This post is written by Jet Toyco, a trader and trading coach.

On the earth of trading oscillators…

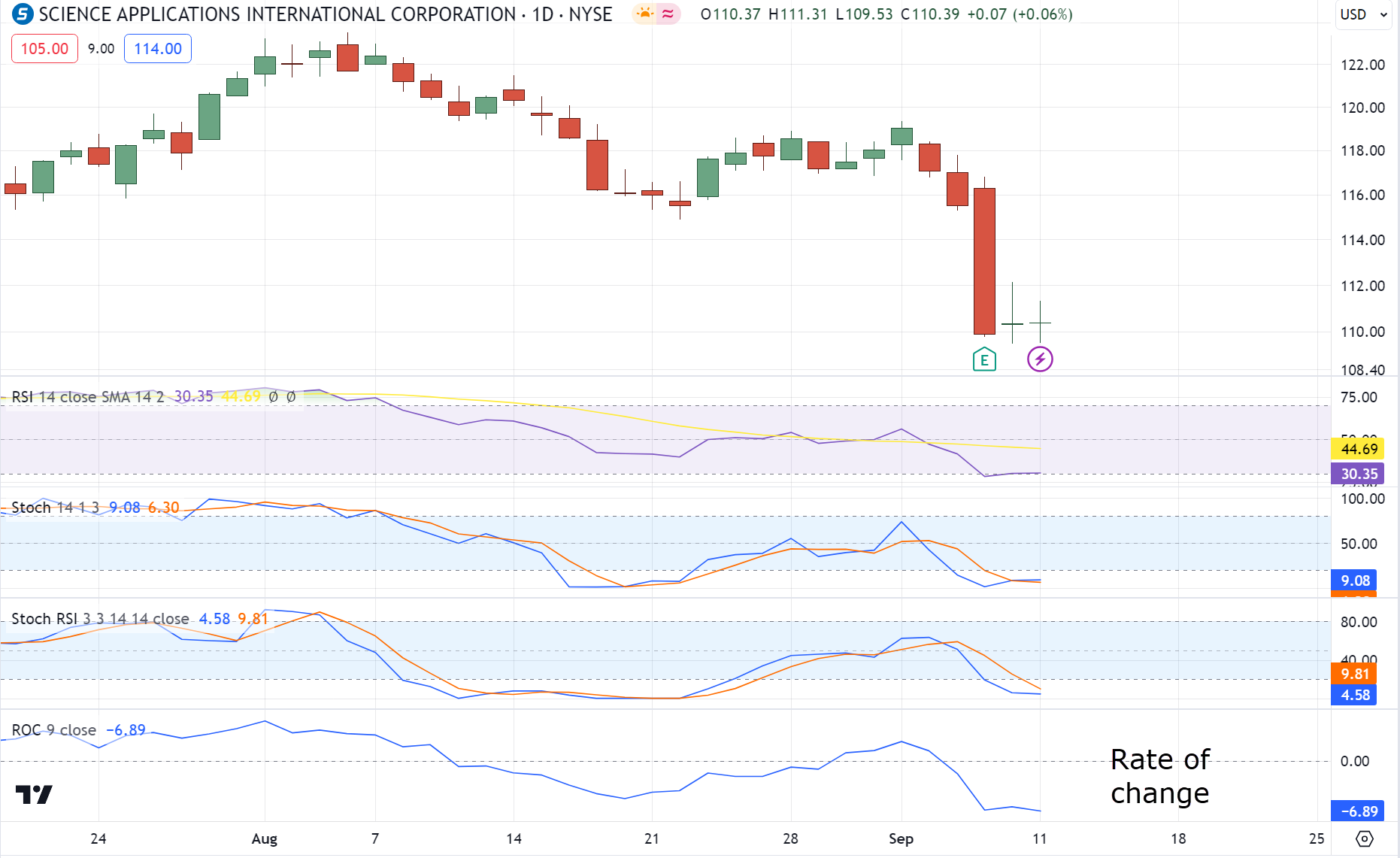

You will have the RSI indicator…

The Stochastic Indicator…

Heck – you even have the Stochastic RSI indicator!…

So, with all of the plethora of indicators on the market…

What does the ROC indicator bring to the table?…

…is it there to higher time your entries?

…or to call out trends, perhaps?

Nope!

It’s there to allow you to pick the very best markets to your watchlist – so that you never need to second-guess yourself again!

That’s why in today’s guide you’ll learn…

- What the ROC indicator is and the way it’s meant for use

- A proven and tested technique to select the very best stocks to trade with the ROC indicator

- Learn how to use the ROC indicator to decide on profitable Forex pairs to trade

- A backtesting result to work out if the ROC indicator works or not

This guide may very well be crucial to support your trading portfolio (especially the last section!).

So, prepare your notes and charts – and let’s start!

What’s the ROC indicator and the way do you utilize it

The speed of change indicator (ROC) is a momentum-based oscillator developed by Fred G. Schutzman back within the Nineteen Fifties.

It’s existed for a reasonably rattling long-time – and for good reason!

But, how does it work?

In easy terms…

The ROC indicator measures how strong or weak a market is.

