After I was 20 years old, I read this book called Buffettology…

The book explains how the world’s best investor Warren Buffett selects firms to take a position in.

I used to be fascinated by how a person could accumulate a lot wealth just by picking the correct stocks

I mean who wouldn’t right?

After reading the book, I became a worth investor. I remember the primary stock that I purchased was called Sembcorp

It was in 2009.

The market is recovering after the financial crisis and I assumed

“This stock the basics were good”

I purchased Sembcorp Marine at $3.28 and I told myself

“I’m going to carry this stock without end similar to Warren Buffett”

5 days later….

I sold the stock since the market went against me.

Not about to present up just yet since the market was entering a bull market, I knew that I needed to get back into this scheme.

I did more research and purchased much more firms with margins.

This time I purchased stocks like Noble Group, Sembcorp, and Keppel Land and I invested about $20,000 of my capital and after two months, I used to be up almost $10,000!

Are you able to imagine the enjoyment that I had?

That is the way it’s done right?

I used to be feeling really good about myself.

My broker commented on it.

“Whatever stocks that you just buy move up higher”

I felt confident and good about myself after I used to be like $10,000 up in a few months.

Then, two weeks later…

My unrealized profits of $10,000 went up in smoke and have become vaporized.

Why is that?

It’s since the Euro debt crisis hit the markets.

There’s lots of panic within the markets all of the stocks that I’ve bought all reversed against me.

All my open profits were gone and it began to dig into my initial Capital.

I felt bad.

I needed to sell all of my positions since the pain was an excessive amount of to remember.

I began reflecting and asking myself, what did I do fallacious?

I noticed that I didn’t have a plan for exits.

Plan For Exit

I began Googling on easy methods to higher exit your stocks:

If you Google such a thing long enough that’s once you realize there’s something called “Trading”

That’s how I got here to find out about trading.

After my failure as an investor, I assumed that

“Possibly, trading would suit me”

That is where I began to find out about risk management strategies and financial markets.

I assumed…

“Why would I would like to take a position in a stock for years once I can earn money as a trader inside minutes”

That made lots of sense to me.

At this point, I assumed that trading wasn’t that difficult.

All I want is a trading strategy that works which I could find online free of charge.

My Initial Trading Strategies

Bollinger Band Strategies

The primary trading strategy that I got here across was taught by a trading guru.

He taught me the “Bollinger band strategy”

Here’s what I mean:

He said something along the lines of

‘Hey Rayner! it’s quite simple, just wait for the value to come back towards the lower Bollinger band and you purchase. When it goes up higher, you sell at this upper Bollinger bond, rinse repeat boom and also you’re done”

I assumed that was it.

It’s so simple as it’s.

But once I tried trading this trading strategy for several weeks, I noticed that my losses seemed larger than my winners.

That’s where I concluded this isn’t figuring out let me move on to something else.

I want something more complicated.

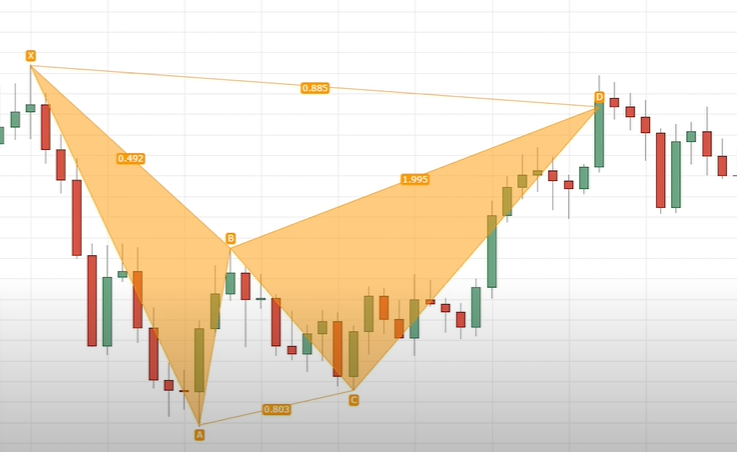

I moved on to a different trading methodology, the harmonic pattern.

