gan chaonan/iStock via Getty Images

Brazil’s Adecoagro (NYSE:AGRO) is an excellent case-in-point that a commodity company can do all the things right (or no less than do many things right) and still see larger commodity and economic trends, and investor worries about those trends, undo that arduous work. Adecoagro, for its part, as long been a low-cost producer of sugar and ethanol (or SEE) in Brazil, in addition to a low-cost producer of grain and other agricultural products in Argentina, nevertheless it has meant mainly nothing for long-term investors, as annualized returns over the past three, five, and 10 years is essentially flat to negative.

I used to be bullish on the prospects for Adecoagro to leverage attractive energy, sugar, and crop prices into solid money flow that might be returned to shareholders within the wake of completing a significant multiyear investment program. While the corporate has indeed instituted a dividend and buyback, the shares are still down about 15% since that last update – outperforming Cosan (CSAN) and Sao Martinho, but still down (and worse than the performance of other ag names like Cresud (CRESY) and SLC Agricola (OTCPK:SLCJY)).

The difficulty with assessing Adecoagro today is that every time you end up asking “how could it worsen?” with a commodity company, the market has an uncanny way of showing you only exactly the way it could worsen. I do think that Adecoagro’s valuation is low, but with real concerns about ethanol and sugar prices over the following 12-18 months, in addition to crop yields and profitability, it is a tough place to go bargain-hunting.

SEE Gets Sawed

Adecoagro, in addition to other Brazilian SEE producers is some difficult selections within the yr to come back with respect to sugar and ethanol production, as each markets are having their very own problems. It does help some that Adecoagro has among the many lowest production costs in Brazil and high flexibility to shift between ethanol and sugar, but there’s only to date these benefits can go.

Ethanol prices have been weakening in Brazil because the spring, hurt partially by oversupply and government efforts aimed toward reducing the fee of fuel for residents. Brazilian hydrous ethanol prices began 2022 at $0.59/liter, rose to over $0.80/liter in April, after which headed steadily lower through the remainder of the yr, ending the yr at around $0.55/liter. While producers had hoped to get some respite with the reimposition of gasoline taxes, President Silva announced last week that he would extend the tax break for no less than one other 60 days and concerns remain that the federal government may seek to curb fuel price volatility by imposing price caps.

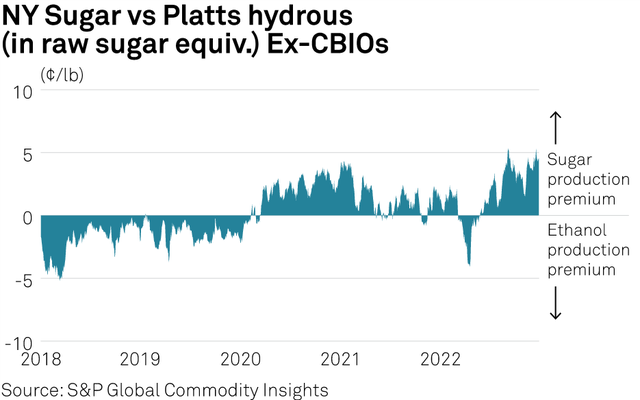

With weaker ethanol prices (below the fee of production for no less than some SEE participants), producing sugar now looks just like the higher bet, and indeed the premium for sugar production has hit a multiyear high.

S&P Global Commodity Insights

Unfortunately, the sugar market looks to be in a somewhat precarious balance. Sugar prices (the #11 contract) are still pretty healthy at $0.196/lb (in comparison with a variety of around $0.147/lb to $0.21/lb over the past two years), but between sugarcane acreage expansion and shifting away from ethanol production, the worldwide sugar market could see a surplus of greater than 4M tons, and that’s before considering the impact of fine growing seasons in areas like Thailand. While the Indian government’s decision to limit exports (more likely to between 8Mt and 10Mt) does help, I do see a risk of weaker sugar prices over the following 12-18 months as Brazilian producers shift production.

