This publish is written by Jet Toyco, a dealer and buying and selling coach.

Everytime you hear buying and selling interviews, they’ll at all times say an analogous factor sooner or later:

“Get a buying and selling journal”

“If you wish to know when you have an edge, get a foreign currency trading journal”

So…

You spend hours sprucing your foreign currency trading journal and begin filling in your metrics as you enter trades.

However simply after a couple of weeks…

You cease and ultimately neglect about it.

You see…

Having a foreign currency trading journal is rarely about how a lot statistics you’ll be able to mash into your spreadsheets.

It’s about how effectively you utilize it.

That’s why in at present’s information you’ll be taught:

- What precisely a foreign currency trading journal is and why is it necessary

- Widespread errors merchants make earlier than you even make a foreign currency trading journal and repair it

- Easy methods to create an efficient buying and selling journal in lower than 5 minutes, as a result of that’s all you want

- The SECRET to utilizing a foreign currency trading journal and never simply gazing it

?

Nice, then let’s get this present on the street…

What’s a foreign currency trading journal and the way does it work

In easy phrases, a foreign currency trading journal is a instrument the place you’ll be able to log your previous trades and ultimately evaluation them.

And a foreign currency trading journal can look one thing like this:

Or it may possibly merely appear like this:

Consider me, my pal.

There are such a lot of combos and variations that there’s no fastened rule on what it appears like!

However actually…

What precisely is the aim of a foreign currency trading journal?

Certain, it’s discovering your edge out there.

Certain, it’s understanding whether or not or not your technique makes cash within the markets.

However what’s its true goal?

Do you need to know?

Let me inform you.

The true goal of a foreign currency trading journal is to…

Establish dangerous buying and selling habits and nurture good ones

You see…

A foreign currency trading journal is not only about whether or not or not your buying and selling technique makes cash.

It’s about you.

Your psychological well-being executes your technique and frame of mind; your feelings when buying and selling.

As a result of what good is a working buying and selling technique if the dealer who’s clicking the purchase and promote buttons is inconsistent?

You’ll get inconsistent outcomes in fact!

So, earlier than you even begin making your foreign currency trading journal.

Know that it’s extra about you than your buying and selling technique.

And this leads me to my subsequent level…

Widespread errors a dealer makes when having a foreign currency trading journal (and resolve them)

Right here’s the reality:

A foreign currency trading journal can both be probably the most highly effective or probably the most ineffective instrument a dealer may have…

Listed below are a few the explanation why…

Mistake #1: Your foreign currency trading journal is simply too advanced

Much less is extra on the subject of creating your buying and selling journal.

Sure, it’s true…

Some helpful statistics and charts can actually make it easier to out such because the:

- Sharpe Ratio

- Expectancy

- Weekly returns

- Fairness Curve

But when this may price you to fill in further particulars in your buying and selling journal manually…

Then filling in your foreign currency trading journal could be too tedious.

This might additionally discourage you to construct an inconsistent routine on commerce journaling, which leads me to my subsequent level…

Mistake #2: Your foreign currency trading journal routine doesn’t match your buying and selling type

Let me ask you:

When must you replace your foreign currency trading journal?

Each hour?

Each commerce?

As soon as every week?

Nicely, it relies upon.

In case you’re a day dealer, then filling your buying and selling journal each commerce would drive you insane!

Then again…

In case you’re a place dealer who barely will get any trades, then filling your foreign currency trading journal will ultimately slip out of your thoughts.

Now that these frequent issues…

What’s the answer?

Answer #1: Set up a constant foreign currency trading journal routine relying in your buying and selling type

In case your actions in buying and selling are inconsistent, then you definitely’d get inconsistent outcomes.

As talked about some time in the past…

Attempting to fill your buying and selling journal manually whereas day buying and selling will finally burn you out!

So when must you precisely fill and evaluation your foreign currency trading journal?

Relaxation assured my pal.

