This post is written by Jet Toyco, a trader and trading coach

Ah yes…

Trend following.

It’s probably the primary strategy you learned as a trader – the classic art of riding the market waves.

Just enter with a trailing stop loss, and call it a day, right?

But guess what?

There’s more to it than meets the attention!

Did you realize that trends are available different flavors?

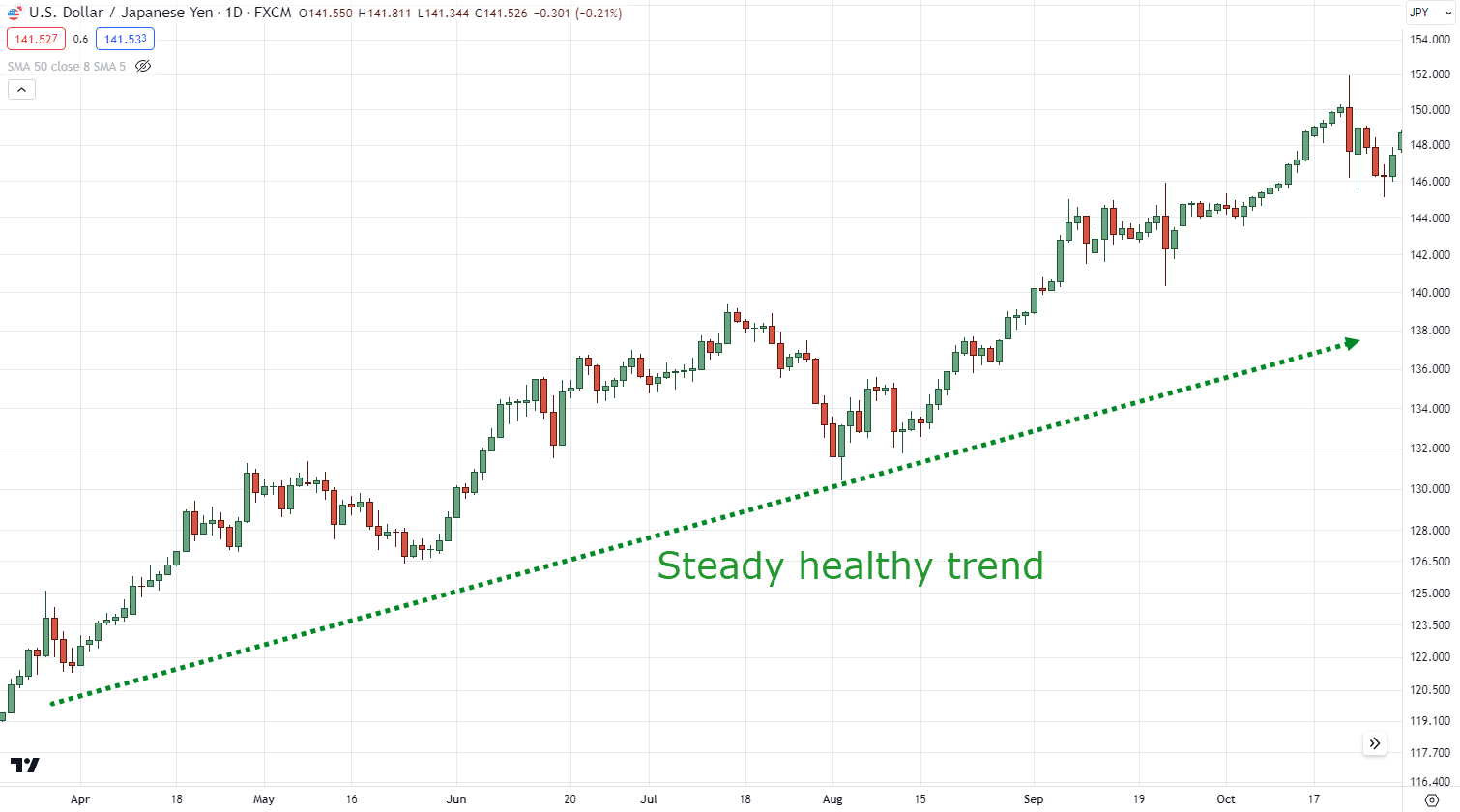

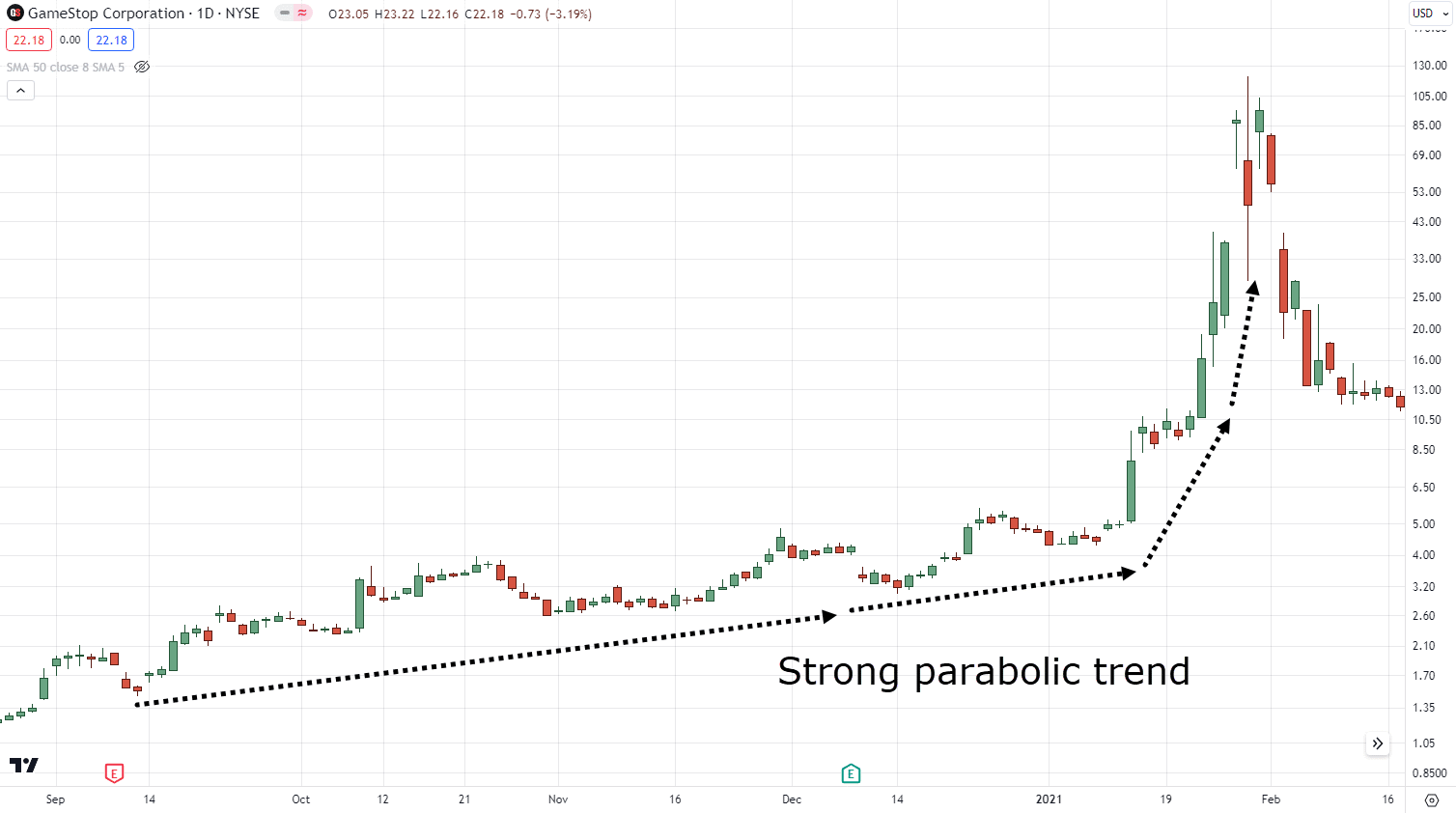

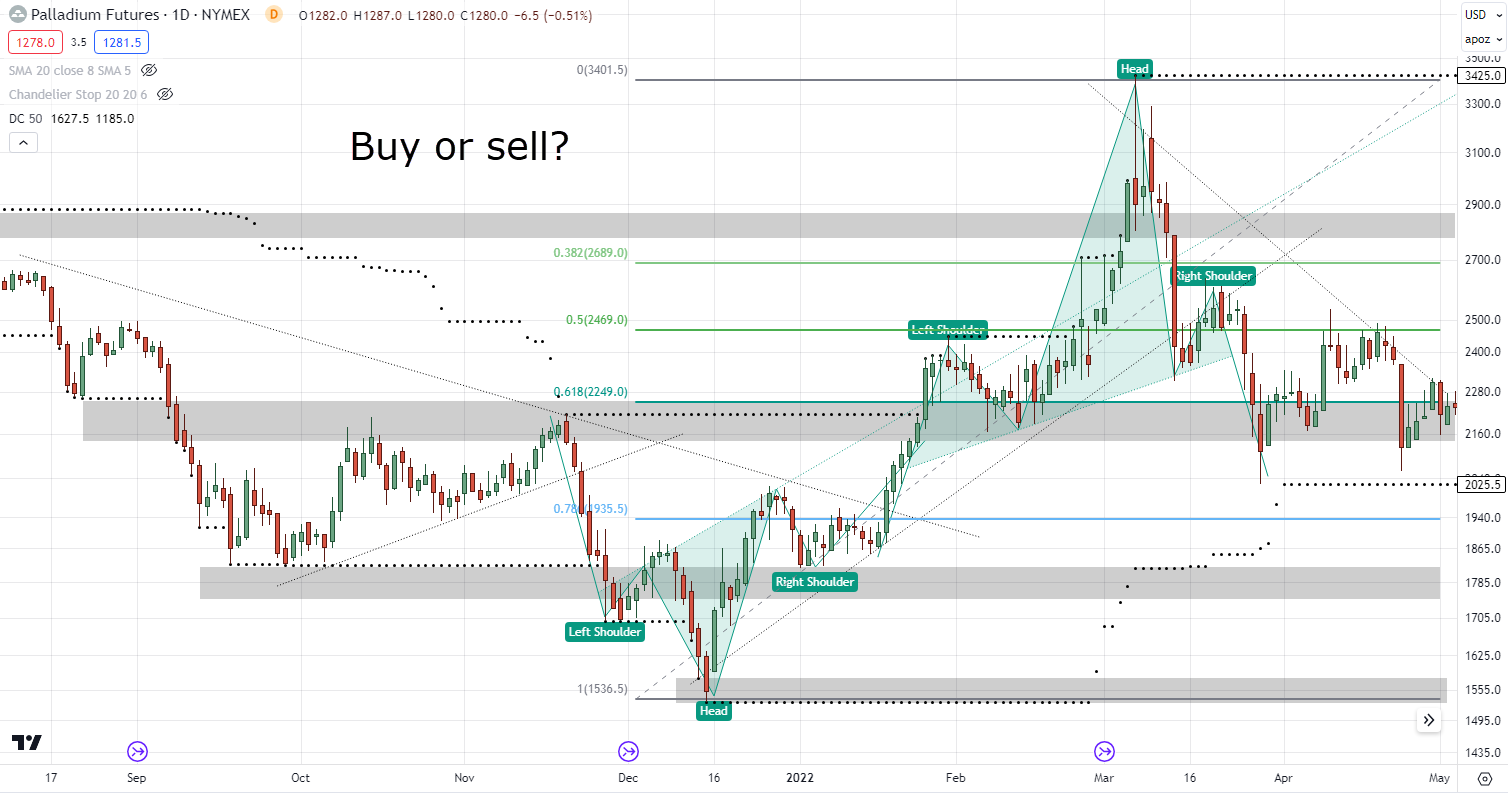

There are smooth and simple trends while there are “bull trap” parabolic trends!

