JacobH

Like most other major iron ore producers, the shares of Vale S.A. (NYSE:VALE) have been on quite a run for the reason that end of November. Since that point, the stock has appreciated by well over 40% as investors anticipate the lifting of COVID restrictions in China and the gradual ramp-up of its economy. That expectation has also led to the costs of copper, iron ore, and nickel to surge to levels not seen for the reason that first half of last yr.

However the market could also be getting ahead of itself, for the Chinese economy was slowing even before the onset of the pandemic, and the structural problems that it was facing then have only gotten worse within the last three years. That realization may soon lead the market to temper its enthusiasm towards the worth of metals in addition to Vale’s shares.

Nevertheless, there’s also one other issue that is overhanging Vale’s stock; that being the proposed deal to hive off its base metals operations right into a separate business. In this text, we’ll review the proposed transaction in addition to the stock’s prospects inside the current macroeconomic environment.

Company Background

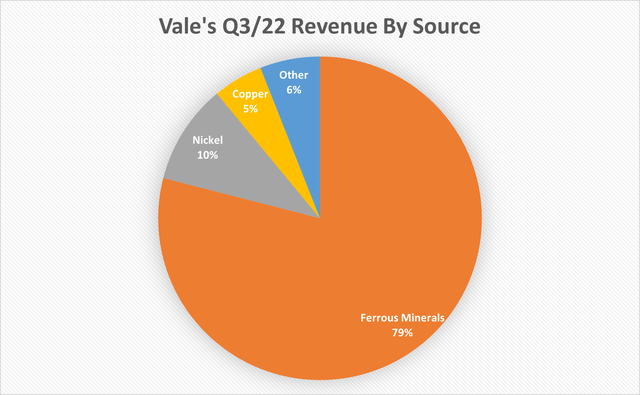

As most readers are probably well aware, Vale is considered one of the world’s largest mining firms, and like nearly all of the opposite major players on this space, it makes most of its money through the sale of iron ore. As may be seen within the exhibit below, the corporate derived almost 80% of its Q3 net operating revenue from the sale of iron ore, in each pellets and fines, while second place nickel trailed far behind with only a ten% share of its revenue.

Vale Q3/22 Revenue Distribution (Creator Using Financial Statement Information)

The heavy deal with a single commodity left the corporate exposed to iron ore price volatility and the pullback in ore prices that occurred throughout many of the second half of last yr. Third quarter revenues from Ferrous Minerals got here in 13% lower than the previous quarter and 26% lower than Q3/21. And given such a steep decline, it was unsurprising that the stock price fell from over $21 in Q2 to simply over $12 in July.

Nevertheless, this is just not a critique of Vale’s business model. Highly focused producers are sometimes easier to research and understand, but when the worth of the underlying commodity declines, there is just not much that management or investors can do about it. Luckily, Vale is well-positioned to ride out these rough patches, and investors can afford to attend for the following cyclical upswing given the corporate’s high dividend yield.

The market also appears to consider that the following upswing is true across the corner. In recent months, the corporate’s stock price has rallied hard in anticipation of an end to Covid lockdowns in China and the restart of that nation’s economy; China is the world’s largest importer of iron ore, and a return to the expansion rates of the past would undoubtedly power ore prices to recent heights. The issue, nonetheless, is that those growth rates will not be coming back anytime soon.

China

In a previous article on Rio Tinto Group (RIO), I discussed the deteriorating environment for international trade and the way that might likely impede China’s future growth. In order to not restate the identical facts, this text will discuss China’s deteriorating real estate sector.

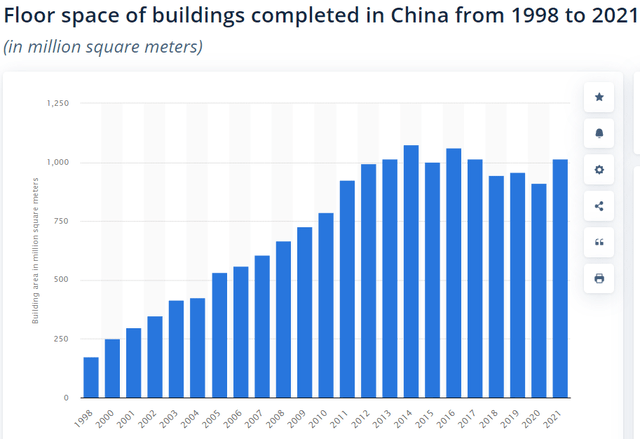

It’s no secret that the Chinese economy has been experiencing a decades-long real estate boom. In 2017, Chinese media reported that China’s floor space per capita had risen to 40.8 square meters, a number equal to that of Europe. After that, many investors predicted that China’s real estate market would soon crash, but developers kept constructing and costs held up. As may be seen within the exhibit below, towards the tip of the last decade the quantity of floor space being added was declining and problems were starting to emerge within the sector. Evergrande Group, considered one of China’s largest developers, defaulted in 2021 and residential prices were starting to fall.