As a result of I’ve made a cheat sheet so that you can confer with relying in your buying and selling type.

Day buying and selling

In case you’re a day dealer who takes in roughly 10-20 trades a day…

Then solely examine and evaluation your foreign currency trading journal on the finish of your session.

Swing buying and selling

In case you’re a swing dealer who takes in 5-10 trades every week…

Naturally, it’s best to examine your buying and selling journal as soon as every week.

Lastly…

Place buying and selling

In case you’re a place dealer who takes in 5-10 trades a month…

Then solely examine and evaluation your buying and selling journal as soon as a month.

Easy, proper?

Nevertheless, hear intently…

You need to promise me that it’s best to solely examine your foreign currency trading journal when the markets are closed or whenever you’re achieved along with your session.

Why?

As a result of in the event you have a look at your buying and selling journal and also you see that you just’re in your string of losses.

How would you are feeling?

You’d really feel like sh*t.

And what are the possibilities of you lashing out your feelings and messing up your buying and selling when the markets are open?

In all probability excessive.

So evaluation your foreign currency trading journal when the markets are closed.

That method, you’ll be able to’t do something silly.

Answer #2: Automate your buying and selling journal as a lot as doable

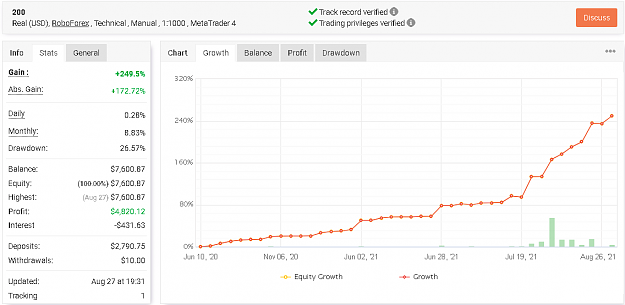

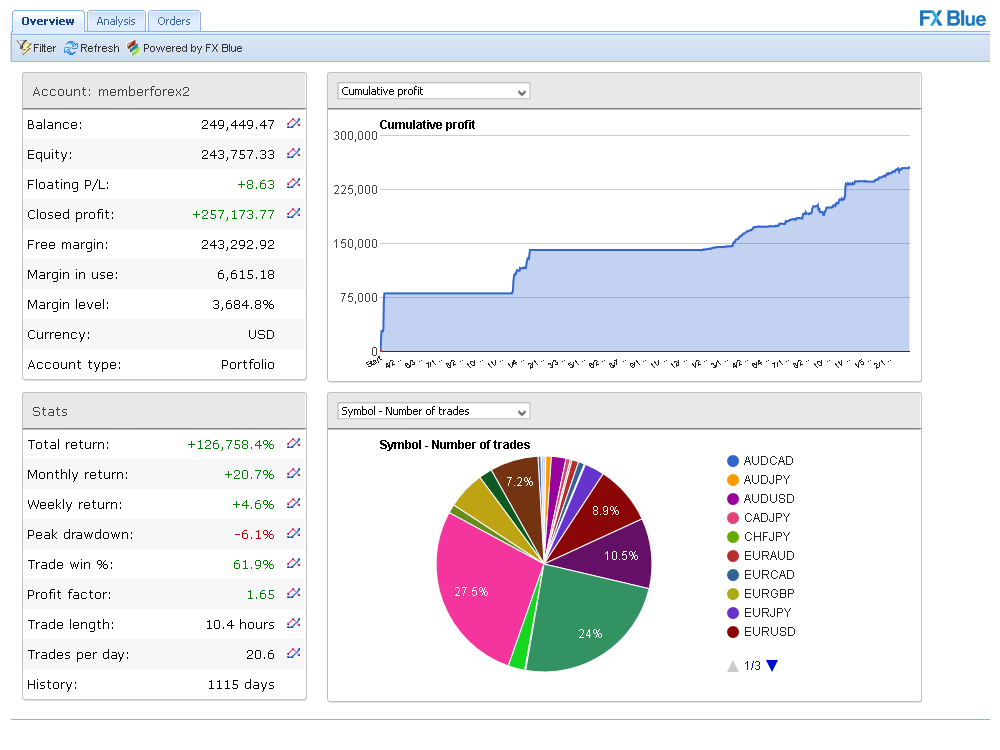

This present day, you have already got free foreign currency trading journals reminiscent of Myfxbook’s buying and selling journal:

