Are you the style of trader that understands the direction of trends?

Even what side of the market you need to be on?

But regardless of what…

…you simply can’t appear to time the entry accurately?!

Or perhaps you struggle to execute trades – uncertain concerning the reversal point at which the market may turn in your favour…

Sound familiar?

Luckily, I actually have something that’ll transform your doubt into solid confidence!

How?

The Tweezer Top Pattern!

Here’s what you’ll learn in this text:

- What the Tweezer Top Pattern is

- Tips on how to trade the Tweezer Top in an already trending market

- Tips on how to trade the Tweezer Top for trend reversal

- How you may transform small winners into impressive trend-capturing giants

- Tips on how to confidently navigate the market with precision

- Mistakes to avoid when adding this tool to the arsenal

Sound promising?

Well, let’s start!

What’s the tweezer Top Pattern?

The tweezer top pattern is a candlestick pattern that each trader must have of their toolbox.

It consists of two candlesticks, each with equal highs – one arriving after the opposite.

Now, these candles can are available all sizes and shapes…

The crucial thing is that the 2 highs of the candles are the identical.

Let me show you…

Tweezer Top Pattern Examples:

Notice how each time the second candle attempts to surpass the previous candle’s price, it merely matches its high?

That is what I’d call a Tweezer Top Pattern.

Now once I say match – do I mean exactly the identical price?

Well, let’s be realistic.

Markets aren’t perfect systems.

With so many alternative participants across limitless brokers and hundreds of thousands of various opinions, markets are rarely going to line up perfectly with the best way the “textbook” shows it.

So once I speak about matching the high, I don’t mean picture-perfect – but close enough!

Allow me to reveal this on a chart…

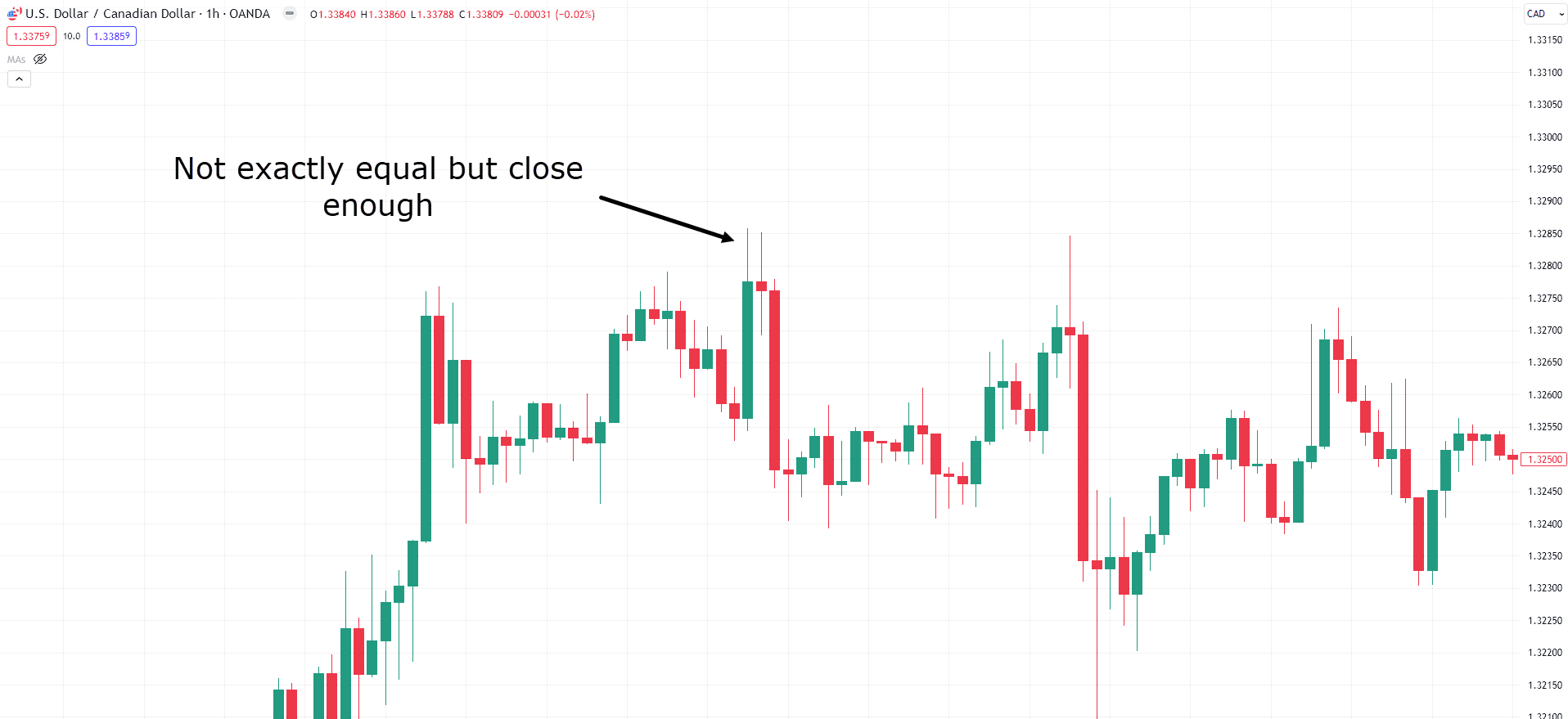

USD/CAD 1-Hour Chart:

While these highs aren’t precisely the identical, they’re very close.

In this instance, I’d still consider what you’re seeing as a Tweezer Top Pattern.

So why is the degree of perfection in these highs not so critical, anyway?

If you deconstruct a Tweezer Top Pattern, what are you truly observing?

Should you give it some thought, you’re principally seeing a short-term shift in momentum.

Price makes a latest high… the bulls are on top of things and able to push the subsequent candle higher!

But the subsequent attempt at making a better high is met with selling pressure by bears!

Hence, on this sense, a Tweezer Top Pattern can discover shifts in momentum.

So let me ask you….

What do you think that you’d see in the event you checked out these very same candles but on a lower timeframe?

Are you able to guess?…

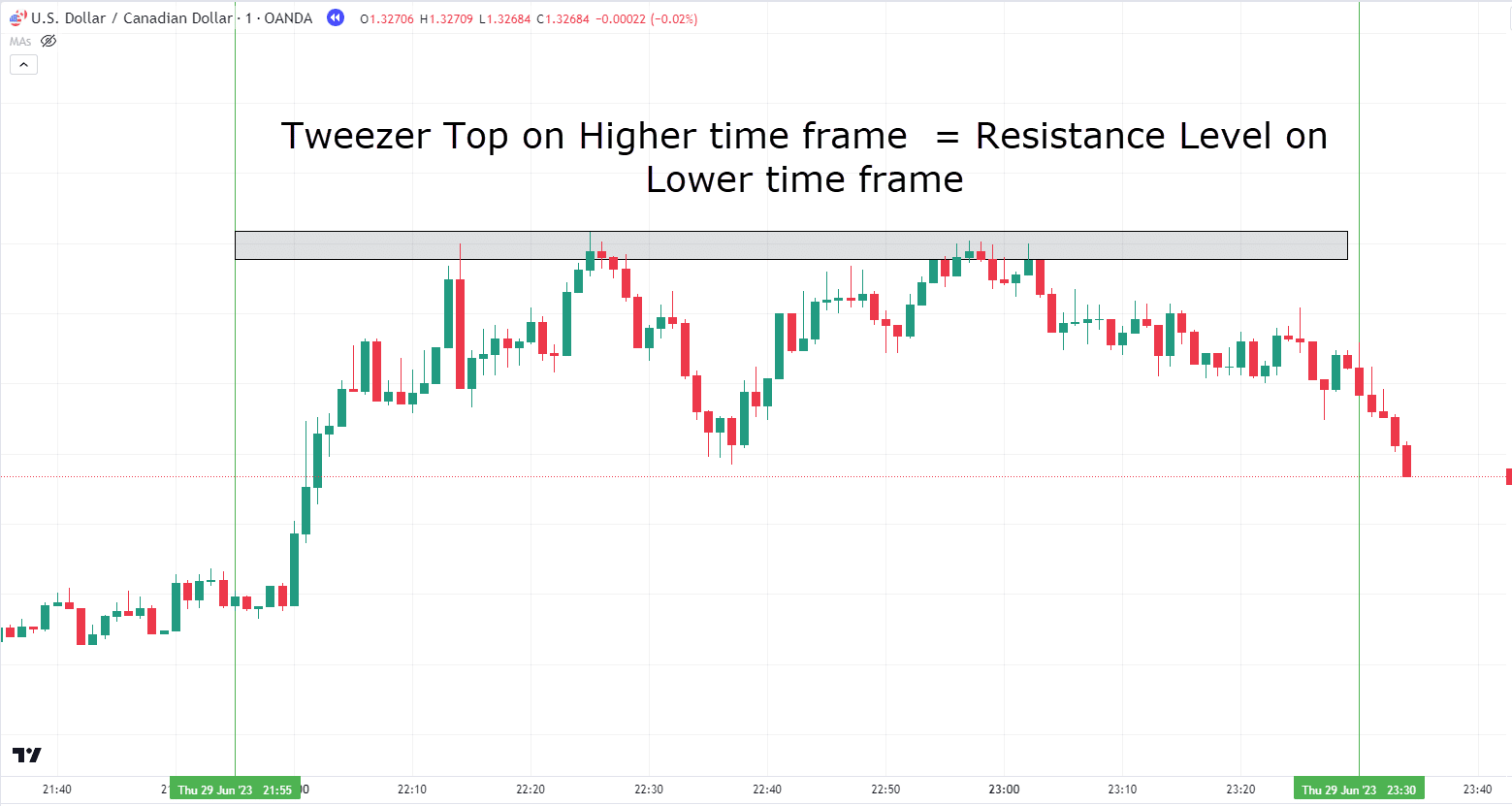

USD/CAD 1 Minute Chart:

See it?

A transparent resistance level, right?

Price made repeated attempts to breach this level but failed after every attempt.

On the lower timeframe, this ends in an easily recognizable resistance level…

…but on the upper timeframes – a Tweezer Top!

Now that you simply are aware of the Tweezer Top Pattern, let’s get to the exciting a part of how you may actually use it to generate profits!

Trading the Tweezer Top

There are two primary methods to trade the Tweezer Top Pattern.

Certainly one of these methods is when you find yourself searching for a pullback trade within the larger trend.

The opposite is when you find yourself searching for reversals from major key levels.

Let’s start with the pullback setup…

Tweezer Top Pullback Setup

You’ve probably seen that in a downtrend, price steadily experiences temporary pullbacks – on account of buyers entering the market at different levels.

These are literally opportunities that mean you can enter the market after the trend has either been confirmed otherwise you missed your initial entry.

But how will you use the Tweezer Top Pattern to trade a pullback?

Well, first you could learn to discover an asset that’s already in a downtrend.

