Video Transcription

In the beginning.

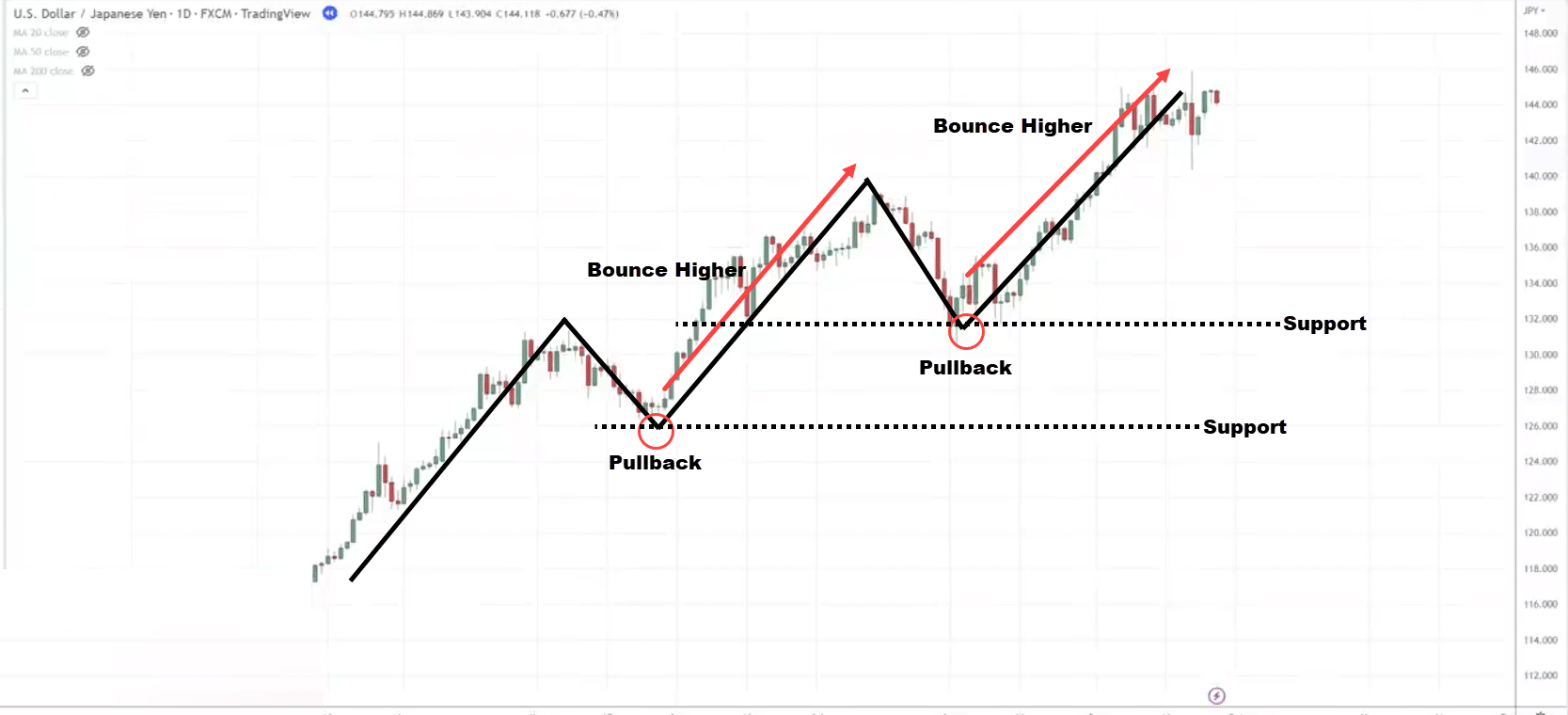

That is an example of a market in an uptrend:

If you happen to know a market is in an uptrend, you simply need to discover an area of support on the chart.

The way in which I do it’s to discover the areas on a chart where the market bounces off higher.