Adecoagro has only limited options – the corporate, like other SEE producers in Brazil, looks to be squeezed between weaker ethanol prices and precarious sugar prices. Management has been actively hedging near-term sugar production at attractive prices, but those hedges will roll off eventually. One positive is the export market – the corporate has been energetic in exporting ethanol to markets just like the EU (about 20% of recent production), and costs there are about 15% higher than in Brazil.

Crops Can’t Really Cushion The Blow

Adecoagro’s farming business isn’t really able to offsetting weaker earnings from the SEE business. The corporate’s farming operations in Argentina are fairly efficient as global standards go, however the business accounts for less than about 20% of total EBITDA in a given yr and that’s really not enough to offset weaker realized prices for sugar and/or ethanol.

Furthermore, it could be premature to assume an important yr for the crop business. The corporate has seen a success to yields from hostile weather lately (they’re not the one ones, it’s a region-wide problem), and there’s still a risk of further droughts this yr. On top of that, production costs are higher (the fee of fertilizer, labor, and other inputs), further pressuring margins, and while grain prices have held up, the present outlook within the futures market is for soy prices to go about 5% lower and corn prices to go about 10% lower.

The Outlook

Perhaps it goes without saying that there are a number of difficult-to-forecast drivers that play into Adecoagro’s outlook. Weather is notoriously unpredictable, and while a better-than-expected growing season can be good for grains, it could likely also increase sugarcane yields and add more supply pressure to the ethanol and sugar markets. Likewise, there are many other drivers of ethanol prices in Brazil, including Brent crude prices, the U.S. dollar – Brazilian real exchange rate, economic growth in Brazil, and the tax and energy policies of the Brazilian government.

One of the best I can really say here is that I believe Adecoagro is better-positioned than most – the corporate has low-cost SEE assets (in addition to efficient, low-cost farming assets) and unusually high flexibility. Furthermore, management has shown itself to be pretty skillful in managing harvesting, crushing, and ethanol/sugar production to maximise earnings. Those skills could well be put to the test over the following yr or two.

I expect Adecoagro to complete 2022 with 9% revenue growth, with low single-digit annualized growth for just a few years thereafter and long-term growth likely within the low-to-mid single-digits. The most important risk here is that prices weaken even further, particularly sugar prices, but that’s likewise a possible source of upside (upside seems more more likely to me in ethanol than sugar). I expect EBITDA margins to fall from 39% in FY’21 to around 34% for FY’22 after which below 30% for a few years before recovering back into the mid-to-high 30%’s.

I do still expect the corporate to generate positive free money flows, and that money flow should fund further returns of capital to shareholders. I wouldn’t be shocked if management seemed to be opportunistic and acquire SEE assets from stressed producers. I expect the market would hate that within the short term, but management has shown up to now that it’s willing to disregard short-term sentiment within the pursuit of its long-term growth strategy.

Valuation is where things get just a little complicated. My revenue estimates are below published Street estimates (about 5% to 10% depending upon the yr) for the following 4 years, and my EBITDA and FCF estimates are likewise below the Street, but I still get a double-digit fair value on discounted money flow. Using EV/EBITDA, a 5x multiple (on the low end of the corporate’s normal historical range) on my trough FY’23 estimate gets me a good value of just about $10, and I’d note that sometimes commodity firms trade at higher-than-normal multiples on trough earnings.

The Bottom Line

I suppose one obvious conclusion is that the Street is pricing in a good more dire outlook for 2023-2024 than what I believe are low estimates in my very own model. I can’t rule that out, particularly as sugar prices could weaken significantly if several incremental tons of Brazilian sugar hit the market.

Alternatively, trading at below book value, I do find these shares interesting. This has been a troublesome place for buy-and-hold investors to earn money, but I’m keen on considering commodity names at cyclical lows and Adecoagro definitely appears to be under serious pressure today despite a bearish outlook that might still see relatively healthy margins and money flow generation.

Editor’s Note: This text discusses a number of securities that don’t trade on a significant U.S. exchange. Please pay attention to the risks related to these stocks.