Take a have a look at this chart…

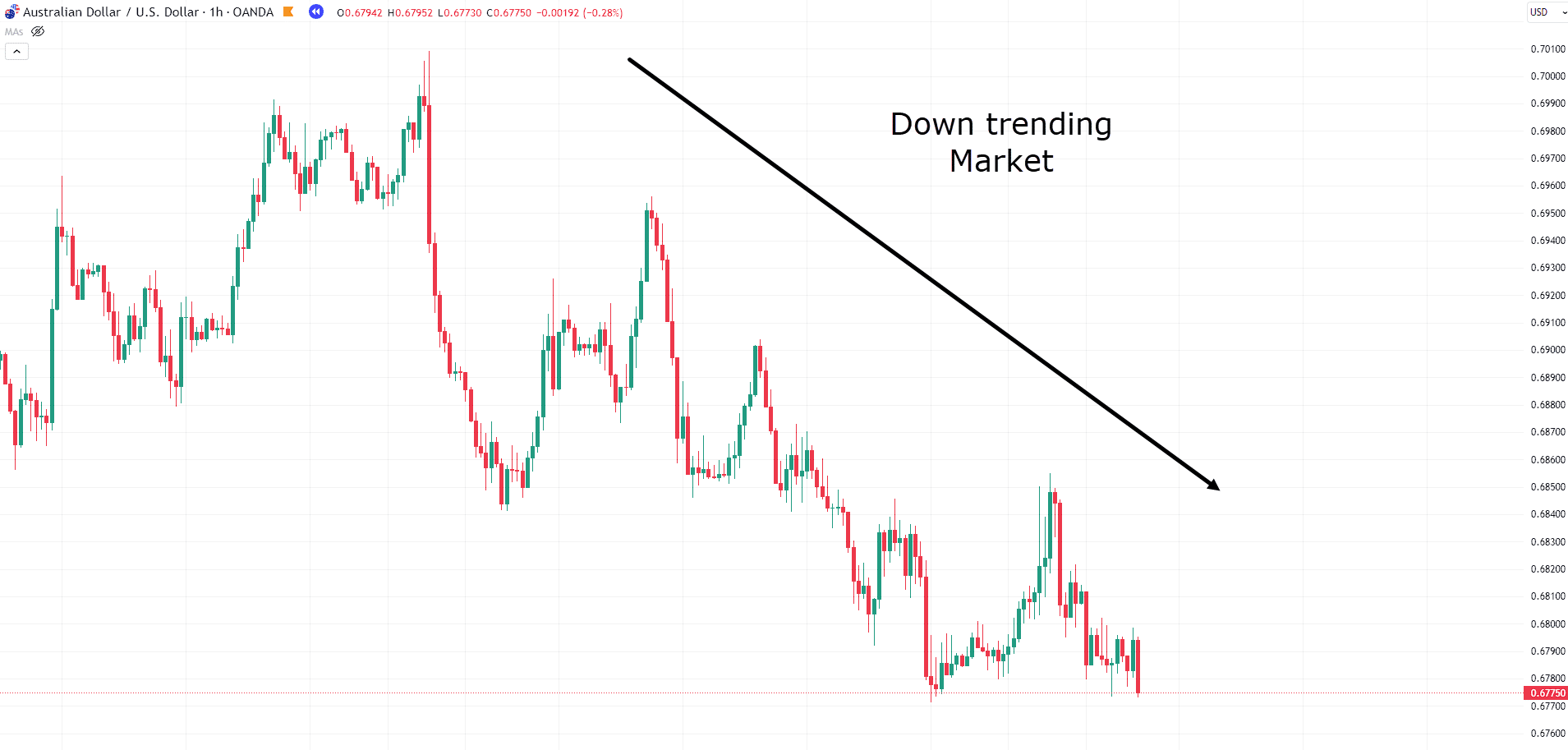

AUD/USD 1-Hour Chart:

See how the worth is moving down but has temporary pullbacks?

Well, these are great opportunities to enter the market.

And the way do I do know when the pullback is able to proceed within the direction of the major trend?

You guessed it… the Tweezer Top pattern!

So let’s wait for a Tweezer Top Pattern to form…

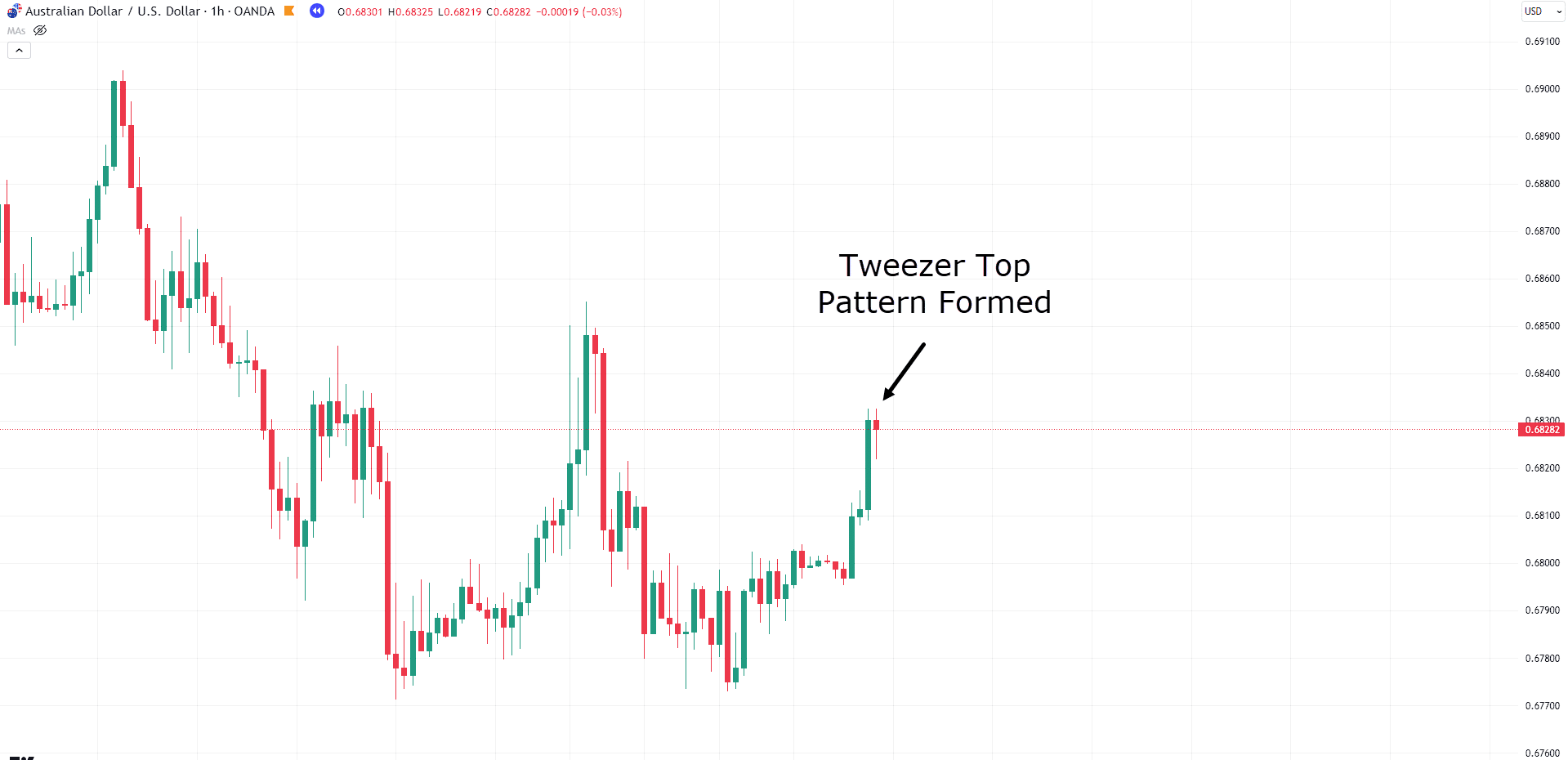

AUD/USD 1-Hour Chart:

As you may see here: overall trend down – CHECK!

Price has paused and is in a “Pullback” – CHECK!

The Tweezer Top Pattern has formed – CHECK!

I do know what you’re considering!

“Rayner – Sell, you might want to sell! Now!”

Hang on a minute! I do know you’re desperate to cash in on this but you’re forgetting something!

Where are you going to set your stop loss and take profits?

As you recognize – I really like to plan my trades fastidiously slightly than take impulsive leaps of religion!

So let’s have a look at a logical option to set your stop losses and take profits…

