Are you craving an easier strategy to discover shifts in market momentum?

Do you would like to pinpoint optimal entry times – especially when trends transform from bearish to bullish?

Or simply getting bored with delayed and mixed signals from contradictory indicators?

Well, the moment you’ve been waiting for has arrived, as I present to you…

The Supertrend Indicator!

In this text, you’ll discover:

- What the Supertrend Indicator is

- Where to locate the Supertrend Indicator

- Learn how to utilize the Supertrend Indicator to streamline and strategize your trades.

- The art of layering the Supertrend Indicator with other essential trading tools.

- Learn how to unleash the raw power of The Supertrend Indicator

- And eventually, understanding the constraints of The Supertrend Indicator

Exciting, isn’t it?

Let’s dive right in!

What’s the Supertrend Indicator?

On the earth of trading, mastering the Supertrend Indicator could be extremely helpful!

The Supertrend Indicator serves as a precious tool, offering confirmation of trends and generating buy and sell signals for each short and long trades.

It’s extremely versatile, offering the power to detect trend direction and even provide information on where to put stop losses!

The Supertrend Indicator could be used on all timeframes and, when layered with a multi-timeframe approach with other indicators, could be an acutely profitable trading tool

So at its core, the Supertrend Indicator is a lagging indicator, meaning it relies on previous price data.

It’s also necessary to notice that on account of it being a trend-following indicator, it performs best when the value is trending moderately than ranging.

Essentially, the Supertrend Indicator is built up of two key components:

ATR length and a multiplier.

The ATR length value defines the historical scope for calculating the Average True Range.

The multiplier adjusts the ATR to create distinct price bands above or below the value.

With these customizable values, you possibly can finely tune the indicator’s sensitivity to cost fluctuations.

Let me explain.

When the indicator transitions from green to red, it signals a shift from a bullish to a bearish sentiment.

Conversely, transitioning from red to green means a shift from bearish to bullish.

In this fashion, the Supertrend Indicator paints a zone above (Bearish) and Below (bullish) — calculated by the values you input.

