This post is written by Jet Toyco, a trader and trading coach.

On this planet of trading…

…there are definitely quite a lot of chart patterns on the market.

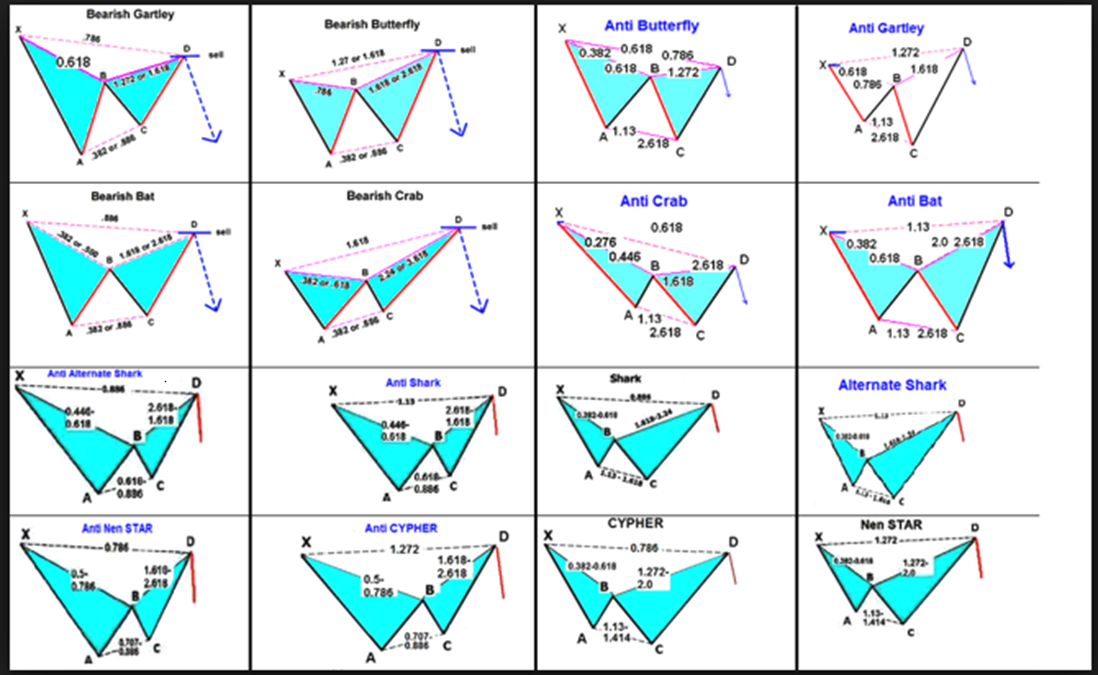

From crabs to dinosaurs, these chart patterns are probably the most well-liked:

And of course…

They is likely to be all that you must succeed as a price motion trader.

But one pattern that stands out and is straightforward and simple to identify, is the ABCD pattern…

It’s a pattern that belongs to the harmonic pattern family introduced by H.M Gartley.

And also you’d be pretty surprised how well this works within the realm of price motion!

But not to fret, my friend…

…we’ll be using none of those complex Fibonacci tools on this guide!

As a substitute, you’ll learn:

- decode the ABCD pattern so that you simply exactly know what it looks like on a chart

- Common mistakes in trading the ABCD pattern that may sabotage your trading results

- The reply on learn how to navigate across the ABCD pattern’s shortcomings

- An easy process and tactic on learn how to approach and trade the ABCD pattern

- One of the best-kept SECRET strategy for trading the ABCD pattern

Are you excited?

Try to be, as this guide’s packed!

So, get your notes and charts up – and let’s start!

ABCD pattern unveiled: What’s it, and the way does it work?

Imagine the vast trading landscape as a charming puzzle…

Alright, perhaps that’s a bit too exaggerated…

But at its heart lies the ABCD pattern!

It’s a remarkable piece that sets the tone for traders in search of strategic insights.

And in contrast to harmonic trading where it (apparently) consists of quite a lot of animals…

…the ABCD pattern employs simplicity to its advantage, built upon the interplay of 4 crucial protagonists: A, B, C, and D.