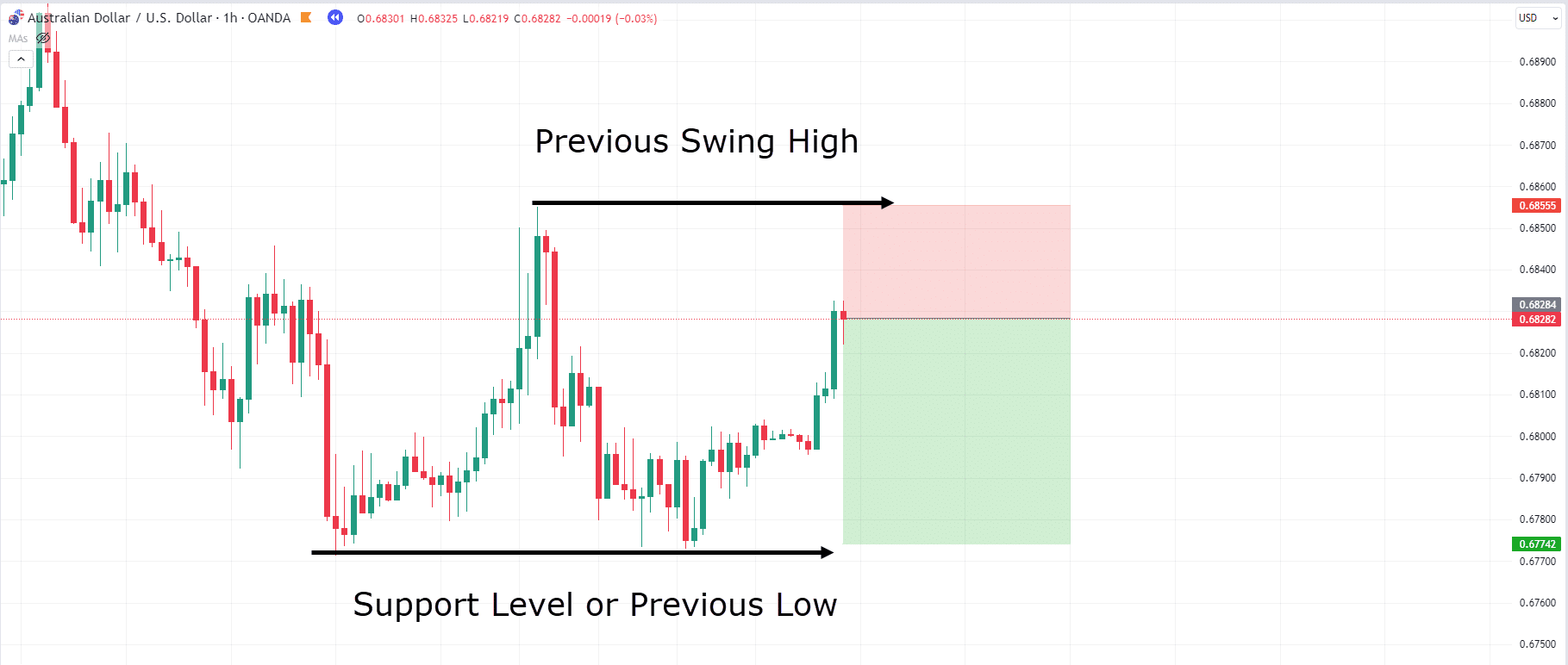

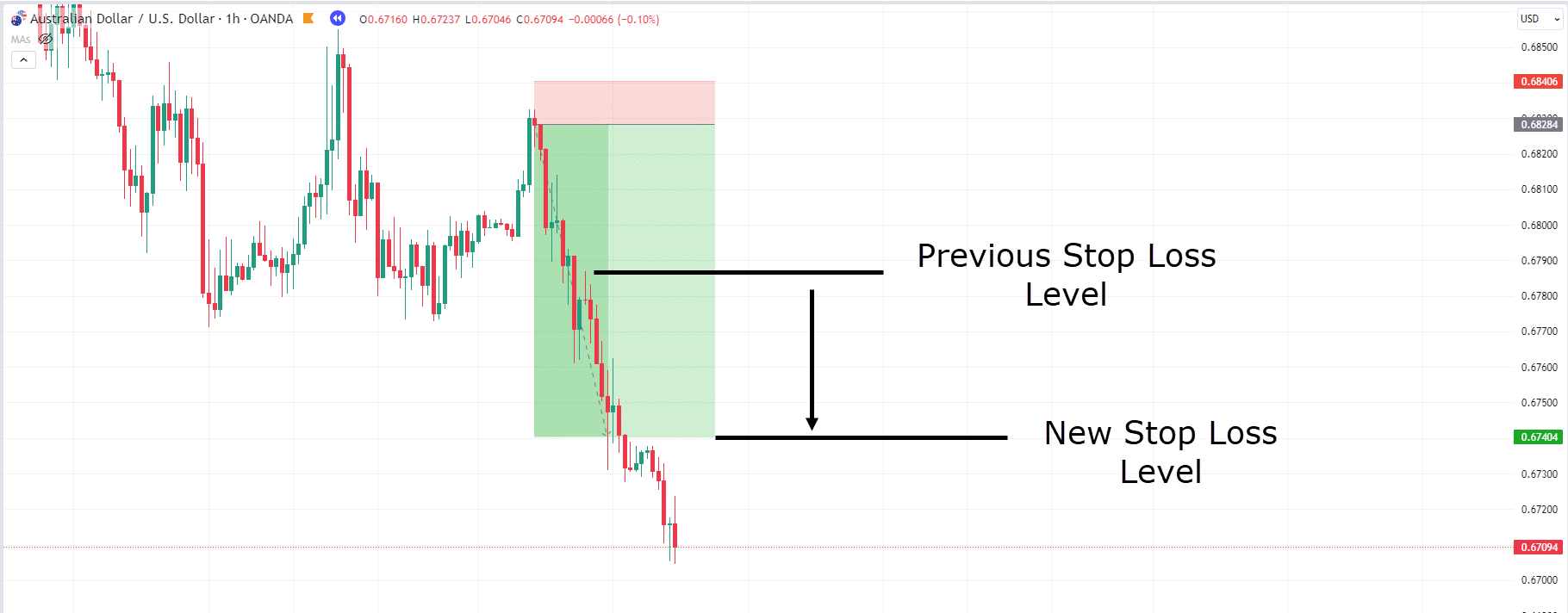

AUD/USD 1 Hour Chart Stop Loss Example #1:

Depending on how aggressive you must be, a logical place to your stop loss could be above the previous high.

Why there?

Because if the worth breaks above this high, your trade could be invalid.

Should the downtrend finish and the worth begin a sequence of upper highs, you likely wouldn’t wish to be holding a brief position, would you?

And what about your take profit?

Depending in your individual trading strategy, a wise place to take either some or your entire profits is at the extent price bounced previously.

It’s because if the worth does come back to this level, buyers could also be interested in buy into the market again and take a look at to ascertain that level as support.

Make sense?

Good!

But what in the event you desired to be extremely aggressive together with your trades?…

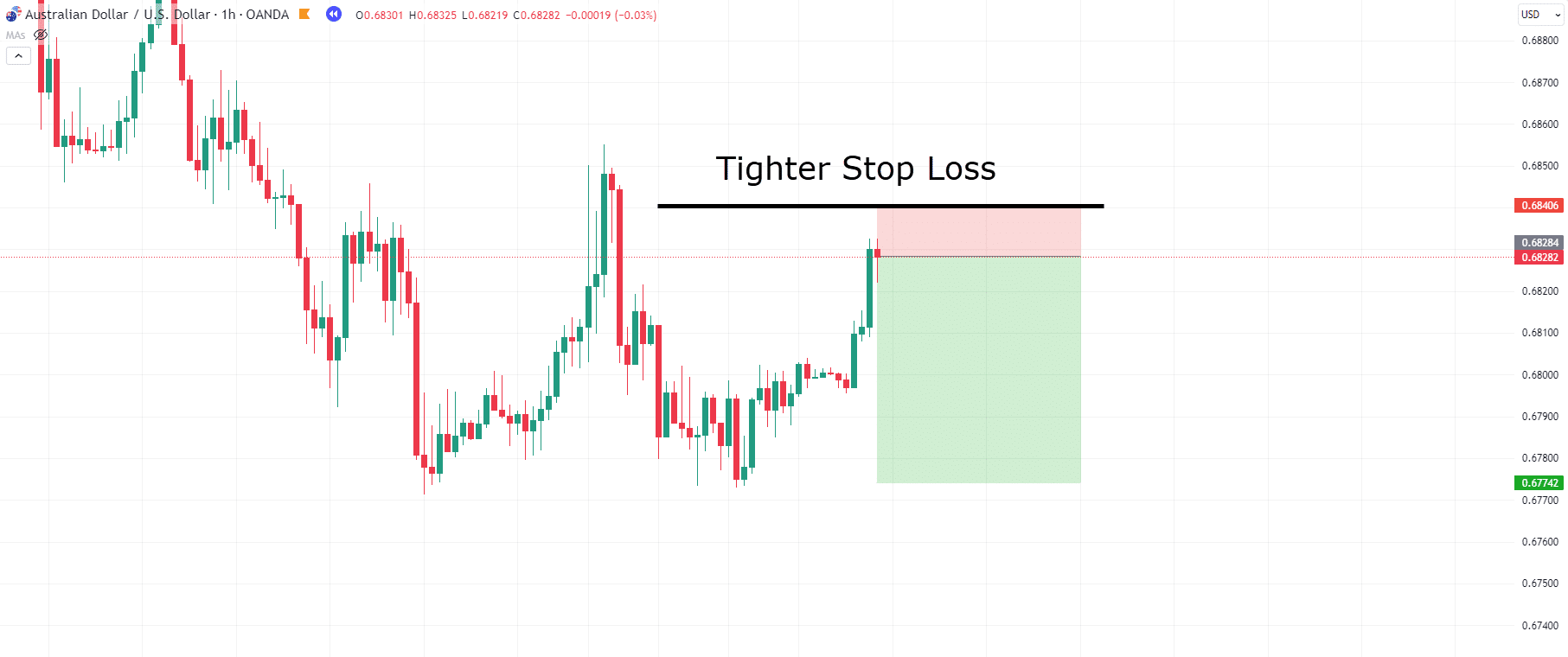

AUD/USD 1-Hour Chart Stop Loss Example #2:

Now the thought behind this stop loss is that you simply are counting on the tweezer top truly being the low timeframe resistance level, and a real reversal point.

The advantage of this approach is that, in the event you do time the Tweezer Top Pattern accurately, your Risk: Reward Ratio is significantly improved!

While this approach could potentially lead to a greater variety of overall losing trades…

…in the event you do emerge victorious, the gains might be that rather more substantial!

So, how would these trades have played out?…

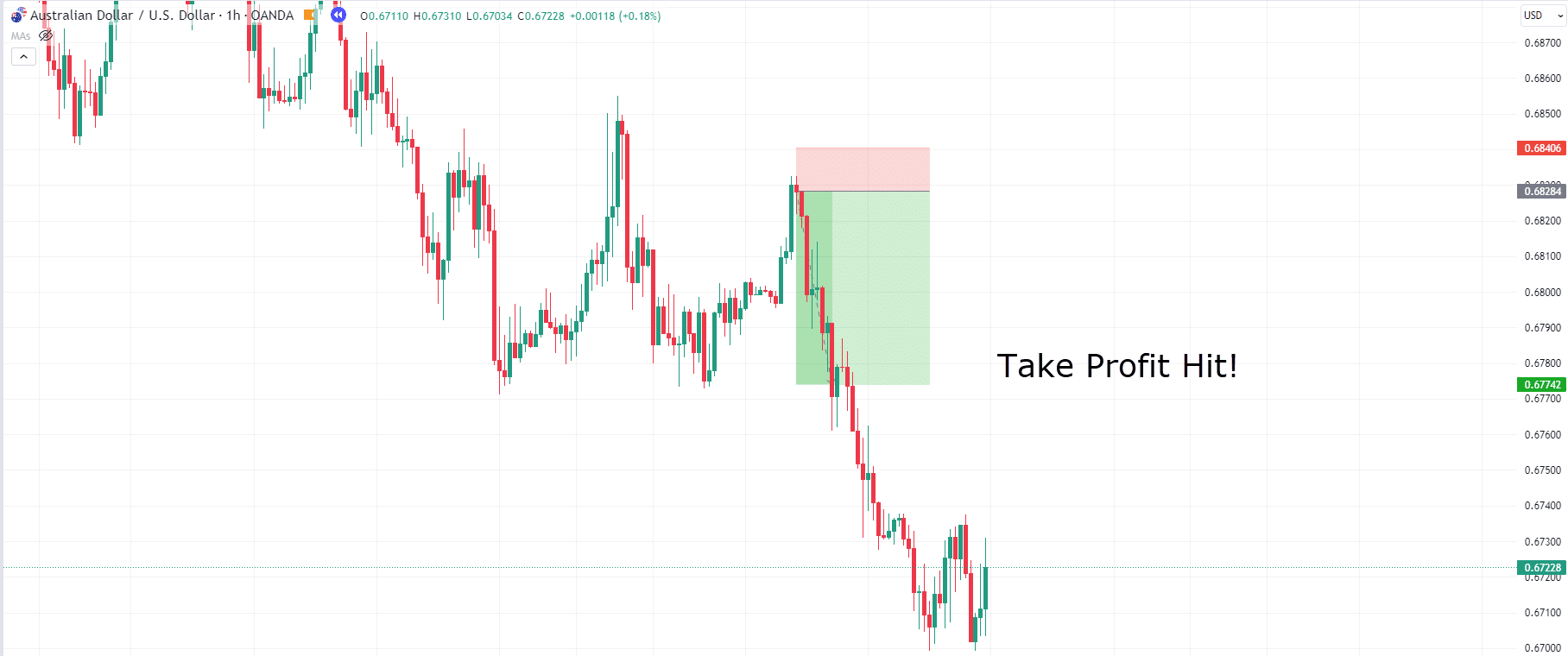

AUD/USD 1-Hour Chart Take Profit:

Wow! What a winner!