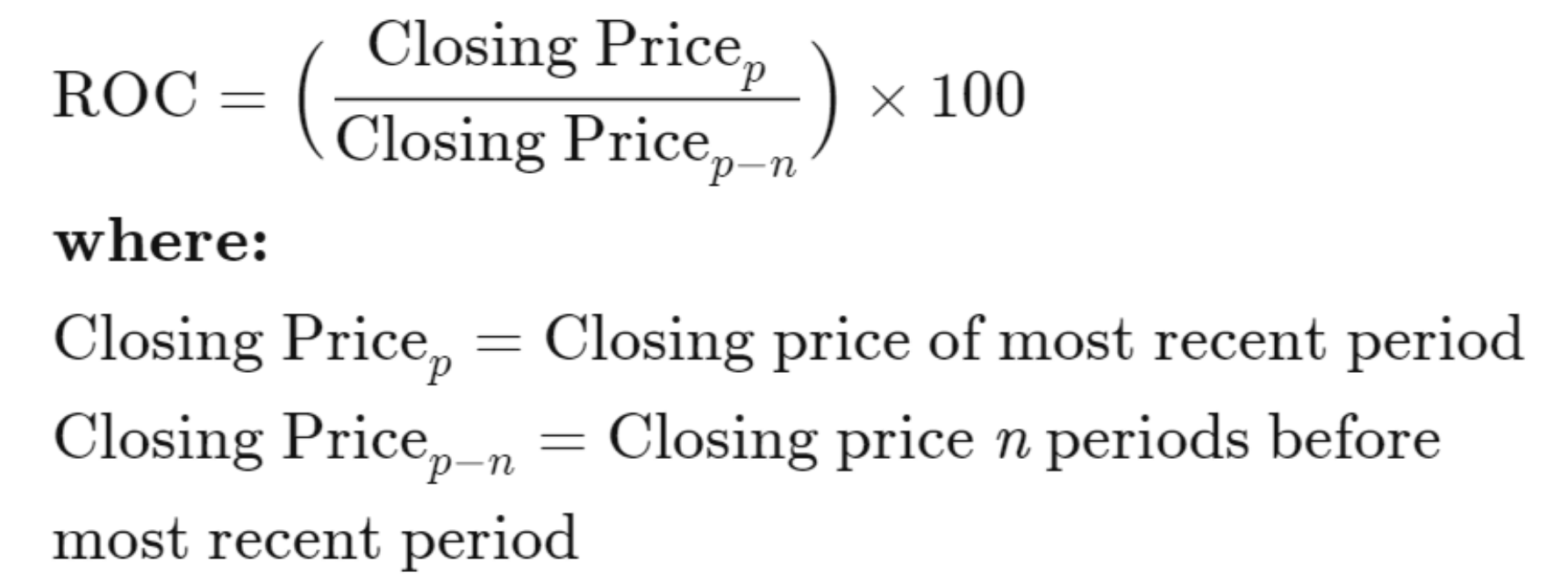

It does this by dividing the last closing price by the previous closing price (depending on the period you select).

Here’s what I mean:

Source: Investopedia

To place it in easy terms…

Let’s say you made the choice to check your physical strength , between 2016 to 2019.

The ROC indicator could be an excellent metric for this – supplying you with a transparent idea of just how much things had modified in that point

And that’s right…

There aren’t any “overbought” and “oversold” levels here…

Simply put – the upper the worth is, the stronger the market is as a complete (in a way, a better or lower value means the market has been trending well).

Alright, now that you already know how it really works…

How do you utilize the ROC indicator?

Two words, my friend…

Market selection

That is what most latest traders miss out on.

…as they’re often way too focused on shiny latest strategies and indicators!

But here’s what I need to let you know immediately.

A consistent technique to select markets to trade is the most important contributor to stable performance.

Now read that again.

Got it?

Great!

OK, I do know what you’re pondering immediately…

“Alright, how exactly do I take advantage of the ROC indicator to pick out markets to trade?”

Well, you’re in for a treat.

Let me show you in the following section…

Using the ROC indicator to select the very best stocks to trade

“There are literally thousands of stocks on the market, which one do I enter?”

“Which market sector should I trade stocks on?”

Have you ever asked these questions before?

I’m sure you have got!

And when the reply isn’t obvious, what’s next?

…Search for stock suggestions, right?!

Some “insider” news on which stocks to select!?

In fact, as you already know, it’s never sustainable.

As a substitute…

What you would like, to consistently pick winning stocks, are three step-by-step processes:

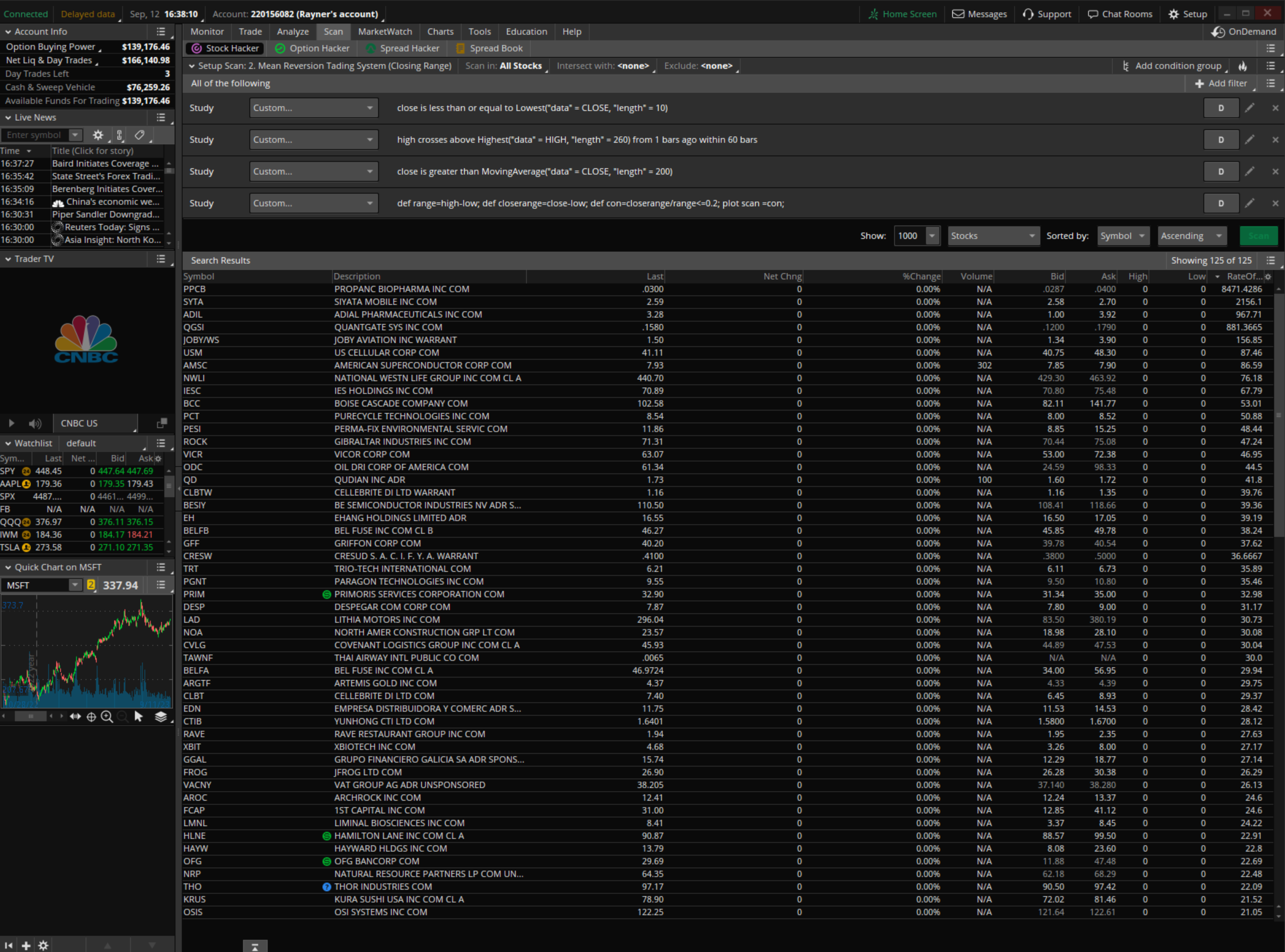

Step #1: Setup your trend filter

Identical to a trading strategy that tells you when to enter and exit your trade…

A trend filter is important to your trading plan.

Now, when you trade the US Stock market, you have got access to screeners resembling:

- Finviz

- TradingView

- Thinkorswim

…and possibly more.

And the very best part?

They’re all free!