You could possibly say it’s an equal-measured move!…

And like puzzle pieces falling into place,

These distinct points hold the essence of market movements.

Your role as a trader is to decipher their tale and translate it – into informed moneymaking decisions!

So…

How does each point within the ABCD pattern fall into place anyway?

ABCD pattern: A to B

The story commences with A to B.

They’re a dynamic duo who launch the proceedings with a daring and powerful market move, rather a lot just like the opening lines of an exciting novel.

Here’s what it looks like on a chart…

This move isn’t merely an introduction; it’s the charming hook that may either set the stage for triumph or leave traders bewildered!

Nonetheless…

The A to B move have to be clean with little to no wicks.

As that is the very first sign as to how we’ll discover the pattern!

ABCD pattern: B to C

Within the unfolding drama of the ABCD pattern, envision B to C as a vital intermission.

Here, the market takes a moment to recalibrate, pulling back from its initial surge.

Briefly, a pullback or a consolidation…

This part is probably the most crucial as most traders have a tough time recognizing it.

But rest assured, my friend!

I’ll cover this shortly within the later sections.

ABCD pattern: C to D

Because the curtain rises on the pattern’s climax, enter C to D – the stage for a dramatic reveal!

This move is what completes the entire ABCD pattern.

But it is best to bear something in mind…

The C to D move must follow the identical concept I used to discover the A to B leg of this pattern…

It’s a robust move with little to no wicks and an impulse move almost equal to the A to B leg.

That’s right…

The A-B and the C-D leg have to be almost equal!

And by the way in which…

I say “almost” because every concept and indicator will at all times be an “area” in your chart (I’ll explain more in the subsequent section).

Make sense to this point?

In summary, the ABCD pattern encapsulates the fantastic thing about simplicity throughout the complexity of the trading world.

From A to B, B to C, and C to D, this pattern offers a dynamic sequence which may even mirror the ebbs and flows of life itself!

So, with all this in mind…

How do I trade the ABCD pattern the precise way?

Let’s figure it out in the subsequent section!

ABCD pattern wizardly: Trading the precise, smart, and sassy way

This time my friend…

Let’s dive into the ABCD pattern – not as spectators, but as players on this trading game.

So, relating to coping with the ABCD pattern you could…

Discover the ABCD pattern with the aim of trading and never analyzing

It’s a core truth that the ABCD pattern has its variations.

Some large ones…

Some small ones…

But remember, any ABCD pattern can fail before completing its pattern – just like every other pattern on the market!

So, when trading an ABCD pattern, stick with one timeframe and spot a pattern where its size is visible in your chart to trade.

And always remember…

ABCD patterns are your ingredients for a winning trade, not an artifact for countless evaluation!

Alright then, are you ready for some trend talk?

Because when you’re going to make use of the ABCD pattern to trade you could…

Have a well-established healthy trend through the use of the 50-period moving average

On the subject of navigating the ABCD pattern terrain, one cardinal rule stands tall: embrace the comfort of a well-established, healthy trend!

This implies in search of a bullish ABCD pattern on a healthy uptrend…

And a bearish ABCD pattern on a healthy downtrend…

And definitely not the opposite way around!…

But perhaps you’re sensibly asking…

“How come?”

“Isn’t this what the ABCD pattern is made for?…”

“…To predict trend reversals?”

Well sure, you may trade the ABCD pattern that way but – you’re putting yourself at an incredible drawback when you do!

Why?

Because irrespective of what the pattern is, you may never consistently predict the tip of a trend.

…and that’s a fact!

Now you furthermore mght is likely to be wondering…

“Why do I want a moving average for this?”

And the rationale is that ABCD patterns could be very huge… or very small!

By adopting a trend filter, you may make sure that that each ABCD pattern you notice may be very consistent in size.

Does it begin to make sense?

Well, one other crucial part is to at all times…

Search for strong equal moves for A to B and C to D and never “choppy” moves

Imagine a dance floor; you’d prefer smooth moves over the cha-cha of choppiness, right?

Well, ABCD patterns are not any different.

Aim for those symmetrical A to B, and C to D moves…

And never the choppy cha-cha ones…

Finding a clean A-B, and C-D move is like finding an ideal dance partner who complements your steps.