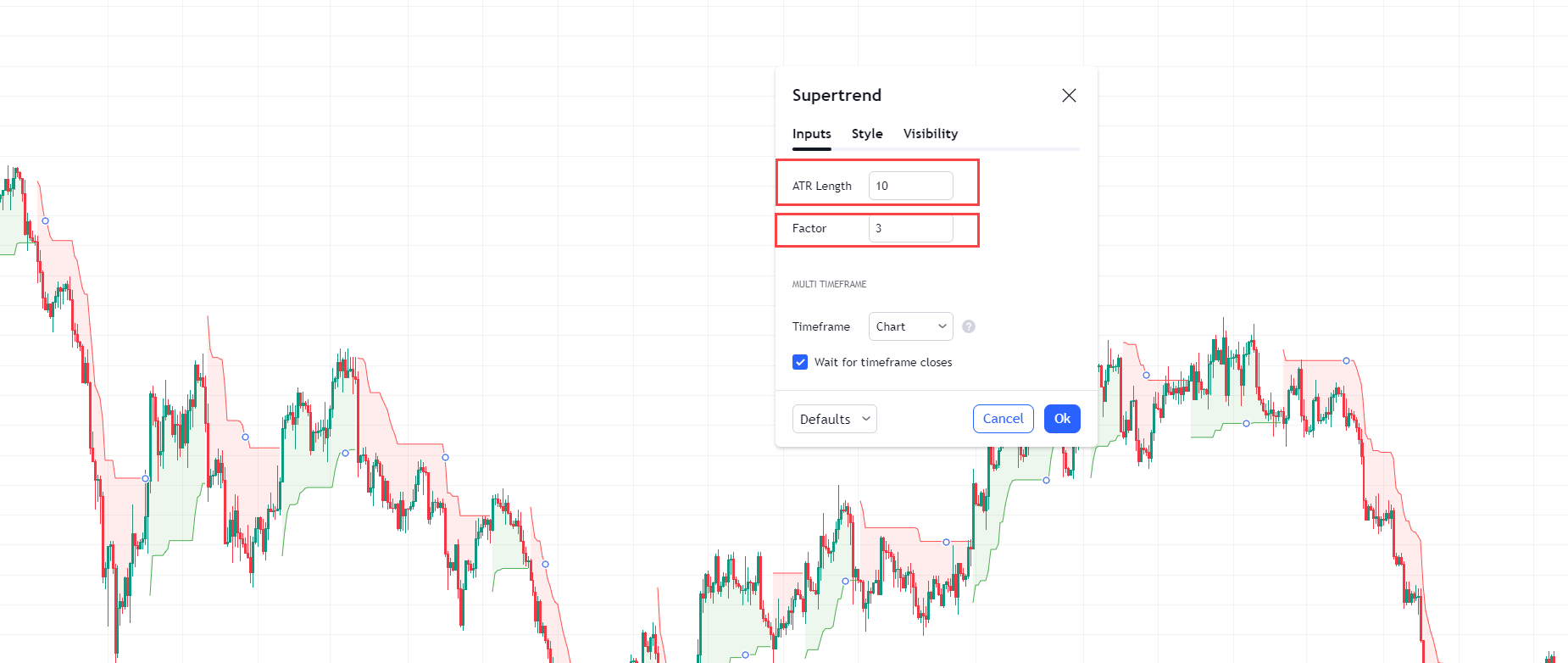

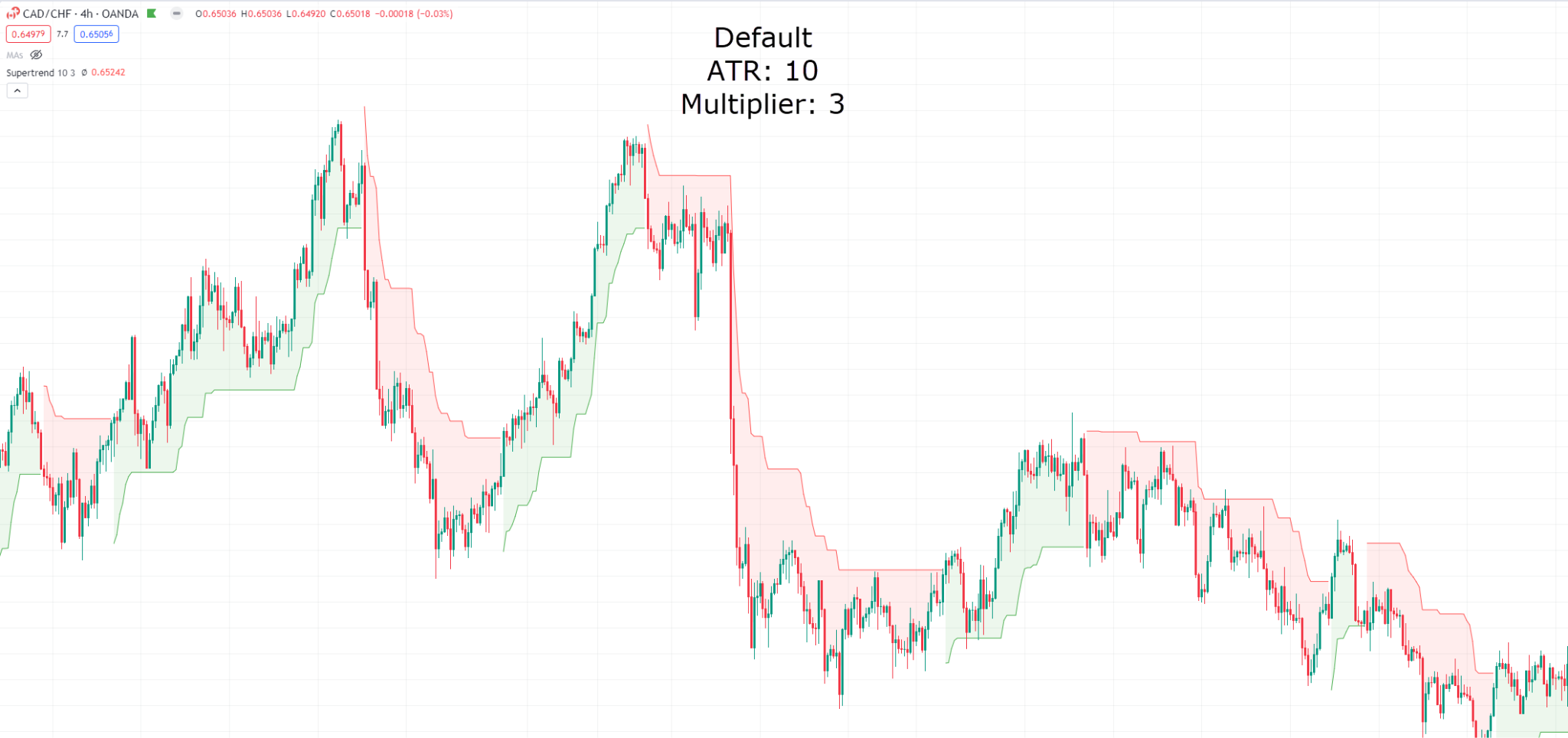

The zones are established by default values, with an ATR Length of 10 and a Factor of three.

When the value closes above or below one among these green or red zones that’s when the super trend indicator will signal a buy or sell signal and switch its bias

Nonetheless, it’s crucial to grasp that, like all indicators, its interpretation isn’t as straightforward as green denoting ‘buy’ and red denoting ‘sell’.

By absorbing the insights shared in this text, you’ll gain a practical understanding, learning find out how to effectively wield the Supertrend Indicator and elevate your trading strategy!

