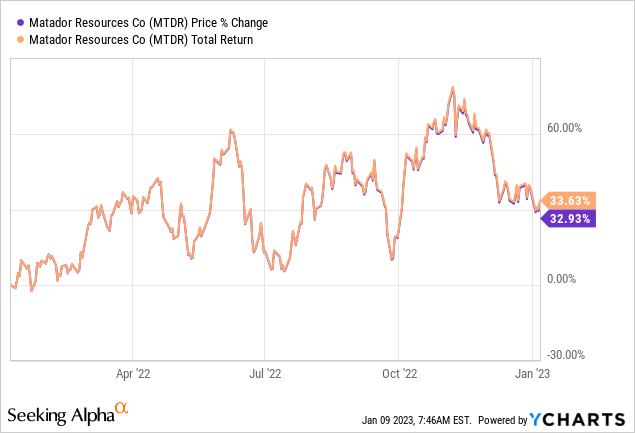

It has been ten months since we covered Matador Resources’ (NYSE:MTDR) stock. Although the safety has garnered total returns of nearly 5% since our initial strong buy rating, it has underperformed our expectations. Today’s article provides an updated outlook amid a changing economic environment, which may lead to cyclical shifts within the stock market.

Operational Update

Hard Operations

Matador Resources released its third-quarter financial ends in October last 12 months, revealing a strong quarter that saw it amplify its revenue by 78.03% year-over-year. Furthermore, the corporate beat analysts’ earnings-per-share goal by 4 cents, indicating good management during a period of increased input costs.

Let’s break down Matador’s recent operational highlights.

Upstream operations remain robust, with the Delaware Basin paying dividends. Along with Wolf Jackson turning to sales in the corporate’s first quarter, Matador’s Stateline site turned to sales within the third quarter. Moreover, the corporate has successfully drilled eight Rodney Robinson wells and anticipates 4 additional Antelope Ridge wells to show to sales in its fourth quarter. Also, Matador expects 12 wells to show to sales in Ranger during its fourth quarter.

Midstream operations are picking up. As mentioned in our previous article, we imagine the corporate’s San Mateo midstream enterprise will add significant leverage as it’d allow Matador to exercise more competitive pricing via a vertically integrated strategy.

In September, the firm transitioned the Pronto Midstream project, which it acquired around mid-year. The asset has 50 million cubic feet per day of takeaway capability and 60 million cubic feet of processing capability. Thus, providing Matador with priceless synergies.

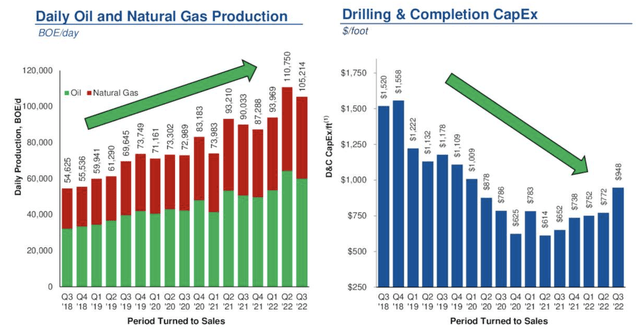

After releasing its earnings, the corporate’s CEO, Founder, and Chairman, Joseph Wm. Foran declared an upgraded outlook. In accordance with Foran: “On account of the better-than-expected well performance across our Delaware Basin asset areas within the third quarter of 2022, we’re increasing the midpoints of our 2022 total oil and natural gas production guidance from 21.7 million barrels to 21.85 million barrels for oil and from 95.5 billion cubic feet to 97.0 billion cubic feet for natural gas,”

Whether Foran’s outlook materializes or not, it’s evident that Matador is expanding rapidly as a nimble up-to-midstream enterprise.

Financial Statement Talking Points

The corporate has successfully executed cost-cutting since 2018. Nevertheless, its CapEx surged during its third quarter. Yet, I do not see this as structural because the fee basis for asset-heavy businesses, basically, has increased significantly throughout the past 12 months resulting from broad-based inflation growth. As well as, Matador is expanding exponentially, requiring significant capital commitments.

CapEx Evaluation (Matador)

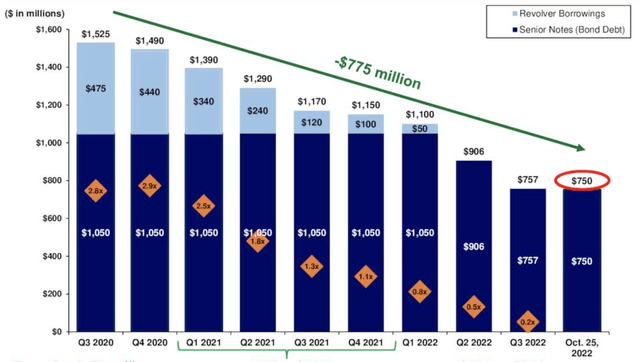

A notable achievement is the corporate’s reduction in revolving loans and its transition to a longer-term debt profile, which earned it a credit standing upgrade. Furthermore, the firm’s $105 million bond repurchase suggests it’s greater than able to restructuring its cost of capital in the longer term.