The Harmonic Pattern

I spent six months learning easy methods to draw harmonic patterns that look something like this:

You’ll use a cluster of Fibonacci ratios and extensions to discover where the market might reverse, they’ve names just like the bat and crab pattern, etc.

I attempted this trading methodology and after several weeks, I used to be still within the red and I concluded that this doesn’t appear to be figuring out as well.

The Cold Hard Truth

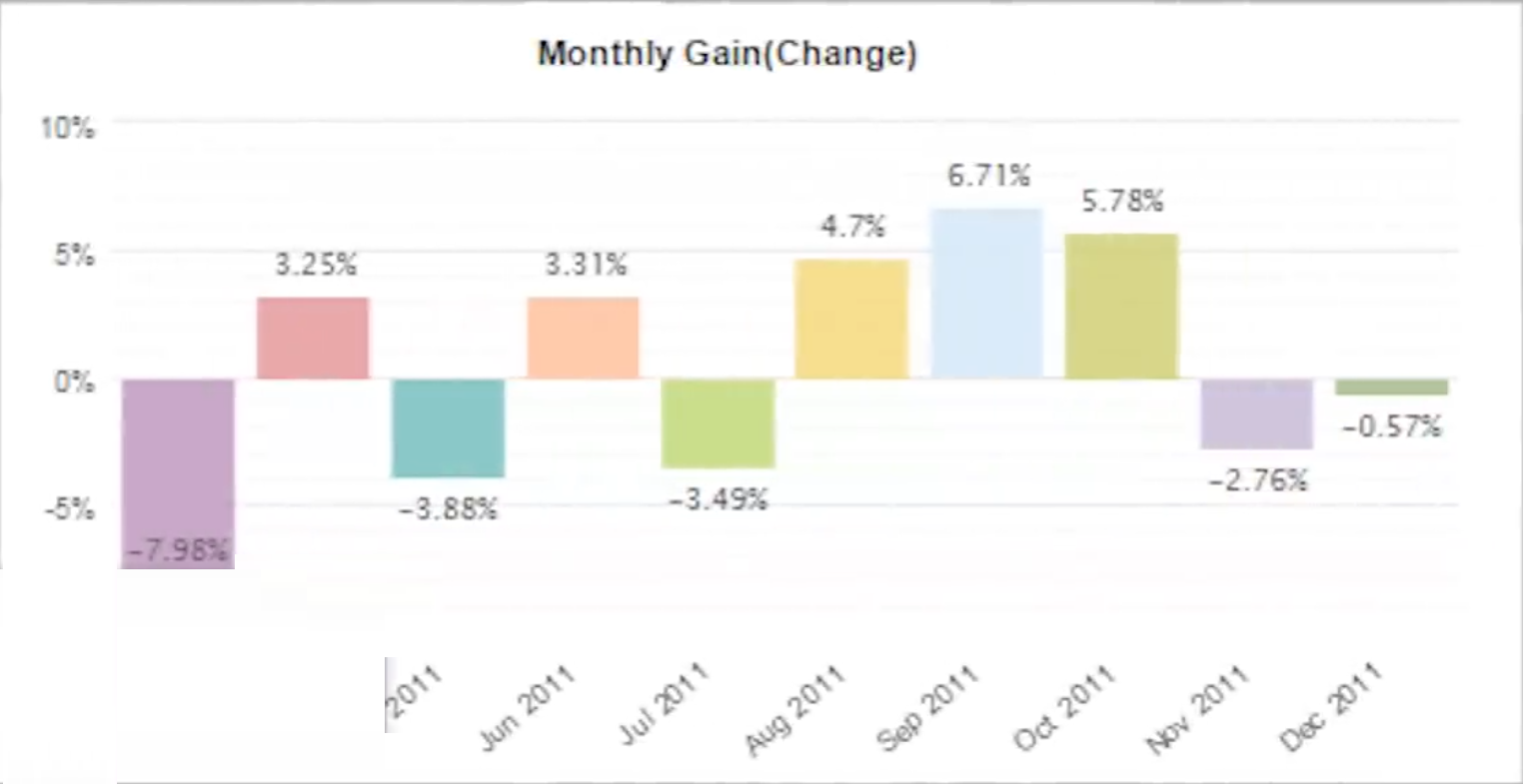

After several years, the fact is that I used to be still a losing trader despite learning so many alternative strategies/techniques about trading.

