Trade in the trail of least resistance

Often a mistake that many traders make this error, and I’m guilty of this too. I used to trade based on what I feel not what I see.

I take a look at the chart and I feel…

“Oh man, look how high the value is, it looks really expensive time to sell”

I do exactly that, I short the market next thing you already know the market continues up even higher.

How about this the stock price is in a downtrend and I’m considering to myself

“Man look how low cost this stock is it could go down let me buy and dabble a bit of bit”

Next thing you already know the stock price got even cheaper.

The error I made is because I trade based on what I feel not what I see.

That is where I would like you to trade along the trail of least resistance trade based on what you see and never what you’re thinking that and to do this could be very easy.

Have a look at this.

If the market is in an uptrend, you look for getting opportunities, and if the market is in a downtrend, you search for selling opportunities and that’s it.

If you happen to’re an authority trader and also you do counter trend trading and stuff like that every one the flamboyant stuff, go ahead.

But in the event you’re a latest trader, in the event you’re struggling to make a profit I like to recommend trading along the trail of least resistance.

That is where trading becomes easier for you.

Examples

You is likely to be wondering…

“Rayner, the market is in an uptrend, but where exactly do I purchase?

Good query.

If we take a look at this chart over here:

You may see that this stock is in an uptrend, you is likely to be wondering…

“Rayner, where exactly do I purchase now that this stock is in an uptrend?

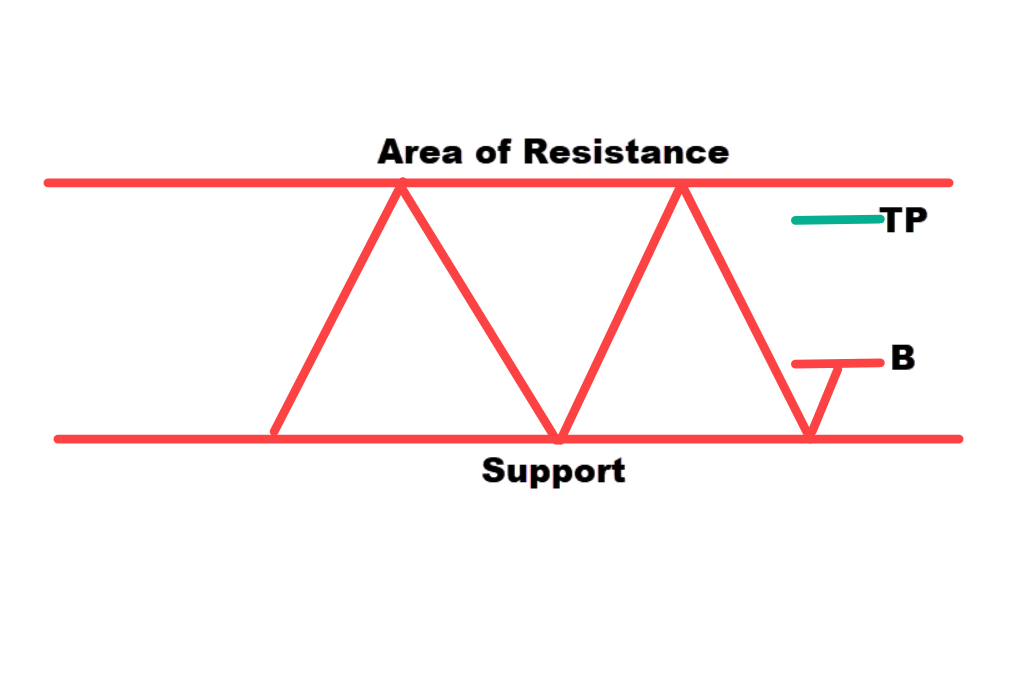

One thing to share with you is that I prefer to look for getting opportunities right in the realm of support.

The world of support is an area on the chart where the market prices reverse up higher.

Here’s what I mean:

To walk you thru, the market rallied up higher, it made a pullback, then it rallied up higher, gave me one other pullback, rallied up higher, gave me one other pullback, after which boom, rallied up higher to where it’s immediately.

If you happen to ask me, that is an area of support a level that I would like to concentrate to. Here is an example:

That is one method to discover your area of value within the chart to look for getting opportunities and in fact, you possibly can stack it up with multiple tools and indicators to discover whether that level has a high probability of reversal.

One other technique I would like to share with you is a method I learned from a trader called @trader1sz, from Korea.

He likes to make use of the yearly open the yearly highs and the yearly lows to search for potential buying opportunities.

I’m going to drag that out you possibly can see over here on the chart:

This dark red line over here simply tells me that’s the previous yr’s high. The present yr is 2023, which tells me that that is the high of 2022. That is what I mean:

The blue line is the low of 2022.

Again, this indicator is free on TradingView. It is a significant area on the chart once you search for potential buying opportunities.

One easy technique is that if the market makes a pullback over here:

I’m on the lookout for bullish reversal candlestick patterns like a hammer., when that happens that’s an indication that the buyers are possibly stepping in. Here’s the way it looks like:

Take an extended position to enter the following candle open, stop can be a distance below the low. A possible goal could possibly be just before this recent swing high. Here’s what I mean:

Allowing me to capture that one swing up higher so there’s a possible trading opportunity that I’m taking a look at.

Along the best way, you’ll understand why I’m on the lookout for this buying opportunity and the way I’m trying to trade this setup.

Now take a look at this chart:

Let me ask you…

Are you on the lookout for buying opportunities or selling opportunities?

The reply is selling opportunities.

Since the market is in a downtrend.

You might be seeing several blue arrows and you might be wondering…

“Rayner, what are those blue arrows?”

Those blue arrows are where the value reverses.