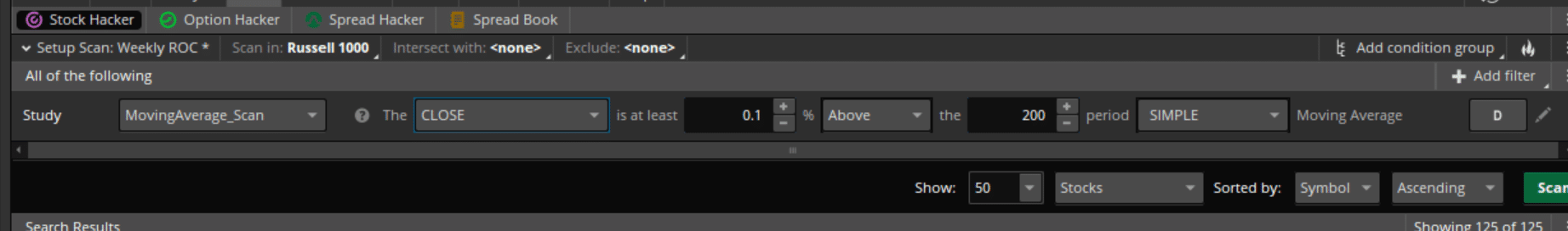

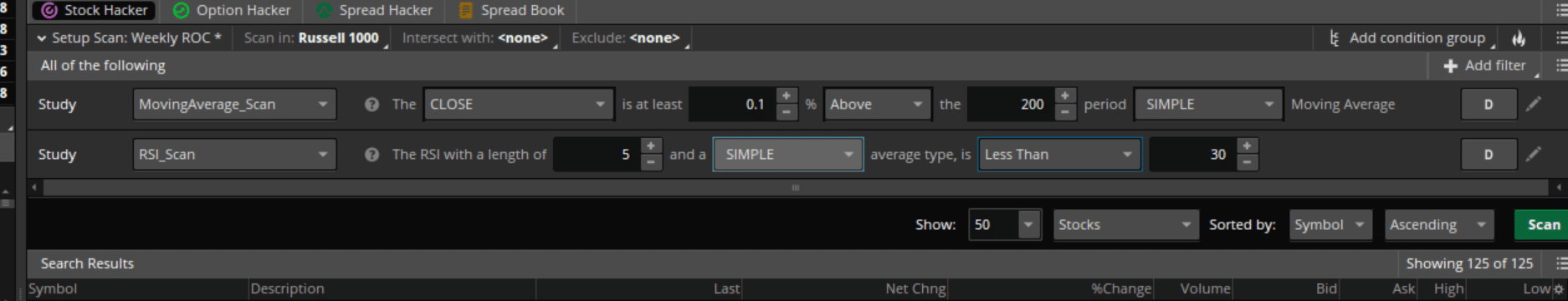

Nonetheless, I’ll be using Thinkorswim for example for this trading guide…

And here’s the thing, my friend…

While I’ll share with you a screener which you could benefit from in your trading…

…I’ll make it so simple as possible – so you have got numerous flexibility to tweak it to your individual!

Sound good?

Alright, so…

Should you’re a trend follower, you may simply add a 200-day moving average to your filter…

And when you’re someone who trades pullbacks inside the trend, you can even add an RSI (relative strength index) into the combination…

But, “why the RSI?”, chances are you’ll ask…

Well, that is your secret sauce – in search of trending stocks which can be making a pullback!

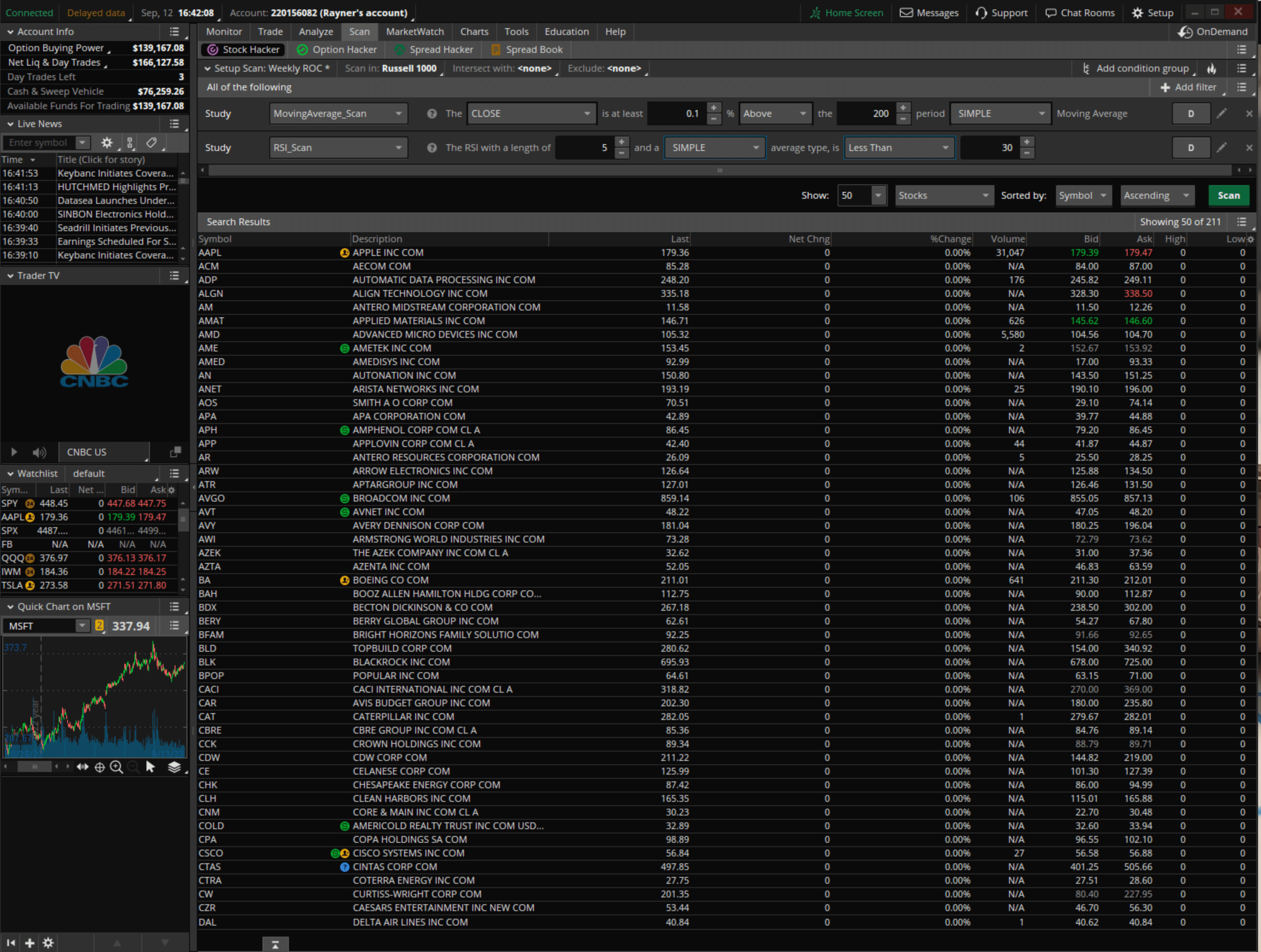

So, when you perform the scan on Russell 1000, search for trending stocks (200 MA) making a pullback (RSI).