No denying it.

You recognize from indicators to patterns just name it I’d probably have tried it.

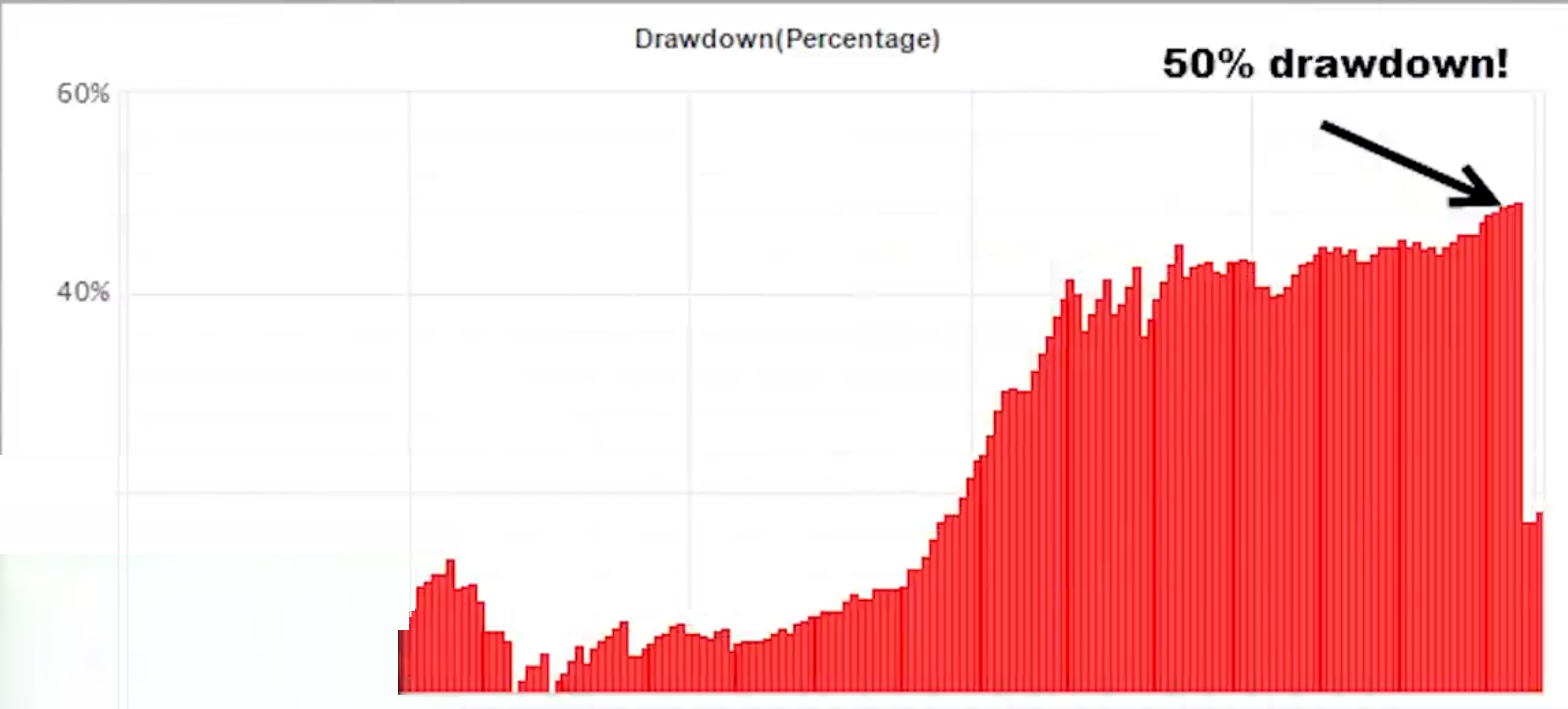

During this era, I incurred a drawdown of fifty% off my trading account. That is what I mean:

You possibly can imagine someone who spent years, 8-10 hours a day learning about trading and after a number of years, the one thing that he can show is that he has lost 50% of his money.