How could you’ve got predicted where this market could reverse ahead of time?

One other thing to share with you is that once you’re coping with support and resistance, those are useful techniques to discover where the market might reverse from.

Because the market is in a downtrend, you should search for selling opportunities at resistance.

One other thing to indicate is that when the market breaks below support, support could turn out to be resistance and reverse down lower from there.

Examples

USD/MXN

This particular currency pair respects this phenomenon.

Notice how nicely right previous support when broken became resistance right over here.

One other area of support tested once, twice, and thrice

We had this reversal at this previous point, which became resistance. Here’s what it looks like:

You may do that ahead of time.

If the market were to interrupt below this low, here’s what I mean:

Then there’s probability that it’s going to search out resistance over here:

Search for selling opportunities with the expectation of lower prices to return since this can be a downtrend.

Hopefully, these techniques will show you how to know where to purchase and sell on the chart and when to be a buyer and a seller.

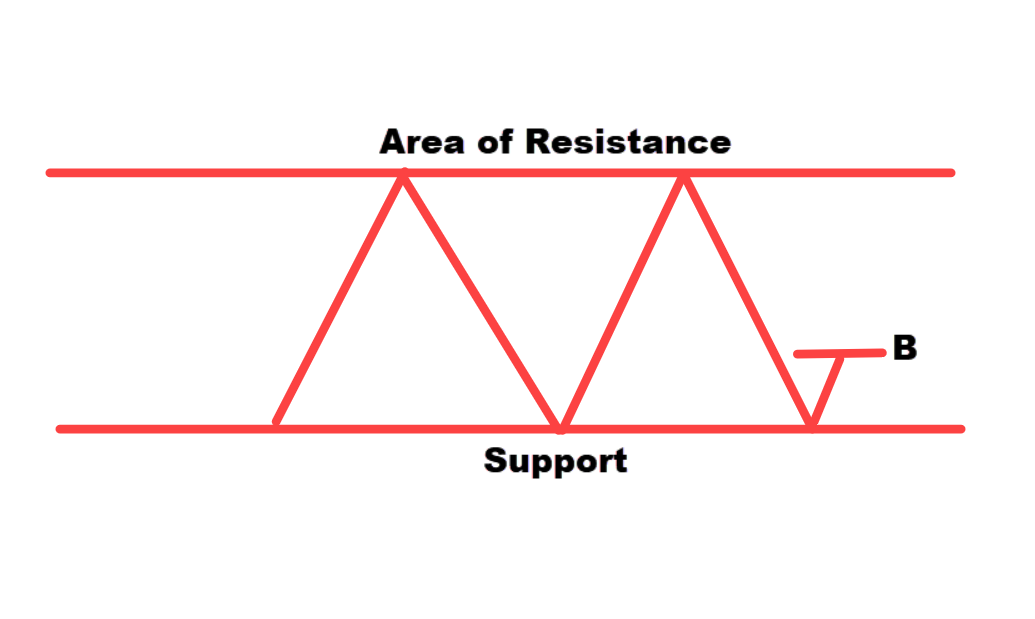

If doubtful, zoom out

EURNZD H4

You is likely to be considering…

“Rayner, should I search for shorting or buying opportunities?”

Because in spite of everything this market looks prefer it’s in a spread. That is what I mean:

Should I look to purchase or sell?

Now, in the event you just look solely based on this chart, it’s quite hard to inform since you don’t have any directional bias.

If you happen to are doubtful, in the event you’re unsure whether to be a buyer or seller, then just zoom out.

Let’s go as much as the day by day timeframe on this case:

You may see that this market is in a long-term uptrend.

Notice the value making a series of upper lows and better highs. That is what I mean:

There’s an area of resistance over here:

Forming an ascending triangle pattern.

There may be probability that the market could break up higher of this resistance.

Since you already know this market is in an uptrend, you’re going to look for getting opportunities.

Does that make sense?

Tips on how to trade the setup

You may see how zooming out offers you a clearer perspective.

Going back to the H4 timeframe, knowing what you already know now.

There are just a few ways you possibly can trade this setup.

Buying opportunities in an uptrend

If you should look for getting opportunities in an uptrend, this will likely be an area of value you could search for. Here is an example:

That is an area of value.

If you happen to take a look at this, perhaps the market could break out higher after which retest the previous resistance which could turn out to be support.

Let’s see… if our yearly high and low have any confluence.

Yes, we now have…

You may see over here, that that is the previous yr’s high. The market, let’s say makes a deeper pullback.

That is an area of value (AOV) and a key area of support.

Tested twice, and possibly here again.

That is where you’ve got to look for getting opportunities towards the long side.

TIP:

If doubtful, just zoom out.

