Here’s the reality:

Irrespective of what strategy you’ve gotten…

You will need to take profits in some unspecified time in the future and money in in your trades to compound your earnings over time.

But achieving that takes discipline and consistency—you may’t just randomly take profit anytime or anywhere you would like!

But there’s excellent news for you.

Because in today’s guide, I’ll dive into take profit orders today and polish you right into a consistently profitable trader.

Here’s what you’ll learn:

- What’s a take profit order and the way is it executed on a chart

- The nice and the hard cold truth about take profit orders in trading

- Common mistakes traders make when using take profit orders (that it’s essential to avoid)

- The best way to use take profit orders to maximise your returns in several market conditions

Ready?

Then let’s jump right into it!

What are take profit orders in trading

In easy terms…

A take profit order gets triggered when the present price hits your pre-determined price that’s in favour of your trade!

Which implies that your trade closes, and you might be to receive the profit you’ve made on that trade.

That’s why it’s called a take “profit,” duh!

Then again…

A stop loss order gets triggered at a pre-specified price to shut your open positions to limit your losses if a trade goes against you.

Mainly…

Each take profit orders and stop loss orders are limit orders which you’ll be able to typically place when executing your trades, and even after.

So, let me show you the way it actually looks like when executing it on TradingView…

During trade execution

Trading platforms lately often help you enter the value levels of your take profit and stop loss orders on a straightforward interface:

After trade execution

You’ll see 3 latest lines in your chart, indicating:

- Your entry price

- Your take profit order

- Your stop loss order

Here’s what I mean…

In this instance where you enter long:

- Your entry price for USD/JPY is 130.718

- Your trade will close with a profit if the value hits your take profit order at 136.876

- Your trade closes at a loss if the value hits your stop loss at 126.403.

Now that you just’re all caught up with the fundamentals, let’s dive deeper into take profit orders.

While the main target of this guide is on take profit orders…

I’ll also bring up stop loss orders where appropriate to enable you see the complete picture.

Sounds good?

Moving on…

The professionals and cons of take profit orders in trading

You will need to already know that take profit orders are essential so that you can lock in your trading profits.

But here’s the tricky bit:

While you must remember to set your take profit orders for each trade…

It doesn’t mean that it is best to at all times set them in the identical way.

Here’s what I’m talking about…

When you’re swing trading and buying into a spread market…

It’s best to place a take profit order before the closest resistance or swing high.

Here’s what I mean:

Because you recognize that’s where the value is probably going going to face some selling pressure and also you’ll wish to secure your profits before that happens.

Nonetheless…

When you’re buying right into a breakout, where would you place your take profit order?

It’s hard because there’s no point of reference like resistance or swing high.

Plus, when you set a take profit order when buying into breakouts—you’re limiting your profit potential!

It might be the beginning of a monster trend!

So, the last item you would like is to inform Mr. Market that you just’re completely satisfied to reap just X variety of pips off that trend.

The underside line is that this, take profit orders are:

- Useful in a spread market or while you’re swing trading

- Not ideal for breakouts or strong trending markets (I’ll share what it is best to do as a substitute later)

Now that you recognize when a take profit order is relevant…

Let me inform you the worst mistake about take profit orders.

Common mistakes traders make when using take profit orders (that it’s essential to avoid)

If you wish to be a consistently profitable trader…

Then it’s essential to not commit these fatal mistakes:

- Being overly concerned about getting each trade right

- Not being disciplined and lacking in conviction

Let me inform you what I mean…

Mistake #1: Being overly concerned about getting a trade right

When you don’t know what you’re doing and also you simply wish to secure a win on each trade…

You’ll likely find yourself setting a decent take profit order (and a much wider stop loss order).

The danger-reward shall be unfavourable against you!

This can be a huge mistake for a newbie trader just in order that they be ok with being right to stroke their egos!

It’s an enormous waste of time to do all of the analyses simply to earn pennies and be right 90% of the time, but while you lose 10% of the time, all of your earnings get wiped.

Now, what when you’re only right 50% of the time (or less) with the identical risk reward?

Your trading account will bleed much more.

Mistake #2: Being ill-disciplined and lacking in conviction

When you don’t have conviction in your trades…

What happens is you’ll keep adjusting the take profit orders (and even the stop loss orders).

