Guest Post from SchiffGold.com:

Breaking Down the Balance Sheet

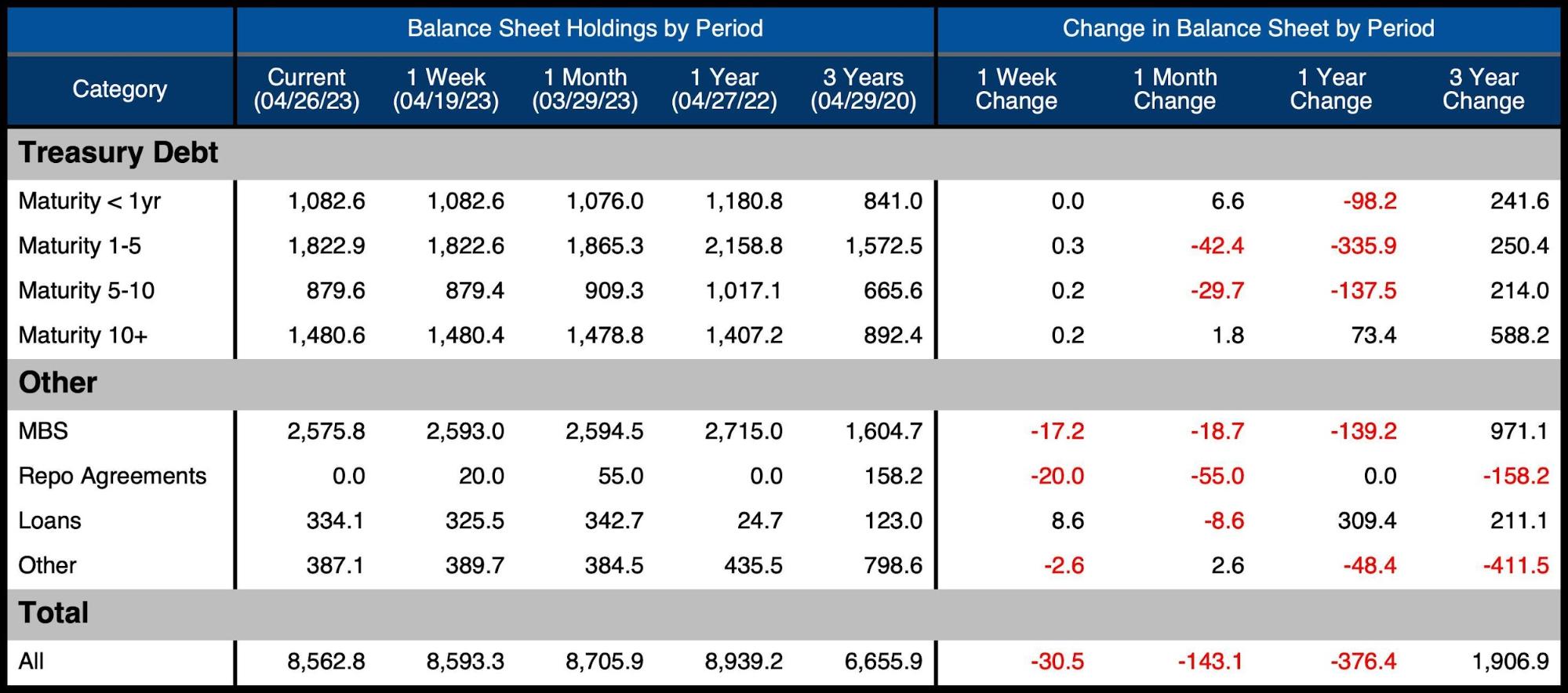

The Fed saw a discount in its balance sheet of $143B during April. Standard QT was chargeable for $83B while $55B of the reduction was in Repurchase (Repo) Agreements which dropped to $0 this week. While Repos dropped to zero, Loans actually increased for the week, despite being down barely for the month by $8.6B.

The Fed has failed again to hit the MBS $35B goal, seeing only an $18B reduction. This could come as no surprise because the Fed has never come near its MBS goal. In reality, last month was the closest the Fed ever got here, with a $25B reduction in MBS.

Figure: 1 Monthly Change by Instrument

The table below provides more detail on the Fed’s QT efforts.

-

- Treasuries saw a net reduction of $63.7B which was on the QT goal

-

- Reduction was focused within the 1-10 12 months range

- Lower than 1 12 months and greater than 10 12 months actually saw an increase of $8.4B

-

- As mentioned above, MBS saw a discount of $18.2B, but $17.2B got here in the newest week

- Repos dropped from $55B to $0, but this was entirely in Foreign

- Loans fell by $8.6B on the month but actually increased by $8.6B on the week

- “Other” increased by $2.6B

- Treasuries saw a net reduction of $63.7B which was on the QT goal

Loans are broken down into multiple categories, the three biggest being Primary Credit ($73B), Bank Term Funding Program ($81B), and Other Credit Extensions ($170B). The primary two actually increased on the week by $4B and $7.5B.