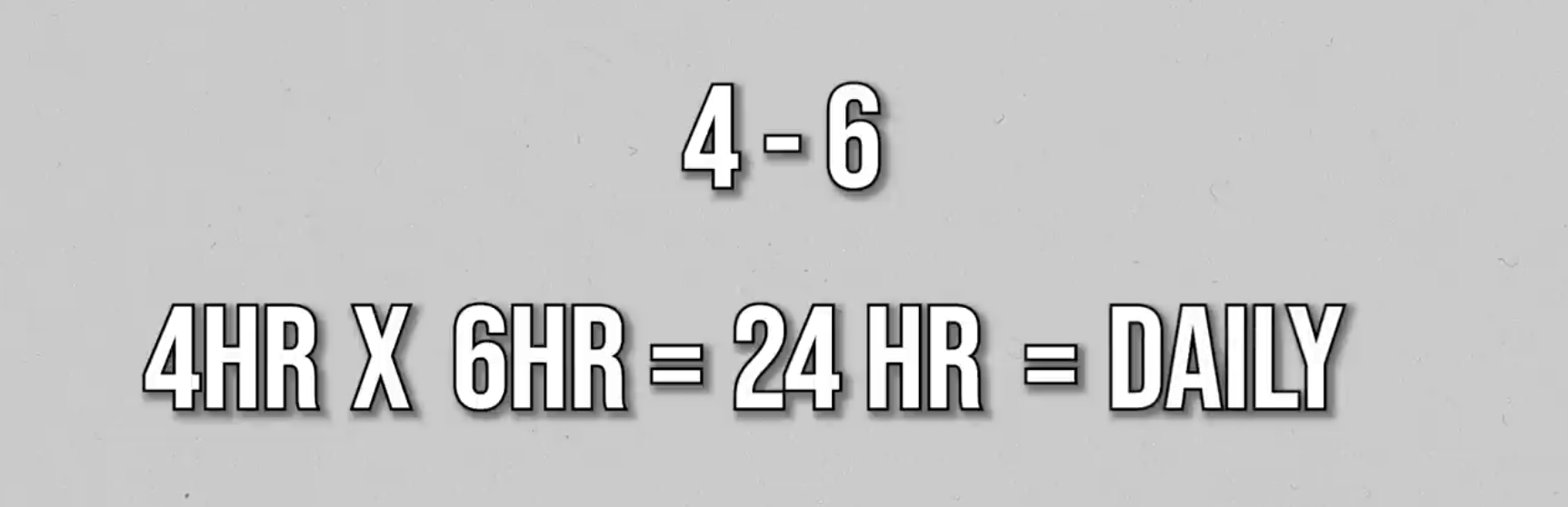

A fast method to know what timeframe to zoom out is you employ an element of 4-6

Previously, we were on the four-hour timeframe. If you happen to go by an element of 6. Multiply 4 by 6hr which is the same as your day by day timeframe.

Now, sometimes once you zoom out of your charts, things might still not make sense to you. And what do you do then?

This brings me to my third lesson.

Still doubtful? Stay out

If you happen to’re still doubtful after zooming out, then stay out. Remember this…

“No position available in the market is a position itself”

The final thing that you should do is to force a trade perhaps since you’re bored.

You may have got itchy fingers, right?

For the fear of missing out you should force the trade.

What happens next?

You find yourself incurring unnecessary losses that wouldn’t have occurred in the event you had followed your trading rules.

Your mental capability and trading account are blown.

You may have thought like, why am I so reckless? Why am I so ill-disciplined? Why am I so silly?…

Let me take back what’s mine from the markets.

When you’ve got such thoughts, what you’re going to do is you begin to revenge trade.

You begin to widen your stop loss, which is out of your trading plan. What happens is that you just find yourself suffering much more.

You don’t wish to go down that path.

To sum it up could be very easy. If doubtful, zoom out. If you happen to’re still doubtful, then stay out.

Honor your stops

This is significant so pay close attention.

BTCUSD

Some traders might even draw this trendline after which say,

“Hey, you already know, Rayner, this could possibly be the reversal of Bitcoin and the market could go up higher”

They appear to enter on the following candle open. Stop loss, possibly below this low or around $38,000 price. Here’s what I mean:

Let’s see what happens next.

The unique plan was to go long on the following candle open stop loss at $38,000.

Then you definitely see the market rally up higher and begin to reverse against you… For instance:

Again, one other reversal at this trendline.

Boom!!!

The market reversed against you and doubtless would have hit your stop loss.

But at this point, some traders might argue

“But Rayner, if I were to chop my loss here, I’m cutting into this area of support.”

Then there’s possibly one other area of support:

I don’t wish to be cutting my loss into this area of support.

Because buyers are coming in and will push the value higher.

So let me hold on to that trade and perhaps the market could just reverse higher shortly.

Let’s see what happens next…

You may see shortly afterward the market collapsed even lower.

You is likely to be considering.

“Rayner, immediately the market is oversold, the rebound has to occur, the market has to rally a buyer”

When the following rally comes, I’ll exit a trade for a smaller loss or perhaps a break even.

You don’t wish to take this huge loss at this point.

See what happens next.

You hold onto the trade, and the market collapses even lower.

At once, the market is over here. If you happen to had risked 2% of your account firstly now, you’re probably down 15-25% of your account.

What’s the lesson over here?

The lesson over here is to honor your stops. Every large loss starts as a small loss.

That’s not all because a small loss is loss.

Why is that?

It’s since you preserve capital, you get to clear your mind and more importantly is that if a trading opportunity presents itself, you possibly can reenter it with a clean way of thinking.

If you happen to fail to plan, you intend to fail

Let me ask you…

Do you already know the explanation why so many traders lose money in markets?

Here’s why…

You take a look at a chart and also you see a series of massive bullish candles you already know, three big candles in a row and here they are going to think to themselves…

“Rayner, look how bullish this price motion is, let me just buy and catch a small piece of the move”

I’ll quickly get out of the trade before the market reverses against me.

Now, what’s the problem with this?

Well, easy…

Let me ask you.

If the market were to reverse against you shortly after you hit buy… Where do you exit?

If the market, let’s say, does move in your favor, when will you’re taking profits?

If the market moves in your favor after which starts to reverse the gains, do hold on to the position considering that you’ll proceed higher?

Do you exit the trade for whatever small profits or a small loss that you just’ve incurred?

Are you able to see where I’m coming from?

If you happen to can’t answer any of the questions that I asked earlier, it signifies that you’ve got did not plan.

That is why in the event you do go on the market you see families with many kids, 3-7 kids, clearly, the couples probably fail to plan.

That explains why I actually have three kids myself ha-ha.

