The False Break Trading Strategy

This strategy is for you should you’re the sort of trader that…

“Rayner, I want to trade with the trend, the trend is your friend but I don’t know when to enter”

If that seems like you then this trading strategy is for you because we’ll share with you the way we are able to hop on board the trend.

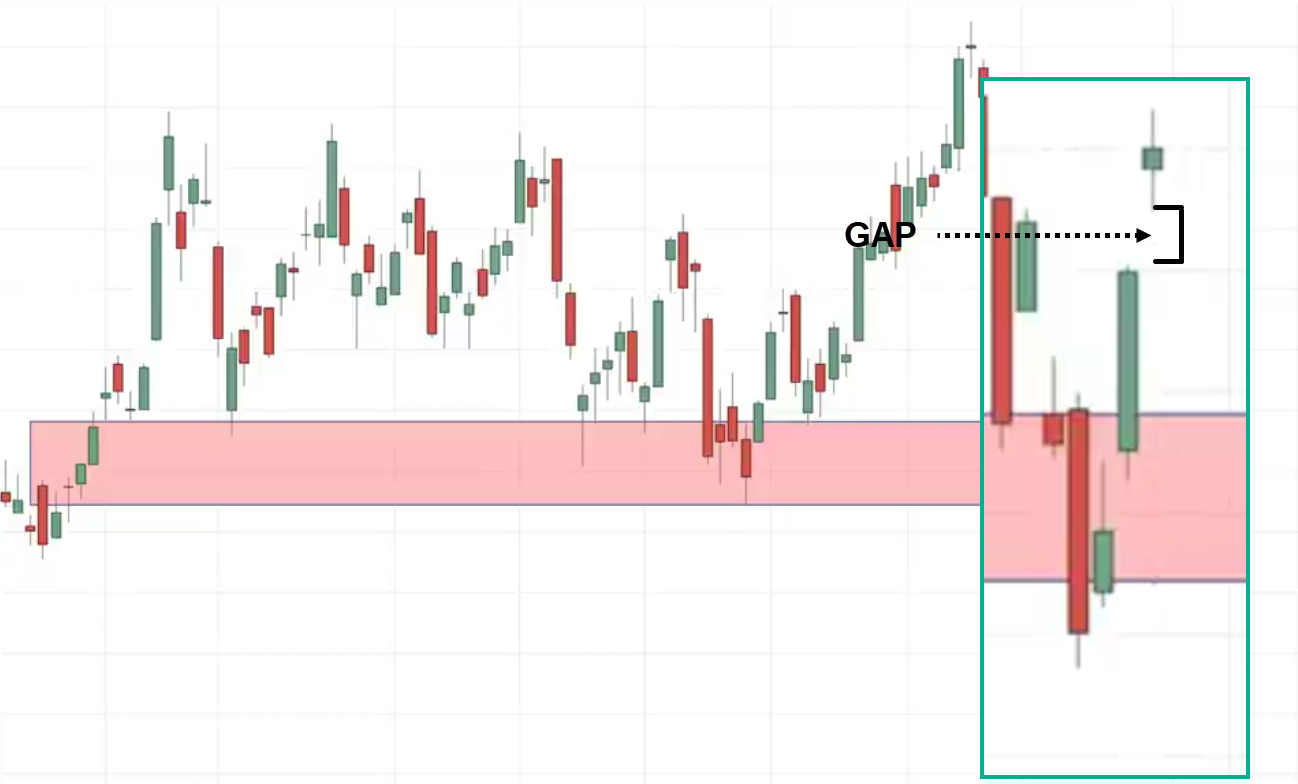

Illustration:

The market is in an uptrend like this, you have no idea where to purchase, you wish to wait for the value to retest this area of support, let it break below support, after which quickly revert above it and shut back above support.

When that happens, you’ll be able to look to enter on the following candle open.

Stops a distance below the low.

Your goal might be just before this recent swing high.

Why don’t we set above the highs?

Well, the issue is typically the market might come into these highs after which reverse down lower from it.

In case you set it above the high, sometimes the market may not reach after which reverse back and hit your stop loss, you don’t want that. Let’s be conservative.

You’ll have your stop loss just before the recent swing high.

Example:

I just need to share with you that the strategies and techniques will also be applied to the stock market.

In case you recall this strategy is pretty straightforward.

We’re searching for the market to be in an uptrend after which retest an area of value.