Oh, yes!

Similar to ice cream, they’ve their unique twists and turns.

And with these several types of trends…

There are also exciting variations in the case of trend following strategies.

So, my fellow traders.

Fasten your seatbelts as we embark on a journey to unravel the secrets of trend following!

Here’s what you may expect in today’s complete guide:

- The fascinating world of trend following strategies and the way they ride market waves.

- Common trend following indicators: Donchian channel, Chandelier Stop, moving average, and price motion.

- The 2 sorts of strategies: discretionary (intuition-based) and systematic (rule-based).

- Secrets of trend following strategy: timeframe selection, market screening, risk management, and trade execution skills. Get able to elevate your trading prowess!

- A whole price motion strategy for thriving within the crypto markets

- A back-tested and proven systematic strategy that works in just about all markets

Excited?

You rattling must be!

As I’m spilling all my trend following trading secrets on this guide.

So, let’s start!

Unraveling the Trendy Magic: How Trend Following Strategies Rock the Trading World

Alright, my friend…

Let’s dive into the groovy world of trend following strategies!

So, here’s the deal:

While other traders is perhaps chasing the elusive “top” of the market prefer it’s the last slice of pizza…

Trend following strategies take a distinct approach.

These strategies are all about capturing the complete move, my friends.

Yep, you heard it right – it’s like catching a wave and riding it to the shore!

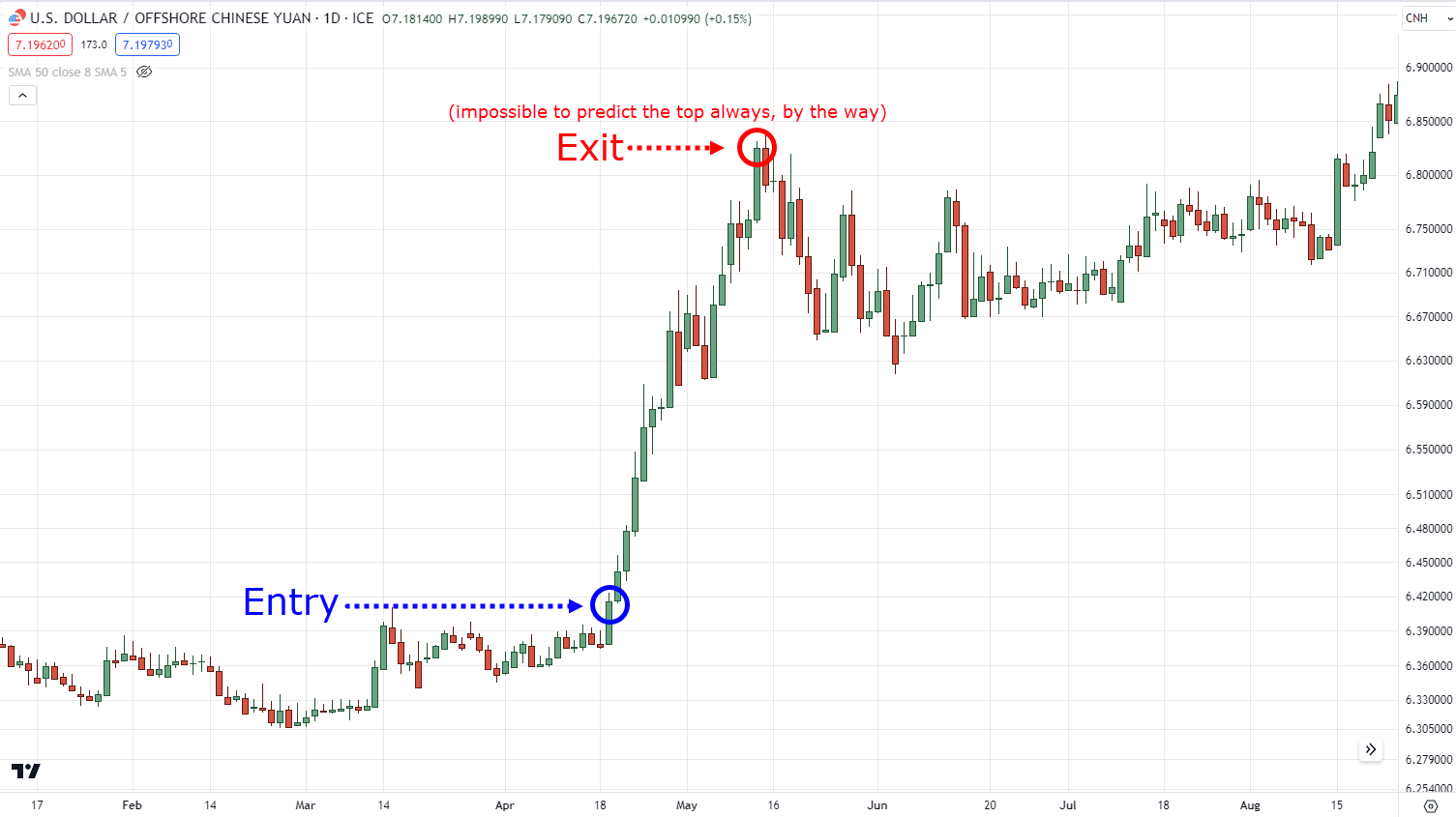

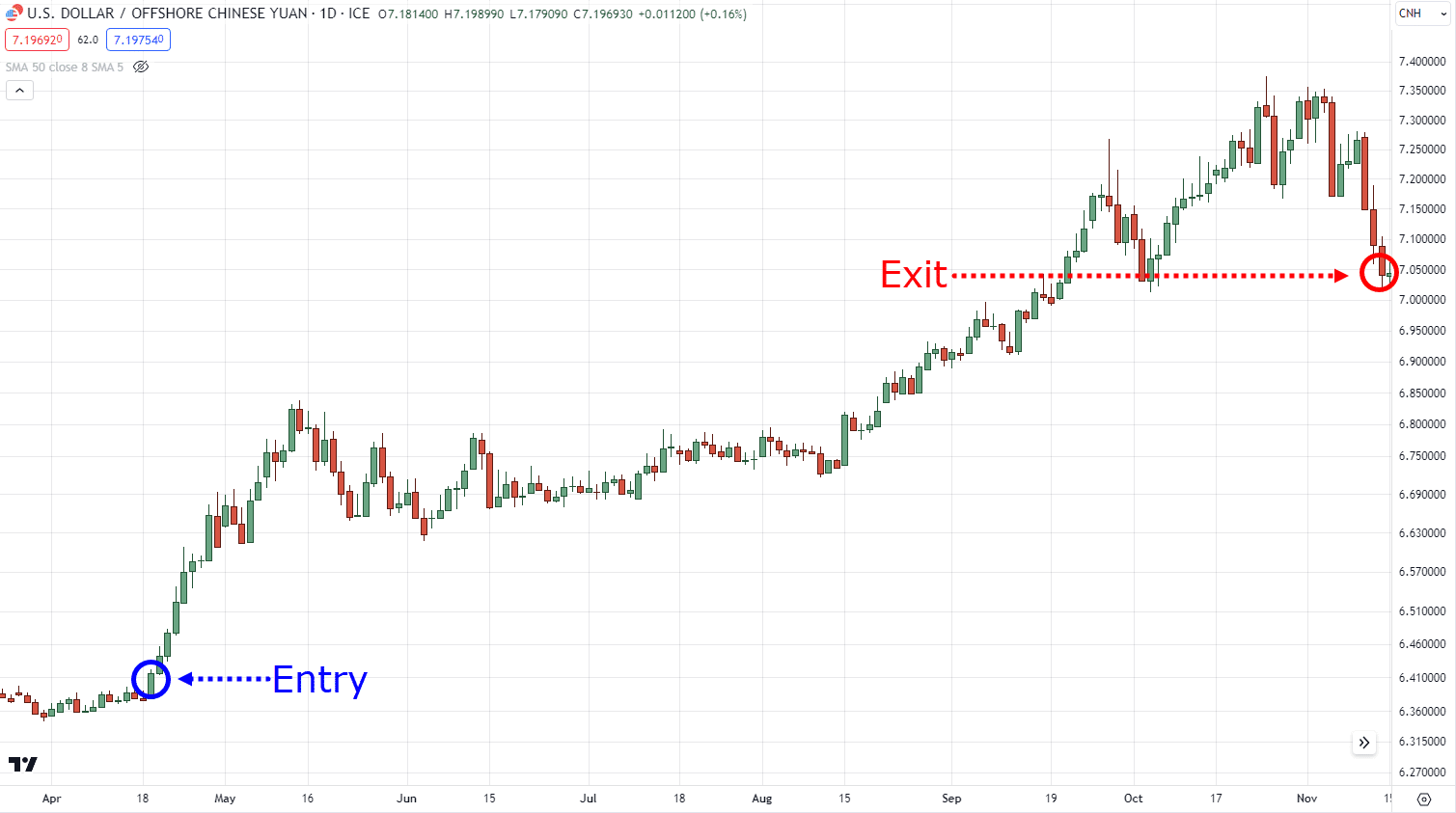

With trend following, it’s possible you’ll miss out on being the primary to shout “I caught the tippy-top!”

But fear not, since you’re in for the entire wild ride.

Unfortunately…

It’s not a “ride” plenty of traders can stomach.