How do you avoid getting caught when the market catches you off guard?

I’m going to share with you this quite simple checklist:

Do you already know why you might be entering the trade?

The reply could be very easy. It must be since you’re following your trading plan, your trading rules, and your trading strategy. Anything like FOMO and itchy fingers.

You shouldn’t be entering the trade in any respect.

Do you already know when to get out in the event you are flawed?

The trading setup could possibly be perfect, all the celebrities are aligned, and you can still get it flawed. The market could still turn against you.

When do you get out in the event you’re flawed?

A quite simple rule that I follow is to set your stops at a level where your trading setup is invalidated.

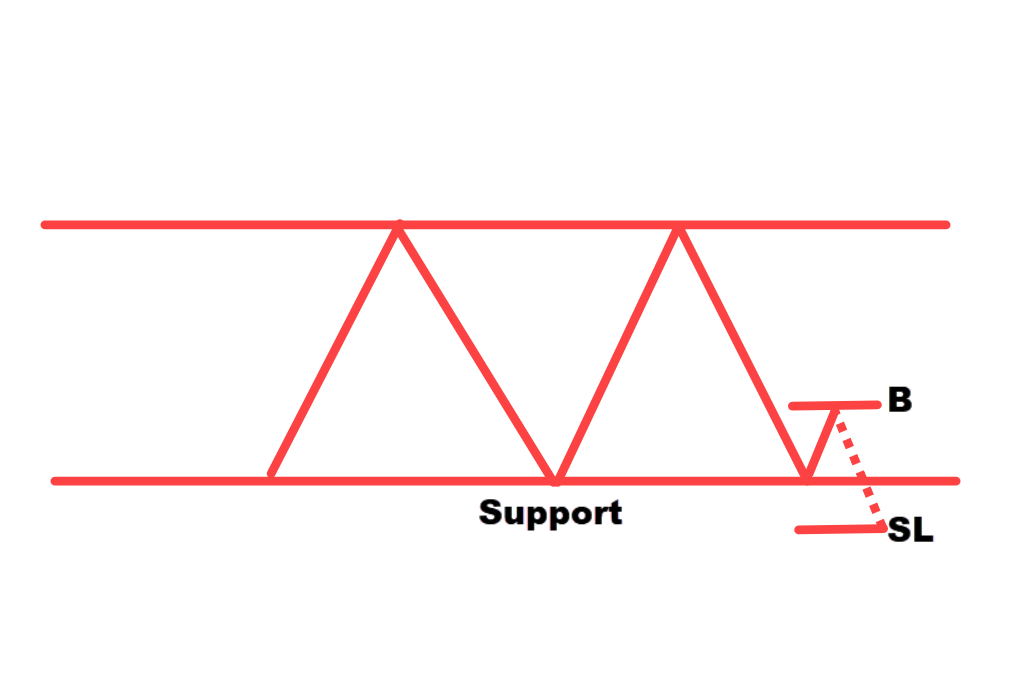

Let’s say you purchase when the value comes into support, and you’ve got an impulse to purchase. At which price on this chart will your trading idea be invalidated?

If the value breaks below support, then your trading setups are invalidated. If the market comes right down to hit your stop loss.

Clearly, at this point, the realm of support is broken, you need to get out of the trade.

If you happen to are flawed, is the loss a fraction of your account?

Ideally, you should be sure that that your loss is just not greater than 1% of your account. This fashion in the event you incur 4-7 losses in a row, it’s still not the tip of the world, since it’s only a fraction of your account.

Do you already know when to get out in the event you are right?

What if the market starts to maneuver in your favor, where do you’re taking profits?

The final thing you should do is to carry the trade ceaselessly, after which watch it come back to your entry hit your stop loss, and all is gone.

A method you could consider is…

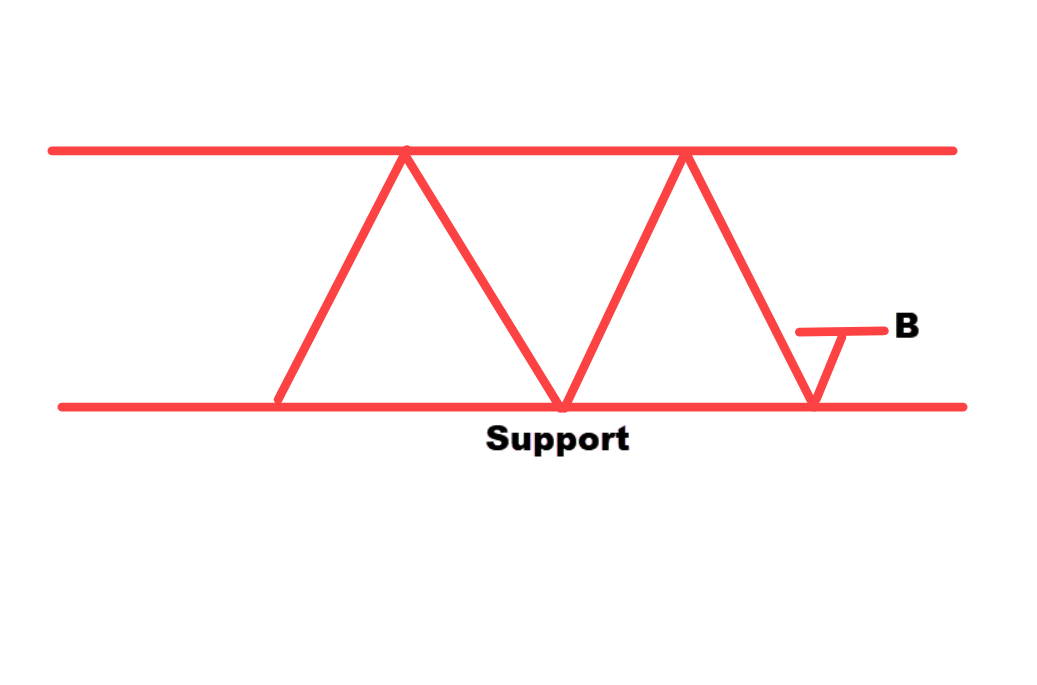

Market in a spread.

