from practical setups, you might have the tools to enter trades with momentum, placing the percentages in your favor from the outset.

- Practical setups equip you with multiple options for taking profits and setting stop losses, letting you manage your trades effectively irrespective of how they unfold.

- By delving into the boundaries of hidden bullish divergence, you may approach your trades with realistic expectations, gaining a resilient trading mindset.

- The article has provided invaluable suggestions and tricks to forestall premature entries, ensuring you might have the confirmation it’s worthwhile to trade with confidence.

So, along with your new-found knowledge, I encourage you to place these techniques into practice, refining your approach to fit your trading style!

Now, what are your thoughts on Hidden Bullish Divergence?

Have you ever grasped the difference between Regular and Hidden divergence?

Do you utilize divergence in any of your trading?

Be at liberty to share your insights within the comments below!