statista.com

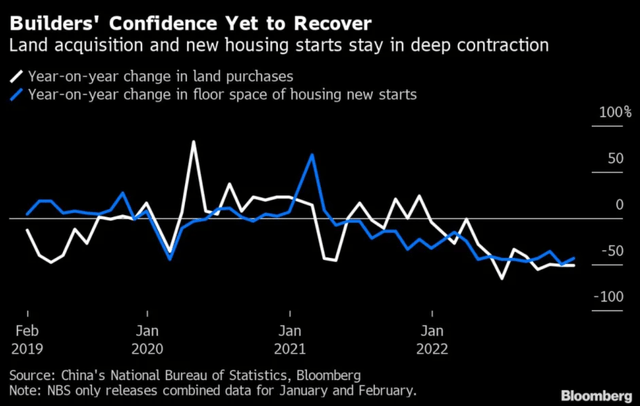

The pandemic went on to compound those problems substantially. Last yr, home sales in China fell by 26.7%, and 31.5% when measured by square meters sold.

bloomberg.com

Granted, warnings about China’s real estate market is something that investors have been hearing about for a few years now, and while it’s true that the Chinese government will probably once more take steps to prop up property prices, at a certain point the music may have to stop. The recent news that China’s population has begun to shrink will only aggravate the issue, and trade tensions with lots of its biggest trading partners won’t help the situation either.

Vale’s management doesn’t appear to be extremely bullish on the worldwide economy, either. They expect iron ore production to extend only barely to 320m tonnes in 2023 in comparison with 310m last yr; that is a far cry from the 100m tonne per quarter run rate the corporate was hitting in 2018.

Base Metals Deal

Nevertheless, it is not all doom and gloom for the corporate. For a while now, management has been trumpeting its dedication and commitment to the energy transition. Throughout the most up-to-date quarterly earnings call, Eduardo Bartolomeo, Vale’s CEO, made sure to once more mention how Vale was positioning itself to be, “the partner of selection of the energy transition and the EV megatrend.” In saying that, he seemed like almost every other CEO of a publicly traded company, who are actually all attempting to by some means associate their firms with the EV industry. The difference with Vale, nonetheless, is that these declarations are being backed up with concrete measures.

In September, the corporate announced that it was in discussions to sell a minority stake in its base metals business in an effort to boost copper and nickel production to satisfy the growing demand resulting from the energy transition. Copper production is already expected to leap to between 335k and 370k tonnes this yr from about 260k tonnes last yr, while nickel production is anticipated to be 300k tonnes in 2023, much higher than the roughly 180k tonnes produced in 2022.

The bottom metals assets will probably be separated from the iron ore operations and be placed right into a recent legal structure named Vale Base Metals. It’s going to have independent governance and a board that features each mining and EV specialists. Vale is seeking to sell a ten% minority stake to a strategic partner for $2.5 billion, and reports say that it has offers on the table which it’s currently evaluating. One thing is evident, though, in the longer term Vale clearly intends to run the nickel and copper assets individually from its iron ore operations.

Takeaway

Those iron ore operations will proceed to dominate Vale’s consolidated balance sheet and income statement, however the slowing Chinese economy will probably be a drag on revenue and earnings. Future growth will likely come from the bottom metals business. So, while we still should wait for the deal to be finalized, the proposed recent structure is intriguing. It could allow Vale to team up with a strategic partner that has deep automotive experience, similar to an auto OEM, and it could provide greater capital raising flexibility.

Given the expansion projections for battery metals similar to nickel, it’s highly possible that Vale Base Metals goes on the acquisition trail shortly after the deal is finalized. We’ll should wait and see. But for now, I rate Vale S.A. stock a Hold; nonetheless, I’ll keep a detailed eye on it and be keenly interested to see who Vale partners with.