Then it comes right down to this area of support, which matches up higher, and then you definately buy.

If you should capture a swing, you possibly can look to exit your trade before opposing pressure steps in.

Let’s say you purchase near support, where my opposing pressure coming in is that this area of resistance, here is an example:

Somewhere about here could possibly be your take-profit level to exit a trade before the opposing pressure steps in.

That is where you get out in the event you are right.

The Holy Grail of Trading

After trading for greater than 10 years now, I’ll say that is the closest thing to a free lunch you could get in trading.

It’s what I call the holy grail of trading.

To clarify this idea, let me share with you a few trading systems that I teach in my premium program called The Ultimate Systems Trader.

Mean Reversion Trading System

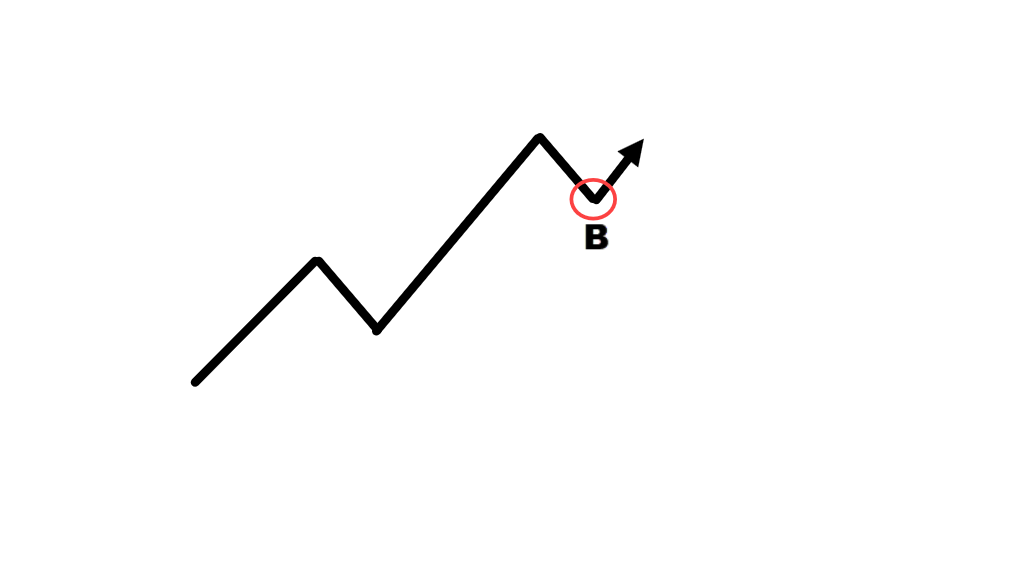

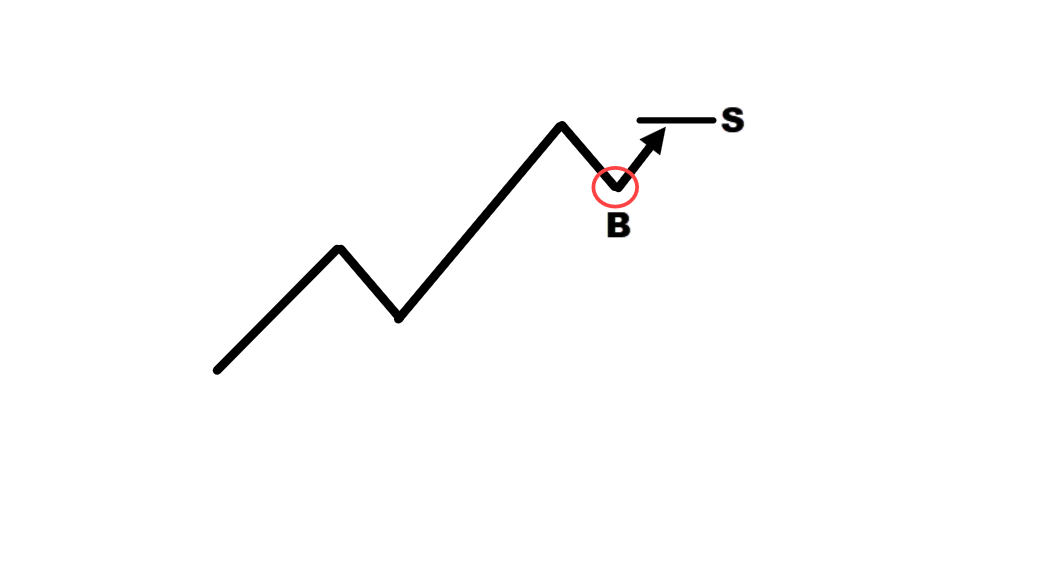

The thought behind this trading system could be very easy. We wish to discover stocks, which are in an uptrend, we wait for a pullback, after which we glance to purchase.

When the stock hits higher, we glance to capture that one swing, and we sell over here.

You may see we try to capture this swing on the market in individual stocks. That’s the mean reversion trading system.