So, skip the “choppy” dance-offs – go for a harmonic duet as a substitute!

Now…

Let’s say that the ABCD pattern is complete.

It’s a part of a sound healthy trend.

And also you’re planning to reap the benefits of the trade….

How do you exactly enter this pattern?

Well, it’s easy…

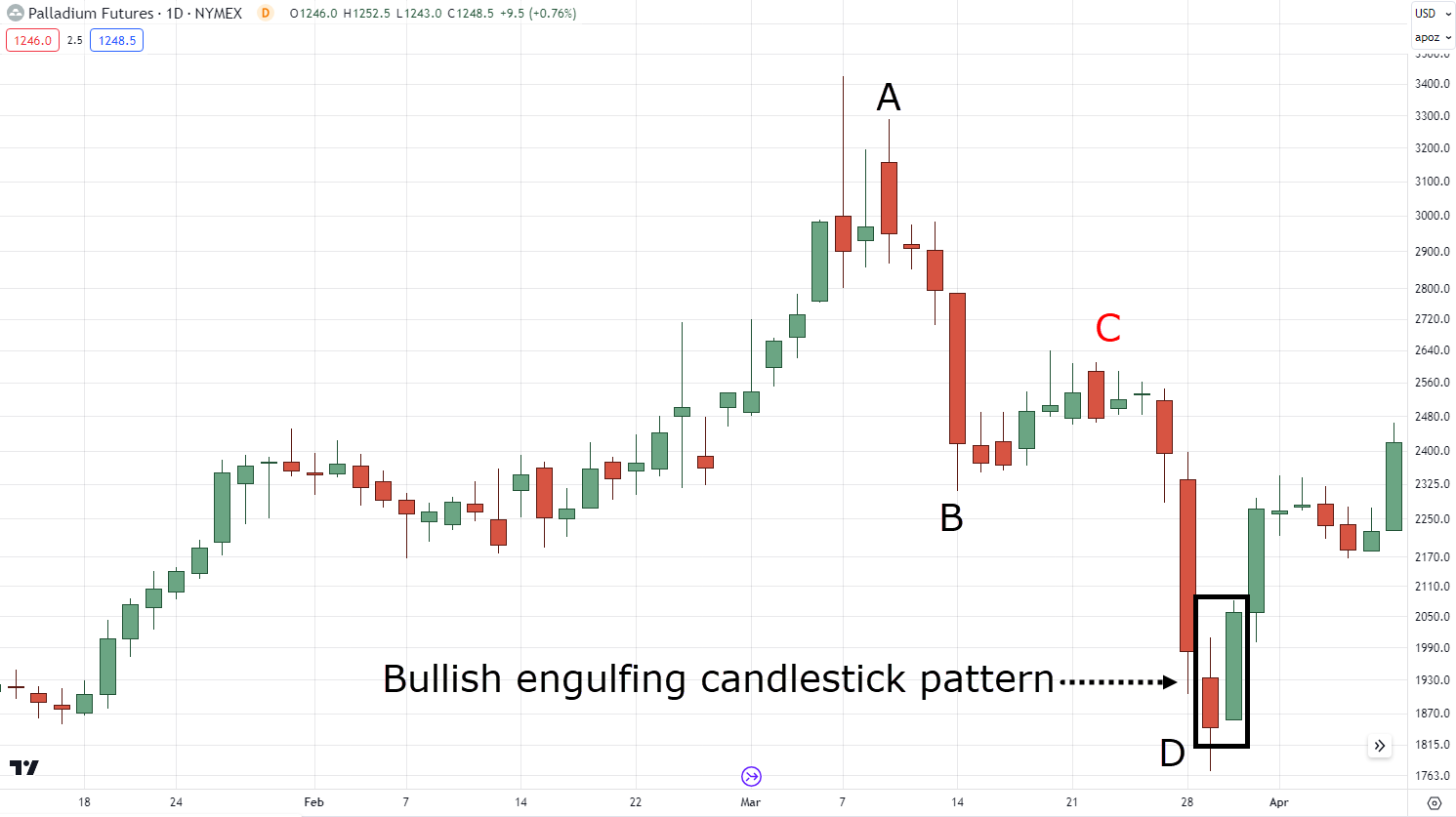

Wait for a robust candle rejection on the “D” completion

You see…

Most traders would blindly place an order the moment the pattern completes…

But in the long run,

It is best to keep in mind that the “D” completion is just an imaginary area.