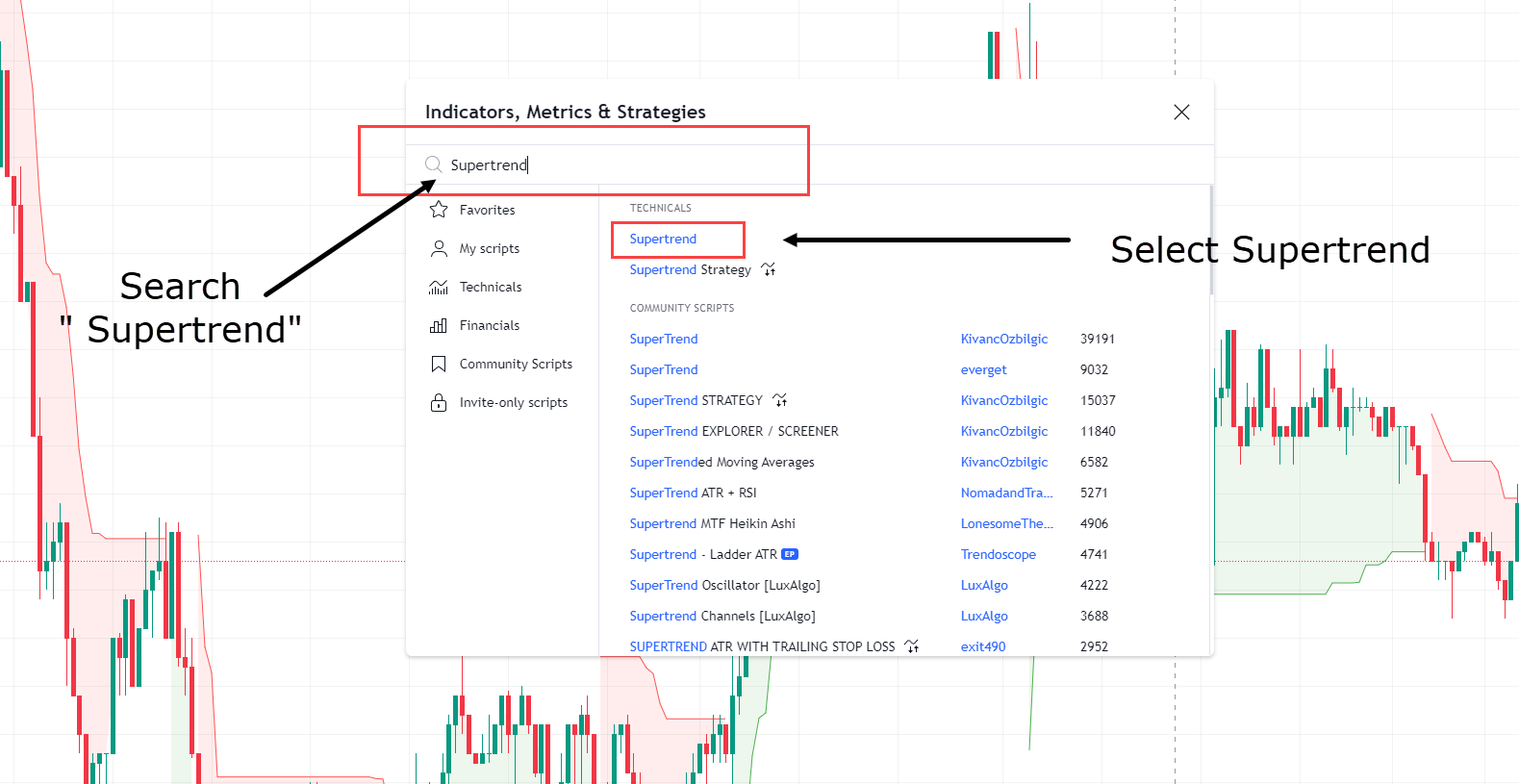

Locating the Indicator

Before delving into the small print, let’s ensure you recognize where to search out the indicator.

Open up Tradingview and click on on the indications emblem found at the highest of your screen…

While you open the indicator tab you can be met with this window…

By clicking on the indicator your chart will look something like this…

As you possibly can see, the Supertrend Indicator is now placed on the charts!

So, now it’s on the chart – let’s get it arrange accurately!

Fantastic-Tuning The Supertrend Indicator Settings

So let’s explore the several settings you should use for the Supertrend Indicator.

These could be adjusted to calibrate the indicator’s sensitivity to cost movements.

Now, it’s necessary to notice that there’s no definitive right or improper strategy to do that.

It’s all about aligning the settings with the particular asset you’re observing, or tailoring them to suit your chosen timeframe and desired signal frequency.

Let’s take a look at find out how to adjust the settings…

After you’ve gotten chosen the super trend indicator from the indications window, a small bar will appear at the highest left of your screen.

While you hover over the indicator a settings icon appears.

Let’s proceed by clicking on it…

You’ll then find the next window appears…

The 2 values you possibly can deal with are the ATR Length and the factor.

ATR Length, or Average True Range Value, defines the span over which you calculate the common true range of previous candles.

So on this instance, you might be only using the previous 10 candle ranges to calculate the Average true range.

The subsequent setting is Factor.

This refers back to the green and red zones on their respective sides of the value.

So, if the present ATR value of the previous 10 candles is say, 10 pips, then the zone would print itself around 30 pips above or below the value (10 x 3 = 30).

OK, now you is likely to be asking yourself…

“But why do these settings matter?”

“How do they alter the way you view the charts?”

Well, let’s take a take a look at three examples with three different settings…

Supertrend Indicator Default Settings ATR 10, Multiplier 3:

This primary example is on the default settings.

The configuration serves as a balanced start line, for identifying smaller trends and shifts in market dynamics.

With this setup, you’ll notice shorter periods of each long and short positions, offering a comprehensive view of market activity.

Let’s take a take a look at one other setup…

Supertrend Indicator Settings ATR 10, Multiplier 8:

On this second example, I’ve adjusted the multiplier to eight.

This modification steers you toward a more prolonged perspective of the market, resulting in less frequent bias shifts.

As you possibly can see, the zone now maintains a substantial distance from the value on account of the substantially higher multiplier.

Such a setup could also be preferred by traders engaged in longer-term trading strategies.

Alright, so here’s yet one more…

Supertrend Indicator Settings ATR 10, Multiplier:

On this final example I actually have reduced the multiplier is 2, leading to far more frequent changes within the Supertrend signals.

As you possibly can see, towards the top of the instance, the indicator begins to present off a variety of false signals…

That is on account of the shortened length of the multiplier and the value starting to range more often.

Now, I like to recommend you are taking a moment to explore the distinctions between the three charts.

It’s through the adjustment of those settings, particularly the multiplier, you could gain a greater understanding of the frequency of buy and sell signals that could be generated.

It’s also price noting I didn’t adjust the ATR on any of those examples…

It is because, generally speaking, the ATR won’t make a major difference to the chart.

The typical true range of the past 10 candles can be fairly just like that of 20, 50, and even 100.

So!