Improved Debt Profile Lead To A Credit Rating Upgrade (Matador)

Unfortunately, Energy Prices Are No Longer Supportive

Oil and gas prices are highly cyclical. In the long term, you may experience various sharp fluctuations of fossil commodities as they don’t seem to be only inextricably linked to industrial production (and reproduction); but the availability of oil and gas is closely controlled by a select few decision-makers, which ends up in abrupt changes in the availability/demand landscape.

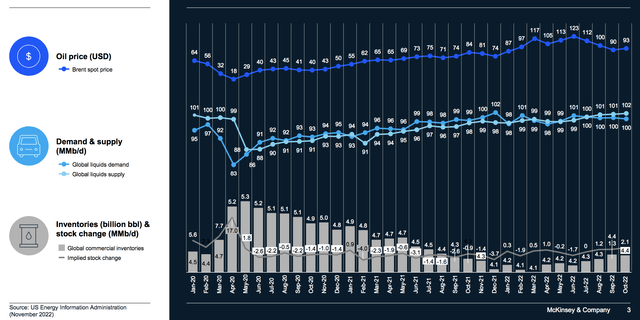

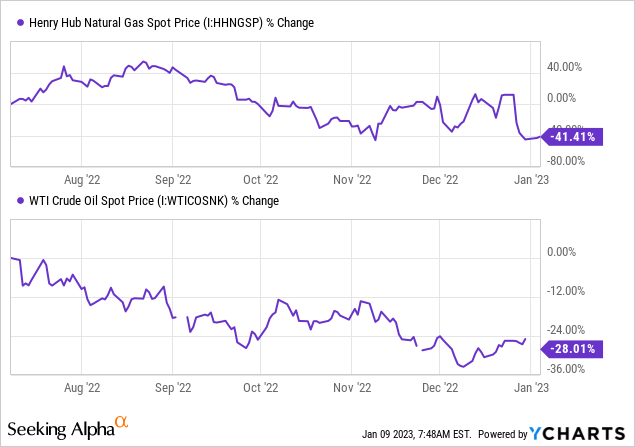

Because the diagram above shows, oil and gas prices have fallen off a cliff throughout the past six months, which should’ve been expected, provided that supply and demand were eventually going to level out to a more realistic level. As well as, slowing global economies have compressed implied demand for core commodities reminiscent of oil and gas.

Looking ahead, it’s unlikely we’ll experience the same surge in oil and gas prices as we experienced in 2022. My explanation is that re-openings have commenced in most parts of the world (including China), producers have ramped up production after the Russia-Ukraine shock, and global economies are running at a lower velocity than they did throughout the low-interest rate/expansionary economic environments, we experienced previously three years.

Oil Liquids Supply Exceeding Demand in November 2022 (McKinsey)

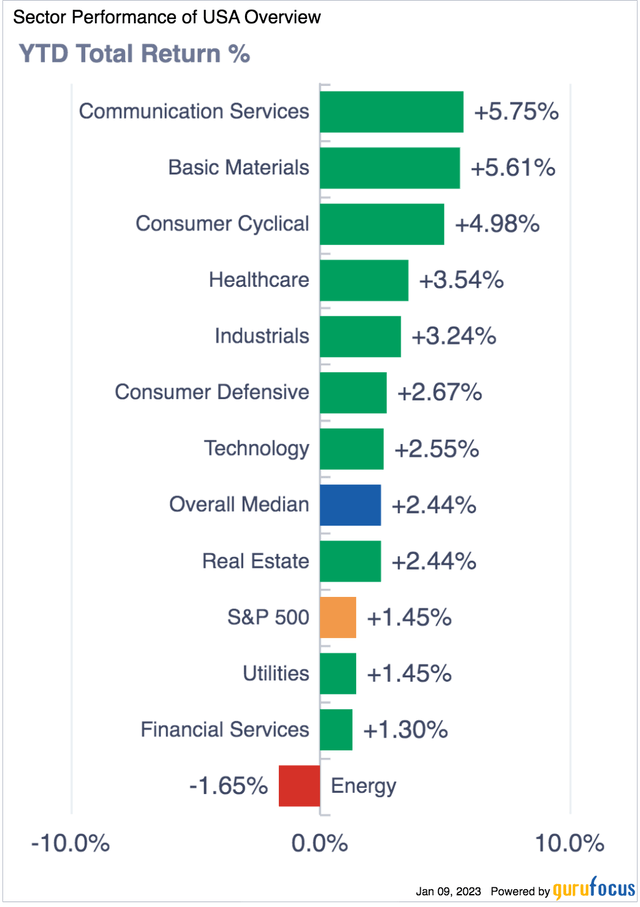

The implied supply surplus has clearly affected energy stocks because the turn of the 12 months. Whether investors have cashed out profits or whether or not they are betting on a cyclical industry downturn stays unclear; nevertheless, each are possible.

