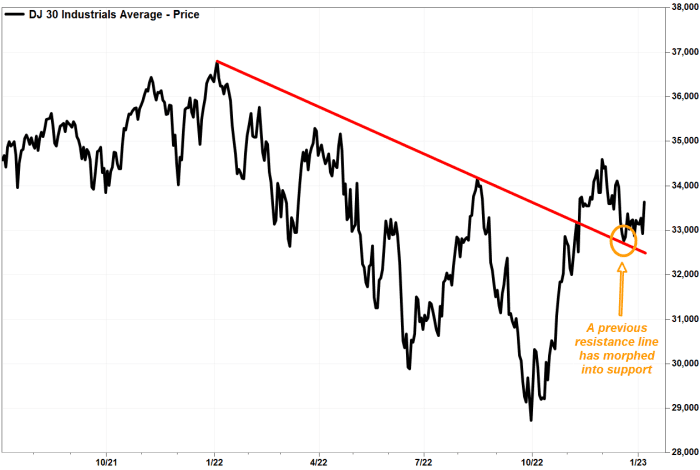

Don’t dis the Dow Jones Industrial Common simply because it’s made up of solely 30 shares, as a result of if the inventory market bounces again from final yr’s selloff, it’ll be the Dow that leads it.

With the Dow

DJIA,

surging 700.53 factors, or 2.1%, to 33,630.61 on Friday, within the wake of upbeat jobs data, it climbed again above the 50-day transferring common (DMA), which prolonged to 33,346.77, in accordance with FactSet knowledge. The 50-DMA is a extensively watched short-term development tracker, being above it implies a bullish outlook for the close to time period.

And again on Dec. 14, the Dow’s 50-DMA crossed above the 200-DMA (32,420.79) to supply a bullish technical pattern known as a “golden cross.” Because the 200-DMA is seen by many as a dividing line between longer-term uptrends and downtrends, a golden cross is seen as marking the spot a shorter-term bounce flips to a longer-term uptrend.

FactSet, MarketWatch

As well as, the Dow’s chart is exhibiting a “minor breakout” above the bear-market downtrend line that began in early 2022, as identified by Dan Wantrobski, technical strategist at Janney Montgomery Scott.

FactSet, MarketWatch

Principally, the Dow is appearing prefer it’s already began a brand new bullish uptrend.

“Although this by no means confirms a brand new bull market is at hand, it is a crucial first step in climbing out of the correction/basing cycle that shares have been locked in for the previous a number of months,” Wantrobski wrote in a latest be aware to purchasers.

The Dow has run up 17.1% since closing at a couple of two-year low of 28,725.51 on Sept. 30, 2022, which places it in correction territory off the 2022 bear market. It might take a rally of 20% or extra off that low, to not less than 34,470.61, for Wall Avenue to stamp a brand new bull market on the Dow.

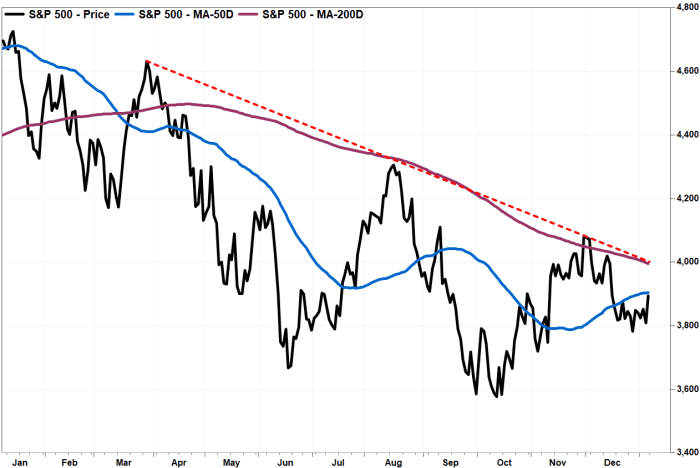

The Dow’s bullish stance is in stark distinction to the technical outlooks for the S&P 500

SPX,

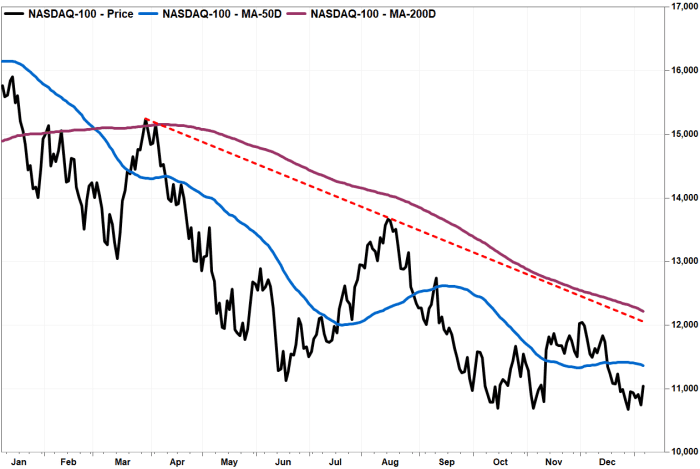

index, the technology-heavy Nasdaq-100 Index

NDX,

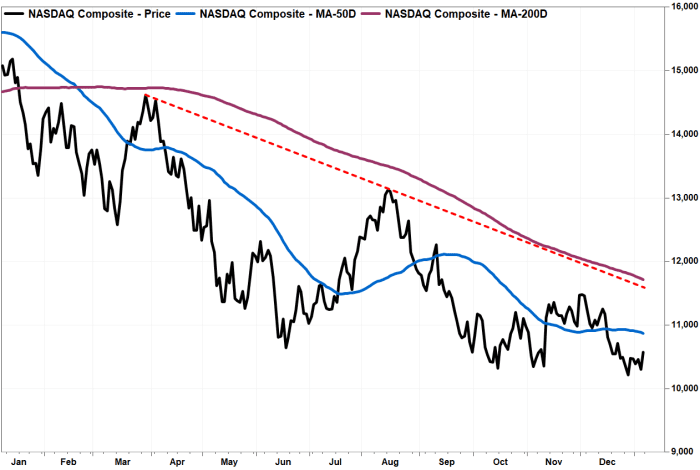

and the Nasdaq Composite Index

COMP,

which all stay locked inside bearish chart patterns.

The S&P 500, which climbed 2.3% to three,895.08 on Friday. It’s received near climbing again above its 50-DMA, which got here in at 3,904.37, in accordance with FactSet, however that 50-DMA remains to be beneath the 200-DMA at 3,996.04. That’s additionally concerning the stage the place a downtrend line beginning on the March 2020 restoration peak extends.

FactSet, MarketWatch

The charts are much more bearish for the Nasdaq-100:

FactSet, MarketWatch

And for the Nasdaq Composite:

FactSet, MarketWatch

“Clearly, a lot can change as we make our means via Q1 of 2023, however beginning off the New Yr, the DJIA is clearly ready of technical energy relative to each the S&P 500 and Nasdaq-100 indices,” Janney’s Wantrobski wrote. “We imagine this may proceed as a development in 2023, although it’s prone to be interrupted infrequently.”

For traders desirous to commerce the Dow, Wantrobski advised utilizing the SPDR Dow Jones Industrial Common exchange-traded fund

DIA,

as a proxy.

“We proceed to love the DJIA right here in a management position, and imagine merchants can make the most of the DIA for some opportunistic buying and selling performs within the coming weeks and months,” he wrote.