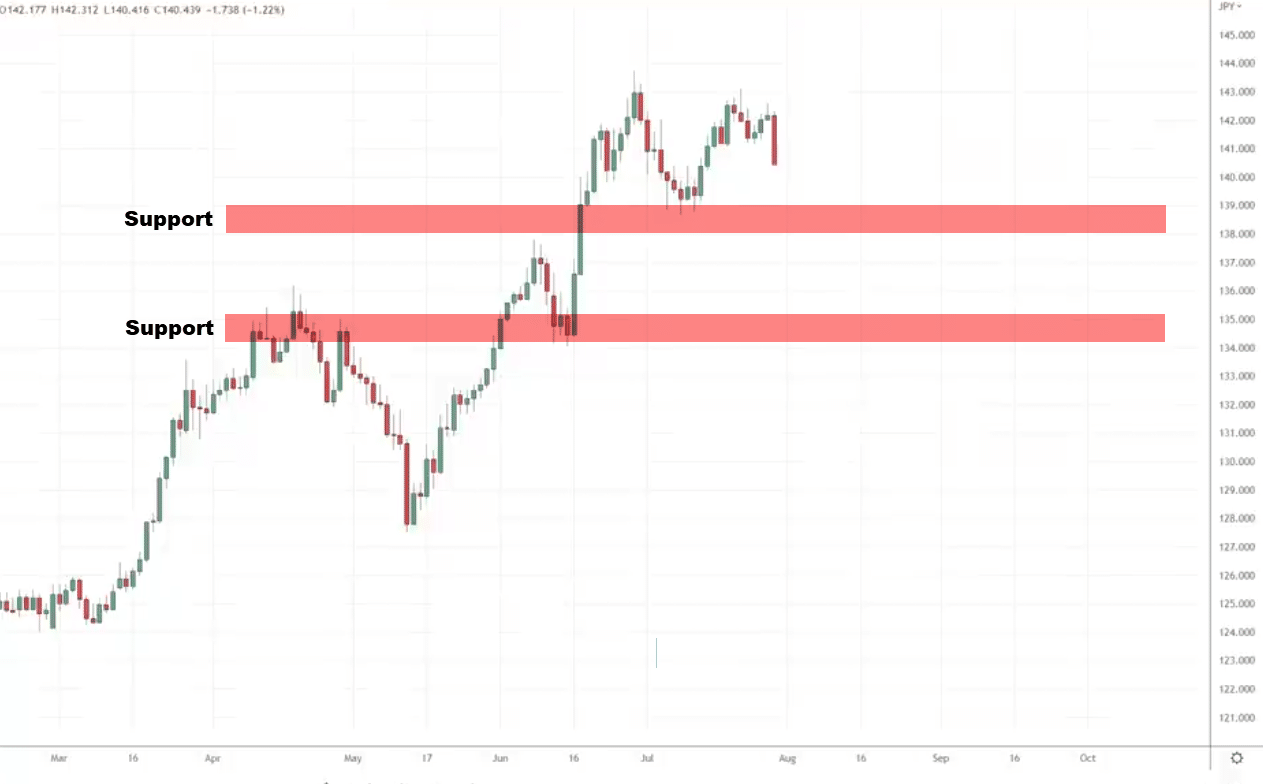

What I’ll do is I’ll draw an area of support.

Here’s what I mean:

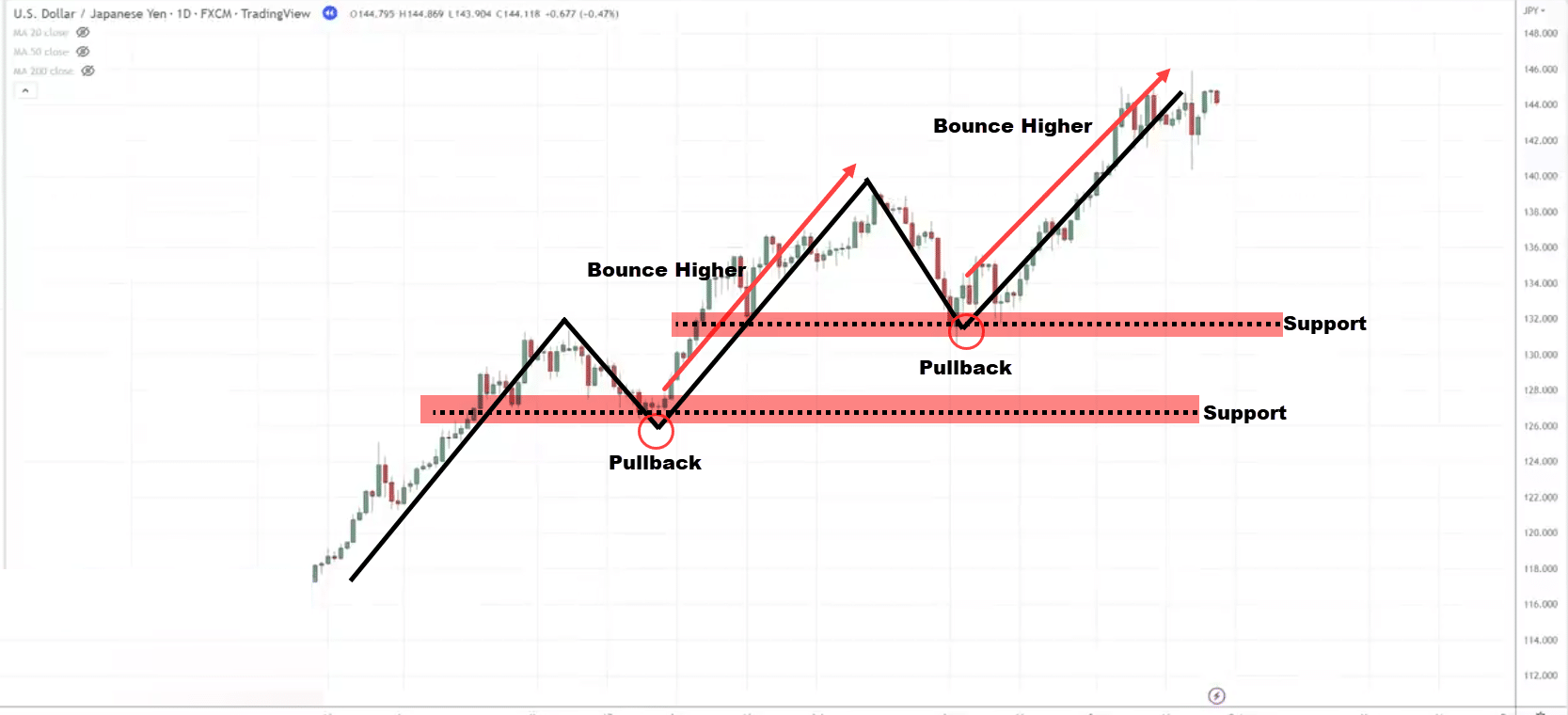

How do I fine-tune my level?

The way in which I wish to do it’s that I like my area of support to get as many touches as possible.

I might just adjust my support and push it barely higher.

This manner, I got multiple touches.

Again, one other tip I would really like to share with you is that support and resistance are an area in your chart, I wish to draw them as lines on the chart.

That’s my habit.

But you should use the rectangle tool on TradingView to focus on the realm in your chart. That is what I mean:

This reminds you that it’s not a line but slightly an area in your chart.

One other thing to share with you is that once you draw support and resistance, I typically haven’t greater than two areas on my chart.

Because if you may have too many, you’re going to feel overwhelmed.

You could be pondering…

“Rayner, what about this one over here, that is one other level you possibly can draw”

That’s true, those are levels that you may draw.

But here’s the thing…

They may just clutter your chart with lots of unnecessary information.

I often just need to keep only the 2 most up-to-date ones.

Why is that?