But… hang on a minute…

Have a look at what could’ve been!!

While securing profits and achieving a winning end result is all the time a very good thing…

…you and I each know this trade might evoke a touch of regret on account of its continuation after the exit…

But don’t worry!

There remains to be a option to capture more profits!

It takes a bit of bit more experience and regular hands but – it could possibly be well well worth the effort.

On this case, trailing stops may be an excellent option to capture trends and squeeze every last little bit of money out of a trade.

Let’s proceed taking a look at this AUD/USD example…

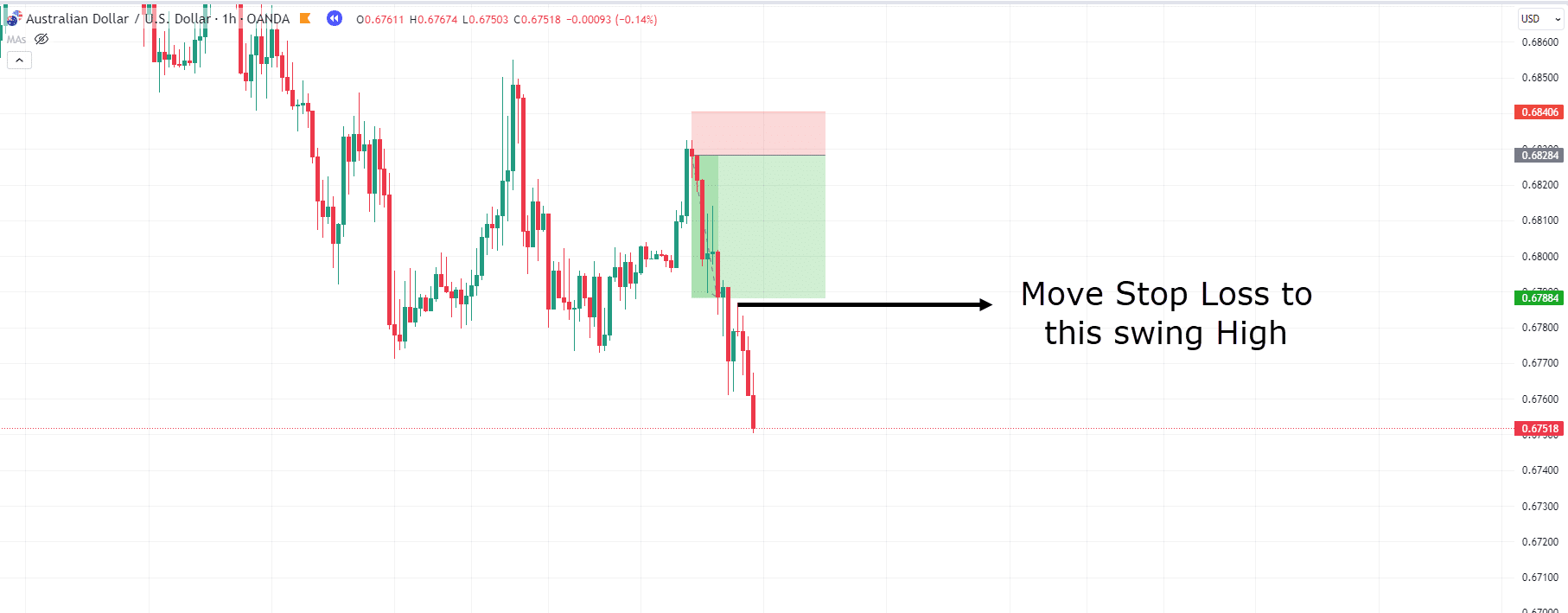

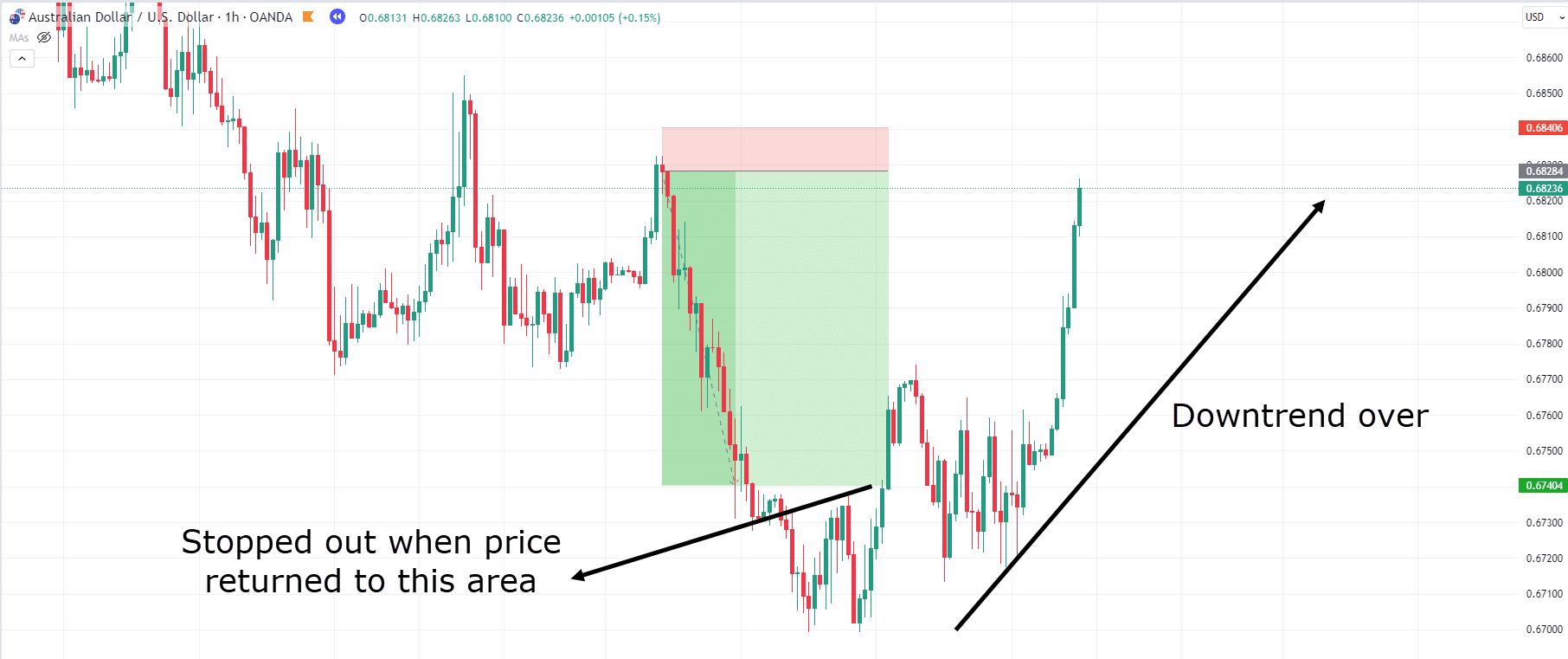

AUD/USD 1-Hour Chart Trailing Stop Loss:

As the worth continues lower and smashes through the potential support area, you may assume that even lower prices are coming…

So the perfect option to take profits, while also allowing the market to maneuver in your favour, is to follow the downtrend swings!

Although this level doesn’t appear like much of a swing high, you may see that price paused and tried to maneuver higher from this point.

Accordingly, it is a logical level to temporarily move your stop loss to – taking any profits should the worth return to this area.

Let’s proceed with this trade…

AUD/USD 1-Hour Chart Trailing Stop Loss #2:

Wow, this trade is actually moving, hey!

Luckily, you didn’t just take profits since you were afraid of losing a small portion of your winnings!

But, guess what! You’re still on this trade!

How far can this go?!

Let’s discover…

AUD/USD 1-Hour Chart Taking Profits:

…and there it’s!

Price tried yet one more time to go lower and did not accomplish that.

When the worth got here back up you’d have been stopped out at a whopping 7RR for this trade!

Hopefully, you may clearly see why being stopped out with the trailing stop loss worked out well.

It captured the vast majority of what the trend had to supply before prices began forming higher highs and better lows.

See how it could possibly be helpful to make use of all of the tools you have got learned through the years of trading to maximise profits with the Tweezer top pattern?