So, let’s paint an image to make it crystal clear what you is perhaps stepping into…

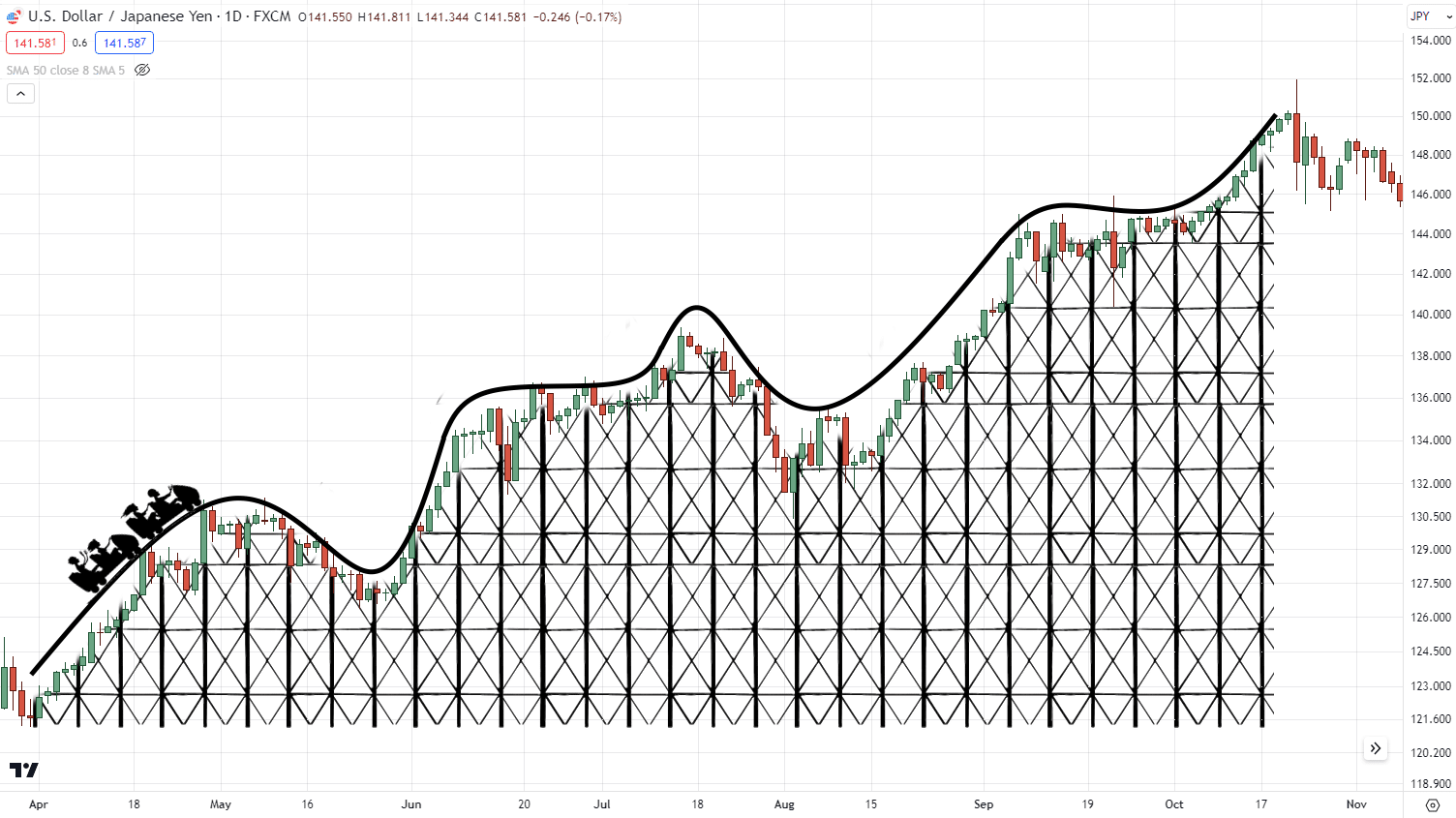

Imagine you’re at a roller coaster park, and the market is the coaster.

Trend following is like hopping on that coaster and embracing the complete thrill.

You don’t get off mid-ride, oh no!

You stay put, having fun with (or screaming) every twist, turn, and loop-de-loop.

Similarly, trend following strategies keep you strapped into the market motion from start to complete.

You could not all the time predict the very best peak, but you’re there to catch the complete heart-pounding, adrenaline-pumping adventure.

That is smart, right?

Adopting trend following strategies isn’t exactly easy breezy as other traders aught it to be.

However it’s a trading methodology where it’s 20% execution, and 80% psychology (a.k.a. staying on the roller coaster ride)

So, buckle up my friend.

Because the following section will show you the important thing indicators and tools which are suited to making trend following strategies.

In order that after you finish this training…

You’ll have the ability to create your trend following strategy.

Ready?

Then keep reading.

Unveiling the Trendy Tools: Rocking Indicators for Trend Following Strategies

Indicators, my friends, are the key sauce of trend following strategies.

This is the reason I’ll unveil a few of the coolest tools for you in today’s guide!

And what are those tools it’s possible you’ll ask?

We’ve got the:

- Donchian Channel

- Chandelier Stop

- Moving Average

- Price Motion

Now let me explain in further detail as these babies are about to turn out to be your latest best friends in your trading journey.

So, let’s kick it off with the Donchian channel.