Let me explain…

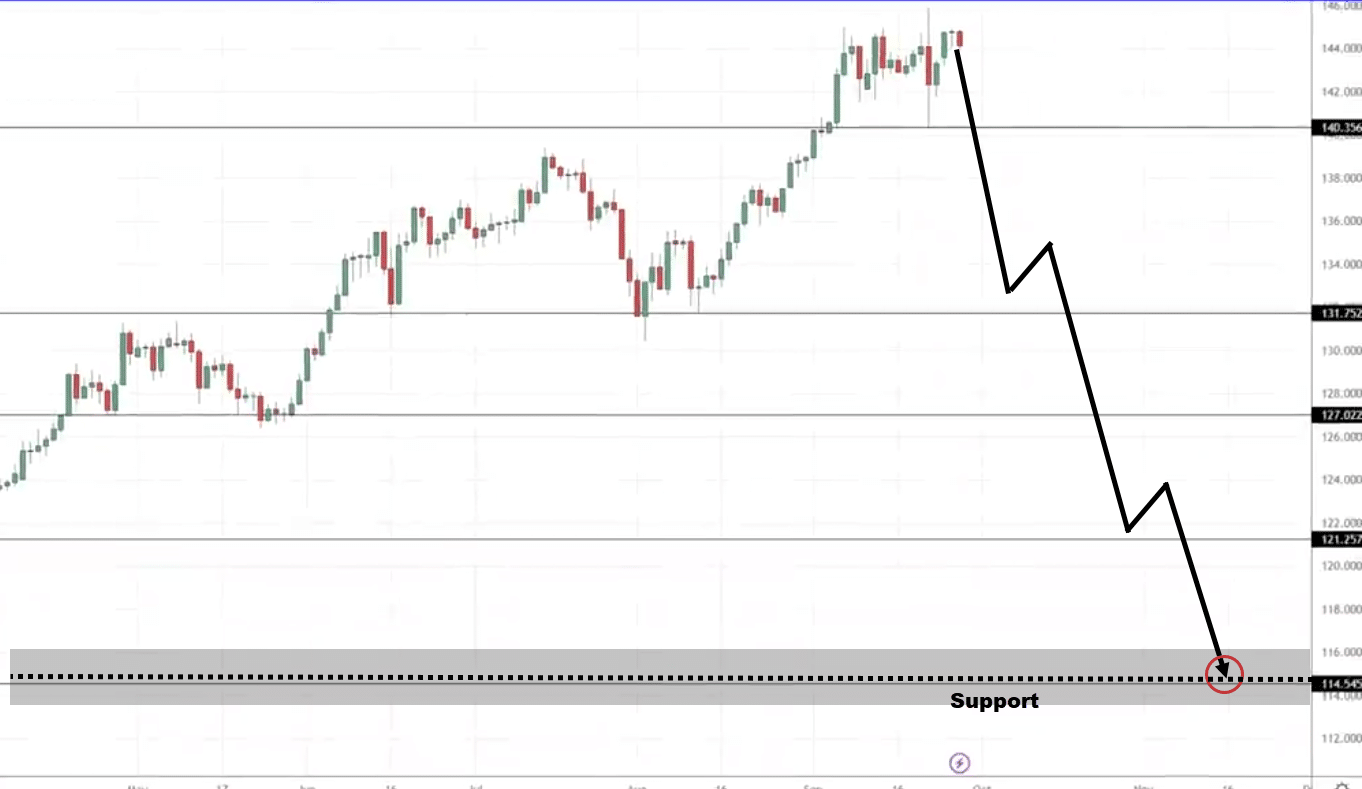

Why don’t I even have this particular level over here to go away it as support?

Take into consideration this if the market comes right down to this area of support over here, the market reverts down twice.

Do you must be buying at this price point?

The reply isn’t any though it’s an area of support.

Why?

Because by then the market isn’t any longer in an uptrend!

At that time, the market is more likely to be in a downtrend.

If the market is in a downtrend, I need to sell it resistance, not buy at support.

Because of this I just haven’t any greater than two areas of support on my chart.