Let’s take a have a look at one other example!…

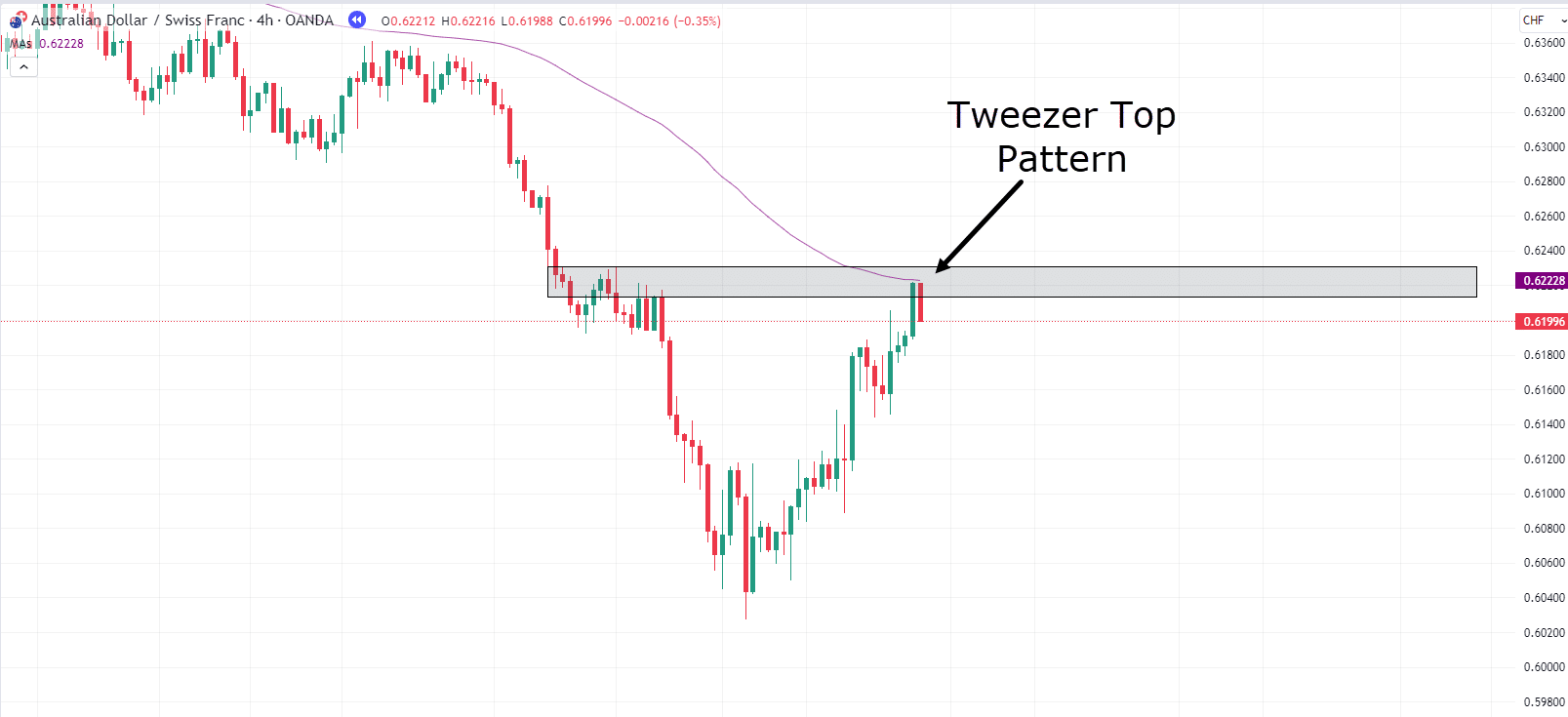

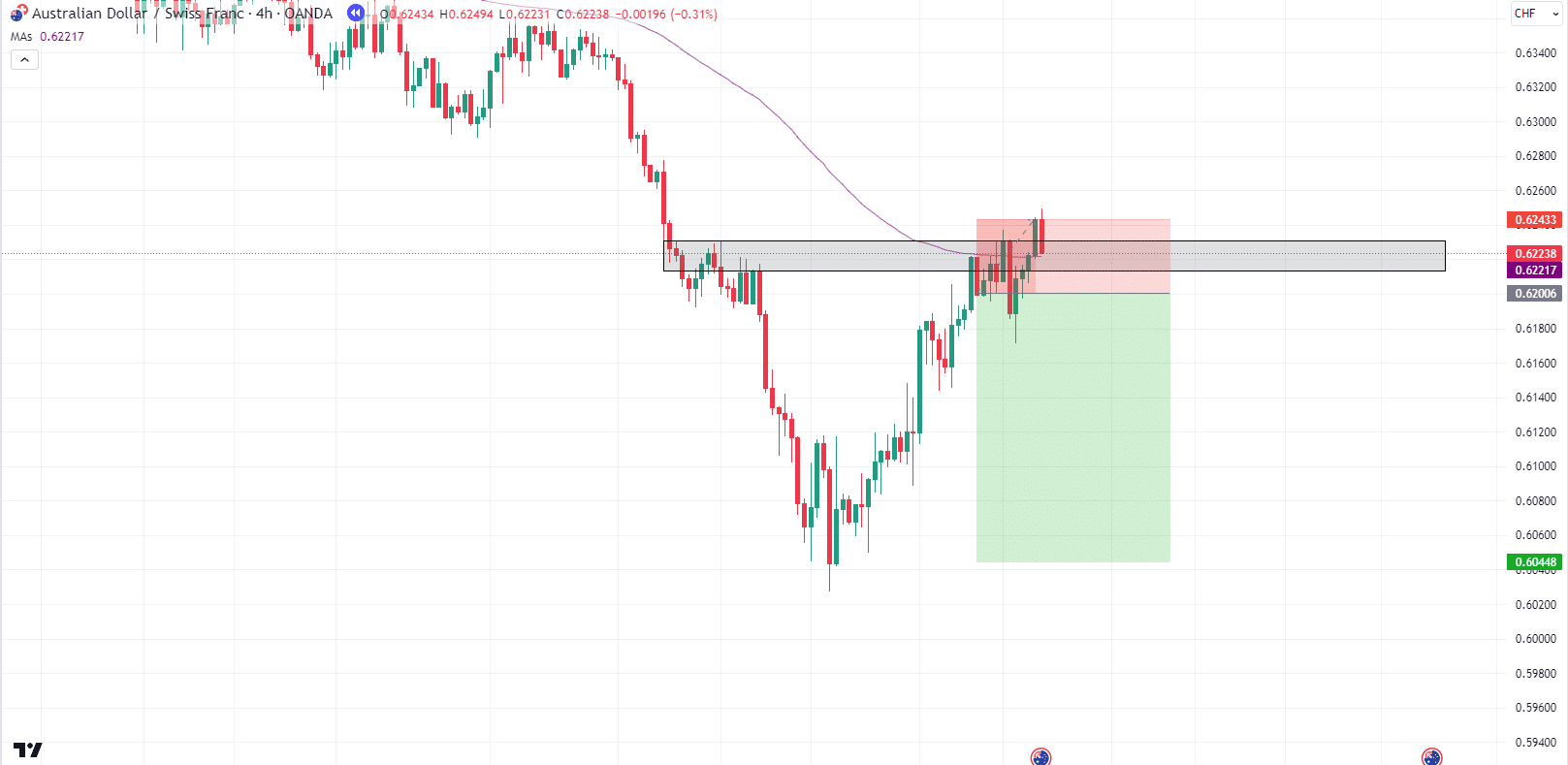

AUD/CHF 4-Hour Chart:

Now, the chart above clearly shows a downtrend.

You possibly can observe a downward movement followed by a retracement that reaches the previous high…

What pattern has formed aligning with the Moving average and horizontal resistance level?

Correct! it’s the Tweezer Top Pattern!

Let’s take the trade!…

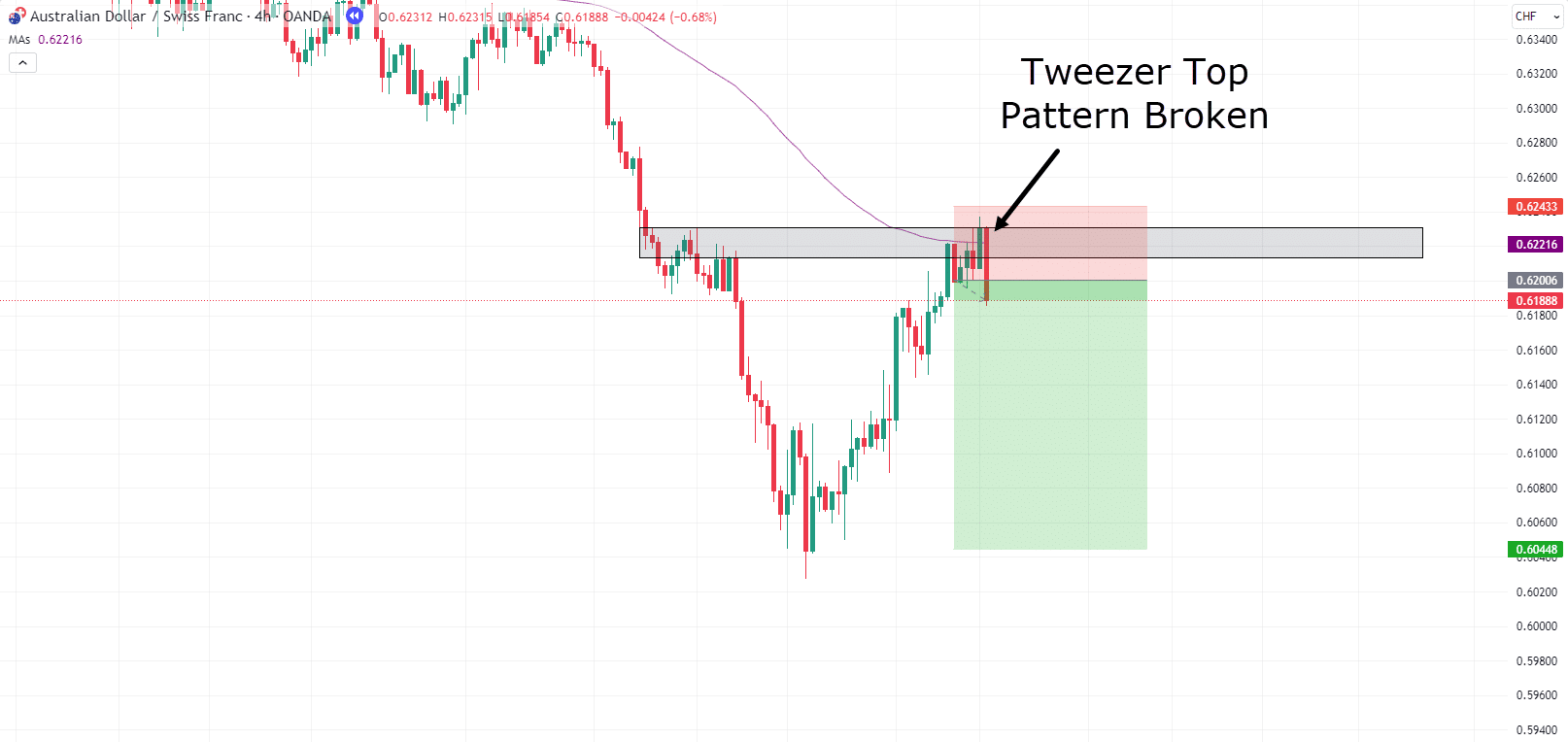

AUD/CHF 4-Hour Chart:

On this case, something interesting has happened!

Price has broken above the tweezer top pattern and appears to be closing above the MA100 as well.

This might indicate that this trade may not be ready for its next downward move.

Nonetheless the worth remains to be rejecting this zone so, let’s persist with it!…

AUD/CHF 4-Hour Chart:

Oh no!

It appears your intuition concerning the price not continuing downward was correct!

But… how could this occur?!

Well, like most systems on the market – the Tweezer Top Pattern won’t all the time work perfectly.

It could be doing you a disservice if I made you think that this trading method was foolproof!

The silver lining on this scenario is, though, that you simply sensed something was up as soon as the worth broke above the tweezer top pattern, right?

It’s this awareness that may have allowed you to exit the trade early and only take a partial loss.

Nonetheless, in the event you were confident in your position and committed to the Tweezer Top Pattern, accepting the total loss can be a legitimate plan of action!

Just keep in mind that even probably the most promising setup won’t work 100% of the time.

This doesn’t mean there’s a flaw within the concept!

It just implies that as traders, losing trades is an element of the method.

As a trader, it’s your responsibility to take the perfect setups you may – based on the data you have got.

And I believe it’s fair to say, with the data that was available… that trade was a very good trade!

So, take a breath, learn from the experience, and prepare for the subsequent opportunity!

Not to say… Congratulations!

You’re now equipped with the knowledge to capture substantial winning trades…

…and likewise with how one can manage your emotions when things don’t all the time go to plan!