And even Psyquation:

I’m certain they extra on the market, however right here’s the very best half…

All of them are free and automatic.

That’s proper!

Whether or not you may have a demo or a stay account, you need to use these instruments freed from cost!

And also you don’t even must enter your trades manually as they’re all automated when you join your account!

So…

Why hassle spending hours creating your “superior” buying and selling journal whilst you can take set all of it up in lower than an hour?

So in the event you’re critical about creating your foreign currency trading journal, it’s essential to automate issues as a lot as you’ll be able to.

Obtained it?

Now at this level, you is likely to be pondering:

“If we are able to simply automate issues, then does that imply that guide commerce journaling is ineffective?”

I do know I’ve stated quite a bit to this point on the subject of automated and guide commerce journaling.

However the reply is not any.

A guide foreign currency trading journal can nonetheless make it easier to out as a dealer, despite the fact that you have already got automated statistics in the back of your buying and selling.

That’s why within the subsequent part…

I’ll train you appropriately create your foreign currency trading journal, and train you use it.

Sounds good?

Then maintain studying…

Easy methods to create your foreign currency trading journal in lower than 5 minutes

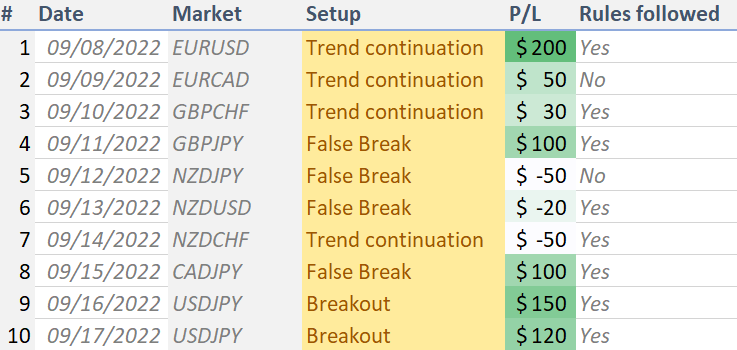

On the subject of creating your personal guide foreign currency trading journal you solely want this stuff:

- Commerce quantity (to reference your screenshots)

- Date (to pick which month you need to evaluation)

- Market (to know which market the commerce was in)

- Buying and selling setup (to find out the kind of commerce you took)

- Revenue or loss (to find out whether or not or not it was a profitable commerce

- Guidelines adopted or not (to find out whether or not or not you tousled large time or not)

In fact, within the subsequent part…

I’ll clarify how all these metrics come collectively.