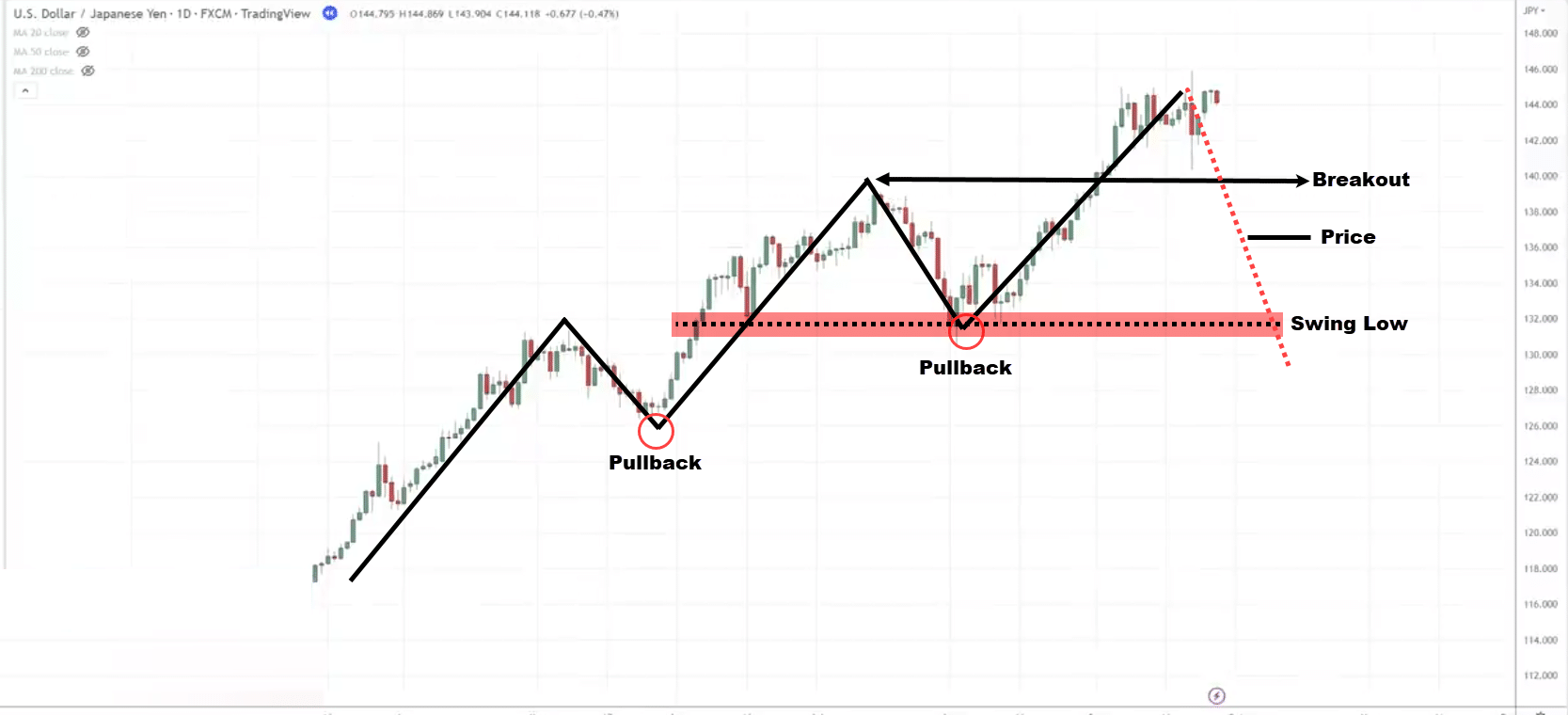

Also, yet another thing so as to add is that this level over here might be significant.

Why is that this level significant?