Figure: 2 Balance Sheet Breakdown

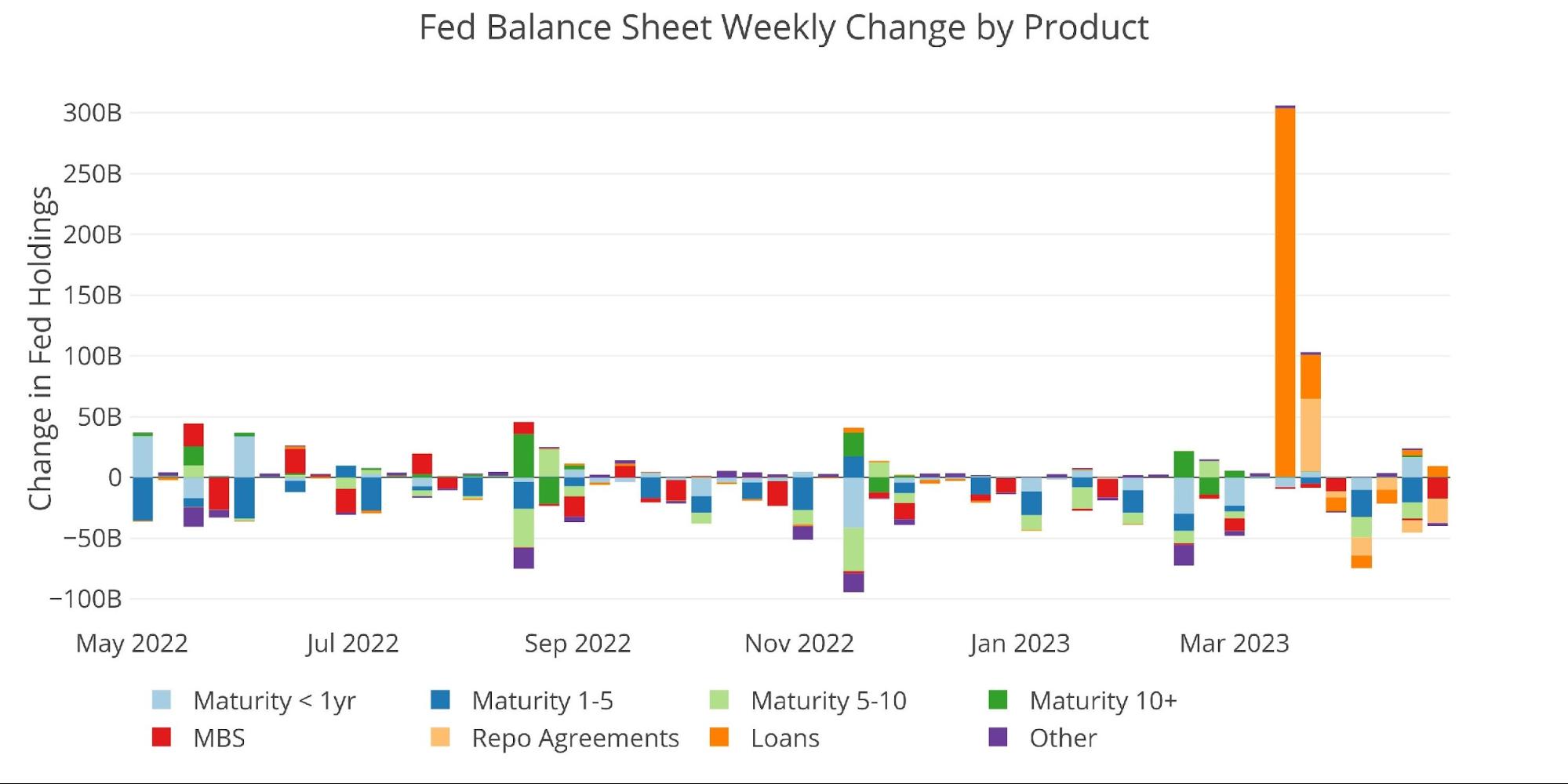

The weekly activity could be seen below. This is definitely the second week in a row that Loans have increased.