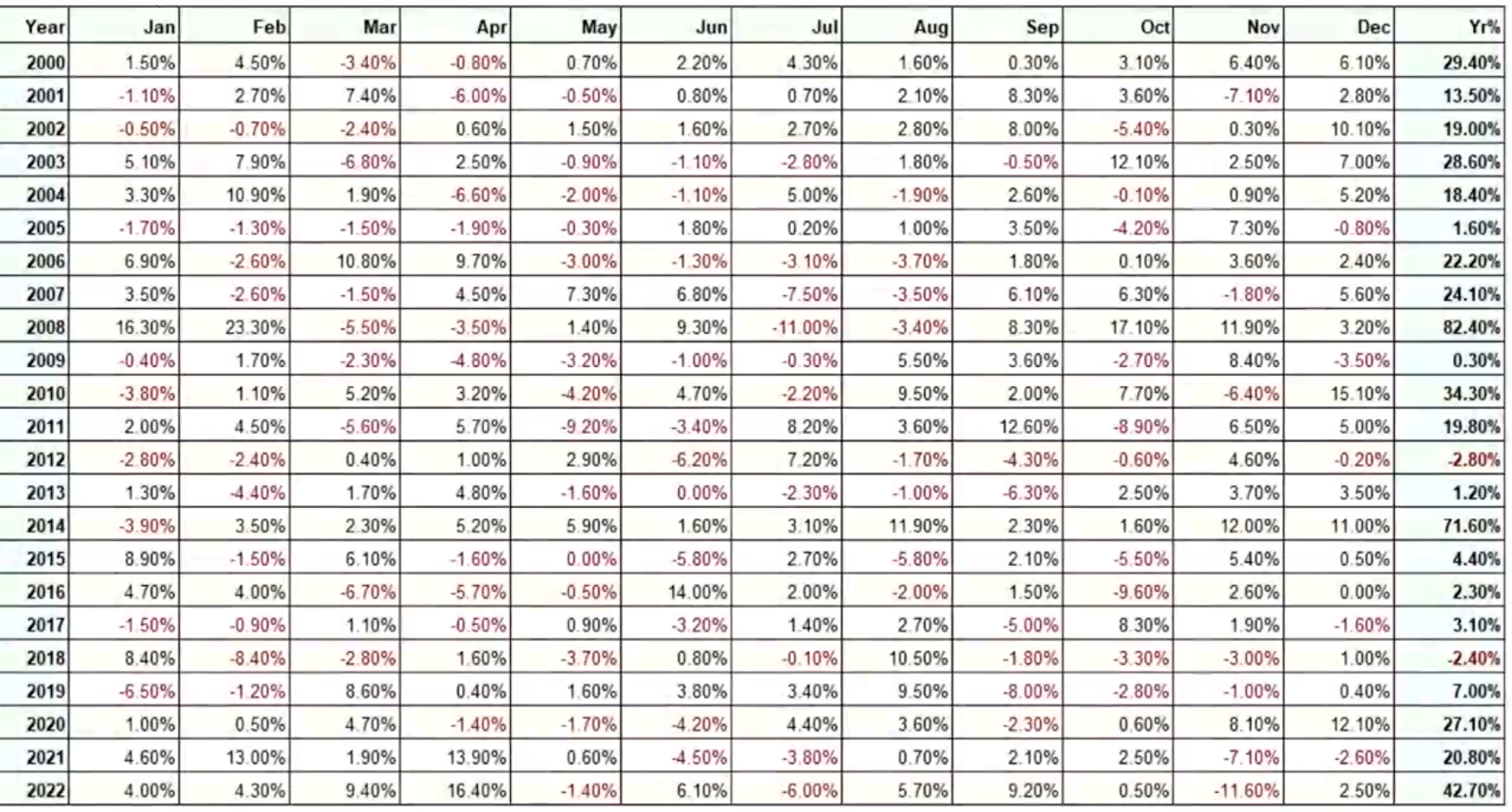

You may see that that is the performance of this technique during the last 23 years:

In 2000, It was up about 165%. In 2022, Down 3.8%, and in 2021 Up 29.8%.

That is the way you read this table.

Systematic Trend following system

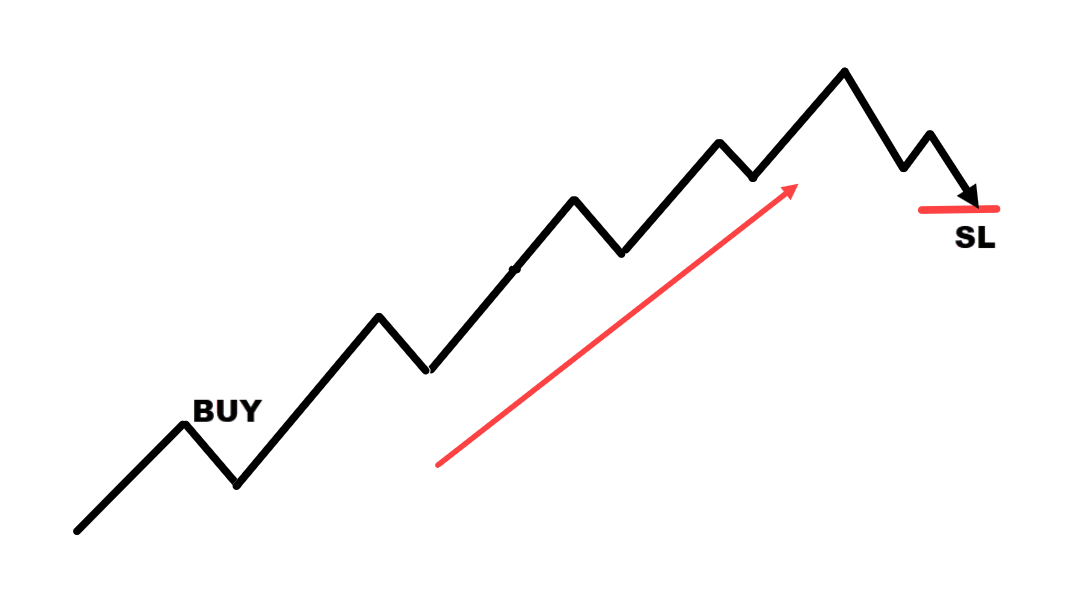

This method looks to ride trends across the commodities currency pairs, indices, and all the various futures markets.