Now, let me ask you something…

What would all this appear like initially of a trend?!

Read on to learn the way Tweezer Top Reversal Patterns can capture much more profits!

Tweezer Top Reversal Pattern

Why does the Tweezer Top Reversal pattern make me only a tad more excited?

Consider this…

Unlike within the previous scenario, you’re not entering the trade midway through the trend…

As a substitute, you’re stepping in – right from the outset!

Now, you is perhaps considering, “So what, Rayner?”, “Is it actually different?”

Here’s the brilliance…

By entering on the trend’s peak, you’re positioning yourself for colossal potential gains in the event you manage to ride that trend to its fullest extent.

And why is that this significant?

Because these opportunities include minimal risk and the promise of MAXIMUM reward!

Brace yourself, as this section demands a major degree of discipline to execute effectively…

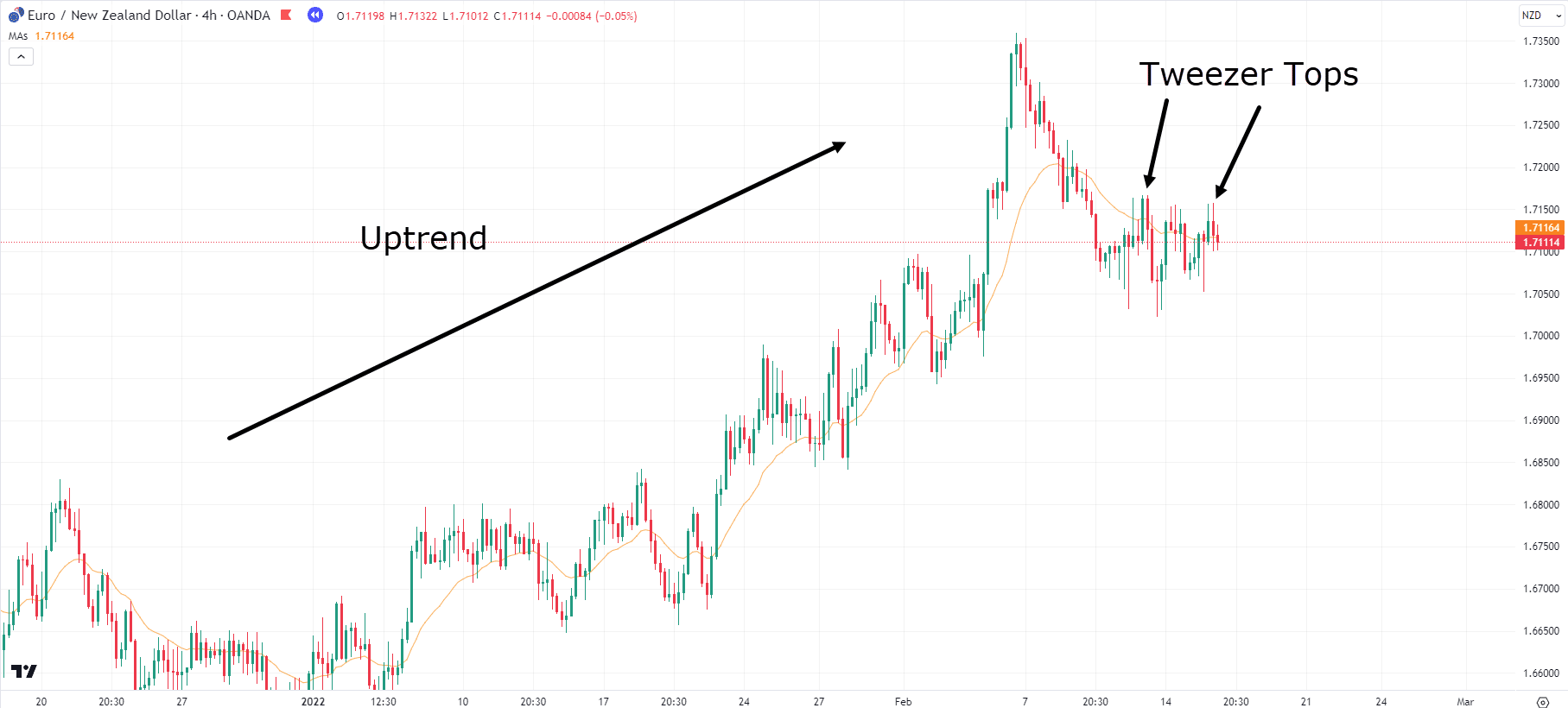

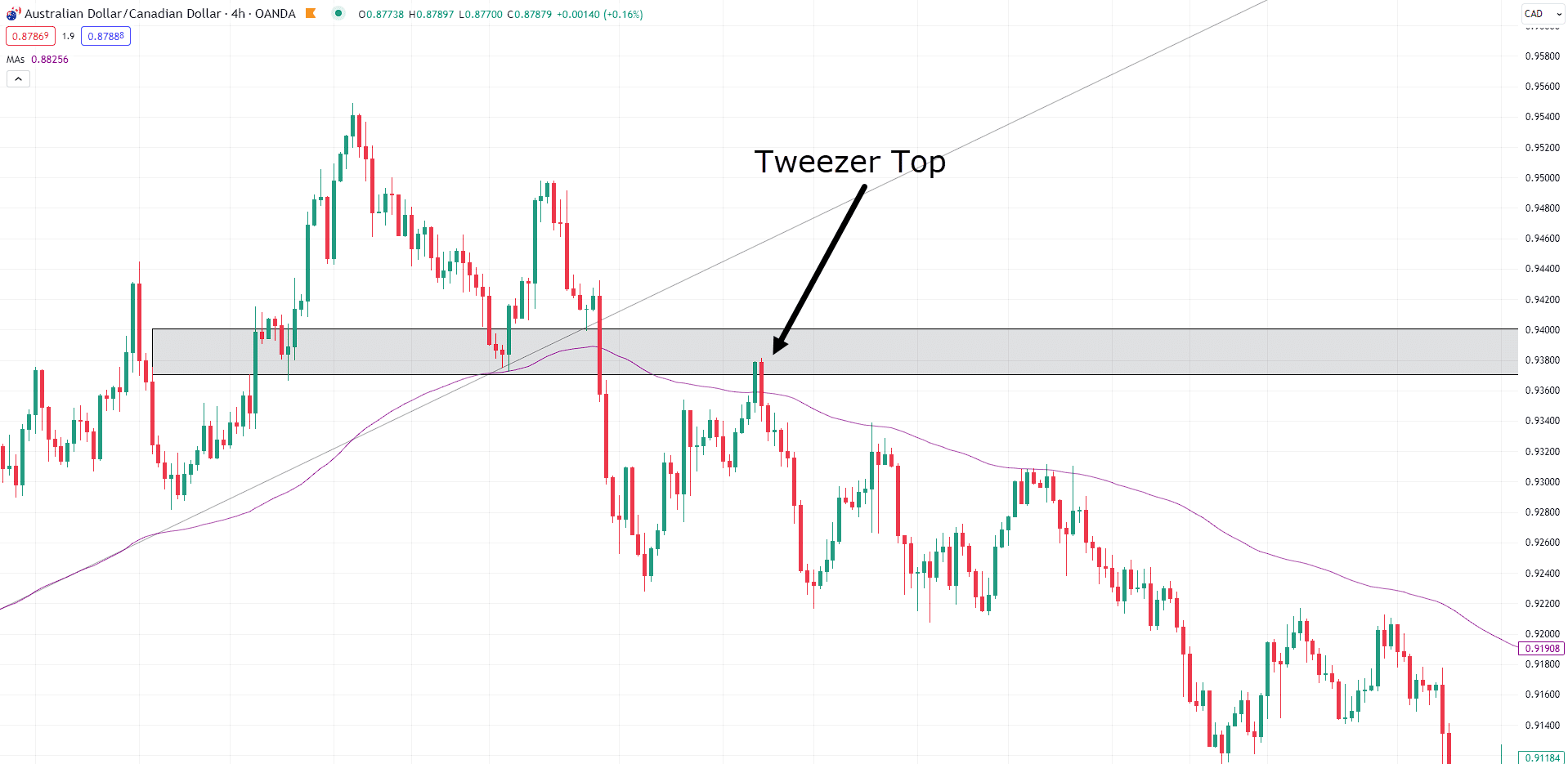

EUR/NZD 4-Hour Chart:

Taking a look at the chart, what do you see?

There’s a transparent uptrend that has one final large push before starting to retrace a substantial distance, right?

The MA20 has began to shift from moving upwards to moving more sideways and even a bit of bit downward….

…there have also been multiple attempts to form higher highs which might be met with failure….

Following that, you may see two Tweezer Top Patterns form.

As mentioned, this could indicate that there’s a “possibility” that trends could also be shifting.

After all, you may’t make certain that is the reversal point…

But multiple indicators are suggesting a shift in momentum!

So let’s take a trade…

EUR/NZD 4-Hour Chart Entry:

The Stop Loss is safely above the tweezer top pattern, allowing for lots of room for the worth to wick up and are available back below…

Actually, in the event you desired to be more aggressive, you possibly can place your Stop Loss even closer to the Tweezer Top Pattern.

Ultimate, all of it comes all the way down to fooling around with what you are feeling comfortable with and what works best to your strategy.