Figure: 3 Fed Balance Sheet Weekly Changes

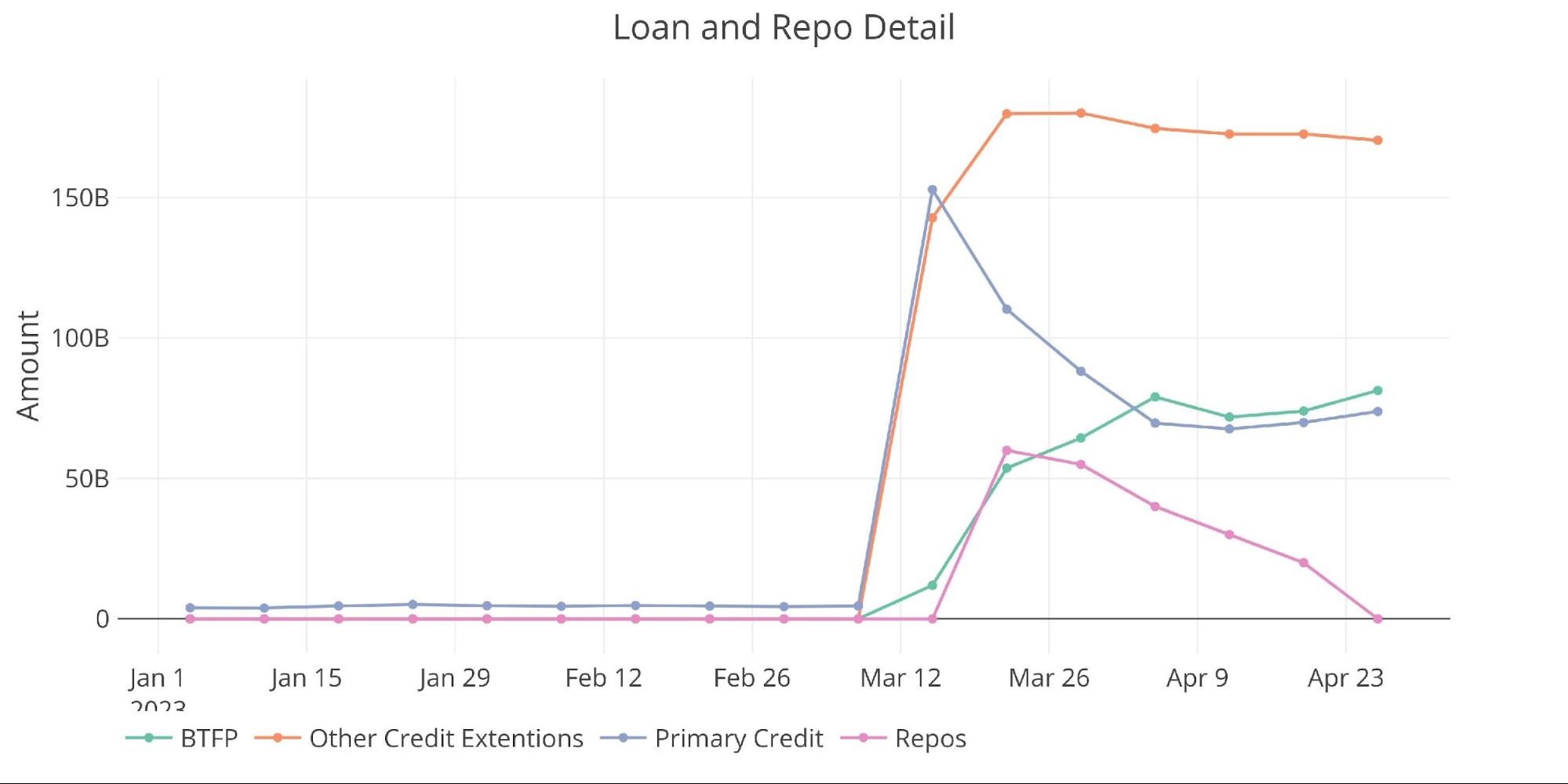

The chart below shows the balance on detailed items in Loans and in addition Repos. Primary Credit continues to be below the high seen in March, but the Bank Term Funding Program (BTFP) has reached a brand new all-time high, suggesting that the banking crisis has not yet passed. Other Credit Extensions also remain elevated.