Now that you just’ve got the foundations in place, it’s time to start out constructing your castle!

Let’s dive into the exciting realm of leveraging this indicator, turning these market insights into healthy profits!

Learn how to use the super trend indicator

You possibly can now see why the Supertrend Indicator is a precious tool to visualise the changes in market structure.

While specializing in which settings suit different trading strategies, let’s take a look at a number of examples of find out how to trade with the super trend indicator!…

Example AUD/NZD 1-Hour Chart:

this chart, you’ll notice the value has closed above the red indicator zone of the Supertrend Indicator, changing the colour of the zone from red to green.

That is an example of if you might consider taking a protracted trade!

Let’s explore this chance further and initiate it…

Example AUD/NZD 1-Hour Chart Entry:

So here’s the setup for the trade.

Note that the Supertrend Indicator eliminates the necessity for setting a selected take-profit level…

As an alternative, you possibly can adopt a method of waiting for an in depth below the green zone to exit your trade.

Let’s see how this trade plays out…

Example AUD/NZD 1-Hour Chart Take Profit:

Considering that only the Supertrend Indicator was used – a 2.7RR trade is nothing to scoff at!

As you possibly can see on this trade, there could have been other opportunities to exit earlier, as the value stalled and formed a resistance.

I feel this instance shows the ability of the Supertrend Indicator and its easy yet effective rule of closing a trade when the indicator changes.