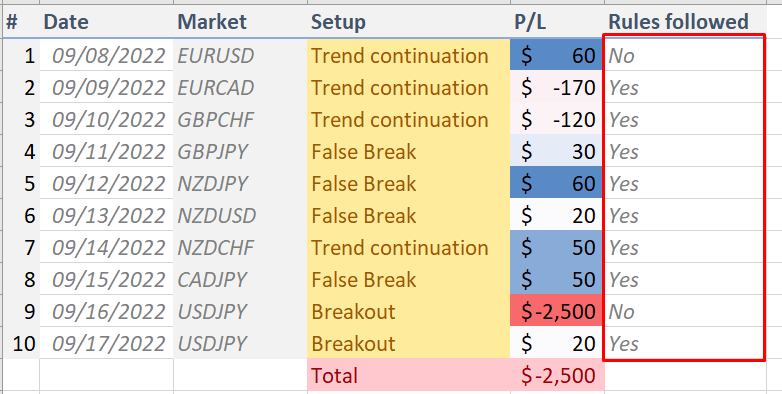

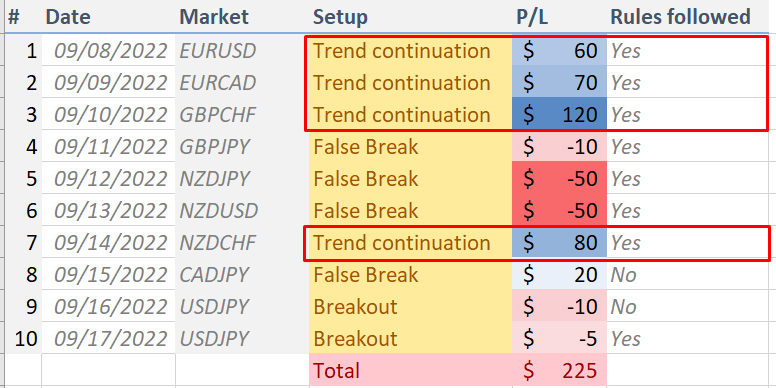

Nonetheless, your buying and selling journal ought to appear like this:

I do know that I’ve added a few easy designs to dazzle this foreign currency trading journal a bit.

However this takes lower than 5 minutes to make (and actually, that is all you want).

And the very best half?

It takes lower than 30 seconds so that you can log one commerce, so utilizing this foreign currency trading journal would one thing be simple to be in line with.

What’s subsequent?

Let me inform you…

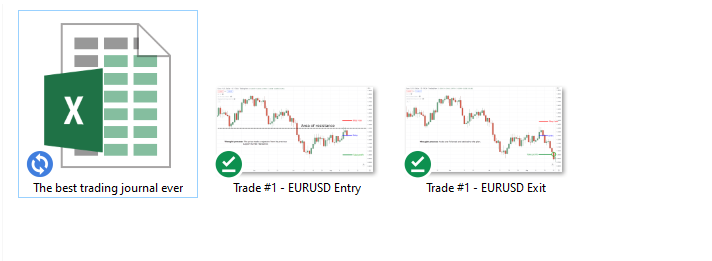

Commerce screenshots

That’s proper, most automated buying and selling journals can’t carry out this.

So, that is one thing that it’s essential to do.

Now, right here’s what it’s best to embrace in your commerce screenshot:

- A screenshot of whenever you took the commerce

- A screenshot of when the commerce was exited

Easy!

However actually, you’ll be able to put something you need in your buying and selling screenshots.

However the idea is that it’s essential to have the ability to put your thought course of behind the commerce.

Right here’s an instance.

Screenshot #1: Entry

Screenshot #2: Exit

In fact, it’s best to be mindful what commerce quantity that is, as you’d need to save the screenshots and maintain them organized.

Right here’s what I imply:

Now at this level…

You’ve made your easy buying and selling journal and also you’ve had a few screenshots saved.

What’s subsequent?

Aha.

You see, that is the place most foreign currency trading journal guides finish.

They train you make your journal however not use it whenever you’ve already populated it with trades.

However I would like you to stay with me…

As a result of the following a part of this information is essential as you’ll have the ability to apply this it doesn’t matter what type of foreign currency trading journal you select.

Prepared?

Then let’s go…

Easy methods to use your foreign currency trading journal that will help you enhance within the markets

Now…

On the subject of utilizing your foreign currency trading journal, I need you to bear in mind the I.D.P course of which stands for:

- Establish

- Diagnose

- Plan

Let me clarify…

1. Establish

Right here’s the reality:

While you’re on a shedding streak, generally it’s not the technique’s drawback.