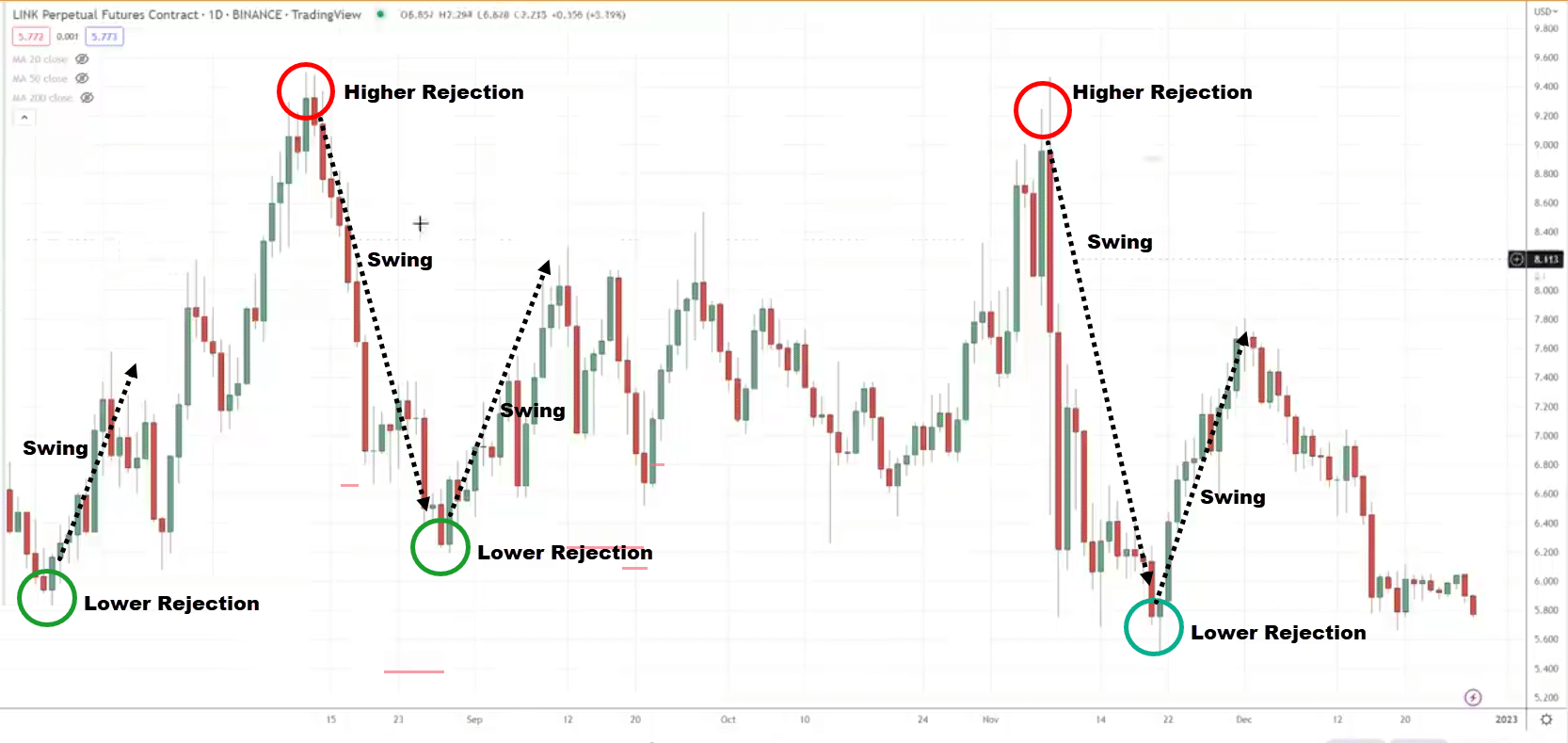

Recall about uptrend invalidation. The uptrend can be invalidated when the value breaks and shut below the swing low that precedes the breakout. That is what I mean:

To me, it’s not in an uptrend it possibly could go into range or perhaps a downtrend altogether.

That is what I call “The last line of defense”

Example:

Have a look at this chart over here:

How will you draw resistance on this downtrend?

Where will you draw your area of resistance on this downtrend?

I need to say that there’s no right or improper. It’s just my way of identifying resistance. If you may have a way that works for you, that’s great.

But should you’re latest, you may have no idea where to begin you then can try using my method first. Then tune what works for you.

For me, I wish to listen to the 2 most up-to-date highs where the market declined. Here is an example:

Why I don’t have so many resistance levels may be very easy.

Imagine where the value is now, let’s say the market rallies as much as this highs:

Do you continue to need to be selling at this price point?

Probably not.

Because this market is probably going not in a downtrend, it’s probably in an uptrend.

As you may have learned, in an uptrend you must be seeking to buy at support.

Because of this I typically have just the 2 most up-to-date resistances on my chart.

That’s just about it.

On this case, let’s say the market comes as much as this area of resistance, that is where I search for selling opportunities to short this market:

But after all, I don’t blindly sell when the market involves this price level, there’s one other thing to look out for which I’ll share with you.

Methods to Draw Support and Resistance in Range Market

The concept is analogous, you must discover the areas on the chart, where the market has an enormous swing.

Example:

These are key areas since the market has a powerful collapse from it.

When you discover these key points where the market just kept getting rejected higher and lower, that is an area on the chart where you must listen.

I like to recommend using the rectangle tool as previously discussed, so you possibly can higher discover your support and resistance.

You may have learned how you can draw support and resistance like a professional.