You’ll be able to see the market is in an uptrend and retest this area of support.

As you’ll be able to see, the market broke below support.

Many traders would think…

“Oh man, it is a breakdown time to short this market”

But I believe by now you already know if the market is in an uptrend and breaks below the lows, there’s an excellent possibility it could reverse up.

You’ll be able to see that we’ve got a green candle over here. But at this point, I wouldn’t have an interest too long just yet.

Because there’s a comparatively long upper shadow or upper wick as you’ll be able to see over here:

I quite hold my horses and see how the value behaves the following day price.

The following day, we’ve got a better close. So, we’ve got a false break setup.

This false break is somewhat bit different from our previous false break. This one requires two candles.

But still, it’s a false break because the value tried to interrupt below this low only to shut back up above support.

On this case, a few of you is likely to be pondering…

“Rayner, I don’t need to be buying these highs over here it’s a reasonably high”

What you’ll be able to do is one technique I can share with you.

In case you are a cheapskate like me, I don’t wish to buy at high prices you’ll be able to place a buy limit order below the day gone by’s closing price.

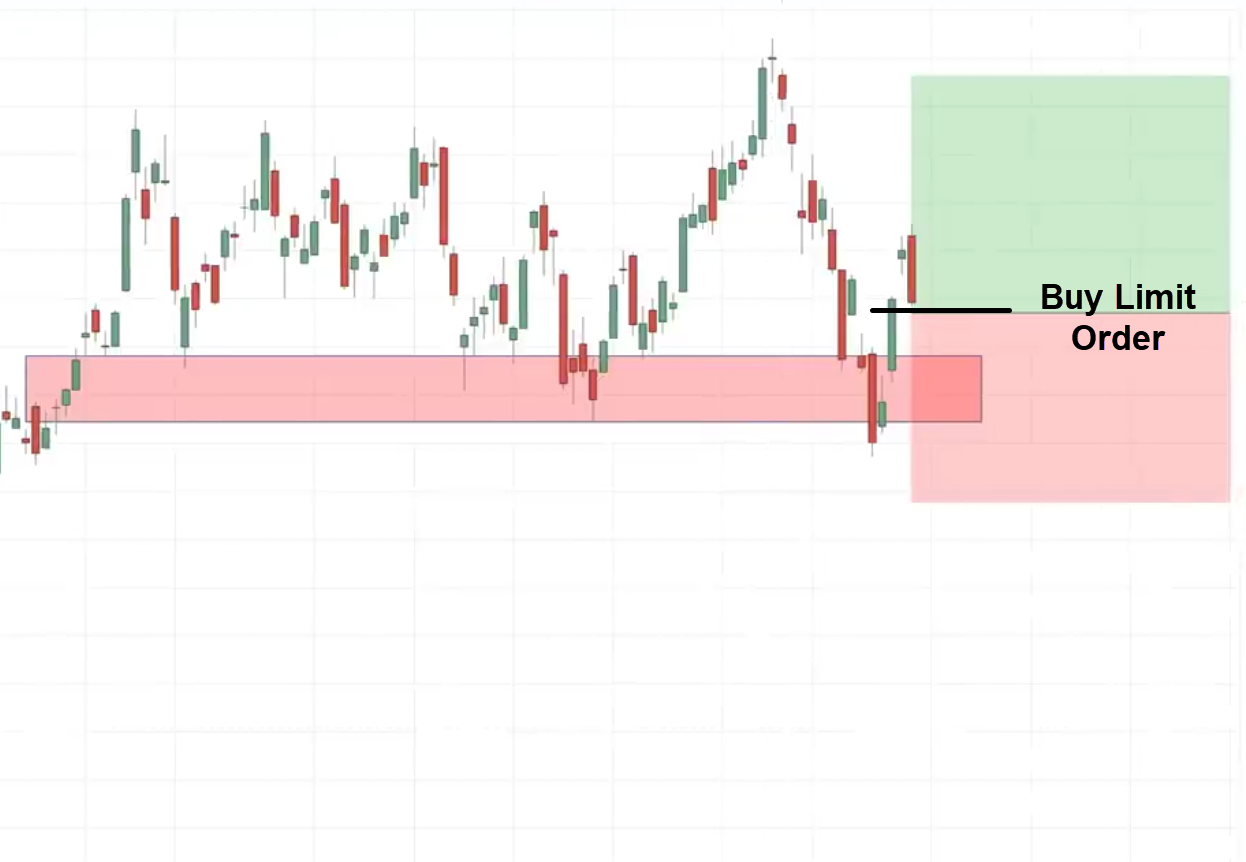

Here’s what I mean:

Let’s say the day gone by, the value closed at $20, you’ll be able to set your order and $19.

