Video Transcription

Hey, hey! what’s up, my friend!

Have a have a look at this chart over here:

Let me ask you….

Do you’re thinking that the worth will reverse higher from support or will break down?

Let’s have a have a look at one other example:

Do you notice how the worth comes into support?

Do you’re thinking that it’s going to reverse up higher or will the worth break down?

So that you can know this, you could first understand the 2 varieties of moves when the worth approaches support or resistance.

Power Move

An influence move into support

That is where you notice a series of huge bearish red candles coming into support.

Illustration:

The market is in a variety. it goes up and comes down with these big candles

An influence move into resistance

That is just the inverse.

Where you see a series of huge green candles approaching resistance.

That is what I call an influence move.

Why is that this significant?

An influence move into resistance

Imagine that somebody short on this area of resistance available in the market:

The trade quickly went of their favor.

They’re already sitting in profits in 1000’s of dollars.

What happens is that this group of traders, they’ve fears of giving back their profits.

They appear to take profits and that might help induce buying pressure.

When you’re short and exit the position, it’s a buy order and would create buying pressure to push the worth up higher.

An influence move into support

It is critical since it’s coming into this obvious area of support and traders who use technical evaluation.

This induces buying pressure as well.

Power Move coming into an area of value

This may be very vital.

At any time when you see a robust power move coming into an area of value like support or resistance.

The reversal will be just as swift towards the upside.

Why is that?

It’s because there is no such thing as a obstacle in the best way or the obstacle is sort of far-off.

For those who take into consideration this,

You desire to buy at an area of support.

For those who understand the market structure.

Where is the subsequent area of resistance?

It’s somewhere here, that is what I mean:

You possibly can see that from support as much as the realm of resistance, that is your potential profit.

Your next obstacle is much.

There’s nothing to induce a selling pressure to push the worth down.

This is the reason while you see an influence move into an area of value, there are occasions when the reversal might be just as swift toward the upside.

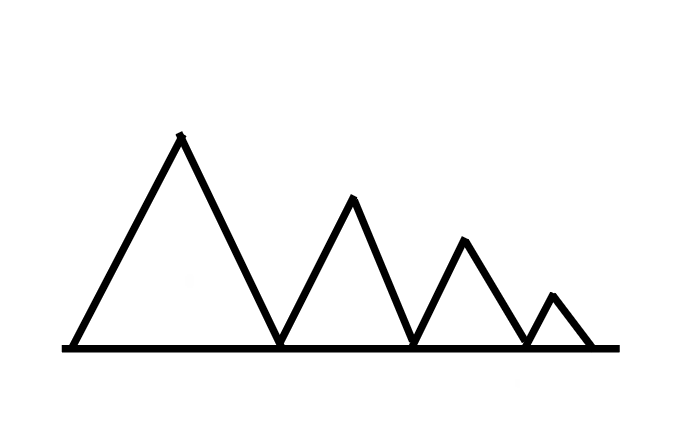

The Crawler Move

Crawler Move into Support:

That is while you get a series of lower highs into support. Let’s say that is an area of support:

The market goes up and comes down, you notice that it gets weaker and weaker from the upside.

For those who look from left to right, you notice a series of lower highs.

That is what we mean by lower highs into support, a crawler moves into support.

After I see a crawler move into support, to me it’s an indication of weakness or this tells me that selling pressure is stepping in.

Why is that and the way do I do know that?

You possibly can see the sellers are willing to sell at these lower prices.

Imagine should you are a seller and also you’re selling near resistance, it doesn’t quite make sense.

Unless you’re thinking that if support does break then it’s an excellent price to short

But should you don’t think that the worth would break support, then it doesn’t make sense to short near support.

The sellers are confident.

They’re willing to sell at these lower prices because they expect support to interrupt.

If you notice a series of lower highs into support, most of the time it results in a breakdown.

That’s not all due to naive traders they are saying;

“Oh man Rayner look the worth is coming to support”

Guess what?

They’ll buy.

Where would they put their stop loss?

They put their stop loss slightly below the lows of support.

If enough recent traders do this and enough stop losses are below this area of support.

This adds fuel to the fireplace because should you take into consideration someone with a protracted position, their stop loss is a brief order to get out of their losing trade.

If the worth goes down and hits their stop loss which is a brief order, they feel much more selling pressure causing the worth to hit lower.

For these few reasons, the crawler move is an indication of weakness or reasonably an indication that you understand that sellers are about to drive the worth lower.

Crawler move into resistance

That is while you get a series of upper lows into resistance.

However, should you see a series of upper lows into resistance as you possibly can see over here:

It is a sign of strength.

Why is that?