You’ll see a few stocks in your results…

Again, depending in your trading methodology you may change the filter accordingly.

So – now you have got them…

…what do you do with these stocks out of your screener?

…which of them must you trade first?

I mean, you may’t trade all of them, right?

That is where the ROC indicator chips into the combination.

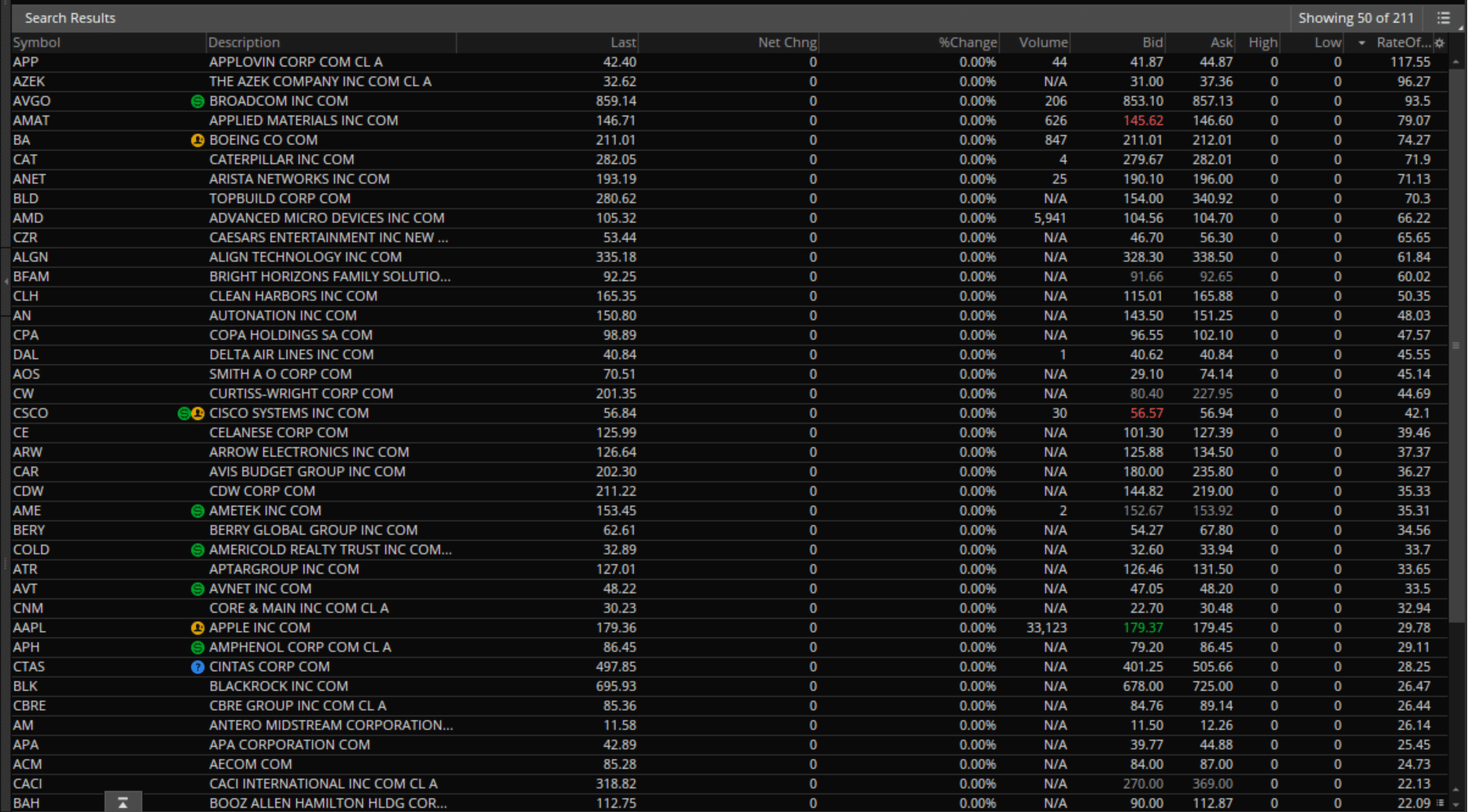

Step #2: Add the ROC indicator to the filter results

Once you have got the screener results…

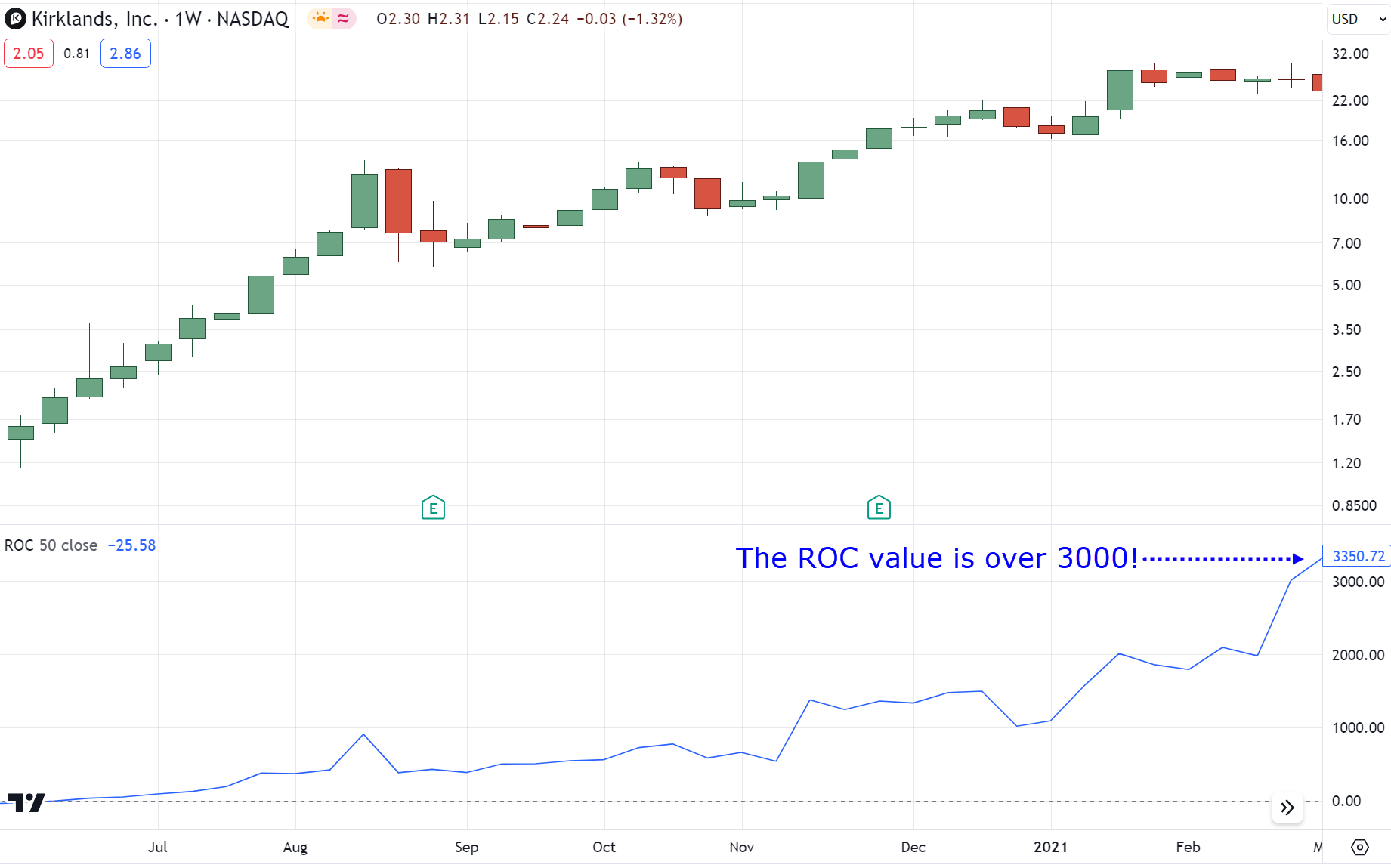

You just add the 50-week rate of change…

What this does is that it adds one other “factor” or column out of your scan results some time ago!…

And by the way in which…

I selected the 50-week ROC indicator period to measure the stock’s strength over one 12 months of information (long-term strength)…

…but you’re free to alter it to twenty to 30-period to measure a stock’s medium-term strength.

What I mean is – there’s no “magic” number here.

…it’s simply whether you would like to find out long, short, or medium-term strength!

Got it?

So now you have got the ROC indicator values showing up in your filter…

…what’s next?