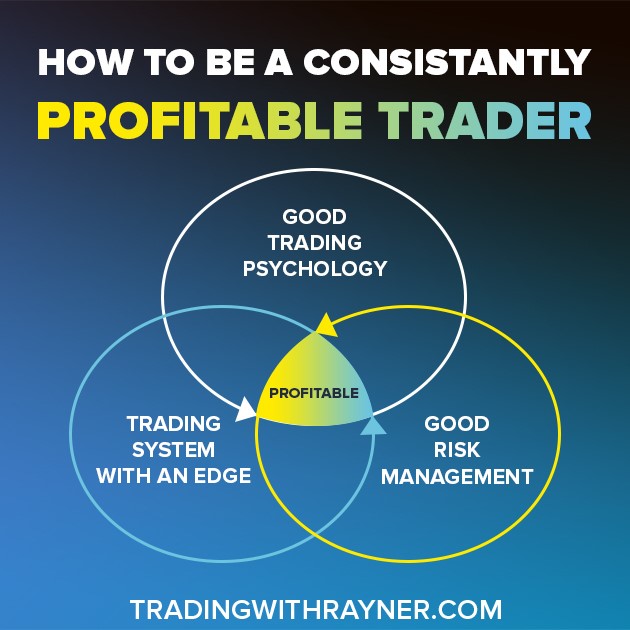

That’s why earlier than you possibly can take into consideration making an attempt to tweak your technique, it’s essential to determine whether or not or not you’re having struggles along with your:

- Buying and selling psychology

- Threat administration

- Technique

That’s proper.

Earlier than you even attempt to tweak your buying and selling technique, in the event you’re having a tough time along with your buying and selling psychology and managing your danger…

You’ll at all times blow up your buying and selling portfolio.

When you have the precise buying and selling psychology and danger administration however you don’t have an edge…

You’ll at all times find yourself breakeven.

When you have a working technique and good danger administration however you’re having points along with your buying and selling psychology since you carry on tweaking the principles…

You’ll find yourself breakeven.

You see my pal.

It’s all about that stability!

Buying and selling psychology + Threat administration + Technique = Constant profitability

Once more, the very first thing that you must ask your self is to find out whether or not or not you’re having a tough time along with your buying and selling psychology.

In case you’ve had a margin name or skilled a 50% loss in lower than every week, then that you must ask your self in the event you’re managing your danger effectively.

Lastly…

When your execution and danger administration are on-point, solely then you definitely’d take a look at your buying and selling technique.

Is sensible?

So, how precisely can we deal with this particularly?

Let me share it with you within the subsequent part.

2. Diagnose

Sadly, each dealer is exclusive.

There’s an opportunity that you just might need to diagnose your buying and selling issues in another way.

So it’s essential to take away the idea or the precept that I’m about to share with you.

Is sensible?

So first…

Buying and selling psychology

Let me provide you with an instance.

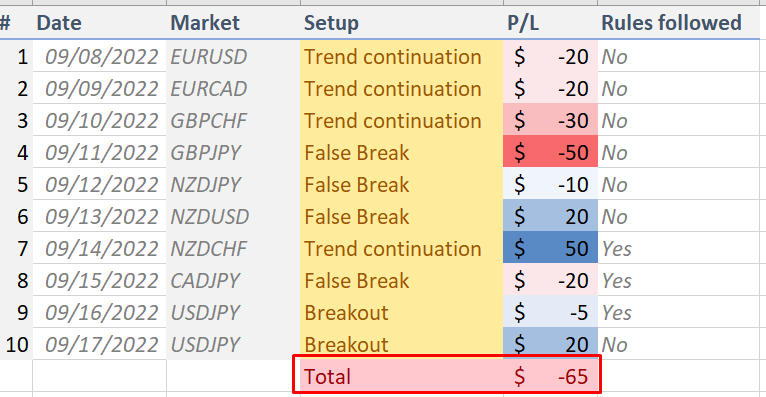

Let’s simply say that you just’re risking 1% of your $5000 account, so that you gained’t danger greater than $50 per commerce.