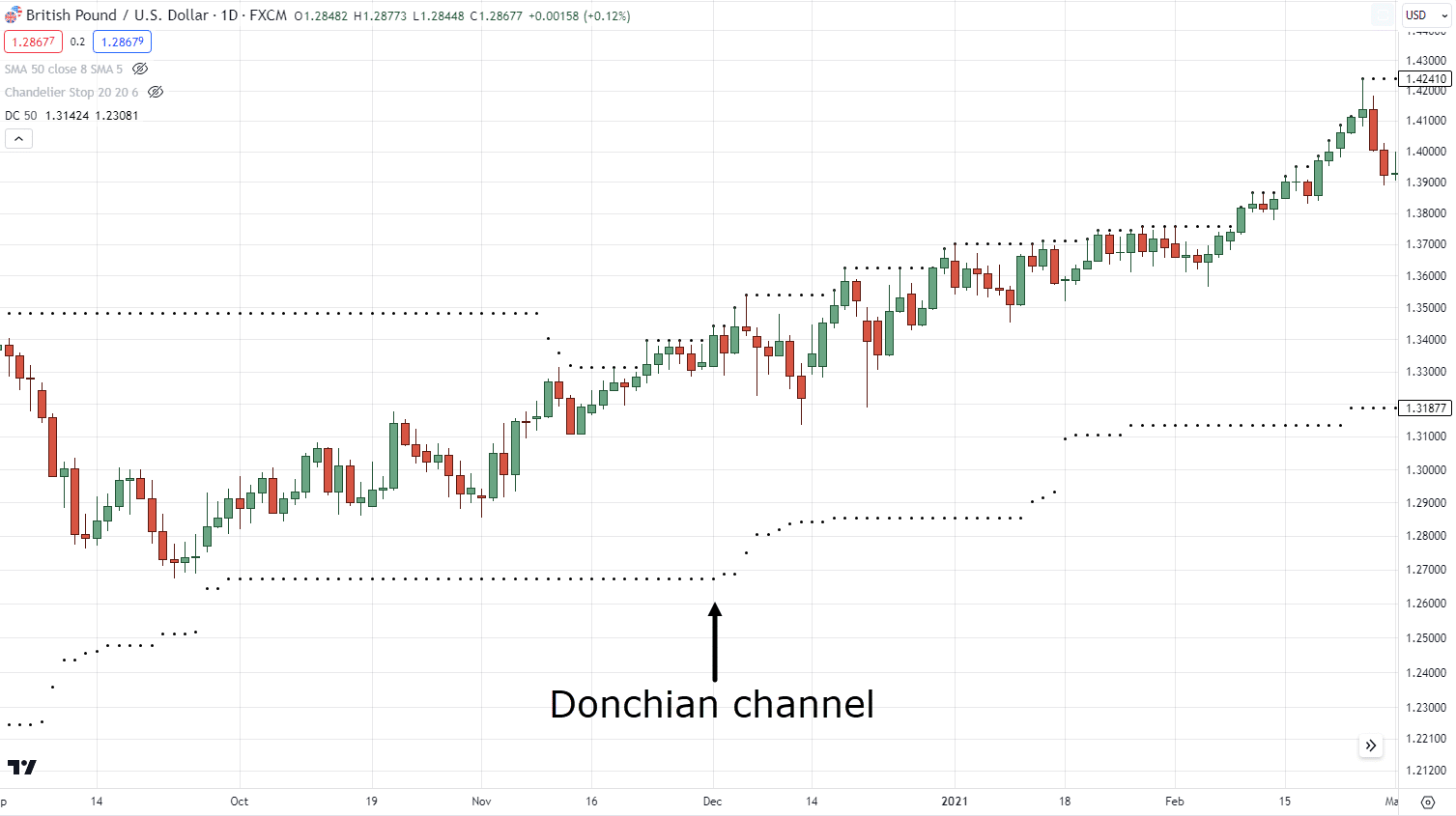

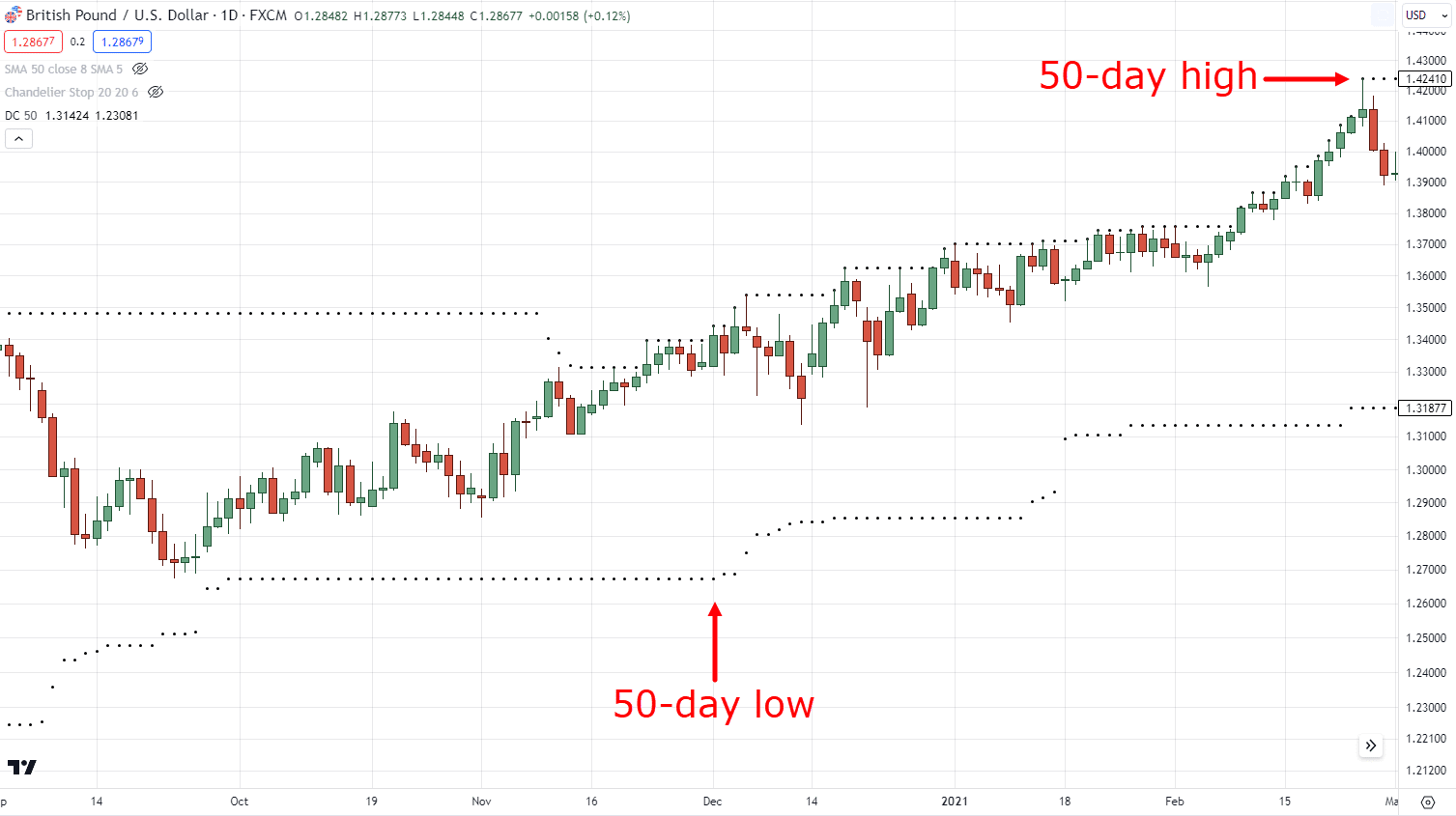

Donchian Channel

This little gem is like having a visible representation of the market’s highs and lows right in your chart.

No errors, and no guessing games.

If you ought to determine the very best highs and the bottom lows for the past 50 days?

Just place it into the settings then boom.

Again, no errors.

A really straightforward indicator, am I right?

So, what is that this indicator best used for?

Well, it’s the last word timing tool in your entries and exits.

Imagine having the clarity to leap in when the time is true and hop off the train just before it takes a nosedive.

That’s the Donchian channel magic, my friends.

An all-in-one simplistic indicator!

But in fact, that’s not all!

Chandelier Stop

Next on the scene, we now have the Chandelier Stop.

Sounds fancy, right?

Well, it’s greater than just a classy name.

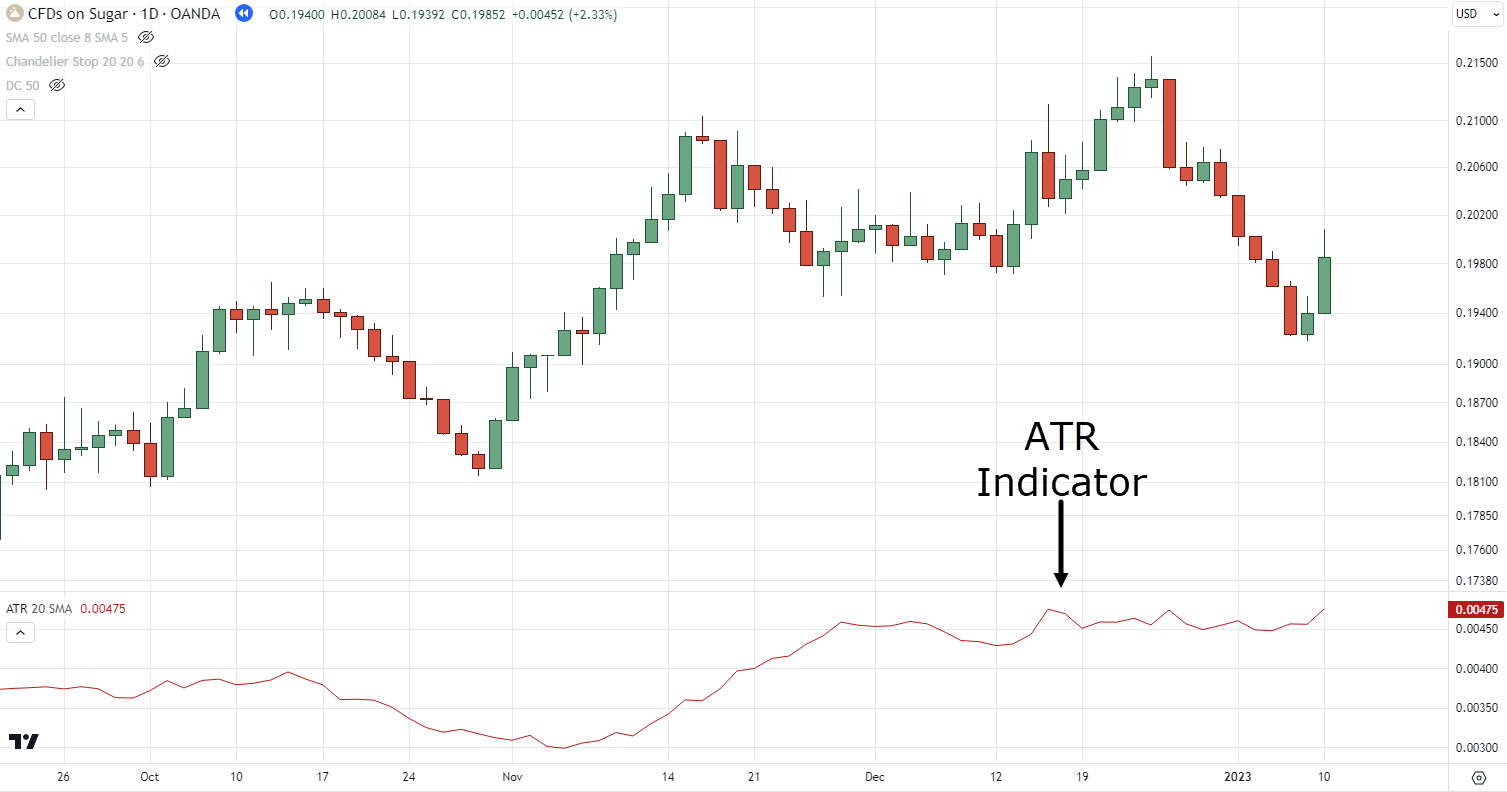

Since it’s the Average True Range indicator (which you’re probably undecided the way to use):

But with a superb visual twist.

Boom, now you realize the way to use the ATR swiftly!

Makes a complete lot easier, right?

As a substitute of manually subtracting the ATR to find out your stop loss, you have already got it in your chart served for you!

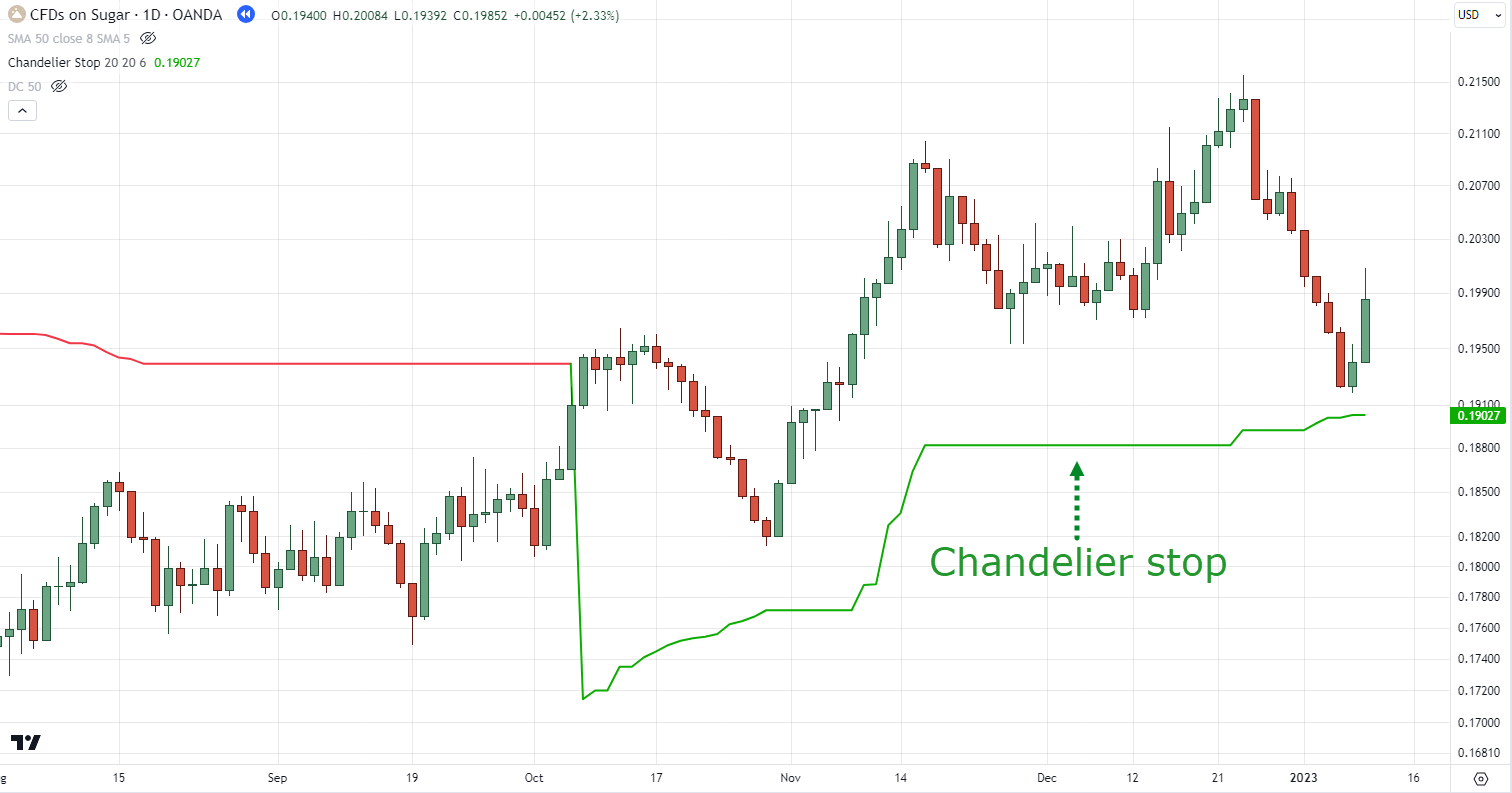

Now, this bad boy helps you set each your initial and trailing stop loss like a boss.

