Chip Somodevilla

OXY is a Buffett stock

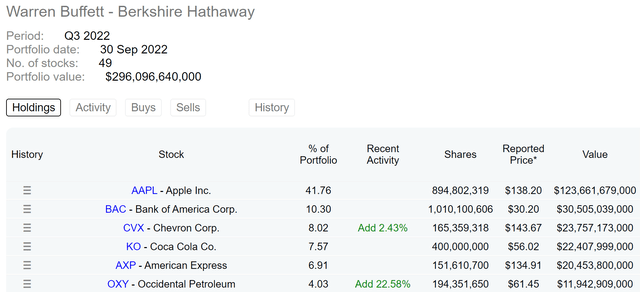

The thesis is basically easy here. I’ll argue that Occidental Petroleum (NYSE:OXY) shouldn’t be only a Warren Buffett stock under current conditions but additionally a Ben Graham stock. The primary a part of the argument is basically easy. Too easy to be an argument in any respect. It’s more of just laying out facts. It’s public information that Buffett’s Berkshire Hathaway (BRK.B) has built a big OXY position in recent quarters. As you may see from the following chart, OXY is currently the sixth largest position within the BRK equity portfolio with a complete market value of $11.9B. BRK now already owns around 20% of OXY shares plus nearly $10 billion price of its preferred stock. Furthermore, BRK recently received permission from federal energy regulatory to purchase as much as 50% of OXY common stock. As such, it is completely conceivable that BRK could acquire the entire OXY business eventually.

The rest of this text will focus more on the second a part of the argument. I’ll explain why Buffett’s mentor would have liked the stock himself too. I’ll detail why I see the stock meets all of Graham’s easy and timeless principles for selecting value stocks.

Source: Dataroma.com

OXY is a Graham stock too

Within the bible for value investors, The Intelligent Investor, Ben Graham developed a set of straightforward rules to value stocks. These easy rules have remained timeless since then and are detailed in my earlier article. A temporary recap is provided below:

- Is the corporate large, outstanding, and conservatively financed? The particular metrics to search for are stable financial strength, consistent capital structure, and a protracted record of continuous dividend payments.

- Especially the dividend record. Graham emphasized countless times the importance of dividend records – for good reasons. In his own words, he thinks “a record of continuous dividend payments for the last 20 years or more is a crucial plus consider the corporate’s quality rating”.

- Has the corporate demonstrated an adequate level of Earnings Growth up to now? For defensive investors, growth shouldn’t be the important thing and “adequate” is enough. In Graham’s mind, a minimum increase of not less than one-third in per-share earnings up to now ten years is adequate enough.

- Finally, are the valuation multiples moderate? As a price investor to the core, he also advisable a series of methods for investors to gauge the worth they need to pay. And likewise, being fully aware of the uncertainties in his own method, he emphasized that it’s best to all the time leave a protected margin of safety.

And next, you will note that OXY is an ideal fit for each considered one of these rules.

OXY: is it large, outstanding, and conservatively financed?

It is easy to reply the first and the 2nd parts of the query. OXY is a worldwide leader within the production of crude oil and natural gas and the associated chemicals (e.g., plastics & fertilizers). It is also a pacesetter within the pipelines used to move natural gases. It has net proved reserves of 1.77 billion barrels of oil and 5.85 billion cubic feet of natural gas.

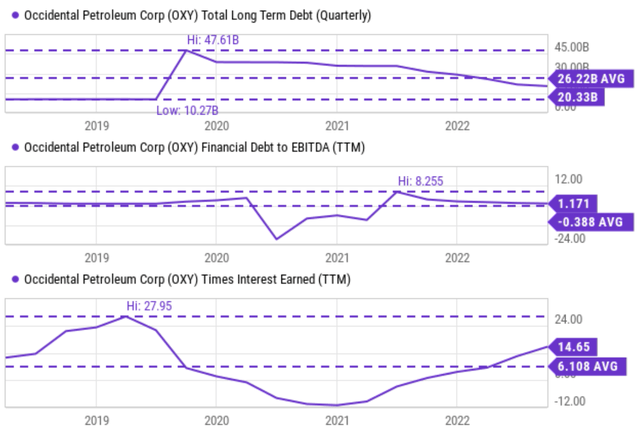

The third a part of the query would be a bit harder to reply a couple of years ago. But the reply is comparatively clear cut under current conditions as you may see from the info shown below. OXY managed to enhance its financial strength tremendously over the few years.

As you may see from the highest panel, OXY was capable of reduce its total debt by greater than ½ since 2020, trimming it from $47B to the present $20B level. Consequently, its current debt/EBITDA sits at a really conservative level of 1.17x only as seen from the center panel. Due to the mixture of debt reduction and improved earnings, OXY’s ability to service its debt is near a peak level in a decade. Its current interest coverage ratio is 14.6x as seen. It shouldn’t be only greater than twice higher than its 6.1x historical average. And it’s also much higher than that of the general economy (whose average interest coverage can also be about 6~7x) despite the proven fact that energy firms, especially those with a midstream sector, typically leverage greater than the general economy.

Source: In search of Alpha data.

OXY: does it have a powerful dividend and growth record?