Let’s take a look at one other example!…

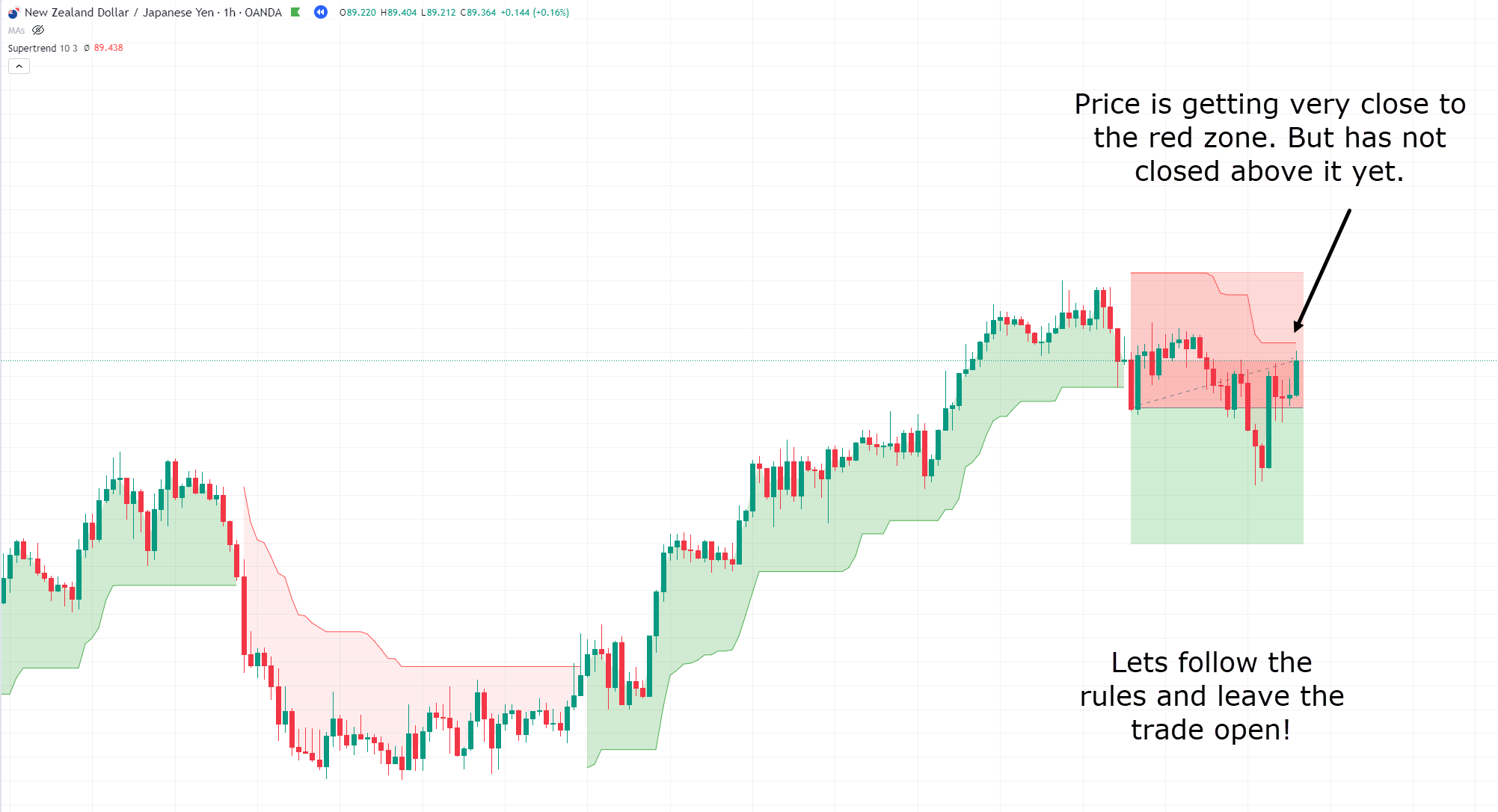

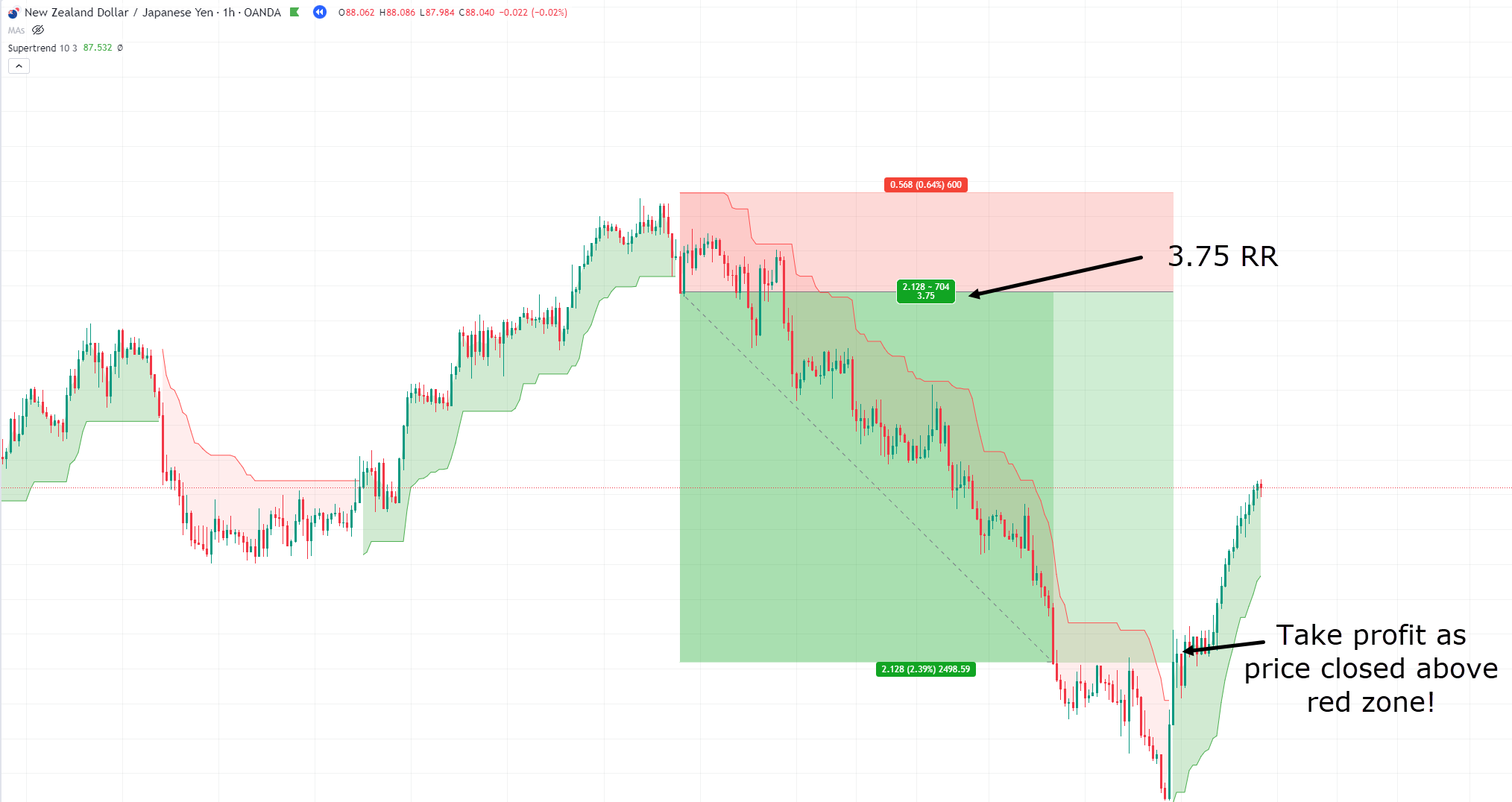

Example NZD/JPY 1-Hour Chart Short Trade Entry:

With the value closing below the green zone, a trade opportunity has presented itself.

So, similar to before, you possibly can take a trade – but this time on the short side.

And again – you possibly can leave your trade open until the value closes above the red zone.

Let’s see the way it plays out…

Example NZD/JPY 1-Hour Chart Short Trade:

Despite the fact that the value is approaching an in depth above the red zone, by following the basic rule of the indicator, you must proceed to permit this trade to evolve…

Let’s stay committed to this strategy and observe the eventual final result…

Example NZD/JPY 1-Hour Chart Short Trade Take Profit:

Well, you recognize what they are saying…

Fortune favors the brave!

A 3.75 RR trade! Just by following one easy rule!

OK, now you is likely to be pondering…

“But Rayner, didn’t you say not to make use of this indicator in isolation?”

And also you’re correct!

As with most indicators, their true potential shines when integrated with other trading techniques…

Let’s explore some now!

Learn how to use Moving Averages with Supertrend

As you recognize, moving averages function a precious tool to filter out market noise and assess the trend status of a pair or asset.

Moreover, they supply a solid foundation for identifying support and resistance levels.

In the next example, I’ll show you the way you would use the Moving Average 200 as support combined with the Supertrend Indicator.

You’ll see the way it helps keep you within the trade, following the momentum of the market.

Here you go…

Example EUR/USD 4-Hour Timeframe MA200:

Notice how the value has begun forming a better low?

The support of the MA200 confirms this may occasionally be the start of a trend shift…

…and at the identical time, the Supertrend Indicator has also turned green!

These multiple indicators suggest a promising long opportunity, on condition that we’re positioned above the MA200, acting as support, with the indicator shifting to a bullish stance!…

Example EUR/USD 4-Hour Timeframe MA200 Trend Continuation:

So, by combining the Moving Average with the Supertrend Indicator, you’re helping remove any false signals which will occur.