And for September, you’ve had a lack of $65:

On the similar time, out of the ten trades, you’ve taken this month…

You broke your guidelines 7 out of 10 occasions:

So, what does this inform you?

Is danger administration the problem?

Nicely, you’ve maintained your danger with a max of $50 loss commerce, so it’s not danger administration.

Is it your buying and selling technique?

Hmm, you’ve damaged your guidelines 7 out of 10 occasions this month, certainly they may’ve been a winner in the event you adopted your guidelines, no?

So, if I ask you what that you must deal with and repair, it must be your buying and selling psychology.

Cool?

Let me provide you with one other instance…

Threat administration

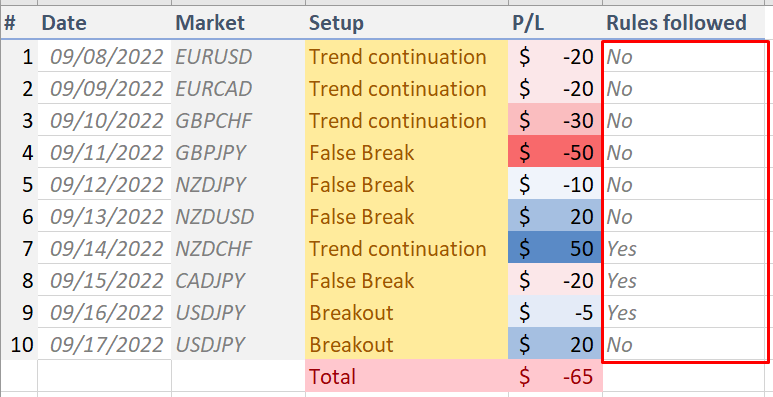

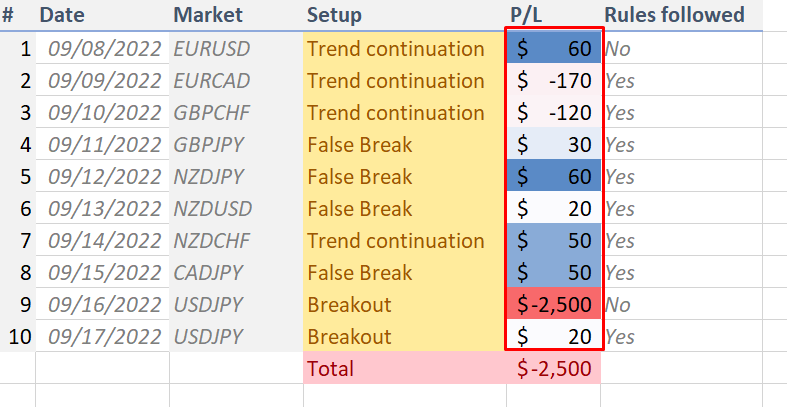

The identical factor, you may have a $5,000 portfolio and also you don’t need to danger greater than 1% per commerce.

However this time, you’ve seen that you just’ve had a 50% loss in only one month.

Holy moly, that my pal is just not regular…

Nicely, I’m certain it’s apparent that your danger administration is the issue right here.

However let’s go this step-by-step, we could?

So, as you’ll be able to see:

You’ve adopted your guidelines 8 out of 10 occasions, so on the subject of your buying and selling psychology…

There’s not a lot of a difficulty.

How about your system?

As you’ll be able to see, you’ve gained 7 out of 10 trades (70% win charge).

So, it’s not your technique both.

And the way about danger administration?

Recall, that you just’d need to danger 1% of your account per commerce.

Nevertheless, all your shedding trades had been above that.

In order you’ll be able to see, danger administration is one thing that you just’d need to deal with, and never your buying and selling psychology or your buying and selling technique.

And eventually, now we have probably the most attention-grabbing half…

Buying and selling technique

You already know the drill.