You’ll eventually find yourself cutting your profits short or extending your losses.

And the foundation reason for this problem?

You don’t have a solid trading plan that you just religiously persist with.

If you wish to be a disciplined and consistently profitable trader, then it’s essential to start having a trading plan and entering into the habit of journaling your trades.

I won’t dive into those on this guide.

But you may discover more here: A Complete Guide To Creating And Using A Forex Trading Journal

So, now that you recognize how a take profit order should and shouldn’t be used…

Let me now teach you use take profit orders in your favour.

We could?

The best way to use take profit orders to maximise your returns in several market conditions

I would like to share with you more on use take profit orders to profit each in a spread market and a trending market.

1) Range markets: use a set take profit order

In a spread or in a sideways market where you’re swing trading, it is best to use a set take profit order.

Since you’ll wish to capture short-term profits in either direction at any time when the value swings between support and resistance.

Here’s a brief example of what a trading plan looks like on this case:

- Discover a spread market bounded by support resistance

- Enter the trade at an area of value with a sound entry trigger

- Place stop loss order 1 ATR away from previous swing low/high

- Place Take profit order before resistance/support

First, discover a spread market bounded by support resistance

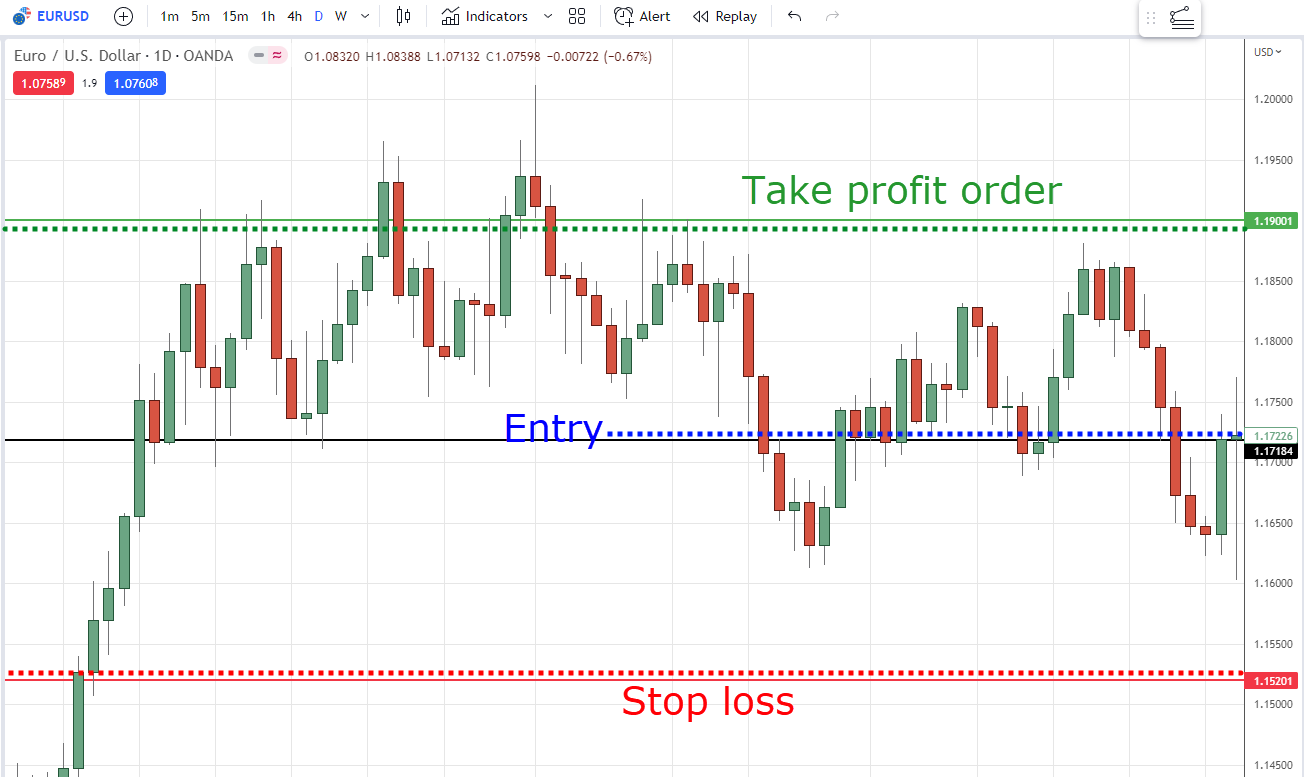

We’re now on the Day by day timeframe of EURUSD, where it’s in a spread market, bounded by support and resistance.