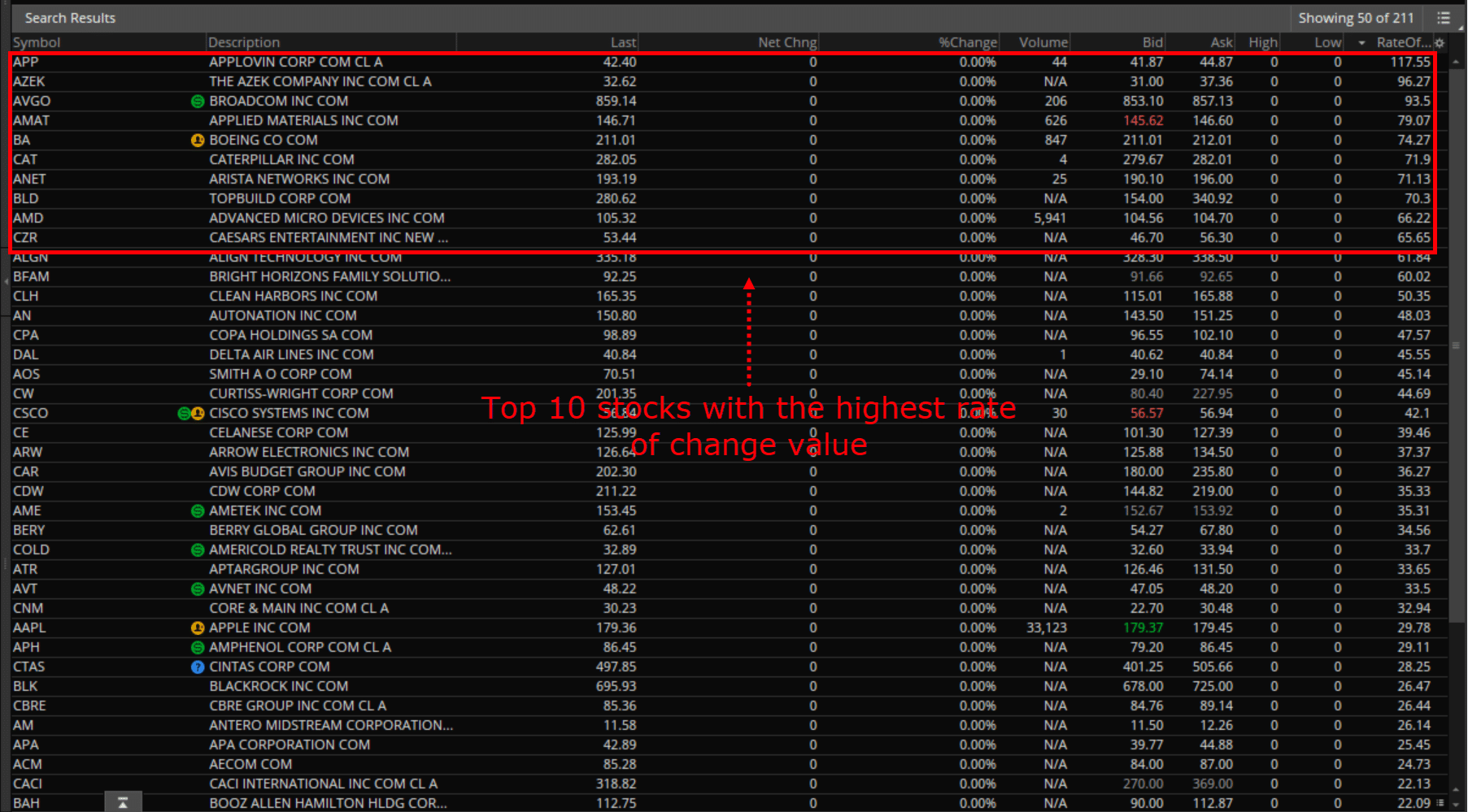

Step #3: Rank the stocks with their ROC values accordingly (highest to lowest)

Once you have got:

- Trend filters set that enhances your trading style

- ROC indicator values showing in your screener results

The third step is to easily to rank those values from top to bottom…

And prioritize entering the highest stocks on the list!

So, Should you allocate 10% of your portfolio on a stock which provides you a max of 10 open trades…

Then only pick the highest 10…

But when you have already got 6 open trades, then only pick the highest 4 on the list.

Make sense?

Here’s one other thing to remember…

I do know these steps may appear to be they might take you without end to execute.

But in point of fact?

…it’ll only take you lower than 5 minutes when you’ve arrange your screener!

It’s a small price to pay for consistently picking winning stocks to trade.

Alright, but…

…what when you don’t trade stocks?

What when you trade forex?

Do the identical steps apply?

Well, unfortunately not with this setup…

…but it might probably be done one other way!

Let me show you easy methods to do it…

Learn how to select forex pairs to trade with the ROC indicator

As you already know…

There are literally thousands of stocks on the market to trade…

But within the forex market?

…Kind of 100 pairs!

That’s way lower than what you’re used to within the stock market, right?

Nevertheless it’s also a likelihood for the ROC indicator to take the highlight.

As a substitute of constructing a filter, you can be using the ROC indicator to make…

…a currency strength cheatsheet…

Step #1: Develop a currency strength cheatsheet

Should you recall…

The essential principle on why I make screeners is to search for strong stocks to trade.

But, how do you apply the identical principle when trading the forex market?

Let me show you.