Notice how, as the value edges closer to the MA200 and eventually slip below it, with the indicator shifting to red, it provides a transparent signal to think about taking profits because the trend shows signs of weakening.

Let’s take a look at one other example!…

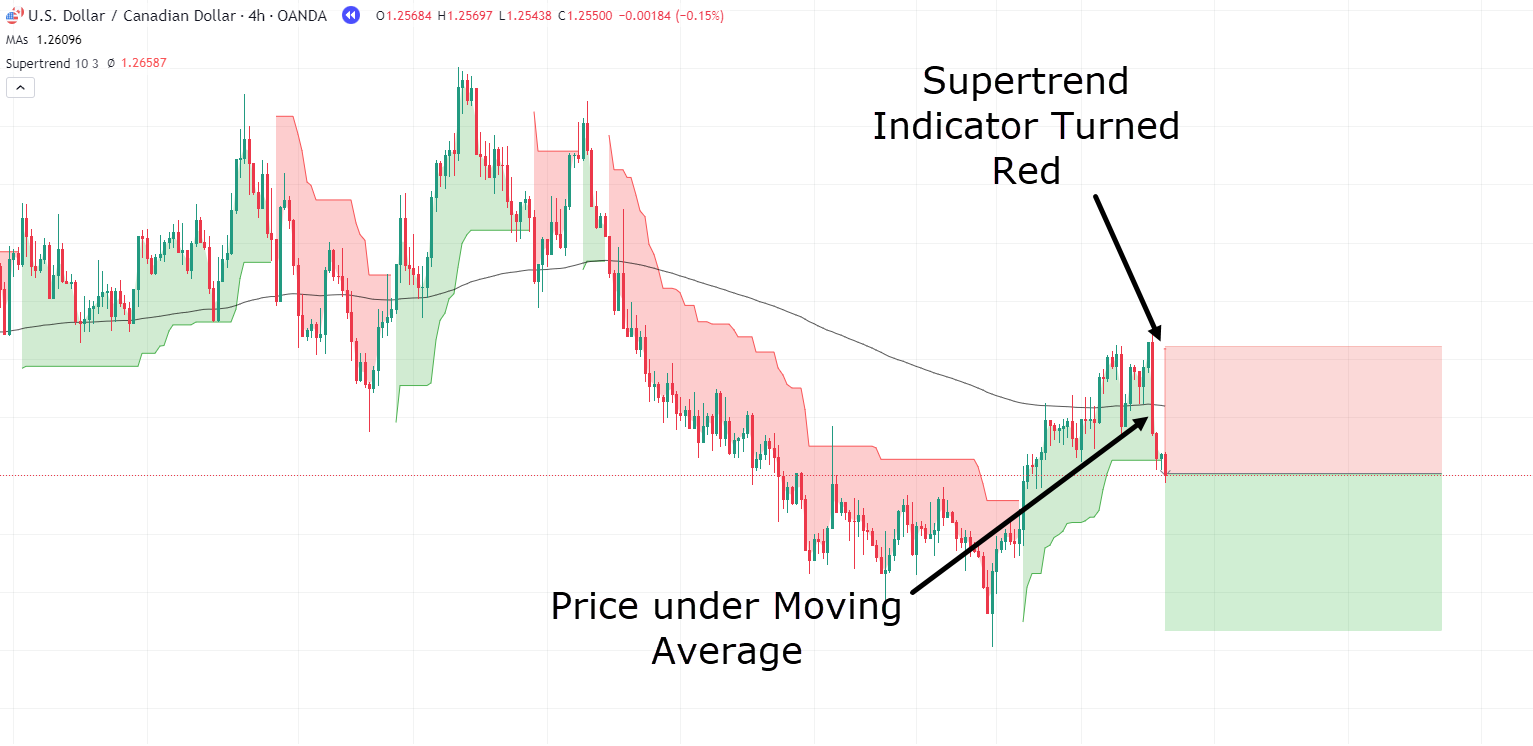

Example USD/CAD 4-Hour Timeframe Entry Chart:

As shown within the chart above, the value has recently broken the MA200 whilst also shifting the Supertrend Indicator to red!

This might give an early indication that the value could also be able to proceed down…

Let’s proceed and execute the trade!

Example USD/CAD 4-Hour Timeframe Chart:

Now, something interesting has occurred…

Price has now broken back above the Moving average…

This shift in price motion could potentially indicate that the initial trade idea is inaccurate!

Let’s see what happens for those who ignore this potential early exit signal and proceed with the trade…

USD/CAD 4-Hour Timeframe Exit Chart:

Upon closer evaluation of this chart, in comparison with a few of the successful examples, it becomes obvious that several signals were warning that the trading strategy won’t play out as planned…

First, the value broke above the Moving Average while still staying below the stop loss.

Second, the value displayed erratic movements above and below the Moving Average, failing to treat it as either support or resistance.

The ultimate and decisive warning got here when the Supertrend Indicator shifted from red to green, signaling a change in market sentiment.

Now, it’s true that this particular trade would have resulted in a small loss.

But it surely’s necessary to grasp that such outcomes are a part of trading and can occur infrequently.

No one desires to lose, however it’s just not realistic to expect every trade to be profitable.

As an alternative, it’s essential to administer risk, cut losses while they’re manageable, and avoid counting on hope to reverse unfavorable market movements.

Reading and responding to the market’s warning signs and flowing with its dynamics is the important thing to sustainable trading success.

Attempting to swim upstream isn’t advisable!

So, having established realistic expectations, let’s delve into one other precious technique: using the Supertrend Indicator on multiple timeframes.