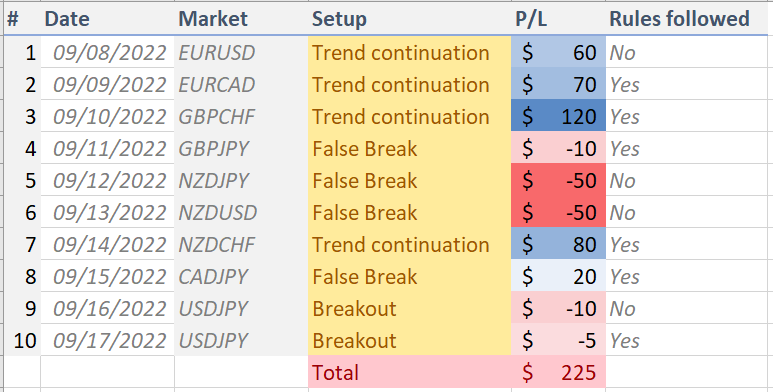

Identical account measurement as the primary instance, after which we go into the step-by-step means of determining what’s the unsuitable column by column.

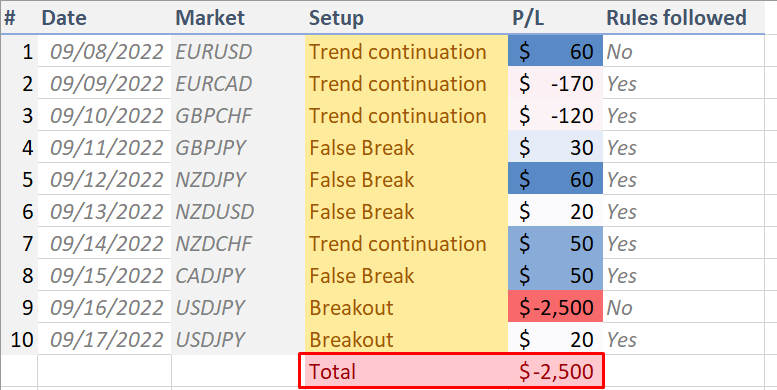

So, right here’s what now we have:

This time, I’ll hand it over to you.

Can you identify what are you able to enhance on this buying and selling journal?

Certain, it’s the technique since I’ve lined the others.

However why I’m wondering?

You’re up for this month!

However that doesn’t imply you have to be complacent.

So let’s break it down:

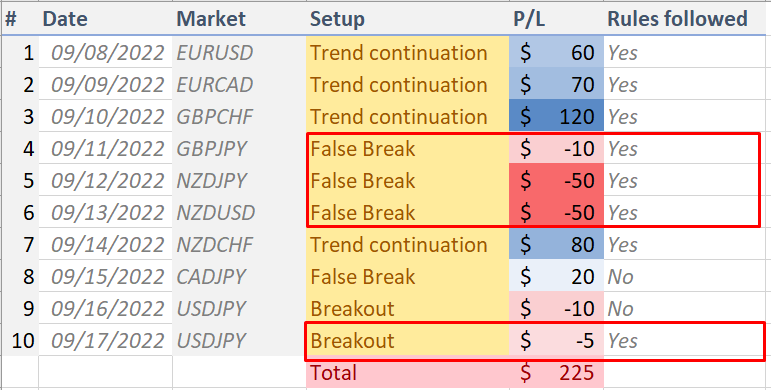

As you’ll be able to see in your foreign currency trading journal…

You’ve adopted your guidelines 80% of the time, and also you’ve maintained your danger in your shedding trades.

However in the event you have a look at your buying and selling setups…

You’ll be able to see that for this month, you’ve misplaced all your False Break and Breakout buying and selling setups.

(and sure, I extremely counsel that you just exclude trades the place guidelines aren’t adopted)

However on the similar time, are you aware which buying and selling setup works?