Figure: 4 Loan Details

Yields

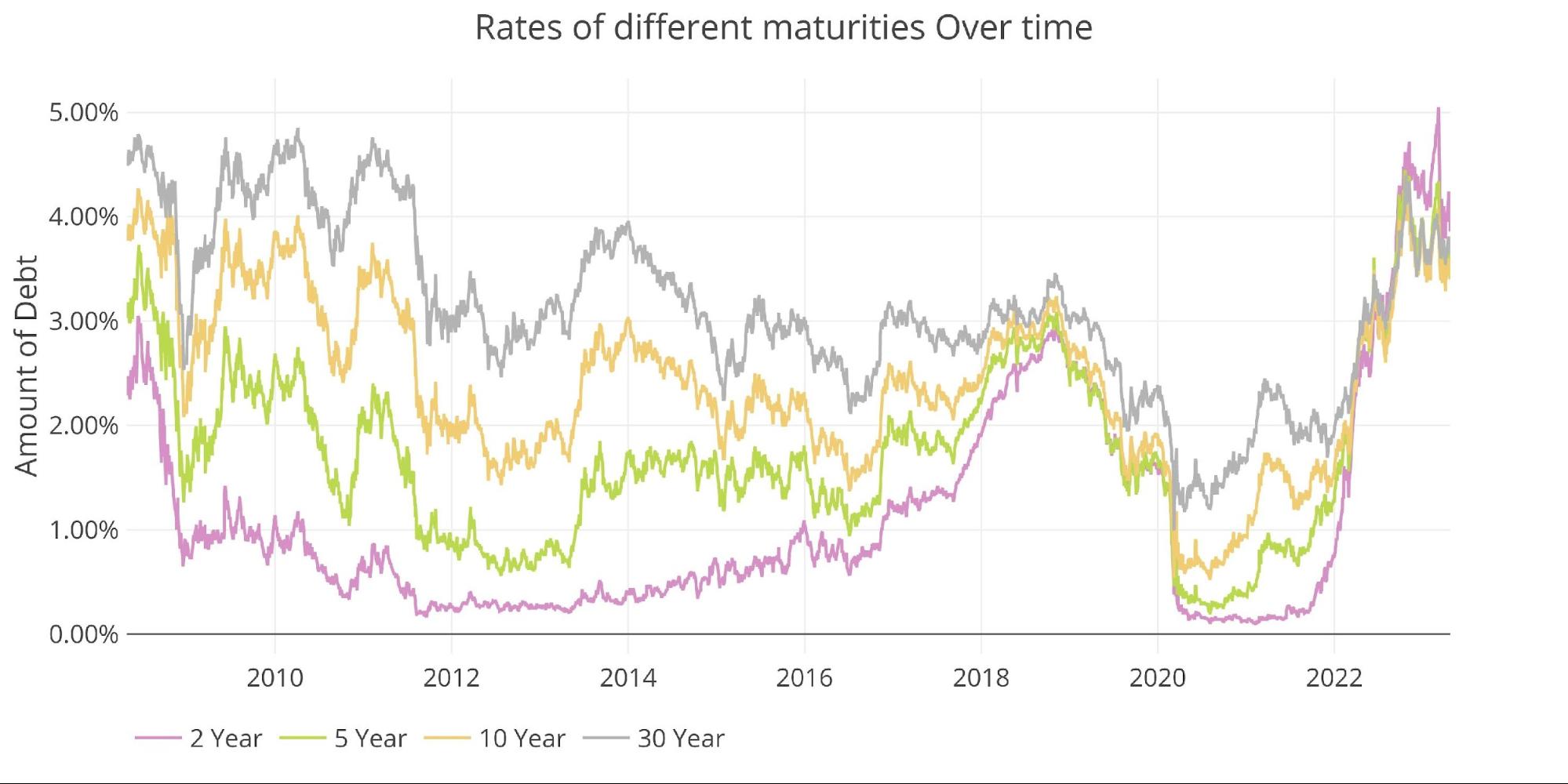

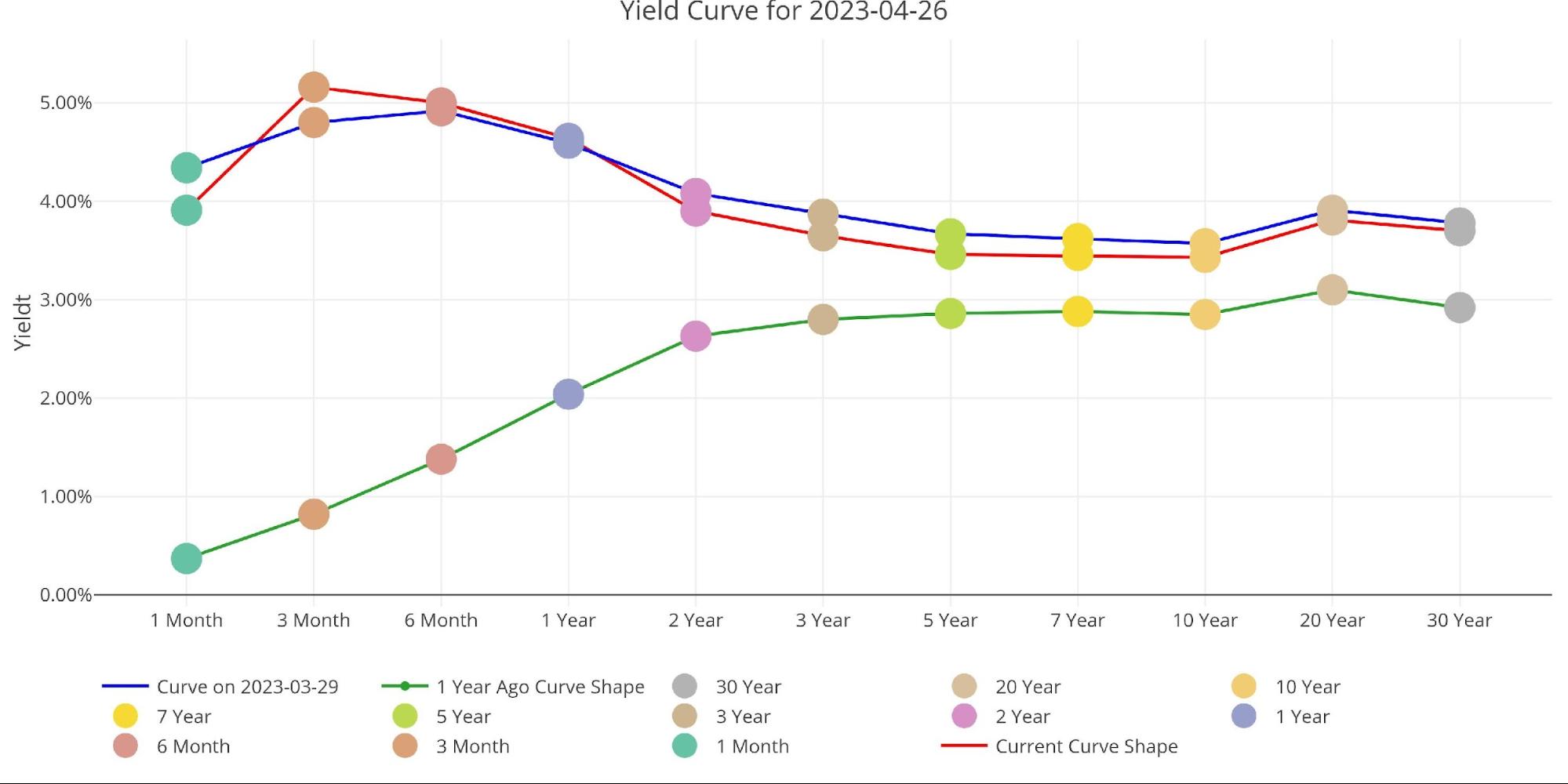

With the Fed’s aggressive rate hikes, yields across Treasuries have gotten extremely congested. Because the chart below shows, the 2-30 12 months are all stuck together. For the reason that collapse of SVB in early May, rates have fallen into a decent range between 3.5% and 4.5%.

