Leonid Ikan

Cenovus Energy (NYSE:CVE) combined with Husky Energy (OTCPK:HUSKF) a while ago. Yet a good variety of comments and articles indicate that the advantages needs to be apparent immediately. To some extent, that’s the case. Nevertheless, it also takes time for a big combination to completely exploit potential advantages. Due to this fact, the variety of debottlenecking and other profit optimization projects mustn’t be a surprise in the present budget.

Oftentimes, management does the optimization one step at a time to find out if there have been any unexpected issues that have to be handled along the way in which. So, a big and sophisticated operation like the present merger can take a couple of years to optimize. But which means increasing profitability at various pricing levels for a couple of more years even when management doesn’t grow the business. But a couple of small acquisitions combined with some modest growth proposals indicate otherwise.

Progress So Far

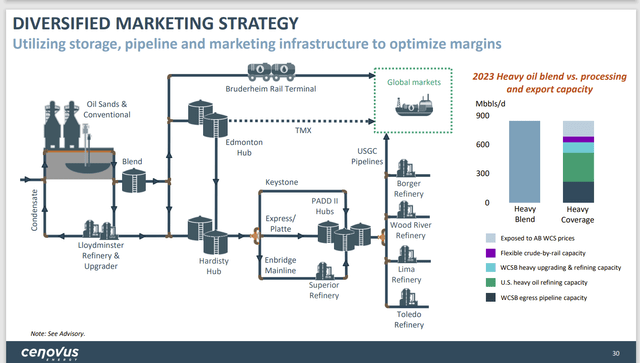

The mix with Husky combined excess refining ability with excess production for a greater coverage of the Cenovus production to permit for less exposure to WCS pricing.

Cenovus Energy Latest Marketing Strategy (Cenovus Energy Fiscal Yr 2023 Budget And Guidance)

The mix with Husky clearly increased the power of the corporate to alter relatively low-cost thermal production into more value-added products. The combined company now makes profits each on the refining and production levels for much of the production.

Nevertheless, the most recent announcement to buy the remaining ownership within the Toledo Refinery and the Sunshine project production still show that management intends to grow each side of the business. Since there continues to be considerable commodity exposure shown above, management will likely emphasize the refining capability additions in future strategies.

The opposite thing to think about is the acquisition of refining capability doesn’t robotically change product flow. That product flow will change over time as contracts expire and management is capable of substitute company production for previous purchases. At this point, considerable progress has likely been made. But it surely wouldn’t surprise me if more progress on this area must occur.

Safety

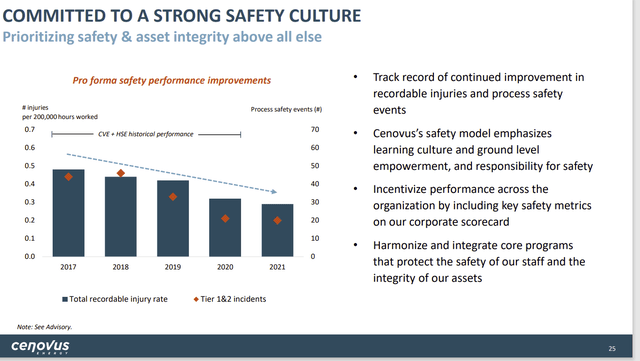

Cenovus generally saves time and cash by running things emphasizing safety.

Cenovus Energy Safety Record And Priorities (Cenovus Energy 2023 Budget And Guidance Corporate Presentation)

The Toledo Refinery fire has had the implications of killed staff and the refinery shutdown. Cenovus generally avoids this type of situation by making safety a high priority. BP (BP), the present operator of the refinery, is well-known for a lower than stellar track record within the accident a part of the business for which the shareholders have paid dearly. That can likely change quite a bit once Cenovus runs this refinery.

This one incident shows all the prices of an accident that generally far exceed the price of stopping accidents in the primary place. Cenovus can save shareholders loads of money just by ensuring something like this doesn’t occur in the longer term.