This offers you a greater entry price and would have improved your risk to reward on this trade.

On this case, let’s see what happened the following day…

The market gapped up higher. Here’s what I mean:

If the market gapped up higher, you wouldn’t be filled on the trade.

What you’ll be able to do is you’ll be able to still leave your buyer limit order there until it reaches your goal then you definitely can remove your buy limit order.

That is what it will appear to be.

That is a protracted position.

We placed a buy-limit order at $19.07. Stop loss a distance below the lows because we don’t need to get stopped prematurely.

Goal a distance before the recent swing high.

The market shows signs of reversal but we haven’t gotten filled on this trade because we’ve got a buy limit order and right away the market appears to be against us.

But remember we’re trading within the direction of the trend.

If the market were to hit our stop loss, it has to first break below this area of support which is sort of a barrier to carry up this higher price so the market has to work hard to achieve our stop loss.

Let’s see what happens next…

We’ve gotten filled on the buy limit order and now the market appears to be against us but remember, we’ve got a stoploss in place.

Let the market do what it must do remember we’re trading within the direction of the trend.

If the market were to hit our stop loss, it has to first break below this area of support which is sort of a barrier to carry up this higher price and so the market has to work hard to achieve our stop loss.

Let’s see what happens…

On this case, the market reverse-down took out these lows over here:

Now you understand why I at all times set my stop loss you already know distance below the lows. Because if I set it on the lows I might have gotten stopped out on this candle over here.

But since my stop loss is here, I’m still protected for now on this trade whether it’s a winner or loser, right?

On this case, the market then slowly consolidates after which finally starts to point out signs of reversal reaching our eventual goal.

This can be a very useful technique that I take advantage of.

The First Pullback Strategy

That is for traders who at all times buy the breakout, but the issue is you see the candle, the breakout is large, you purchase, and the market reverses and also you get stopped out.

Why is that taking place?

Well probably is since you’re chasing breakouts.

This strategy is to make it easier to avoid chasing breakouts and avoid unnecessary losses. That is what I call the primary pullback trading strategy.

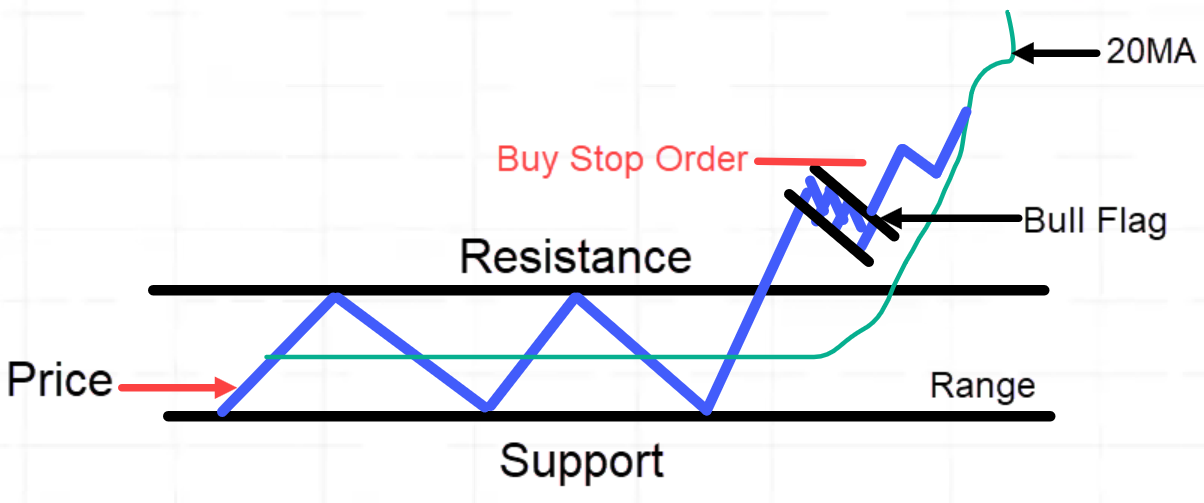

It looks like this…

The market is in a variety, it breaks out after which pullback forming something like a bull flag pattern.