Figure: 5 Interest Rates Across Maturities

Because the yield curve has grown more congested, the yield curve inversion has fallen some. The two to 10-year inversion is at -47bps. On March eighth the inversion exceeded 100bps! Regardless, the yield curve continues to be inverted and has been since July fifth last 12 months. An prolonged inversion only increases the probabilities of a recession. Most would consider a recession inevitable at this point. Even the Fed is looking for the potential for one.

Figure: 6 Tracking Yield Curve Inversion

The chart below shows the present yield curve, the yield curve one month ago, and one 12 months ago. The change over the past month has been minimal, however the change from a 12 months ago is sort of dramatic.

Figure: 7 Tracking Yield Curve Inversion

The Fed Takes Losses

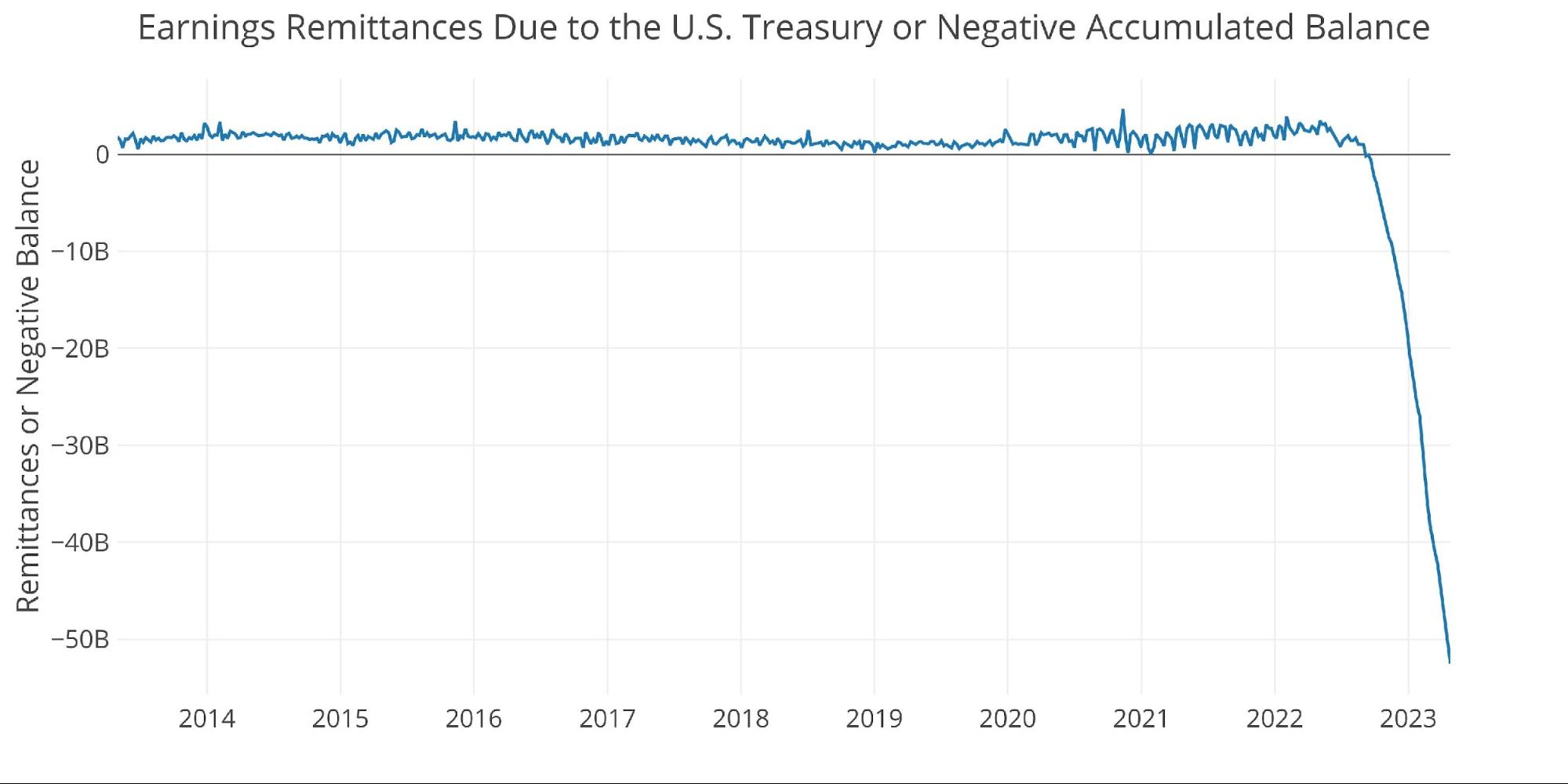

The Fed has recently gathered about $52B in total losses. That is driven by two aspects:

-

- Much like SVB, it’s selling assets (under QT) which can be now value lower than after they bought them

- The interest paid out to banks (4%+) is bigger than the interest it receives from its balance sheet (2%)

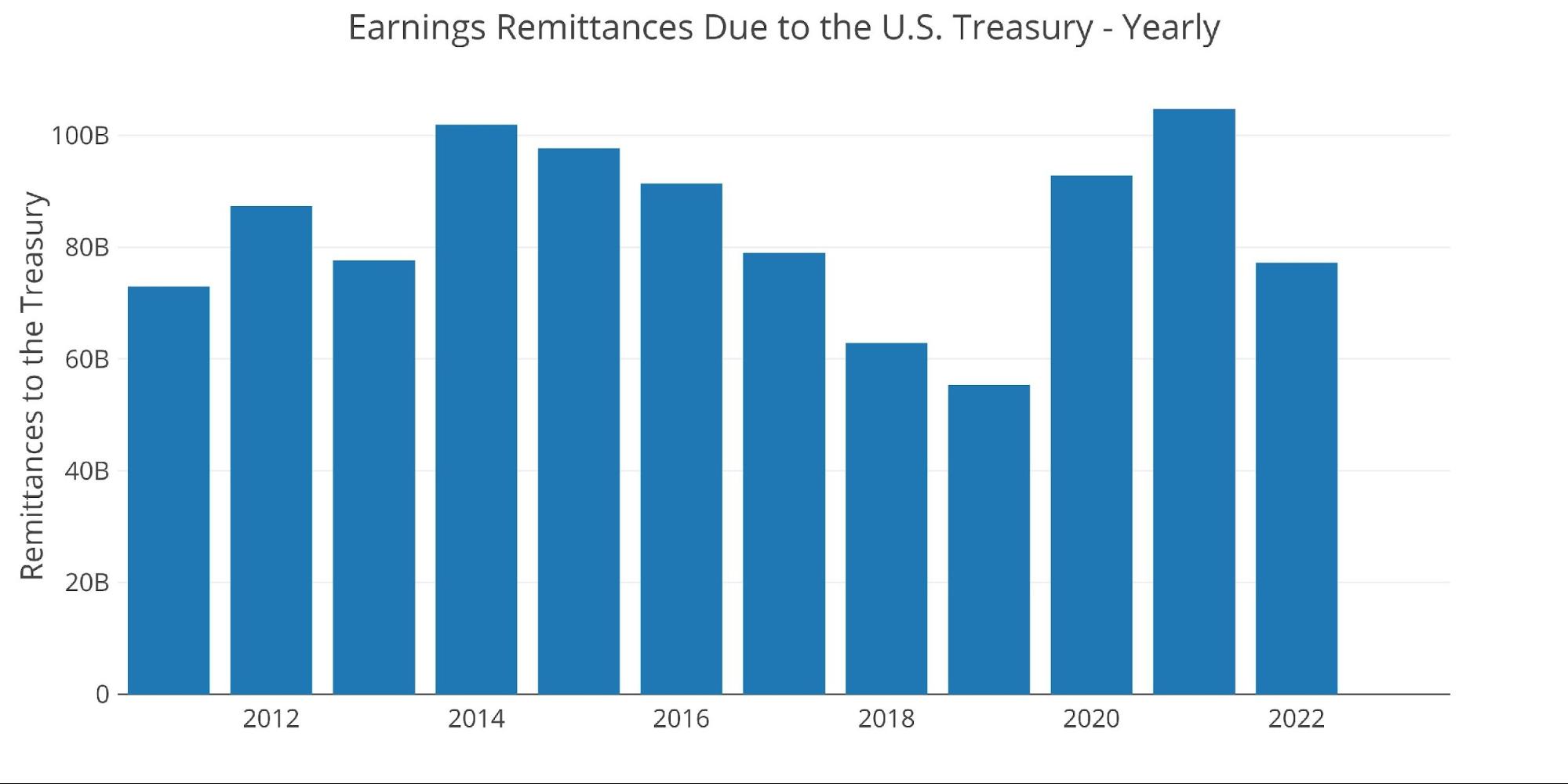

When the Fed makes money, it sends it back to the Treasury. This has netted the Treasury near $100B a 12 months. This could be seen below.

Figure: 8 Fed Payments to Treasury

You could notice within the chart above that 2023 is showing $0. That’s since the Fed is losing money this 12 months. In accordance with the Fed: The Federal Reserve Banks remit residual net earnings to the U.S. Treasury after providing for the prices of operations… Positive amounts represent the estimated weekly remittances because of U.S. Treasury. Negative amounts represent the cumulative deferred asset position … deferred asset is the quantity of net earnings that the Federal Reserve Banks need to appreciate before remittances to the U.S. Treasury resume.

Principally, when the Fed makes money, it gives it to the Treasury. When it loses money, it keeps a negative balance by printing the difference. That negative balance has just exceeded $52B!