Trading Strategy That Allows You Profit in a Bull and Bear Market

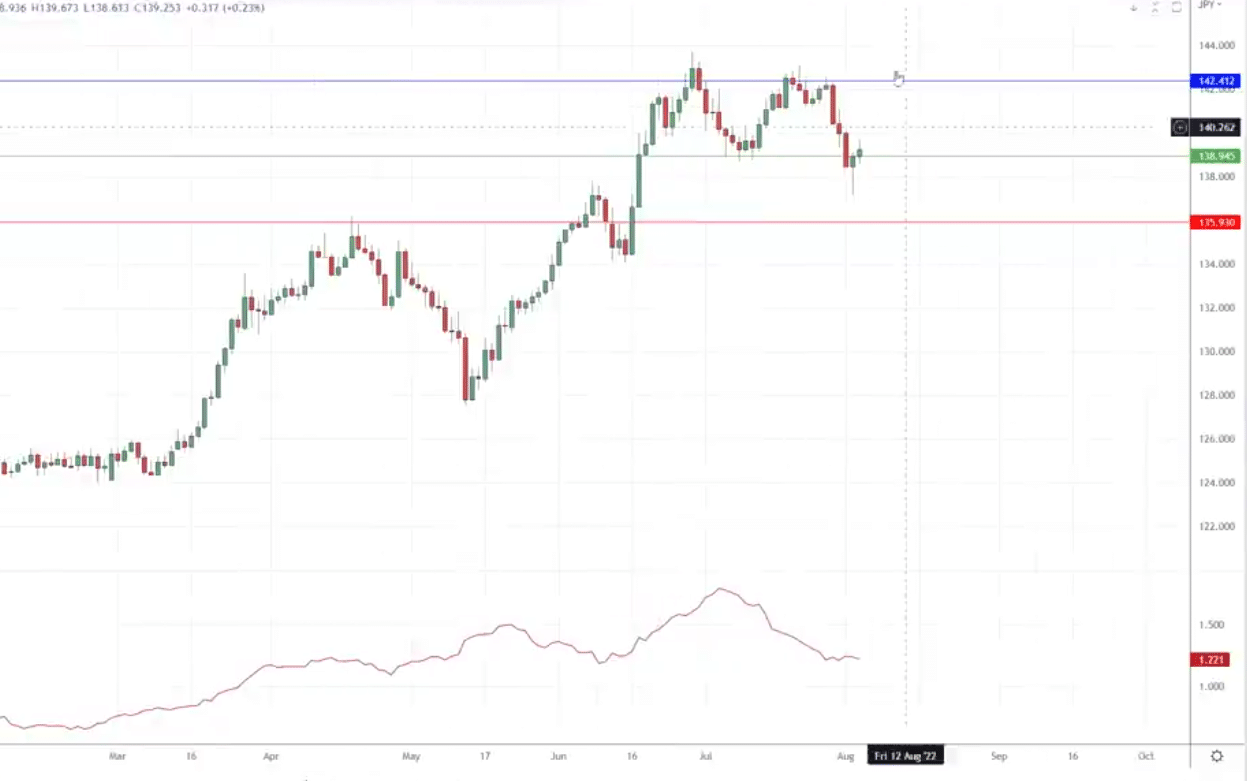

Take a take a look at this chart:

What’s the market structure?

Market Structure

When the market is in an uptrend, we wish to be buying as much as possible at support.

Area of Value

Let’s discover our area of support on this chart:

These are the 2 most up-to-date swing points.

My next plan is that I might be in search of buying opportunities in the primary and second areas of support if the value comes down.

Let’s see what happens next…

Entry

The market comes down into this area of support and we’ve a hammer.

If you happen to remember a hammer tells us that the buyers are temporarily on top of things as they’ve managed to push the value and shut near the highs of the day.

So, this can be a valid entry trigger to go long. We go long on the subsequent candle open.

Exit

Generally, after I set my stop loss, I’d wish to have it a distance below the realm of support.