The market can still push lower and ignore the entire pattern itself…

So, how do you understand when this imaginary pattern turns right into a healthy reality?

Well, you could make sure that the market responds to a sound candlestick price rejection…

The moment you see the market rejects from the “D” pattern completion is the moment you may consider the pattern acknowledged by the markets!

In a nutshell, my friend…

With purposeful play, trend tales, groove-worthy moves, and confluence quests with the ABCD pattern…

You’re set to beat the trading realm with style!

But before I am going further, let me ask you…

Is life perfect on a regular basis?

Not likely, right?

There are some euphoric highs among the many lows, with loads of mistakes as well!

This is the reason, in the subsequent section,

I share with you the common mistake when coping with the ABCD pattern in order that we will reduce those lows in your ABCD trading life.

Sound good?

Then keep reading!

ABCD pattern detours: Keep away from these dangerous mistakes

Let’s right into it and kick off our exploration of ABCD pattern trading with a classic blunder…

Mistake #1: Trading the pattern even when the pattern isn’t complete yet

That is probably the most common mistake harmonic traders make.

Simply because the value made an ABC pattern it never…

I say again NEVER…

It never guarantees a C to B pattern completion!

The market can reverse easily – as you’ve seen within the previous example!…

This is the reason it’s vital to find out the prevailing trend first!

Attempting to trade the “C” leg against the trend can be way too dangerous.

That’s why you could remember…

Patience is greater than a virtue here!

Waiting for the entire ABCD pattern is totally key to keeping those trading gears turning easily.

Got it?

Mistake #2: Attempting to discover every ABCD pattern you see

Here’s one other golden principle to be mindful when trading the ABCD pattern.

We use the pattern to trade the markets – not to investigate!

What do I mean?

Well, when you’re using the ABCD pattern to investigate the markets, your chart would probably look something like this…

But after you’ve done your superhuman evaluation…

Which one do you trade?

Which ABCD pattern do you have to reference your stop loss or take profit?

Well, even I wouldn’t know!

Even when you may have a gazillion indicators of “confluence” in your chart, it doesn’t mean anything if it’ll only paralyze you – stopping you from hitting that buy button!

That’s why the important thing here, my friend…

…is to concentrate on one ABCD pattern that’s relevant to the present price – not the tons of ABCD patterns behind you…

So, stop turning your trading process right into a noisy circus; don’t draw a couple of ABCD pattern in your chart, and avoid evaluation paralysis!

Mistake #3: Expecting all ABCD patterns to look the identical

Imagine a bunch of cats – same species, different personalities.

Well, ABCD patterns are like that too!

They may share a family resemblance, but they’ve each got quirks and variations…

Here’s what I mean:

A resemblance…

With different quirks and variations…

So… what’s the answer to identifying them?

Luckily, I’ve already shared it with you, my friend!

It’s by:

1. All the time discover the trend through the use of the 50-period moving average

2. Sticking to 1 timeframe

This manner, you’re placed able where you’ll almost never be mistaken spotting ABCD patterns!…

Beginning to make more sense now?

So, in a nutshell…

Consider these ABCD pattern pitfalls as quirky characters in your trading journey…

Just as any adventure has its challenges, so does ABCD pattern trading!

But by steering clear of those pitfalls, you’ll be higher equipped to navigate the twists, turns, and triumphs that lie ahead.

Are you learning something latest?

Great!

Because you’ve reached this far…

I’ll now disclose to you my secret strategy for trading the ABCD pattern!

And even when you don’t trade the precise strategy, you should use some concepts so as to add to your individual strategy.

Sound good?

Then let’s get right to it!

Unlocking the ABCD pattern mastery: A whole trading strategy

Time for the grand finale as we decipher the “SECRET” technique to ace ABCD pattern trading!

So imagine you’re on a mission, unlocking doors that result in treasure-filled rooms…

What’s the treasure you’re after?

Winning trades, in fact!