Figure: 9 Remittances or Negative Balance

Note: these charts are a correction to earlier articles that aggregated the Fed’s negative balance, overstating the losses.

Who Will Fill the Gap?

The Fed has been absent from the Treasury marketplace for a 12 months. The debt ceiling has kept debt issuance low for the last several months, but once the debt ceiling is raised (and make no mistake – it’s going to be raised), some party needs to soak up all the brand new debt. The federal government budget deficit has gotten much worse in a rush with spending going up as tax revenue falls. The Treasury can be issuing quite a lot of debt within the months and years ahead. If the Fed sticks to QT, then they are going to only add to the selling pressure out there.

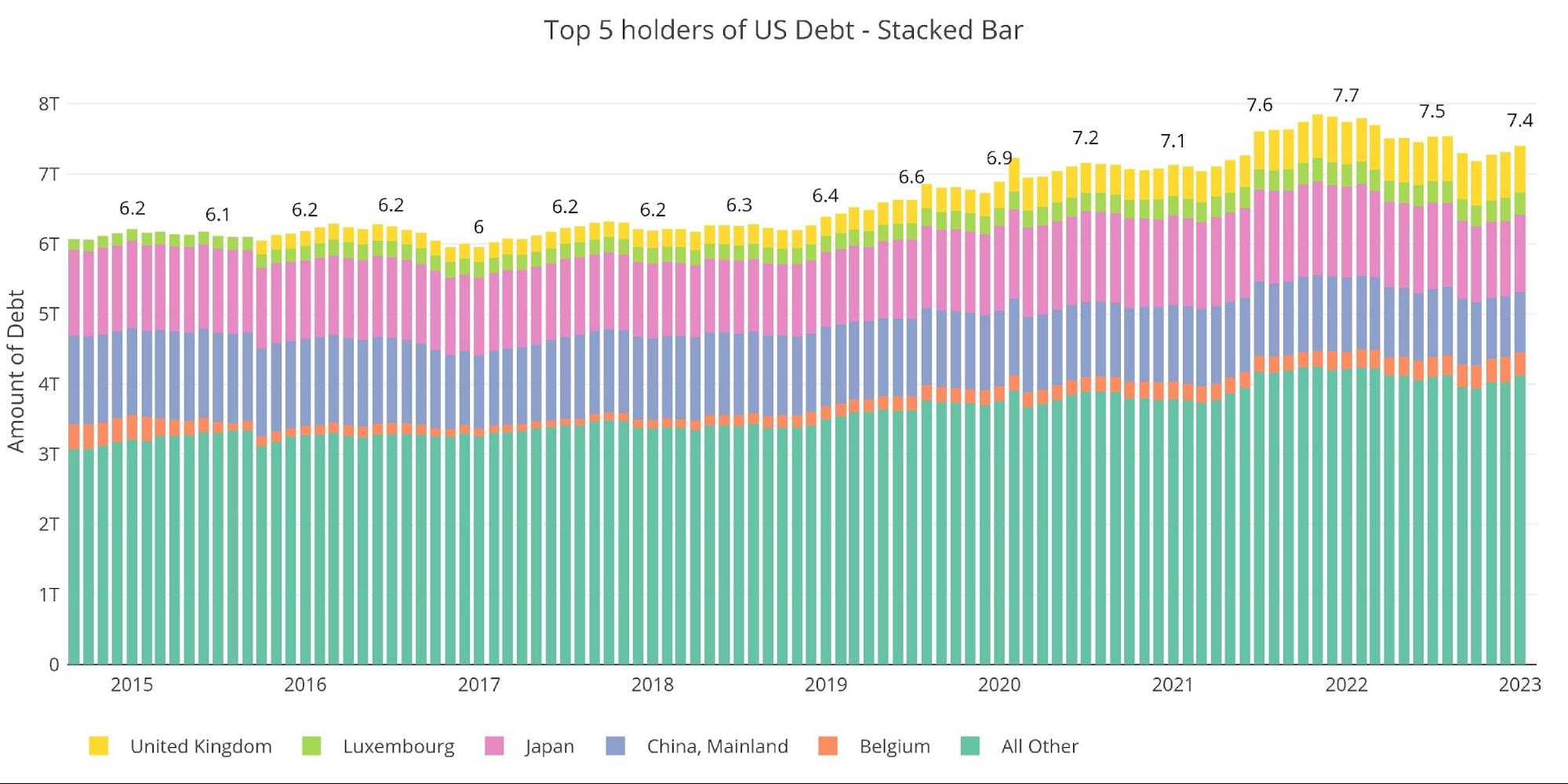

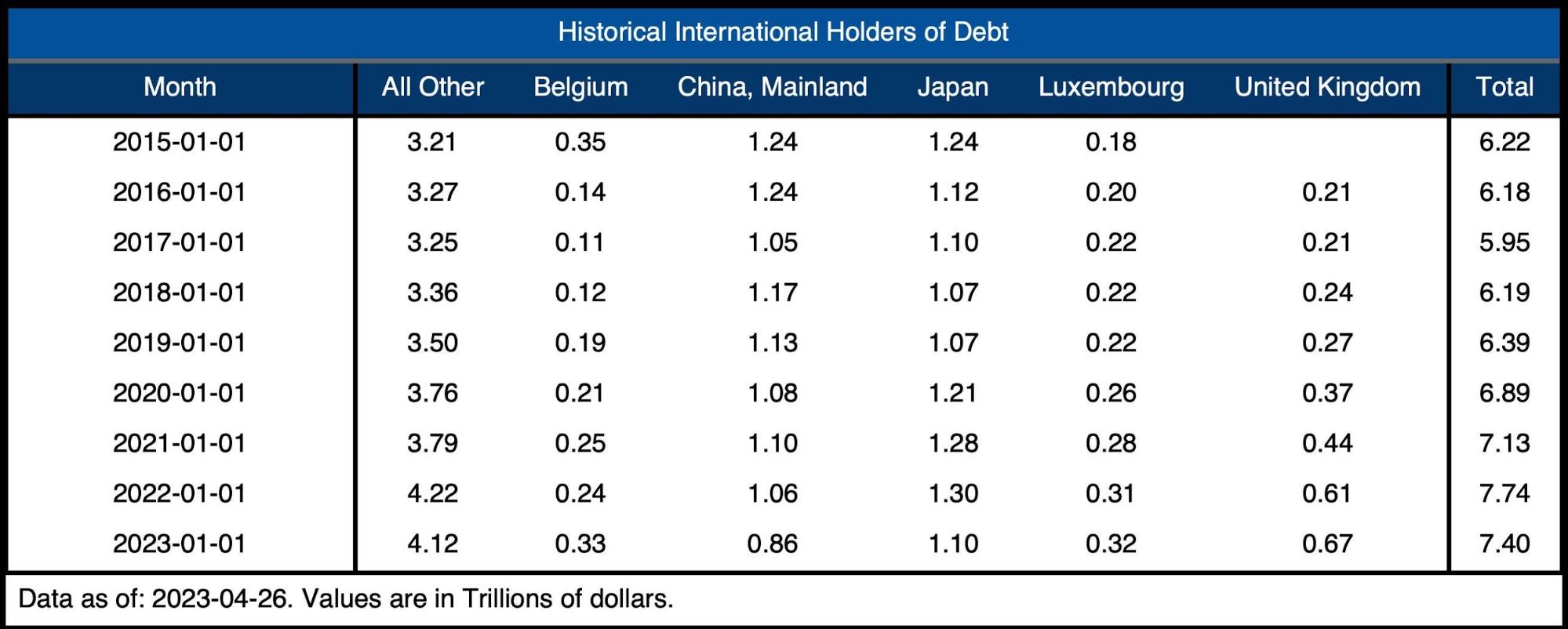

International holdings have been stagnant since July 2021 at around $7.5T. With the Treasury set to issue $2T a 12 months combined with the Fed selling $65B a month, that’s quite a lot of debt for the market to soak up.

Note: data has not been updated for February yet and was last updated for January on March 15

Figure: 10 International Holders

It ought to be noted that each China and Japan (the biggest international holders of Treasuries) have been reducing Treasury holdings. Over the past 12 months, they’ve reduced holdings by a combined $40B. Again, this could come as no surprise as talk of the dollar reserve status has been questioned by even the mainstream media. Foreign countries are attempting to do away with their US debt!

Figure: 11 Average Weekly Change within the Balance Sheet

Historical Perspective

The ultimate plot below takes a bigger view of the balance sheet. It is obvious to see how the usage of the balance sheet has modified because the Global Financial Crisis.

The recent moves by the Fed within the wake of the SVB collapse can be seen below. When the subsequent break within the economy occurs, it’s likely that the balance sheet will spike again.

