Up to now in 2023, there have been three major bank failures. And I do mean MAJOR: all told the three banks had $532 billion in assets. That quantity is definitely greater in size that the combined assets of the 25 banks that failed in 2008.

What is occurring here?

What is occurring is that the Fed created this mess… and bad risk management on the banks has exacerbated it.

Let me explain.

Traditionally, banks generate profits as follows:

1) You deposit your money on the bank.

2) The bank pays you a low rate of interest on this residue.

3) The bank turns around and loans out $5, $7, even $10 in loans for each $1 you deposited. The bank charges a much higher rate of interest on these loans than the rate of interest it pays you in your deposit.

4) Alternatively, the bank buys $5, $7, and even $10 in long-duration assets (Treasuries, or other long-term bonds) for each $1 you deposited.

5) The bank pockets the spread between the interest it earns on its loans/ bonds and the rate of interest is pays you in your deposits.

This case works well provided the Fed keeps rates of interest low. Unfortunately for the banks, the Fed unleashed inflation by printing ~$5 TRILLION between 2020 and 2022.

Bond yields trade based on many things… including inflation. And once inflation entered the economic system, Treasury yields ripped higher.

When Treasury yields rise, bond prices FALL. And who was sitting on trillions of dollars’ price of long-term Treasuries and loans that traded based on long-term Treasuries?

You guessed it… the regional banks.

Courtesy of the Fed’s idiocy, the banks were destined to be sitting on tons of of billions of dollars price of losses on these assets.

But it surely gets worse.

Once the Fed finally decided to get off its rear and do something about inflation, it launched into its most aggressive rate hike cycle in history, raising rates from 0.25% to five% within the span of a single 12 months.

Why does this matter?

Remember how banks pay you a low rate of interest in your deposit? Well who’s going to wish to keep his or her money in a bank that pays 0.3% at best… when he or she will earn 4% and even 5% in a money market fund or short-term Treasury bond, courtesy of the Fed raising rates so high so fast ?

And so, depositors began pulling their money from banks… and never by just a little: 2022 was the primary 12 months since 1945 by which money on a NET BASIS left the banking system within the U.S.

But hang on… remember how the bank loaned out or bought $5, $7, and even $10 price of loans or long-term assets based on every $1 you deposited within the bank? Well while you pull your money out of the bank, the bank has to unload all that stuff to take care of its capital requirements.

And so, the Fed delivered the last word 1-2 punch to the U.S. regional banking system.

The primary punch was it ignored inflation to the purpose that the banks were sitting on tons of of billions of dollars’ price of losses.

Nevertheless, the KO punch was the Fed raised rates aggressively, which resulted in depositors pulling money out of the banks in the hunt for higher returns on their money.

Now, don’t get me incorrect. The banks are partially responsible for the indisputable fact that didn’t act once the Fed announced it might be raising rates to finish inflation. With proper risk management (bond hedges as an illustration) these banks would have been higher prepared for the bond market massacre of 2022.

Nevertheless, even careful risk management would have done nothing to assist these banks once depositors began pulling their money out. And no bank could raise its deposit rates to 4% or 5% to compete with money market funds or short-term Treasuries while staying in business.

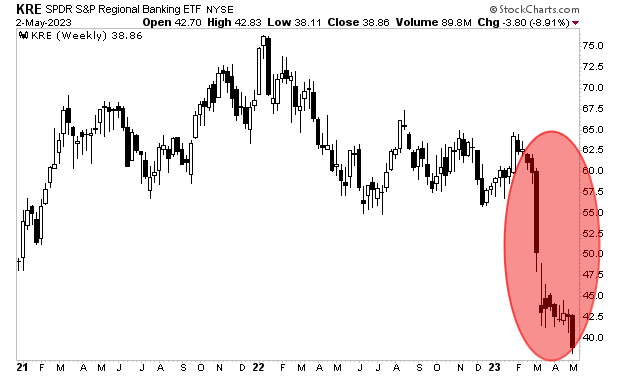

And so we get this: a situation by which MAJOR regional banks are going bust and the regional bank ETF has lost a 3rd of its value within the span of six weeks.

This case is nowhere near over. In line with some evaluation, HALF of the U.S.’s banks are currently insolvent.

The clock is ticking here. Ignore trader games, something BAD is coming to the markets.