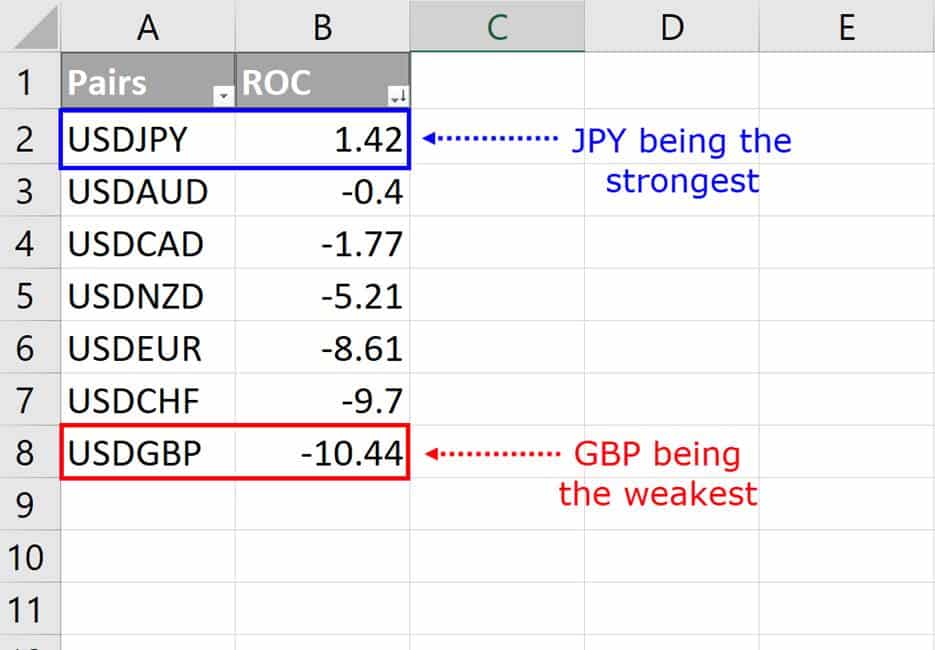

First, you retrieve the present 50-week ROC indicator values from these pairs:

- USDJPY

- UPDATED

- USDGBP

- USDCHF

- USDCAD

- USDEUR

- USDNZD

Yes – you read that right!

The USD pair have to be the bottom currency for this.

Next, retrieve the values by pulling out an ROC indicator in your chart…

The values should look something like this after collecting all of them across the main pairs…

Now that you have got this “cheat sheet”, what the heck do you do with it?

Step #2: Rank the ROC indicator values from top to bottom

Pretty obvious, right?

It’s the identical thing I did just slightly while ago!…

But there’s a twist here…

Step #3: Match the weakest and strongest currencies

That is what makes the forex market “the” forex market.

There are at all times two currencies to think about, not only one!

Now, when you have a look at the cheatsheet…

…you may see that the JPY is the strongest pair while GBP being the weakest pair.

(By the way in which, the USD is at all times 0 because it is the premise)

Knowing these, what do you do next?

You match them by adding GBPJPY to your watchlist!

Easy, right?

It’s almost the identical thing as rating stocks with the ROC indicator!

The very best part is that you have got flexibility over the rating table, as you’re free to cross-match other currencies…

So, you may consider trading GBPNZD, GBPCAD, GBPAUD, GBPJPY, and so forth – for other currencies as well.

That’s all there may be to it!

It’s a consistent method to pick out forex pairs to trade – using the ROC indicator!

Oh – and yes, those ROC values do change…

So, I suggest you refresh your watchlist every week!

Now…

I do know that I shared with you easy methods to use the ROC indicator as a market selection tool for the stock and forex markets.

But still…

It doesn’t change the incontrovertible fact that it’s just “certainly one of those” indicator lines in your chart!

So, to make this tool stand out in your arsenal…

I’ll perform a historical backtest to seek out out whether or not this tool works.

Ready?

Then let’s start…

The ROC indicator: Does it work?

For this test…

I’ll be using a mean reversion trading strategy with these rules:

- The stock have to be above the 200-period moving average

- The stock have to be below 2-period RSI 30

- If the stock closes above RSI 30 enter at the following candle open

- Exit the stock if it closes above 2-period RSI 50

- Allocate a max of 20% per stock (max 5 open trades)

All clear?

Well, after performing a 20-year backtest with the Russell 1000 stock market universe…

Here’s the way it performed:

- Av annual return: 8.81%

- Max drawdown: -27.77%

- Win rate: 61%

Now what when you add a 100-day ROC indicator filter into the combination where you rank stocks and prioritize trading them?

- annual return: 13.59%

- Max drawdown: -31.86%

- Win rate:10%

Pretty impressive, right?

Without changing the foundations of the strategy, the performance of the system has increased!

I simply added a portfolio management rule with the ROC indicator!

Are you able to see how essential that is?

So, the following time you encounter a losing streak…

…the last item you’d wish to do is mess along with your strategy…

Now at this point, I’m sure you already noticed that I attempted to make this guide as practical as possible…

…revealing as many secrets as I could.

But at all times remember…

…testing the ROC indicator first is crucial before putting your hard-earned money on the road.

Right! Let’s do a fast recap…

Conclusion

The ROC indicator can easily be a “free upgrade” to your existing trading strategy.

It’s a versatile indicator that’s an excellent addition to any trading plan.

So, even when you have already got a ton of indicators in your chart,

You’ll be able to keep them there and use the ROC indicator to allow you to navigate where the “big fishes” are on this vast sea of markets to trade.

Nonetheless, here’s what you’ve learned for today’s guide:

- The ROC indicator measures how strong or weak a market is, by simply comparing the present price with the previous prices (the upper or lower the values are, the higher)

- The speed of change indicator can easily be used to trade the stock markets, by rating your screener results based on its results

- Making a currency strength meter that’s based on the ROC indicator is a must, to find out the strongest and the weakest currencies to pair and trade

- A backtest result that shows how the ROC indicator can improve your results, without even changing your existing strategy

And there you go, my friend!

An entire (no bars held) guide to using and trading with the ROC indicator!

So, here’s what I need to know…

Have you ever been expecting this guide for some time after hearing this indicator multiple times on videos?

Will you concentrate on using the ROC indicator in your strategy after today’s guide?

Let me know within the comments below!