The inverse is true because you possibly can see that the buyers, initially bought they usually pushed the worth up higher before making a pullback.

You possibly can see that every subsequent low is higher than the one before:

For those who take into consideration this, who in the appropriate mind set desires to buy just in front of resistance?

This tells you that purchasing pressure is stepping in.

Most of the time, while you see a series of upper lows coming into resistance the market is prone to break out.

Trading Strategies to Profit in a Bull and Bear Market

We shall be using the MAEE formula

Market Structure

What’s the market structure that you just’re seeing on this chart?

The market is in a downtrend.

Knowing that the market is in a downtrend, where will you look to trade from?

Area of Value

Where is the realm of value that you ought to concentrate to?

On this case, the true area of value is at resistance. That is what I mean:

The following thing to do is to attend for the market to come back towards your area of value. You possibly can see the market hit up into resistance and break. That is what I mean:

Entry

At this candle over here, we now have a legitimate entry trigger that is what we call a bearish engulfing pattern:

The story behind it is analogous to a shooting star pattern, where the buyers were initially on top of things after which they quickly disrupted the market and got pushed down by the sellers closing below resistance.

It is a false break as well, the market took off the highs and quickly reversed back into resistance.

What you possibly can do is enter on the subsequent candle open.

Exit

What about our stop loss?

On this case, again you possibly can pull out the ATR indicator:

What we try to do here is to set our stop loss a distance away from the resistance because we don’t need to get stopped prematurely.

What you’ll do is use out what’s the high.

Then add one by this variety of ATR value

On this case is about 45 Pips.

That offers you 7930.

Your stop loss shall be placed at 0.7930:

Where is your goal?

For those who have a look at the goal, two levels show up:

This recent swing low and this second one is further away

On this case, I prefer to have a conservative goal.

You possibly can have your trade all exit at the primary goal.

That’s a legitimate thought process.

At the identical time, you could be pondering…

“But Rayner, should you look back at this promote it is within the downtrend”

The value tends to interrupt below the lows.

Won’t we be giving up some potential profits because we are able to still look to capture these additional moves because the market breaks down?

What you possibly can do on this case is to have two targets…

- More conservative goal

- An additional goal

As you understand, the market is in a downtrend and it could break below the lows and go just a little bit further.

How are you going to do that objectively?

What you possibly can do is you should utilize a tool called “Fibonacci extension”

Then look to exit just before the 1.27

You have a look at the Trend-based Fibonacci extension.

You draw it from the swing High to the swing low:

That is an objective way where you possibly can look to set your second goal.

You need to use this to project where the market would go.

The query is where exactly do you’re taking profits because the market breaks down lower?

This Fibonacci extension gives you just a little little bit of objectivity to it.

Normally what I do is that I set my stop loss at a logical level.

Ride the Short-Term Uptrend Using the MAEE

What you possibly can do is to make use of the 20-period moving average. That is what I mean:

You possibly can see the red line.

What happens is that if the market breaks out higher.

You go long…

The 20-week moving average will naturally move up together with it.

If it closes below it, then you definitely exit the trade.

Examples

Your entry is as shown after the breakout.

Let’s say your stop losses is below the resistance.

You could have your exit

Notice the market at this candle break and shut below the 20-week moving average.

There may be where you exit your trade.

What if the market doesn’t break out?

What if the market doesn’t break out, it’s not consolidated, and comes down lower?

For those who’ve been being attentive earlier there’s one other potential trading opportunity.

Let’s say that that is an area of support, that is what I mean:

If the market comes with an influence move into this area of support

Are you seeking to short or long the market?

You possibly can search for a reversal higher allowing you to capture one swing higher into resistance.

Here’s what I mean:

Allowing you to capture a swing into resistance.

With proper risk management, it’s possible to exit a portion of your trade at these highs after which let the remaining half go higher.

Conclusion

While learning how one can draw support & resistance is crucial…

Knowing when it could break and bounce is of same importance as well which I even have shared with you on this guide!

Nonetheless, here’s what you’ve learned today:

- Seeing “power moves” have a high tendency to bounce off your support levels

- Having a descending triangle (or a crawler move) occur into an area of support is an indication that sellers are regularly breaking the realm of support

- Using the MAEE formula is essentially the most effective technique to trade with support and resistance levels

- When managing trades, you should utilize tools resembling the Fibonacci extension and the 20-period moving average

There you go!

An all-in-one support & resistance guide that teaches you how one can spot, interpret, and trade!

But now I would like to listen to your thoughts…

Are there every other “suggestions” you possibly can share with me when coping with support & resistance?

Are you already using a few of the strategies I’ve shared with you today?

Let me know within the comments below!