Second, enter the trade at an area of value with a sound entry trigger

You ought to start on the brink of go long when the value reaches the world of value, which is the support here.

You’ll only go long on the open of the subsequent candle after the value closes bullishly back into the range.

On this case, the value closed back into the range with a giant bullish engulfing candle.

Third, place stop loss order 1 ATR away from the previous swing low

You’ll want to position your stop loss order 1 ATR away from the support.

This takes into consideration the volatility of the value of the recent periods to offer your trade some buffer space.

Learn all in regards to the ATR indicator here: The Complete Guide to ATR Indicator

Lastly, place take profit order before the world of resistance

You’ll wish to also take profit before or near resistance so that you could lock in your profits before selling pressure steps in against your favor.

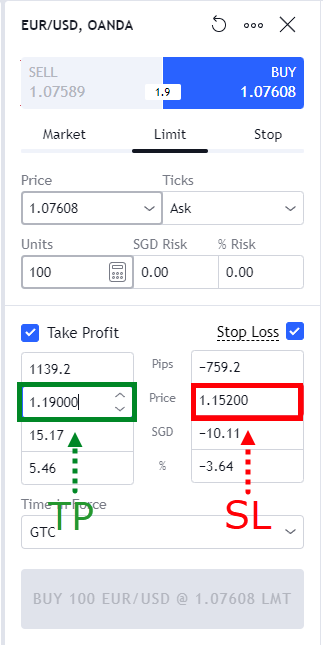

On some trading platforms, you may very easily enter the precise take profit levels and stop loss levels on a single interface:

Pretty straightforward, isn’t it?

Next…

2) Trending markets: use a trailing stop loss order as your take profit order for monster gains

Now you is likely to be considering:

“Hey Rayner, isn’t a trailing stop loss order used to chop our losses and it’s different from a take profit order?”

Yes, buddy, you’re technically right.

However the thing is…

When you want huge gains from a robust trending market, you may’t use a traditional, fixed take profit order—else it’ll limit your gains.

Here’s a brief example of how this works:

- Discover a trending market that’s consolidating

- Enter the trade once the value breaks out of consolidation

- Set trailing stop loss order 1 ATR away from previous swing low/high

- Exit trade once the value hits the trailing stop loss order

First, discover a trending market that’s consolidating

On this USDJPY example, the value is in an uptrend and is consolidating into an ascending triangle and the value is near resistance.

Second, enter the trade once the value breaks out of consolidation

As soon as the value breaks out, you wish to be within the trade.

How do you be certain that?

You may place a buy limit order above resistance ahead of time so that you won’t should manually place a market order to catch the breakout.

Third, set trailing stop loss order 1 ATR away from the previous swing low

Take a look at the ATR indicator and minus that value from the previous swing low.

That’s where your trailing stop loss order shall be.

Lastly, exit trade once the value hits the trailing stop loss order

In any respect times, the trailing stop loss order will:

- Move up at any time when the value moves in your favor

- Not move in any respect at any time when the value moves against you

And since it doesn’t re-adjust at any time when the value moves against you…

You may expect your profits in these strong trending markets to be “routinely locked in” for you.

In fact, not every trading platform has a trailing stop loss order that routinely adjusts itself for you.

In that case, you may at all times manually trail your stop loss order using the moving average or market structure.

If you wish to discover the secrets to trading breakouts like a professional, then read this: The Definitive Guide to Trading Breakouts

So, with that said…

Let’s do a fast recap on what you’ve learned today.

We could?

Conclusion

- A take profit order is a limit order which closes your open positions when the value reaches its level

- Use take profit orders in range markets but not in strong trending markets

- Keep on with a trading plan and keep a trading journal to construct your trading confidence

- Use a set take profit order in range markets, but use a trailing stop loss order in strong trending markets

Now, have you ever had issues committing to your take profit orders that you just set?

How does it affect your trading?

I’ll be completely satisfied to listen to your thoughts within the comments below.