U.S. Sector Returns YTD. (GuruFocus)

As an investor, it’s essential to ask yourself whether less supportive commodity prices will deter Matador’s profitability. Sure, broad-based inflation is tapering. Nevertheless, I imagine the firm’s revenue is more elastic than a few of its variable costs and definitely more elastic than its fixed costs. Thus, I would favor to avoid onboarding risk with an investment that may suffer from cyclical price pressure.

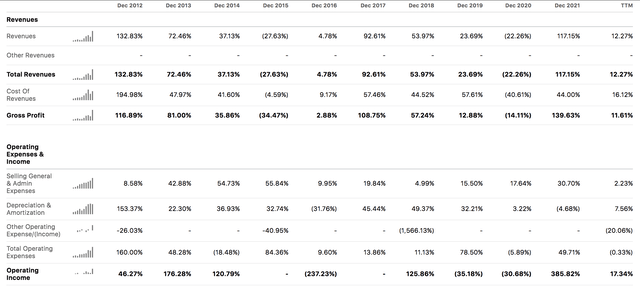

MTDR’s income statement – Notice the cyclicality of the firm’s Y/Y growth rates (Searching for Alpha)

Valuation

Model Output

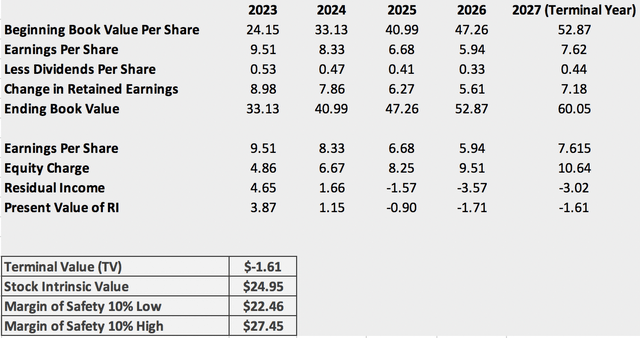

I made a decision to value the stock with a residual income model (the model is explained in considered one of our previous articles) because it is a natural resource company that requires an emphasis on book value. Based on my model, Matador Resources is severely overvalued and will recede to $24.95 per share if we assume an efficient financial market.

In large, the stock’s poor valuation is probably going resulting from a possible cyclical downturn of its earnings-per-share, which is systemically driven. As well as, I imagine the market has priced a big asset base expansion because Matador’s price-to-book ratio is at a 2.27x premium. If earnings expectations had been brighter, I believe the firm could’ve expanded its asset base. Nevertheless, high-interest rates, uncertain asset cost bases, and a looming recession make exponential acquisitions and expansion projects highly unlikely.

Creator’s Calculations

Note: The RI model is an objective indicator. Yet, it doesn’t guarantee that its price goal will realize within the marketplace.

Model Inputs

Listed here are the input variables that I utilized for the RI model.

- Book Value: I divided the stock’s price by its price-to-book ratio to find Matador’s initial benchmark book value per share.

- Earnings-per-share: I utilized Searching for Alpha’s database to sample Matador’s analyst EPS estimates. Moreover, the terminal 12 months’s estimate is a normalized average of the preceding years’ values.

- Dividends: Searching for Alpha’s database was leveraged over again to find the corporate’s dividend estimates. On account of the firm’s thin dividend history, estimates were limited. Thus, I assumed dividends to grow in step with earnings-per-share.

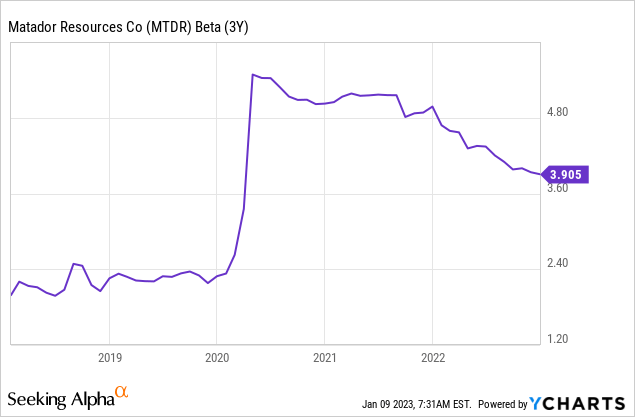

- Equity Charge: I employed the CAPM formula to calculate the equity charge, which was multiplied by the “starting book value” figure to acquire an absolute value. The present U.S. market risk premiums were used; nevertheless, I compressed the stock’s beta coefficient to its pre-pandemic figure of two.4 to normalize the chance environment.

Concluding Thoughts

Despite Matador’s rapid expansion inside each its upstream and midstream segments, the corporate is more likely to suffer from less supportive oil and gas prices during 2023 amid a shift in global supply versus demand dynamics; as well as, a possible recession looms.

Despite its rapidly increasing asset base, near-term acquisitions and expansion projects will probably be arduous in an environment with unfavorable capital structures and unsure asset cost bases. Thus, the stock’s price-to-book ratio spells trouble, especially when incorporated right into a residual income valuation model.

I/we downgrade Matador Resources’ stock to sell with a six-month horizon.