by jessefelder

It’s no secret that for the past decade and a half the Federal Reserve has made it its mission to create a “wealth effect” within the economy by boosting asset prices. Back in 2010, Ben Bernanke explained, “…higher stock prices will boost consumer wealth and help increase confidence, which may also spur spending. Increased spending will result in higher incomes and profits that, in a virtuous circle, will further support economic expansion.” And so he began a technique of printing money with the express purpose of inflating asset prices, a policy that has been continued by each of his successors.

Over this time, quntitative easing, because the policy known as, has been inordinately successful in boosting asset prices while not so effective in boosting the economy. Probably the most straightforward evidence of that is the indisputable fact that household net value relative to the economy has soared to record highs through the QE era. If it had worked the way in which Bernanke intended then, after a temporary surge within the ratio, it will have flattened out as growth within the economy caught as much as growth in asset prices. Clearly, that didn’t occur.

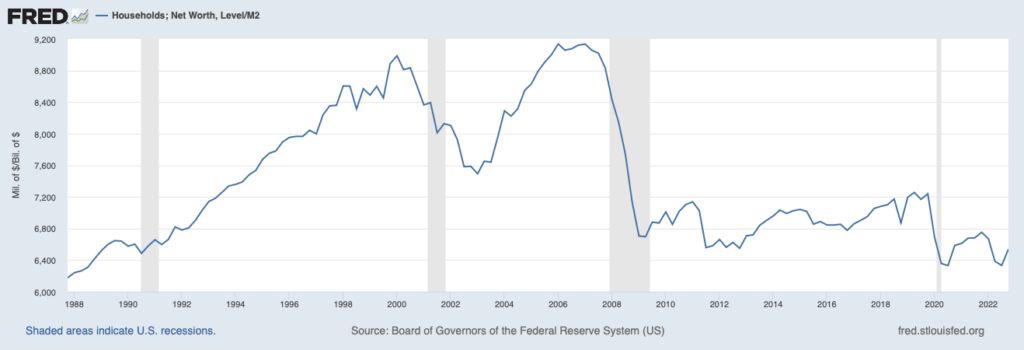

It does appear, nonetheless, as if the central bank did not less than accomplish the primary half of Bernanke’s mission (boosting wealth) even when it didn’t quite accomplish the second half (kickstarting a virtuous circle of economic growth). But if you have a look at household net value relative to the expansion in the cash supply, it’s clear that the rise in the previous was nothing greater than an illusion. Net value has actually declined relative to M2 since 2008 and is now back to levels not seen within the 20 years prior to that point. The reality is that there was no “real” wealth created in any respect when measured this manner.

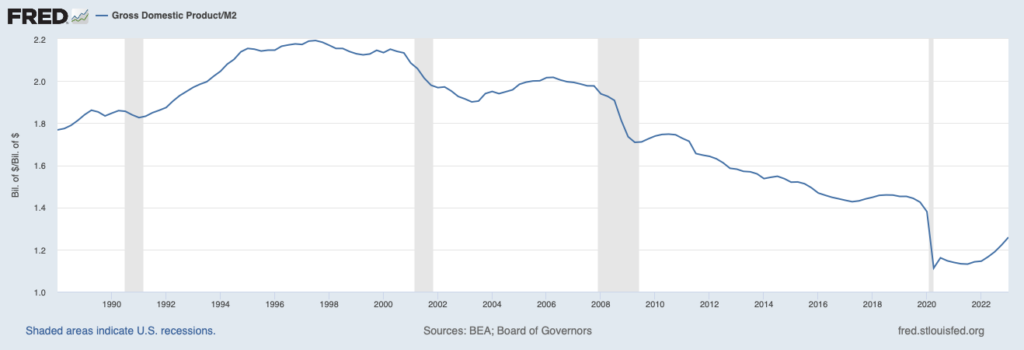

And if you deflate GDP by the expansion in the cash supply, the image is much more damning. Since quantitative easing began in 2008, the trajectory of the economy in relation to the expansion of M2 has been much more deeply negative than that in household net value. The reality is that there was no “real” growth within the economy since 2008 when it’s measured in this manner; in actual fact, the economy has been in protracted decline relative to the cash supply for a long time, a phenomenon that has only worsened through the QE era.

As today’s CPI report reminds us, that after a long time of disinflation essentially the most recent round of cash printing has result in the return of inflation. At the tip of the day, it might not be the economy or household net value but inflation that the central bank’s great monetary experiment has been simplest in stoking. After all, history could have told us that will be the likely final result long before Bernanke ever began firing up the printing press. And it’s failure to heed the warnings of history may help to clarify why confidence within the Fed is now at an all-time low, a trend which will only exacerbate the inflation problem over time.

Post Views: 34