Now buckle up as we unveil the total strategy, starting with step one…

Step #1: Discover a healthy trend

Remember what I shared with you before in regards to the healthy trend?

Good, because this time…

We use a 50-period moving average to systematically define a healthy trend!…

P.S. On the lookout for ABCD patterns in a healthy trend is beneficial, but you can too decide to search for ABCD patterns in a weak trend through the use of a 200-period moving average when you wish.

Next…

Step #2: Discover an ABCD pattern

With the strengths and weaknesses that we discussed some time ago…

All of it boils all the way down to this step – properly identifying the pattern.

So, to maintain this so simple as possible….

The subsequent step is to discover an ABCD pattern in your chosen timeframe inside an existing healthy trend…

Sound easy enough?

Great!

Because the subsequent step is where the actual motion begins…

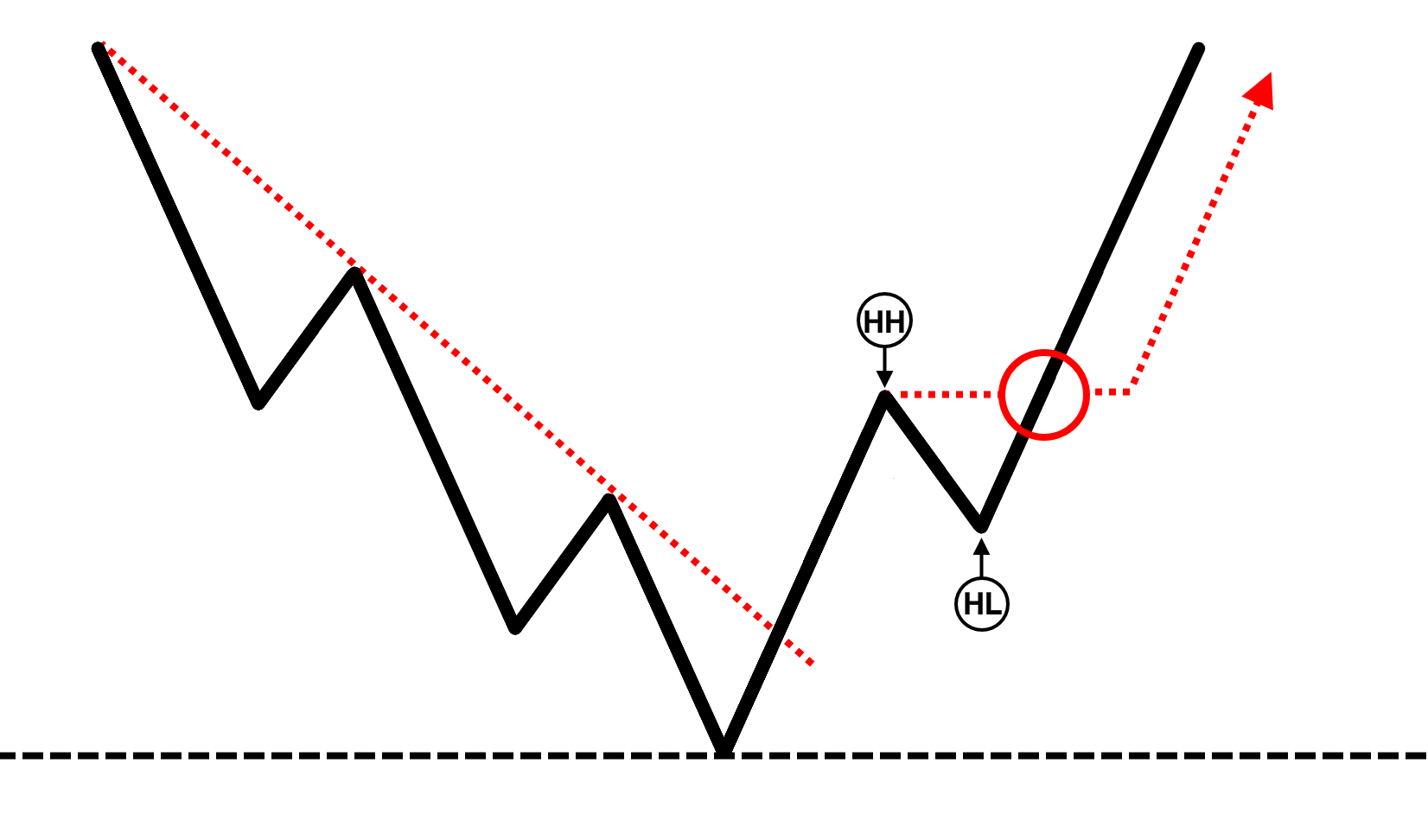

Step #3: Go all the way down to the 4-hour timeframe and wait for a break of structure

So perhaps you’re saying, “Wait, what?”