Are you able to guess the result?…

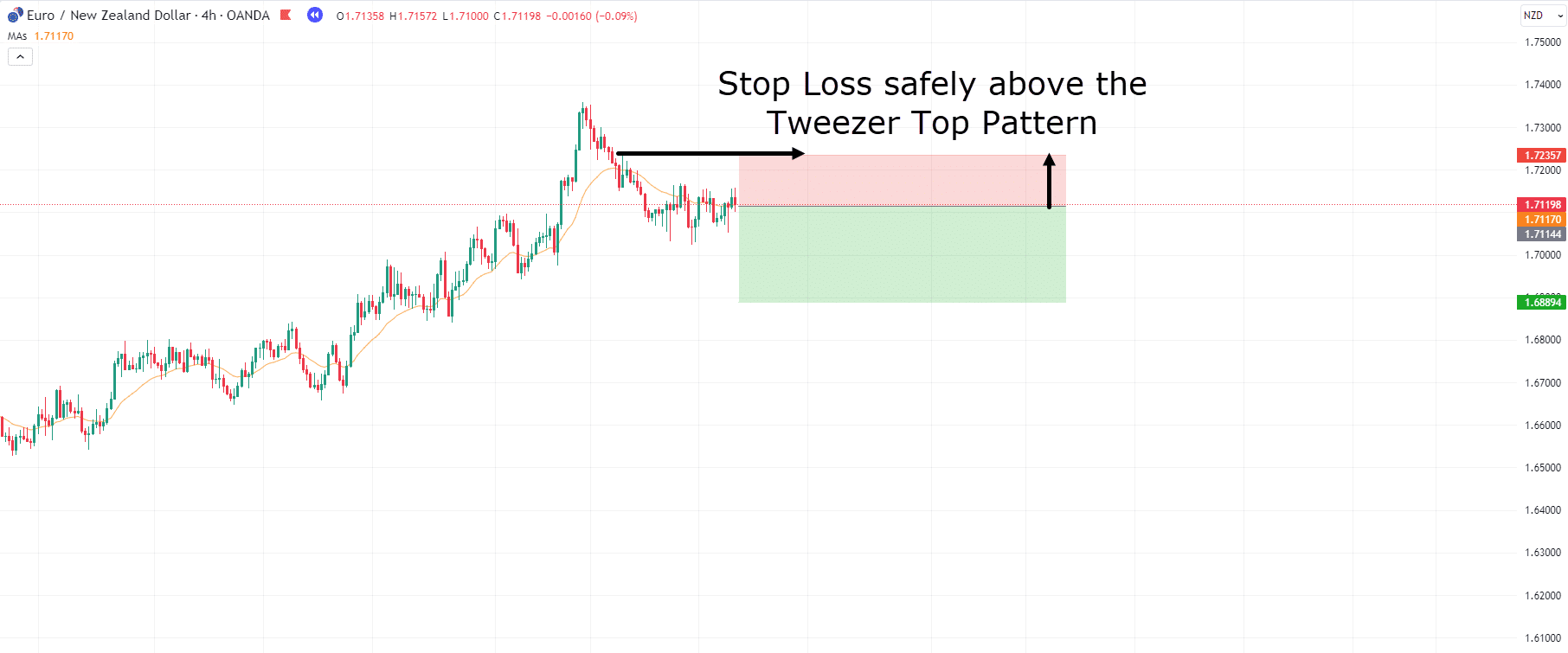

EUR/NZD 4-Hour Chart Exit:

Wow! Nice win!

There are a number of different exit strategies in this example.

Let’s quickly undergo them…

Firstly, you possibly can close the trade when a candle closes above the MA20.

That is an excellent way at capturing profits while reacting to the momentum of the market.

Nonetheless, you will see that, unless the situation is comparable to this instance where selling pressure could be very strong, you is perhaps stopped out more steadily as a substitute of capturing your complete trend.

Option two is… waiting for a better high to form.

As you may see on the chart, a possible take profit could occur when the worth began breaking the highs of the previous highs…

The rationale that is a very good place to take profits is since it is identifying that momentum is shifting – from a downtrend ( Lower highs and Lower Lows ) to an uptrend (Higher highs and better lows).

At that time, you need to be removing your position and waiting for brand new opportunities.

The downside to this approach is you have got to permit for price to eat into your profits barely before confirming the trend is over and it’s time to exit.

Now the ultimate option is solely to take profits along the best way, pre-defining areas that make sense to you and committing to removing a few of your position at those prices.

What prices, you say?

These might be key levels from previous support and resistances, each day targets, or they may even be set Risk Reward levels of 2RR, 4RR and so forth.

But… this next bit is vital…

I don’t want you to walk away from this text assuming you’ll catch the entire trend each time.

You must keep your wits about you when using patterns.

Sometimes, if the market is screaming at you that it’s time to exit the trade… it’s best to exit the trade!

Nonetheless, in the event you are in profit and win your trade – pat yourself on the back, walk away and be completely satisfied with the paycheck!

At the top of the day, it’s simply not well worth the stress and pain of not exiting at the fitting time and watching a large winning position turn to dust!

High-quality setups for trading Tweezer Tops

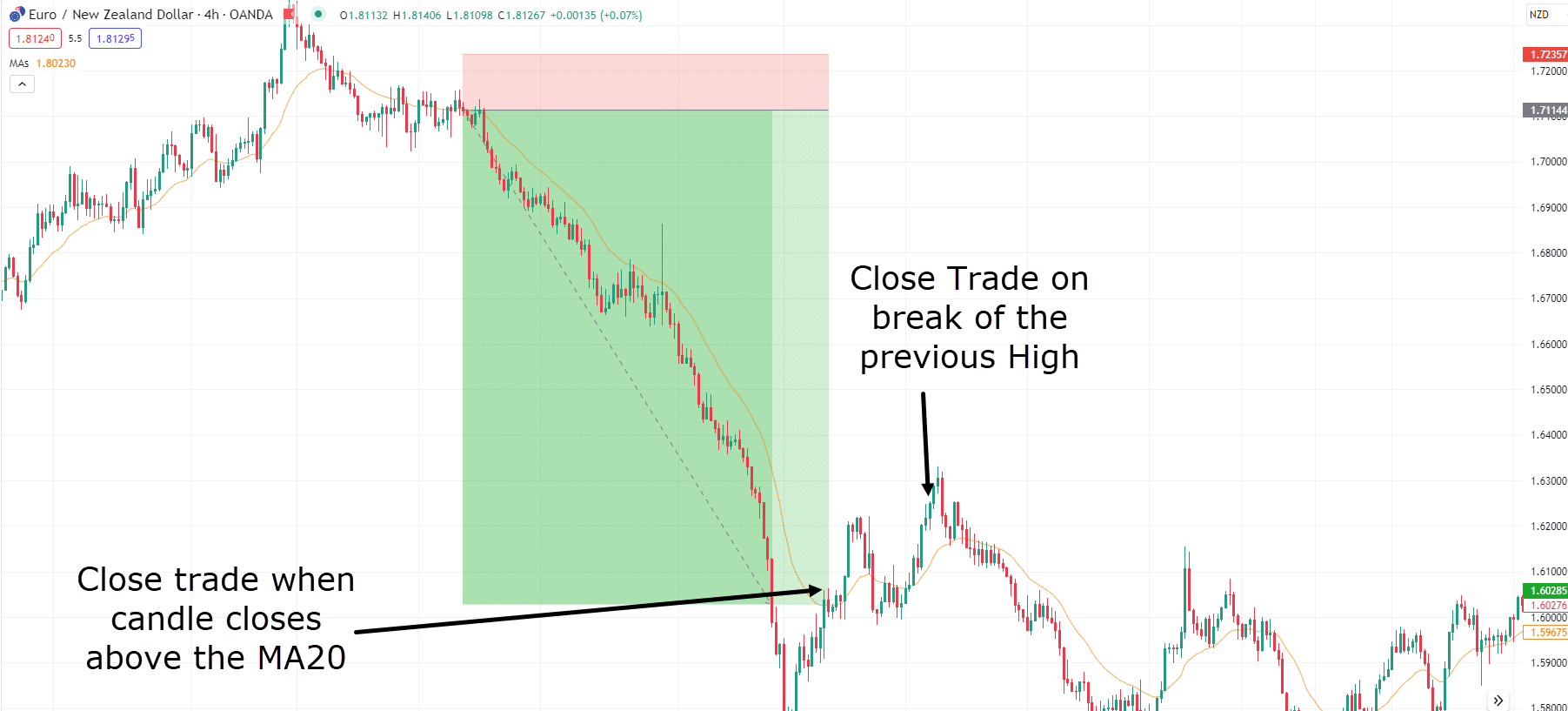

Have a look at this chart…

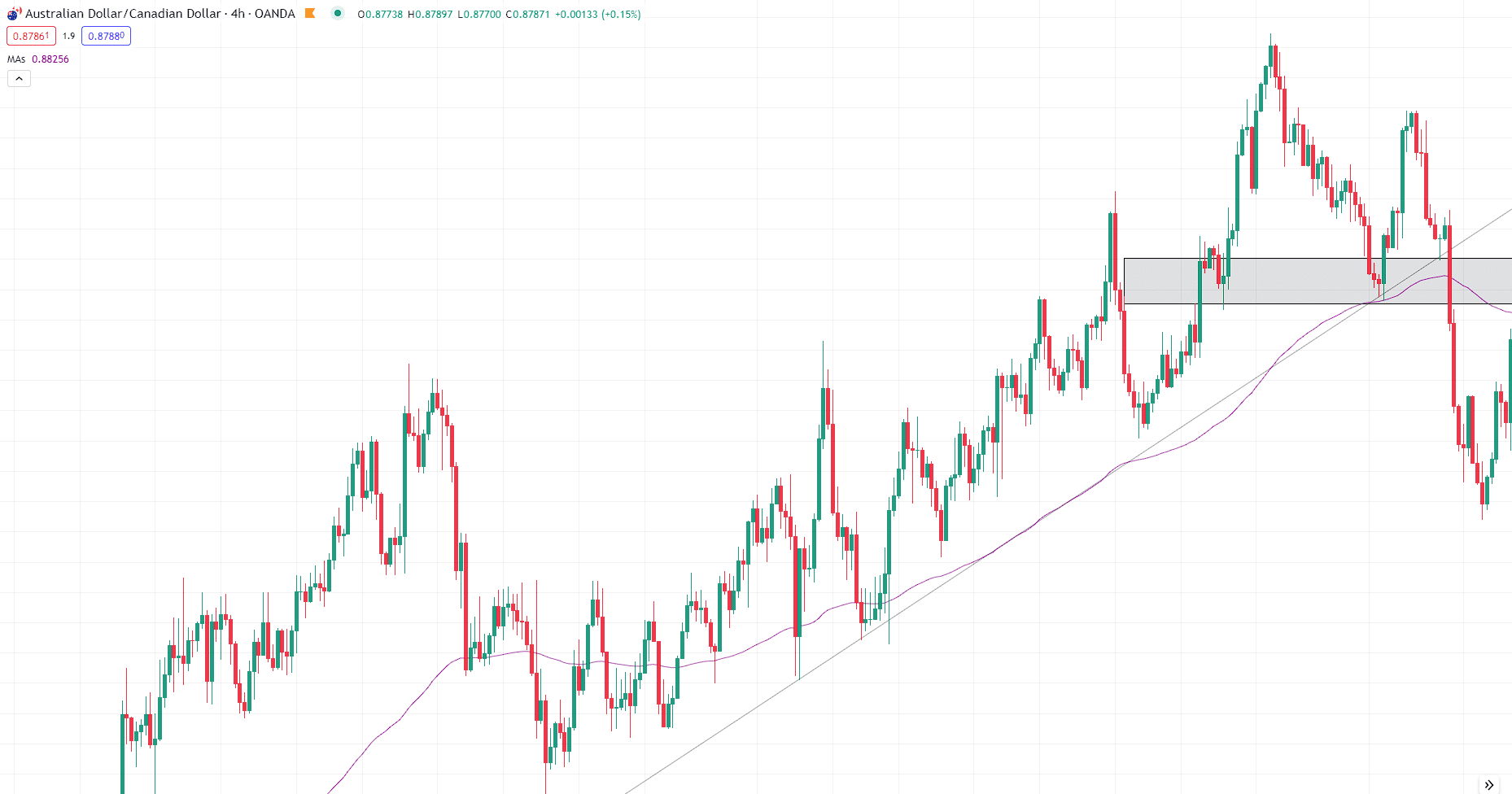

AUD/CAD 4-Hour Chart:

What do you see?