Figure: 12 Historical Fed Balance Sheet

Wrapping up

While the combination balance sheet looks to be shrinking, the detailed data shows it’s more complex than that. The Repo agreements have gone back to $0 so nothing more can be rolling off. The query now becomes, how much do loans change over the approaching weeks and months? If it continues to extend, then it indicates further signs of stress within the banking sector.

Moreover, the Treasury math is pretty easy. The federal government can be issuing trillions of dollars of debt per 12 months in perpetuity. The remainder of the world is openly attempting to do away with the US dollar dependence, which suggests less accumulation and even selling of US Treasuries. The Fed cannot keep to QT and expect the Treasury market to survive unscathed.

As mentioned persistently, something else goes to interrupt. It’s not about “if” but “when”. Anyone who’s currently denying the fact of recession can be in for a rude awakening. Now that the Fed has acknowledged the potential for a recession, they can be able to “solve” the issue with all their old tricks (i.e., lowering rates and printing money). The one thing they still have improper is the severity. When this recession kicks into high gear, the Fed can be pulling every tool out of its toolkit to attempt to rescue the economy. At the moment, they are going to undo all their QT after which some even quicker than they did in March with the SVB collapse.

Once this becomes a reality, the market could have to reprice quite a lot of assets. Gold and silver stand to learn probably the most. Some astute investors seem to pay attention to this reality and have been pillaging the Comex for all of the physical metal they will get their hands on.

Data Source: fred.stlouisfed.org/series/WALCL and fred.stlouisfed.org/release/tables?rid=20&eid=840849#snid=840941