This is definitely how your trading would appear to be once you don’t have an edge available in the market:

That is the cycle I used to be trapped in, this needed to be certainly one of my darkest days in trading.

The outcomes stood right in my face

I followed my trading plan religiously; I had proper risk management but still, it wasn’t enough.

I asked myself countless times

“What must I do to grow to be a profitable trader?”

I followed all of the textbooks and I even doubted myself If I’d make it as a trader.

The funny thing is that I graduated with first-class honors by the way in which. This shows that I’m someone who can study.

But even the first-class honors degree wasn’t enough to make me a profitable Trader.

I assume the saying is true.

“You recognize you possibly can be a wise guy with a high IQ, nevertheless it doesn’t mean that you’re going to succeed as a Trader”

I can vouch for that.

I feel most traders would throw within the towel and hand over.

I mean who would spend hours, lots of time, money, and energy only to lose even extra money than he began?

The stubborn me just refused to present up, at all times believing that I used to be at all times one step closer.

Now during this era, there’s one quote that kept playing in my head that helped me to maintain moving forward.

“There isn’t any such thing as failure, only feedback.”

In the event you take into consideration this failure would only occur if I hand over. If I don’t hand over, then whatever I’ve encountered to date, they are only simply feedback

Feedback that tells me what works and what doesn’t work.

After years of trying out different trading strategies, techniques, patterns, and whatnot, I actually have idea of what works and what doesn’t.

What I Learned About Myself

At the identical time, I also began to learn more about myself as a trader.

What are the things that I gravitate towards, I noticed a number of things about myself

- I desired to be within the markets when It’s trending strongly

- I desired to be systematic with less room for discretion

- I can accept being fallacious more often than not

- I’m patient and disciplined

Just once I did this reflection, that is where I got this trading methodology called the “Trend Following”

Trend Following

Initially, my impression of trend following was just

“Oh, just trade with the trend”

But as I dug deeper, I noticed that Trend following is far more than that.

If you should be a trend follower, I’m going to share with you five principles that you have to embrace.

In the event you can try this right, there’s likelihood you might be a successful Trend follower.

5 Principles That You Must Embrace

Follow The Price

This implies if the market is trending up higher, look for purchasing opportunities.

Don’t attempt to be a counter-trend trader likewise if the market is trending in a downtrend, search for selling opportunities.

Risk Management

You might be fallacious persistently, but you should ensure that when you find yourself fallacious and when the market moves against you, your losses are contained in not greater than 1% of your account.

Trade Many Markets

You ought to trade many markets.

Let me ask you…

If you should get your wife pregnant, are you going to shoot once a month or 30x a month?

You ought to shoot as much as possible to get your wife pregnant.

It’s the identical thing for trend followers. If you should capture trends available in the market, do you should be trading one market or markets?

You’re going to be trading more markets since you increase your odds of capturing your trend.

Trailing Stop Loss

You ought to have a trailing stop loss.

Which means you don’t need to have a predefined goal ahead of time because you’ve gotten no idea how high or low the trend can go.

That is why you’ll just need to trail your stop loss and ride the move till it ends.

Ignore the News

As a trend follower, you should ignore the Newsroom because every little thing that is embedded in the value.

This implies the news might be bearish but when there’s a signal to go long as a trend follower, you’ll go along.

Those are the five principles of trend following.