“Why are we within the lower timeframe?”

Let me explain…

Pattern trading basically could be quite hard for some traders…

Why?

Because you may have to attend until the pattern completes!

You may have to be patient and hold your trigger finger – letting the pattern materialize!

And a few traders (potentially even you) may not be too comfortable with that, right?

So, how do you treatment this?

Well, go all the way down to the lower timeframe!

That way, you may make absolutely sure you don’t miss the pattern you’ve been waiting for.

But you is likely to be wondering:

“Okay so, what are we in search of down here?”

Put simply – a break of structure and a flag pattern breakout, my friend!

Here’s what I mean…

Once you notice the break of that sweet flag pattern…

You possibly can enter at the subsequent candle open and subtract 1 ATR from the lows of the flag…

And again, this is identical chart we were taking a look at from the previous step!

P.S. You should utilize the factor of 4-6 when selecting timeframes (e.g. in case your entry timeframe is the H1 your higher timeframe could be the H4)

Now…

Only the ultimate step awaits in your journey.

Step #4: Trail your stop loss with the 20-period moving average on the every day timeframe

“Nani!?”

“What on this planet are we doing this time?”

So this, my friend…

…known as transition trading!

It’s where we use the lower timeframe to enter and the upper timeframe to administer your trade.

Consider this as a security detail following your treasure.

And let me explain its inner workings based on our example…

When you’ve entered your break of structure on the 4-hour timeframe, you return to the every day timeframe and pull out the 20-period moving average…

You simply exit the trade until the value closes (not touches) beyond the 20-period moving average…

P.S. The worth was below the 20 MA after we entered, on this case, the trade remains to be valid and also you’d wait for the value to go above it.

And together with your stop loss in place – there you may have it!

You’re now the proud owner of a whole trend-continuation strategy using the ABCD pattern!

Now, I can already feel your questions rushing into my bloodstream:

“Why the 20-period?”

“Why don’t we use the 50-period moving average as a substitute?”

Well, it doesn’t change the indisputable fact that we entered the lower timeframe, right?

To compensate for the moves on the lower timeframe…

We use a short-term moving average on a every day!

Make sense?

Good!

So at this point… Congratulations!

You’ve uncovered a few of the core secrets behind ABCD pattern trading!

From identifying trends to hourly adventures, you’ve navigated the maze of trading with excellent strategy and a good amount of wit!

So, to place this guide to an end, let’s have a fast recap of what you’ve learned today…

Conclusion

In comparison with other chart patterns…

Learning learn how to trade the ABCD pattern is so simple as it gets… similar to the alphabet characters it’s based on!

But just like every other chart pattern on the market…

The ABCD pattern has its strengths and weaknesses as well.

While having the ability to hop into trades easily is great, traders can turn into liable to evaluation paralysis, so be careful!

At any rate, here’s what you’ve learned today:

- The ABCD pattern consists of two impulse moves that are A-B and C-D, then one pullback move which is B-C

- When identifying an ABCD pattern, it’s crucial to stick with one timeframe at the identical time and be open to its different variations, while being patient enough to attend for the pattern to finish

- When trading the ABCD pattern, it pays to attend for a healthy trend and a pleasant false break on the “D” completion before entering the trade

- One in every of the key ways to trade the ABCD pattern is to make use of transition trading, by waiting for a break of structure on the lower timeframe and trailing your stop loss in the upper timeframe

And there you go!

A whole guide and strategy for the ABCD pattern!

With every thing said and done, though, there’s still something I need to know from you…

Are you acquainted with transition trading?

If not, do you want to learn more about it?

How in regards to the ABCD pattern… have you ever found success trading it before?

Let me know within the comments below!