What we do is we discover markets which are already trending

Then ride the trend for so long as it lasts until it shows signs of weakness or hits our stop loss.

That is the result since 2000-2022:

2022 it’s up about 42%. A losing yr in 2012 for two.8%.

In 2000 we’re up about 29.4%.

What’s interesting about this technique is that it does well during a crisis period in a recession.

Example:

In 2008, It was up 82%. In 2022, we had the Russia/Ukraine crisis it was up about 42% and in 2000 we had the dot com bubble up 29%.

One thing to notice is that each of those trading Systems, earn a living in the long term, but on a year-to-year basis.

You may still have losing years, in 2012, the systematic trend following is down -2.8%. In 2018, it was down 2.4%.

Same for the mean reversion trading. In 2014, it was down -1.9%. In 2022, it was down -3.8%.

Now the query is…

How will you reduce the variety of your losing years such you could earn a living almost every yr from the markets?

The trick is that you should trade multiple uncorrelated systems.

Which means that if you’ve got $100,000, don’t put all $100,000 in a single market trading system

As a substitute, put $50,000 in each of those trading systems. Split it into two equal parts.

Here’s what happens next.

You may see over here within the last column: that that is the results of trading multiple uncorrelated trading systems.

As you possibly can see, from 2000-2022, you’ve got been making a profit each yr for the last 23 years.

That’s the facility of trading multiple uncorrelated trading systems.

If you happen to ask me, for my part, that’s the holy grail of trading.

The rationale why this works is that at any time when a system does poorly in a single yr, chances are high you’ve got one other trading system that can do well available in the market condition in order that this fashion can cushion the losses.

Go Slow, to Go Far

Here’s the thing for a lot of traders, they’ve unrealistic out-of-this-world expectations of what trading is presupposed to offer.

They think…

“Man, I’m presupposed to make 100% return a yr. If not, I can’t be called a trader”

Unsure where to get those ideas from.

Here’s the argument.

Let’s say they’ve a $1,000 trading account, after which they’d think I’ll just risk 50% of this account, which is $500 on one trade and if I earn a 1:2 risk-reward ratio on this particular trade, I’ll then make a profit of $1,000.

Let’s say in the event you start with $1,000, you make a profit of $1,000. That may be a 100% return.

“That’s how trading is finished!!!”

You’re crazy…

What’s the issue with this?

The issue with that is that you just are at all times just two losses away from blowing up your trading account.

This process will rinse and repeat itself over and yet again until you quit trading altogether.

Only realizing that this is just not sustainable, or you discover a greater way of doing things.

What’s a greater way of doing things?

Let’s say again, you’ve got a $1,000 trading account. Then what you possibly can do is that you just don’t search for 100% return a month.

Since you’re taking numerous risk to perform it.

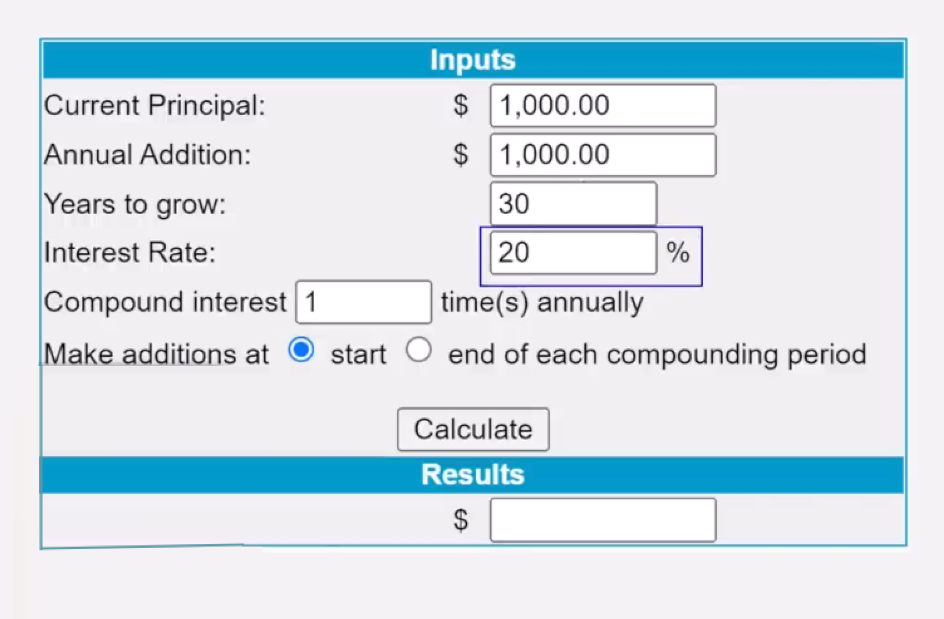

As a substitute, just aim for a 20% return a yr, risking 1% of your account on a straight 20%/ yr.

That’s doable.

Then let’s say you compound it for the following 30 years, along the best way, every yr you add an additional $1,000 to your trading account as well.

Now, are you able to guess, after 30 years, how much your trading account will likely be value?

Your account will likely be value $1.6 million.

I kid you not this can be a compound interest calculator, you possibly can return and plug in those numbers into your calculator and see it for yourself.

Here’s the thing, I only start with $1,000, In this instance.

If you’ve got more capital, you possibly can put more cash into your account every year, you possibly can see that your earnings, the sky is your limit.