In case you overly the 20-period moving average, you’ll see the 20MA support the value.

You’re waiting for the low of this build-up to the touch the 20MA.

Once it has done it then the value starts going up higher.

You’ll be able to place a buy-stop order above these highs and if it breaks up, you go long and then you definitely trail your stop loss to ride the trend higher.

Example

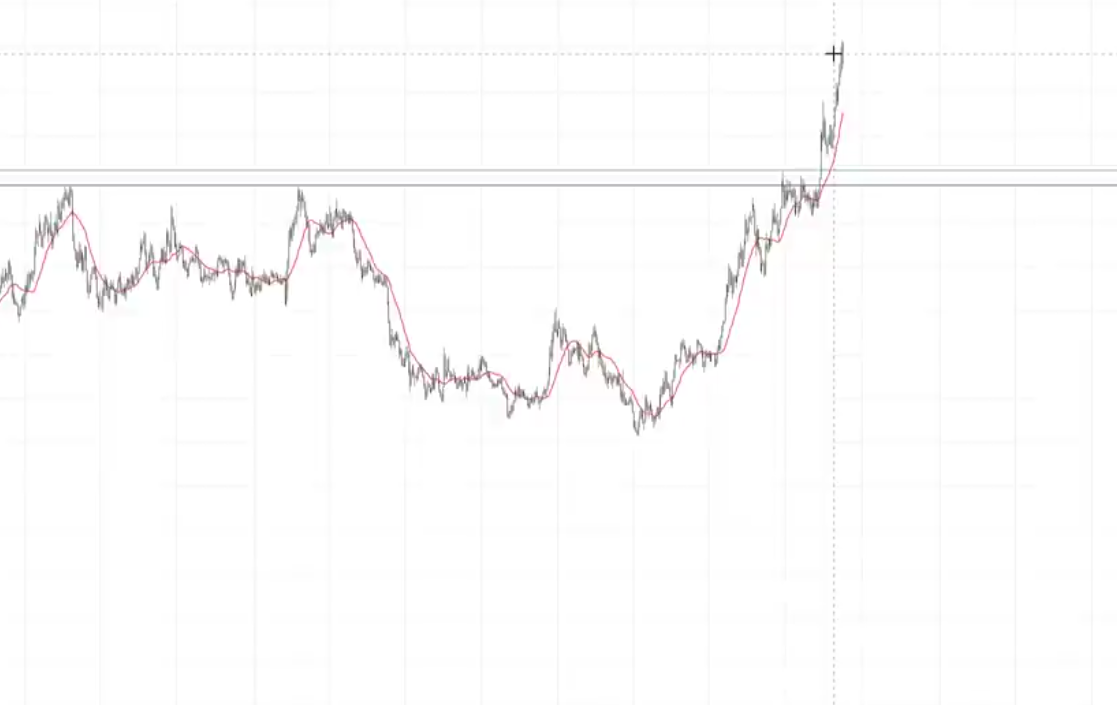

You’ll be able to see that we had a breakout over here on this candle recently.

Many traders would say…

“Rayner, that is bullish is time to purchase, it’s time to go long”

But the issue is where you’ll be able to set your stop loss. You’ll be able to reference the lows and this might be a really wide stop loss, that is what I mean:

Is there a greater solution to go about it?

Yes…

That’s what I call the primary pullback strategy which I’ll share with you.

On this case, you’ll be able to see the market starts to reverse so at this point, traders who buy the pullback are probably sweating out on me.

They’ve gotten stopped out, especially those that have a tighter stop loss.

You’ll be able to see it starts to consolidate over here…

Remember at this point, we also use the 20-period moving average to overlay it.

You see the value has already retested 20MA, this tells you that the market has digested the recent breakout move and it has stored enough energy to stage the following breakout higher.

What you’ll be able to do is place a buy-stop order above these highs for traders preferring the candle to interrupt and shut above the highs, that remains to be high-quality.

The market did eventually break about these highs over here and continues higher.

I don’t have a set goal over here because you’ll be able to see the value is trading at a no man’s land.

There is no such thing as a price structure and resistance nearby, you’ll be able to trail a stop loss to ride the trend higher.

There’s a 20-period moving average that you could use to trail your stop loss.

If the value breaks below the 20MA you exit the trade.