For those who go long, you may place your stop loss on the green line.

For those who go short, you may place your stop loss on the red line!

It’s like having a trusty bodyguard by your side, protecting your hard-earned profits while still giving the market room to bounce!

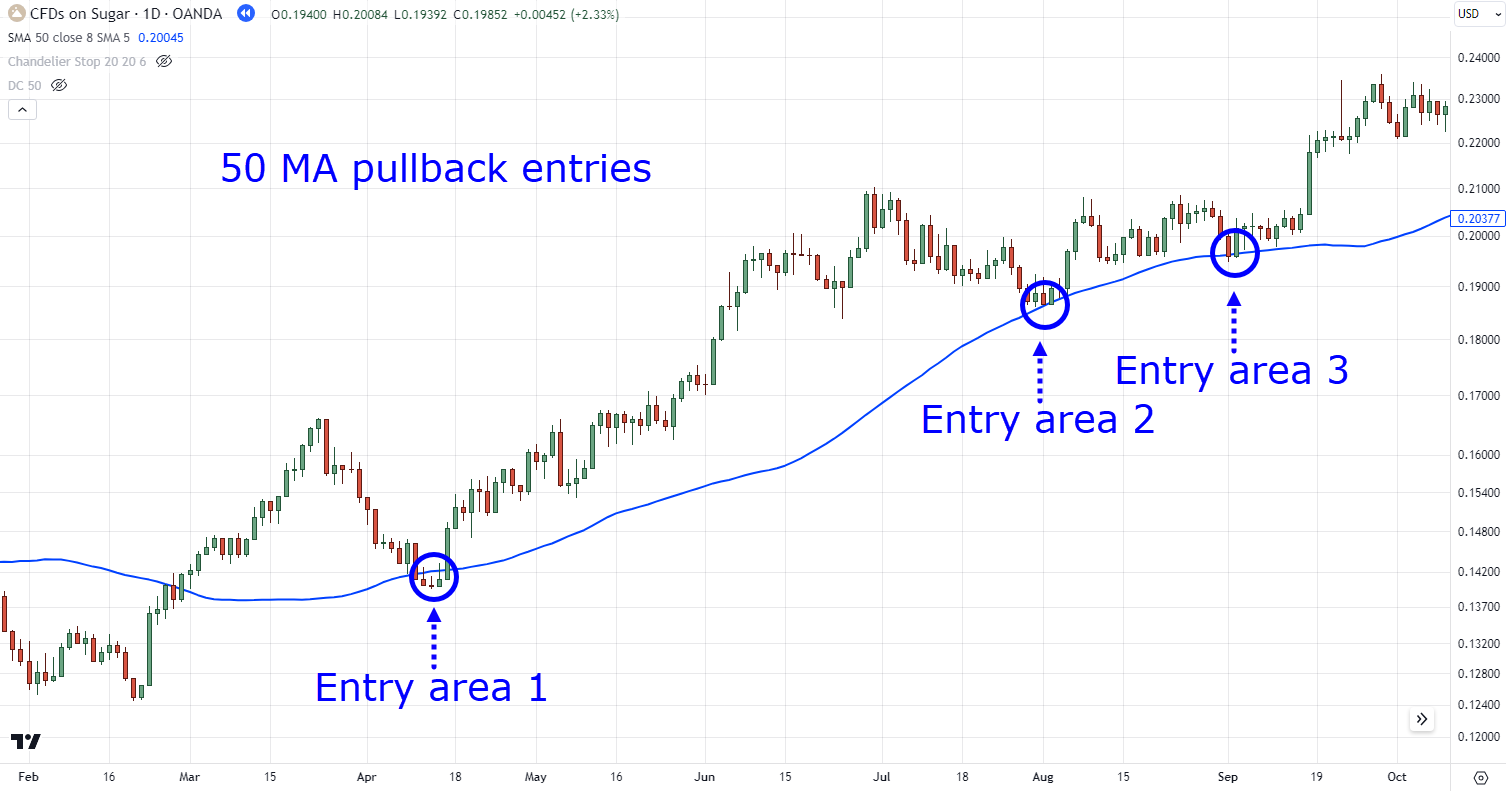

Moving Average

Ah, and who can forget the favored moving average?

It’s just like the trend-following maestro, continually measuring the common movement of the value.

Picture it as your guide, leading you thru the wild market terrain.

Nevertheless, one thing it’s truly good for is:

1. Objectively defining a long-term trend

2. Timing entries on a pullback

3. Trailing your stop loss.

It’s no wonder why the moving average stays to be one of the popular indicators on the market.

Because on the suitable trader’s hands…

This indicator may be flexible enough to capture every kind of trends.

That’s why don’t you dare underestimate this indicator!

So, my trading amigos…

Embrace these indicator heroes, learn their quirks, and make them a component of your trend-following arsenal.

Because within the later section, I’ll share with you which ones ones to make use of (and the way to use them).

But before we get into the strategies themselves…

There’s one thing most traders miss out on.

And that’s having the ability to distinguish discretionary and systematic trend following strategies.

Let me let you know more in the following section…

Decoding the Dance: Discretionary vs. Systematic Trend Following Strategies

Within the mesmerizing world of trend following…

Two distinct partners take the stage: discretionary and systematic trading.

These two have their unique styles, moves, and philosophies.

So, what makes them different?

Discretionary trend following strategies

First up, we now have the improvisational maestro: discretionary trend following.

It’s like freestyle dancing on the charts, where you make the calls based in your judgment and intuition.

With discretionary trading, you have got the liberty to adapt to any market condition.

Twirling and spinning with the ever-changing trends.

One of the best part?

Being discretionary gives you a likelihood to showcase your creativity and seize explosive gains when the celebrities align.

And that’s what makes discretionary trading appealing!

But let’s be honest…

This dance isn’t all the time a walk within the park.

The downside of discretionary trend following strategies (and the way to fix it)

With the word “discretion” in itself…

Subjectivity can creep in, resulting in evaluation paralysis and second-guessing.

There’s also a likelihood that you just’ll start mixing and matching indicators simply to get well out of your loss!

Moreover, it takes a little bit of “faith” to see whether or not your process and strategy work!

So, what’s the treatment to this?

Two things:

- Having a trading plan

- Having a trading journal

Those two things are the important thing to having a working and sustainable discretionary trend following strategies.

Sure, things will still take time before you may see those greens in your portfolio!

So, should you’re into discretionary trading, then these guides will enable you to out…

A Complete Guide To Creating And Using A Forex Trading Journal

How one can be a Profitable Trader Throughout the Next 180 Days

Now, let’s switch gears and meet the disciplined partner…

Systematic trend following strategies

Systematic trading is like executing a well-rehearsed performance, where every move is pre-defined.

No room for interpretation here!

Price breaks above the 50-day high?

Enter.

Breaks below the lows?

Exit.

Easy!

It’s all about simplicity and objectivity, allowing you to give attention to executing the steps flawlessly.

So, for instance…

If you have got a sound entry signal but then you definately hear news like:

“The markets are crashing”

“War is about to begin!”

“Banks are crashing!”

What do you do as a scientific trend follower?

That’s right.

You enter the trade with no hesitation.

That’s what it means to adopt systematic trend following strategies!

One other upside of systematic trading is you can easily test your strategy since rules are sometimes easy and may be coded to backtest years of knowledge repeatedly with ease.

On this case…

You’ll immediately know whether or not your trend following strategies has an edge available in the market or not before you even put your hard-earned money!

So, by sticking to the foundations…

You’ll be able to filter out the noise and let your execution shine.

The downside of systematic trend following strategies (and the way to fix it)

Nevertheless, flexibility just isn’t a part of this dance.

The principles are fixed.

And losing years could also be a component of the journey.

So, having the suitable mindset, expectations, and restraint to maintain on tweaking your rules after just a few losing trades can also be the important thing to being successful.

Moreover…

Testing a system requires meticulous work, and you may expect 99% of the strategies you’ll test might not be profitable.

And even should you’ve arrived at that 1%, you’d should be certain that it’s robust enough that it’ll not only work previously but additionally the long run!

Again, what’s the treatment for this?

Excellent news for you, my friend!

As we now have the book prepared for you should you want to embark on the journey of being a scientific trend follower.

One of the best part?

It’s free!

You’ll be able to test it out here: The Essential Guide to Systems Trading

So, there you have got it!

The fascinating duo of discretionary and systematic trend following.

Each brings their flair to the dance floor, offering traders different paths to success.

So, it’s about finding the very best one for you.

At this point, you is perhaps wondering…

“Rattling, I’ve learned lots!”

“But when are you able to teach us a trend following strategy this time?”

“Show me the strategy right away!”

Don’t fret, my friend!

Because at the top of this section, I’ll offer you two trend following strategies!

But before that, we have to be clear on one thing, and this is significant:

What makes a whole and tradeable trend following strategies?

Must you trade the crypto markets?

Stock markets?

What timeframe?

What indicators to make use of?

See what I mean?

That’s why on this section let’s dive into what makes a sustainable trading plan for trend following strategies!

The Trendy Secrets: Unveiling the Elements of a Killer Trend Following Strategy

Alright, my trend-following aficionados.

It’s time to spill the beans on what makes trend following strategy.

So, first off, we now have the mighty primary…

#1: knowing your timeframe

Jumping from one timeframe to a different on a regular basis breeds inconsistency.

You’ve read that right!

Because should you’re entering trades off different timeframes inconsistently, how are you going to expect consistent results?

Moreover…

Hopping from one timeframe to a different three timeframes makes it almost not possible to trace whether your strategy works!

This is the reason for discretionary traders, I suggest you stick with one or two timeframes.

While for systematic traders, I suggest you stick with just one timeframe to make testing your system efficient.

Now, let’s move on to the marvelous number two…

#2: having a market selection process

Consider it as having your very own team of screeners that enable you to find the juiciest opportunities.

You’re not only randomly picking any ol’ stock or asset.

Oh no! You’ve got your criteria set, and also you meticulously filter through the market to uncover those gems that align together with your trend-following mojo.

That’s why irrespective of what markets you trade.

Having some kind of screener or a technique to construct your watchlist consistently is a must!

Next up, we now have the powerful number three…

#3: knowing to administer your risk and portfolio

You’re not a reckless cowboy, my friend.

You understand the way to protect your capital and balance your portfolio like a seasoned tightrope walker.