Here’s my query…

Do you should blow up your account consistently over the following three years or want to securely grow your money consistently?

The selection is yours.

You need to have an Edge

Let’s say you’ve got a trading strategy that wins 50% of the time, half the time let’s say you’ve got a $1,000 trading account and also you risk 2% on each trade.

This implies at any time when you’ve got a loss, you lose $20 and at any time when you might be right, you win $10.

Let me ask you this very vital query.

If you happen to were to trade this trading strategy, would you earn a living in the long term?

Yes, or No?

The reply is No

Why is that?

The rationale is straightforward is because your losses, which is $20 are much larger than your winner.

On top of it, you simply win 50% of the time, meaning you furthermore mght lose 50% of the time.

Clearly, in this instance, this particular strategy doesn’t offer you an edge within the markets.

What in the event you are a disciplined trader?

Would that matter? No

Because you only find yourself as a disciplined loser.

Hopefully, by now you possibly can see how vital it’s to have an edge.

Now a few of you is likely to be considering

“Rayner, how do I find an edge available in the market?”

For my part, the fastest method to do it’s to face on the shoulders of giants.

You don’t should reinvent the wheel, simply study what works. These are several trading books that I might recommend you to go and skim because they’ve come built with proven trading systems that work with back-tested results.

Trading Books with backtest results:

- Following the Trend: Andreas Clenow

- Trading Systems: Urban & Emilio

- Automated stock trading: Laurens Bensdorp

- Short-term trading strategies that work: Larry & Cesar

- Constructing Reliable Trading Systems: Keith Fitschen

Manage Your Risk

Imagine this:

John and Sally are two traders.

They each have $1,000 trading accounts and so they have a 50% winning rate on their trading system, and so they have a mean of a 1:2 risk-reward ratio.

Let’s assume… Over the following few trades, that is the outcomes of their trades…

Lose-Lose-Win-Win-Lose-Lose-Win-Win-Win

That is the end result for the following few trades.

Let’s say John risked 50% of his account on each trade which is about $500 and Sally, risked $20 of her account per trade.

John: $500

Sally: $20

Let’s have a take a look at John first having $500

-500, -500, -1000

With a mean 1:2 risk-to-reward ratio.

John has essentially blown out his trading account.

What about Sally?

–20, -20, +40

How much did Sally make?

It’s 40 because as you’ve seen over here, we now have a mean of 1:2 risk-to-reward ratio.

Her winners are twice the dimensions of her loss.

In total, how much money did Sally make or lose?

Sally made a complete of $120 which is a couple of 12% gain of her account.

What’s the purpose I’m attempting to make?

The purpose is that this, you possibly can have a proven trading strategy that works, but without proper risk management, you’ll still lose.

Are you with me to this point?

Consistent motion gives you consistent results

I do know this sounds a bit of bit vague so let me offer you an example so that you understand how this works…

Imagine your trades. The end result of the following few trades is something like this:

Lose-Lose-Lose-Win-Win-Win-Win

Let’s say you’re trading with a proven trading system and also you’re following your rules.

As you possibly can see here. Your first three trades are losers.

When the fourth trade comes, you choose to skip it due to recent losses that you just had you’re thinking that.

Guess what?

It seems to be a winner over here.

Then your fifth trade comes along.

You select to skip the trade due to recent losses that you’ve got encountered, the pain remains to be very flawed so let me skip the trade again.

Again, seems to be a winner over here.

Then comes the following trading opportunity, and now you’re stuck. Considering should I skip the trade?

Since the recent losses are still an excessive amount of to bear, you choose to let your emotions take over and skip the trade.

Then guess what?

One other winning trade that you just missed.

Then guess what? One other winning trade that you just missed.

At this point, you possibly can’t take it anymore.

You made the decision to follow your trading strategy because if not, you would possibly miss out on further again.

We decided to take the following trade that got here along and eventually, you caught this winner over here.

Nevertheless, in the event you look back your winner is just not enough to cover your losses the three losses that you just had earlier.

If you happen to take a look at this from a big-picture standpoint, in the event you had followed your rules, you’ll have come up profitable since you had 4 winners over in comparison with your earlier losses that you just had earlier.

4 winners against three losers, you’ll have made money over this series of trades.

But since you didn’t follow your rules, due to emotions your actions weren’t consistent, and that’s why you didn’t get consistent results.

You may see that if you should be a consistently profitable trader, you could have a consistent set of actions at any time when the setup presents itself.

You may have to take it so that you don’t second guess yourself:

Because guess what?

If you happen to find yourself skipping trades, your results is not going to be consistent because your actions aren’t consistent.

Conclusion

My 13 years of trading journey has never been easy with a lot of ups and downs at first before achieving true profitability.

That’s why I’m sharing these with you.

So you could learn all these lessons even in the event you’re in your 1st yr of trading:

- Trade in the trail of least resistance by benefiting from trends and avoid range and choppy markets

- If you happen to can’t find “answers” in your timeframe, zoom out of your chart

- In an uptrend, wait for a buying setup as the value bounces from its are of support, vice versa for downtrends

- When there’s an excessive amount of conflicting information, never hesitate to remain out

- No trading plan equals no consistency: have a solid trading plan in place!

- Have an easy checklist where you already know why you’ll enter the trade and when to get out of the trade in the event you’re flawed

- The holy grail of trading is by trading two uncorrelated trading systems and by consistently adding funds to it

- Trading is just not a get-rich-quick scheme, patience is crucial as you wait to your edge and compounding to play out

There you go!

Now…

I do know each trader is different.

So, what else are you able to add into these lessons?

What are you currently struggling on now as a trader?

Let me know within the comments below!