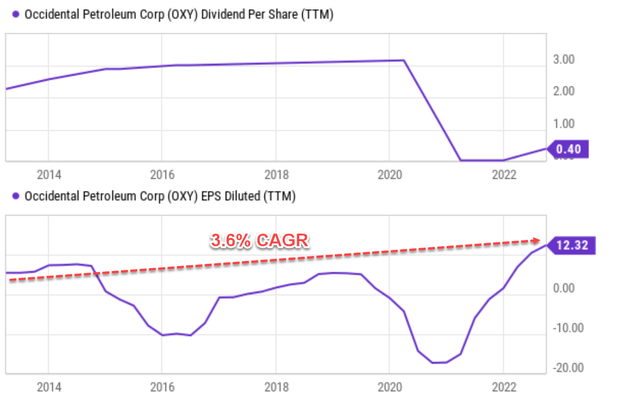

Let’s discuss the earnings growth query first as dividends are derived from earnings. As aforementioned, Graham’s guideline requires an EPS increase of 1/3 or more in 10 years. These numbers translate to a couple of 2.9% annual growth rate. OXY’s earnings growth shouldn’t be consistent on account of large fluctuations in commodity prices as seen within the chart below. Nevertheless, when the fluctuations are averaged out, say over the past 10 years, roughly one whole business cycle, its EPS has grown at 3.6% CAGR, exceeding Graham’s requirement.

By way of its dividend record, OXY has been paying out generous dividends in the long run, definitely meeting Graham’s requirement of 20 years of continuous dividend track record. Nevertheless, investors need to remember that its dividend payout fluctuates substantially along with its earnings as the next chart shows too. For instance, in 2021, it had to scale back its quarterly payout from about $0.8 per share in 2020 to just one cent in 2021. Then it increased the quarterly dividend back to $0.13 per share in 2022.

Source: creator based on In search of Alpha data.

OXY: does it have a moderate valuation?

Finally, as also mentioned earlier,

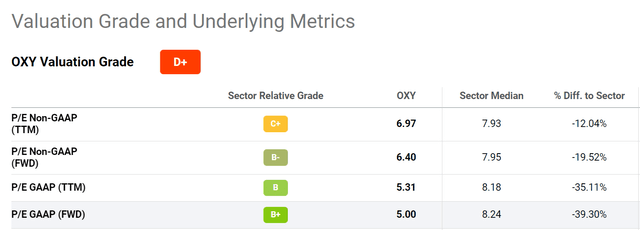

As a price investor to the core, Graham advisable a series of methods for investors to gauge the worth they need to pay. Here we are going to examine two of them (the opposite methods he advisable essentially paint the identical picture). First, he advisable the PE for a defensive stock needs to be around 8.5 plus twice the expected annual growth rate, which I call the Graham PE. Hence, in his mind, a business that completely stagnates needs to be price about 8.5x PE.

And in OXY’s case, I’m projecting its EPS growth rates to be within the low-single-digit based on its return on capital employed (about 24%) and likewise reinvestment rate (about 10%). These analyses are detailed in my earlier article here. Assuming a 2.4% growth rate (24% ROCE * 10% reinvestment rate), the business needs to be priced around a P/E of 13x. Even assuming a 0% growth, the Graham P/E needs to be 8.5x. While the stock is currently trading at a P/E within the range of ~6x depending on which EPS metric you selected, a big discount off the Graham P/E.

Source: In search of Alpha data.

Graham is definitely aware of the restrictions of any valuation “rules”. Thus, he also developed other methods so he can cross-check and estimate the uncertainties. And here I’ll examine OXY’s valuation against an alternate metric, the so-called Graham Number:

Usually, Graham cautions against paying a price of greater than 15x times earnings or greater than 1.5x times the book value (“BV”). Nevertheless, a PE multiple above 15x might be justified if the P/BV ratio is lower than 1.5x. And vice versa. And consequently, the Graham number considers each the 15x PE limit and the 1.5x P/BV limit. More specifically, the Graham number is the square root of A) 22.5 (which equals 15 times 1.5), B) the EPS, and C) the book value.

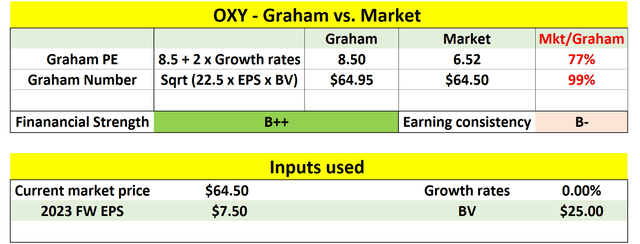

My analyses of the Graham number for OXY are provided in the following table. All of the financial information was either obtained from In search of Alpha or Value Line as of this writing. As seen, OXY’s Graham number turned out to be $64.95 per share, remarkably near its market price of $64.5.

Source: Writer based on In search of Alpha data

Risks and final thoughts

Investment in OXY does entail risks. As mentioned already, OXY is sensitive to commodity prices and its earnings and dividends can fluctuate substantially. To further compound the commodity price uncertainties, the present Russian/Ukraine situation can impact oil and natural gas prices tremendously depending on the duration and eventual consequence of the war. And eventually, the market price of the stock probably already includes what I call a Buffet premium given Buffett’s strong interest within the stock and the market’s interest in Buffett’s actions. These details are provided in our other articles. A possible option to minimize the impact of the Buffett premium, in our view, is to own OXY through BRK relatively than directly owning OXY shares (for those who don’t mind owning other stuff that BRK holds).

To conclude, the thesis of this text is basically easy. It is clear that Buffett likes OXY very much. And my view is that his mentor, Ben Graham, would have liked the stock too. My results show that OXY is an ideal fit for each considered one of Graham’s timeless rules. Particularly, the market valuation of the stock is at a big discount to the Graham P/E and shut to the Graham number, signaling low valuation risks.