So, in the case of risk management you should answer these questions on a regular basis:

- How much am I risking per trade? (e.g. 1% risk per trade)

- For stocks, how much should I allocate per trade? (e.g. 10% portfolio allocation)

- What are my maximum open trades?

- Do I even have an exit method or stop loss in place?

Sure, it’s a checklist you may write down in your notepad.

But when you ought to learn every little thing there’s to find out about risk management, you may check this out:

Forex Risk Management and Position Sizing (The Complete Guide)

Last but not least, we now have the game-changing number 4…

#4: knowing your setup, trade management, and exits.

You’re not only shooting at nighttime and hoping for the very best.

No, no, no my friend!

You’ve got your setups dialed in (pullback, or breakout?).

Your trade management techniques fine-tuned (trailing stop, or fixed take profits?)

And your initial stop loss is planned like a grand finale before you even hit that buy button!

Because here’s the thing:

Lots of traders love gathering suggestions and pieces of recommendation simply to enter a trade.

But in the case of exiting the trade at a loss or profit?

No rattling idea!

And that my friend, just isn’t sustainable.

Is smart?

So, my fellow trend followers…

Remember these essential elements:

- Embracing your timeframe

- Honing your market selection process

- Mastering risk management and portfolio management

- Knowing your setup, trade management, and exits.

With these secrets in your pocket, you’ll be unstoppable in your trend following strategies which I’ll share with you in the following section.

Yep, you heard that right!

So carry on reading!

Trend following strategies for discretionary traders

Recall…

Discretionary trading may be subjective at times, so there might be many various types of trend following strategies!

But for this guide…

I’ll share with you a short-term trend following strategy for the crypto markets.

Sounds good?

Nevertheless, I first need you to take the consistently profitable trader’s oath.

Ready?

I, (say your name)

Solemnly swear that I’ll backtest all the strategies shared with me today first and make crucial tweaks to this strategy before risking my hard-earned money.

In order that I can take full responsibility for my trading destiny.

Great?

Awesome.

So, listed below are our criteria for this trend following strategy…

- Market: Cryptocurrency

- Timeframe/s: Every day timeframe only

- Risk management: Maximum of two% capital loss per trade if the value hits stop loss

- Market selection: Give attention to the highest 20 most capitalized crypto coin

- Setup: Flag pattern breakout

- Initial stop loss method: Subtract 1 ATR below the lows of the Flag pattern

- Take profit method: 20-period moving average trailing stop loss

- Maximum open trades: 10

Now that you have got those criteria…

How the hell do you execute this trend following strategy step-by-step?

Step #1: Market selection

All of this information on finding the highest 20 capitalized crypto coins may be present in coinmarketcap:

After you’ve seen the list, all you have got to do is to put it in your watchlist in your platform!

Easy, right?

Step #2: Market setup

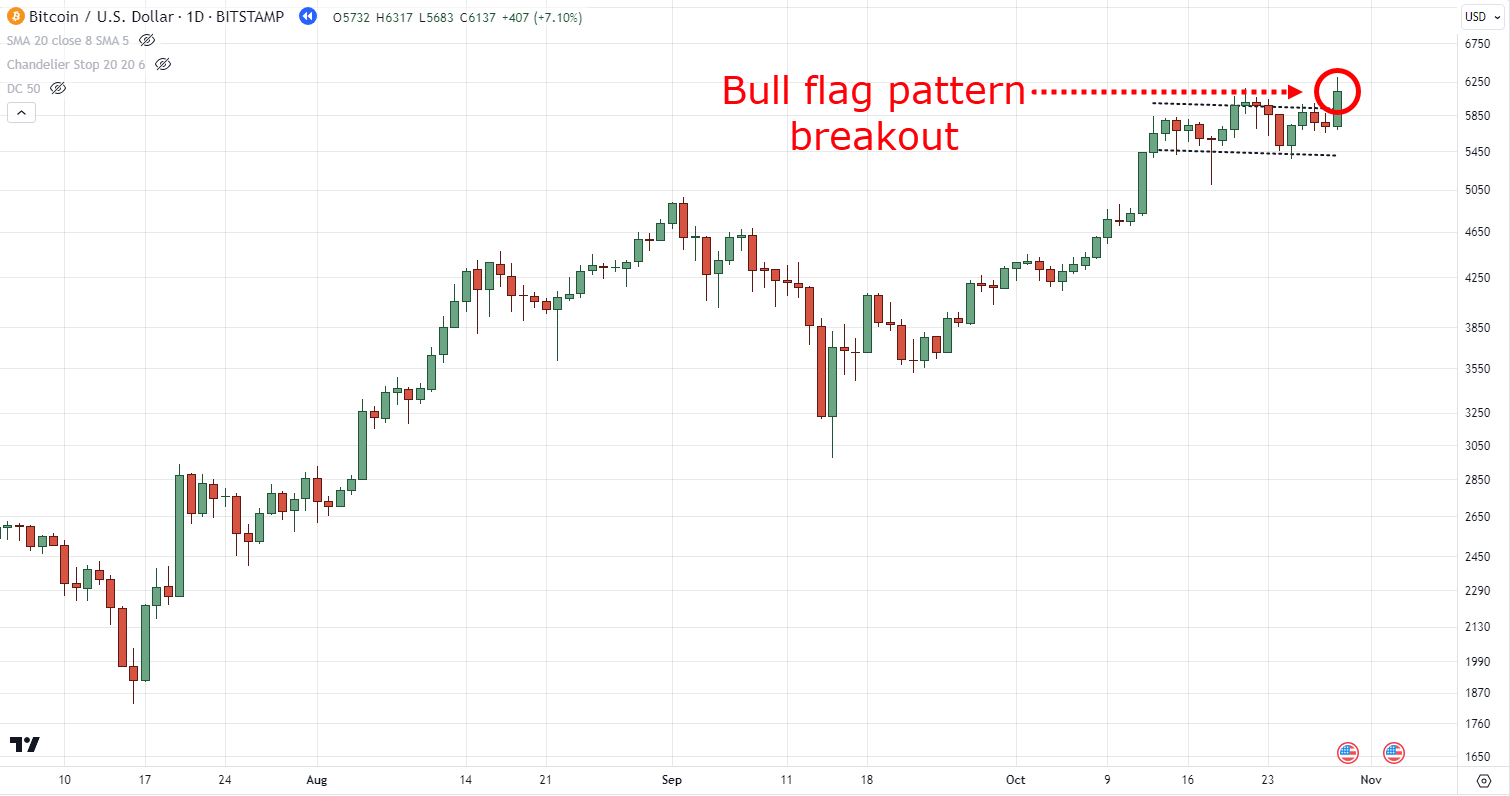

For those who take a look at the factors above, it’s best to know that we’re searching for a flag pattern breakout on the each day timeframe!

[BULL FLAG GIF]

Which means all you have got to do is to have a look at the watchlist you’ve built and find which markets are constructing a flag pattern.

Following to date?

Step #3: Entries and exits

If we’re talking pin-point execution here, one thing I suggest is to attend for a bullish close from the flag pattern:

Then enter at the following candle open:

On your stop loss, you may subtract 1 ATR from the lows of that flag pattern!

Or should you prefer, you should utilize the chandlier stop (remember this indicator?):

Finally, trade management.

How will you manage this trade?

Again, taking a look at the factors…

We’ll wait for the value to shut below the 20-period moving average until we exit this trade:

There you go!

A whole discretionary trend following strategy!

But here’s the thing…

This strategy may be improved upon by:

- Adding more criteria to your market selection

- Adopting more trading setups

- Lowering your risk per trade and increasing your max open trades to diversify

But in fact, I’ll leave it as much as you!

Finally, we now have the systematic trend following strategy…

Trend following strategies for systematic traders

Unlike discretionary trading…

We’ll perform a comprehensive backtest of the factors before I share with you the way to execute it!

Which means right from the beginning, you’ll know that the strategy has an edge and know what returns to expect.

Sounds good?

So, listed below are the factors for this strategy:

- Market: Forex, bonds, agriculture, commodities, and indices

- Timeframe/s: Every day timeframe only

- Risk management: Maximum of 1% capital loss per trade if the value hits stop loss

- Market selection: Give attention to the 25 markets on the watchlist (fixed)

- Setup: 200-day breakouts

- Initial stop loss method: Subtract 6 ATR below the lows of the Flag pattern

- Take profit method: 6 ATR trailing stop loss

- Maximum open trades: 25

On this case…

We’ll test the system from the yr 2000 as much as 2022 via Amibroker with Norgate data.

So, how does the system perform?

First, are the essential statistics:

- Variety of trades: 763

- Winning rate: 46.13%

- Annual return: 10.76%

- Max drawdown: -15.86%

- Risk-adjusted return: 85.19%

What does this all mean?

Does it mean you get to make 10.76% a yr, guaranteed?

That’s not the case, my friend!

It implies that there will probably be years where you’ll have BIG gains identical to within the 2008 financial crisis and the 2020 pandemic:

And years where you’ll barely have any gains or simply be at breakeven equivalent to from 2015 to 2019:

Now, how in regards to the maximum drawdown?

What does it mean?

Does it mean that you just’ll lose a maximum of -15.86% every yr?

Again, nope!

It implies that at one cut-off date…

The system has lost -15.86%

The more serious-case-scenario!

And eventually, the equity curve:

Why is that this essential?

Well, traders take a look at the equity curve to see whether or not the system is value risking your hard-earned money into!

And with every little thing you’ve seen to date on this test…

Would you trade this technique?

It’s as much as you, my friend!

But sure…

It’s the very best system around that makes 1000% every rattling yr.

However it sure does appear to be it has an edge available in the market, having survived multiple financial crises!

Now, knowing how this technique has an edge available in the market, how do you exactly implement it?

Let me show you…

Step #1: Watchlist constructing

For those who recall…

We’re trading different market sectors here equivalent to forex, bonds, agriculture, commodities, and indices

But which markets are they?

Well, listed below are the markets I’ve included within the test:

I do know what you’re pondering:

“What, these markets are correlated!”

“I shouldn’t be trading this technique in any respect!”

And yes, you have got some extent!

Nevertheless, correlation just isn’t static and changes in the long term.

And whenever you apply the identical principle across different markets where correlation just isn’t static…

You get a nicely diversified portfolio that makes gains and losses more stable!

Also, you is perhaps pondering:

“25 open max open trades?”

“That’s outrageous!”

“Won’t I lose all money when I even have those many open trades?”

I get you!

But should you take a look at the risk-adjusted return, where we divide the annual return and exposure from the factors, you get an 85.19%!

Which means the strategy would perform higher the more trades you have got open!

So, now that you have got those markets in your watchlist…

What’s next?