That’s proper…

Your development continuation trades!

It signifies that there’s an opportunity that it’s the precise setup for the precise market situation.

Now, it doesn’t imply your different buying and selling setups don’t work and that it’s best to discard them.

It solely signifies that since market situations change on a regular basis, no buying and selling technique works on a regular basis.

Is sensible?

3. Plan

Right here comes the tough half.

As a result of as I stated, planning on deal with these issues in your buying and selling journal (after diagnosing) can depend upon the dealer.

So, issues is probably not as particular because the final half, alright?

Now, in the event you’re having a tough time along with your…

Buying and selling psychology

It might be these three issues…

- Private relationships

- Buying and selling capital

- Expectations in buying and selling

Now, are you aware why I ask you to examine in your buying and selling psychology first earlier than the remaining?

That’s proper, as a result of we’re all people in spite of everything, and there’s extra to life than buying and selling.

So, in the event you’re having a tough time along with your relationships, and also you assume it’s immediately affecting your buying and selling efficiency…

Then, don’t hesitate to pause.

In case you assume that you just’re creating a variety of buying and selling errors (reminiscent of overtrading) as a result of your buying and selling capital is simply too big…

Then, don’t hesitate to withdraw and scale back your buying and selling capital.

As a result of there’s a excessive probability that you just’re buying and selling with out confidence and that that you must construct it up slowly with out stress.

Lastly, I’m going exhausting on this one.

In case you assume that buying and selling is a get-rich-quick scheme and also you’re anticipating a gentle supply of earnings each month to interchange your full-time job?

Then, I don’t assume buying and selling is for you, my pal.

Nonetheless, I extremely counsel you examine these articles out on the subject of buying and selling psychology:

Trading Psychology: 6 Practical Tips to Master Your Mind and Money

Trading Psychology: 3 Profitable Tips To Trading Success

I Lost 50% Of My Capital Before Turning Profitable. Here’s How…

Subsequent…

Threat administration

On the subject of danger administration, it’s essential to get to reply these two questions:

- Do you precisely understand how a lot you will lose earlier than you enter a commerce?

- What number of models do that you must purchase in order that in case your commerce hits your cease loss, you gained’t lose greater than 1% or 2% per commerce?

When you’re capable of determine these solutions earlier than each single commerce you are taking…

Then you definately’ve acquired a sustainable buying and selling enterprise, my pal.

Nonetheless, I extremely counsel you examine this out:

Forex Risk Management and Position Sizing (The Complete Guide)

Stock Risk Management: How To Calculate Your Position Size

Buying and selling Technique

Much like buying and selling psychology, it’s not as simple as supplying you with a working technique.

As a result of as …

Not all methods work on a regular basis, and never all dealer’s danger appetites are the identical.

Nonetheless, one factor that has helped me is to know the place you stand first as a dealer.

The place you’re a:

- Discretionary dealer

- Systematic dealer

Realizing the place you stand between the 2 would lower your studying curve by half.

Since you’d know what to search for!

So, if you wish to go down the route of being a discretionary dealer, I counsel you examine this out:

The Price Action Trading Strategy Guide

And if you wish to be a scientific dealer, then these articles will assist to provide you an concept:

Turtle Trading Rules: Does It Still Work Today?

There you go!

An entire and complete information to creating and utilizing your buying and selling journal!

Have you ever discovered one thing new at present?

Conclusion

In case you’ve reached the top of this buying and selling information…

I’m certain that it’s best to understand by now that having a foreign currency trading journal is just not about your technique.

But it surely’s all about you.

Realizing what you need as a dealer, what works for you, and what might be the very best for you.

That’s why I hope that after you learn this buying and selling information…

You wouldn’t deal with a foreign currency trading journal the identical method once more.

However over to you…

Have you ever used a foreign currency trading journal earlier than?

How did it make it easier to?

Are there any suggestions you possibly can share with me?

Let me know within the feedback under!