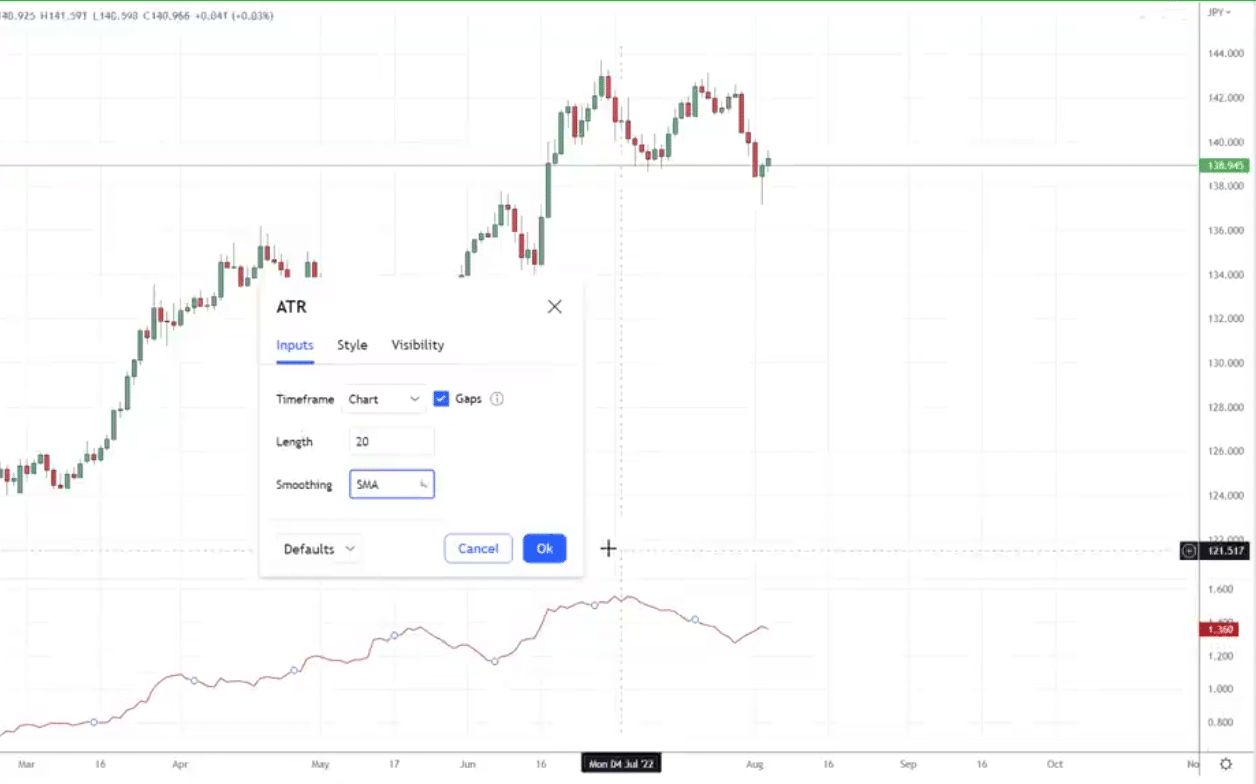

The one technique to go about doing it’s that we will use the ATR indicator to assist us with it.

So just search ATR, and pull it up. I typically go along with our 20-period ATR and SMA

The ATR Value is 1.221

We discover the lows of the candle and minus 1.221

The low of the candle is 137.15

137.15 – 1.221 = 135.93

This may be our stop loss.

Targets

There are lots of ways to go about setting your goal, but for simplicity’s sake, we will set our goal just before the recent swing high.

This swing high over here may very well be a great reference point for us to take profit where sellers might are available and put some selling pressure over here.

This a great example of how you should use support and resistance to time your entry and discover trading setups available in the market.

Conclusion

Support and resistance levels are essentially the most versatile tool you possibly can ever learn and master.

Nonetheless, learning how you can draw support and resistance levels accurately generally is a double-edged sword.

It will possibly give you accurate entries and trade management ideas.

But at the identical time…

Learning how you can draw and apply them accurately could be quite difficult.

Nonetheless, here’s what you’ve learned today:

- You possibly can fine-tune your support and resistance levels by all the time bearing in mind essentially the most touches in an area

- Support and resistance levels are areas in your chart: drawing them using boxes and contours captures the principle that they’re areas (and never lines) in your chart

- In a variety market, all the time look out for higher and lower rejections as a reference to your support and resistance levels

- Support and resistance levels are powerful tool to time your entries as the value rejects from support and to also time your exits if the value reaches resistance

Over to you…

Has support and resistance stuck in your trading for the longest time?

If that’s the case, are there every other suggestions you possibly can add to the list on how you can draw them accurately?

Let me know within the comments below!