Step #2: Finding the setup

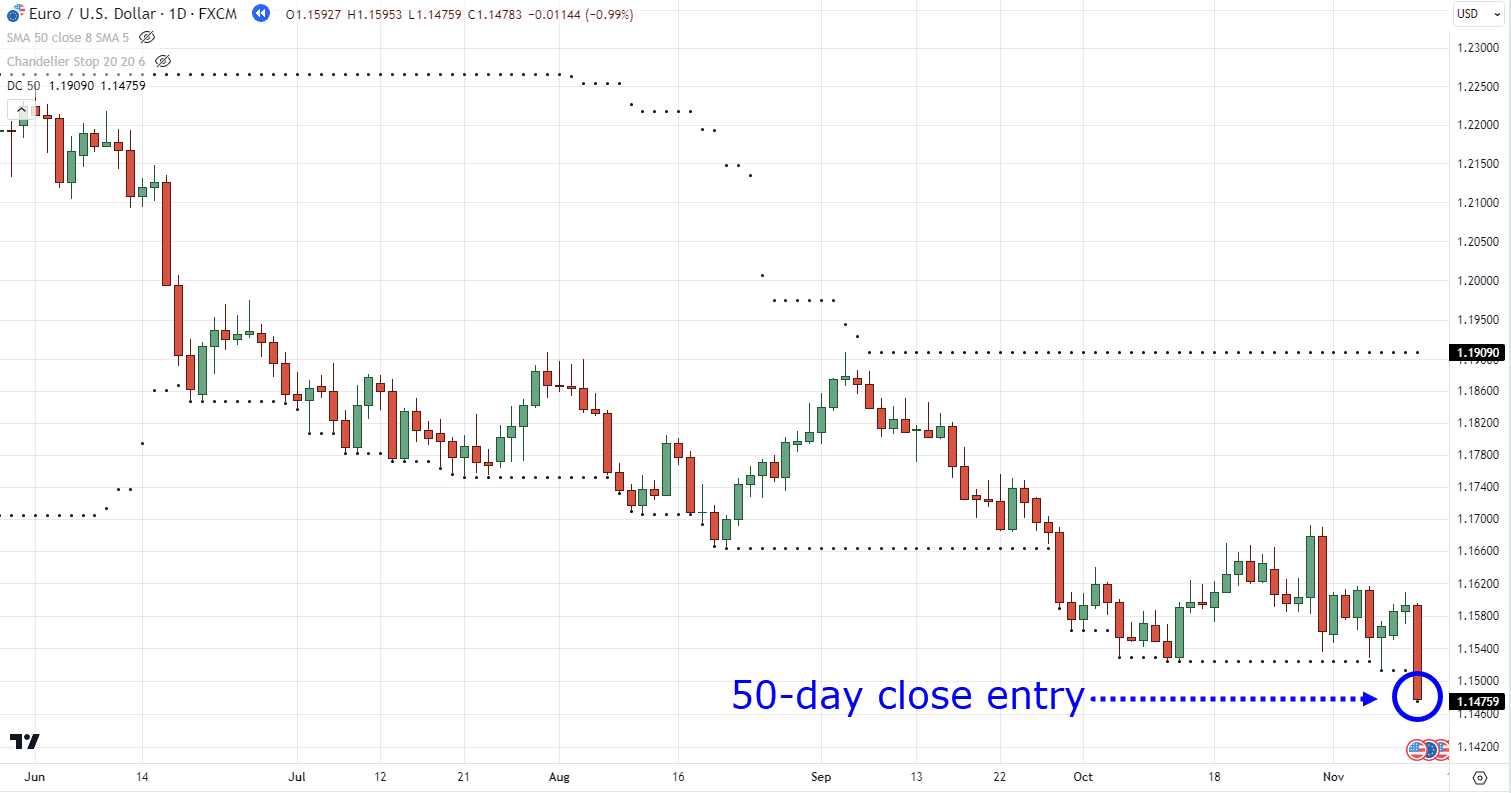

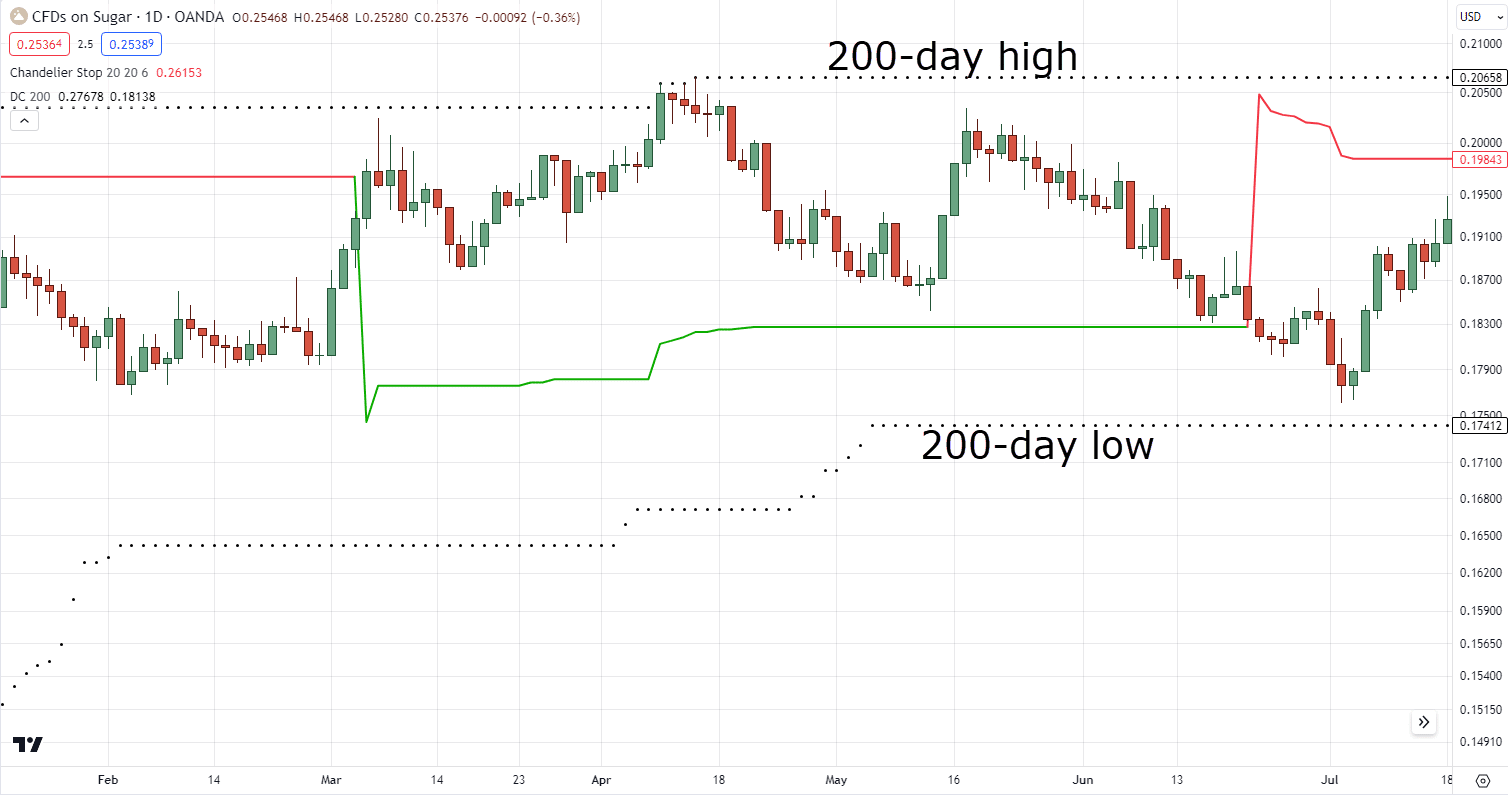

This trend following strategy is easy:

Wait for a 200-day high or low breakout close using the Donchian channel!

And set your initial stop loss on the 6 ATR chandelier stop!

Remember the symptoms I shared with you some time ago?

Good, because all you have got to do is to search for this same setup every trading day out of your watchlist:

Finally, crucial part…

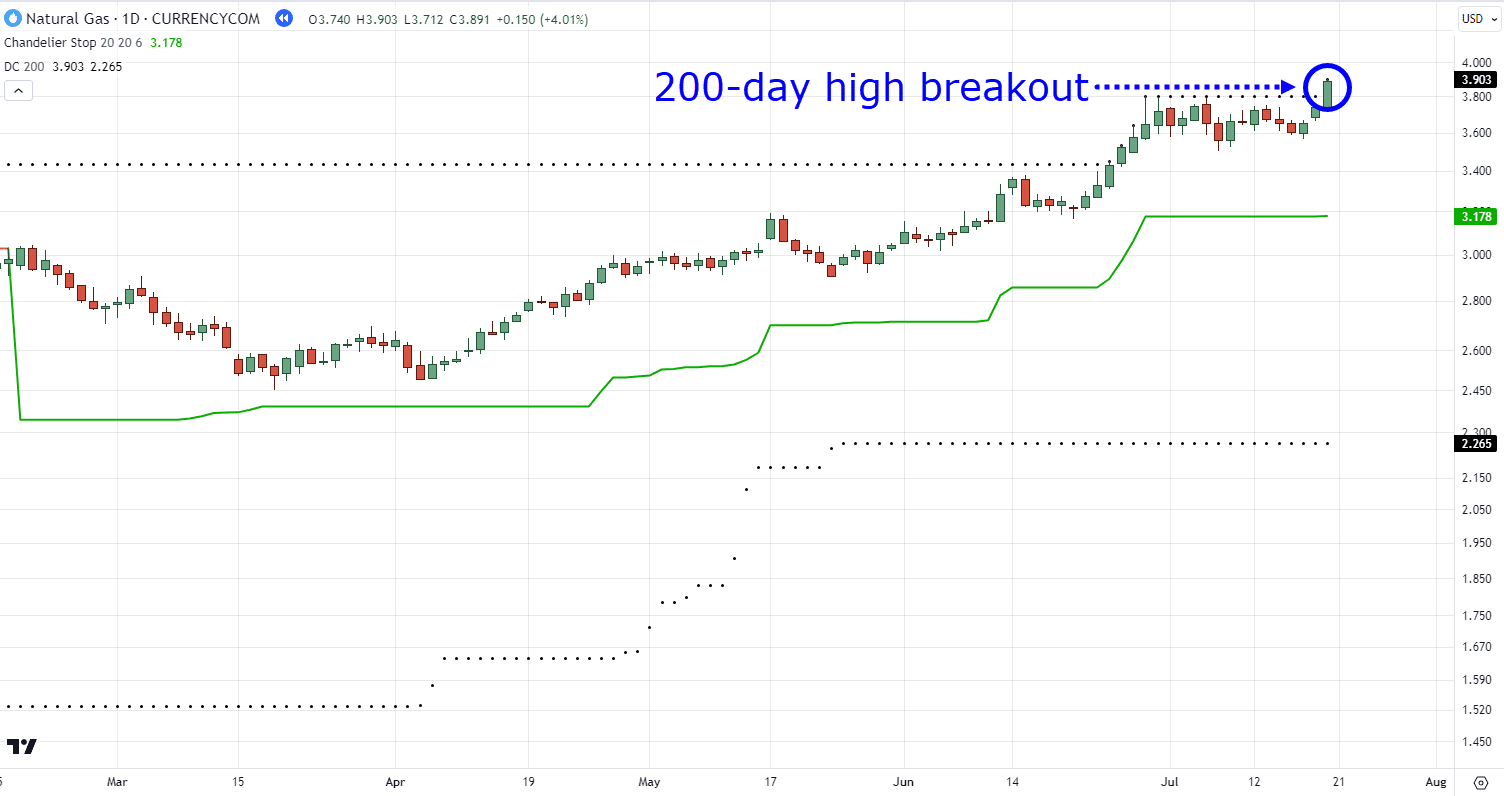

Step #3: Trade execution

Executing this technique is easy as all you wish are two indicators:

- 200-period Donchian Channel

- 6 ATR chandelier stop

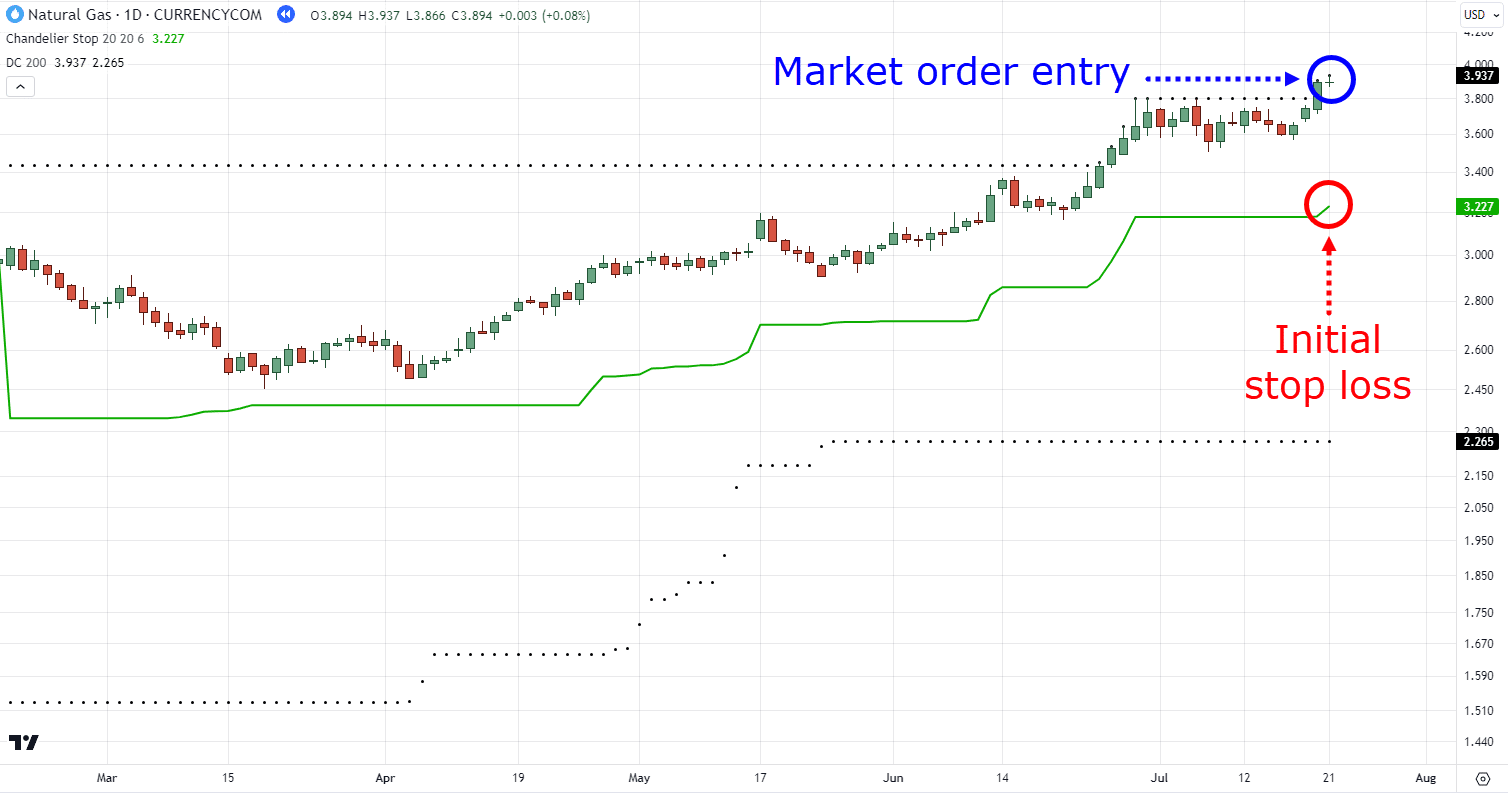

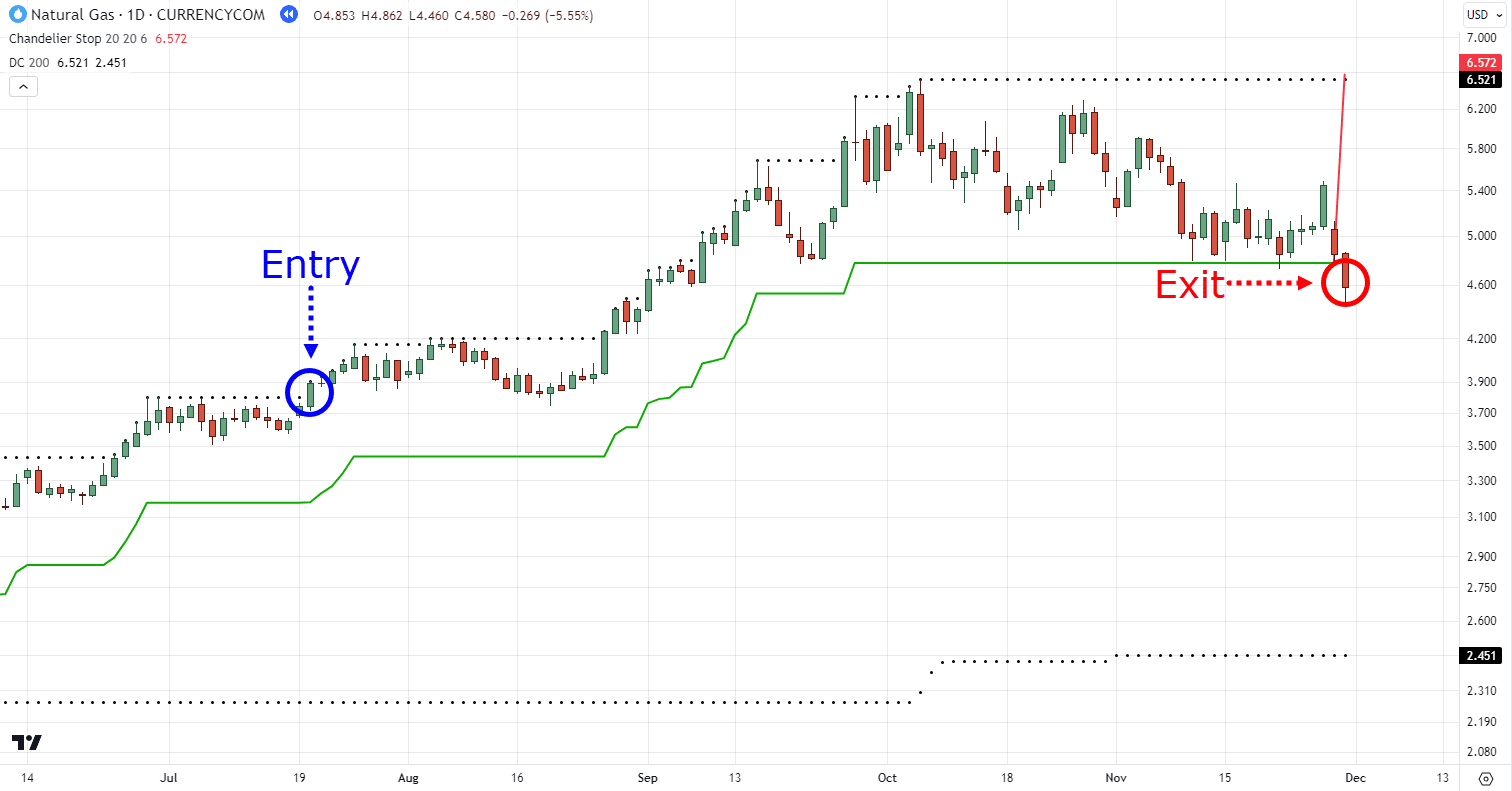

So, if the value makes a latest 200-day high:

You set your initial stop loss on the chandelier stop and enter at the following candle open via market order:

And only exit your trade if the value makes a detailed above the 6 ATR:

Easy, right?

No drawings in your chart.

No second-guessing.

No subjectivity.

Now…

How will you improve this trend following a method system?

Since this technique is strong, there are a few things you may tweak and the system would still have an edge available in the market, they usually are:

- Adding more markets to the watchlist

- Increasing or lowering the 200-day entry settings

- Increasing or lowering the 6 ATR initial and trailing stop loss

Sounds good?

Mind’s all filled with knowledge?

Great, then let’s do a fast recap on what you’ve learned today!

Conclusion

Adopting trend following strategies has different forms with different tools you should utilize.

Ultimately, it’s all about finding the suitable style and tools for you and piecing them together in a way that won’t conflict with one another!

So, here’s what you’ve learned today:

- Trend following goals to capture the complete market move, embracing the fun of riding market waves from start to complete.

- Common trend following indicators include the Donchian channel, Chandelier Stop, moving average, and price motion, helping traders navigate market trends.

- Discretionary trend following allows traders to make use of judgment for decisions, while systematic trend following follows fixed rules and objective criteria.

- A very good trend following strategy involves knowing your timeframe, employing a market selection process with screeners, mastering risk management, and being expert in setups, trade management, and exits.

- A discretionary price motion strategy for the crypto markets

- A scientific backtested strategy designed to trade different market sectors

There you go!

With that said, here’s what I would like to know…

Have you ever tried any trend following strategies previously?

How did it go?

And can you make some tweaks and take a look at again after this guide?

Let me know what you’re thinking that within the comments below!