This approach empowers you as a trader to align the trend direction from a better timeframe with the entry signals generated by a lower timeframe indicator.

Let’s explore this strategy in some more detail…

Learn how to align the Supertrend Indicator on multiple Timeframes

Consider this: In a trending market, temporary pullbacks are a typical occurrence.

These retracements shouldn’t necessarily be interpreted as the top of a trend, though.

Somewhat, they often signify a short lived pause before the value resumes its journey in the general trend direction.

So, what’s the takeaway?

Through the appliance of multi-timeframe evaluation, you possibly can pinpoint assets which might be trending on a better timeframe – identifying entry opportunities on a lower timeframe.

Luckily, the Supertrend Indicator on the lower timeframe provides the precise entry signal you wish!

I’m confident that by the top of this demonstration, you’ll grasp the ability of this approach.

Let me show you!…

Example USD/CAD Day by day Timeframe Chart:

Take a look at this Day by day Chart.

As you possibly can see similar to previous examples the Supertrend Indicator will change from green to red or red to green upon a trend shift.

Examining the every day timeframe, you may also observe that the value has breached the red zone and shifted from red to green, triggering a buy signal.

Now, you would possibly wonder,

“Why didn’t you enter the trade immediately, Rayner?”

Well, trends typically have pullbacks.

I feel it’s necessary to refrain from entering a trade right when it begins, but as an alternative, wait for a pullback where the value temporarily pauses.

And what’s the advantage of doing so?

By waiting, you increase your risk-reward potential, as your stop loss could be placed closer to the underside of the Supertrend green zone.

You furthermore mght won’t be buying while prices are potentially at their highest!

Furthermore, you could also get some extra confirmation that the value will proceed in your intended trade direction…

With these considerations in mind, let’s delve into the lower timeframe…

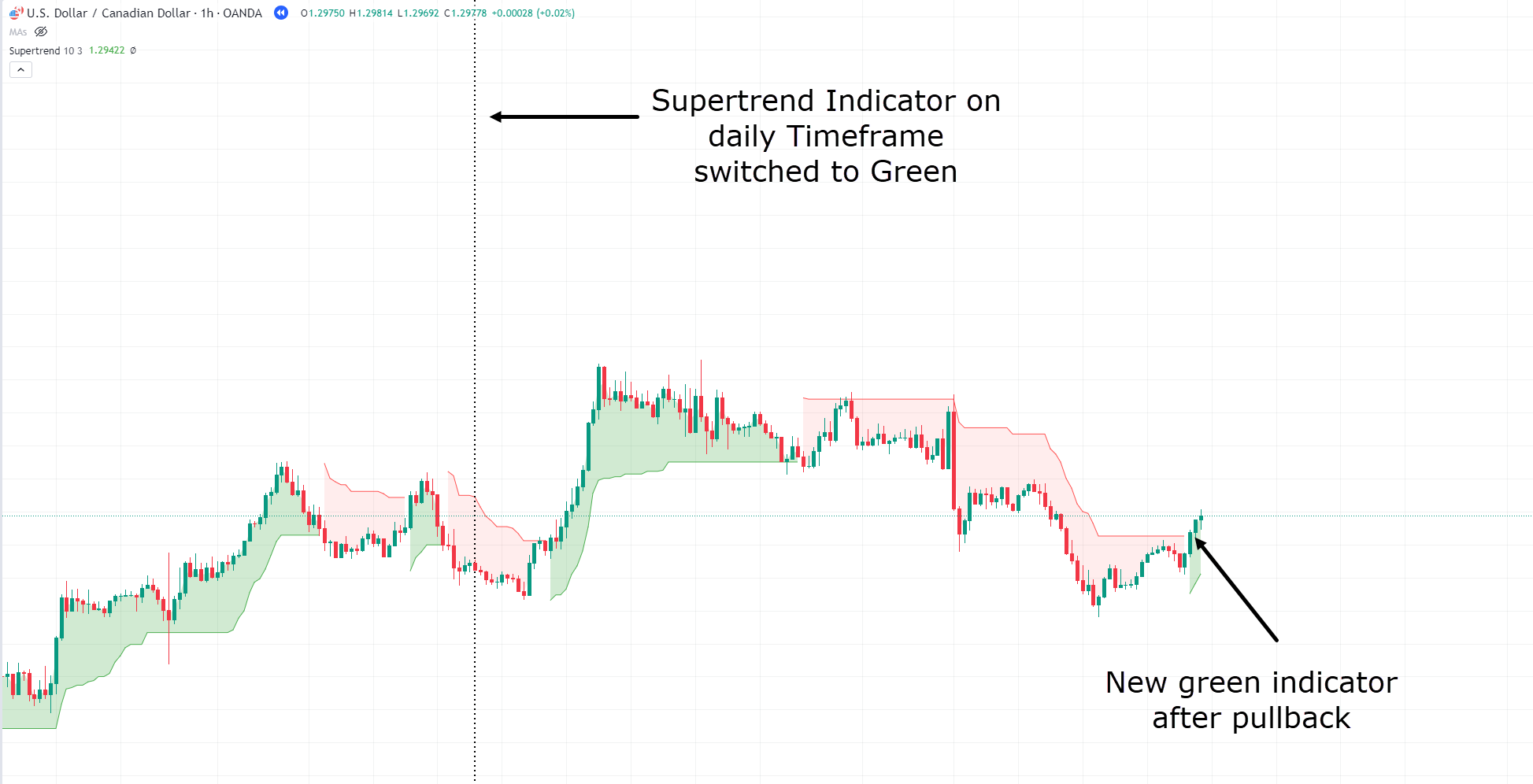

Example USD/CAD 1-hour Timeframe Chart:

See how the value has a big push initially, as indicated by the green zone, but subsequently undergoes the anticipated pullback.