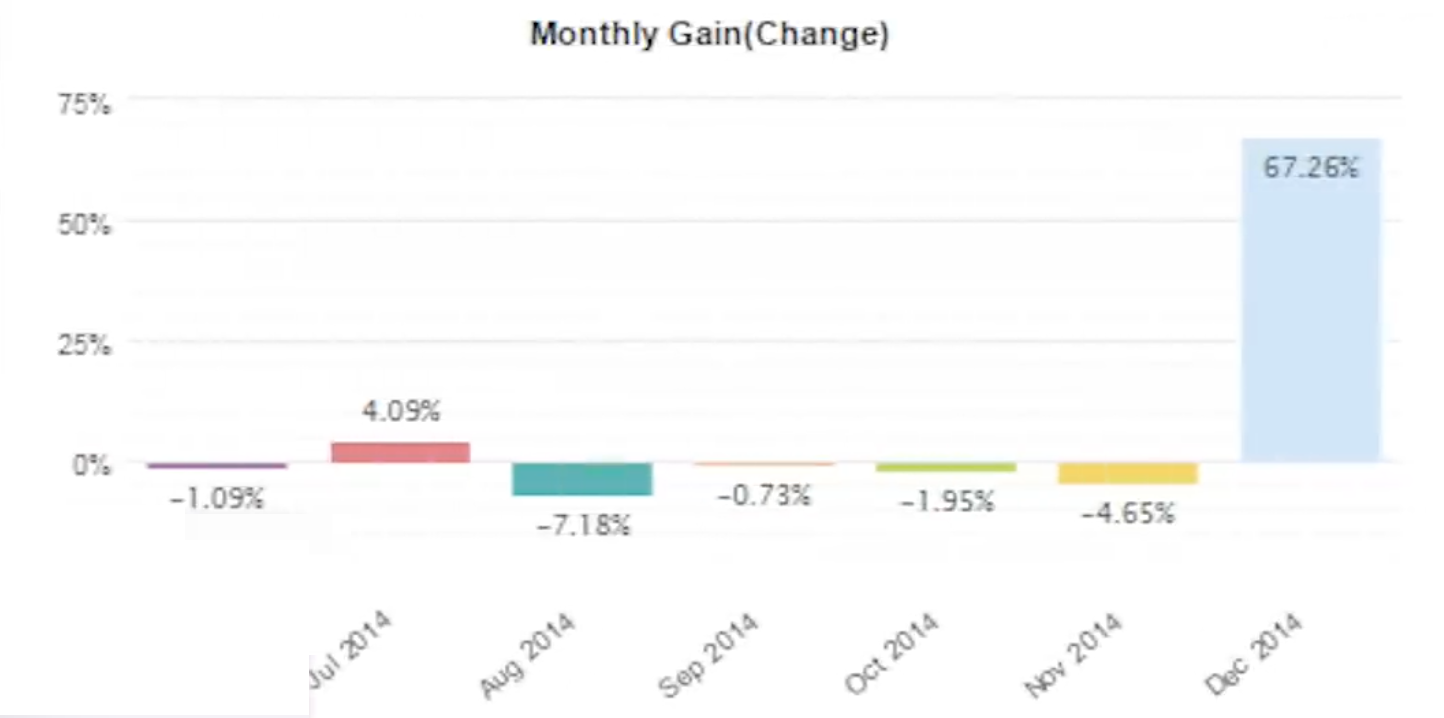

Using those principles in mind, I developed a trend-following strategy for myself.

Guess what?

Inside six months I made every little thing back and more!

It felt good to see that my account which was in red for years finally back within the green, here’s what I mean…

I used to be like…

“Yes! You’re in money, baby! Finally!”

It’s like your dreams just coming to fruition after a few years of trial-and-error effort.

Finally, you’ve gotten something tangible that reflects that effort now it wasn’t life-changing money, nevertheless it was a game-changer for me.

Since it gave me the arrogance that I can do it. With that confidence, I then scaled up my trading business over time.