Brand Latest Capability

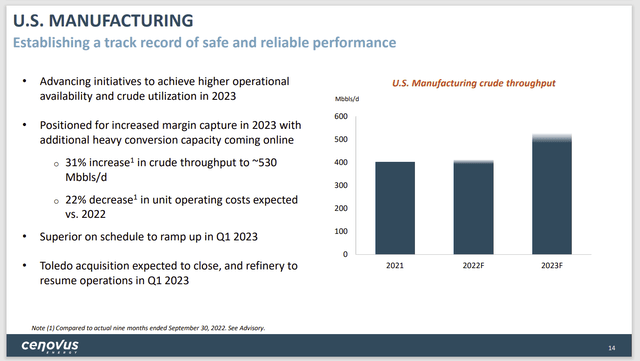

Cenovus will bring online the Superior Refinery in the primary quarter. It is a brand-new refinery that was built primarily with insurance money when the unique refinery burned to the bottom. As such, this refinery is prone to be very low price and low emissions since it has the most recent technology.

Cenovus Energy U.S. Refining (Manufacturing) Guidance (Cenovus Energy 2023 Budget and Guidance Corporate Presentation)

Moreover, the corporate will bring back the Toledo Refinery because the operator and sole owner. Management does have some capability expansion proposals which might be supposedly being considered. But the primary order of business is to review safety protocols as noted before and to do small efficiency enhancing projects.

Among the refineries are operated by Phillips 66 (PSX) because the managing partner. So, there may be one other potential acquisition of ownership interest down the road for this company.

Overall, there was an enormous profit to the corporate to extend the refining abilities while decreasing the corporate exposure to the very volatile WCS. It’s going to take time for all those advantages to turn out to be apparent. But clearly, management is well on its strategy to that goal.

Dividends

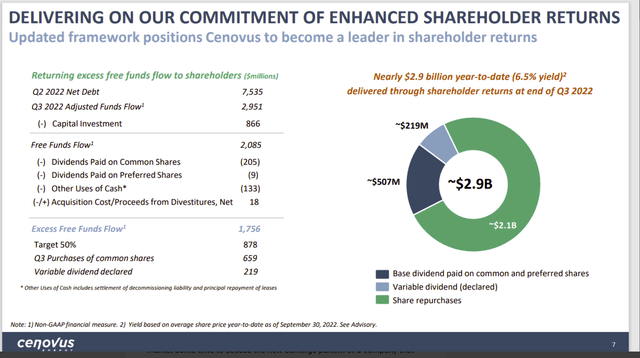

Management has long had a goal to return extra money to shareholders when the debt levels reach levels which might be expected in the primary quarter. That goal is restricted by the acquisitions and profit-optimizing goals of management.

The free money flow will likely be limited by the general growth goals of the corporate. But that ought to unlock rather a lot more money in the longer term.

Cenovus Energy Calculation Of Amounts Returned To Shareholders (Cenovus Energy Third Quarter 2022, Earnings Conference Call Slides)

Management replaced the above presentation with the budget for next yr. So, I got this from a previous article. To this point, management has delivered a 50% return as calculated above. But management has long promised that the returns to shareholders will increase as debt levels decline.

This is important because thermal corporations have large upfront costs that have to be recovered. So, the businesses often use money flow generously even once they lose money. Unlike the unconventional business, there may be a somewhat decent money flow during times of weak pricing because much of the prices are upfront.

This company could subsequently have some very significant shareholder returns in the longer term that exceed loads of unconventional competitors. As a variable distribution entity, this deserves consideration for those investors taken with that sort of distribution together with some growth.

The Future

This company has grown rapidly for much of the time I even have covered the corporate. Now that the corporate is much larger than after I began coverage, it’s prone to transition to a growth and income play. Large corporations simply don’t normally grow as fast as this one has prior to now.

The opposite consideration is that the refining ability brings more money flow stability from the value-added products than is the case with just WCS pricing exposure for the thermal production. This company is popping a reduced raw material into value-added products. That ought to lead to some additional profitability at various pricing points.

Acquisitions are prone to proceed. But also they are prone to be smaller (with bolt-on type acquisitions favored). So, there will likely be some growth. But that growth rate is prone to be in the only digits.

Nevertheless, the combined long-term return from distributions and a few growth is prone to be in the teenagers. So, this lower debt entity with downstream and upstream abilities will likely appeal to a greater diversity of investors than prior to now.

Editor’s Note: This text discusses a number of securities that don’t trade on a significant U.S. exchange. Please pay attention to the risks related to these stocks.