Price respects the trendline for two months before a powerful bearish candle cuts through the trendline.

That is the primary indication that the trend could also be shifting.

Similtaneously the trend breaks, the 100 Moving Average can be broken.

Moving averages may be used as support and resistance levels, and thus, the breach of this level further bolsters the concept that momentum is shifting…

Remember when support is lost, it becomes resistance…

Let’s take a better have a look at what happened next…

AUD/CAD 4-Hour Chart:

Are you able to guess what pattern formed on the resistance level?

Yep, you guessed it…

Tweezer Top!

So for this high-quality setup, what arguments for a brief sell are there?

Trendline break – CHECK!

100MA Break – CHECK!

Support And Resistance Flip – CHECK!

Tweezer Top Pattern – CHECK!

Should you asked me, it’s hard to come back by a more convincing set of indicators for initiating a trade on this context!

That is what I’d call a high-quality setup.

Mistakes to avoid when trading Tweezer Top

By now you almost certainly realize that not all indicators, candlestick patterns, or strategies are foolproof.

Let’s have a look at some mistakes you need to avoid when using the Tweezer top pattern.

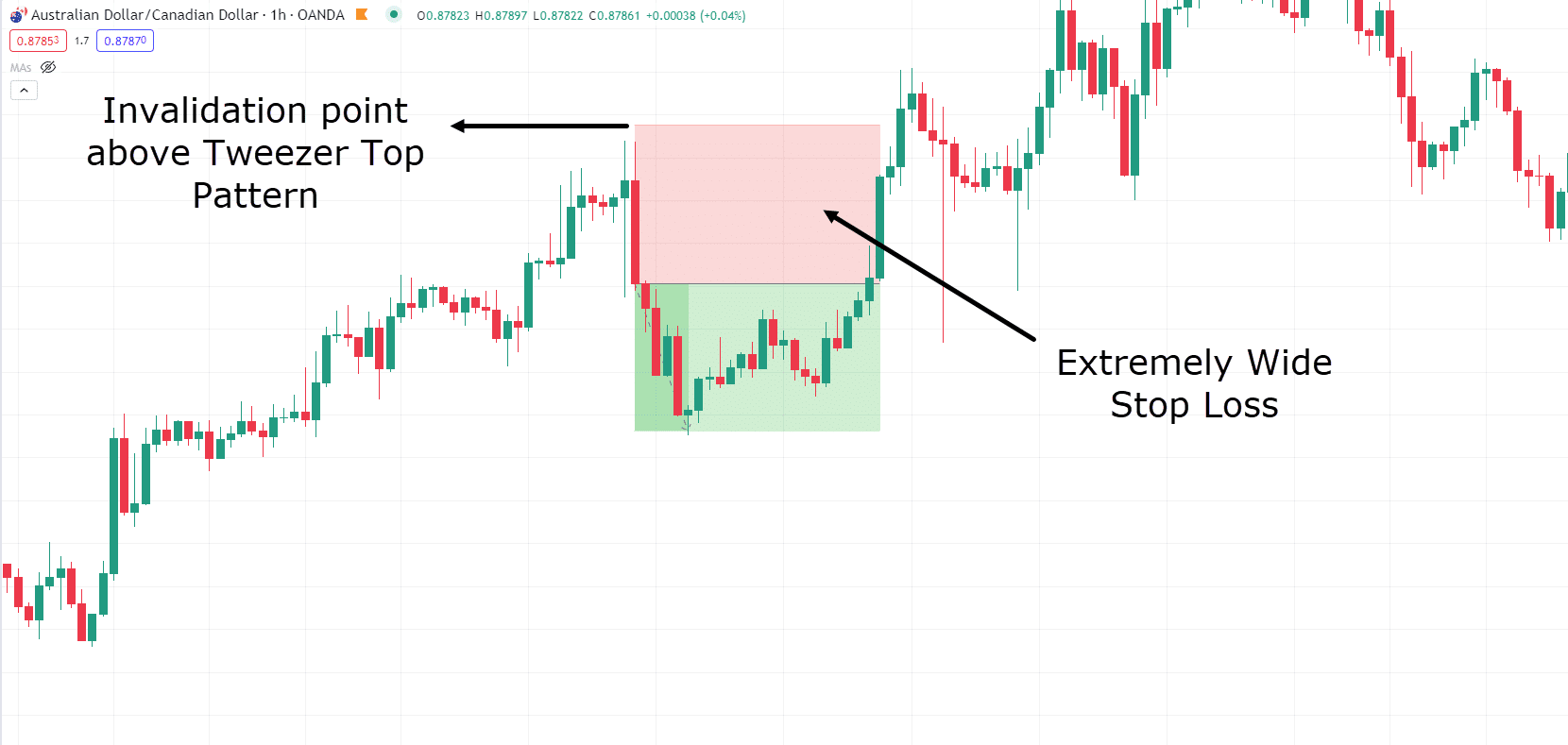

Entering too removed from price movement

This may increasingly be as much as your discretion as a trader, but try avoiding setups that require you to enter a great distance away out of your invalidation point.

So what do I mean by this?

Well, let’s have a look at the below example…

AUD/CAD 1-Hour Chart:

The tweezer top pattern formed with a big bearish candle that closed well down near the low of the previous candle.

This does show great rejection…

Nonetheless, in the event you are attempting to take a profitable trade from it, the big distance between the entry and stop loss makes it difficult to have a positive Risk to reward setup.

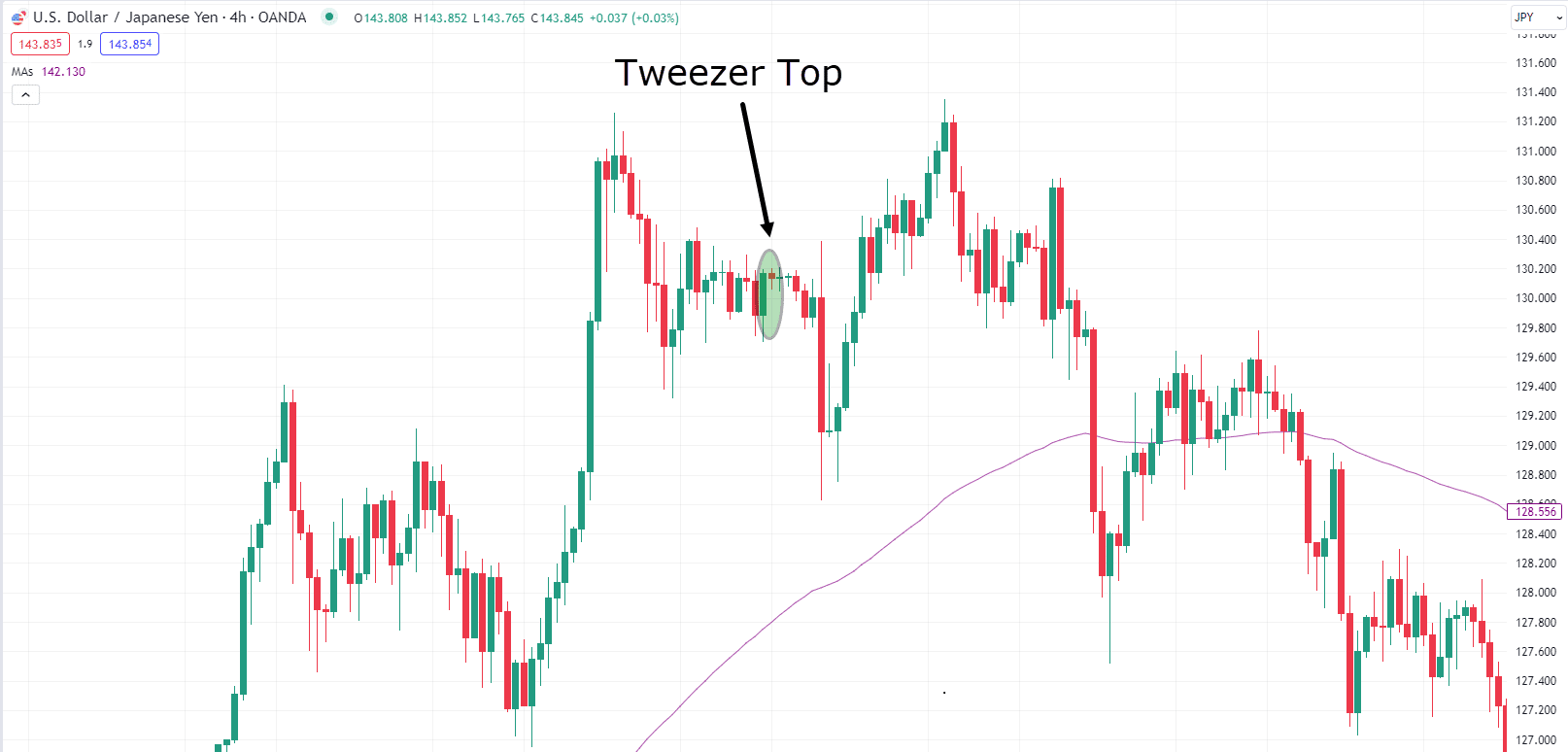

Random Tweezer Top Patterns

Now how about this chart…

What’s flawed with considering this tweezer top pattern?

There’s a powerful uptrend so it’s advantageous to be searching for Tweezer Top patterns, right?

Nonetheless, when considering this setup, there are a lot of other aspects going against the trade….

The MA100 stays unbroken, and so far, neither lower lows nor lower highs have manifested.

At this point, there isn’t a shift in market structure and momentum.

So the crucial takeaway here is that not every Tweezer Top pattern warrants consideration as a trade.

You must use the pattern within the context of the entire market, amongst different levels and indicators which might be added to your argument of why a trade is sensible.

Patterns aren’t perfect

Plainly speaking, on account of the high frequency of Tweezer Top patterns out there, there’s a high probability that not all of them are selling signals.

The tweezer top pattern is an especially helpful tool that provides an early warning signal that market momentum MIGHT be shifting.

This does NOT mean it’s guaranteed to each time.

Sometimes on account of news or simply the unpredictability of the market, tweezer top patterns can form without it signifying anything greater than market indecision.

Head reeling from all that?

Let me wrap it up for you!

Conclusion

Tweezer Top Patterns are an especially useful gizmo when used accurately.

They mean you can higher time your entries, supplying you with added confluence and confidence to initiate the sell trade.

Tweezer Tops may be utilized in trending markets while also used as a reversal pattern to capture much larger trend setups.

When added with indicators corresponding to moving averages, key levels and trendlines, arguments for high-quality setups can bolster your winning percentage.

Put together, Tweezer Top Patterns give you the chance to enter trades at points of potential Low risk, high-reward scenarios!

Nonetheless, it’s essential to keep in mind that, like several pattern, effectiveness is influenced by the general market context, and you need to be aware of its limitations.

So, do you employ the Tweezer Top Pattern?

Or are you excited to do that latest tool out?

Let me know within the comments below!