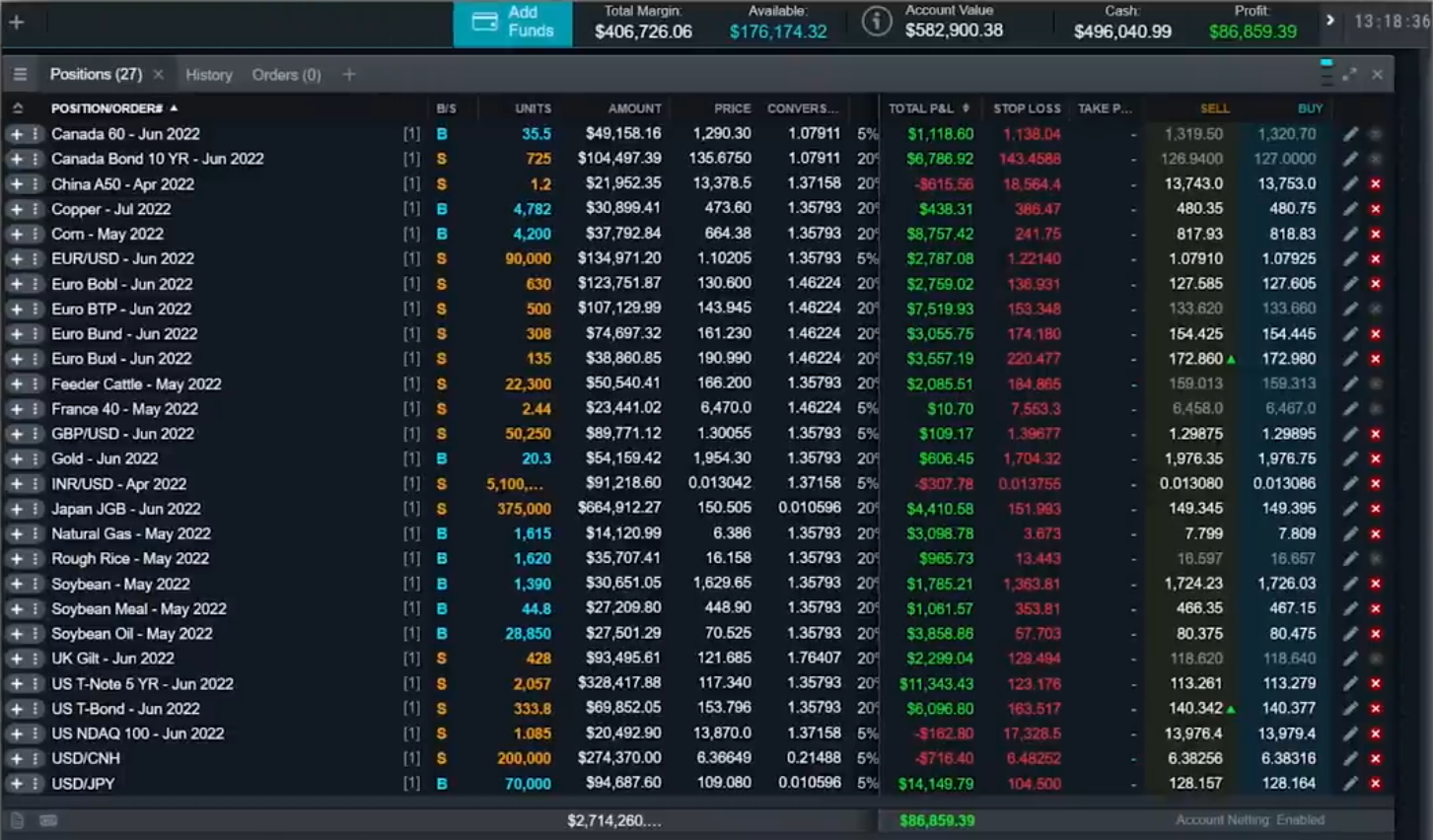

Today, I trade multiple trading strategies across multiple markets, here’s what I mean:

In the event you ask me, trend following holds a special place in my heart.

I still trade a variation of this trading strategy today and it is a trading methodology that brought me out of the red and into the green.

So….

In the event you are struggling to grow to be a profitable trader, perhaps you’re still losing your month of the month, 12 months after 12 months, I would like to inform you that it will possibly be done.

Yes…

The journey is hard the obstacles are huge, and the warmth is on, however the reward is value it, and I feel you possibly can do it.

So, go for it!

Conclusion

The underside line is that this:

Making a living in trading is feasible.

You possibly can grow serious wealth.

At the identical time…

You possibly can lose all of them at the identical time.

But by having a system that works not only in markets but a system that suits your personality, and the arrogance to execute it through ups and downs…

It’s only a matter of time before you grow to be a profitable trader.

So, how about you?

What’s your journey?

It doesn’t matter whether you’ve “made” it your your struggling.

Let me know your story within the comment section below!