Now that the pullback has occurred, you possibly can patiently await the fresh green signal from the Supertrend Indicator on the lower timeframe…

This could allow for a low timeframe entry but in an try to capture a every day timeframe trend!

So what would that seem like?…

Example USD/CAD 1-hour Timeframe Chart Entry:

On this low timeframe, this trade looks to be pretty straightforward…

But, hold on a minute…

Do not forget that you aren’t targeting the 1-hour trend change back to red, you might be targeting the every day trend….

Which means that you would possibly remain on this trade for potentially weeks and even months, with an exit determined by the signals on the every day timeframe.

While not for everybody, this approach has real advantages if don’t have enough time to continuously monitor the charts, right?

Well, let’s explore how this trade unfolded…

Example USD/CAD 1-hour Timeframe Chart Take Profit:

Now that’s a powerful trade!

It’s necessary to notice that allowing for the every day trend to play out is the essential reason why the RR on this trade is so high.

In essence, the 10RR is your reward – for waiting a substantial period of time!

Nonetheless, when performing the identical strategy across multiple pairs or assets, it may well rapidly speed up the profit-taking process.

So for those who’re short on time, such a strategy is an important strategy to make multilayered decisions.

Let’s go over a few of the Supertrend Indicator’s merits yet one more time…

The essential advantages of Supertrend Indicator

Simplicity and Effectiveness

As demonstrated throughout this text, the Supertrend Indicator stands out for its simplicity and effectiveness.

It provides you with clear entry levels and it even supplies you with an inexpensive stop-loss position.

The straightforward color change allows any trader to quickly Discover the trend and plan their trades accordingly.

Extremely customizable

One other significant advantage of the Supertrend Indicator is its high degree of customization.

As shown within the examples, you possibly can tune settings to fit your trading strategy – customizing them to extend and reduce the frequency through which you receive buy and sell signals.

This could provide an enormous number of opportunities, regardless of what variety of trader you might be!

A strong tool when used with other Indicators

Like most indicators, the true power of the Supertrend Indicator could be amplified when layering it with other indicators, comparable to Moving averages.

Experimenting with different indicator mixtures permits you to retain your favorite tools while harnessing the Supertrend Indicator’s power.

Effective for setting stop losses or trailing stops

The Supertrend Indicator excels in placing stop losses at logical levels.

Moreover, it has the advantage of securing profits as the value continues in your trade’s direction.

Since the green and red zones follow price, these will naturally move within the direction of the market and hence your trade!

When the value crosses and closes above or below one among these levels, it initiates your exit signal – effectively acting as a trailing stop loss!

Performance in Established Trends

Certainly one of the standout qualities of the Supertrend Indicator is its performance in well-established trends.

It’s where the Supertrend Indicator starts to shine!

The Supertrend Indicator will can help you capture nearly all of the trend and can proceed to maintain you in a trade so long as that asset remains to be trending in the specified direction.

So, using the Supertrend Indicator during favorable market conditions can significantly boost trading success.

But as you and I each know, there are ups and downs to all the pieces…

Limitations of Supertrend Indicator

Supertrend Indicator is a lagging indicator

Like most indicators, the Supertrend Indicator does have its limitations.

Certainly one of these is its inherent lagging nature.

By providing information based on previous candles, it’s reacting to past economic events.

It’s price remembering the info is probably not indicative of future trends.

Adjustment for Strategy

One other limitation of the Supertrend Indicator is its fine-tuning aspect.

It is usually difficult to find out what indicator settings might suit a certain pair or asset over a specific timeframe.

As such, finding the optimal settings can sometimes be a trial-and-error process.

While it may well be highly effective for some assets, it could not perform as well for others.

False Signals

It’s a well known fact, but is price repeating – using any Indicator by itself can result in false signals.

While the Supertrend Indicator may go independently during certain scenarios, its true power is harnessed when integrated with other technical trading tools and techniques.

It’s necessary to grasp that the Supertrend Indicator must be practiced and tested in your trading strategies and beliefs.

Ranging Market Challenges

The Supertrend Indicator is designed to discover trends, as evidenced by its name.

Hence, it performs well in trend identification but struggles in ranging markets.

Due to this fact, it’s crucial to evaluate whether the market is currently in a trend or a range.

When the value is in a variety, the indicator is more prone to generate frequent and infrequently less profitable signals before a trade exit signal.

Well, that was a variety of information – let’s summarize all of it for you…

Conclusion

So there you’ve gotten it!

The Supertrend Indicator is a precious tool in any trader’s arsenal.

It offers simplicity, customizability and effectiveness in identifying trends and entry points!

Traders can apply it to all timeframes, whilst also sticking to fundamental trading rules, comparable to trailing stop losses and logical stop loss placement.

The Supertrend Indicator will give great signals and potentially capture larger trends when used accurately, especially when layered with other indicators!

Nonetheless, like all indicators, the Supertrend Indicator has its limitations…

Being a lagging indicator, it relies on past data and will not all the time accurately predict future trends.

Remember too, that the optimal settings can vary from asset to asset and different timeframes.

Finally, the Supertrend Indicator performs best in trending markets and will yield false signals in ranging markets – so double-check!

By fully understanding these strengths and weaknesses, traders are able to harness the indicator’s potential as a part of a comprehensive trading strategy!

Well, I hope you might be excited to make use of the Supertrend Indicator to level up your trading.

Let me know within the comments how you’re going to utilize the ability of the Supertrend Indicator!